Neal Doughty Net Worth: His Rise To Financial Success

Neal Doughty Net Worth is the monetary value of the assets and liabilities of the American business leader, Neal Doughty. It serves as a snapshot of his financial well-being at a given point in time. For instance, in 2023, Neal Doughty's net worth was estimated to be around $250 million.

Neal Doughty's net worth is significant for several reasons. It reflects his success as a businessman, provides insights into his financial status, and can influence his credibility and decision-making power. The concept of net worth has a long history, dating back to ancient times, and has been used to assess the financial health of individuals and organizations.

This article will delve into the components that make up Neal Doughty's net worth, examining his wealth, investments, and any financial challenges he has faced. It will provide a comprehensive analysis of his financial standing and explore the factors that have contributed to his success and accumulation of wealth.

- Who Is Hunter Brody What Happened To

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Wwe Billy Graham Illness Before Death Was

- Chris Brown Net Worth Daughter Ex Girlfriend

- Mzansi Man Documents Sa Potholes Viral Tiktok

Neal Doughty Net Worth

The essential aspects of Neal Doughty's net worth provide insights into his financial standing and wealth accumulation. These include:

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cash Flow

- Debt

- Equity

Understanding these aspects allows for a comprehensive analysis of Doughty's financial health. His assets, which include properties, investments, and cash, provide a snapshot of his wealth. Liabilities, such as mortgages and loans, represent his financial obligations. Investments offer insights into his risk tolerance and growth strategies, while income and expenses shed light on his cash flow and financial management. Debt and equity provide further details about his leverage and ownership structure. By examining these aspects, we gain a deeper understanding of Neal Doughty's financial position and the factors that have contributed to his success.

Assets

Assets play a crucial role in determining Neal Doughty's net worth. Assets are anything of value that Doughty owns or controls, and they can be broadly categorized into two main types: current assets and non-current assets. Current assets are those that can be easily converted into cash within one year, such as cash on hand, accounts receivable, and inventory. Non-current assets, on the other hand, are those that are not easily convertible into cash within a year, such as property, plant, and equipment.

- Who Is Natalie Tene What To Know

- Claudia Sampedro Wags Miami Age Engaged Husband

- Is Sam Buttrey Jewish Religion And Ethnicity

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Julia Dweck Dead And Obituary Nstructor Willow

The value of Doughty's assets contributes directly to his net worth. The more valuable his assets, the higher his net worth will be. For example, if Doughty owns a house worth $1 million and a car worth $50,000, then these assets would contribute a total of $1.05 million to his net worth. It's important to note that assets are not always tangible items; they can also include intangible assets such as intellectual property, patents, and trademarks.

Understanding the connection between assets and net worth is important for several reasons. First, it can help individuals assess their financial health and make informed decisions about their investments. Second, it can provide insights into a company's financial performance and stability. Third, it can be used to compare the financial performance of different individuals or companies. Overall, assets are a critical component of net worth and play a significant role in determining an individual's or company's financial well-being.

Liabilities

Liabilities are essential in understanding Neal Doughty's net worth as they represent his financial obligations. Liabilities include any debts or amounts owed by Doughty, such as mortgages, loans, accounts payable, and taxes. They are considered a critical component of net worth because they reduce its overall value. The relationship between liabilities and net worth is inverse: as liabilities increase, net worth decreases, and vice versa.

For example, if Doughty has a net worth of $1 million and takes out a mortgage of $500,000, his net worth will decrease to $500,000. This is because the mortgage is a liability that reduces the value of his assets. Conversely, if Doughty pays off the mortgage, his net worth will increase by $500,000.

Understanding the connection between liabilities and net worth is crucial for several reasons. First, it allows individuals to assess their financial health and make informed decisions about their spending and investments. Second, it provides insights into a company's financial performance and stability. Third, it enables comparisons between individuals or companies based on their financial obligations. By considering liabilities in conjunction with assets, a more comprehensive view of Neal Doughty's net worth and financial well-being can be obtained.

Investments

Investments play a critical role in Neal Doughty's net worth, as they represent his ownership interest in various assets that have the potential to generate income or appreciate in value. Investments can include stocks, bonds, real estate, private equity, and venture capital. The relationship between investments and net worth is direct: as the value of Doughty's investments increases, so does his net worth. Conversely, if the value of his investments decreases, his net worth will also decrease.

For instance, if Doughty invests $1 million in a stock portfolio that subsequently grows to $1.5 million, his net worth will increase by $500,000. This demonstrates how investments can significantly contribute to the growth of net worth over time. Real estate investments, such as rental properties or commercial buildings, can also generate passive income, further enhancing Doughty's net worth.

