Unveiling The Wealth Of Josh Cox: A Comprehensive Guide For Financial Success

Noun: Josh Cox Net Worth

Josh Cox's net worth, which represents the value of his assets minus his liabilities, indicates his financial standing. It reflects his income, investments, and spending habits, and can provide insights into his financial health.

Understanding net worth is essential for both individuals and financial institutions. It helps individuals manage their finances, make informed investment decisions, and qualify for loans. For financial institutions, net worth assessment is crucial for evaluating creditworthiness and lending risks.

- Mzansi Man Documents Sa Potholes Viral Tiktok

- Jasprit Bumrah Injury Update What Happened To

- Truth About Nadine Caridi Jordan Belfort S

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Joe Kennedy Iii Religion Meet His Parents

Historically, net worth has evolved as a key indicator of financial well-being. In the early 19th century, it was used to determine a person's eligibility for bail. Today, it remains a fundamental financial metric for assessing individuals and businesses.

Josh Cox Net Worth

Understanding the essential aspects of Josh Cox's net worth is crucial for assessing his financial well-being and making informed decisions. These aspects provide insights into his income, investments, spending habits, and overall financial health.

- Income sources

- Investment portfolio

- Property holdings

- Business interests

- Debt obligations

- Tax liabilities

- Insurance coverage

- Estate planning

- Philanthropic activities

- Market fluctuations

Josh Cox's income streams primarily come from his successful business ventures, including his tech startup and real estate investments. His investment portfolio consists of a diversified mix of stocks, bonds, and alternative assets. He owns multiple properties, both residential and commercial, which contribute to his net worth. Cox also has various business interests, such as a venture capital firm and a non-profit organization. While he has substantial debt obligations, including mortgages and business loans, he also has comprehensive insurance coverage to protect his assets. Cox is known for his philanthropic activities, donating to various charities and causes. His net worth is subject to market fluctuations, which can impact the value of his investments and properties.

- Discover The Net Worth Of American Actress

- Wiki Biography Age Height Parents Nationality Boyfriend

- Tony Romo Net Worth 2023 Assets Endorsements

- Did Tori Bowie Baby Survive What Happened

- Noah Pc3a9rez Chris Perez Son Age

Income sources

Income sources are a critical component of Josh Cox's net worth, reflecting the various ways in which he generates revenue. These sources provide insights into his financial stability, growth potential, and overall financial well-being.

- Business ventures: Cox's primary income source is his successful tech startup, which has generated substantial revenue through its innovative products and services. He also has investments in other businesses, including real estate and venture capital, which contribute to his overall income.

- Investments: Cox has a diversified investment portfolio that includes stocks, bonds, and alternative assets. These investments generate passive income through dividends, interest, and capital appreciation, providing a steady stream of revenue.

- Property rentals: Cox owns multiple properties, both residential and commercial, which he rents out to tenants. Rental income provides a consistent and reliable source of income, contributing to his net worth.

- Other sources: Cox may have additional income sources, such as royalties from intellectual property or earnings from consulting or advisory roles. These sources can supplement his primary income streams and further enhance his net worth.

The diversity of Josh Cox's income sources strengthens his financial position by reducing reliance on any single source. This diversification strategy helps mitigate risks and ensures a steady flow of income, contributing significantly to his overall net worth.

Investment portfolio

Josh Cox's investment portfolio holds a central place in his overall financial health and the determination of his net worth. It encompasses a diversified mix of stocks, bonds, and alternative assets, each offering unique risk and return profiles. Cox's investment strategy reflects his long-term financial goals, risk tolerance, and desire to grow his wealth over time.

The performance of Cox's investment portfolio directly impacts his net worth. Positive returns on investments, such as capital appreciation or dividend income, lead to an increase in his net worth. Conversely, losses or underperformance in the portfolio can diminish his net worth. This dynamic interplay highlights the significance of portfolio management and the expertise required to navigate market fluctuations.

Real-life examples illustrate the practical applications of investment portfolios in determining net worth. Warren Buffett, renowned investor and CEO of Berkshire Hathaway, has amassed a vast net worth largely through his successful investment portfolio. His long-term investment approach, focused on value investing and compounding returns, has significantly contributed to his overall wealth.

