Discover Chrystie Crownover's Net Worth And Financial Success

Noun: Chrystie Crownover Net Worth is the total value of all financial assets owned by the American actress, producer, and entrepreneur, Chrystie Crownover. For instance, her net worth would be the summation of the market value of her homes, business stakes, and liquid assets (e.g., money in bank accounts, stocks, and bonds) minus her liabilities (e.g., debts, loans, and mortgages).

Understanding Chrystie Crownover Net Worth is important because it provides insight into her financial success and standing. It can be used to compare her wealth against other individuals, gauge her financial stability, and evaluate her investment and spending decisions. A key development in the history of net worth is the widespread adoption of electronic financial management tools, which have simplified the process of tracking and managing financial assets and liabilities.

This article delves into the details of Chrystie Crownover Net Worth, exploring her income sources, investment strategies, and other factors that have contributed to her financial status.

- Is Sam Buttrey Jewish Religion And Ethnicity

- Woody Allen Net Worth 2023 What Are

- Antony Varghese Wife Net Worth Height Parents

- Truth About Nadine Caridi Jordan Belfort S

- Meet Jordyn Hamilton Dave Portnoy S Ex

Chrystie Crownover Net Worth

Understanding the essential aspects of Chrystie Crownover Net Worth is crucial for gaining a comprehensive view of her financial standing and success. These key aspects include:

- Income sources

- Investment strategies

- Assets

- Liabilities

- Financial management

- Philanthropy

- Tax implications

- Estate planning

These aspects are interconnected and provide a holistic understanding of Chrystie Crownover's financial situation. Her income sources, such as acting, producing, and business ventures, generate the cash flow that she uses to acquire assets and cover her liabilities. Her investment strategies determine how she allocates her assets to maximize returns and minimize risks. Financial management involves tracking and managing her financial transactions to ensure her financial stability. Philanthropy reflects her commitment to giving back to society, while tax implications and estate planning are essential considerations for preserving and passing on her wealth.

Income sources

Income sources are fundamental to understanding Chrystie Crownover Net Worth as they represent the means by which she generates wealth. Her diverse income streams contribute to her overall financial stability and success.

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Wwe Billy Graham Illness Before Death Was

- Has Claire Mccaskill Had Plastic Surgery To

- Najiba Faiz Video Leaked On Telegram New

- Is Shauntae Heard Fired From Her Job

- Acting

Chrystie Crownover's acting career has been a significant source of income. Her roles in films and television shows, such as "American Horror Story" and "The Mindy Project," have generated substantial earnings.

- Producing

As a producer, Crownover has been involved in several successful projects, including the film "The 40-Year-Old Virgin" and the television series "Arrested Development." These ventures have contributed to her net worth.

- Business ventures

Crownover has also ventured into business, co-founding the production company Crownover Productions. This company has produced films, television shows, and other projects, adding to her income sources.

- Endorsements

Crownover's fame has led to endorsement deals with various brands, including L'Oreal and Coca-Cola. These partnerships provide her with additional income and enhance her net worth.

The combination of these income sources has enabled Chrystie Crownover to build a substantial net worth, allowing her to pursue her passions, invest in new ventures, and support philanthropic causes.

Investment strategies

Investment strategies play a crucial role in shaping Chrystie Crownover Net Worth, as they determine how she allocates her financial resources to maximize returns and achieve her financial goals. Her investment approach encompasses a combination of asset classes, risk management techniques, and long-term planning.

- Diversification

Diversification is a cornerstone of Crownover's investment strategy. She spreads her investments across various asset classes, such as stocks, bonds, real estate, and commodities, to reduce overall risk and enhance returns.

- Risk management

Crownover employs prudent risk management strategies to mitigate potential losses in her investment portfolio. She sets appropriate risk limits, employs hedging techniques, and regularly monitors her investments to make timely adjustments.

- Long-term investing

Crownover adopts a long-term investment horizon, focusing on capital growth and compounding returns over extended periods. She believes in the power of staying invested through market fluctuations to capture the full potential of her investments.

- Alternative investments

In addition to traditional asset classes, Crownover explores alternative investments, such as private equity, venture capital, and hedge funds, to diversify her portfolio and seek higher returns.

The combination of these investment strategies enables Chrystie Crownover to navigate the complexities of financial markets, preserve her wealth, and continue to grow her net worth over time. Her prudent approach, coupled with a disciplined investment philosophy, has contributed significantly to her financial success.

Assets

Assets play a pivotal role in understanding Chrystie Crownover Net Worth, representing the valuable resources and properties she owns. These assets contribute to her overall wealth and financial security, providing a foundation for future growth and opportunities.

- Real Estate

Crownover owns multiple residential and commercial properties, including her primary residence, investment properties, and land holdings. These assets appreciate in value over time and generate rental income, contributing to her net worth.

