Shelter Your Roof With Allstate's Extended Coverage Endorsement: A Homeowner's Guide

An extended coverage endorsement, such as the Allstate Roof Surfaces Extended Coverage Endorsement, is an optional addition to a standard homeowners insurance policy that provides enhanced protection for specific parts of your home.

The Allstate Roof Surfaces Extended Coverage Endorsement, for example, offers additional coverage for damage to your roof caused by hail, wind, or other covered perils. This endorsement can be a valuable addition to your policy if you live in an area that is prone to severe weather.

This article will provide a more detailed overview of the Allstate Roof Surfaces Extended Coverage Endorsement, including its benefits, limitations, and cost.

- Has Claire Mccaskill Had Plastic Surgery To

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Wwe Billy Graham Illness Before Death Was

- David Foster Net Worth From Grammy Winning

- Legendary Rella S Relationship Status Is She

What Is Allstate Roof Surfaces Extended Coverage Endorsement

The Allstate Roof Surfaces Extended Coverage Endorsement is an important addition to your homeowners insurance policy if you live in an area that is prone to severe weather. This endorsement provides enhanced protection for your roof, which is one of the most expensive parts of your home to repair or replace.

- Coverage: The endorsement provides coverage for damage to your roof caused by hail, wind, and other covered perils.

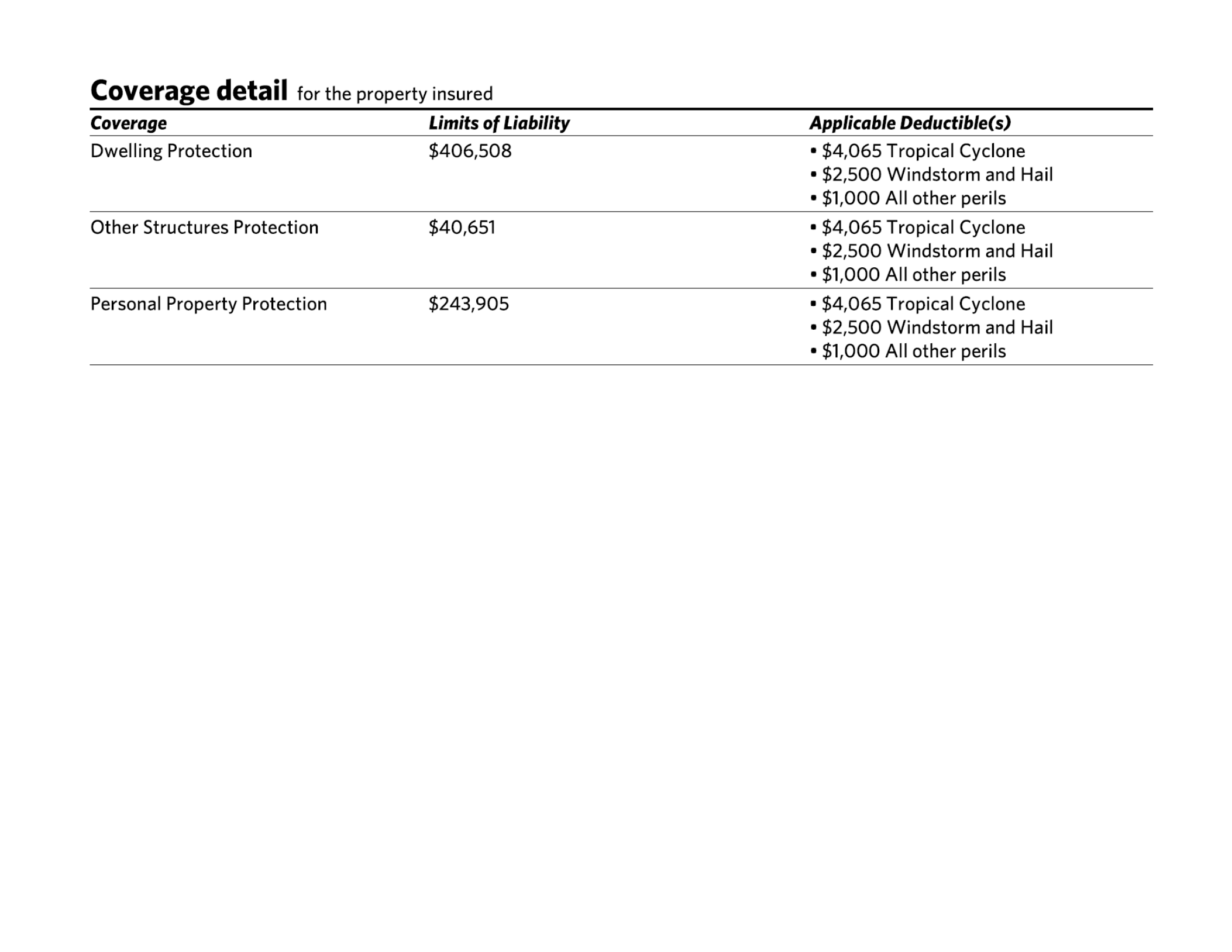

- Deductible: The endorsement has a separate deductible from your homeowners insurance policy.