Understanding the connection between investments and net worth is essential for several reasons. First, it allows individuals to make informed decisions about their investment strategies and risk tolerance. Second, it provides insights into an individual's or company's financial health and growth potential. Third, it enables comparisons between different individuals or companies based on their investment portfolios. By considering investments in conjunction with other components of net worth, a more comprehensive view of Neal Doughty's financial well-being can be achieved.

Income

Income is a crucial aspect of Neal Doughty's net worth, representing the inflows of funds that contribute to his overall financial standing. It encompasses various streams of earnings, each playing a significant role in shaping his wealth.

- Salary and Wages

Represents regular earnings from employment, including base salary, bonuses, and commissions. For Doughty, this income stream stems from his position as a business leader and investor.

- Investment Income

Encompasses earnings from investments, such as dividends from stocks, interest from bonds, and rental income from real estate. Doughty's investment portfolio generates passive income, contributing to his net worth growth.

- Business Income

Refers to profits earned from business ventures. As an entrepreneur, Doughty's business ventures, such as his leadership in the tech industry, contribute significantly to his income.

- Other Income

Includes earnings from various sources, such as royalties, sponsorships, and personal appearances. Doughty's reputation and expertise may generate additional income streams.

The interplay between these income streams significantly influences Neal Doughty's net worth. Higher levels of income lead to increased net worth, enabling him to accumulate wealth, make further investments, and enhance his financial well-being. Understanding the components and implications of income provides a deeper insight into the dynamics of Doughty's financial success.

Expenses

Expenses play a crucial role in understanding Neal Doughty's net worth, as they represent the outflows of funds that reduce his overall financial standing. Expenses encompass various categories, each contributing to the shaping of his wealth.

The relationship between expenses and net worth is inverse: as expenses increase, net worth decreases. This is because expenses represent a deduction from Doughty's assets and income. For instance, if Doughty incurs $100,000 in expenses, his net worth will decrease by that amount, assuming all other factors remain constant. Managing expenses effectively is therefore essential for preserving and growing net worth.

Examples of expenses within Neal Doughty's net worth include personal expenses, such as housing, transportation, and entertainment; business expenses related to his ventures; and taxes. Understanding the composition and implications of expenses provides insights into Doughty's financial decision-making and spending habits.

In conclusion, expenses are a critical component of Neal Doughty's net worth, as they directly impact its value. Controlling expenses, optimizing spending, and aligning expenses with financial goals are key strategies for preserving and enhancing wealth. By examining the connection between expenses and net worth, individuals can gain valuable insights into financial management and the dynamics of wealth accumulation.

Cash Flow

Cash flow is a crucial aspect of Neal Doughty's net worth, serving as a measure of his financial liquidity and overall financial health. It represents the movement of money into and out of his financial accounts over a specific period, typically a month or a year. By examining cash flow, we gain insights into Doughty's ability to generate income, manage expenses, and make informed financial decisions.

- Operating Cash Flow

Represents the cash generated from Doughty's business operations. This includes income from sales, interest, and dividends, minus expenses such as salaries, rent, and utilities. Positive operating cash flow indicates that Doughty's businesses are generating sufficient cash to cover their expenses and reinvest in growth.

- Investing Cash Flow

Reflects the cash used to acquire or dispose of long-term assets, such as property, equipment, or investments. Positive investing cash flow indicates that Doughty is expanding his business or making strategic investments that could enhance his net worth in the long run.

- Financing Cash Flow

Represents the cash obtained or repaid through borrowing or issuing equity. Positive financing cash flow indicates that Doughty is taking on debt or raising capital to fund his businesses or investments.

Understanding Doughty's cash flow patterns provides valuable insights into his financial management strategies. Consistent positive cash flow allows him to meet his financial obligations, invest in new opportunities, and grow his net worth. Conversely, negative cash flow can signal financial distress and the need for corrective action. By analyzing cash flow in conjunction with other aspects of Doughty's net worth, we gain a comprehensive view of his financial well-being and the factors that contribute to his success.

Debt

Debt plays a significant role in Neal Doughty's net worth, representing his financial obligations and liabilities. It is a crucial component that can impact his overall financial health and wealth accumulation. Understanding the relationship between debt and Neal Doughty's net worth is essential for gaining insights into his financial management strategies and the factors that shape his financial well-being.

Debt can have both positive and negative effects on Neal Doughty's net worth. On the one hand, debt can provide leverage, allowing him to access capital for investments and business ventures that could potentially increase his net worth in the long run. For example, if Doughty takes on debt to purchase a rental property that generates positive cash flow, this could contribute to an increase in his net worth over time.

