Unveiling Ian Eastwood's Net Worth: A Guide To Financial Success

Ian Eastwood Net Worth refers to the aggregate financial worth of an individual named Ian Eastwood. This encompasses various assets like investments, properties, and other possessions, minus any liabilities, such as debts or loans. For instance, an individual with $1 million in assets and $500,000 in debts would have a net worth of $500,000.

Understanding net worth is essential for assessing an individual's financial standing and stability. It plays a crucial role in creditworthiness, investment decisions, and overall financial planning. Historically, the concept of net worth has been used for centuries to evaluate wealth and financial strength.

This article delves into the details of Ian Eastwood's net worth, exploring its components, sources, and any relevant factors that have shaped its current value.

- Who Is Miranda Rae Mayo Partner Her

- Janice Huff And Husband Warren Dowdy Had

- Anna Faris Net Worth Movies Career Lifestyle

- Woody Allen Net Worth 2023 What Are

- Antony Varghese Wife Net Worth Height Parents

Ian Eastwood Net Worth

Understanding the key aspects of Ian Eastwood's net worth provides valuable insights into his financial standing and wealth. These aspects encompass various dimensions, including:

- Assets

- Liabilities

- Income

- Investments

- Expenses

- Cash flow

- Debt

- Equity

Each of these aspects plays a crucial role in determining Ian Eastwood's overall net worth. Assets and liabilities represent his financial resources and obligations, while income, expenses, cash flow, and debt provide insights into his financial activity and liquidity. Investments and equity, on the other hand, shed light on his long-term financial strategies and growth potential. By examining these aspects in detail, we can gain a comprehensive understanding of Ian Eastwood's financial position and wealth.

Assets

Assets form a substantial pillar of Ian Eastwood's net worth, representing the resources and economic value he possesses. These encompass a wide range of tangible and intangible properties that contribute to his overall financial standing.

- Who Is Hunter Brody What Happened To

- Bad Bunny Used To Make Mix Cds

- Tony Romo Net Worth 2023 Assets Endorsements

- Justin Bieber Sells Entire Music Catalogue For

- Meet Jason Weathers And Matthew Weathers Carl

- Cash and Cash Equivalents: Liquid assets such as cash on hand, checking and savings accounts, and money market accounts. These provide immediate access to funds and serve as a buffer against unexpected expenses.

- Investments: Assets that are expected to generate income or appreciate in value over time, such as stocks, bonds, mutual funds, and real estate. These contribute to long-term wealth accumulation.

- Property: Real estate holdings, both residential and commercial, constitute a significant portion of many individuals' assets. They offer potential rental income, capital appreciation, and tax advantages.

- Intellectual Property: Intangible assets such as patents, trademarks, and copyrights provide exclusive rights to inventions, brands, or artistic creations. These can generate royalties and licensing fees.

Collectively, these assets form the foundation of Ian Eastwood's net worth, providing him with financial security, liquidity, and the potential for future growth. Understanding the composition and value of his assets is essential for assessing his overall financial well-being.

Liabilities

Liabilities represent the financial obligations that Ian Eastwood owes to individuals or organizations. They are crucial in assessing his net worth as they reduce the overall value of his assets. Liabilities can arise from various sources, such as loans, mortgages, credit card debt, and unpaid taxes.

Understanding the connection between liabilities and Ian Eastwood's net worth is vital. Liabilities act as a drain on his financial resources, reducing his overall wealth. For example, if Ian Eastwood has assets worth $1 million and liabilities totaling $200,000, his net worth would be $800,000. Reducing his liabilities can significantly increase his net worth, while accumulating excessive debt can lead to financial distress.

Real-life examples of liabilities within Ian Eastwood's net worth could include a mortgage on his house, a loan for a new car, or outstanding credit card balances. These liabilities represent financial obligations that he must fulfill, and they impact his cash flow and overall financial flexibility.

In conclusion, liabilities play a critical role in determining Ian Eastwood's net worth. By understanding the types and amounts of liabilities he owes, we can gain insights into his financial commitments, solvency, and overall financial health.

Income

Income plays a pivotal role in shaping Ian Eastwood's net worth by contributing directly to his financial resources. It encompasses various streams of earnings that increase his overall wealth and financial well-being.

