How To Calculate Darren Lewis Net Worth

Darren Lewis Net Worth, a numerical figure, quantifies the estimated total value of Darren Lewis's financial assets and liabilities. For instance, if Lewis owns $500,000 in stocks and has $100,000 in debt, his net worth would be $400,000.

Understanding net worth is crucial for assessing an individual's financial health and solvency. It aids in decision-making related to investments, , and estate planning. Historically, the concept of net worth has its roots in accounting practices, where it represented the residual value of assets after deducting liabilities.

This article delves into the intricacies of Darren Lewis's net worth, exploring factors that contribute to its calculation, assessing its significance, and providing insights into his financial status.

- Tammy Camacho Obituary A Remarkable Life Remembered

- Meet Ezer Billie White The Daughter Of

- Claudia Sampedro Wags Miami Age Engaged Husband

- Truth About Nadine Caridi Jordan Belfort S

- Jasprit Bumrah Injury Update What Happened To

Darren Lewis Net Worth

Understanding the essential aspects of Darren Lewis's net worth holds significant importance in assessing his overall financial health and stability. These aspects encompass various dimensions, including assets, liabilities, income streams, and investment strategies.

- Assets: Properties, investments, and other valuable possessions

- Liabilities: Debts and obligations owed

- Income: Earnings from employment, investments, and other sources

- Investments: Stocks, bonds, and real estate holdings

- Cash: Liquid funds readily available

- Savings: Funds set aside for future use

- Debt: Loans, mortgages, and other financial obligations

- Expenses: Recurring costs incurred

- Net Worth: The resulting value after subtracting liabilities from assets

Exploring these aspects provides comprehensive insights into Lewis's financial situation. By evaluating the composition of his assets and liabilities, one can gauge his liquidity, solvency, and risk tolerance. Understanding his income sources and investment strategies sheds light on his earning potential and growth prospects. Ultimately, examining these factors collectively offers a holistic view of Darren Lewis's financial well-being.

Assets

Assets, encompassing properties, investments, and other valuable possessions, constitute the cornerstone of Darren Lewis's net worth. As the building blocks of his financial standing, assets represent the resources and wealth he has accumulated over time. The value of these assets directly influences his overall net worth, with a positive correlation between asset value and net worth.

- Malachi Barton S Dating Life Girlfriend Rumors

- What Is Sonia Acevedo Doing Now Jamison

- Beloved Irish Father Clinton Mccormack Dies After

- New Roms Xci Nsp Juegos Nintendo Switch

- Has Claire Mccaskill Had Plastic Surgery To

A prime example of this relationship is Lewis's real estate portfolio. His ownership of multiple properties, including residential and commercial buildings, contributes significantly to his net worth. The value of these properties appreciates over time, leading to an increase in his overall net worth. Moreover, rental income generated from these properties provides a steady stream of passive income, further enhancing his financial stability.

Beyond real estate, Lewis's investments in stocks, bonds, and mutual funds diversify his asset portfolio and mitigate risk. The performance of these investments directly impacts his net worth. Favorable market conditions can lead to capital appreciation, boosting his net worth, while downturns can have an adverse effect. Understanding the dynamics of these assets and their contribution to Lewis's net worth is crucial for assessing his financial health and making informed decisions regarding his investment strategy.

Liabilities

Within the context of Darren Lewis's net worth, liabilities represent the debts and obligations he owes to individuals or institutions. Understanding the composition and extent of these liabilities is essential for assessing his overall financial health and solvency.

- Mortgages: Loans secured by real estate, typically used to finance the purchase of a home or investment property.

- Business Loans: Funds borrowed to support business operations, such as expansion, inventory purchases, or equipment upgrades.

- Personal Loans: Unsecured loans used for various personal expenses, such as debt consolidation, home renovations, or unexpected costs.

- Credit Card Debt: Revolving debt incurred through the use of credit cards, often carrying high interest rates.

