How To Build A Net Worth Like Carlos Santos: Expert Tips For Financial Success

Carlos Santos Net Worth, a quantifiable representation of an individual's financial standing, measures the combined value of all assets minus outstanding liabilities. For example, a renowned businessman with extensive investments, property holdings, and minimal debts might possess a substantial net worth.

Assessing net worth proves crucial for evaluating financial stability, securing loans, and making informed investment decisions. Historically, the concept has evolved with the advent of modern banking systems and sophisticated financial instruments.

This article delves into the intricacies of Carlos Santos's net worth, exploring his wealth accumulation strategies, investments, and personal financial journey.

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- All About Dmx S Son Tacoma Simmons

- Simona Halep Early Life Career Husband Net

- Zeinab Harake Boyfriend Who Is She Dating

- How To Make Water Breathing Potion In

Carlos Santos Net Worth

Understanding the essential aspects of Carlos Santos's net worth is crucial for gaining a comprehensive view of his financial status and wealth accumulation strategies.

- Assets: Real estate, investments, cash

- Liabilities: Loans, mortgages, debts

- Income: Earnings from businesses, investments, endorsements

- Expenses: Personal, business, taxes

- Investments: Stocks, bonds, real estate, venture capital

- Business ventures: Ownership stakes, partnerships, ventures

- Financial management: Tax strategies, investment diversification

- Lifestyle: Personal spending habits, charitable contributions

These aspects are interconnected and influence each other. For instance, high-performing investments can increase assets, while debt repayment reduces liabilities. Understanding their interplay provides a holistic view of Carlos Santos's financial position and wealth management strategies.

Assets

Assets form the foundation of Carlos Santos's net worth, representing the totality of his valuable possessions. They encompass real estate, investments, and cash, each contributing uniquely to his financial standing.

- Layke Leischner Car Accident Resident Of Laurel

- New Roms Xci Nsp Juegos Nintendo Switch

- Antony Varghese Wife Net Worth Height Parents

- Wwe Billy Graham Illness Before Death Was

- Who Is Hunter Brody What Happened To

- Real estate: Properties, land, and buildings constitute a substantial portion of Carlos Santos's assets. These investments offer potential appreciation in value, rental income, and tax benefits.

- Investments: Stocks, bonds, mutual funds, and other securities form a diversified portfolio that generates passive income through dividends, interest, and capital gains.

- Cash: Liquid assets such as cash and cash equivalents provide immediate access to funds for expenses, investments, or emergencies.

- Other assets: Additional assets like intellectual property, artwork, or collectibles may also contribute to Carlos Santos's overall net worth.

The composition and value of these assets play a critical role in determining Carlos Santos's financial strength and flexibility. Their careful management and diversification mitigate risks, maximize returns, and contribute to the growth of his net worth.

Liabilities

Liabilities, encompassing loans, mortgages, and debts, represent financial obligations that Carlos Santos owes to external parties. They directly impact his net worth by reducing its overall value. When liabilities exceed assets, an individual's net worth becomes negative, indicating insolvency.

Liabilities play a dual role in Carlos Santos's financial landscape. On the one hand, they can facilitate wealth creation by financing investments in real estate, businesses, or other ventures that have the potential to generate income and appreciate in value. On the other hand, excessive liabilities can strain financial resources, limit investment opportunities, and increase financial risk.

For instance, a substantial mortgage on a property can reduce Carlos Santos's net worth while simultaneously providing him with a place to live or an investment that could increase in value over time. Conversely, high-interest debts, such as credit card balances or personal loans, can erode his net worth and hinder his ability to save and invest.

Understanding the relationship between liabilities and Carlos Santos's net worth is crucial for making informed financial decisions. Careful management of liabilities, including debt consolidation, refinancing, and responsible borrowing, is essential for preserving and growing his wealth.

Income

Income, encompassing earnings from businesses, investments, and endorsements, serves as the lifeblood of Carlos Santos's net worth, providing the financial resources necessary for wealth accumulation and financial security.

- Business ventures: Carlos Santos's business ventures, ranging from real estate development to technology startups, generate substantial income through profits, dividends, and capital gains.

- Investment returns: His diversified investment portfolio, spanning stocks, bonds, and alternative assets, provides passive income through dividends, interest, and capital appreciation.

- Endorsement deals: As a prominent figure in his industry, Carlos Santos commands lucrative endorsement deals with reputable brands, bolstering his income streams.