Understanding the relationship between investment portfolios and net worth is essential for both individuals and financial professionals. Individuals can make informed decisions about their investments, considering their risk appetite and financial goals. Financial professionals, such as wealth managers and financial advisors, leverage this understanding to create personalized investment strategies for their clients, helping them achieve their financial aspirations.

Property holdings

Property holdings constitute a significant component of Josh Cox's net worth and play a crucial role in determining his overall financial standing. They encompass various types of real estate assets, each with unique characteristics and implications.

- Residential properties: Cox owns multiple residential properties, including his primary residence and several rental units. These properties generate rental income and appreciate in value over time, contributing to his net worth.

- Commercial properties: Cox has invested in commercial properties, such as office buildings and retail spaces. Commercial properties offer potential for higher rental income and long-term capital appreciation, further enhancing his net worth.

- Land: Cox holds land assets, which may include undeveloped land or land with development potential. Land can provide future development opportunities, increasing his net worth.

- Vacation homes: Cox owns vacation homes in desirable locations. While vacation homes may not generate direct income, they offer personal enjoyment and can appreciate in value, adding to his net worth.

The diversity of Josh Cox's property holdings contributes to his financial stability and risk mitigation. Real estate investments provide a hedge against inflation and can offer potential tax benefits. Additionally, property holdings can serve as collateral for loans, allowing Cox to access capital for other investments or business ventures. Overall, his property holdings play a significant role in the accumulation and preservation of his net worth.

Business interests

Josh Cox's business interests play a pivotal role in determining his net worth. As an entrepreneur and investor, Cox has established a diverse portfolio of businesses that contribute significantly to his overall financial standing.

The most notable business interest that has positively impacted Cox's net worth is his tech startup. Founded several years ago, the company has experienced remarkable growth and success, generating substantial revenue and attracting significant investment. The value of Cox's stake in the startup has grown exponentially, contributing significantly to his net worth.

Beyond his tech startup, Cox has invested in other businesses, including real estate and venture capital. These investments provide diversification to his portfolio and offer potential for long-term growth. Additionally, Cox's business interests extend to philanthropic activities, where he supports various charitable causes and non-profit organizations.

Understanding the connection between business interests and net worth is crucial for individuals and investors alike. By actively managing and growing their business interests, individuals can potentially increase their net worth and achieve financial success. Conversely, poorly managed or unsuccessful business ventures can negatively impact net worth. It is essential to conduct thorough due diligence, seek professional advice, and make informed decisions when investing in business interests.

Debt obligations

Debt obligations occupy a crucial position in the financial tapestry of Josh Cox's net worth. These obligations represent borrowed funds that must be repaid with interest, potentially impacting his overall financial health and net worth.

The relationship between debt and net worth is a double-edged sword. On one hand, debt can provide leverage for investments and business ventures, potentially amplifying returns and contributing to net worth growth. On the other hand, excessive or poorly managed debt can lead to financial strain and a decrease in net worth. In Cox's case, his debt obligations primarily stem from business loans and mortgages, which he has strategically utilized to finance his entrepreneurial endeavors and real estate investments.

Real-life examples illustrate the practical implications of debt obligations within Josh Cox's net worth. His business loans have enabled him to expand his tech startup's operations and invest in new technologies, contributing to its growth and increased valuation. Similarly, his mortgages have allowed him to acquire multiple properties, generating rental income and potential capital appreciation, further bolstering his net worth.

Understanding the interplay between debt obligations and net worth is essential for both individuals and investors. Prudent debt management involves carefully considering the terms, interest rates, and repayment schedules associated with borrowed funds. By weighing the potential benefits against the risks, individuals like Cox can make informed financial decisions that optimize their net worth and long-term financial well-being.

Tax liabilities

Tax liabilities are a crucial component of Josh Cox's net worth, directly impacting his overall financial standing. As with any individual or business, Cox is legally obligated to pay taxes on his income and assets, and these liabilities can significantly affect his net worth.

