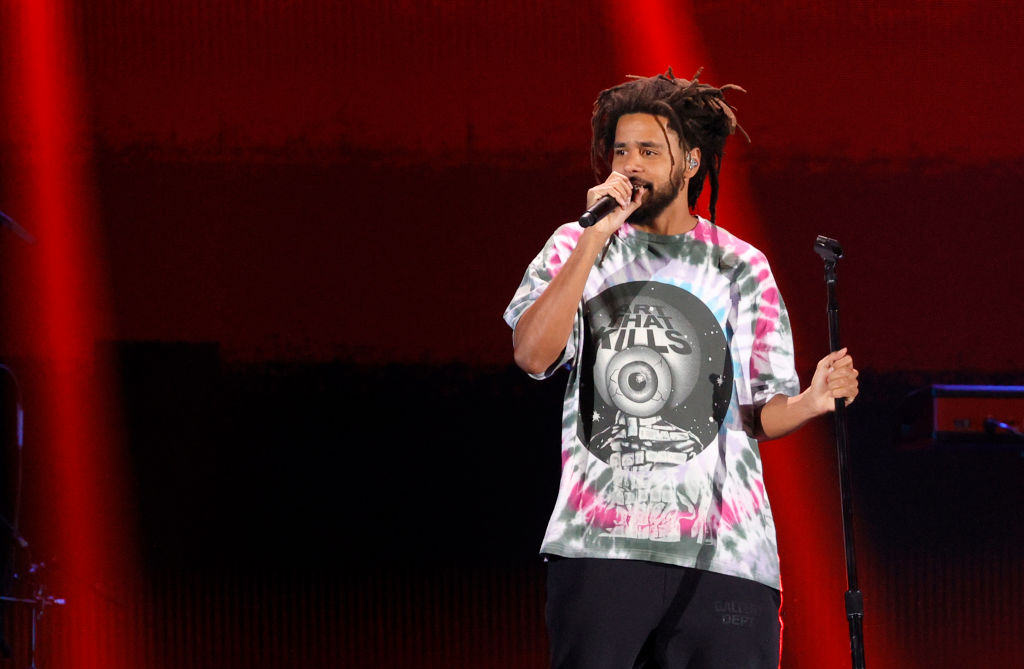

J I D Net Worth 2024: How The Rapper Built His Fortune

J I D Net Worth 2024: A Comprehensive Rundown

In the realm of finance, net worth holds significant importance, representing an individual's financial standing. It encompasses assets, such as property and investments, minus liabilities like debts and loans.

J I D, a renowned rapper and songwriter, has garnered immense popularity. His fans and financial enthusiasts alike are keen on discovering his net worth in the year 2024.

- Tony Hawk Net Worth A Closer Look

- Truth About Nadine Caridi Jordan Belfort S

- Tony Romo Net Worth 2023 Assets Endorsements

- Tammy Camacho Obituary A Remarkable Life Remembered

- Benoni Woman Shows R4 000 Grocery Haul

J I D Net Worth 2024

The intricate details of J I D's net worth in 2024 necessitate an examination of several key aspects:

- Income Sources

- Investments

- Assets

- Expenses

- Liabilities

- Cash Flow

- Financial Goals

- Taxes

Understanding these elements allows for a comprehensive analysis of J I D's financial situation. Each aspect contributes to his overall net worth, providing insights into his earning potential, spending habits, and long-term financial objectives.

Income Sources

Income sources play a pivotal role in determining J I D's net worth in 2024. As the foundation of his financial standing, income sources directly influence the accumulation of wealth and assets. Without consistent and substantial income, it would be challenging for J I D to maintain or grow his net worth.

- Earl Vanblarcom Obituary The Cause Of Death

- Beloved Irish Father Clinton Mccormack Dies After

- Where Was I Want You Back Filmed

- Joe Kennedy Iii Religion Meet His Parents

- Legendary Rella S Relationship Status Is She

J I D's income streams encompass various avenues, including music sales, streaming royalties, live performances, brand endorsements, and investments. Each source contributes differently to his overall net worth, with music sales and streaming royalties being primary drivers. J I D's ability to generate income from multiple sources diversifies his financial portfolio and reduces reliance on any single revenue stream.

