Dave Winfield Net Worth: A Path To Financial Success

Dave Winfield Net Worth, a measure of the total value of an individual's assets, is an important financial indicator.

It reflects an individual's financial success and can impact their access to credit, investments, and other financial opportunities.

Historically, net worth has been used to assess an individual's financial health and stability. This article will delve into the details of Dave Winfield's net worth, examining its components and exploring its significance.

- Beloved Irish Father Clinton Mccormack Dies After

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Kathy Griffin S Husband Was An Unflinching

- Benoni Woman Shows R4 000 Grocery Haul

- Zeinab Harake Boyfriend Who Is She Dating

Dave Winfield Net Worth

Dave Winfield's net worth, an indicator of his financial well-being, encompasses various key aspects that provide a comprehensive view of his financial standing.

- Assets

- Investments

- Income

- Expenses

- Liabilities

- Cash flow

- Debt

- Financial planning

Understanding these aspects is crucial for assessing Winfield's overall financial health, as they reflect his ability to generate income, manage expenses, and plan for the future. These factors not only impact his personal finances but also influence his investment decisions and financial security.

Assets

Assets play a crucial role in determining Dave Winfield's net worth, acting as a cornerstone of his financial well-being. They represent the resources he owns and controls, contributing positively to his overall financial position.

- Hilaree Nelson Wiki Missing Husband Family Net

- Wwe Billy Graham Illness Before Death Was

- Carson Peters Berger Age Parents Mom Rape

- Matthew Cassina Dies In Burlington Motorcycle Accident

- Is Duncan Crabtree Ireland Gay Wiki Partner

Assets can take various forms, including cash equivalents, real estate, investments, and personal belongings. Winfield's net worth is heavily influenced by the value of these assets, as they represent potential sources of liquidity and future income. For instance, if Winfield sells a property for a profit, the proceeds from the sale would increase his net worth.

The management of assets is essential for Winfield's financial success. By diversifying his assets and making sound investment decisions, he can mitigate risks and potentially grow his net worth over time. Assets provide a buffer against financial emergencies and allow Winfield to pursue his financial goals, such as retirement planning or philanthropic endeavors.

Investments

Investments are crucial components of Dave Winfield's net worth, acting as engines for growth and potential sources of passive income. Winfield's investment decisions directly impact the trajectory of his net worth, as they can appreciate in value over time or generate regular returns.

Winfield's investments encompass a range of asset classes, including stocks, bonds, real estate, and private equity. Each asset class carries its own risk and return profile, allowing Winfield to diversify his portfolio and mitigate risk. For example, Winfield's investment in a rental property may provide him with a steady stream of rental income while also appreciating in value over the long term.

Understanding the connection between investments and Dave Winfield's net worth is essential for assessing his financial well-being. By making sound investment decisions and managing his portfolio effectively, Winfield can increase his net worth and secure his financial future. This understanding also highlights the importance of financial literacy and the role of investments in wealth creation.

Income

Income, the lifeblood of Dave Winfield's net worth, represents the financial inflows that contribute to his overall wealth. It serves as the primary driver of Winfield's financial growth and stability, directly influencing his net worth's trajectory.

Winfield's income streams encompass various sources, including salaries, bonuses, and investment returns. These inflows positively impact his net worth by increasing his financial resources and providing him with the means to acquire assets, invest, and plan for the future. For instance, a substantial signing bonus from a major league baseball contract would significantly boost Winfield's net worth, allowing him to invest in real estate or other ventures.

Understanding the relationship between income and Dave Winfield's net worth is essential for assessing his financial well-being. By maximizing his income potential and managing his finances prudently, Winfield can increase his net worth, enhance his financial security, and achieve his long-term financial goals. This understanding also emphasizes the importance of financial literacy and income-generating strategies in wealth creation.

Expenses

Expenses, a crucial aspect of Dave Winfield's net worth, represent the financial outflows that reduce his overall wealth. Understanding the nature and components of Winfield's expenses is vital for assessing his financial well-being and identifying areas for optimization.

- Fixed Expenses: Regular, predictable expenses such as mortgage or rent payments, insurance premiums, and property taxes. These expenses are essential and typically remain constant over time.

- Variable Expenses: Expenses that fluctuate based on usage or consumption, such as utilities (electricity, gas, water), groceries, and entertainment. These expenses can vary significantly from month to month.