- Stocks and Bonds

Crownover invests in a diversified portfolio of stocks and bonds to grow her wealth. Stocks represent ownership in publicly traded companies, while bonds are loans made to governments or corporations that pay interest over time.

- Intellectual Property

Crownover's acting and producing work generate intellectual property rights, such as copyrights and trademarks. These assets have value and can be licensed or sold to generate additional income.

- Business Interests

Crownover is a co-founder of the production company Crownover Productions. Her stake in this business contributes to her net worth and provides her with a source of ongoing income.

Collectively, these assets form a substantial part of Chrystie Crownover Net Worth, providing her with financial stability, growth potential, and a foundation for future endeavors. Her prudent investment decisions and strategic management of her assets have contributed significantly to her overall financial success.

Liabilities

Liabilities are a crucial component of Chrystie Crownover Net Worth, representing her financial obligations and debts. They are essential to consider when evaluating her overall financial health and stability, as they can impact her ability to generate wealth and achieve her financial goals.

Liabilities can arise from various sources, such as mortgages, loans, credit card debt, and unpaid taxes. When Crownover incurs a liability, it reduces her net worth because it represents a claim against her assets. For example, if she takes out a mortgage to purchase a property, the mortgage balance becomes a liability on her financial statement, decreasing her net worth.

Managing liabilities effectively is critical for Crownover's financial success. High levels of debt can strain her cash flow, limit her investment opportunities, and increase her financial risk. To mitigate these risks, she employs various strategies, such as prioritizing high-interest debts, negotiating favorable loan terms, and diversifying her income sources to ensure she can meet her financial obligations.

Understanding the relationship between liabilities and Chrystie Crownover Net Worth is essential for investors, creditors, and financial analysts. By carefully examining her liabilities, they can assess her creditworthiness, evaluate her financial leverage, and make informed decisions regarding her financial well-being. Moreover, this understanding can help individuals manage their own liabilities more effectively, promoting financial stability and long-term wealth creation.

Financial management

Financial management plays a vital role in shaping and preserving Chrystie Crownover Net Worth. It encompasses the processes and strategies used to manage her financial resources, including income, assets, liabilities, and investments. Effective financial management is crucial for long-term financial success and stability.

- Budgeting

Crownover's financial management strategy begins with creating a budget that outlines her income and expenses. This budget helps her track her cash flow, identify areas for potential savings, and make informed financial decisions.

- Investment planning

Managing her investments is a key aspect of Crownover's financial management. She has a diversified investment portfolio that includes stocks, bonds, real estate, and alternative investments. This diversification helps mitigate risk and maximize returns.

- Tax planning

Crownover's financial management also involves tax planning strategies. She utilizes legal means to reduce her tax liability and optimize her financial position. This includes utilizing tax-advantaged accounts and exploring tax deductions and credits.

- Estate planning

Estate planning is a crucial part of financial management for Crownover. She has created a comprehensive estate plan that outlines her wishes for the distribution of her assets after her death. This plan includes a will, trusts, and other legal documents to ensure her assets are managed and distributed according to her intentions.

Effective financial management is an ongoing process that allows Crownover to maintain her wealth, plan for the future, and achieve her financial goals. By managing her finances prudently, she can navigate market fluctuations, minimize risks, and maximize her net worth over the long term.

Philanthropy

Philanthropy plays a significativa role in shaping Chrystie Crownover Net Worth, extending beyond mere financial contributions to encompass a deep commitment to social responsibility. Her philanthropic endeavors are driven by a desire to create positive change and support causes close to her heart.

While financial resources are essential for philanthropic activities, it is the passion and dedication that make Crownover's philanthropy truly impactful. Her understanding of societal issues and her willingness to use her platform and resources for good are invaluable assets that enhance her overall net worth in a meaningful way.

Examples of Crownover's philanthropy include her support for organizations dedicated to education, healthcare, and the environment. She has established scholarship funds, donated to hospitals, and participated in environmental cleanup initiatives. These actions demonstrate her commitment to investing in the well-being of her community and the world at large.

Understanding the connection between philanthropy and Chrystie Crownover Net Worth provides valuable insights into the importance of social responsibility and the power of wealth to create positive change. It highlights the multifaceted nature of net worth, which encompasses not only financial assets but also the values and contributions that individuals make to society.

Tax implications

Tax implications play a significant role in shaping Chrystie Crownover Net Worth, affecting the overall value of her financial assets. Understanding these implications is crucial for managing her wealth effectively and making informed financial decisions.

- Taxable Income

Crownover's taxable income is the foundation for calculating her tax liability. It includes income from all sources, such as acting, producing, and investments. By optimizing her income streams and utilizing tax deductions, she can reduce her taxable income and minimize her tax burden.

