How Ken Read Built His Impressive Net Worth: Lessons For Financial Success

Ken Read Net Worth, a noun, represents the total value of assets owned by Ken Read, calculated as the sum of all assets minus liabilities. An example is an individual with assets worth $10 million and liabilities worth $2 million, resulting in a net worth of $8 million.

Determining net worth is essential for financial planning and tracking wealth over time. It provides insights into financial health, creditworthiness, and investment capacity. Historically, the concept of net worth emerged from the double-entry accounting system developed by Luca Pacioli in the 15th century.

This article delves into Ken Read's net worth, exploring the contributing factors, investments, and financial strategies that have shaped his wealth.

- Joe Kennedy Iii Religion Meet His Parents

- How Tall Is Markiplier The Truth About

- Chris Brown Net Worth Daughter Ex Girlfriend

- Justin Bieber Sells Entire Music Catalogue For

- Truth About Nadine Caridi Jordan Belfort S

Ken Read Net Worth

Understanding the essential aspects of Ken Read Net Worth is crucial for assessing his financial status and wealth management strategies. Key aspects to consider include:

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cash Flow

- Debt

- Equity

- Risk Tolerance

- Investment Strategy

These aspects provide insights into Ken Read's financial strength, liquidity, solvency, and risk profile. By analyzing these factors, individuals can better understand the factors contributing to his wealth and make informed decisions regarding their own financial strategies.

Assets

Assets play a critical role in understanding Ken Read's net worth, as they represent the foundation of his financial wealth. Assets are anything of value owned by Ken Read that can be converted into cash or used to generate income. They are a crucial component of net worth, as they contribute positively to its overall value. The more valuable Ken Read's assets are, the higher his net worth will be.

- Tony Romo Net Worth 2023 Assets Endorsements

- Who Is Miranda Rae Mayo Partner Her

- Patrick Alwyn Age Height Weight Girlfriend Net

- Claudia Sampedro Wags Miami Age Engaged Husband

- Where Was I Want You Back Filmed

Examples of assets that may contribute to Ken Read's net worth include real estate, stocks, bonds, vehicles, and intellectual property. Each of these assets has a specific value and can be bought, sold, or traded to generate income or increase in value over time. By diversifying his assets across different categories, Ken Read can spread his risk and potentially increase his overall net worth.

Understanding the relationship between assets and net worth is crucial for anyone seeking to build and manage their own wealth. By identifying, acquiring, and managing assets effectively, individuals can increase their net worth and secure their financial future. It is important to note that assets can also depreciate in value, so it is essential to monitor their performance and make adjustments as needed to maintain or increase net worth over time.

Liabilities

Liabilities are financial obligations that Ken Read owes to other entities or individuals. They represent the claims against his assets and can significantly impact his net worth. Liabilities arise from various sources, such as loans, mortgages, unpaid bills, and taxes. Understanding the connection between liabilities and Ken Read's net worth is crucial for assessing his financial health and stability.

Liabilities have an inverse relationship with net worth. As liabilities increase, Ken Read's net worth decreases. This is because liabilities represent a reduction in his overall financial resources. For instance, if Ken Read takes out a $100,000 loan, his net worth will decrease by $100,000, as the loan becomes a liability that he must repay. Conversely, as liabilities decrease, Ken Read's net worth increases.

Managing liabilities effectively is essential for maintaining a healthy net worth. Ken Read can reduce liabilities by paying down debt, negotiating lower interest rates, or consolidating multiple debts into a single loan with a lower interest rate. By strategically managing liabilities, he can minimize their impact on his net worth and improve his overall financial position.

Understanding the connection between liabilities and net worth is crucial for anyone seeking to manage their finances effectively. By monitoring liabilities and taking steps to reduce them, individuals can increase their net worth and secure their financial future.

Investments

Investments play a vital role in shaping Ken Read's net worth, representing the allocation of his financial resources in assets that have the potential to generate income, appreciate in value, or both.