- Discretionary Expenses: Non-essential expenses that can be adjusted or eliminated without affecting Winfield's basic needs. These expenses include dining out, travel, and luxury purchases.

- Unexpected Expenses: Unforeseen expenses that can arise suddenly, such as medical emergencies or car repairs. These expenses can disrupt Winfield's financial plan and impact his net worth.

Managing expenses effectively is key to preserving and growing Dave Winfield's net worth. By controlling discretionary expenses, optimizing variable expenses, and planning for unexpected expenses, Winfield can minimize financial outflows and maximize his net worth over time. Expense management is an ongoing process that requires discipline and a commitment to financial well-being.

Liabilities

Within the comprehensive assessment of Dave Winfield's net worth, liabilities represent financial obligations that reduce his overall financial standing. They encompass various forms of debt, each with its own unique characteristics and implications for Winfield's financial well-being.

- Loans: Winfield may have outstanding loans, such as mortgages, auto loans, or personal loans. These loans represent contractual obligations to repay borrowed funds, along with interest, over a specified period.

- Accounts Payable: Winfield's business ventures may involve accounts payable, which are unpaid bills owed to suppliers or vendors. These obligations must be fulfilled to maintain and avoid late payment penalties.

- Deferred Income Taxes: If Winfield has received income that has not yet been taxed, this amount may be recorded as a liability until the tax liability becomes due.

- Lawsuits or Judgments: In the event of legal disputes or judgments against Winfield, the resulting financial obligations would be reflected as liabilities.

Understanding the nature and extent of Winfield's liabilities is crucial for evaluating his financial health and making informed decisions. By effectively managing his liabilities, Winfield can minimize their impact on his net worth and preserve his financial stability.

Cash flow

Cash flow, a vital aspect of Dave Winfield's net worth, encompasses the movement of money in and out of his financial accounts. Understanding cash flow is crucial for assessing his liquidity and financial stability.

- Operating Cash Flow: Represents the cash generated from Winfield's business operations, including income from investments and revenue from endorsements. This cash flow provides insights into his earning capacity and financial performance.

- Investing Cash Flow: Reflects the cash used to acquire or dispose of assets, such as real estate or investments. This cash flow indicates Winfield's investment activities and their impact on his net worth.

- Financing Cash Flow: Represents the cash obtained or repaid through financing activities, such as loans or issuing bonds. This cash flow affects Winfield's debt levels and overall financial structure.

- Free Cash Flow: The cash remaining after operating expenses, investments, and financing activities are accounted for. Free cash flow provides Winfield with flexibility and can be used for debt reduction, dividends, or reinvestment opportunities.

Analyzing these facets of cash flow provides a comprehensive view of Dave Winfield's financial health. Positive cash flow indicates his ability to generate income, meet obligations, and pursue financial goals. Conversely, negative cash flow can raise concerns about liquidity and financial stability.

Debt

Debt, a significant component of Dave Winfield's net worth, represents financial obligations that decrease his overall financial standing. Understanding the nature and extent of Winfield's debt is crucial for evaluating his financial health and decision-making.

Debt can arise from various sources, such as mortgages on real estate, loans for business ventures, or personal loans for expenses. When Winfield incurs debt, he assumes a legal obligation to repay the borrowed funds, along with interest and other charges, over a specified period. The presence of debt can impact his net worth by reducing his equity in assets and increasing his monthly expenses.

Analyzing the types and terms of Winfield's debt is essential for assessing his financial leverage and risk tolerance. High levels of debt, particularly unsecured debt with high interest rates, can strain his cash flow and limit his ability to pursue new investments or opportunities. Effectively managing debt requires careful budgeting, disciplined spending, and a commitment to reducing debt over time. By understanding the relationship between debt and Dave Winfield's net worth, we gain insights into his financial management strategies and overall financial well-being.

Financial planning

Financial planning is integral to Dave Winfield's net worth, guiding his financial decisions to maximize wealth and secure his financial future.

- Investment Strategy: Winfield's financial plan outlines his investment strategy, including asset allocation, diversification, and risk management. This strategy helps him grow his wealth while mitigating potential losses.

- Retirement Planning: Winfield's plan includes provisions for retirement, ensuring a secure financial future. It considers his retirement income goals, tax implications, and healthcare expenses.

- Tax Optimization: Winfield's financial plan incorporates tax optimization strategies to minimize his tax liability. This involves maximizing deductions, utilizing tax-advantaged accounts, and planning for potential tax law changes.