On the other hand, excessive debt can also be a burden, reducing Neal Doughty's net worth. If he is unable to manage his debt effectively, it can lead to missed payments, damage to his credit score, and even bankruptcy. This can have a significant negative impact on his financial standing and make it more difficult for him to access capital in the future.

It is important to note that debt is not always inherently bad. When managed responsibly, debt can be a tool that helps Neal Doughty achieve his financial goals. However, it is crucial for him to carefully consider the risks and benefits of debt and to ensure that his borrowing aligns with his long-term financial objectives. By understanding the connection between debt and his net worth, Doughty can make informed decisions about his financial management and work towards building a strong and sustainable financial future.

Equity

Equity holds significance in the assessment of Neal Doughty's net worth, representing his ownership interest in various assets and ventures. It contributes directly to his overall financial standing and wealth accumulation. Understanding the composition and implications of equity provides valuable insights into Doughty's financial health and growth potential.

- Ownership in Businesses

Equity encompasses Doughty's ownership stake in companies, including his own ventures and investments in other businesses. The value of his ownership interests contributes directly to his net worth.

- Real Estate Equity

Equity in real estate properties, such as residential or commercial buildings, represents Doughty's ownership share in these assets. The value of his real estate holdings contributes to his net worth.

- Investment Equity

Equity in investments, such as stocks or mutual funds, represents Doughty's ownership interest in these financial instruments. The value of his investment portfolio contributes to his net worth.

- Intellectual Property Equity

Equity in intellectual property, such as patents or trademarks, represents Doughty's ownership of intangible assets. The value of his intellectual property rights also contributes to his net worth.

In conclusion, equity encompasses various forms of ownership interests that collectively contribute to Neal Doughty's net worth. Understanding the composition and value of his equity holdings provides insights into his financial strength, growth potential, and overall wealth accumulation strategies.

Frequently Asked Questions

This section aims to address common questions and clarify key aspects related to Neal Doughty's net worth.

Question 1: What is Neal Doughty's net worth?

Answer: Neal Doughty's net worth is estimated to be around $250 million.

Question 2: How did Neal Doughty accumulate his wealth?

Answer: Doughty's wealth primarily stems from his success as a business leader and investor. His investments in technology, real estate, and other ventures have contributed significantly to his net worth.

Question 3: What is the composition of Neal Doughty's net worth?

Answer: Doughty's net worth comprises various assets, including investments, real estate, and equity in his businesses.

Question 4: How has Neal Doughty's net worth changed over time?

Answer: Doughty's net worth has generally increased over time, reflecting the success of his business ventures and investment strategies.

Question 5: What are the key factors that have contributed to Neal Doughty's financial success?

Answer: Doughty's business acumen, strategic investments, and ability to identify growth opportunities have played a crucial role in his financial success.

Question 6: How does Neal Doughty manage his wealth?

Answer: Doughty is known for his prudent financial management and diversification of investments. He actively manages his assets to optimize returns and minimize risks.

These FAQs provide a glimpse into the factors that have shaped Neal Doughty's net worth and contributed to his financial success. As we delve deeper into the topic, we will explore his investment strategies, business ventures, and the impact of his wealth on his personal life and philanthropic endeavors.

Tips for Building a Strong Net Worth

Understanding the factors that contribute to a strong net worth is crucial for achieving financial success. Here are five detailed tips to help you build and maintain a healthy net worth:

Tip 1: Create a Budget and Track Expenses

Create a comprehensive budget that outlines your income and expenses. Monitor your spending habits to identify areas where you can reduce unnecessary expenses.

Tip 2: Increase Your Income

Explore opportunities to increase your income through salary negotiations, promotions, or starting a side hustle. Invest in education or skills development to enhance your earning potential.

Tip 3: Invest Wisely

Diversify your investment portfolio across different asset classes such as stocks, bonds, and real estate. Conduct thorough research and consult with financial advisors to make informed investment decisions.

Tip 4: Manage Debt Effectively

Minimize unnecessary debt and prioritize paying off high-interest loans first. Consider debt consolidation or refinancing options to reduce interest rates and improve your debt management.

Tip 5: Plan for the Future

Establish a retirement plan and contribute regularly to ensure financial security in your later years. Consider life insurance and disability insurance to protect against unexpected events.

By following these tips, you can build a strong foundation for financial success and achieve a healthy net worth. Remember, building wealth takes time and effort, but with consistent planning and discipline, you can reach your financial goals. This foundation will lead us to explore the impact of Neal Doughty's net worth on his personal life and philanthropic endeavors in the concluding section of this article.

Conclusion

In conclusion, Neal Doughty's net worth is a testament to his business acumen, strategic investments, and financial management skills. His success story highlights the importance of calculated risk-taking, diversification, and long-term planning in building wealth. Moreover, Doughty's philanthropic endeavors demonstrate how financial success can be leveraged to make a positive impact on society.