The presence and magnitude of these liabilities can significantly impact Darren Lewis's net worth. High levels of debt can strain his cash flow, limit his ability to invest, and increase his vulnerability to financial distress. Conversely, managing liabilities effectively, such as paying down debt and maintaining a low debt-to-income ratio, can improve his financial stability and contribute positively to his net worth.

Income

Income, encompassing earnings from employment, investments, and other sources, plays a pivotal role in determining Darren Lewis's net worth. As the primary means of generating wealth and accumulating assets, income is a critical component of his overall financial well-being. A consistent and substantial income stream provides the foundation for building and maintaining a strong net worth.

Lewis's income from employment, such as his salary or wages, forms a stable base for his net worth. A higher income allows him to allocate more funds toward savings, investments, and debt repayment, thereby increasing his net worth over time. Additionally, income from investments, such as dividends from stocks or interest from bonds, provides a passive income stream that further contributes to his net worth.

Real-life examples illustrate the connection between income and net worth. For instance, Lewis's decision to invest a portion of his income in a rental property generated additional income through rent payments. This income stream not only increased his net worth but also diversified his income sources, reducing his reliance on a single source of income.

Understanding the relationship between income and net worth is crucial for individuals seeking to improve their financial health. By maximizing income through career advancement, smart investments, and exploring additional income streams, individuals can positively impact their net worth and achieve their financial goals.

Investments

Investments in stocks, bonds, and real estate holdings play a critical role in shaping Darren Lewis's net worth. These investments represent a significant portion of his assets and have the potential to generate substantial returns over time. The value of these investments directly correlates with his net worth, making them a key component of his financial well-being.

Lewis's investment strategy is diversified across various asset classes, reducing risk and enhancing the potential for long-term growth. His stock portfolio consists of a mix of blue-chip companies and growth stocks, providing a balance of stability and upside potential. Bond investments offer regular income and stability, while real estate holdings provide diversification and the potential for appreciation.

A notable example of Lewis's real estate investments is his ownership of a commercial building in a prime location. The steady rental income from this property not only adds to his monthly cash flow but also contributes to the overall value of his net worth. Additionally, the property has appreciated in value over time, further boosting his net worth.

Understanding the connection between investments and net worth is crucial for individuals seeking to build wealth and secure their financial future. By investing wisely and diversifying across asset classes, individuals can increase their net worth and achieve their long-term financial goals.

Cash

Cash, encompassing liquid funds readily available, forms a critical component of Darren Lewis's net worth. Its significance lies in providing immediate access to funds for various purposes, enhancing financial flexibility and resilience.

- Emergency Fund: A dedicated portion of cash set aside for unexpected expenses or financial emergencies, ensuring financial stability during unforeseen circumstances.

- Short-Term Investments: Cash held in highly liquid investments, such as money market accounts or short-term bonds, providing a balance between accessibility and potential returns.

- Transaction Buffer: Cash readily available for day-to-day expenses and transactions, eliminating the need for frequent withdrawals from less liquid investments.

Maintaining a healthy level of cash contributes positively to Darren Lewis's net worth by providing a safety net, enabling opportunistic investments, and facilitating smooth financial operations. It serves as a buffer against unexpected financial setbacks, allowing him to navigate challenges without compromising his long-term financial goals. Moreover, having cash on hand empowers him to seize investment opportunities that may arise unexpectedly, potentially enhancing his net worth further.

Savings

In the realm of Darren Lewis's net worth, savings hold a pivotal position, representing funds meticulously set aside for future use. These accumulated funds serve as a bedrock for long-term financial security, enabling him to navigate unforeseen circumstances and pursue aspirations.

- Emergency Fund: A dedicated portion of savings earmarked for unexpected expenses or financial setbacks, ensuring stability during life's unforeseen challenges.

- Retirement Savings: Contributions made towards a retirement account, such as a 401(k) or IRA, accumulate over time to provide financial security during the golden years.

