How To Uncover The Secrets Of Paul Wall Net Worth

Paul Wall Net Worth is the measure of the financial value of the assets and liabilities owned by the American rapper, Paul Wall. The phrase is a combination of the rapper's name and "net worth", a commonly used term for the remaining value of assets after deducting liabilities.

Understanding Paul Wall's net worth is important for investors, analysts, and fans seeking insights into his financial stability and career success. It provides a comprehensive view of his wealth, which can influence investment decisions and provide context for his financial decisions.

The concept of net worth has been used for centuries to assess an individual's financial standing. Historically, it played a vital role in determining eligibility for loans, investments, and other financial transactions.

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

- Who Is Miranda Rae Mayo Partner Her

- Know About Camren Bicondova Age Height Gotham

- Meet Maya Erskine S Parents Mutsuko Erskine

- Does Robert Ri Chard Have A Wife

Paul Wall Net Worth

Understanding the key aspects of Paul Wall's net worth is essential for assessing his financial well-being and career achievements. These aspects provide valuable insights into his financial standing and the factors that have contributed to his success.

- Assets: Properties, investments, and valuable possessions.

- Liabilities: Debts, loans, and financial obligations.

- Income: Earnings from music sales, performances, and endorsements.

- Expenses: Costs associated with maintaining his lifestyle and business.

- Investments: Stocks, real estate, or other financial assets.

- Cash: Liquid assets readily available for use.

- Debt: Amount owed to creditors, including mortgages and loans.

- Equity: The value of assets after deducting liabilities.

- Net Worth: The final value of assets minus liabilities, representing his overall financial worth.

These aspects are interconnected and influence Paul Wall's net worth. His income from music and investments increases his assets, while expenses and liabilities reduce them. Understanding these dynamics provides a comprehensive view of his financial situation, allowing for informed analysis and decision-making.

Assets

Assets, encompassing properties, investments, and valuable possessions, form a crucial component of Paul Wall's net worth. They represent the rapper's ownership of tangible and intangible resources that contribute to his overall financial standing. The value of these assets directly influences his net worth, as they are considered positive contributions to his financial portfolio.

- Anna Faris Net Worth Movies Career Lifestyle

- Melissa Kaltveit Died Como Park Senior High

- Who Is Jahira Dar Who Became Engaged

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Jasprit Bumrah Injury Update What Happened To

Real estate properties, such as houses, apartments, or land, constitute a significant portion of Paul Wall's assets. These properties provide him with rental income, potential appreciation in value, and collateral for loans. Investments in stocks, bonds, or mutual funds diversify his portfolio and contribute to long-term wealth growth. Valuable possessions, including jewelry, artwork, or collectibles, may also hold substantial monetary value and contribute to his net worth.

Understanding the connection between assets and Paul Wall's net worth is crucial for several reasons. Firstly, it provides insights into his financial stability and ability to generate passive income. Secondly, it demonstrates the rapper's diversification of wealth across different asset classes, reducing risk and ensuring financial security. Thirdly, it highlights the importance of asset management and investment strategies in building and maintaining wealth.

Liabilities

Liabilities are financial obligations that represent claims against Paul Wall's assets. They reduce his net worth and can significantly impact his financial stability and decision-making. Liabilities encompass various forms, including debts, loans, and other financial commitments.

- Mortgages

Mortgages are loans secured by real estate, representing a significant liability for Paul Wall. Repaying these loans with interest reduces his net worth until the property is fully owned. - Business Loans

Business loans are funds borrowed to finance business operations or investments. These loans add to Paul Wall's liabilities and must be repaid with interest, potentially affecting his cash flow and profitability. - Personal Loans

Personal loans are unsecured loans used for various personal expenses, such as debt consolidation or home renovations. They typically have higher interest rates and can accumulate over time, impacting Paul Wall's financial obligations. - Taxes

Taxes are financial obligations imposed by government entities, such as income tax or property tax. Failure to pay taxes can result in penalties and legal consequences, making them a significant liability.

Understanding the types and implications of liabilities is crucial for assessing Paul Wall's net worth. High levels of liabilities can limit his financial flexibility, restrict his ability to make investments, and increase his vulnerability to financial distress. Conversely, managing liabilities effectively can improve his creditworthiness, reduce interest expenses, and contribute to long-term financial stability.

Income

Income derived from music sales, performances, and endorsements represents a critical component of Paul Wall's net worth. Music sales, including album sales, digital downloads, and streaming revenue, provide a substantial portion of the rapper's earnings. Successful album releases, chart-topping singles, and collaborations with other artists directly contribute to the growth of his net worth.