- Stocks

Stocks represent ownership shares in publicly traded companies. Ken Read's investment in stocks provides him with potential for capital appreciation and dividend income.

- Bonds

Bonds are fixed-income securities that represent loans made to companies or governments. Ken Read earns interest income from bonds, contributing to his overall investment returns.

- Real Estate

Real estate investments encompass land, buildings, and other property. Ken Read may generate rental income, capital appreciation, or both through his real estate portfolio.

- Alternative Investments

Alternative investments, such as private equity, venture capital, and hedge funds, offer diversification and potentially higher returns. However, they may also carry higher risks and require specialized knowledge.

By carefully selecting and managing his investments, Ken Read can potentially increase his net worth over time. However, it is important to note that investments are subject to market fluctuations and may lose value. Ken Read's investment strategy and risk tolerance will influence the composition and performance of his investment portfolio.

Income

Income plays a significant role in Ken Read's net worth, as it represents the inflow of financial resources that contribute to his overall wealth. Income can come from various sources, including employment, investments, and business ventures. Understanding the connection between income and Ken Read's net worth is crucial for assessing his financial health and wealth accumulation strategies.

A consistent and stable income is a critical component of Ken Read's net worth. It provides him with the necessary resources to cover expenses, invest for the future, and increase his overall wealth. Without a steady income, it would be challenging for Ken Read to maintain or grow his net worth over time. Real-life examples of income sources that may contribute to Ken Read's net worth include his earnings from professional surfing competitions, sponsorships, and investments in various businesses.

The practical significance of understanding the connection between income and Ken Read's net worth lies in its implications for financial planning and wealth management. By analyzing his income streams, Ken Read can make informed decisions about his spending, saving, and investment strategies. Additionally, it enables him to identify areas where he can potentially increase his income and further grow his net worth.

In summary, income is a fundamental component of Ken Read's net worth, providing the financial resources necessary to cover expenses, invest for the future, and increase his overall wealth. Understanding this connection empowers Ken Read to make informed financial decisions and strategically manage his resources to maximize his net worth over time.

Expenses

Expenses represent the outflow of financial resources that reduce Ken Read's net worth. Every expense he incurs, whether personal or business-related, directly impacts his overall wealth. Understanding the relationship between expenses and Ken Read's net worth is crucial for effective financial management and wealth accumulation.

Expenses can be classified into various categories, such as living expenses (e.g., housing, food, transportation), business expenses (e.g., salaries, marketing, inventory), and financial expenses (e.g., interest payments, loan repayments). Each expense item can have a significant effect on Ken Read's net worth. For instance, a large purchase like a luxury car would reduce his net worth, while cutting back on unnecessary expenses can help him preserve or increase it.

Managing expenses effectively is essential for Ken Read to maintain a healthy net worth. By analyzing his spending habits, identifying unnecessary expenses, and negotiating lower costs, he can minimize the impact of expenses on his net worth. Additionally, Ken Read can explore alternative ways to fulfill his needs, such as renting instead of buying or utilizing public transportation instead of owning a car. These strategies can contribute to reducing expenses and increasing his overall net worth over time.

Cash Flow

Cash flow is a vital aspect of Ken Read's net worth, representing the movement of money in and out of his financial accounts. Understanding cash flow provides insights into his liquidity, financial flexibility, and overall financial health.

- Operating Cash Flow

Generated from Ken Read's primary business activities, such as surfing competitions and sponsorships. A positive operating cash flow indicates the business's ability to generate revenue and cover expenses.

- Investing Cash Flow

Represents the cash used to acquire or dispose of assets, such as real estate or investments in other businesses. A negative investing cash flow indicates Ken Read is reinvesting in his portfolio.

- Financing Cash Flow

Involves activities related to raising capital, such as taking out loans or issuing stocks. A positive financing cash flow can increase Ken Read's liquidity and financial flexibility.

