How To Grow Your Half Pint Net Worth: Tips From Harper Lee's Life And Legacy

Half Pint Net Worth refers to the estimated financial value of a person's half pint of blood, which is approximately 500ml. Historically, people exchanged blood for medical procedures, and its monetary value varied based on factors like rarity and compatibility.

Today, the concept of Half Pint Net Worth serves as a metaphorical representation of an individual's overall well-being and financial stability. It encompasses not only monetary resources but also health, happiness, and relationships, which contribute significantly to a person's quality of life.

This article delves into the fascinating evolution of Half Pint Net Worth, providing insights into its historical significance and contemporary relevance.

- New Roms Xci Nsp Juegos Nintendo Switch

- Hilaree Nelson Wiki Missing Husband Family Net

- Layke Leischner Car Accident Resident Of Laurel

- Fun Fact Is Sydney Leroux Lesbian And

- A Tragic Loss Remembering Dr Brandon Collofello

Half Pint Net Worth

Understanding the essential aspects of Half Pint Net Worth is crucial for gaining a comprehensive view of its significance and relevance.

- Financial resources

- Health status

- Happiness and well-being

- Social connections

- Personal values

- Career prospects

- Risk tolerance

- Investment strategy

- Insurance coverage

- Estate planning

These aspects are interconnected and influence each other. For instance, good health can lead to increased earning potential, while strong social connections can provide emotional support and access to resources. Understanding and managing these aspects effectively can contribute to a higher Half Pint Net Worth and overall well-being.

Financial resources

Financial resources constitute a critical pillar of Half Pint Net Worth, encompassing the monetary assets, investments, and income streams that contribute to an individual's financial well-being. These resources provide the foundation for meeting basic needs, pursuing personal and professional goals, and securing future financial stability.

- Legendary Rella S Relationship Status Is She

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Julia Dweck Dead And Obituary Nstructor Willow

- What Is Sonia Acevedo Doing Now Jamison

- Earl Vanblarcom Obituary The Cause Of Death

- Income

Income, whether from employment, self-employment, or investments, provides the cash flow necessary to cover expenses, save for the future, and invest in personal growth. - Savings

Savings, including emergency funds and long-term savings for retirement or major purchases, act as a safety net during unexpected events and enable individuals to pursue opportunities and achieve financial goals. - Investments

Investments, such as stocks, bonds, and real estate, have the potential to generate returns that outpace inflation and contribute to the growth of an individual's Half Pint Net Worth over time. - Insurance

Insurance policies, such as health, life, and disability insurance, provide financial protection against unforeseen events that could otherwise deplete financial resources or impact earning potential.

Effective management of financial resources involves careful budgeting, responsible spending, and strategic planning to maximize returns on investments. By nurturing their financial resources, individuals can enhance their Half Pint Net Worth and build a solid foundation for a secure and fulfilling life.

Health status

Health status plays a pivotal role in determining an individual's Half Pint Net Worth, as it directly affects an individual's ability to earn, save, and invest. Good health is essential for maintaining a stable income, pursuing career opportunities, and engaging in activities that contribute to personal growth and well-being.

For example, chronic health conditions can lead to reduced work productivity, absenteeism, and even job loss, significantly impacting an individual's financial resources. Conversely, individuals who prioritize their health through regular exercise, a balanced diet, and preventive care are more likely to maintain good health, which translates into higher earning potential and increased Half Pint Net Worth over time.

Furthermore, health status influences an individual's capacity to manage their finances responsibly. Good health promotes mental clarity, focus, and decision-making abilities, which are crucial for effective financial planning and investment management. On the other hand, individuals with poor health may struggle with financial management due to cognitive impairments, fatigue, or the stress associated with their condition.

Understanding the connection between health status and Half Pint Net Worth empowers individuals to make informed choices that prioritize their well-being and financial security. By investing in their health through preventive measures and lifestyle changes, individuals can enhance their earning capacity, reduce healthcare expenses, and cultivate a more fulfilling and financially stable life.

Happiness and well-being

Happiness and well-being are crucial aspects of Half Pint Net Worth, as they encompass an individual's emotional, mental, and social state, which significantly influence their overall quality of life and financial decision-making.

