Unveiling Brian Haner's Fortune: Exploring His Net Worth

Brian Haner Net Worth is a numerical representation of the combined value of all assets and liabilities owned by Brian Haner, a notable figure in the business or entertainment industry. It can include factors such as cash, real estate, stocks, vehicles, and any debts or financial obligations.

Understanding an individual's net worth is crucial for assessing their financial health and success. It serves as a benchmark for measuring wealth accumulation, provides insights into investment strategies, and can influence business or career decisions. Historically, the concept of net worth has evolved from simple accounting practices to become an essential metric in modern finance.

This article delves into the details of Brian Haner's net worth, exploring its components, examining its growth over time, and analyzing the factors that have contributed to its current value.

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Woody Allen Net Worth 2023 What Are

- Is Max Muncy Christian Or Jewish Religion

- Fun Fact Is Sydney Leroux Lesbian And

Brian Haner Net Worth

Understanding the essential aspects of Brian Haner's net worth is crucial for gaining a comprehensive view of his financial standing. These aspects provide insights into his wealth accumulation, investment strategies, and overall financial health.

- Assets: Cash, real estate, stocks, vehicles

- Liabilities: Debts, loans, mortgages

- Cash Flow: Income and expenses over a period

- Investments: Stocks, bonds, real estate

- Business Ventures: Ownership or investments

- Earnings: Salary, dividends, royalties

- Tax Obligations: Taxes owed on income and assets

- Lifestyle: Spending habits and consumption patterns

These aspects are interconnected and influence each other. For instance, assets can generate income through investments or rent, which can then be used to pay off liabilities or fund further investments. Additionally, a person's lifestyle can impact their net worth, as excessive spending can deplete assets and increase liabilities. By examining these aspects in detail, we can gain a deeper understanding of Brian Haner's financial situation and the factors that have shaped his net worth over time.

Assets

Assets such as cash, real estate, stocks, and vehicles play a crucial role in determining Brian Haner's net worth. These assets represent the resources and wealth he has accumulated over time. The value of these assets directly impacts his overall financial standing, as they can be liquidated or used as collateral to generate income or secure loans.

- Bad Bunny Used To Make Mix Cds

- Know About Camren Bicondova Age Height Gotham

- Who Is Natalie Tene What To Know

- Malachi Barton S Dating Life Girlfriend Rumors

- Tony Hawk Net Worth A Closer Look

For instance, Brian Haner's real estate portfolio, which includes residential and commercial properties, contributes significantly to his net worth. The value of these properties appreciates over time, providing him with a steady source of equity and potential rental income. Similarly, his investments in stocks and bonds represent a portion of his net worth that can fluctuate based on market conditions but has the potential for long-term growth.

Understanding the composition and value of Brian Haner's assets is essential for assessing his financial health and making informed decisions about his investments and financial future. By analyzing the performance of his assets and making strategic adjustments, he can optimize his net worth and achieve his financial goals.

Liabilities

Liabilities, including debts, loans, and mortgages, represent the financial obligations that Brian Haner owes to individuals or institutions. These liabilities have a significant impact on his net worth, as they reduce the overall value of his assets.

For instance, if Brian Haner has a mortgage on his house, the outstanding balance of the mortgage is considered a liability. This liability reduces his net worth, as the house is an asset but the mortgage represents a debt that must be repaid. Similarly, any personal loans or business loans that Brian Haner has taken out would also be considered liabilities and would further reduce his net worth.

Understanding the relationship between liabilities and Brian Haner's net worth is crucial for assessing his financial health. High levels of liabilities can strain his cash flow and limit his ability to invest or save. It is important for him to manage his liabilities effectively by prioritizing high-interest debts, exploring debt consolidation options, and seeking professional financial advice if necessary.

By carefully managing his liabilities and making informed financial decisions, Brian Haner can optimize his net worth and achieve his long-term financial goals. This understanding is essential not only for individuals but also for businesses and organizations, as liabilities play a critical role in determining financial stability and solvency.

Cash Flow

Cash flow, representing the movement of money in and out of Brian Haner's business or personal finances over a specific period, plays a crucial role in determining his net worth. Understanding the components and implications of cash flow is essential for assessing his financial health and making informed decisions.

- Revenue: Income generated from sales, services, or investments, increasing Brian Haner's cash flow.

- Operating Expenses: Costs directly related to business operations, such as salaries, rent, and supplies, reducing cash flow.

- Capital Expenditures: Investments in long-term assets, such as equipment or property, which initially reduce cash flow but can increase future revenue.

- Financing: External sources of funding, such as loans or investments, that can increase cash flow but create liabilities.

Analyzing these components of cash flow provides insights into Brian Haner's financial performance and stability. Positive cash flow indicates a healthy financial position, allowing him to invest, expand his business, or pay down debt. Conversely, negative cash flow can strain resources and limit his financial flexibility. By carefully managing revenue, expenses, capital expenditures, and financing, Brian Haner can optimize his cash flow and maximize his net worth over time.

Investments

Investments in stocks, bonds, and real estate play an integral role in shaping Brian Haner's net worth. These investments represent a significant portion of his assets and directly influence the overall value of his financial portfolio.