- Royalties and intellectual property: Income from royalties on creative works or intellectual property rights further contributes to his overall earnings.

These income sources cumulatively fuel Carlos Santos's net worth, enabling him to expand his business ventures, invest in growth opportunities, and maintain a comfortable lifestyle. Moreover, a consistent and growing income stream provides financial stability, reduces reliance on debt, and facilitates long-term wealth creation.

Expenses

Expenses, encompassing personal, business, and tax obligations, play a crucial role in determining Carlos Santos's net worth and overall financial well-being. Every dollar spent on expenses directly reduces his net worth, highlighting the importance of expense management in wealth creation and preservation.

Personal expenses, such as housing, transportation, food, and entertainment, are essential for maintaining a comfortable lifestyle. However, excessive personal spending can deplete financial resources and hinder savings and investment. Balancing personal expenses with long-term financial goals is crucial for Carlos Santos to sustain his wealth.

Business expenses, including salaries, marketing costs, and equipment purchases, are necessary for operating and growing his ventures. Strategic allocation of business expenses can enhance profitability, increase revenue, and ultimately contribute to net worth growth. However, uncontrolled expenses can erode profit margins and jeopardize financial stability.

Taxes, both personal and business-related, represent a significant expense category. Tax liabilities can vary depending on income levels, investments, and applicable tax rates. Carlos Santos must carefully navigate tax laws and optimize his tax strategies to minimize tax burdens while ensuring compliance.

In conclusion, understanding the relationship between expenses and Carlos Santos's net worth is essential for effective financial management. By controlling personal expenses, optimizing business expenses, and implementing sound tax strategies, he can maximize net worth growth, preserve capital, and achieve long-term financial success.

Investments

As a prominent figure in the business world, Carlos Santos recognizes the transformative power of investments. His strategic allocation of assets across a diversified portfolio of stocks, bonds, real estate, and venture capital has played a pivotal role in building and sustaining his substantial net worth.

Stocks, particularly those of well-established companies, offer the potential for long-term capital appreciation and dividend income. Bonds, on the other hand, provide stability and regular interest payments. Real estate investments, whether direct ownership or through real estate investment trusts (REITs), can generate rental income, capital gains, and tax benefits. Venture capital investments, while higher risk, have the potential for exponential returns.

For instance, Carlos Santos's early investment in a technology startup that later became a global tech giant has significantly contributed to his overall net worth. His real estate portfolio, spanning residential, commercial, and industrial properties, provides a steady stream of passive income and capital appreciation. Additionally, his investment in a diversified bond portfolio mitigates risk and generates a reliable income.

Comprehending the significance of investments in relation to Carlos Santos's net worth empowers investors to make informed decisions about their financial strategies. Diversification, strategic asset allocation, and a long-term investment horizon are crucial elements for building wealth and achieving financial independence.

Business ventures

Carlos Santos's business ventures, encompassing ownership stakes, partnerships, and other entrepreneurial endeavors, stand as cornerstones of his remarkable net worth. These ventures extend across various industries, from technology and real estate to entertainment and hospitality, showcasing his astute investment acumen and ability to identify and capitalize on growth opportunities.

The success of Carlos Santos's business ventures directly translates into the expansion of his net worth. Ownership stakes in thriving companies yield substantial returns in the form of dividends, capital gains, and increased equity value. Strategic partnerships with like-minded entrepreneurs and investors provide access to new markets, resources, and expertise, amplifying the potential for wealth creation.

One notable example is Santos's investment in a tech startup specializing in artificial intelligence. His early recognition of the transformative potential of AI led to significant returns as the company became a global leader in the field. Similarly, his partnership with a renowned hotelier resulted in a chain of luxury hotels that have become renowned for their exceptional service and profitability.

Comprehending the interdependence between Carlos Santos's business ventures and his net worth offers valuable insights for aspiring investors and business leaders. By identifying high-growth industries, forging strategic alliances, and executing sound investment strategies, individuals can harness the power of business ventures to build and grow their wealth. Moreover, this understanding underscores the importance of calculated risk-taking, innovation, and perseverance in the pursuit of financial success.

Financial management

Carlos Santos's financial management acumen, particularly his deft implementation of tax strategies and investment diversification, has served as a cornerstone in the growth of his net worth. Understanding the cause-and-effect relationship between these strategies and his overall wealth is crucial for aspiring investors and business leaders.

