How Adam Hillman Built His Fortune: A Net Worth Deep Dive For Harper Lee Enthusiasts

Adam Hillman Net Worth: Understanding a Businessperson's Financial Standing

In the realm of business and finance, the net worth of an individual, such as Adam Hillman, holds significant importance. It offers insights into their financial stability and overall success. Adam Hillman, a renowned entrepreneur, has made headlines for his remarkable business ventures. His net worth is a subject of curiosity among financial analysts and the public alike.

Exploring Adam Hillman's net worth provides valuable information for investors, entrepreneurs, and anyone interested in understanding the financial dynamics of successful businesspeople. This article aims to delve into the details of Hillman's net worth, examining its components, relevance, and key historical developments that have shaped his financial trajectory.

- David Foster Net Worth From Grammy Winning

- Meet Maya Erskine S Parents Mutsuko Erskine

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Truth About Nadine Caridi Jordan Belfort S

- Matthew Cassina Dies In Burlington Motorcycle Accident

Adam Hillman Net Worth

The key aspects of Adam Hillman's net worth provide valuable insights into his financial standing and business success. These aspects encompass various dimensions, including:

- Assets

- Liabilities

- Income

- Investments

- Business ventures

- Financial ratios

- Historical trends

- Industry benchmarks

Examining these aspects helps analysts and investors assess Hillman's financial performance, risk profile, and overall wealth management strategies. Understanding the interplay between these factors provides a comprehensive view of his net worth and its implications for his business ventures.

Assets

Assets, a crucial component of Adam Hillman's net worth, represent the resources and valuables he owns. These assets contribute significantly to his overall financial standing and provide insights into his investment strategies and wealth management approaches.

- Does Robert Ri Chard Have A Wife

- Layke Leischner Car Accident Resident Of Laurel

- Wiki Biography Age Height Parents Nationality Boyfriend

- Noah Pc3a9rez Chris Perez Son Age

- Julia Dweck Dead And Obituary Nstructor Willow

- Cash and Cash Equivalents

Liquid assets readily convertible to cash, such as checking and savings accounts, money market accounts, and short-term certificates of deposit.

- Investments

Stocks, bonds, mutual funds, real estate, and other financial instruments that represent ownership or lending arrangements and have the potential to generate income or appreciate in value.

- Property

Real estate, including land, buildings, and other physical assets, which can provide rental income, capital appreciation, or both.

- Intellectual Property

Intangible assets such as patents, trademarks, copyrights, and trade secrets that grant exclusive rights to use and profit from creative works or inventions.

By analyzing the composition and value of Adam Hillman's assets, investors and financial analysts can gain insights into his risk tolerance, investment philosophy, and overall financial health. A diverse portfolio of assets, including a balance of liquid and illiquid investments, can provide stability and growth potential.

Liabilities

Liabilities represent the financial obligations and debts that Adam Hillman owes to other individuals or organizations. Understanding the nature and extent of his liabilities is crucial for assessing his overall financial health and net worth.

- Accounts Payable

Short-term obligations to suppliers, vendors, and other creditors for goods or services purchased on credit.

- Loans

Long-term debts owed to banks, financial institutions, or individuals, typically secured by collateral and requiring regular interest payments and eventual repayment of the principal.

- Taxes Payable

Obligations to government entities for taxes incurred but not yet paid, such as income taxes, property taxes, and sales taxes.

- Notes Payable

Formal written promises to repay a debt, often issued by businesses to borrow funds and typically bearing interest.

The composition and value of Adam Hillman's liabilities provide insights into his financial leverage, creditworthiness, and ability to meet his financial commitments. A high level of liabilities relative to assets can indicate a higher level of financial risk, while a manageable level of liabilities can be a sign of prudent financial management and access to capital for business growth.

Income

Income plays a pivotal role in determining Adam Hillman's net worth. It represents the inflow of funds that contribute to his overall financial well-being and ability to accumulate wealth. Adam Hillman's income is primarily generated through his business ventures, investments, and other income-generating activities.

The relationship between income and net worth is direct and causal. Higher income levels typically lead to a higher net worth, as more funds are available for savings, investments, and asset acquisition. Adam Hillman's success in generating substantial income through his business ventures has been a key driver of his increasing net worth over time.

Real-life examples of income within Adam Hillman's net worth include profits from his various business ventures, dividends from his investment portfolio, and royalties from his intellectual property. Understanding the connection between income and net worth is crucial for investors and financial analysts seeking to evaluate Adam Hillman's financial performance and growth potential.

In summary, income is a critical component of Adam Hillman's net worth, providing the foundation for his wealth accumulation. By analyzing his income sources and patterns, investors and analysts can gain insights into his financial trajectory, risk tolerance, and overall financial health.