- Cost: The cost of the endorsement will vary depending on the size and location of your home.

- Benefits: The endorsement can provide peace of mind knowing that your roof is protected from damage.

- Limitations: The endorsement may not cover all types of roof damage.

- Exclusions: The endorsement may have exclusions for certain types of damage, such as damage caused by earthquakes or floods.

- Availability: The endorsement is not available in all states.

- Importance: The endorsement can help you to protect your home from financial loss in the event of a covered peril.

- Endorsement: The endorsement is a legally binding contract between you and your insurance company.

The Allstate Roof Surfaces Extended Coverage Endorsement is a valuable addition to your homeowners insurance policy if you live in an area that is prone to severe weather. The endorsement can provide peace of mind knowing that your roof is protected from damage, and it can help you to protect your home from financial loss in the event of a covered peril.

Coverage

This coverage is important because it can help you to protect your home from financial loss in the event of a covered peril. For example, if your roof is damaged by hail, the endorsement can help you to pay for the cost of repairs or replacement.

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Who Is Jahira Dar Who Became Engaged

- Where Was I Want You Back Filmed

- Meet Maya Erskine S Parents Mutsuko Erskine

- Najiba Faiz Video Leaked On Telegram New

The endorsement is a critical component of the Allstate Roof Surfaces Extended Coverage Endorsement because it provides the actual coverage for damage to your roof. Without this coverage, you would not be able to make a claim for roof damage under the endorsement.

Real-life examples of the coverage provided by the endorsement include:

- A homeowner whose roof was damaged by hail was able to file a claim under the endorsement and receive payment for the cost of repairs.

- A homeowner whose roof was damaged by wind was able to file a claim under the endorsement and receive payment for the cost of replacement.

The practical significance of understanding the coverage provided by the endorsement is that it can help you to make informed decisions about your homeowners insurance policy. If you live in an area that is prone to severe weather, you may want to consider adding the endorsement to your policy to protect your roof from damage.

In summary, the coverage provided by the Allstate Roof Surfaces Extended Coverage Endorsement is an important part of the endorsement. It can help you to protect your home from financial loss in the event of a covered peril, such as hail or wind damage.

Deductible

The deductible is the amount of money that you have to pay out of pocket before your insurance company will start to cover the costs of a claim. The deductible for the Allstate Roof Surfaces Extended Coverage Endorsement is separate from the deductible for your homeowners insurance policy. This means that you will have to pay two deductibles if you file a claim under the endorsement.

The reason why the endorsement has a separate deductible is because it provides additional coverage for your roof. This additional coverage comes with an additional cost, which is reflected in the higher deductible. However, the higher deductible can be worth it if you live in an area that is prone to severe weather.

For example, if you live in an area that is prone to hailstorms, you may want to consider adding the Allstate Roof Surfaces Extended Coverage Endorsement to your homeowners insurance policy. The endorsement will provide you with additional coverage for hail damage to your roof, and the higher deductible will help to keep your insurance premiums affordable.

In summary, the deductible for the Allstate Roof Surfaces Extended Coverage Endorsement is an important part of the endorsement. It helps to keep your insurance premiums affordable while still providing you with the coverage you need to protect your roof from damage.

Cost

The cost of the Allstate Roof Surfaces Extended Coverage Endorsement will vary depending on the size and location of your home. This is because the cost of the endorsement is based on the risk of damage to your roof. For example, if you live in an area that is prone to hailstorms, the cost of the endorsement will be higher than if you live in an area that is not prone to hailstorms.

The size of your home will also affect the cost of the endorsement. This is because a larger home has a greater risk of damage than a smaller home. Therefore, the cost of the endorsement will be higher for a larger home than for a smaller home.

It is important to understand how the cost of the endorsement is determined so that you can make an informed decision about whether or not to add the endorsement to your homeowners insurance policy. If you live in an area that is prone to severe weather, the cost of the endorsement may be worth it. However, if you live in an area that is not prone to severe weather, you may want to consider other options, such as increasing your deductible.

Benefits

The Allstate Roof Surfaces Extended Coverage Endorsement provides peace of mind knowing that your roof is protected from damage. This is because the endorsement provides additional coverage for damage to your roof caused by hail, wind, and other covered perils. This coverage is important because it can help you to protect your home from financial loss in the event of a covered peril.