- Net Cash Flow

Calculated as the sum of the three cash flows, it provides an overall view of Ken Read's cash surplus or deficit. A positive net cash flow indicates an increase in his liquidity and financial resources.

Monitoring cash flow allows Ken Read to assess his financial performance, make informed decisions, and maintain a healthy net worth. By tracking the sources and uses of cash, he can ensure that there is sufficient liquidity to meet financial obligations, fund investments, and manage expenses effectively.

Debt

Debt, representing borrowed funds, plays a complex role in Ken Read's net worth. Understanding the connection between debt and Ken Read's net worth is crucial for assessing his financial health, liquidity, and overall financial strategy.

Debt can impact Ken Read's net worth in various ways. Taking on debt increases his liabilities, which can reduce his overall net worth. However, debt can also be used strategically to acquire assets or invest in growth opportunities, which could potentially increase his net worth in the long run. The key is to manage debt effectively to minimize its negative impact and maximize its potential benefits.

In the context of Ken Read's net worth, debt can be a critical component. For instance, Ken Read may have taken on debt to finance a real estate investment property. If the property appreciates in value and generates rental income, the debt can be used as leverage to increase his net worth. However, if the property depreciates in value or does not generate sufficient income, the debt can become a burden, negatively impacting his net worth.

Understanding the practical applications of the connection between debt and Ken Read's net worth is essential for effective financial management. By carefully considering the terms of debt, the potential risks and rewards, and his overall financial situation, Ken Read can make informed decisions about using debt to achieve his financial goals. Effective debt management can help him optimize his net worth, increase his financial flexibility, and secure his financial future.

Equity

Equity, a crucial aspect of Ken Read Net Worth, represents the ownership interest in assets after deducting liabilities. Understanding equity is essential for assessing his financial health, solvency, and overall wealth position.

- Shareholder Equity

Represents Ken Read's ownership in a corporation, calculated as total assets minus total liabilities. Positive shareholder equity indicates solvency and financial stability.

- Home Equity

Refers to the difference between the market value of Ken Read's home and the outstanding mortgage balance. Home equity can be leveraged for loans and investments.

- Investment Equity

Represents the value of Ken Read's investments in stocks, bonds, and other financial instruments. These investments contribute to his overall equity portfolio.

- Net Worth Equity

Calculated as total assets minus total liabilities, net worth equity provides a comprehensive view of Ken Read's overall financial position and wealth.

Ken Read's equity plays a significant role in determining his net worth and financial flexibility. By managing equity effectively, he can increase his net worth, secure his financial future, and achieve his financial goals.

Risk Tolerance

Risk tolerance plays a significant role in shaping Ken Read's net worth. It refers to his willingness to take on financial risk in pursuit of higher returns. Ken Read's risk tolerance can impact his investment decisions, asset allocation, and overall financial strategy.

A high risk tolerance may lead Ken Read to invest in volatile assets like stocks, with the potential for higher returns but also greater risk of losses. Conversely, a low risk tolerance may steer him towards more conservative investments like bonds, which offer lower returns but also lower risk.

Understanding Ken Read's risk tolerance is crucial for evaluating his net worth. A mismatch between his risk tolerance and investment strategy can result in suboptimal outcomes. For instance, if Ken Read has a low risk tolerance but invests in high-risk assets, he may experience significant losses that negatively impact his net worth.

Therefore, it is essential for Ken Read to carefully assess his risk tolerance and align his investment strategy accordingly. By doing so, he can optimize his net worth, minimize losses, and achieve his financial goals in a manner consistent with his risk appetite.

Investment Strategy

Investment strategy plays a crucial role in shaping Ken Read's net worth. It refers to the overall approach and decisions made regarding the allocation of financial resources across various investment vehicles. Ken Read's investment strategy directly influences the growth and preservation of his wealth.

A well-defined investment strategy considers factors such as risk tolerance, time horizon, and financial goals. Ken Read's strategy may involve a diversified portfolio that includes a mix of stocks, bonds, real estate, and alternative investments. By spreading his investments across different asset classes, he aims to minimize risk and maximize returns.