Tax strategies play a critical role in preserving and growing net worth. Santos employs a team of tax experts to optimize his tax liabilities, ensuring compliance while minimizing the impact of taxes on his investments and income. This strategic approach allows him to retain more of his earnings, reinvesting the savings into wealth-generating ventures.

Investment diversification, another pillar of Santos's financial management strategy, involves spreading investments across a range of asset classes, such as stocks, bonds, real estate, and venture capital. This strategy reduces risk, as the performance of different asset classes tends to vary over time. By diversifying his portfolio, Santos mitigates the impact of market fluctuations and enhances the overall stability of his net worth.

Comprehending the practical applications of this understanding enables individuals to make informed decisions about their financial strategies. By implementing tax-saving strategies and diversifying their investments, they can maximize wealth accumulation and minimize the erosion of their net worth. Ultimately, these insights empower investors with the knowledge and tools to navigate the complexities of financial management and achieve their long-term financial goals.

Lifestyle

The examination of Carlos Santos's lifestyle unveils the intricate interplay between his personal spending habits and charitable contributions, offering insights into how these choices shape his overall net worth. This exploration encompasses various facets, including:

- Personal Expenses: Santos's personal spending habits, ranging from luxury purchases to travel, reflect his affluence and personal preferences. However, mindful spending and avoiding excessive indulgences contribute to the preservation of his wealth.

- Investments in Experiences: Beyond material possessions, Santos values investments in experiences that enrich his life, such as travel, education, and attending cultural events. These investments enhance his well-being while potentially expanding his network and knowledge.

- Philanthropy: Santos actively engages in philanthropy, donating to charitable causes aligned with his values. Strategic giving not only supports meaningful causes but also offers tax benefits and strengthens his reputation as a socially responsible individual.

- Balancing Wealth and Purpose: Santos recognizes the duality of wealth, balancing his personal enjoyment with a commitment to making a positive impact on society. This approach ensures that his net worth serves both his individual aspirations and the greater good.

Understanding these facets highlights the dynamic relationship between "Lifestyle: Personal spending habits, charitable contributions" and "Carlos Santos Net Worth." Calculated spending, investments in meaningful experiences, strategic philanthropy, and a commitment to balancing wealth and purpose contribute to the sustainable growth and positive impact of Santos's net worth.

Frequently Asked Questions

This section addresses common inquiries and provides clarification on various aspects of "Carlos Santos Net Worth," offering a deeper understanding of the topic.

Question 1: What are the primary sources of Carlos Santos's wealth?

Santos's wealth stems from a combination of successful business ventures, strategic investments in stocks, real estate, and venture capital, as well as endorsements and royalties.

Question 2: How does Carlos Santos manage his substantial net worth?

Santos employs a team of financial experts to implement tax-saving strategies, optimize investments, and manage his overall financial portfolio, ensuring its growth and preservation.

Question 3: What role does philanthropy play in Carlos Santos's financial strategy?

Santos believes in giving back to society and actively supports charitable causes aligned with his values. His strategic philanthropy not only makes a positive impact but also contributes to tax benefits and enhances his reputation.

Question 4: How does Carlos Santos's lifestyle impact his net worth?

Santos maintains a balance between personal enjoyment and mindful spending, avoiding excessive indulgences that could deplete his wealth. He also invests in experiences and education that enrich his life and expand his knowledge.

Question 5: What are the key factors contributing to the growth of Carlos Santos's net worth?

Santos's astute business acumen, strategic investments, financial management skills, and commitment to calculated risk-taking have all played significant roles in the growth of his net worth.

Question 6: How can individuals learn from Carlos Santos's financial strategies?

Understanding the principles behind Santos's financial decisions, such as diversification, tax optimization, and strategic philanthropy, can provide valuable insights for individuals seeking to build and manage their wealth effectively.

These FAQs shed light on the multifaceted aspects of "Carlos Santos Net Worth," providing a comprehensive overview of its sources, management, and impact on Santos's lifestyle and philanthropic endeavors.

The next section delves deeper into the intricacies of Carlos Santos's investment strategies, exploring the specific choices and techniques that have contributed to his wealth accumulation.

Tips to Enhance Your Financial Strategy

This section provides actionable tips inspired by Carlos Santos's financial strategies, empowering you to make informed decisions and build your wealth.

Tip 1: Diversify Your Investments: Spread your investments across different asset classes to reduce risk and enhance returns.