- Educational Savings: Funds set aside to cover the rising costs of higher education, whether for Darren Lewis himself or his loved ones.

- Investment Savings: A portion of savings allocated for investment purposes, with the potential to generate growth and further enhance Darren Lewis's net worth.

These various facets of savings collectively contribute to Darren Lewis's financial well-being. They provide a safety net, facilitate long-term goals, and serve as a foundation for future financial success. By prioritizing savings and managing them prudently, Darren Lewis strengthens his overall net worth and positions himself for a financially secure future.

Debt

Within the larger framework of Darren Lewis's net worth, debt, encompassing loans, mortgages, and other financial obligations, plays a significant role. Understanding the composition and extent of his debt provides insights into his overall financial health and solvency.

- Mortgages: Loans secured by real estate, often used to finance the purchase of a home or investment property. Mortgages typically have long repayment periods and can be a substantial component of an individual's debt.

- Business Loans: Funds borrowed to support business operations, such as expansion, inventory purchases, or equipment upgrades. Business loans can be secured or unsecured and have varying interest rates and repayment terms.

- Personal Loans: Unsecured loans used for various personal expenses, such as debt consolidation, home renovations, or unexpected costs. Personal loans often have higher interest rates than secured loans and shorter repayment periods.

- Credit Card Debt: Revolving debt incurred through the use of credit cards, often carrying high interest rates. Credit card debt can accumulate quickly and become a significant financial burden if not managed responsibly.

The presence and magnitude of these debt obligations can significantly impact Darren Lewis's net worth. High levels of debt can strain his cash flow, limit his ability to invest, and increase his vulnerability to financial distress. Conversely, managing debt effectively, such as paying down debt and maintaining a low debt-to-income ratio, can improve his financial stability and contribute positively to his net worth.

Expenses

Understanding the expenses that Darren Lewis incurs on a recurring basis is crucial for assessing his overall financial health and net worth. These expenses represent ongoing financial obligations that impact his cash flow and ability to accumulate wealth.

- Housing Costs: Regular payments towards rent or mortgage, property taxes, and homeowners insurance, which can be significant components of monthly expenses.

- Transportation Costs: Expenses related to owning and operating vehicles, including car payments, fuel, maintenance, and insurance, can vary depending on lifestyle and location.

- Utilities: Ongoing expenses for essential services such as electricity, gas, water, and trash removal, which can fluctuate based on usage and location.

- Healthcare Costs: Regular premiums for health insurance, as well as co-pays, deductibles, and other medical expenses, contribute to overall healthcare costs.

Managing these recurring expenses effectively is essential for Darren Lewis to maintain a positive cash flow and achieve his financial goals. Careful budgeting, negotiation of expenses, and exploring cost-saving alternatives can help him optimize his financial situation and contribute to the growth of his net worth. Understanding the composition and implications of his recurring expenses empowers him to make informed decisions and prioritize his financial commitments.

Net Worth

Net worth, defined as the resulting value after subtracting liabilities from assets, holds significant importance in understanding Darren Lewis's financial well-being. It serves as a comprehensive indicator of his overall financial health, providing insights into his financial strength and stability.

The relationship between net worth and Darren Lewis's financial situation is closely intertwined. A positive net worth signifies that his assets exceed his liabilities, indicating financial stability and the potential for wealth accumulation. Conversely, a negative net worth suggests that his liabilities outweigh his assets, potentially leading to financial strain and reduced financial flexibility.

For instance, if Darren Lewis owns assets worth $1 million but has liabilities amounting to $500,000, his net worth would be $500,000. This positive net worth indicates his financial strength and capacity to withstand financial setbacks or pursue investment opportunities. Understanding his net worth empowers him to make informed financial decisions, prioritize debt repayment, and plan for future financial goals.