The relationship between tax liabilities and net worth is a cause-and-effect dynamic. Higher tax liabilities can reduce net worth, as a portion of Cox's income and assets must be allocated towards tax payments. Conversely, lower tax liabilities can contribute to a higher net worth, leaving more of Cox's income and assets available for investment and growth. Effective tax planning and management are therefore essential for optimizing net worth.

Real-life examples illustrate the practical implications of tax liabilities within Josh Cox's net worth. In 2021, Cox's tech startup experienced a surge in profits, resulting in increased tax liabilities. To meet these obligations, Cox had to allocate a significant portion of the company's earnings towards tax payments, which reduced the amount available for reinvestment and expansion. This, in turn, impacted the startup's growth potential and ultimately affected Cox's net worth.

Understanding the connection between tax liabilities and net worth is crucial for both individuals and investors. Prudent tax planning can help minimize tax liabilities and maximize net worth, while neglecting tax obligations can have severe financial consequences. By staying informed about tax laws and seeking professional advice when necessary, individuals and businesses can make informed decisions that optimize their financial well-being.

Insurance coverage

Insurance coverage significantly contributes to the financial well-being and stability reflected in Josh Cox's net worth. It provides protection against potential financial losses and unexpected events that could erode his assets and impact his overall financial standing.

- Life insurance: This coverage offers financial protection for Cox's family in the event of his untimely demise. It ensures that his dependents will have financial support and security, mitigating the impact on his net worth.

- Health insurance: Health insurance safeguards Cox against medical expenses and ensures access to quality healthcare. By covering medical costs, it prevents unexpected medical expenses from depleting his assets and affecting his financial stability.

- Property insurance: This coverage protects Cox's real estate investments, including his primary residence and rental properties, against damage or loss. It provides financial compensation in the event of events such as fire, natural disasters, or theft, preserving his net worth and ensuring the continued generation of rental income.

- Business insurance: Cox's business ventures are protected by various insurance policies, such as liability insurance, workers' compensation, and property insurance. These policies mitigate financial risks associated with business operations, safeguarding his net worth and fostering business continuity.

In summary, Josh Cox's comprehensive insurance coverage plays a vital role in maintaining and enhancing his net worth. It provides financial protection against a wide range of risks, ensuring his financial well-being and the preservation of his assets. By mitigating potential financial losses and safeguarding his business interests, insurance coverage contributes to the stability and growth of his net worth over time.

Estate planning

Estate planning is a crucial aspect of Josh Cox's net worth management and plays a significant role in protecting and preserving his wealth for the future. It involves a comprehensive strategy to manage the distribution of assets and minimize potential financial and legal complications after his passing.

Estate planning is a critical component of Josh Cox's net worth as it provides him with the ability to control the distribution of his assets according to his wishes. By creating a will or trust, he can specify how his assets will be divided among his beneficiaries, ensuring that his intentions are carried out and potential disputes are minimized. Additionally, estate planning allows Cox to reduce estate taxes and other financial burdens that could erode his net worth upon his death.

A practical example of estate planning within Josh Cox's net worth is the creation of a revocable living trust. This legal document transfers ownership of his assets to a trust, while he retains control during his lifetime. Upon his passing, the assets in the trust are distributed to his beneficiaries according to his wishes, avoiding the probate process and potential legal challenges. This strategy helps preserve his net worth and ensures a smooth transition of his assets to his intended heirs.

Understanding the connection between estate planning and Josh Cox's net worth is essential for individuals seeking to protect and manage their wealth. By implementing a comprehensive estate plan, Cox has taken proactive steps to safeguard his assets, minimize taxes, and ensure his legacy is preserved according to his wishes. It serves as a reminder of the importance of estate planning for individuals of all wealth levels to protect their net worth and provide peace of mind for their loved ones.

Philanthropic activities

Philanthropic activities significantly contribute to Josh Cox's net worth, reflecting his commitment to social responsibility and making a positive impact beyond financial success. His generous donations to various charitable causes and non-profit organizations have a direct and indirect impact on his overall wealth management strategy.