Real-life examples of Ken Read's investment strategy can be seen in his investments in growth stocks, dividend-paying stocks, and real estate. His strategy focuses on long-term capital appreciation and passive income generation. By carefully selecting and managing his investments, Ken Read aims to increase his net worth while preserving his wealth.

Understanding the connection between investment strategy and Ken Read's net worth is essential for anyone seeking to manage their finances effectively. By developing a sound investment strategy that aligns with their risk tolerance and financial goals, individuals can potentially increase their net worth and secure their financial future.

Frequently Asked Questions on Ken Read Net Worth

This section addresses commonly asked questions and clarifies key aspects related to Ken Read's net worth.

Question 1: How is Ken Read's net worth calculated?

Answer: Ken Read's net worth is calculated by subtracting his total liabilities from his total assets, providing a snapshot of his overall financial position.

Question 2: What are the major contributors to Ken Read's net worth?

Answer: Ken Read's net worth is primarily driven by his investments in stocks, bonds, real estate, and his earnings from professional surfing and sponsorships.

Question 3: How does Ken Read manage his investments?

Answer: Ken Read employs a diversified investment strategy, allocating his portfolio across different asset classes to manage risk and optimize returns.

Question 4: What is Ken Read's risk tolerance?

Answer: Ken Read exhibits a moderate risk tolerance, balancing the pursuit of growth with the preservation of capital in his investment decisions.

Question 5: How has Ken Read's net worth changed over time?

Answer: Ken Read's net worth has grown steadily over the years, reflecting the success of his investments and earnings from his professional surfing career.

Question 6: What is the significance of understanding Ken Read's net worth?

Answer: Analyzing Ken Read's net worth provides insights into his financial health, investment strategies, and overall wealth management approach.

These FAQs offer a concise overview of the key factors shaping Ken Read's net worth. To further explore the intricacies of his financial strategies and the lessons we can learn from his success, let's delve into a more detailed analysis in the next section.

Tips for Understanding Ken Read's Net Worth

This section offers practical tips to help you grasp the intricacies of Ken Read's net worth and apply the principles to your financial management.

Tip 1: Track Your Assets and Liabilities: Regularly monitor your assets and liabilities to stay informed about your financial position and net worth.

Tip 2: Analyze Investment Performance: Evaluate the performance of your investments to identify areas for improvement and optimize your portfolio for growth.

Tip 3: Manage Risk Effectively: Assess your risk tolerance and align your investment strategy to minimize losses and maximize returns.

Tip 4: Seek Professional Advice: Consider consulting with a financial advisor for expert guidance on managing your wealth and making informed decisions.

Tip 5: Stay Informed: Keep up with financial news and market trends to stay abreast of factors that may impact your net worth.

Understanding Ken Read's net worth journey can inspire you to take control of your finances, make informed investment decisions, and develop a solid financial foundation.

In the next section, we will explore strategies for optimizing your net worth and achieving your long-term financial goals.

Conclusion

Throughout this exploration of Ken Read's net worth, we gained valuable insights into the factors that have contributed to his financial success. Understanding the dynamics of assets, liabilities, and investment strategies is crucial for managing wealth effectively.

Key takeaways include the importance of diversifying investments to mitigate risk, aligning investment strategies with individual risk tolerance, and continuously monitoring and adjusting financial plans to optimize net worth growth. Ken Read's journey serves as a reminder that financial success is not solely defined by high earnings but by prudent financial management and a commitment to long-term wealth preservation.