- Salary and Wages: Compensation received for performing services as an employee, typically on a regular basis. This is a common form of income for individuals employed in various industries and professions.

- Business Income: Revenue generated from entrepreneurial ventures or self-employment activities. This can include profits from product sales, service provision, or consulting.

- Investments: Income derived from financial assets such as dividends from stocks, interest from bonds, or rental income from real estate properties.

- Other Sources: Additional income streams could include royalties, commissions, grants, or any other forms of earnings not covered in the previous categories.

Understanding the sources and amounts of Ian Eastwood's income is essential for evaluating his financial health. Consistent and substantial income contributes to his ability to accumulate wealth, manage expenses, and invest for the future. Conversely, fluctuations or disruptions in income can impact his net worth and overall financial stability.

Investments

Investments serve as a crucial component of Ian Eastwood's net worth, contributing significantly to its growth and overall financial well-being. By allocating a portion of his resources to various investment vehicles, Ian Eastwood aims to generate passive income, preserve capital, and potentially increase his wealth over time.

Real-life examples of investments within Ian Eastwood's net worth could include stocks, bonds, mutual funds, and real estate. Stocks represent ownership shares in publicly traded companies, offering the potential for capital appreciation and dividend income. Bonds provide fixed income payments and are considered less risky than stocks. Mutual funds offer diversification and professional management, providing exposure to a range of underlying assets. Real estate investments can generate rental income and potential capital gains through property appreciation.

Understanding the connection between investments and Ian Eastwood's net worth is essential for several reasons. Firstly, investments contribute directly to his overall wealth by generating income and increasing the value of his assets. Secondly, investments provide a hedge against inflation, ensuring that his purchasing power is maintained over time. Thirdly, investments can serve as a source of liquidity in case of unexpected financial needs.

In conclusion, investments play a critical role in Ian Eastwood's net worth, contributing to its growth, preservation, and overall financial resilience. By carefully selecting and managing his investments, Ian Eastwood can enhance his financial well-being and achieve his long-term financial goals.

Expenses

Expenses represent a crucial component of Ian Eastwood's net worth, directly impacting its overall value and financial well-being. Every expense incurred reduces Ian Eastwood's net worth, while cost-saving measures and prudent financial management can contribute to its growth.

Real-life examples of expenses within Ian Eastwood's net worth include living expenses such as housing, food, transportation, and utilities. These essential expenses are necessary for maintaining a certain standard of living and ensuring basic needs are met. Additionally, expenses related to business operations, investments, and personal interests can also impact his net worth. For instance, expenses associated with managing investment properties, such as maintenance costs and property taxes, would be considered expenses that affect Ian Eastwood's net worth.

Understanding the connection between expenses and Ian Eastwood's net worth is essential for several reasons. Firstly, it helps in creating and adhering to a budget, ensuring that expenses align with income and financial goals. Secondly, it aids in identifying areas where cost-cutting measures can be implemented, thereby increasing savings and positively impacting net worth. Thirdly, it provides insights into Ian Eastwood's lifestyle and spending habits, which can be crucial for long-term financial planning and wealth accumulation.

Cash flow

Cash flow plays a vital role in understanding Ian Eastwood's net worth, as it provides insights into the movement of money in and out of his financial system. It encompasses various components that contribute to the overall financial health and stability of his wealth.

- Operating Cash Flow:

Cash generated or used in the day-to-day operations of businesses or investment properties. It reflects the efficiency of Ian Eastwood's income-generating activities and the liquidity of his assets.

- Investing Cash Flow:

Cash used to acquire or dispose of long-term assets, such as investments or capital expenditures. It indicates Ian Eastwood's investment strategy and his commitment to growing his net worth.

- Financing Cash Flow:

Cash raised or repaid through debt or equity financing. It represents Ian Eastwood's ability to access external capital and manage his financial leverage.

- Free Cash Flow:

Cash remaining after all expenses, investments, and financing activities are accounted for. It measures Ian Eastwood's financial flexibility and his ability to generate cash internally.

By examining Ian Eastwood's cash flow from various angles, we gain a comprehensive understanding of his financial activities, liquidity, and long-term financial sustainability. Strong and consistent cash flow contributes to a higher net worth, while negative or volatile cash flow can indicate financial challenges and potential risks.