Live performances, such as concerts and music festivals, are another significant source of income for Paul Wall. Touring and performing allow him to connect with his fans, generate ticket sales, and promote merchandise. Endorsements and sponsorship deals with brands and companies further supplement his earnings and contribute to his overall financial standing.

The relationship between income and net worth is fundamental. Higher income levels enable Paul Wall to accumulate more assets, invest in his career, and increase his overall wealth. Conversely, a decline in income can negatively impact his net worth and financial stability. Understanding this relationship is crucial for assessing his financial health and making informed decisions about his career and investments.

In the context of Paul Wall's net worth, income plays a pivotal role in determining his financial success. It provides the foundation for building and maintaining his wealth, allowing him to make strategic investments, support his lifestyle, and achieve long-term financial goals.

Expenses

Understanding the expenses associated with maintaining Paul Wall's lifestyle and business is essential in assessing his net worth. These expenses represent the costs incurred to sustain his personal and professional endeavors, shaping his financial landscape and overall financial stability.

- Personal Expenses

Personal expenses encompass costs related to Paul Wall's personal life, such as housing, transportation, food, clothing, and entertainment. These expenses contribute to his quality of life and personal well-being. - Business Expenses

Business expenses include costs incurred in operating and maintaining Paul Wall's music career and business ventures. These expenses may include studio time, equipment, marketing, travel, and staff salaries. - Taxes

Taxes are mandatory payments made to government entities, including income tax, property tax, and sales tax. These expenses reduce Paul Wall's disposable income and impact his net worth. - Investments

Investment expenses involve costs associated with managing and growing Paul Wall's financial portfolio. These expenses may include investment fees, advisory services, and research costs.

Analyzing these expense categories provides valuable insights into Paul Wall's financial obligations and priorities. High expenses relative to income can strain his cash flow and limit his ability to accumulate wealth. Conversely, managing expenses effectively can optimize his financial resources, increase his net worth, and enhance his long-term financial stability.

Investments

Investments form a crucial aspect of Paul Wall's net worth, representing his allocation of financial resources to grow his wealth over time. These investments encompass a range of assets, including stocks, real estate, and other financial instruments.

- Stocks

Stocks represent ownership shares in publicly traded companies. Paul Wall's investment in stocks provides him with potential returns through dividends and capital appreciation, subject to market fluctuations.

- Real Estate

Real estate investments include properties such as residential buildings, commercial spaces, and land. They offer potential returns through rental income, property appreciation, and tax benefits.

- Bonds

Bonds are fixed-income investments that pay regular interest payments and return the principal amount at maturity. Paul Wall's bond investments provide a steady stream of income and help diversify his portfolio.

- Commodities

Commodities are raw materials or agricultural products, such as gold, oil, or wheat. Investing in commodities can provide diversification and potential returns based on market demand and supply.

Paul Wall's investment strategy and the performance of these assets directly impact his net worth. Successful investments can increase his wealth, while underperforming investments may reduce it. Understanding the dynamics of his investment portfolio is essential for assessing his financial stability and overall financial well-being.

Cash

Cash, encompassing liquid assets readily available for use, constitutes a vital component of Paul Wall's net worth. It represents his financial flexibility and ability to meet short-term obligations or seize investment opportunities.

- Currency and Coins

Physical currency and coins held by Paul Wall form a tangible and easily accessible portion of his cash assets. - Demand Deposits

Funds deposited in checking or savings accounts that can be accessed on demand, providing liquidity and convenience. - Money Market Accounts

Specialized accounts offering higher interest rates than traditional savings accounts, while maintaining easy access to funds. - Short-Term Investments

Highly liquid investments with maturities of less than a year, such as certificates of deposit or Treasury bills, providing a balance between liquidity and potential returns.

Understanding the composition and management of Paul Wall's cash assets is essential in assessing his overall financial health. Ample cash reserves provide a buffer against unexpected expenses, facilitate financial transactions, and offer flexibility in decision-making. By effectively managing his cash position, Paul Wall enhances his financial stability and maximizes the potential of his net worth.

Debt

Debt, encompassing amounts owed to creditors through mortgages, loans, and other financial obligations, represents a critical component of Paul Wall's net worth. It directly impacts his overall financial standing and ability to accumulate wealth.

High levels of debt can significantly reduce Paul Wall's net worth. Mortgages, for instance, represent a substantial liability that must be repaid over an extended period. Repaying these loans, along with interest, reduces his net worth until the properties are fully owned. Similarly, business loans and personal loans, if not managed prudently, can accumulate and become a financial burden, further decreasing his net worth.