- Tax Rates

Crownover's tax liability is determined by applicable tax rates, which vary depending on her income level and tax filing status. Understanding the progressive nature of tax rates is crucial for planning her financial strategies and making informed decisions about investments and charitable contributions.

- Capital Gains Taxes

When Crownover sells assets, such as stocks or real estate, she may be subject to capital gains taxes. These taxes are levied on the profit realized from the sale and can have a significant impact on her net worth. By understanding the tax implications of capital gains, she can plan her investments and sales accordingly.

- Estate Taxes

Estate taxes are imposed on the value of an individual's assets at the time of their death. Crownover can utilize estate planning strategies, such as trusts and charitable donations, to minimize the impact of estate taxes on her net worth and ensure her assets are distributed according to her wishes.

Managing tax implications effectively allows Crownover to preserve her wealth, maximize her income streams, and plan for the future. By considering the various tax factors outlined above, she can make informed financial decisions and optimize her net worth over the long term.

Estate planning

Estate planning encompasses a range of legal strategies that individuals implement to manage the distribution of their assets upon their death. It plays a critical role in preserving and enhancing Chrystie Crownover Net Worth, ensuring that her wealth is distributed according to her wishes and minimizes the impact of estate taxes.

As part of her estate plan, Crownover may establish trusts, designate beneficiaries for her retirement accounts, and create a will outlining her specific instructions for asset distribution. These measures provide her with control over how her assets are managed and distributed after her passing, ensuring that her legacy aligns with her values and financial goals.

For instance, Crownover could establish a charitable trust to support causes close to her heart, ensuring that a portion of her wealth is dedicated to making a positive impact on society. Alternatively, she could create a trust for her children, providing financial support and protecting their inheritance from potential creditors or lawsuits.

Understanding the connection between estate planning and Chrystie Crownover Net Worth highlights the importance of proactive wealth management. By implementing a comprehensive estate plan, Crownover can preserve her wealth, minimize tax liabilities, and ensure that her assets are distributed according to her wishes. This understanding empowers individuals to take control of their financial legacy and make informed decisions that protect their wealth and support their loved ones.

Frequently Asked Questions

This FAQ section provides answers to common questions and clarifies aspects related to Chrystie Crownover Net Worth, offering insights into her financial standing and wealth management strategies.

Question 1: What are the primary sources of Chrystie Crownover's income?

Answer: Chrystie Crownover's income primarily stems from her successful acting career, including roles in films and television shows. Additionally, she generates income through producing projects, business ventures, and endorsement deals.

Question 2: How does Chrystie Crownover manage her diverse income streams?

Answer: Crownover employs a diversified investment strategy to manage her income. She allocates her earnings across various asset classes, including stocks, bonds, and real estate, to mitigate risk and maximize returns. Additionally, she invests in alternative investments, such as private equity and venture capital.

Question 3: What is the significance of estate planning in Chrystie Crownover's financial strategy?

Answer: Estate planning plays a crucial role in preserving and enhancing Crownover's net worth. Through trusts, designated beneficiaries, and a comprehensive will, she ensures that her assets are distributed according to her wishes upon her passing. Estate planning also minimizes the impact of estate taxes, protecting her wealth and legacy.

Question 4: How does philanthropy impact Chrystie Crownover's overall net worth?

Answer: Crownover's philanthropic endeavors extend beyond financial contributions, aligning with her values and social responsibility. By supporting causes related to education, healthcare, and the environment, she creates a positive impact on society. While philanthropy reduces her net worth in the short term, it enhances her legacy and contributes to a greater good.

Question 5: What are the potential risks and challenges associated with managing a high net worth?

Answer: Managing a high net worth involves navigating market volatility, tax implications, and potential legal or financial disputes. It requires prudent decision-making, risk management, and a team of trusted financial advisors to preserve and grow wealth effectively.

Question 6: How can individuals learn from Chrystie Crownover's financial strategies?

Answer: While Crownover's financial strategies are tailored to her unique circumstances, they offer valuable lessons for individuals seeking to manage their wealth effectively. Diversification, long-term investing, and proactive planning are key principles that can be applied to personal finance, regardless of net worth.

These FAQs provide a deeper understanding of Chrystie Crownover Net Worth, highlighting the various factors that contribute to her financial success and the strategies she employs to manage her wealth. As we delve further into this topic, we will explore additional aspects of her financial journey and discuss how her net worth has evolved over time.

Tips for Understanding Chrystie Crownover Net Worth

This section provides practical tips to help you better understand Chrystie Crownover Net Worth, its significance, and how it is managed. By implementing these tips, you can gain valuable insights into the financial strategies of high-net-worth individuals and apply relevant principles to your own financial journey.

