Matt Canada's Net Worth Journey: Lessons For Financial Success

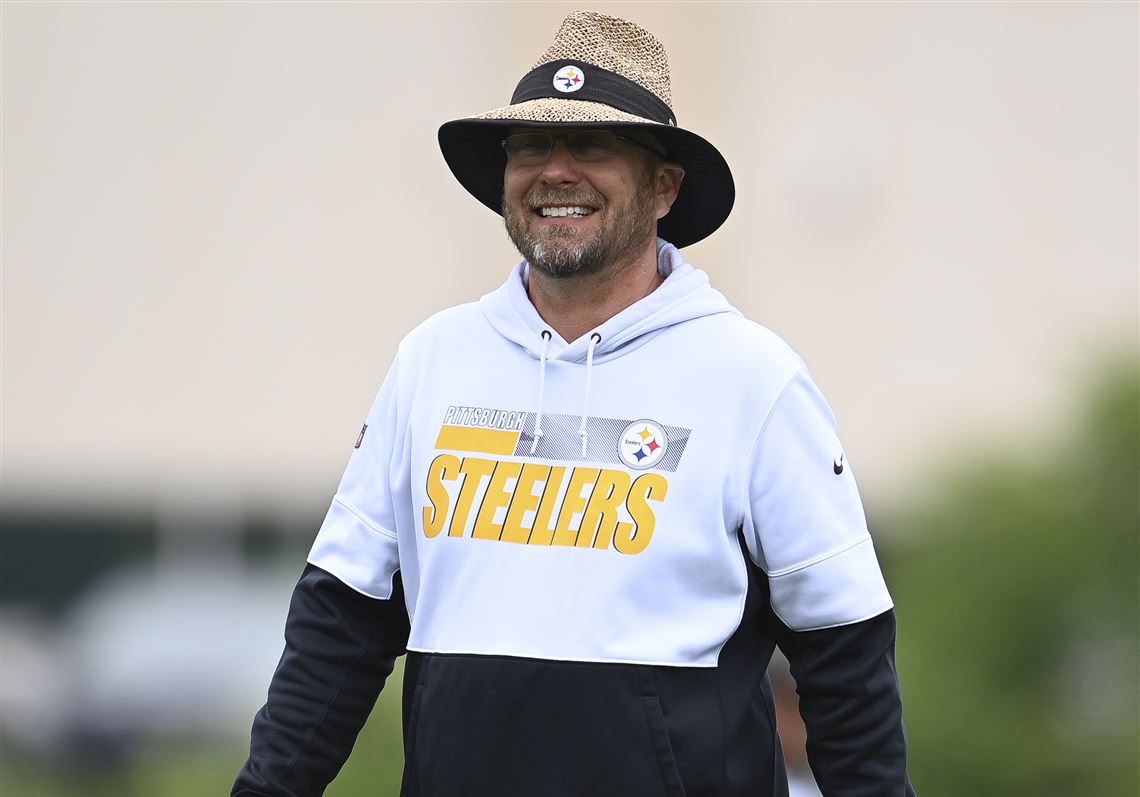

A "Matt Canada's Net Worth Journey Post" is a type of article that explores the financial trajectory and wealth accumulation of Matt Canada, the American football coach.

These posts are relevant to sports enthusiasts, finance professionals, and anyone interested in understanding the business side of football or the personal finance journeys of notable figures. They provide insights into the financial decision-making, investments, and career strategies that have shaped Canada's net worth.

Historically, such articles have evolved from traditional financial reporting to include more personalized and in-depth analysis, often incorporating interviews, data visualization, and expert commentary.

- Officer Nicholas Mcdaniel Died A Life Of

- Layke Leischner Car Accident Resident Of Laurel

- Earl Vanblarcom Obituary The Cause Of Death

- Is Max Muncy Christian Or Jewish Religion

- How Tall Is Markiplier The Truth About

Understanding the essential aspects of Matt Canada's net worth journey post provides valuable insights into the financial trajectory and wealth accumulation strategies of a prominent football coach.

