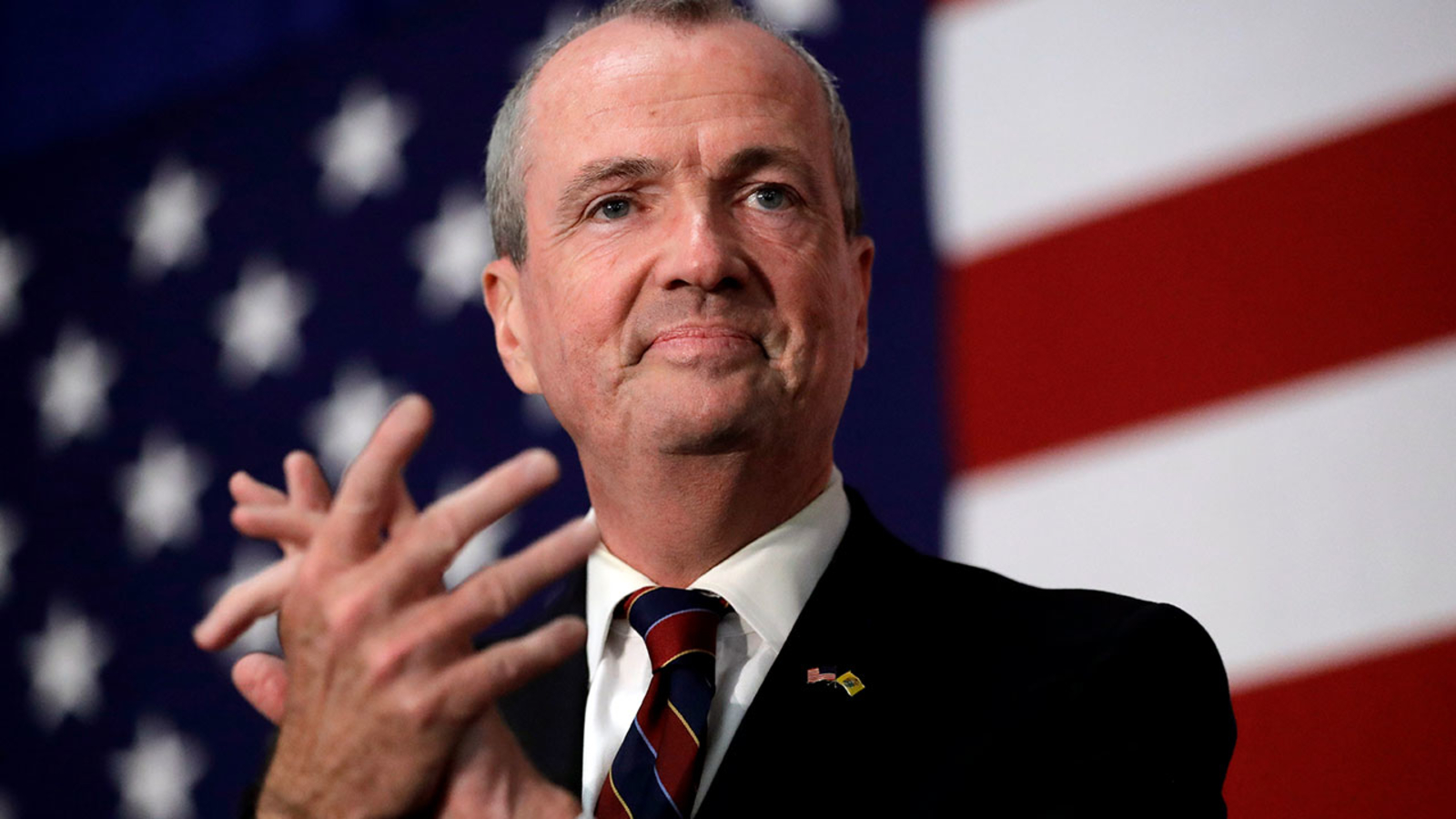

Unveiling The Wealth Of Phil Dunton Murphy: A Net Worth Deep Dive

Phil Dunton Murphy's Net Worth: Understanding His Financial Assets

Phil Dunton Murphy's net worth encapsulates his total financial worth, encompassing assets, investments, and liabilities. It not only reflects his financial status but also speaks to his wealth accumulation and investment strategies. Understanding his net worth provides insights into the financial circumstances of the 56th Governor of New Jersey.

The significance of knowing individuals' net worth lies in its ability to assess their financial health and economic prosperity. It helps gauge their investment choices and provides a foundation for making informed financial decisions. Historically, understanding net worth has been crucial for financial planning, taxation, and creditworthiness evaluations.

- Mzansi Man Documents Sa Potholes Viral Tiktok

- New Roms Xci Nsp Juegos Nintendo Switch

- Dd Returns Ott Release Date The Most

- Is Max Muncy Christian Or Jewish Religion

- Who Is Hunter Brody What Happened To

Phil Dunton Murphy Net Worth

The multifaceted nature of Phil Dunton Murphy's net worth necessitates a thorough examination of its essential aspects. These aspects, ranging from his assets and investments to his liabilities and income sources, paint a comprehensive picture of his financial standing.

- Assets

- Investments

- Liabilities

- Income

- Cash Equivalents

- Real Estate

- Business Interests

- Trusts

Understanding these key aspects provides valuable insights into Murphy's financial strategies, wealth management, and overall economic well-being. For instance, his investments shed light on his risk tolerance and long-term financial goals. Similarly, his liabilities reveal his debt obligations and leverage, while his income sources indicate his earning capacity and cash flow. By delving into these aspects, we gain a deeper comprehension of Phil Dunton Murphy's net worth and its implications.