- Estate Planning: Winfield's financial plan addresses estate planning, ensuring the orderly distribution of his assets after his passing. It involves creating a will or trust, appointing beneficiaries, and minimizing estate taxes.

These components of financial planning work in tandem to enhance Dave Winfield's net worth and overall financial well-being. By adhering to a comprehensive financial plan, he can make informed decisions, optimize his investments, prepare for future financial needs, and ensure the preservation and distribution of his wealth.

FAQs about Dave Winfield Net Worth

This section aims to address frequently asked questions and clarify aspects related to Dave Winfield's net worth.

Question 1: What is Dave Winfield's estimated net worth?

As of 2023, Dave Winfield's net worth is estimated to be around $12 million. This figure encompasses his earnings from a successful baseball career, investments, and various endorsements.

Question 2: How did Winfield accumulate his wealth?

Winfield's wealth primarily stems from his exceptional baseball career. He played 22 seasons in Major League Baseball (MLB), earning significant salaries and bonuses. Additionally, he has made wise investments and pursued endorsement deals, contributing to his overall net worth.

Question 3: What are the major components of Winfield's net worth?

Winfield's net worth is composed of various assets, including real estate, investment portfolios, and personal belongings. He also has endorsement contracts and other sources of income that contribute to his overall financial standing.

Question 4: How has Winfield managed to sustain his net worth?

Winfield has maintained his net worth through prudent financial management. He has diversified his investments, made sound financial decisions, and continues to generate income through various endeavors.

Question 5: What are Winfield's financial goals for the future?

Winfield's financial goals involve preserving his wealth, continuing to grow his investments, and ensuring financial security for his family. He is also committed to philanthropy and giving back to the community.

Question 6: What lessons can be learned from Dave Winfield's financial journey?

Winfield's financial journey highlights the importance of perseverance, financial literacy, and smart investment decisions. It demonstrates the potential for building wealth through a combination of hard work, strategic planning, and financial discipline.

These FAQs provide insights into Dave Winfield's net worth, its composition, and the principles that have guided his financial success. His journey serves as a reminder of the significance of financial planning, sound decision-making, and the pursuit of both personal and financial goals.

The next section will explore the impact of Winfield's net worth on his lifestyle and financial security.

Tips for Managing Net Worth

This section provides actionable tips to help individuals manage their net worth effectively and achieve financial well-being.

Tip 1: Track Your Income and Expenses: Monitor cash flow by tracking all income and expenses to identify areas for optimization and savings.

Tip 2: Create a Budget: Develop a budget that aligns with financial goals, prioritizing essential expenses and allocating funds wisely.

Tip 3: Reduce Unnecessary Expenses: Identify non-essential expenses that can be eliminated or reduced to enhance savings and improve cash flow.

Tip 4: Explore Income-Generating Opportunities: Identify additional sources of income through side hustles, investments, or career advancement to increase financial resources.

Tip 5: Invest for Long-Term Growth: Allocate a portion of income towards investments with potential for long-term appreciation, diversifying investments to mitigate risk.

Tip 6: Manage Debt Wisely: Prioritize paying off high-interest debts and consolidate debts when possible to reduce interest payments and improve financial stability.

Tip 7: Seek Professional Advice: Consult with a financial advisor to develop a comprehensive financial plan tailored to individual circumstances and goals.

Tip 8: Stay Informed and Be Disciplined: Keep up-to-date on financial news and trends, and maintain financial discipline to stay on track towards financial goals.

By implementing these tips, individuals can gain control over their finances, make informed decisions, and build a solid foundation for long-term financial success.

The following section will discuss strategies for protecting and growing net worth, building on the foundation established through these tips.

Conclusion

This comprehensive exploration of Dave Winfield's net worth has shed light on the key components and strategies that have shaped his financial success. Understanding his income streams, investments, and financial planning provides valuable insights into building and managing personal wealth.

Several key points emerge from this analysis. Firstly, Winfield's net worth is a testament to the significance of capitalizing on opportunities and maximizing earning potential. His success on the baseball field, coupled with prudent investments and endorsements, has contributed significantly to his financial standing. Secondly, effective financial planning and management are crucial for preserving and growing wealth. Winfield's disciplined approach to budgeting, debt management, and tax optimization has allowed him to maintain his net worth over time. Finally, the article underscores the importance of seeking professional advice and staying informed about financial trends. By leveraging expert guidance and staying abreast of market fluctuations, individuals can make informed decisions that support their long-term financial goals.