Investments

Investments play a significant role in the composition of Adam Hillman's net worth, representing a substantial portion of his overall wealth. Hillman's investment strategies and the performance of his investment portfolio directly impact his financial standing and long-term wealth accumulation.

- Stocks

Investments in publicly traded companies through the purchase of shares, offering potential returns through capital appreciation and dividend income.

- Bonds

Fixed-income investments that provide regular interest payments and return of principal at maturity, offering a more conservative investment option with lower potential returns.

- Real Estate

Investments in land, buildings, and other property, offering potential rental income, capital appreciation, and diversification benefits.

- Venture Capital

Investments in early-stage, high-growth companies, offering the potential for substantial returns but also carrying higher risk.

The diversification of Adam Hillman's investment portfolio across these different asset classes helps to mitigate risk and enhance the overall return potential of his investments. His ability to identify and capitalize on investment opportunities has been a key factor in the growth of his net worth.

Business ventures

Business ventures lie at the heart of Adam Hillman's net worth, serving as the primary drivers of his wealth accumulation and overall financial success. Through his entrepreneurial endeavors and strategic investments, Hillman has built a diverse portfolio of businesses that contribute significantly to his net worth.

- Company Ownership

Ownership of companies, both public and private, provides Hillman with control over their operations and access to their profits, dividends, and other forms of income.

- Equity Investments

Investments in the equity of other businesses, such as venture capital or private equity, offer the potential for high returns but also carry higher risk.

- Real Estate Development

Investments in real estate development projects, including residential, commercial, and industrial properties, provide Hillman with rental income, capital appreciation, and diversification benefits.

- Advisory Roles

Hillman's expertise and experience are sought after by various businesses, and he often holds advisory roles, providing strategic guidance and insights in exchange for equity or other forms of compensation.

The success of Adam Hillman's business ventures has been instrumental in the growth of his net worth. His ability to identify and execute profitable opportunities, manage risk, and adapt to changing market conditions has been key to his financial achievements.

Financial ratios

Within the assessment of Adam Hillman's net worth, financial ratios play a crucial role in providing insights into the financial health and performance of his businesses. These ratios, calculated using specific formulas, offer valuable metrics for evaluating various aspects of his financial standing.

- Liquidity ratios

Measure the ability of Hillman's businesses to meet short-term obligations, such as the current ratio and quick ratio, indicating the availability of liquid assets relative to current liabilities.

- Solvency ratios

Assess the long-term financial stability of Hillman's businesses, including the debt-to-equity ratio and debt-to-asset ratio, providing insights into the extent to which debt is used to finance operations.

- Profitability ratios

Evaluate the efficiency and profitability of Hillman's businesses, such as gross profit margin and net profit margin, indicating the relationship between revenues and expenses.

- Valuation ratios

Determine the market value of Hillman's businesses relative to their financial performance, including price-to-earnings ratio and price-to-sales ratio, offering insights into investor sentiment and growth potential.

By analyzing these financial ratios, investors, analysts, and other stakeholders can gain a deeper understanding of Adam Hillman's net worth, assess the financial risks and opportunities associated with his businesses, and make informed decisions about potential investments or business dealings.

Historical trends

Historical trends play a significant role in understanding the evolution and composition of Adam Hillman's net worth. By examining historical data and economic conditions, we can gain valuable insights into the factors that have influenced his financial trajectory and overall wealth accumulation.

One of the key ways in which historical trends impact Adam Hillman's net worth is through the performance of his business ventures. Economic downturns, technological advancements, and changes in consumer behavior can have a direct effect on the profitability and value of his companies. For example, during the 2008 financial crisis, the value of Hillman's real estate holdings declined significantly, leading to a decrease in his overall net worth. Conversely, the rise of e-commerce has benefited Hillman's investments in technology-based businesses, contributing to an increase in his net worth.

Moreover, historical trends provide context for understanding the investment strategies employed by Adam Hillman. By analyzing historical market data and economic indicators, Hillman can make informed decisions about the allocation of his assets and the timing of his investments. For instance, during periods of economic uncertainty, Hillman may choose to invest more conservatively in bonds or real estate, while in periods of economic growth, he may invest more aggressively in stocks or venture capital.

Understanding the connection between historical trends and Adam Hillman's net worth is crucial for investors, analysts, and other stakeholders seeking to assess his financial performance and make informed decisions about potential investments or business dealings. By considering the historical context and the impact of economic conditions on Hillman's wealth, investors can gain a more comprehensive view of his financial standing and make more informed investment decisions.

