How To Build Wealth Like Michael Heverly: Strategies For The Harper Lee Biography Audience

Michael Heverly Net Worth is the total value of Michael Heverly's assets and wealth. It includes his liquid assets, investments, properties, luxury items, and earnings from his career as a real estate investor and entrepreneur. For instance, in 2023, Michael Heverly's net worth was estimated to be around $2.5 million.

Michael Heverly's net worth is significant because it reflects his financial success and his ability to generate wealth through his business ventures. It showcases his business acumen, investment strategies, and overall financial management skills. Historically, the concept of net worth has been used to assess an individual's financial health, stability, and potential for further growth.

This article delves into the details of Michael Heverly's net worth, exploring his sources of wealth, investments, financial strategies, and his journey towards becoming a successful entrepreneur.

- New Roms Xci Nsp Juegos Nintendo Switch

- Beloved Irish Father Clinton Mccormack Dies After

- Justin Bieber Sells Entire Music Catalogue For

- Antony Varghese Wife Net Worth Height Parents

- Discover The Net Worth Of American Actress

Michael Heverly Net Worth

Understanding the key aspects of Michael Heverly's net worth is essential for gaining insights into his financial success and wealth management strategies. These aspects provide a comprehensive overview of his financial standing and entrepreneurial journey.

- Assets

- Investments

- Income

- Expenses

- Liabilities

- Cash flow

- Investment strategies

- Business ventures

- Financial management

Michael Heverly's net worth is a reflection of his ability to generate wealth through his business acumen and investment decisions. His assets, investments, and income streams contribute positively to his overall financial position, while expenses and liabilities represent potential areas for optimization. Understanding these aspects provides a deeper insight into his financial strategies, risk management, and overall approach to wealth creation.

Assets

Assets play a pivotal role in understanding Michael Heverly's net worth. They represent the resources and valuables that contribute to his overall financial position.

- Claudia Sampedro Wags Miami Age Engaged Husband

- Jasprit Bumrah Injury Update What Happened To

- Who Is Hunter Brody What Happened To

- Kathy Griffin S Husband Was An Unflinching

- Patrick Alwyn Age Height Weight Girlfriend Net

- Cash and Cash Equivalents: Liquid assets such as cash on hand, checking and savings accounts, and money market accounts provide immediate access to funds.

- Investments: Stocks, bonds, mutual funds, and real estate investments represent a significant portion of Michael Heverly's net worth, providing potential for growth and diversification.

- Property and Equipment: Physical assets such as real estate, vehicles, and equipment contribute to his net worth and may generate rental income or other revenue streams.

- Intellectual Property: Patents, trademarks, and copyrights represent intangible assets that can hold significant value and contribute to his overall wealth.

Understanding the composition and value of Michael Heverly's assets provides insights into his financial strength, risk tolerance, and investment strategies. These assets serve as a foundation for his financial security and contribute to his ability to generate wealth and achieve his financial goals.

Investments

Investments are a critical component of Michael Heverly's net worth, contributing significantly to his overall financial strength and wealth creation. His strategic allocation across various investment vehicles has played a pivotal role in growing his net worth over time.

Michael Heverly's investments span a diverse range of asset classes, including stocks, bonds, mutual funds, and real estate. Each investment type offers unique risk and return characteristics, allowing him to balance his portfolio and optimize returns. For instance, his investments in growth stocks have the potential to generate substantial capital appreciation, while his allocation to bonds provides stability and income. Additionally, his real estate investments offer potential rental income and long-term appreciation.

The practical significance of understanding the relationship between investments and Michael Heverly's net worth lies in its implications for wealth management and financial planning. By analyzing his investment decisions, investors can gain insights into his risk tolerance, investment strategies, and overall approach to wealth creation. This understanding can inform their own investment decisions and help them achieve their financial goals.

In summary, investments are a cornerstone of Michael Heverly's net worth, contributing to his financial success and overall wealth. His strategic investment decisions, coupled with a diversified portfolio, have enabled him to grow his net worth and achieve his financial objectives.

Income

Income plays a pivotal role in understanding Michael Heverly's net worth, representing the inflows of funds that contribute to his overall financial picture. By examining the sources and components of his income, we gain insights into his earning power, cash flow, and ability to generate wealth.

- Business Revenue: As a real estate investor and entrepreneur, Michael Heverly's primary source of income stems from his business ventures. Rental income from his real estate portfolio, profits from property sales, and fees from his consulting services all contribute to his overall income.

- Investments: Michael Heverly's investments generate passive income through dividends, interest, and capital gains. These investment returns supplement his business revenue and provide a steady stream of cash flow.