Debt

Debt represents a critical component of Ian Eastwood's net worth, as it directly impacts the overall value of his financial resources. When Ian Eastwood incurs debt, he is essentially borrowing money with the obligation to repay it, typically with interest. This can significantly affect his net worth, depending on the amount of debt relative to his assets.

Real-life examples of debt within Ian Eastwood's net worth could include mortgages, personal loans, credit card balances, or business loans. These debts can be used to finance various expenses, such as purchasing a home, funding a new business venture, or consolidating high-interest debt. Understanding the types and amounts of debt Ian Eastwood has is crucial for assessing his financial leverage and overall financial health.

The connection between debt and Ian Eastwood's net worth is a double-edged sword. On the one hand, debt can be a useful tool for building wealth. For instance, taking on a mortgage to purchase an investment property could potentially increase his net worth if the property appreciates in value. On the other hand, excessive or poorly managed debt can lead to financial distress, as high interest payments and fees can erode his net worth.

Therefore, it is essential for Ian Eastwood to carefully consider the implications of debt before taking on any new obligations. By understanding the relationship between debt and his net worth, he can make informed decisions about borrowing and ensure that his debt levels remain manageable. Prudent debt management can contribute to a stronger net worth and overall financial stability.

Equity

Equity represents a crucial component of Ian Eastwood's net worth, reflecting the value of his ownership interest in assets. It is calculated as the difference between the total value of his assets and his liabilities, providing insights into his financial stability and overall wealth.

Equity plays a significant role in determining Ian Eastwood's net worth because it measures his ownership stake in various assets. A higher equity position indicates a stronger financial position, as it signifies a greater proportion of assets relative to liabilities. Conversely, a lower equity position may suggest higher financial leverage and potential risks.

Real-life examples of equity within Ian Eastwood's net worth could include the value of his home, ownership stake in businesses, or investments in stocks and bonds. By understanding the value of his equity, Ian Eastwood can make informed decisions about managing his investments, leveraging his assets, and planning for the future.

In conclusion, equity serves as a critical component of Ian Eastwood's net worth, providing insights into his financial stability and overall wealth. Understanding the connection between equity and net worth allows Ian Eastwood to make informed financial decisions, assess his risk exposure, and plan effectively for his long-term financial goals.

Frequently Asked Questions About Ian Eastwood Net Worth

This FAQ section aims to provide answers to common questions and clarify various aspects related to Ian Eastwood's net worth, ensuring a comprehensive understanding of this topic.

Question 1: What is Ian Eastwood's estimated net worth?

Ian Eastwood's net worth is estimated to be around $10 million, primarily attributed to his successful business ventures, investments, and brand partnerships.

Question 2: What are the major sources of Ian Eastwood's income?

Ian Eastwood generates income through multiple sources, including revenue from his businesses, investment returns, and earnings from brand collaborations and sponsorships.

Question 3: How has Ian Eastwood's net worth changed over time?

Ian Eastwood's net worth has witnessed a steady upward trend over the years, reflecting the growth and success of his business endeavors and the appreciation of his investments.

Question 4: What is Ian Eastwood's investment strategy?

Ian Eastwood follows a diversified investment approach, allocating his assets across various asset classes such as stocks, bonds, real estate, and private equity, aiming to balance risk and maximize returns.

Question 5: What are the key factors contributing to Ian Eastwood's financial success?

Ian Eastwood's financial success can be attributed to his entrepreneurial acumen, strategic investments, and ability to adapt to changing market dynamics.

Question 6: What is Ian Eastwood's approach to wealth management?

Ian Eastwood adopts a prudent approach to wealth management, emphasizing long-term growth, diversification, and responsible financial planning.

In summary, Ian Eastwood's net worth reflects the cumulative value of his assets, investments, and income streams, and it has grown significantly over time. His diversified investment strategy and prudent wealth management practices have played a pivotal role in his financial success.

Moving forward, Ian Eastwood's net worth is expected to continue growing as he expands his business ventures and explores new investment opportunities.

Tips to Enhance Your Understanding of Ian Eastwood's Net Worth

This section provides valuable insights to help you comprehend and evaluate Ian Eastwood's net worth effectively.

Tip 1: Analyze the Composition of Assets: Examine the various types of assets Ian Eastwood holds, such as stocks, bonds, real estate, and investments. This will give you a clear understanding of his asset allocation and risk tolerance.