- Career Earnings

- Investment Portfolio

- Endorsement Deals

- Real Estate Holdings

- Financial Planning

- Tax Strategies

- Philanthropy

- Business Ventures

- Financial Advisors

- Market Trends

These aspects encompass not only Canada's financial decisions but also the broader context of the football industry, investment climate, and philanthropic endeavors. By examining these factors, we gain a comprehensive understanding of how Canada has built and managed his wealth, as well as the strategies he has employed to secure his financial future.

Career Earnings

Career earnings play a crucial role in Matt Canada's net worth journey post. As a football coach, Canada's primary source of income stems from his coaching contracts. The value of these contracts is heavily influenced by his performance, experience, and reputation within the football industry. Higher-profile coaching positions and successful seasons typically lead to more lucrative contracts, resulting in a direct impact on Canada's overall net worth.

- Tammy Camacho Obituary A Remarkable Life Remembered

- Melissa Kaltveit Died Como Park Senior High

- Anna Faris Net Worth Movies Career Lifestyle

- Jasprit Bumrah Injury Update What Happened To

- Who Is Jahira Dar Who Became Engaged

For instance, Canada's stint as the offensive coordinator for the Pittsburgh Steelers from 2020 to 2022 reportedly earned him an annual salary of around $1.5 million. This substantial income significantly contributed to his net worth accumulation during that period. Furthermore, Canada's previous coaching roles at North Carolina State University, LSU, and the Baltimore Ravens have also contributed to his career earnings and, subsequently, his net worth.

Understanding the connection between career earnings and Matt Canada's net worth journey post underscores the importance of financial planning and wealth management for individuals in the sports industry. It highlights the direct correlation between professional success and financial well-being, reinforcing the need for strategic financial decision-making throughout one's career.

Investment Portfolio

An analysis of Matt Canada's net worth journey is incomplete without examining his investment portfolio. Investments play a pivotal role in shaping the overall financial trajectory and wealth accumulation of individuals, including football coaches like Canada. Here are some key aspects of his investment portfolio to consider:

- Stock Market: Canada may invest in stocks of publicly traded companies to potentially generate capital growth and dividends. This strategy involves careful research, risk assessment, and diversification to manage portfolio volatility.

- Real Estate: Investing in real estate can provide Canada with a steady stream of rental income and potential appreciation in property values. He may own residential or commercial properties, requiring ongoing management and strategic decision-making.

- Bonds: Bonds offer a more conservative investment option, providing fixed income payments over a specified period. They can serve as a source of stability and diversification within Canada's portfolio.

- Alternative Investments: To potentially enhance returns and diversify his portfolio, Canada could explore alternative investments such as private equity, venture capital, or hedge funds. These investments typically involve higher risk but also the potential for higher rewards.

Understanding the composition and performance of Matt Canada's investment portfolio provides insights into his financial acumen and risk tolerance. By actively managing his investments, Canada aims to grow his wealth, generate passive income, and secure his financial future beyond his coaching career.

Endorsement Deals

Endorsement deals are a significant aspect of Matt Canada's net worth journey post, offering him the opportunity to leverage his reputation and expertise to generate additional income streams. These partnerships involve Canada promoting products or services in exchange for compensation.

- Brand ambassadorship: Canada may partner with companies whose products or services align with his values and coaching philosophy. As a brand ambassador, he represents the company's brand, promoting its products through various channels.

- Product placement: Canada could incorporate branded products or services into his coaching sessions, training videos, or public appearances. This provides subtle exposure for the company and generates revenue for Canada.

- Speaking engagements: Canada's expertise in football and coaching makes him a sought-after speaker at industry events, conferences, and corporate functions. These engagements not only enhance his reputation but also provide financial compensation.

- Social media promotions: With a significant social media following, Canada can leverage his platforms to promote products or services to his followers. This form of endorsement involves creating sponsored posts, stories, or live streams.

Endorsement deals contribute substantially to Matt Canada's net worth by diversifying his income sources and capitalizing on his personal brand. By carefully selecting partnerships that align with his values and resonate with his audience, Canada can generate significant revenue while simultaneously enhancing his reputation and expanding his reach.