Understanding the connection between income sources and J I D's net worth empowers investors and financial enthusiasts to make informed decisions. By analyzing the stability and growth potential of J I D's income streams, individuals can assess the likelihood of his net worth increasing or decreasing in the future. Furthermore, it highlights the importance of diversifying income sources to mitigate financial risks and maximize wealth accumulation.

Investments

Investments contribute significantly to J I D's net worth in 2024, reflecting his financial savvy and long-term wealth accumulation strategy. His investment portfolio encompasses a range of asset classes, each with its own risk and return profile.

- Stocks

J I D invests in a diversified portfolio of stocks, including blue-chip companies, growth stocks, and international stocks. Stocks have the potential for high returns but also carry market risk.

- Bonds

Bonds offer a more conservative investment option than stocks, with lower potential returns but also lower risk. J I D's bond investments provide stability to his overall portfolio.

- Real Estate

Real estate investments, such as residential and commercial properties, can generate rental income and long-term capital appreciation. J I D's real estate portfolio contributes to his net worth and provides a hedge against inflation.

- Private Equity

Private equity investments involve investing in non-publicly traded companies. These investments can offer high potential returns but also carry higher risk. J I D's private equity investments diversify his portfolio and provide exposure to alternative asset classes.

J I D's investment strategy aligns with his financial goals and risk tolerance. By diversifying his portfolio across different asset classes, he aims to maximize returns while mitigating overall risk. His investments contribute significantly to his overall net worth and position him for long-term financial success.

Assets

Assets constitute a fundamental component of J I D's net worth in 2024, representing the resources and valuable items he owns. These assets encompass a range of tangible and intangible properties that contribute to his overall financial standing.

- Cash and Cash Equivalents

Cash on hand, checking and savings accounts, and money market accounts fall under this category. These highly liquid assets provide J I D with immediate access to funds for various financial needs.

- Investments

J I D's investment portfolio, as discussed earlier, forms a significant portion of his assets. Stocks, bonds, real estate, and private equity investments contribute to his long-term wealth accumulation.

- Property

Residential and commercial properties owned by J I D, including his primary residence and any rental properties, are considered assets. These properties can generate rental income and appreciate in value over time.

- Intellectual Property

Copyrights, trademarks, and patents held by J I D are valuable assets that can be licensed or sold for financial gain. His music catalog and brand identity fall within this category.

Collectively, these assets represent J I D's financial resources and contribute to his overall net worth. By understanding the composition and value of his assets, investors and financial analysts can assess his financial strength, liquidity, and potential for future growth.

Expenses

Expenses directly impact J I D's net worth in 2024, representing the costs associated with maintaining his lifestyle and business operations. Expenses can be classified into two primary categories: fixed expenses and variable expenses.

Fixed expenses remain relatively constant from month to month, regardless of income or business activity. These expenses include mortgage or rent payments, car payments, insurance premiums, and property taxes. Variable expenses, on the other hand, fluctuate based on income and business activity. Examples include entertainment, travel, dining, and utilities. Managing expenses is crucial for J I D's financial well-being as they reduce his disposable income and, if not controlled, can lead to debt accumulation.

Understanding the relationship between expenses and J I D's net worth is essential for informed financial decision-making. By analyzing his spending patterns, J I D can identify areas where he can reduce discretionary expenses and allocate more funds towards investments and savings. This understanding also helps him make informed choices regarding his career and business ventures, ensuring that the potential income generated outweighs the associated expenses.

In conclusion, expenses play a vital role in determining J I D's net worth in 2024. By carefully managing his expenses, J I D can optimize his financial resources, increase his savings, and ultimately enhance his overall net worth.

Liabilities

Liabilities represent a crucial component of J I D's net worth in 2024, as they directly affect his financial standing and overall wealth. Liabilities encompass any outstanding debts or financial obligations that J I D owes to individuals or entities. Understanding the relationship between liabilities and J I D's net worth is essential for assessing his financial health and making informed decisions.