- Antony Varghese Wife Net Worth Height Parents

- Tony Romo Net Worth 2023 Assets Endorsements

- Zeinab Harake Boyfriend Who Is She Dating

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Chris Brown Net Worth Daughter Ex Girlfriend

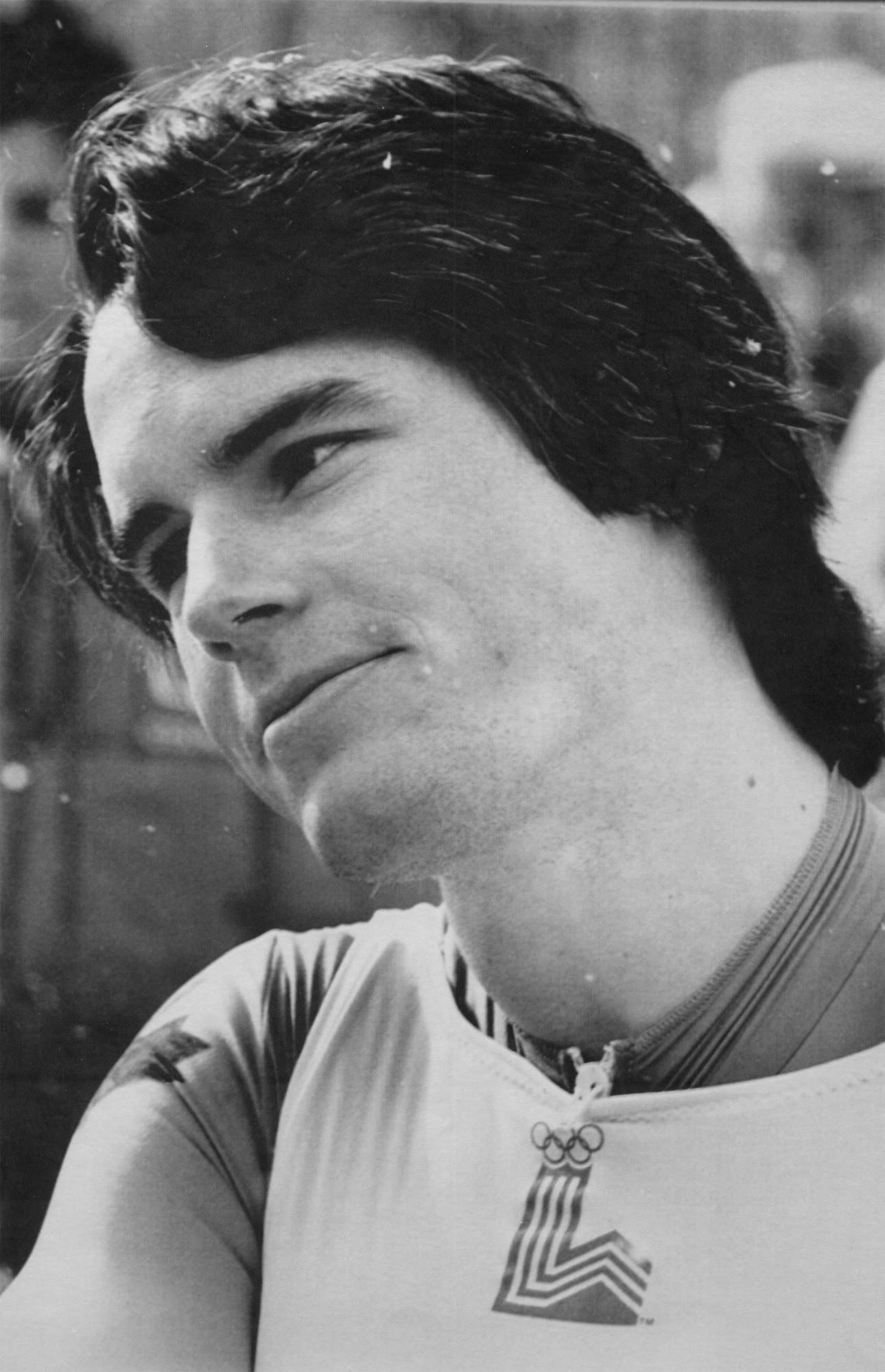

Ken Read Team Canada Official Olympic Team Website

Ken Read, Olympic Skier showusyourmoves

Ken Read Interview YouTube