- Emotional well-being

Emotional well-being refers to an individual's ability to manage their emotions effectively, cope with stress, and maintain a positive outlook on life. It is essential for maintaining healthy relationships, pursuing personal goals, and making sound financial decisions.

- Mental well-being

Mental well-being encompasses cognitive function, clarity of thought, and resilience in the face of challenges. It is crucial for maximizing earning potential, managing finances responsibly, and adapting to changing circumstances.

- Social well-being

Social well-being involves positive relationships with family, friends, and the community. It provides emotional support, access to resources, and opportunities for personal growth, all of which contribute to a higher Half Pint Net Worth.

- Purpose and meaning

A sense of purpose and meaning in life is essential for happiness and well-being. It provides direction, motivation, and a sense of fulfillment, which can lead to increased productivity, financial success, and overall life satisfaction.

By investing in their happiness and well-being through activities such as pursuing hobbies, cultivating relationships, and engaging in self-care practices, individuals can enhance their Half Pint Net Worth. A holistic approach that prioritizes both financial resources and emotional, mental, social, and purposeful well-being leads to a more balanced and fulfilling life.

Social connections

Social connections are an integral aspect of Half Pint Net Worth, encompassing the relationships and networks that contribute to an individual's overall well-being and financial stability.

- Emotional support

Strong social connections provide emotional support, reducing stress, boosting resilience, and promoting a positive mindset, which can lead to increased productivity and better financial decision-making.

- Access to resources

Social networks can provide access to resources such as job opportunities, financial advice, and investment tips, expanding an individual's financial prospects and increasing their Half Pint Net Worth.

- Collaboration and innovation

Social connections foster collaboration and innovation, allowing individuals to share ideas, learn from each other's experiences, and create new opportunities for wealth creation.

- Social capital

Building social capital through strong social connections can enhance an individual's reputation, credibility, and trust, which can lead to better business relationships, increased earning potential, and a higher Half Pint Net Worth.

Investing in social connections through building and maintaining meaningful relationships, engaging in social activities, and participating in community organizations can significantly contribute to an individual's overall Half Pint Net Worth. By leveraging the power of social capital, individuals can unlock opportunities, enhance their well-being, and achieve greater financial success.

Personal values

Personal values are deeply held beliefs and principles that guide an individual's behavior and decision-making. In the context of Half Pint Net Worth, personal values play a significant role in shaping financial habits, investment strategies, and career choices.

- Integrity

Individuals with strong moral values are more likely to make ethical decisions in their financial dealings, avoid risky investments, and prioritize long-term financial stability over short-term gains.

- Responsibility

A sense of responsibility towards oneself and others leads to prudent financial management, such as budgeting, saving for the future, and planning for unexpected events.

- Independence

Individuals who value independence strive to achieve financial self-sufficiency, reducing reliance on debt and seeking opportunities for personal growth and wealth creation.

- Generosity

Those who prioritize generosity are more likely to engage in charitable giving, supporting causes they believe in and contributing to the well-being of their communities.

Understanding and aligning personal values with financial decisions can lead to greater financial well-being and a more fulfilling life. By embracing values such as integrity, responsibility, independence, and generosity, individuals can make choices that resonate with their core beliefs and contribute positively to their Half Pint Net Worth.

Career prospects

Career prospects hold significant sway in shaping an individual's Half Pint Net Worth, encompassing the earning potential, career advancement opportunities, and job security associated with one's profession.

- Earning potential

The earning potential of a career path is a crucial determinant of Half Pint Net Worth, as higher earnings translate into greater financial resources and investment opportunities.

- Career advancement

Opportunities for career advancement, such as promotions and leadership roles, can lead to substantial increases in income and wealth accumulation over time.

- Job security

Stable employment with a low risk of job loss provides a solid foundation for financial planning, allowing individuals to confidently invest and build their Half Pint Net Worth.

- Industry growth

Working in a growing industry with strong demand for skilled professionals can enhance earning potential and career advancement opportunities, positively impacting Half Pint Net Worth.

Understanding and aligning career prospects with personal values and financial goals is essential for maximizing Half Pint Net Worth. By pursuing careers that offer strong earning potential, advancement opportunities, job security, and industry growth, individuals can set the stage for financial success and a fulfilling life.