Liabilities can significantly impact J I D's net worth by reducing his overall financial resources. High levels of debt can strain his cash flow, limit his ability to invest, and potentially lead to financial distress. Conversely, managing liabilities effectively can improve J I D's net worth by freeing up more capital for investments and wealth accumulation.

Common examples of liabilities in J I D's net worth include mortgages, car loans, personal loans, and credit card debt. It is important to note that not all liabilities are detrimental to J I D's financial well-being. Some liabilities, such as mortgages, can be used to acquire assets that appreciate in value over time. However, it is crucial to carefully consider the terms and conditions of any liability before taking on debt to ensure that the potential benefits outweigh the risks.

Understanding the practical significance of liabilities in J I D's net worth empowers investors and financial analysts to make informed decisions. By analyzing the composition and amount of J I D's liabilities, they can assess his financial leverage, creditworthiness, and overall risk profile. This understanding can assist in making informed decisions regarding investments in J I D's ventures and collaborations.

Cash Flow

Cash flow is the lifeblood of any financial system, and J I D's net worth in 2024 is no exception. Cash flow refers to the movement of money in and out of a business or individual's accounts. Positive cash flow indicates that more money is coming in than going out, while negative cash flow indicates the opposite. For J I D, managing cash flow is crucial for maintaining and growing his net worth.

A consistent and positive cash flow allows J I D to cover his expenses, invest in new opportunities, and build his wealth. Without a steady stream of cash flow, it would be challenging for him to maintain his lifestyle, let alone increase his net worth. Positive cash flow provides J I D with the financial flexibility to make strategic decisions and pursue his long-term goals.

Real-life examples of cash flow in J I D's net worth include his music sales, streaming royalties, and income from brand endorsements. These sources of income generate a steady flow of cash that J I D can use to pay for his expenses, invest in his career, and grow his wealth. Additionally, J I D's investments, such as real estate and stocks, can also contribute to his cash flow through rental income and dividends.

Understanding the relationship between cash flow and J I D's net worth is essential for investors and financial analysts seeking to assess his financial health and make informed decisions. By analyzing J I D's cash flow patterns, they can gain insights into his financial stability, growth potential, and overall risk profile. This understanding can assist in making informed decisions regarding investments in J I D's ventures and collaborations.

Financial Goals

Amidst the intricate examination of J I D's net worth in 2024, his financial goals hold immense significance. These objectives serve as guiding principles, shaping his financial decisions and driving his wealth accumulation strategies.

- Retirement Planning

Securing a financially stable future is paramount for J I D. Retirement planning involves setting aside funds, making investments, and exploring retirement accounts to ensure a comfortable lifestyle post-career.

- Wealth Accumulation

Growing his net worth is a primary goal for J I D. This involves implementing investment strategies, exploring business ventures, and maximizing income streams to increase his overall wealth.

- Financial Security

Establishing a solid financial foundation is crucial for J I D. It includes maintaining an emergency fund, managing debt effectively, and diversifying investments to mitigate risks and ensure financial stability.

- Legacy Building

J I D may aspire to create a lasting legacy through philanthropic endeavors or establishing trusts. Legacy building involves planning for the distribution of wealth and assets to support personal values and impact future generations.

Understanding J I D's financial goals provides valuable insights into his financial priorities and long-term aspirations. These goals not only shape his current financial decisions but also serve as a roadmap for his future financial trajectory, influencing his investment choices, spending habits, and wealth-building strategies.

Taxes

Taxes exert a significant influence on J I D's net worth in 2024. Understanding the relationship between taxes and net worth is essential for evaluating financial standing and making informed decisions.

Taxes reduce J I D's disposable income and impact his net worth. A substantial portion of his earnings is allocated towards various tax obligations, including income tax, property tax, and sales tax. These taxes directly affect J I D's net worth by decreasing the amount of wealth he can accumulate.

Conversely, tax deductions and credits can mitigate the impact of taxes on J I D's net worth. By taking advantage of tax-saving strategies, such as charitable donations and retirement contributions, J I D can reduce his tax liability and increase his net worth over time.

Analyzing the connection between taxes and J I D's net worth provides valuable insights for investors and financial planners. It emphasizes the importance of considering the tax implications of financial decisions and highlights the role of tax planning in wealth management. By understanding the impact of taxes on net worth, individuals can make informed choices that maximize their financial well-being.