- Did Tori Bowie Baby Survive What Happened

- Malachi Barton S Dating Life Girlfriend Rumors

- Who Is Miranda Rae Mayo Partner Her

- Dd Returns Ott Release Date The Most

- Know About Camren Bicondova Age Height Gotham

Dave Winfield Net Worth 2024 Wiki, Married, Family, Wedding, Salary

Dave Winfield’s Net Worth (Updated 2023) Inspirationfeed

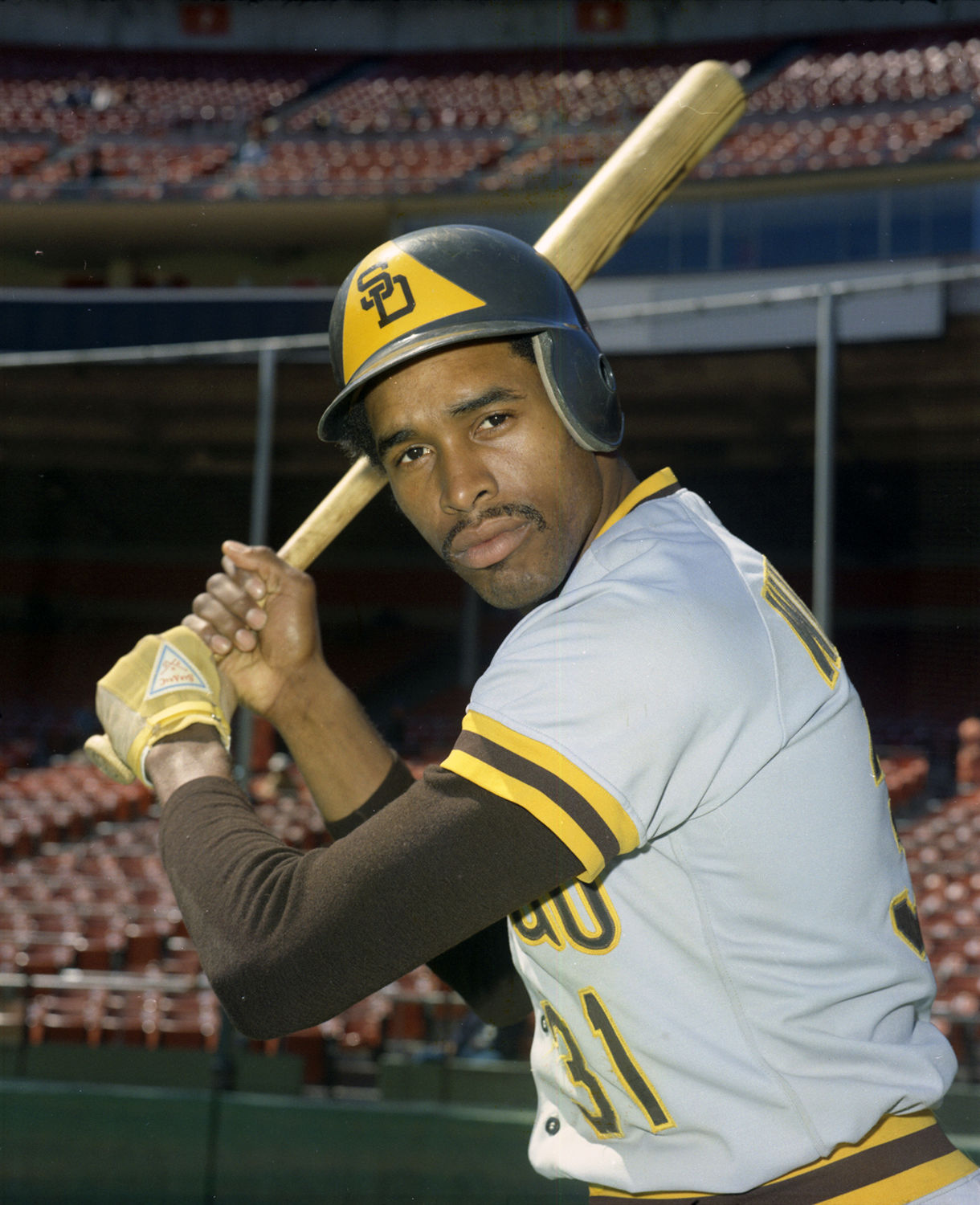

Dave Winfield 31 Days until Padres’ Opening Day Padres