Risk tolerance

Risk tolerance plays a pivotal role in determining an individual's Half Pint Net Worth, as it influences the types of investments they make and the level of financial risk they are willing to take. Individuals with a high risk tolerance are more likely to invest in assets with the potential for higher returns, such as stocks or real estate, as they are comfortable with the associated volatility and uncertainty.

Conversely, individuals with a low risk tolerance tend to favor safer investments, such as bonds or certificates of deposit, as they prioritize preserving their capital over maximizing returns. This risk-averse approach can limit their Half Pint Net Worth growth potential, but it also provides greater peace of mind and protection against financial losses.

Understanding one's risk tolerance is crucial for making informed investment decisions. A financial advisor can assist individuals in assessing their risk tolerance and developing an investment strategy that aligns with their financial goals and risk appetite. By carefully considering their risk tolerance, individuals can optimize their Half Pint Net Worth and navigate the financial markets with greater confidence.

Investment strategy

Investment strategy is a crucial component of Half Pint Net Worth, as it outlines the plan and approach for managing financial resources with the aim of achieving specific financial goals. An effective investment strategy can significantly enhance an individual's financial well-being and contribute to a higher Half Pint Net Worth over time.

A well-defined investment strategy considers various factors such as risk tolerance, time horizon, and financial goals. It involves selecting and allocating investments across different asset classes, such as stocks, bonds, real estate, and alternative investments. The goal is to create a diversified portfolio that aligns with an individual's unique financial situation and objectives.

Real-life examples of investment strategies include the classic 60/40 stock-bond portfolio for moderate risk tolerance and long-term growth, or a more conservative approach with a higher allocation to bonds for those seeking stability and income. Active investment strategies involve frequent trading and market timing, while passive strategies focus on long-term investments in index funds or exchange-traded funds (ETFs) that track market indices.

Understanding the connection between investment strategy and Half Pint Net Worth is essential for making informed financial decisions and achieving financial success. By carefully considering risk tolerance, time horizon, and financial goals, individuals can develop an investment strategy that aligns with their needs and aspirations. This understanding empowers individuals to optimize their portfolio returns, navigate market fluctuations, and ultimately build a strong foundation for their Half Pint Net Worth.

Insurance coverage

Within the multifaceted realm of Half Pint Net Worth, insurance coverage plays a pivotal role in safeguarding financial well-being and preserving the value of one's assets. It provides a safety net against unforeseen events and helps mitigate the financial consequences of life's uncertainties.

- Health insurance

Health insurance protects against the high costs of medical expenses, ensuring access to quality healthcare without draining financial resources. It provides coverage for hospital stays, doctor visits, and prescription medications, safeguarding Half Pint Net Worth from potential healthcare-related expenses.

- Life insurance

Life insurance provides financial support for dependents in the event of the policyholder's untimely demise. It ensures that loved ones can maintain their quality of life and financial stability, preserving Half Pint Net Worth against the loss of income or unexpected expenses.

- Disability insurance

Disability insurance protects against loss of income due to an illness or injury that prevents an individual from working. It provides a safety net to maintain living expenses and financial obligations, safeguarding Half Pint Net Worth from the impact of temporary or permanent disability.

- Property and casualty insurance

Property and casualty insurance protects against financial losses resulting from damage to or loss of property, such as a home, car, or other valuables. It provides coverage for repairs, replacements, and liability, ensuring that Half Pint Net Worth is not diminished by unforeseen events.

These facets of insurance coverage work in synergy to create a comprehensive safety net that bolsters Half Pint Net Worth. By mitigating financial risks and providing peace of mind, insurance coverage empowers individuals to pursue their goals, safeguard their assets, and achieve long-term financial well-being.

Estate planning

Estate planning plays an integral role in safeguarding and managing Half Pint Net Worth, ensuring that an individual's assets are distributed according to their wishes after their passing. It provides a clear roadmap for the transfer of wealth, minimizing the impact of taxes and legal complexities while preserving the value of the estate for beneficiaries.

A comprehensive estate plan typically includes a will, trusts, and other legal documents that outline the distribution of assets, appoint executors, and establish guardians for minor children. By engaging in estate planning, individuals can exert control over the distribution of their Half Pint Net Worth, ensuring that their legacy aligns with their values and financial goals.