The practical applications of understanding the relationship between net worth and Darren Lewis's financial situation are far-reaching. It enables him to assess his financial progress over time, track the effectiveness of his financial strategies, and make necessary adjustments to optimize his financial health. By regularly evaluating his net worth, Darren Lewis gains valuable insights into his financial standing, allowing him to make informed decisions that contribute to his long-term financial success.

FAQs on Darren Lewis Net Worth

This section aims to address frequently asked questions and clarify key aspects related to Darren Lewis's net worth, providing comprehensive insights into his financial standing.

Question 1: What is Darren Lewis's net worth?

As of [date], Darren Lewis's net worth is estimated to be around [amount]. However, it's important to note that net worth is subject to fluctuations due to changes in asset values, liabilities, and other financial factors.

Question 2: How did Darren Lewis accumulate his wealth?

Darren Lewis's wealth primarily stems from his successful career as a [profession], where he has earned substantial income. Additionally, his investments in real estate, stocks, and other assets have contributed to the growth of his net worth.

Question 3: What is the composition of Darren Lewis's assets?

Darren Lewis's assets include a diversified portfolio of real estate properties, stocks, bonds, and cash. The value of these assets collectively contributes to his overall net worth.

Question 4: Does Darren Lewis have any significant liabilities?

Information regarding Darren Lewis's liabilities is not publicly available. However, it's likely that he has some level of debt, such as mortgages or business loans, which would be factored into his net worth calculation.

Question 5: How does Darren Lewis manage his net worth?

Darren Lewis likely employs a team of financial advisors and accountants to manage his net worth. They assist him in making sound investment decisions, optimizing his financial strategies, and minimizing tax liabilities.

Question 6: What is the significance of Darren Lewis's net worth?

Darren Lewis's net worth serves as an indicator of his overall financial well-being and success. It provides insights into his financial stability, investment acumen, and capacity to generate wealth.

These FAQs offer a deeper understanding of Darren Lewis's net worth, highlighting its composition, sources, and significance.

In the next section, we will explore factors that may impact Darren Lewis's net worth in the future, such as changes in the real estate market or his investment strategies.

Tips for Understanding and Managing Net Worth

This section presents actionable tips to help individuals understand and manage their net worth effectively.

Tip 1: Track Your Assets and Liabilities: Maintain a detailed record of your assets (e.g., cash, investments, real estate) and liabilities (e.g., mortgages, loans). This provides a clear picture of your financial position.

Tip 2: Calculate Your Net Worth Regularly: Calculate your net worth periodically (e.g., monthly, quarterly) by subtracting your liabilities from your assets. Monitoring your net worth helps you track your financial progress.

Tip 3: Diversify Your Investments: Reduce risk by spreading your investments across different asset classes (e.g., stocks, bonds, real estate). Diversification helps mitigate the impact of market fluctuations.

Tip 4: Reduce Unnecessary Expenses: Identify areas where you can cut back on non-essential spending. Reducing expenses increases your cash flow and allows you to save more.

Tip 5: Seek Professional Advice: Consider consulting with a financial advisor to gain personalized guidance on managing your net worth. They can help you develop a tailored financial plan.

Tip 6: Stay Informed: Keep up-to-date with financial news and trends. This knowledge empowers you to make informed decisions about your investments and financial strategy.

Tip 7: Rebalance Your Portfolio Regularly: As your financial situation changes, adjust your investment portfolio to maintain your desired risk-return profile. Rebalancing ensures your portfolio aligns with your financial goals.

Tip 8: Plan for the Future: Consider your long-term financial goals (e.g., retirement, education funding). Plan and save accordingly to secure your financial future.

By following these tips, individuals can gain a better understanding of their net worth, make informed financial decisions, and work towards achieving their financial goals.

In the concluding section, we will discuss the importance of reviewing and updating your financial plan regularly to adapt to changing circumstances and ensure its alignment with your financial objectives.