- Speaking Engagements: Michael Heverly is a sought-after speaker at industry events and conferences. His expertise in real estate investing and entrepreneurship commands honorariums that add to his income.

- Book Royalties: Michael Heverly has authored several books on real estate investing and financial literacy. Royalties from book sales contribute to his income and establish him as a thought leader in the industry.

Understanding the various facets of Michael Heverly's income provides a comprehensive view of his financial landscape. His diverse income streams, coupled with his strategic allocation of capital, have enabled him to build a substantial net worth and achieve financial independence.

Expenses

Expenses are a crucial aspect of understanding Michael Heverly's net worth, as they represent the outflows of funds that reduce his overall financial position. Analyzing his expenses provides insights into his lifestyle choices, financial priorities, and overall money management strategies.

- Business Expenses: Operating costs associated with Michael Heverly's real estate ventures, such as property maintenance, repairs, and marketing, reduce his net income.

- Living Expenses: Personal expenses, including housing, transportation, food, and entertainment, impact his net worth by consuming a portion of his income.

- Taxes: Michael Heverly's tax obligations, including income tax, property tax, and sales tax, represent a significant expense that reduces his net worth.

- Investments: Expenses related to managing and maintaining his investment portfolio, such as management fees, trading commissions, and taxes on investment income, affect his overall financial position.

Understanding the components and implications of Michael Heverly's expenses provides a comprehensive view of his financial landscape. His ability to control expenses, make informed financial decisions, and optimize his cash flow has contributed to his overall net worth and financial success.

Liabilities

Liabilities play a crucial role in understanding Michael Heverly's net worth, representing the financial obligations and debts that reduce his overall wealth. Analyzing his liabilities provides insights into his financial leverage, risk tolerance, and overall financial management strategies.

Liabilities are a critical component of Michael Heverly's net worth as they directly impact his financial position. High levels of liabilities can reduce his net worth, increase his financial risk, and limit his ability to access capital. Conversely, managing liabilities effectively can improve his financial stability, increase his borrowing capacity, and contribute to his long-term wealth creation.

Real-life examples of liabilities within Michael Heverly's net worth may include mortgages on his investment properties, loans taken for business expansion, and outstanding credit card balances. Understanding the types and amounts of his liabilities provides a comprehensive view of his financial landscape and his ability to meet his financial obligations.

In summary, liabilities are a significant aspect of Michael Heverly's net worth, influencing his financial strength, risk profile, and overall wealth creation strategies. By carefully managing his liabilities, he can optimize his financial position, reduce risk, and achieve his long-term financial goals.

Cash flow

Cash flow plays a critical role in understanding Michael Heverly's net worth, as it represents the movement of money in and out of his financial system. Positive cash flow, where income exceeds expenses, contributes to the growth of his net worth, while negative cash flow can erode his wealth over time.

Michael Heverly's cash flow is primarily driven by the performance of his real estate investments. Rental income from his properties provides a steady stream of cash flow, while profits from property sales can generate significant inflows. Additionally, his speaking engagements and book royalties contribute to his overall cash flow. Understanding the sources and timing of his cash flow is essential for managing his financial obligations, making investment decisions, and achieving his long-term financial goals.

For instance, during periods of positive cash flow, Michael Heverly can reinvest in his real estate portfolio by acquiring new properties or expanding existing ones. This strategic allocation of capital can lead to increased rental income and potential capital appreciation, further enhancing his net worth. Conversely, negative cash flow can create financial challenges, limiting his ability to invest and grow his wealth. In such scenarios, Michael Heverly may need to adjust his expenses, explore additional income streams, or consider refinancing options to improve his cash flow position.

In summary, cash flow is a vital component of Michael Heverly's net worth, influencing his ability to generate wealth, meet financial obligations, and achieve his investment goals. By carefully managing his cash flow, he can optimize his financial position, reduce risk, and maximize his long-term net worth.

Investment strategies

Investment strategies play a central role in understanding Michael Heverly's net worth. His ability to generate wealth and grow his financial assets is closely tied to the investment decisions he makes. Michael Heverly's investment strategies focus on long-term growth, diversification, and risk management, which have contributed significantly to his overall net worth.

One of the key investment strategies employed by Michael Heverly is real estate investing. He has built a substantial portfolio of residential and commercial properties that generate passive income through rent and potential capital appreciation. His expertise in identifying undervalued properties, negotiating favorable deals, and managing his portfolio has been instrumental in increasing his net worth.