Firstly, Cox's philanthropic activities enhance his personal reputation and public image. By actively supporting causes he believes in, he establishes himself as a socially conscious individual, which can translate into increased trust and credibility in his business dealings. This positive reputation can lead to improved relationships with stakeholders, clients, and investors, ultimately benefiting his net worth.

Secondly, Cox's philanthropic efforts often align with his business interests. For instance, his support for educational initiatives in STEM fields may contribute to a more qualified workforce for his tech startup. By investing in the community, he creates a favorable environment for his business to thrive, potentially enhancing its long-term profitability and, consequently, his net worth.

In summary, Josh Cox's philanthropic activities are not only admirable acts of social responsibility but also strategic components of his net worth management. They contribute to his positive reputation, foster relationships with key stakeholders, and align with his business goals. Understanding this connection allows individuals and businesses to recognize the broader implications of philanthropy and its potential impact on financial well-being.

Market fluctuations

Market fluctuations, characterized by price variations in financial markets, significantly influence Josh Cox's net worth due to his diverse investments and business interests. These fluctuations can impact the value of his portfolio, business performance, and overall financial standing.

- Stock market volatility: Changes in stock prices can affect the value of Cox's investment portfolio. Bull markets lead to potential gains, while bear markets may result in losses, impacting his net worth.

- Bond market fluctuations: Bond prices can fluctuate due to changes in interest rates. When interest rates rise, bond prices may fall, potentially affecting the value of Cox's bond holdings.

- Real estate market trends: Market conditions in the real estate sector influence the value of Cox's property investments. Rising property values contribute to net worth growth, while downturns may lead to losses.

- Currency exchange rates: Cox's net worth can be impacted by fluctuations in currency exchange rates, especially if he has international business interests or investments denominated in foreign currencies.

Understanding the dynamics of market fluctuations is crucial for Cox to make informed investment decisions and manage risk effectively. By diversifying his portfolio across asset classes and industries, he can mitigate the impact of any single market downturn on his overall net worth. Additionally, monitoring market trends and economic indicators allows him to anticipate potential fluctuations and adjust his investment strategy accordingly, preserving and growing his wealth over the long term.

Frequently Asked Questions about Josh Cox Net Worth

This FAQ section aims to address common questions and clarify key aspects related to Josh Cox's net worth.

Question 1: What is the primary source of Josh Cox's wealth?

Josh Cox primarily derives his wealth from his successful tech startup and real estate investments.

Question 2: How diverse is Josh Cox's investment portfolio?

Cox's investment portfolio is well-diversified, encompassing stocks, bonds, and alternative assets to mitigate risk and enhance returns.

Question 3: Does Josh Cox engage in philanthropic activities?

Yes, Cox is actively involved in philanthropy, supporting various charitable causes and non-profit organizations.

Question 4: How do market fluctuations impact Josh Cox's net worth?

Market fluctuations can significantly influence Cox's net worth due to his investments in the stock and real estate markets, as well as his international business interests.

Question 5: What strategies does Josh Cox employ to manage risk?

Cox employs various risk management strategies, including portfolio diversification, hedging, and asset allocation, to mitigate potential losses.

Question 6: Is Josh Cox's net worth publicly available information?

While Josh Cox's net worth is not publicly disclosed, estimates and approximations based on available information are often reported by financial media outlets and analysts.

These FAQs provide insights into the various components and considerations surrounding Josh Cox's net worth. Understanding these aspects is crucial for assessing his financial standing and the factors that contribute to his overall wealth.

In the next section, we will delve deeper into the investment strategies and financial decisions that have shaped Josh Cox's net worth, offering further analysis and insights into his approach to wealth management.

Tips for Managing Your Net Worth

Effectively managing your net worth is crucial for financial well-being. These tips provide actionable steps to help you optimize your financial standing:

Tip 1: Track Your Income and Expenses: Monitor your cash flow to gain insights into spending patterns and identify areas for improvement.

Tip 2: Create a Budget: Allocate funds wisely by creating a budget that aligns with your financial goals and priorities.

Tip 3: Invest Regularly: Start investing early and consistently to harness the power of compounding returns.