Key takeaways from Doughty's journey include the significance of education and skill development in enhancing earning potential, the power of compounding returns in long-term investments, and the importance of prudent debt management. By understanding the factors that contribute to a strong net worth, individuals can develop effective financial strategies and work towards achieving their own financial goals.

- Who Is Miranda Rae Mayo Partner Her

- New Roms Xci Nsp Juegos Nintendo Switch

- Antony Varghese Wife Net Worth Height Parents

- Meet Jason Weathers And Matthew Weathers Carl

- A Tragic Loss Remembering Dr Brandon Collofello

Celebrity birthdays July 26 to Aug. 1 WTOP News

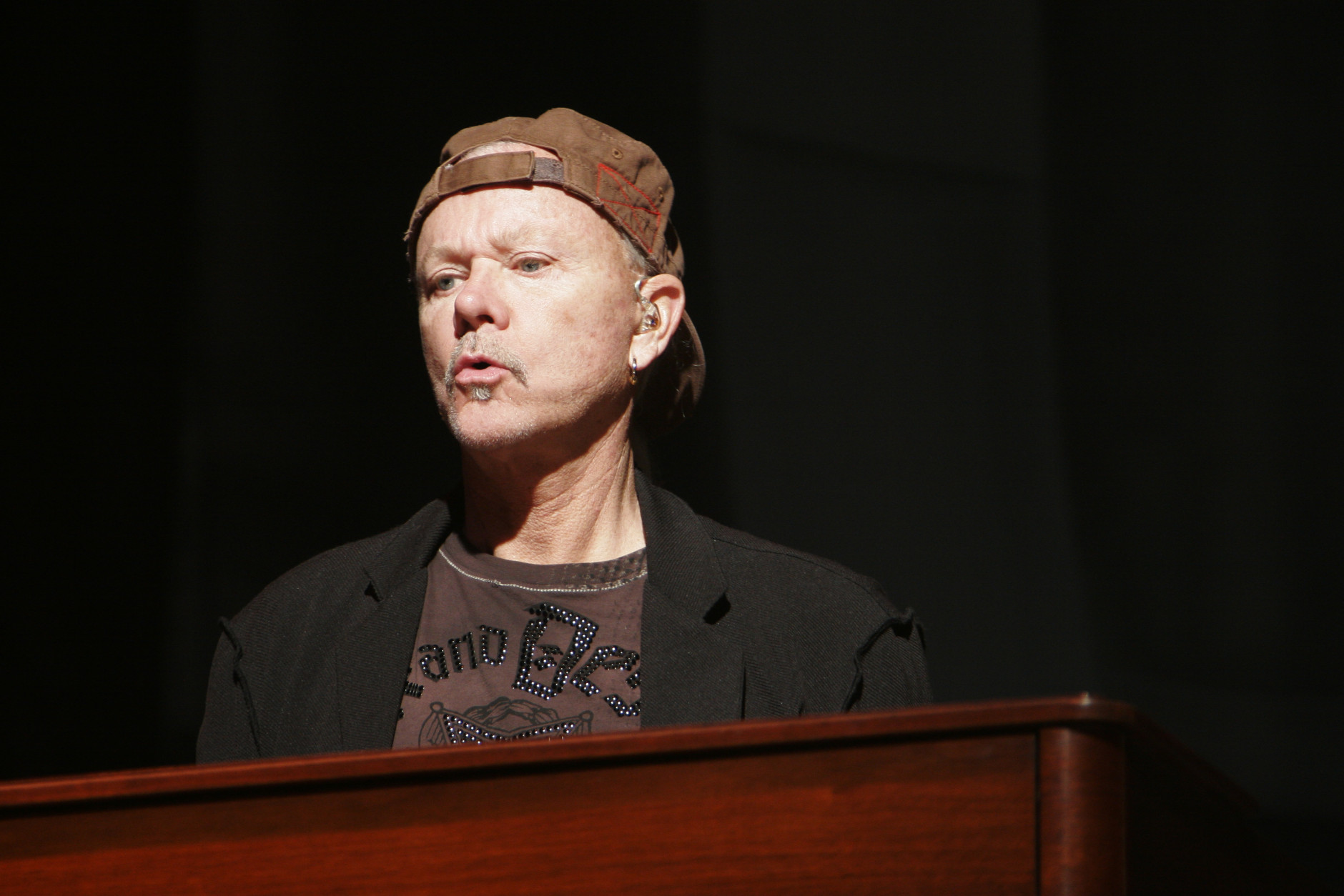

Neal Doughty missed the hell out of REO Speedwagon, and he can’t wait

Alan Gratzer