Real-life examples abound of how estate planning has preserved Half Pint Net Worth. For instance, consider the case of a successful entrepreneur who established a trust to hold their business interests. Upon their passing, the trust ensured a smooth transition of ownership to their designated heirs, minimizing disruptions to the business and preserving its value.

Understanding the connection between estate planning and Half Pint Net Worth is crucial for individuals seeking to protect and manage their wealth effectively. By implementing a well-crafted estate plan, individuals can safeguard their assets, provide for their loved ones, and ensure that their Half Pint Net Worth is transferred in accordance with their wishes.

Frequently Asked Questions about Half Pint Net Worth

This FAQ section provides concise answers to common questions and clarifies crucial aspects of Half Pint Net Worth, empowering readers with a deeper understanding of this concept.

Question 1: What exactly is Half Pint Net Worth?

Half Pint Net Worth is a holistic measure of an individual's overall well-being, encompassing financial resources, health status, happiness, social connections, personal values, career prospects, risk tolerance, investment strategy, insurance coverage, and estate planning.

Question 2: How does Half Pint Net Worth differ from traditional measures of wealth?

Traditional wealth measures focus solely on financial assets, while Half Pint Net Worth considers a broader range of factors that contribute to an individual's overall quality of life and financial well-being.

Question 3: Why is it important to understand Half Pint Net Worth?

Understanding Half Pint Net Worth allows individuals to make informed decisions that positively impact their financial well-being, health, and overall happiness. It provides a comprehensive view of one's financial situation and empowers individuals to identify areas for improvement and growth.

Question 4: How can I improve my Half Pint Net Worth?

Improving Half Pint Net Worth involves focusing on all its components, such as managing finances responsibly, prioritizing health and well-being, building strong social connections, aligning personal values with financial decisions, exploring career opportunities, assessing risk tolerance, developing an effective investment strategy, obtaining adequate insurance coverage, and implementing a comprehensive estate plan.

Question 5: What are the common challenges to increasing Half Pint Net Worth?

Challenges may include financial constraints, health issues, personal setbacks, lack of social support, misalignment of values, limited career prospects, difficulty managing risk, poor investment decisions, inadequate insurance coverage, or lack of estate planning.

Question 6: How can I get professional help in managing my Half Pint Net Worth?

Consider consulting with a financial advisor, health professional, therapist, career counselor, or estate planning attorney for personalized guidance and support in managing the various aspects of Half Pint Net Worth.

In summary, Half Pint Net Worth provides a holistic perspective on financial well-being and overall quality of life. By understanding and improving its various components, individuals can make informed decisions that lead to a more fulfilling and financially secure future.

In the next section, we will delve deeper into the strategies and practical steps individuals can take to enhance their Half Pint Net Worth and achieve their financial goals.

Tips to Enhance Half Pint Net Worth

This section provides practical and actionable tips to help individuals enhance their Half Pint Net Worth. By implementing these strategies, individuals can improve their overall well-being, secure their financial future, and achieve their goals.

1. Manage Finances Responsibly

:Create a budget, track expenses, and seek professional advice to make informed financial decisions.

2. Prioritize Health and Well-being

:Engage in regular exercise, maintain a healthy diet, and prioritize mental health to improve overall well-being and reduce healthcare expenses.

3. Build Strong Social Connections

:Cultivate meaningful relationships with family, friends, and community members to gain support, access resources, and boost emotional well-being.

4. Align Values with Financial Decisions

:Consider personal values when making financial choices, such as supporting ethical businesses or investing in causes that align with personal beliefs.

5. Explore Career Opportunities

:Research different career paths, develop skills, and network to increase earning potential and job satisfaction.

6. Assess Risk Tolerance

:Determine the level of financial risk an individual is comfortable taking to make informed investment decisions and manage potential losses.

7. Develop an Effective Investment Strategy

:Create a diversified investment portfolio that aligns with financial goals and risk tolerance, considering stocks, bonds, and alternative investments.

8. Obtain Adequate Insurance Coverage

:Secure health, life, disability, and property insurance to protect against financial risks and ensure peace of mind.

By implementing these tips, individuals can proactively manage the various aspects of Half Pint Net Worth, leading to a more secure and fulfilling financial future.