For example, if your roof is damaged by hail, the endorsement can help you to pay for the cost of repairs or replacement. This can save you a significant amount of money, especially if you have a large or expensive roof.

In addition to providing financial protection, the endorsement can also provide peace of mind. Knowing that your roof is protected from damage can give you peace of mind and allow you to sleep soundly at night.

Limitations

The Allstate Roof Surfaces Extended Coverage Endorsement provides valuable coverage for damage to your roof caused by hail, wind, and other covered perils. However, it is important to understand that the endorsement may not cover all types of roof damage.

- Excluded Perils

The endorsement may not cover damage caused by certain perils, such as earthquakes, floods, or acts of war.

- Roof Age

The endorsement may not cover damage to roofs that are older than a certain age, such as 15 or 20 years.

- Roof Condition

The endorsement may not cover damage to roofs that are in poor condition, such as roofs with missing or damaged shingles.

- Pre-Existing Damage

The endorsement may not cover damage that existed before the endorsement was added to the policy.

It is important to carefully review the terms and conditions of the endorsement to understand what is and is not covered. You should also talk to your insurance agent to make sure that you have the right coverage for your needs.

Exclusions

Allstate Roof Surfaces Extended Coverage Endorsement provides valuable coverage, but it's crucial to understand its limitations. One key aspect is its exclusions, which limit coverage for specific types of damage. This article examines various facets of these exclusions, exploring their implications and providing real-life examples.

- Natural Disasters

The endorsement often excludes damage caused by natural disasters such as earthquakes, floods, and hurricanes. These events can cause severe damage to roofs, but the endorsement may not provide coverage unless additional riders are purchased.

- Maintenance Issues

Exclusions may apply to damage resulting from poor maintenance or neglect. For instance, if a roof collapses due to lack of proper repairs or cleaning, the endorsement may not cover the damage.

- Pre-Existing Conditions

The endorsement may exclude coverage for damage that existed before the policy was issued. This means that if a roof has pre-existing issues, such as missing or damaged shingles, any subsequent damage caused by those issues may not be covered.

- Wear and Tear

The endorsement typically excludes coverage for gradual wear and tear. As roofs age, they naturally deteriorate, and the endorsement may not cover damage caused by this gradual process.

Understanding these exclusions is essential when evaluating the Allstate Roof Surfaces Extended Coverage Endorsement. Homeowners should carefully review the policy and consult with their insurance agent to ensure they have adequate coverage for their specific needs and circumstances.

Availability

The availability of the Allstate Roof Surfaces Extended Coverage Endorsement varies from state to state due to regulatory differences and insurance market conditions. This limited availability impacts the accessibility of enhanced roof protection for homeowners in certain regions.

The endorsement's unavailability in some states can pose challenges for homeowners seeking comprehensive coverage for their roofs. Without the endorsement, they may have limited options to protect their homes from specific perils like hail or wind damage, which can be prevalent in certain areas.

Real-life examples illustrate the practical significance of this availability issue. In states where the endorsement is unavailable, homeowners may face higher out-of-pocket costs for roof repairs or replacements following severe weather events. This can create financial burdens and potentially leave their homes vulnerable to damage.

Understanding the endorsement's availability limitations is crucial for homeowners when evaluating their insurance options. They should consult with their insurance agents to determine if the endorsement is available in their state and explore alternative coverage options if it is not. By being informed about the endorsement's availability, homeowners can make informed decisions to protect their homes and mitigate potential financial risks.

Importance

Within the context of "What Is Allstate Roof Surfaces Extended Coverage Endorsement", this aspect underscores the crucial role of the endorsement in safeguarding homeowners from substantial financial burdens resulting from unexpected events.

- Coverage for Repairs and Replacement

The endorsement provides coverage for repairs or replacement of damaged roof surfaces caused by covered perils, mitigating the significant costs associated with restoring the roof's integrity.

- Reduced Out-of-Pocket Expenses

By covering the costs of repairs or replacement, the endorsement reduces the financial burden on homeowners, preventing them from dipping into their savings or incurring high-interest debt to address roof damage.

- Peace of Mind

The endorsement provides homeowners with peace of mind, knowing that their roof is protected and that they won't face unexpected financial consequences in the event of a covered peril.

- Enhanced Home Value

A well-maintained roof enhances the overall value of a home. The endorsement helps maintain the roof's condition, potentially increasing the home's value in the long run.

In conclusion, the importance of the Allstate Roof Surfaces Extended Coverage Endorsement lies in its ability to shield homeowners from the financial burden of roof repairs or replacement, provide peace of mind, and contribute to the preservation of their home's value.