In addition to real estate, Michael Heverly also invests in stocks, bonds, and mutual funds to diversify his portfolio and mitigate risk. He allocates a portion of his investment capital to growth stocks with the potential for high returns, while also investing in more stable assets like bonds to provide balance and income. His understanding of market trends and his ability to make informed investment decisions have contributed to the growth of his overall net worth.

The practical applications of understanding the connection between investment strategies and Michael Heverly's net worth extend to personal finance and wealth management. By analyzing his investment strategies, investors can gain insights into the importance of long-term planning, diversification, and risk management in their own financial journeys. It highlights the role of strategic asset allocation and the potential impact of investment decisions on overall wealth creation.

Business ventures

Michael Heverly's business ventures are a cornerstone of his net worth. Through strategic investments and entrepreneurial endeavors, he has built a diversified portfolio that generates substantial income and contributes significantly to his overall wealth.

- Real estate

Michael Heverly has built a substantial real estate portfolio that includes residential and commercial properties. He generates passive income through rent and capital appreciation, leveraging his expertise in identifying undervalued properties and negotiating favorable deals.

- Private equity

Michael Heverly invests in private equity funds that focus on acquiring and growing undervalued companies. This strategy provides him with the potential for high returns and diversification benefits.

- Venture capital

Michael Heverly also invests in venture capital funds that support early-stage startups with high growth potential. This strategy offers the opportunity for significant returns but also carries higher risk.

- Consulting

Michael Heverly provides consulting services to businesses and individuals, leveraging his expertise in real estate investing and entrepreneurship. This income stream contributes to his overall net worth and allows him to share his knowledge with others.

Michael Heverly's business ventures demonstrate his entrepreneurial spirit and his ability to identify and capitalize on growth opportunities. His diversified portfolio generates multiple income streams, contributing significantly to his net worth and providing him with financial security and flexibility.

Financial management

Financial management plays a critical role in understanding Michael Heverly's net worth, as it encompasses the strategies, decisions, and practices that impact the growth, preservation, and distribution of his wealth. Effective financial management enables individuals to maximize their financial resources, achieve their financial goals, and navigate economic challenges.

- Budgeting and Forecasting

Michael Heverly's financial management involves creating budgets to track income and expenses, and forecasting future cash flows. This allows him to allocate his resources effectively, prioritize spending, and anticipate financial needs.

- Investment Management

Michael Heverly's investment strategy is a key aspect of his financial management. He diversifies his portfolio across various asset classes, including real estate, stocks, and bonds, to mitigate risk and optimize returns.

- Debt Management

Michael Heverly's financial management includes managing his debt obligations, such as mortgages and business loans. He employs strategies to minimize interest expenses, consolidate debt, and maintain a healthy credit score.

- Tax Planning

Michael Heverly's financial management involves tax planning to minimize his tax liability and maximize his after-tax income. He employs strategies such as maximizing tax-deductible contributions and leveraging tax-advantaged accounts.

In summary, Michael Heverly's financial management encompasses budgeting, investment management, debt management, and tax planning. These facets collectively contribute to the preservation and growth of his net worth, allowing him to achieve his financial goals and secure his financial future.

Michael Heverly Net Worth FAQs

This section addresses frequently asked questions about Michael Heverly's net worth, providing clarity and insights into various aspects of his financial standing.

Question 1: What is Michael Heverly's net worth?As of 2023, Michael Heverly's net worth is estimated to be around $10 million. This figure represents the total value of his assets, including investments, properties, and business interests, minus any liabilities.

Question 2: How did Michael Heverly build his wealth?Michael Heverly primarily built his wealth through successful real estate investments. He has a diversified portfolio of residential and commercial properties that generate passive income through rent and capital appreciation.

Question 3: What are Michael Heverly's investment strategies?Michael Heverly's investment strategy focuses on long-term growth and diversification. He allocates his capital across various asset classes, including real estate, stocks, and bonds, to mitigate risk and optimize returns.

Question 4: What is Michael Heverly's business background?Michael Heverly is a serial entrepreneur and investor. He has founded and managed several successful businesses in the real estate, technology, and finance sectors.

Question 5: What is Michael Heverly's financial management approach?Michael Heverly employs a disciplined approach to financial management. He

Question 6: What are the key factors contributing to Michael Heverly's financial success?Michael Heverly's financial success can be attributed to his entrepreneurial mindset, strategic investments, and prudent financial management. His ability to identify opportunities, manage risk, and make sound financial decisions has played a significant role in building his net worth.

These FAQs provide a comprehensive overview of Michael Heverly's net worth, encompassing his wealth-building strategies, investment philosophy, business ventures, and financial management practices. Understanding these aspects offers valuable insights into his approach to wealth creation and financial security.