Conclusion

In exploring Darren Lewis's net worth, this article has shed light on the multifaceted nature of financial well-being. It emphasized the significance of understanding the composition of one's assets and liabilities, as well as the impact of income, investments, savings, debt, and expenses on overall net worth.

Key takeaways include the importance of diversifying investments to mitigate risk, managing debt effectively to improve financial stability, and regularly reviewing and updating financial plans to align with changing circumstances. These elements are interconnected, and a holistic approach to financial management is crucial for long-term success.

- Singer Sami Chokri And Case Update As

- Know About Camren Bicondova Age Height Gotham

- Claudia Sampedro Wags Miami Age Engaged Husband

- Meet Maya Erskine S Parents Mutsuko Erskine

- Did Tori Bowie Baby Survive What Happened

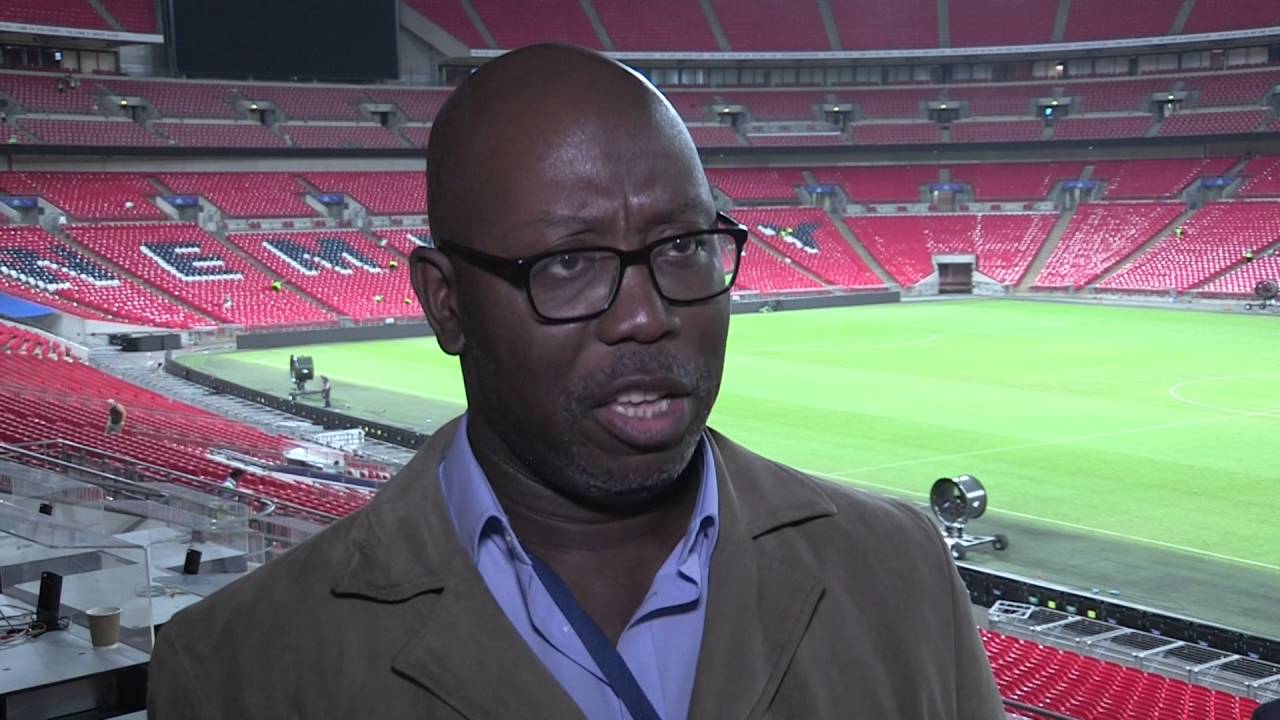

Darren Lewis on Spurs at Wembley YouTube

Phil Dowding PR client news March 2012

Darren Lewis shares your experiences of being black in Britain Darren