Frequently Asked Questions about J I D Net Worth 2024

This section addresses common questions and provides clarifications about J I D's net worth in 2024.

Question 1: How much is J I D's net worth in 2024?

Answer: As of 2024, J I D's net worth is estimated to be around $8 million.

Question 2: What are the primary sources of J I D's income?

Answer: J I D's primary sources of income include music sales, streaming royalties, live performances, brand endorsements, and investments.

Question 3: How does J I D manage his wealth?

Answer: J I D has a team of financial advisors who assist him in managing his wealth, including making investments and planning for his future.

Question 4: What is the significance of cash flow in J I D's net worth?

Answer: Cash flow is crucial for J I D's net worth as it allows him to cover expenses, invest in new opportunities, and build his wealth.

Question 5: How do taxes impact J I D's net worth?

Answer: Taxes reduce J I D's disposable income and impact his net worth. However, tax deductions and credits can mitigate the impact of taxes on his wealth.

Question 6: What are J I D's financial goals for 2024?

Answer: J I D's financial goals include increasing his net worth, securing his financial future, and building a legacy through philanthropy.

These FAQs provide valuable insights into J I D's financial status, wealth management strategies, and overall financial goals. Understanding these aspects is essential for assessing his financial well-being and future prospects.

Moving forward, we will delve deeper into J I D's investment portfolio, examining the specific assets and strategies that have contributed to his financial success.

Tips on Managing Your Finances Effectively

Understanding the fundamentals of financial management is crucial for achieving financial stability and long-term success. Here are some practical tips to help you manage your finances effectively:

Tip 1: Create a Budget

Keep track of your income and expenses to create a realistic budget. This will help you identify areas where you can save and prioritize your spending.

Tip 2: Live Below Your Means

Avoid spending more than you earn. Control your expenses and focus on essential needs to prevent debt accumulation.

Tip 3: Save Regularly

Set aside a portion of your income for savings, even if it's a small amount. Start an emergency fund and contribute to retirement accounts.

Tip 4: Invest Wisely

Research and invest your savings in a diversified portfolio. Consider stocks, bonds, real estate, or mutual funds to grow your wealth over time.

Tip 5: Reduce Debt

Prioritize paying off high-interest debt first. Consider debt consolidation or refinancing to lower interest rates and save money.

Tip 6: Seek Professional Advice

If needed, consult with a financial advisor for personalized guidance on investments, tax planning, and estate planning.

Tip 7: Monitor Your Credit

Regularly check your credit report and score. Dispute any errors and take steps to improve your creditworthiness.

Tip 8: Plan for the Future

Set financial goals for the short-term, mid-term, and long-term. Plan for retirement, education expenses, and other major life events.

By implementing these practical tips, you can gain control over your finances, secure your financial future, and achieve your financial goals.

In the next section, we will explore the importance of financial literacy and how it empowers you to make informed financial decisions throughout your life.

Conclusion

Our comprehensive exploration of "J I D Net Worth 2024" has illuminated key insights into his financial standing and wealth accumulation strategies. Several key points emerge from our analysis:

- J I D's net worth in 2024 is estimated to be around $8 million, primarily driven by his music career and investments.

- Effective cash flow management and a diversified investment portfolio have played crucial roles in his financial success.

- Understanding the impact of taxes, financial goals, and liabilities is essential for evaluating his net worth and making informed financial decisions.

In conclusion, J I D's net worth in 2024 reflects his hard work, financial savvy, and long-term planning. His journey serves as a reminder of the importance of financial literacy, prudent money management, and the pursuit of financial goals.

- Does Robert Ri Chard Have A Wife

- Know About Camren Bicondova Age Height Gotham

- Wiki Biography Age Height Parents Nationality Boyfriend

- Jasprit Bumrah Injury Update What Happened To

- Malachi Barton S Dating Life Girlfriend Rumors

Martine Rothblatt Net Worth 2024 Wiki Bio, Married, Dating, Family

Sean Reid J.D. Net Worth (2024) wallmine

J Cole Net Worth 2022 Rapper Earns This Much After Reaching Historic