Understanding the relationship between debt and net worth is crucial for informed decision-making. By managing debt effectively, Paul Wall can improve his creditworthiness, reduce interest expenses, and increase his disposable income. This, in turn, allows him to invest more, grow his assets, and ultimately increase his net worth. Conversely, excessive debt can lead to financial distress, reduced flexibility, and difficulty in obtaining future financing.

In conclusion, debt plays a significant role in determining Paul Wall's net worth. By carefully managing his debt obligations, he can optimize his financial health, maximize his net worth, and achieve long-term financial success.

Equity

Equity represents a crucial component of Paul Wall's net worth, directly impacting his overall financial standing. It reflects the true value of his assets after deducting all outstanding liabilities, providing a clearer picture of his financial stability and wealth.

Equity plays a pivotal role in determining Paul Wall's net worth because it measures his actual ownership and financial interest in his assets. A high equity position indicates that he has a substantial stake in his assets, reducing the risk of financial distress and increasing his borrowing capacity. Conversely, low equity may limit his ability to obtain financing or withstand financial setbacks.

Real-life examples within Paul Wall's net worth highlight the significance of equity. His ownership of multiple properties, for instance, contributes positively to his equity position. The value of these properties, minus any outstanding mortgages, represents a substantial portion of his net worth. Additionally, Paul Wall's investments in stocks and bonds further enhance his equity, providing diversification and potential for growth.

Understanding the connection between equity and net worth has practical applications for Paul Wall's financial decision-making. By focusing on increasing his equity, he can strengthen his financial position, reduce his reliance on debt, and maximize his wealth-building potential. This understanding allows him to make informed choices about investments, asset allocation, and financial planning, ultimately leading to long-term financial success.

Net Worth

Within the context of "Paul Wall Net Worth", understanding the concept of "Net Worth: The final value of assets minus liabilities, representing his overall financial worth" is pivotal. It encapsulates the true measure of his financial standing, considering both his possessions and debts.

- Assets: Foundation of Wealth

Assets, such as real estate, investments, and cash, form the cornerstone of Paul Wall's net worth. They represent the value of what he owns and contribute positively to his overall financial picture.

- Liabilities: Obligations and Debt

Liabilities, including mortgages, loans, and unpaid bills, represent Paul Wall's financial obligations. They reduce his net worth and must be carefully managed to maintain financial stability.

- Equity: True Ownership

Equity, the difference between assets and liabilities, reflects Paul Wall's true ownership and financial interest in his assets. A high equity position strengthens his financial standing and provides a buffer against financial setbacks.

- Financial Stability and Growth

Paul Wall's net worth serves as a barometer of his financial stability and growth potential. A positive net worth indicates financial well-being and the ability to withstand financial challenges. It also provides opportunities for further wealth accumulation and investment.

In conclusion, "Net Worth: The final value of assets minus liabilities, representing his overall financial worth" is a comprehensive measure that captures Paul Wall's financial health. By considering both his assets and liabilities, it provides valuable insights into his ability to generate wealth, manage debt, and plan for the future.

FAQs on Paul Wall Net Worth

This section addresses frequently asked questions and clarifies crucial aspects of Paul Wall's net worth.

Question 1: What is Paul Wall's net worth?

As of [date], Paul Wall's net worth is estimated to be around [amount], placing him among the wealthiest rappers in the industry.

Question 2: How did Paul Wall accumulate his wealth?

Paul Wall's net worth primarily stems from his successful music career, including album sales, concert tours, and collaborations. He has also ventured into acting, business investments, and brand endorsements.

Question 3: What are Paul Wall's most valuable assets?

Paul Wall's most valuable assets include his music catalog, real estate holdings, and investments in stocks and bonds. His music catalog generates substantial royalties, while his real estate and investments provide passive income and potential appreciation.

Question 4: What are Paul Wall's financial liabilities?

Paul Wall's financial liabilities include mortgages on his properties, business loans, and personal expenses. Managing these liabilities effectively is crucial for maintaining his financial stability.

Question 5: How does Paul Wall manage his finances?

Paul Wall reportedly has a team of financial advisors who assist him with managing his investments, tax planning, and overall financial strategy. Prudent financial management has contributed to his continued wealth growth.

Question 6: What factors could impact Paul Wall's net worth in the future?

Paul Wall's net worth may be influenced by factors such as the success of his future music releases, the performance of his investments, and changes in the real estate market. Economic conditions and tax laws can also impact his financial standing.