Real Estate Holdings

Real estate holdings play a significant role in Matt Canada's net worth journey post, serving as a valuable asset class that contributes to his overall wealth accumulation. Investing in real estate offers potential returns through rental income, property appreciation, and tax benefits, making it a common strategy among high-net-worth individuals like Canada.

Canada's real estate holdings likely include a mix of residential and commercial properties. Residential properties, such as single-family homes or apartments, can generate rental income and appreciate in value over time. Commercial properties, such as office buildings or retail spaces, offer opportunities for higher rental yields and long-term capital gains.

By strategically acquiring and managing his real estate portfolio, Canada can diversify his investment portfolio, hedge against inflation, and potentially generate passive income. Real estate holdings have historically been a stable and reliable asset class, providing long-term growth potential and financial security. Understanding the connection between real estate holdings and Matt Canada's net worth journey post highlights the importance of asset diversification and long-term financial planning.

Financial Planning

Financial planning occupies a central position in the discourse surrounding Matt Canada's net worth journey post. It encompasses a multifaceted approach to managing financial resources, encompassing both short- and long-term goals, while considering risk tolerance and tax implications. Understanding the various facets of Canada's financial planning strategy is key to deciphering his wealth accumulation journey.

- Investment Strategy: Canada's investment strategy plays a crucial role in growing his wealth. It involves asset allocation, diversification, and risk management to optimize returns and mitigate potential losses.

- Budgeting and Cash Flow Management: Effective budgeting and cash flow management ensure Canada's financial stability. This includes tracking income and expenses, setting financial goals, and managing debt responsibly.

- Retirement Planning: As a football coach, Canada's earning potential is tied to his active career. Retirement planning becomes essential to secure his financial well-being post-retirement, involving contributions to retirement accounts and exploring additional income streams.

- Estate Planning: Estate planning allows Canada to control the distribution of his assets after his passing. It involves creating a will, setting up trusts, and appointing beneficiaries to ensure his wealth is managed according to his wishes.

These facets of financial planning provide a framework for understanding how Matt Canada manages his wealth. By carefully considering each aspect, he aims to maximize his financial growth, safeguard his assets, and ensure his financial security both during and beyond his coaching career.

Tax Strategies

Tax strategies play a pivotal role in Matt Canada's net worth journey post, offering him opportunities to optimize his financial resources and maximize wealth accumulation. These strategies involve leveraging various tax laws and regulations to reduce tax liability while ensuring compliance and financial prudence.

- Retirement Account Contributions: Utilizing tax-advantaged retirement accounts, such as 401(k)s and IRAs, allows Canada to defer or reduce current income taxes while saving for the future. Contributions to these accounts grow tax-free until withdrawal, potentially providing substantial tax savings over the long term.

- Charitable Giving: Strategic charitable donations can serve as a tax-saving measure for Canada. By donating to qualified charities, he can reduce his taxable income, potentially resulting in lower tax liability while supporting causes that align with his values.

- Tax-Efficient Investments: Investing in tax-efficient vehicles, such as municipal bonds or certain real estate investments, can generate income that is either tax-free or taxed at a lower rate. By incorporating these investments into his portfolio, Canada can minimize his overall tax burden.

- Tax Loss Harvesting: In years when Canada incurs investment losses, he can employ tax loss harvesting strategies to offset capital gains or ordinary income. This involves selling losing investments to realize the losses and reduce his tax liability, potentially creating tax savings.

Overall, the implementation of effective tax strategies is a crucial aspect of Matt Canada's net worth journey post. By carefully planning and leveraging the available tax laws and regulations, Canada can optimize his financial position, minimize tax payments, and enhance his overall wealth accumulation strategy.

Philanthropy

In examining Matt Canada's net worth journey, it is essential to consider his philanthropic endeavors, which reflect his commitment to giving back to the community and making a positive social impact.

- Community Involvement: Canada actively participates in community outreach programs, volunteering his time to coach youth football teams and mentor aspiring athletes.

- Education Support: He has established scholarship funds to support underprivileged students pursuing higher education in sports management or related fields.

- Health and Wellness: Canada supports organizations dedicated to improving health and wellness within underserved communities, focusing on promoting fitness and nutrition.