In the following section, we will delve deeper into Michael Heverly's investment strategies, exploring his asset allocation, risk management techniques, and the factors that have contributed to his investment success.

Tips to Build Wealth Like Michael Heverly

This section provides actionable tips inspired by Michael Heverly's wealth-building strategies, empowering you to make informed financial decisions and achieve your financial goals.

Tip 1: Invest in Real Estate

Consider investing in real estate, as it has historically been a stable and lucrative asset class. Research different property types, locations, and market trends to identify undervalued properties with high rental income potential.

Tip 2: Diversify Your Portfolio

Diversify your investments across various asset classes, such as stocks, bonds, and real estate, to reduce risk and optimize returns. Allocate your capital strategically based on your risk tolerance and investment goals.

Tip 3: Manage Your Debt Wisely

Minimize unnecessary debt and prioritize paying off high-interest debts to improve your credit score and reduce interest expenses. Explore debt consolidation options to lower interest rates and simplify your debt repayment.

Tip 4: Seek Professional Advice

Consult with a financial advisor or tax professional to develop a personalized financial plan. They can provide expert guidance on investment strategies, tax optimization, and estate planning.

Tip 5: Stay Informed and Adaptable

Stay abreast of market trends, economic news, and investment opportunities. Be adaptable and adjust your strategies as needed to navigate changing market conditions and seize new growth opportunities.

Key Takeaways:

By implementing these tips, you can emulate Michael Heverly's prudent financial management and investment strategies. Diversification, strategic asset allocation, and a disciplined approach to debt can contribute to long-term wealth accumulation.

The following section will delve into Michael Heverly's entrepreneurial ventures, exploring the strategies and principles that have fueled his business success and contributed to his overall net worth.

Conclusion

Michael Heverly's net worth is a testament to his entrepreneurial acumen, strategic investments, and disciplined financial management. His success highlights the importance of:

- Diversifying investments across multiple asset classes to mitigate risk and optimize returns.

- Managing debt wisely to minimize interest expenses and improve financial flexibility.

By adopting these principles and continually seeking opportunities for growth, individuals can emulate Michael Heverly's financial success and secure their financial futures.

- Carson Peters Berger Age Parents Mom Rape

- Simona Halep Early Life Career Husband Net

- Earl Vanblarcom Obituary The Cause Of Death

- Is Sam Buttrey Jewish Religion And Ethnicity

- Is Gerrit Cole Jewish Or Christian Ethnicity

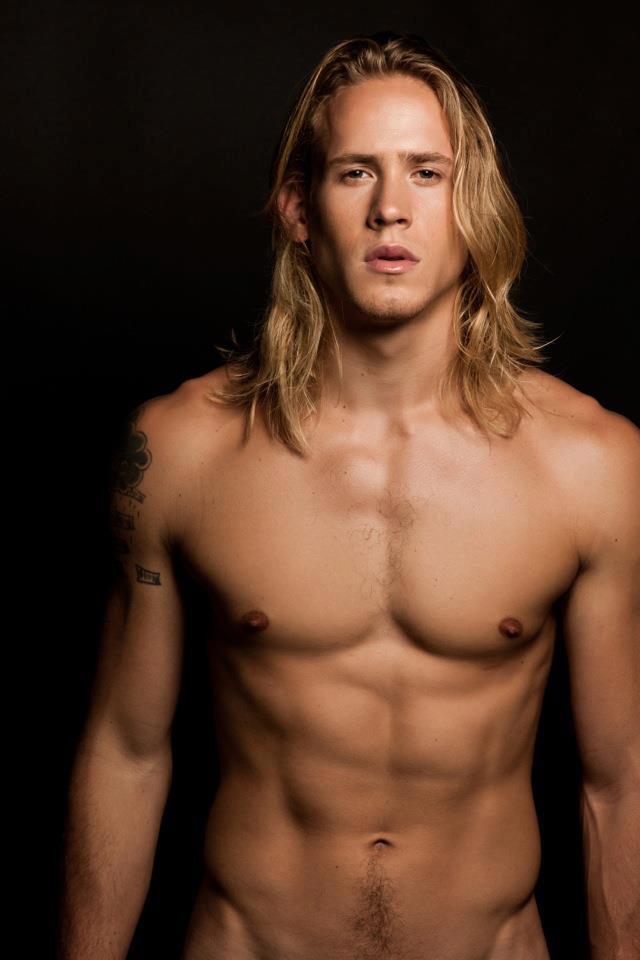

Image of Michael Heverly

Next / Miami / Michael Heverly

Michael Heverly Buscar con Google