These FAQs provide a glimpse into Paul Wall's financial situation, highlighting his wealth accumulation strategies and the factors that shape his net worth. Understanding these aspects offers insights into the financial success of one of the most influential rappers in the industry.

Moving forward, we will explore Paul Wall's investment philosophy, examining his approach to wealth management and the strategies he employs to preserve and grow his fortune.

Tips for Understanding Paul Wall's Net Worth

This section provides actionable tips to help you comprehend and analyze Paul Wall's net worth effectively.

Tip 1: Examine Asset Composition: Determine the types of assets Paul Wall owns, such as real estate, investments, and cash. This provides insight into the sources of his wealth and potential income streams.

Tip 2: Analyze Liability Structure: Identify Paul Wall's financial obligations, including mortgages, loans, and taxes. Understanding his liabilities helps assess his financial leverage and risk exposure.

Tip 3: Consider Income Sources: Determine how Paul Wall generates income through music sales, performances, and other ventures. This provides context for his cash flow and ability to meet financial obligations.

Tip 4: Evaluate Investment Strategy: Analyze Paul Wall's investment portfolio, including asset allocation, risk tolerance, and investment time horizon. This offers insights into his financial goals and risk management approach.

Tip 5: Monitor Cash Flow: Assess Paul Wall's cash flow by tracking his income and expenses. This helps determine his liquidity and ability to cover short-term obligations.

Tip 6: Understand Equity Position: Calculate Paul Wall's equity by subtracting his liabilities from his assets. A strong equity position indicates financial stability and the ability to withstand financial setbacks.

Summary: By applying these tips, you can gain a comprehensive understanding of Paul Wall's net worth, including his sources of wealth, financial obligations, and investment strategies. This analysis provides valuable insights into his financial health and overall financial well-being.

Moving forward, we will delve into Paul Wall's investment philosophy, examining the strategies he employs to preserve and grow his fortune.

Conclusion

In examining the various facets of Paul Wall's net worth, we have gained valuable insights into his financial standing and wealth accumulation strategies. A key takeaway is the interconnectedness between his assets, liabilities, and income streams. His music catalog, real estate investments, and brand endorsements contribute significantly to his overall wealth, while his financial obligations, including mortgages and loans, impact his net worth position.

Paul Wall's financial success highlights the importance of diversifying income sources and making strategic investments. By leveraging his music career, exploring business ventures, and managing his finances prudently, he has built a substantial net worth. His journey serves as a reminder that financial success can be achieved through a combination of talent, hard work, and sound financial planning.

- Benoni Woman Shows R4 000 Grocery Haul

- Wiki Biography Age Height Parents Nationality Boyfriend

- Fun Fact Is Sydney Leroux Lesbian And

- Who Is Miranda Rae Mayo Partner Her

- Janice Huff And Husband Warren Dowdy Had

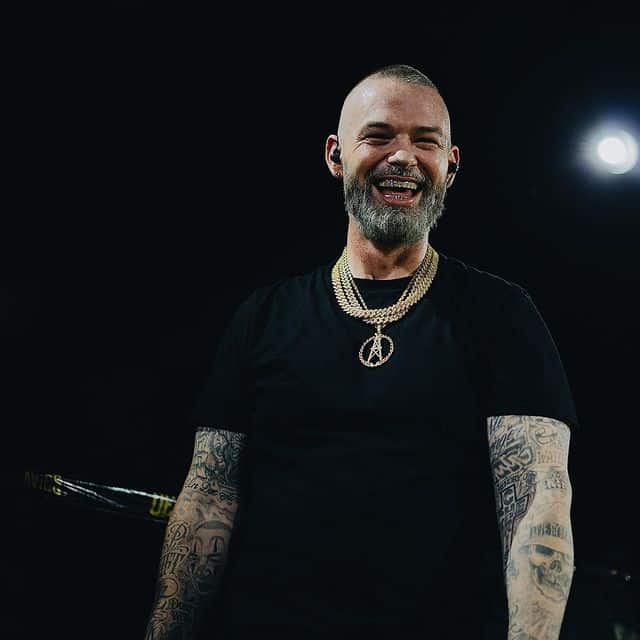

Paul Wall Net Worth, Bio 20172016, Wiki REVISED! Richest Celebrities

Paul Wall Net Worth, Bio, Wife, Songs, Ethnicity and Sideways etc

Paul Wall Net Worth 2022 Age, Songs, Slab, Cars, And Wife