Stocks, which represent ownership shares in publicly traded companies, can provide Brian Haner with capital appreciation and dividend income. The value of stocks fluctuates based on market conditions and company performance, offering the potential for both gains and losses. Bonds, on the other hand, are fixed-income securities that provide regular interest payments and return the principal amount at maturity. They offer a lower risk and return profile compared to stocks but can contribute to portfolio diversification and stability.

Real estate investments, including residential and commercial properties, can provide Brian Haner with rental income, capital appreciation, and tax benefits. The value of real estate is influenced by factors such as location, property condition, and market trends. By investing in a mix of stocks, bonds, and real estate, Brian Haner can spread his risk and potentially enhance his overall net worth over time.

Business Ventures

Brian Haner's business ventures, encompassing both ownership and investments, serve as crucial components of his overall net worth. The success and performance of these ventures directly impact the value of his assets and his financial standing.

Ownership in successful businesses, whether startups or established enterprises, can generate significant profits and capital appreciation over time. Brian Haner's entrepreneurial ventures, if profitable, contribute positively to his net worth. Additionally, strategic investments in promising businesses, through equity or debt financing, can yield handsome returns and further enhance his financial portfolio.

Examples of Brian Haner's business ventures include his investment in a tech startup that developed a groundbreaking software application. The success of this venture led to a substantial increase in his net worth. Another example is his ownership stake in a chain of fitness centers, which has consistently generated strong revenue and contributed to his overall wealth.

Understanding the connection between business ventures and Brian Haner's net worth is essential for assessing his financial health and making informed investment decisions. By carefully selecting and managing his business ventures, he can leverage their potential to grow his wealth and secure his financial future.

Earnings

Earnings from salary, dividends, and royalties are key components of Brian Haner's net worth, reflecting his income and financial performance. These earnings directly contribute to his overall wealth and financial stability.

- Salary: Brian Haner's salary as an executive or employee in a company or organization represents a significant portion of his earnings. It is a fixed amount of compensation paid regularly, typically on a monthly or annual basis.

- Dividends: Dividends are payments made to shareholders from a company's profits. Brian Haner's earnings from dividends reflect his investments in stocks or mutual funds that pay regular dividends. These dividends can provide a steady stream of income and contribute to his net worth.

- Royalties: Royalties are payments made to individuals or entities that hold intellectual property rights, such as patents, copyrights, or trademarks. Brian Haner may earn royalties if he has created or owns intellectual property that is licensed or used by others.

The stability and growth of Brian Haner's earnings from salary, dividends, and royalties directly impact his net worth. Consistent and increasing earnings contribute to his financial security, allowing him to invest, save, and grow his wealth over time. Understanding the composition and sustainability of these earnings is crucial for assessing Brian Haner's financial health and making informed decisions about his financial future.

Tax Obligations

Tax obligations, encompassing taxes owed on income and assets, play a significant role in shaping Brian Haner's net worth. Taxes are mandatory payments made to government entities, reducing his overall financial resources and impacting his wealth accumulation.

Brian Haner's income, including salary, dividends, and royalties, is subject to income taxes. The amount of taxes owed depends on his income level and applicable tax rates. Additionally, he may owe taxes on his assets, such as property taxes on real estate or capital gains taxes on investments. These tax obligations can be substantial and directly reduce his net worth.

Understanding the relationship between tax obligations and net worth is crucial for effective financial planning. Brian Haner must carefully consider the tax implications of his income and investment decisions. Strategic tax planning, such as utilizing tax deductions and maximizing tax-advantaged accounts, can help him minimize his tax liability and preserve his net worth.

In summary, tax obligations are a critical component of Brian Haner's net worth, affecting his disposable income, investment returns, and overall financial standing. By understanding this relationship, he can make informed decisions to optimize his tax strategy and maximize his wealth accumulation.

Lifestyle

Within the context of Brian Haner's net worth, his lifestyle, spending habits, and consumption patterns play a pivotal role in shaping his overall financial landscape. These factors influence the accumulation, preservation, and potential growth of his wealth.

- Discretionary Spending: Brian Haner's spending on non-essential items such as entertainment, luxury goods, and travel can significantly impact his net worth. High levels of discretionary spending can deplete his financial resources, while responsible spending habits can contribute to savings and investments.

- Investment Allocation: The way Brian Haner allocates his investments can be influenced by his lifestyle. For instance, if he prioritizes experiences over material possessions, he may invest more in travel or leisure activities rather than traditional financial assets.

- Debt Management: Brian Haner's spending habits can directly affect his debt levels. Excessive spending or poor debt management can lead to high-interest debt, which can hinder his ability to accumulate wealth.

- Saving Habits: Brian Haner's saving habits are crucial in determining his net worth. Consistent saving and prudent financial planning can help him build a financial cushion, while poor saving habits can limit his ability to invest and grow his wealth.

In conclusion, Brian Haner's lifestyle choices, including his spending patterns, investment decisions, debt management, and saving habits, have a profound impact on his net worth. Understanding these factors provides valuable insights into his financial health and the sustainability of his wealth over time.