Industry benchmarks

In assessing Adam Hillman's net worth, industry benchmarks serve as valuable reference points for evaluating his financial performance and comparing it to similar businesses within his industry. These benchmarks provide context and insights into the financial health, efficiency, and growth potential of Hillman's ventures.

- Revenue growth

Comparing the percentage change in Hillman's revenue over time to industry averages helps assess the growth trajectory of his businesses and their market share performance.

- Profitability margins

Analyzing Hillman's profit margins, such as gross and net profit margins, against industry benchmarks indicates the efficiency of his operations and his ability to generate profits.

- Return on investment

Evaluating the return on investment (ROI) generated by Hillman's businesses relative to industry norms provides insights into the effectiveness of his investment strategies and the value created for shareholders.

- Debt-to-equity ratio

Comparing Hillman's debt-to-equity ratio to industry benchmarks assesses his financial leverage and the extent to which he relies on debt financing, providing insights into his risk profile and financial stability.

By analyzing these industry benchmarks in relation to Adam Hillman's net worth, investors, analysts, and other stakeholders gain a comprehensive understanding of his financial performance, competitive positioning, and potential for future growth. Deviations from industry benchmarks may indicate areas for improvement or opportunities for strategic adjustments, enabling informed decision-making and risk assessment.

Frequently Asked Questions about Adam Hillman Net Worth

This FAQ section addresses common questions and provides clarifications regarding various aspects of Adam Hillman's net worth.

Question 1: How is Adam Hillman's net worth calculated?

Adam Hillman's net worth is calculated by taking the total value of his assets, such as investments, property, and business interests, and subtracting his liabilities, including debts and outstanding loans.

Question 2: What are the major sources of Adam Hillman's wealth?

Hillman's wealth primarily stems from his successful business ventures, particularly in the technology and real estate sectors. His investments in stocks, bonds, and private equity have also contributed significantly to his net worth.

Question 3: How has Adam Hillman's net worth changed over time?

Hillman's net worth has experienced significant growth over the years, driven by the success of his businesses and strategic investments. Market fluctuations and economic conditions have also influenced the value of his assets, leading to fluctuations in his overall net worth.

Question 4: What factors could potentially impact Adam Hillman's net worth in the future?

Future economic conditions, the performance of his businesses, and changes in investment strategies could potentially impact Hillman's net worth. Market volatility, industry trends, and personal financial decisions may also play a role in shaping his financial trajectory.

Question 5: How does Adam Hillman's net worth compare to others in his industry?

Hillman's net worth is substantial compared to many in his industry. His success in building and growing businesses has placed him among the wealthiest individuals in his field.

Question 6: What lessons can be learned from Adam Hillman's approach to wealth management?

Hillman's focus on diversification, calculated risk-taking, and long-term investment strategies offers valuable lessons for individuals seeking to manage their wealth effectively.

These FAQs provide insights into the key aspects of Adam Hillman's net worth, highlighting its composition, sources, and potential influencing factors. Understanding these dynamics helps investors, analysts, and other stakeholders make informed decisions and gain a deeper perspective on Hillman's financial standing.

The next section will delve into the investment strategies employed by Adam Hillman, examining his approach to asset allocation, risk management, and wealth preservation.

Tips for Understanding Adam Hillman's Net Worth

This section provides practical tips to enhance your understanding of Adam Hillman's net worth and its implications.

Tip 1: Examine the composition of his assets. Understand the types of assets he holds, their value, and how they contribute to his overall net worth.

Tip 2: Analyze his liabilities. Identify the types of debts and obligations he has, their terms, and how they impact his financial stability.

Tip 3: Track income sources. Determine the sources of his income, including business revenue, investments, and other income streams.

Tip 4: Evaluate investment strategies. Study the asset allocation, risk tolerance, and investment philosophy that guide his investment decisions.

Tip 5: Consider business ventures. Examine the performance and contributions of his various business ventures to his net worth.

Tip 6: Analyze financial ratios. Calculate and interpret financial ratios to assess the liquidity, solvency, profitability, and valuation of his businesses.

Tip 7: Review historical trends. Study past economic conditions and their impact on his net worth to understand the factors that have influenced its growth.

Tip 8: Compare industry benchmarks. Benchmark his financial performance against industry averages to identify areas of strength and weakness.

These tips provide a comprehensive approach to understanding the dynamics of Adam Hillman's net worth. By following these steps, you can gain valuable insights into his financial standing, investment strategies, and overall wealth management approach.

The following section will delve into the investment strategies employed by Adam Hillman, examining his approach to asset allocation, risk management, and wealth preservation.

Conclusion

This exploration of Adam Hillman's net worth provides valuable insights into his financial standing, investment strategies, and wealth management approach. Key takeaways include the diversification of his assets, his prudent use of debt, and his focus on long-term growth.