In the concluding section, we will discuss the importance of monitoring and adjusting Half Pint Net Worth over time to adapt to changing circumstances and achieve long-term financial success.

Conclusion

Throughout this exploration of Half Pint Net Worth, we've uncovered a multifaceted concept that encompasses not only financial resources but also health, happiness, social connections, and personal values. Understanding and managing these interconnected aspects is crucial for achieving overall well-being and financial security.

Key takeaways include recognizing that financial well-being extends beyond monetary wealth, the importance of prioritizing health and happiness as investments in Half Pint Net Worth, and the need to align personal values with financial decisions. By embracing a holistic approach that encompasses all these elements, we can strive towards building a strong and sustainable Half Pint Net Worth that supports a fulfilling and balanced life.

- Tlc S I Love A Mama S

- Does Robert Ri Chard Have A Wife

- How To Make Water Breathing Potion In

- Who Is Jay Boogie The Cross Dresser

- Know About Camren Bicondova Age Height Gotham

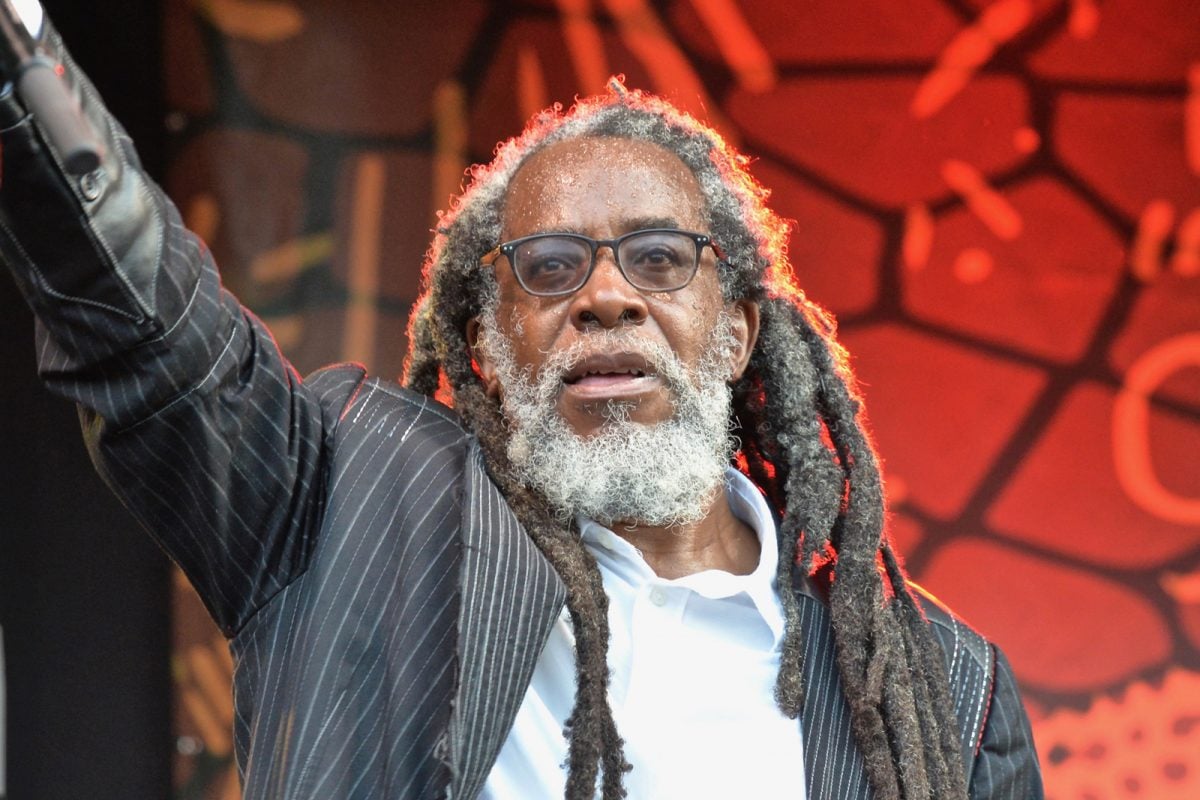

Half Pint Turns 60 An Earthstrong Playlist Of The Reggae Legend's Best

Half Pint Alchetron, The Free Social Encyclopedia

halfapint_d Mama Geek