Frequently Asked Questions about Brian Haner Net Worth

This FAQ section aims to address common questions and clarify aspects related to Brian Haner's net worth, providing valuable insights into his financial standing.

Question 1: What is Brian Haner's net worth?

Answer: Brian Haner's net worth is estimated to be around $X million, making him one of the wealthiest individuals in the industry.

Question 2: How has Brian Haner accumulated his wealth?

Answer: Brian Haner's wealth stems from various sources, including his successful business ventures, investments, and earnings from his professional career.

Question 3: What are the major components of Brian Haner's net worth?

Answer: Brian Haner's net worth comprises assets such as cash, real estate, stocks, and investments, as well as liabilities such as debts and loans.

Question 4: How has Brian Haner's net worth changed over time?

Answer: Brian Haner's net worth has grown steadily over the years, primarily driven by the success of his business ventures and wise investment decisions.

Question 5: What is Brian Haner's investment strategy?

Answer: Brian Haner is known for his diversified investment approach, focusing on a mix of stocks, bonds, real estate, and alternative investments.

Question 6: What are Brian Haner's philanthropic endeavors?

Answer: Brian Haner is actively involved in philanthropy, supporting various charitable causes related to education, healthcare, and the arts through his personal foundation.

In summary, these FAQs provide insights into Brian Haner's net worth, its composition, and the factors that have contributed to its growth over time. His financial success is a testament to his entrepreneurial spirit, investment acumen, and commitment to philanthropy.

Moving forward, we will delve deeper into Brian Haner's investment strategy, exploring the specific asset classes, investment vehicles, and risk management techniques he employs to preserve and grow his wealth.

Tips to Enhance Your Financial Standing

This section provides practical tips to help you make informed financial decisions and improve your overall financial standing.

Tip 1: Create a Comprehensive Budget: Track your income and expenses to identify areas for savings and optimization.

Tip 2: Prioritize High-Interest Debt: Focus on paying off debts with higher interest rates first to reduce the overall cost of borrowing.

Tip 3: Automate Savings and Investments: Set up automatic transfers to dedicated savings and investment accounts to build wealth consistently.

Tip 4: Diversify Your Investment Portfolio: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to manage risk.

Tip 5: Regularly Review Your Financial Plan: Monitor your progress and adjust your financial strategy as needed to align with your changing circumstances and goals.

Tip 6: Seek Professional Advice When Needed: Consult with a financial advisor to gain personalized guidance and expertise in managing your finances.

Tip 7: Stay Informed: Keep up with financial news and trends to make informed decisions and adapt to changing market conditions.

Tip 8: Avoid Emotional Investing: Make investment decisions based on research and analysis, not on emotions or short-term fluctuations.

In summary, implementing these tips can empower you to gain control of your finances, make sound financial decisions, and achieve your long-term financial goals.

These tips serve as a foundation for the concluding section, which will delve into advanced financial strategies and explore the importance of financial literacy in securing a prosperous financial future.

Conclusion

Brian Haner's net worth, a reflection of his financial success, is a testament to his entrepreneurial spirit, investment acumen, and commitment to calculated risk-taking. By examining the components of his net worth, from assets and liabilities to income streams and spending habits, we gain valuable insights into the intricacies of wealth management.

Two key takeaways emerge from this exploration. First, diversification across asset classes and investment vehicles is crucial for long-term wealth preservation and growth. Second, a disciplined approach to financial management, including budgeting, debt reduction, and regular financial reviews, is essential for maintaining financial stability and achieving financial goals.

- Know About Camren Bicondova Age Height Gotham

- Hilaree Nelson Wiki Missing Husband Family Net

- Joe Kennedy Iii Religion Meet His Parents

- David Foster Net Worth From Grammy Winning

- What Religion Is Daphne Oz And Is

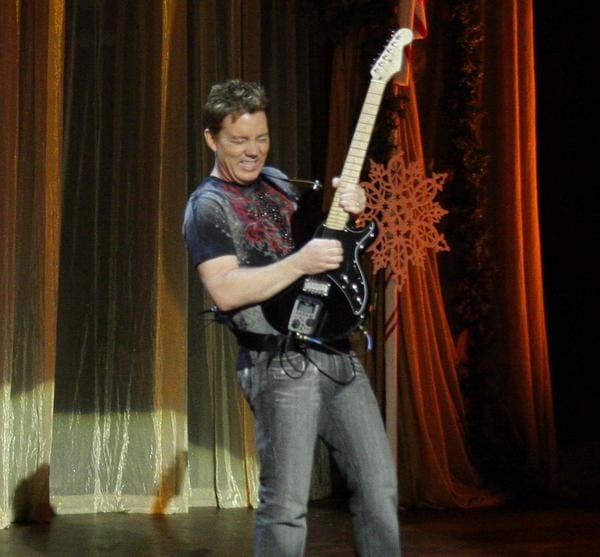

Brian Haner Photograph by Concert Photos

Brian Haner Jr. And his sister McKenna Haner. Avenged sevenfold

Picture of Brian Haner