Understanding the dynamics of Adam Hillman's net worth goes beyond mere curiosity; it offers lessons for investors, entrepreneurs, and anyone interested in managing their wealth effectively. His approach to asset allocation, risk management, and wealth preservation provides a roadmap for building and sustaining financial success.

- Meet Ezer Billie White The Daughter Of

- Kathy Griffin S Husband Was An Unflinching

- Noah Pc3a9rez Chris Perez Son Age

- Who Is Jay Boogie The Cross Dresser

- Beloved Irish Father Clinton Mccormack Dies After

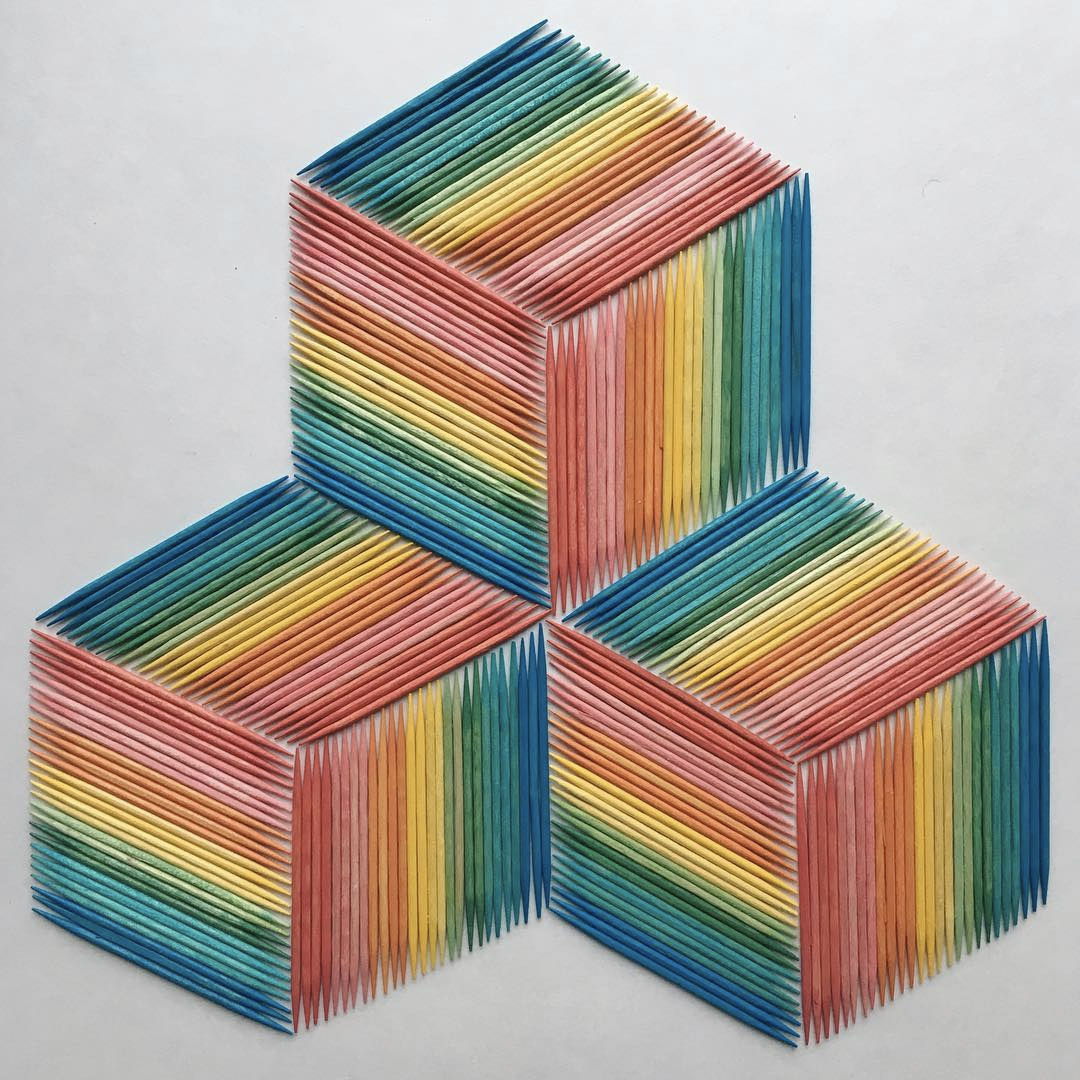

Meticulously Arranged Objects by Artist Adam Hillman BOOOOOOOM

Adam Hillman INAG I Need A Guide

Mercer Alumnus Adam Hillman achieves worldwide fame by his art work