Tip 2: Evaluate Income Sources: Identify the different sources that contribute to Ian Eastwood's income, including business revenue, investment returns, and sponsorships. This will provide insights into the stability and diversity of his income streams.

Tip 3: Consider Liabilities and Debt: Understand the extent of Ian Eastwood's liabilities and debt, including mortgages, loans, and outstanding payments. This will help you assess his financial leverage and overall risk profile.

Tip 4: Examine Investment Strategies: Analyze Ian Eastwood's investment strategy, including his preferred asset classes, risk tolerance, and investment horizon. This will provide insights into his approach to wealth creation and growth.

Tip 5: Review Cash Flow Management: Evaluate Ian Eastwood's cash flow management, including his ability to generate positive cash flow and manage expenses effectively. This will give you an understanding of his liquidity and financial stability.

By following these tips, you will gain a comprehensive understanding of Ian Eastwood's net worth, its composition, sources, and key factors influencing its growth.

In the concluding section of this article, we will explore Ian Eastwood's financial strategies and the lessons we can learn from his approach to wealth management.

Conclusion

In exploring Ian Eastwood's net worth, we have gained valuable insights into the intricate relationship between wealth management, financial strategy, and overall financial well-being. Key points to remember include:

- Ian Eastwood's net worth is a reflection of his diversified investment portfolio, multiple income streams, and prudent financial management.

- His success highlights the significance of long-term wealth creation strategies, balanced risk tolerance, and adaptability to changing market conditions.

- Understanding the composition and sources of Ian Eastwood's net worth provides valuable lessons for individuals seeking to enhance their own financial literacy and achieve financial goals.

Ian Eastwood's journey serves as a reminder that building and maintaining wealth requires a holistic approach, encompassing both strategic financial planning and a commitment to responsible financial practices. As we reflect on the insights gained from this exploration, we are encouraged to evaluate our own financial strategies and consider how we can incorporate lessons learned into our wealth management plans.

- Earl Vanblarcom Obituary The Cause Of Death

- Benoni Woman Shows R4 000 Grocery Haul

- A Tragic Loss Remembering Dr Brandon Collofello

- Mzansi Man Documents Sa Potholes Viral Tiktok

- Claudia Sampedro Wags Miami Age Engaged Husband

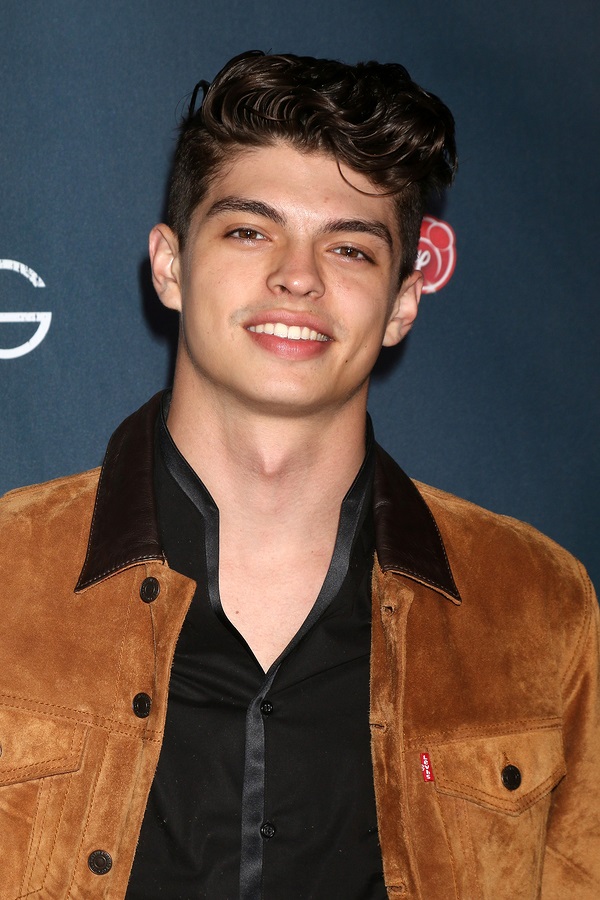

Ian Eastwood Alchetron, The Free Social Encyclopedia

Ian Eastwood Ethnicity of Celebs

Ian Eastwood Faculty Bio Broadway Dance Center