Tip 4: Diversify Your Portfolio: Spread your investments across different asset classes and sectors to mitigate risk.

Tip 5: Manage Debt Wisely: Prioritize high-interest debts and consider debt consolidation or refinancing options to reduce interest payments.

Tip 6: Seek Professional Advice: Consult with a financial advisor or tax professional to optimize your financial strategies and maximize your net worth.

Tip 7: Review and Rebalance Regularly: Monitor your investments and make adjustments as needed to maintain your desired risk tolerance and asset allocation.

By implementing these tips, you can take control of your finances, increase your net worth, and secure your financial future.

The following section will explore advanced strategies for wealth management, building upon these fundamental principles to achieve even greater financial success.

Conclusion

Our exploration of Josh Cox's net worth reveals the intricate interplay between various financial components. His success stems from a combination of entrepreneurial ventures, strategic investments, and prudent financial management. The diversification of his income sources, investment portfolio, and property holdings provides stability and mitigates risk.

Understanding the dynamics of market fluctuations and their impact on net worth is essential for informed decision-making. Effective risk management strategies, such as portfolio diversification and asset allocation, are crucial for preserving and growing wealth over the long term. Philanthropic activities not only reflect personal values but can also align with business goals.

- Wwe Billy Graham Illness Before Death Was

- Janice Huff And Husband Warren Dowdy Had

- Beloved Irish Father Clinton Mccormack Dies After

- Legendary Rella S Relationship Status Is She

- Mzansi Man Documents Sa Potholes Viral Tiktok

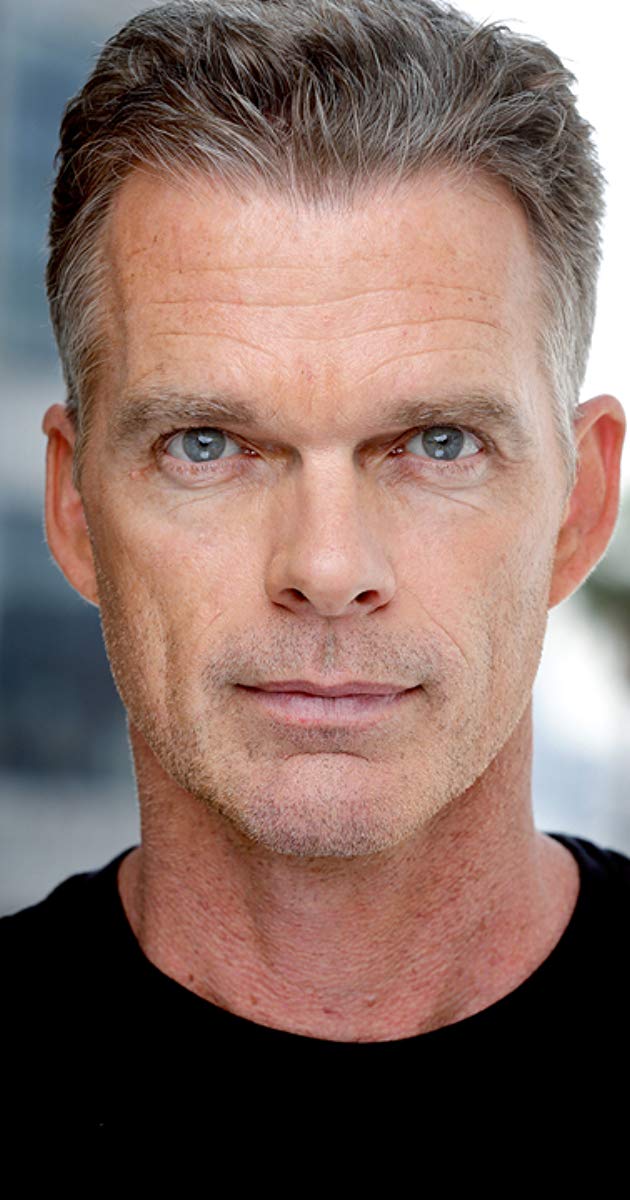

Josh Cox Nashville Wiki Fandom

Home Josh Cox

Home Josh Cox