Tip 2: Implement Tax-Saving Strategies: Consult with financial experts to optimize your tax liabilities and maximize your wealth.

Tip 3: Invest in High-Growth Sectors: Identify emerging industries and invest in companies poised for growth potential.

Tip 4: Manage Your Lifestyle Mindfully: Avoid excessive spending and focus on meaningful experiences that enrich your life.

Tip 5: Seek Mentorship and Education: Surround yourself with experienced professionals and continuously expand your financial knowledge.

Tip 6: Embrace Calculated Risk-Taking: Assess opportunities with a balanced approach, recognizing that calculated risks can lead to substantial rewards.

Implementing these tips can help you build a solid financial foundation, preserve your wealth, and achieve long-term financial success.

The following section explores the significance of financial planning and how it can empower you to navigate economic challenges and achieve your financial goals.

Conclusion

This comprehensive exploration of "Carlos Santos Net Worth" unveiled the intricate interplay of strategic investments, financial management, and personal choices that have contributed to his remarkable wealth accumulation. Key insights include the importance of diversification, tax optimization, and calculated risk-taking, all of which are interconnected and essential for building and preserving net worth.

Understanding these principles empowers individuals to make informed financial decisions, navigate economic challenges, and achieve their long-term financial goals. The success of individuals like Carlos Santos serves as a testament to the transformative power of financial literacy and the pursuit of wealth creation.

- Who Is Natalie Tene What To Know

- Wwe Billy Graham Illness Before Death Was

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Tony Hawk Net Worth A Closer Look

- Patrick Alwyn Age Height Weight Girlfriend Net

Carlos Santos

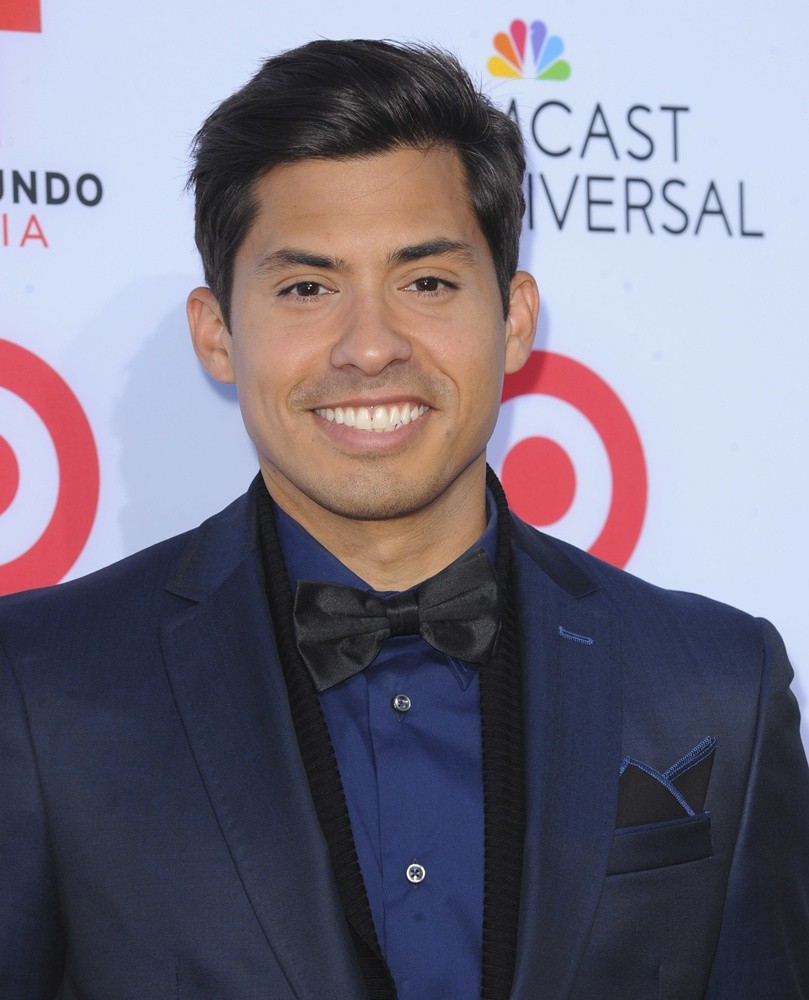

Carlos Santos Picture 1 The 2013 NCLR ALMA Awards

Carlos Santos, President of Ethos Asset Management Inc Entrepreneur