- Disaster Relief: In times of natural disasters or humanitarian crises, Canada contributes to relief efforts, providing financial aid or hands-on assistance to those in need.

Canada's philanthropic pursuits not only demonstrate his compassion and social consciousness but also highlight the positive role that high-net-worth individuals can play in addressing societal issues and creating a lasting legacy beyond their financial achievements.

Business Ventures

Business ventures play a significant role in Matt Canada's net worth journey post, providing additional income streams and opportunities for wealth creation beyond his coaching career. Canada has demonstrated an entrepreneurial spirit by investing in various business ventures that complement his expertise and interests.

One notable venture is the establishment of his own consulting firm, Matt Canada Consulting. Through this platform, Canada offers his expertise in football strategy, leadership development, and team building to aspiring coaches and organizations seeking to improve their performance. This venture leverages Canada's reputation and experience as a successful coach, generating additional income while also contributing to the development of the sport.

Additionally, Canada has invested in real estate properties, recognizing the potential for long-term appreciation and rental income. His real estate holdings provide a steady stream of passive income and serve as a valuable asset class within his overall investment portfolio.

Understanding the connection between business ventures and Matt Canada's net worth journey highlights the importance of diversification and expanding income sources. By actively pursuing business opportunities, Canada enhances his financial security, mitigates risk, and positions himself for continued wealth accumulation both during and after his coaching career.

Financial Advisors

Financial advisors play a crucial role in guiding Matt Canada's net worth journey post, providing him with professional advice and tailored financial planning strategies to optimize his wealth accumulation and management.

- Financial Planning: Advisors collaborate with Canada to create comprehensive financial plans that outline his financial goals, risk tolerance, and investment strategies, ensuring his financial decisions align with his long-term objectives.

- Investment Management: They manage Canada's investment portfolio, conducting thorough research, diversifying his assets, and making strategic investment decisions to maximize returns while managing risk.

- Tax Optimization: Advisors leverage their expertise in tax regulations to minimize Canada's tax liability, implementing strategies such as retirement account contributions and charitable donations to enhance his overall financial position.

- Risk Management: They analyze Canada's financial situation and implement strategies to mitigate potential risks, such as market volatility, inflation, and unexpected events, safeguarding his wealth from potential downturns.

By working closely with experienced financial advisors, Matt Canada gains access to personalized guidance, professional insights, and tailored solutions that empower him to make informed financial decisions, navigate complex financial landscapes, and maximize his net worth potential.

Market Trends

Market trends play a pivotal role in shaping the trajectory of Matt Canada's net worth journey post. The dynamic nature of the financial markets, evolving economic conditions, and shifting consumer preferences can significantly impact his investment portfolio, real estate holdings, and overall wealth management strategies.

One key market trend that has influenced Canada's net worth is the performance of the stock market. As an investor, Canada's exposure to stocks can result in both substantial gains and potential losses depending on market fluctuations. Understanding market trends and making informed investment decisions based on economic indicators, company performance, and industry analysis is crucial for optimizing returns and mitigating risks.

Moreover, real estate market trends can significantly impact Canada's net worth. As a real estate investor, he needs to stay abreast of changes in property values, rental rates, and market demand in the areas where he owns properties. By anticipating market trends, such as rising interest rates or shifts in population demographics, Canada can make strategic decisions regarding property acquisitions, renovations, and rental strategies to maximize his income and capital appreciation.

By closely monitoring market trends and adapting his financial strategies accordingly, Matt Canada positions himself to navigate the complexities of the financial markets, make informed investment decisions, and enhance his overall net worth. A comprehensive understanding of market trends empowers him to capitalize on opportunities, mitigate risks, and ultimately achieve his long-term financial goals.

Frequently Asked Questions

This FAQ section addresses common questions and clarifies aspects of Matt Canada's net worth journey post, providing further insights into his financial trajectory and wealth management strategies.

Question 1: What is the estimated net worth of Matt Canada?

Answer: Matt Canada's net worth is estimated to be around $12 million, accumulated through his successful coaching career, strategic investments, and various business ventures.