Endorsement

The endorsement is a critical component of "What Is Allstate Roof Surfaces Extended Coverage Endorsement" because it establishes a legally binding agreement between the homeowner and the insurance company. This agreement outlines the terms and conditions of the coverage, including the perils covered, the limits of coverage, and the responsibilities of both parties.

Real-life examples of the endorsement's importance include situations where homeowners have successfully filed claims for roof damage under the endorsement. In these cases, the endorsement served as the legal basis for the insurance company to provide coverage for the repairs or replacement of the roof.

Understanding the endorsement's role as a legally binding contract is crucial for homeowners because it provides them with the assurance that their roof is protected and that the insurance company is obligated to fulfill its coverage obligations.

In summary, the endorsement is an essential part of "What Is Allstate Roof Surfaces Extended Coverage Endorsement" because it establishes a legal framework for the coverage, ensuring that homeowners have the necessary protection against financial loss in the event of roof damage.

Frequently Asked Questions about Allstate Roof Surfaces Extended Coverage Endorsement

This section aims to address common questions and clarify aspects of the Allstate Roof Surfaces Extended Coverage Endorsement.

Question 1: What is the purpose of the Allstate Roof Surfaces Extended Coverage Endorsement?

Answer: The endorsement provides enhanced coverage for damage to your roof caused by covered perils, such as hail, wind, and other severe weather events.

Question 2: What are the benefits of adding the endorsement to my policy?

Answer: The endorsement offers peace of mind, financial protection against costly roof repairs or replacements, and can help maintain your home's value.

Question 3: Are all types of roof damage covered under the endorsement?

Answer: The endorsement typically covers damage caused by covered perils, but it may have exclusions for certain types of damage, such as pre-existing conditions or damage caused by earthquakes or floods.

Question 4: How much does the endorsement cost?

Answer: The cost of the endorsement varies depending on factors such as the size and location of your home, and the level of coverage you choose.

Question 5: Is the endorsement available in all states?

Answer: The availability of the endorsement may vary from state to state due to regulatory and insurance market conditions.

Question 6: How do I add the endorsement to my homeowners insurance policy?

Answer: You can contact your insurance agent or Allstate directly to discuss adding the endorsement to your policy.

These FAQs provide key insights into the Allstate Roof Surfaces Extended Coverage Endorsement, helping you make informed decisions about protecting your roof and home.

For further discussion, the next section will explore the claims process under this endorsement and provide tips for maximizing your coverage.

Tips for Maximizing Coverage

This section provides practical tips to help you maximize the coverage offered by the Allstate Roof Surfaces Extended Coverage Endorsement.

Tip 1: Review Your Policy: Carefully read your policy and endorsement to understand the covered perils, limits, and exclusions.

Tip 2: Maintain Your Roof: Regular maintenance and inspections can help prevent damage and extend the lifespan of your roof.

Tip 3: Document Existing Damage: Take photos or videos of any pre-existing roof damage to avoid coverage disputes.

Tip 4: Report Claims Promptly: Notify your insurance company promptly after a covered event to initiate the claims process.

Tip 5: Collect Evidence: Gather documentation, such as photos, estimates, and receipts, to support your claim.

Tip 6: Negotiate with Adjuster: Discuss the claim settlement with the insurance adjuster and negotiate a fair settlement that covers your expenses.

Tip 7: Consider Replacement Cost Coverage: This coverage ensures that you receive the full cost to replace your roof, regardless of its age.

By following these tips, you can maximize the coverage provided by the Allstate Roof Surfaces Extended Coverage Endorsement and protect your home from financial loss.

The next section will provide insights into the claims process under this endorsement, helping you navigate it effectively.

Conclusion

In exploring "What Is Allstate Roof Surfaces Extended Coverage Endorsement," this article has shed light on its purpose, benefits, and considerations. Key insights include the endorsement's ability to provide enhanced roof protection, the importance of understanding its coverage and limitations, and the value of maximizing its coverage potential through proactive measures and effective claims handling.

Overall, the Allstate Roof Surfaces Extended Coverage Endorsement offers homeowners valuable protection against costly roof repairs or replacements resulting from covered perils. By carefully evaluating its terms, maintaining their roofs, reporting claims promptly, and negotiating fair settlements, homeowners can ensure they receive the maximum benefits from this endorsement and safeguard their homes from financial loss.

- Bad Bunny Used To Make Mix Cds

- Wiki Biography Age Height Parents Nationality Boyfriend

- Who Is Natalie Tene What To Know

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Melissa Kaltveit Died Como Park Senior High

Amid Crisis, Allstate Helping Customers with Extended Coverage, Payment

Allstate's policies should worry you. The Weikum Group

Allstate Roof Replacement Policy (Coverage + More)