Tip 1: Track Your Income and Expenses: Monitor all sources of income and expenses to gain a clear picture of your financial situation. This will help you identify areas for potential savings and make informed decisions about your spending.

Tip 2: Diversify Your Investments: Spread your investments across different asset classes, such as stocks, bonds, real estate, and alternative investments, to reduce risk and maximize returns.

Tip 3: Understand Tax Implications: Consider the tax implications of your financial decisions, such as investment strategies and estate planning. Seek professional advice to optimize your tax efficiency and minimize your tax liability.

Tip 4: Plan for the Future: Develop a comprehensive financial plan that outlines your long-term financial goals, including retirement planning and estate planning. This will help you make informed decisions and ensure your financial security in the future.

Tip 5: Seek Professional Advice: Consult with a financial advisor or wealth manager to gain personalized advice tailored to your specific financial situation and goals.

Tip 6: Stay Informed: Keep up-to-date with financial news and trends to make informed decisions about your investments and financial strategies.

Tip 7: Be Patient and Disciplined: Building wealth takes time and discipline. Avoid making impulsive decisions or chasing short-term gains, and focus on long-term strategies that align with your financial goals.

Tip 8: Give Back: Consider incorporating philanthropy into your financial plan. Supporting causes you care about can provide personal fulfillment and create a lasting impact on society.

By following these tips, you can develop a deeper understanding of Chrystie Crownover Net Worth and its implications. Remember that managing wealth effectively requires a combination of knowledge, planning, and discipline.

In the concluding section of this article, we will discuss the importance of financial literacy and how it can empower individuals to make informed decisions about their financial future.

Conclusion

This comprehensive exploration of Chrystie Crownover Net Worth has provided valuable insights into the financial strategies and wealth management principles that have contributed to her success. Key takeaways include the importance of income diversification, prudent investment strategies, and proactive planning. Crownover's commitment to philanthropy demonstrates the positive impact that individuals can make through their financial resources.

Understanding the nuances of net worth is essential for managing wealth effectively, navigating financial markets, and achieving long-term financial goals. By implementing sound financial strategies and seeking professional advice when needed, individuals can emulate the principles that have shaped Chrystie Crownover's financial journey and work towards building their own financial security and success.

- Tlc S I Love A Mama S

- Bad Bunny Used To Make Mix Cds

- Noah Pc3a9rez Chris Perez Son Age

- How Tall Is Markiplier The Truth About

- Patrick Alwyn Age Height Weight Girlfriend Net

Who were Caitlyn Jenner's wives? Love life with Chrystie Crownover

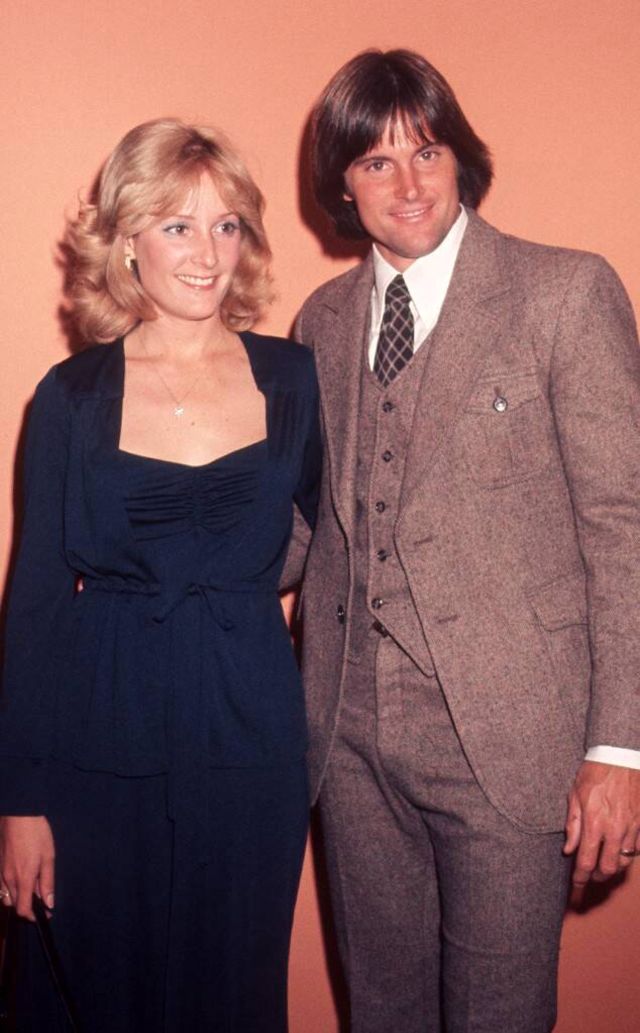

Lovely Photos of Bruce Jenner and His First Wife Chrystie Crownover

Chrystie Crownover RealityTV MRD Wiki Fandom