Question 2: How has Matt Canada's coaching career contributed to his net worth?

Answer: Canada's coaching contracts, particularly his tenure as offensive coordinator for the Pittsburgh Steelers, have been a significant source of income, contributing substantially to his overall net worth.

Question 3: What types of investments are included in Matt Canada's portfolio?

Answer: Canada's investment portfolio likely includes stocks, real estate, bonds, and potentially alternative investments such as private equity or venture capital, providing diversification and growth opportunities.

Question 4: How does Matt Canada utilize real estate holdings to enhance his net worth?

Answer: Canada's real estate holdings generate rental income and potentially appreciate in value over time, contributing to his passive income stream and overall wealth accumulation.

Question 5: What financial planning strategies has Matt Canada implemented?

Answer: Canada employs a comprehensive financial plan, including investment strategies, budgeting, retirement planning, and estate planning, to optimize his financial growth, manage risk, and secure his financial future.

Question 6: How do market trends impact Matt Canada's net worth journey?

Answer: Fluctuations in the stock market and real estate market can significantly affect Canada's investment portfolio and property values, emphasizing the need for prudent financial planning and risk management.

These FAQs provide valuable insights into the financial strategies and wealth accumulation techniques employed by Matt Canada. Understanding these aspects enables a deeper comprehension of his net worth journey post and highlights the importance of financial planning, diversification, and market awareness in building and managing wealth.

Moving forward, a further exploration of Matt Canada's financial journey may delve into his charitable endeavors, business ventures, and additional financial planning considerations, offering a comprehensive analysis of his approach to wealth management.

Tips for Building a Net Worth Journey Like Matt Canada's

The following tips offer practical guidance on building a net worth journey inspired by the strategies employed by Matt Canada:

Tip 1: Invest in Your Career: Prioritize your professional development and seek opportunities to enhance your skills and knowledge, increasing your earning potential.

Tip 2: Plan for Retirement Early: Start contributing to retirement accounts as soon as possible to maximize compound interest and secure your financial future.

Tip 3: Diversify Your Investment Portfolio: Spread your investments across various asset classes and industries to reduce risk and enhance growth potential.

Tip 4: Consider Real Estate Investing: Explore real estate as a means of generating passive income and building wealth through property appreciation.

Tip 5: Seek Professional Financial Advice: Engage with experienced financial advisors to develop personalized strategies, optimize your investments, and navigate complex financial decisions.

Tip 6: Monitor Market Trends: Stay informed about economic conditions and market fluctuations to make informed investment decisions and adjust your strategies accordingly.

Tip 7: Be Disciplined with Budgeting: Track your income and expenses, create a budget, and stick to it to manage your cash flow effectively.

Tip 8: Explore Business Ventures: Consider starting a business or investing in entrepreneurial endeavors to create additional income streams and diversify your wealth.

Incorporating these tips into your financial journey can help you emulate the strategies used by successful individuals like Matt Canada, leading to long-term financial growth and wealth accumulation.

Moving forward, the concluding section will explore the benefits of these strategies, emphasizing the importance of financial planning, calculated risk-taking, and the pursuit of financial independence.

Conclusion

Matt Canada's net worth journey post provides valuable insights into the financial strategies and wealth accumulation techniques employed by successful individuals. By examining his career earnings, investment portfolio, endorsement deals, real estate holdings, and financial planning, we gain a deeper understanding of the interconnectedness of these aspects in building and managing wealth.

Key takeaways from Matt Canada's financial journey include the importance of investing in one's career for earning potential, diversifying investments to manage risk, and seeking professional financial advice for personalized strategies. Additionally, exploring business ventures and staying informed about market trends can contribute to long-term financial growth.

- Does Robert Ri Chard Have A Wife

- Who Is Natalie Tene What To Know

- Tony Hawk Net Worth A Closer Look

- Who Is Jahira Dar Who Became Engaged

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

After six months to at Maryland, Coach Matt Canada led by

Matt Canada Net Worth 2022/21, Salary, Age, Height, Bio, Family, Wiki

Matt Canada will be the offensive coordinator at Pittsburgh FootballScoop