Assets

Assets constitute a fundamental pillar of Phil Dunton Murphy's net worth, representing the valuable resources and properties he owns. These assets encompass a wide range of categories, each contributing to his overall financial standing.

- Janice Huff And Husband Warren Dowdy Had

- Tlc S I Love A Mama S

- Know About Camren Bicondova Age Height Gotham

- Is Sam Buttrey Jewish Religion And Ethnicity

- Did Tori Bowie Baby Survive What Happened

- Cash and Cash Equivalents

This category includes liquid assets such as checking and savings accounts, money market accounts, and short-term certificates of deposit. These provide immediate access to funds and serve as a safety net for various financial needs.

- Real Estate

Murphy's real estate holdings include his primary residence, investment properties, and land. These assets appreciate in value over time and generate rental income, contributing to his wealth accumulation.

- Business Interests

Murphy has ownership stakes in various businesses, including investment firms and technology companies. These investments provide him with a share of the profits and potential capital gains.

- Trusts

Trusts are legal entities that hold assets for the benefit of designated beneficiaries. Murphy may have established trusts for estate planning purposes or to manage specific investments.

Collectively, these assets form a significant portion of Phil Dunton Murphy's net worth, reflecting his prudent financial management and investment strategies. They provide him with financial security, income streams, and potential for future wealth growth.

Investments

Investments play a pivotal role in shaping Phil Dunton Murphy's net worth, representing a strategic allocation of his financial resources to generate long-term growth and income. His investment portfolio encompasses a diverse range of asset classes and strategies, each contributing to his overall financial well-being.

- Stocks

Murphy's stock investments provide him with ownership shares in publicly traded companies. These investments offer the potential for capital appreciation and dividend income, contributing to his wealth growth and cash flow.

- Bonds

Bonds are fixed-income investments that provide regular interest payments. Murphy's bond investments offer stability and income generation, balancing the risk-reward profile of his portfolio.

- Private Equity

Private equity investments involve ownership stakes in privately held companies. These investments offer the potential for higher returns but also carry a higher degree of risk.

- Alternative Investments

Alternative investments encompass a wide range of assets beyond traditional stocks and bonds, such as hedge funds, real estate investment trusts (REITs), and commodities. These investments provide diversification and the potential for uncorrelated returns.

Collectively, these investment facets contribute to Phil Dunton Murphy's net worth by generating passive income, fostering long-term wealth accumulation, and diversifying his financial portfolio. His investment strategy reflects a balance between risk and reward, seeking to maximize returns while preserving capital.

Liabilities

Liabilities represent the financial obligations that Phil Dunton Murphy must fulfill. They are a crucial component of his net worth, as they reduce the overall value of his assets. Liabilities can arise from various sources, such as mortgages, loans, and unpaid taxes.

Understanding Murphy's liabilities is essential for assessing his financial health. High levels of debt can strain his cash flow and limit his ability to invest and grow his wealth. Conversely, manageable liabilities can provide leverage and enable him to acquire assets that generate income or appreciate in value.

For instance, Murphy's mortgage on his primary residence is a liability that reduces his net worth. However, this liability also represents an investment in a tangible asset that provides him with shelter and potential appreciation. By carefully managing his liabilities and ensuring that they are outweighed by his assets, Murphy can maintain a strong financial position.

The relationship between liabilities and net worth is a delicate balance. Liabilities can provide financial leverage and opportunities, but they must be managed responsibly to avoid overextension and financial distress. Phil Dunton Murphy's financial acumen and prudent decision-making have allowed him to navigate this balance effectively, contributing to his overall net worth.

Income

Income plays a critical role in shaping Phil Dunton Murphy's net worth. It represents the inflow of funds that increase his overall wealth and financial well-being. Income can stem from various sources, such as salaries, wages, business profits, investments, and royalties.

As a key component of net worth, income provides the financial foundation for Murphy's assets and investments. Without a steady income stream, it would be challenging for him to accumulate wealth and build his net worth over time. Income acts as the fuel that drives his financial growth and enables him to maintain his current lifestyle.

For instance, Murphy's salary as the Governor of New Jersey contributes directly to his net worth. Additionally, his investments in stocks, bonds, and private equity generate passive income that further increases his wealth. By managing his income wisely and investing it strategically, Murphy has been able to grow his net worth significantly.

Understanding the connection between income and net worth is crucial for individuals seeking to improve their financial health. By increasing their income through career advancements, skill development, or entrepreneurial ventures, individuals can positively impact their net worth and secure their financial future.

Cash Equivalents

Cash equivalents, a significant component of Phil Dunton Murphy's net worth, encompass highly liquid assets that can be quickly converted into cash. These assets play a crucial role in maintaining financial stability, managing cash flow, and seizing investment opportunities.

- Money Market Accounts

Money market accounts offer a combination of checking and savings account features, providing easy access to funds while earning interest. Murphy may utilize these accounts for short-term savings or as a buffer for unexpected expenses. - Short-Term Certificates of Deposit

Short-term certificates of deposit (CDs) are time deposits with fixed interest rates and maturities of less than one year. These CDs provide a slightly higher return than money market accounts while preserving capital. - Commercial Paper

Commercial paper represents unsecured, short-term loans issued by corporations. Murphy may invest in commercial paper to earn higher yields than traditional savings accounts while maintaining liquidity. - Treasury Bills

Treasury bills are short-term debt obligations issued by the U.S. government. These bills are considered highly secure and offer a competitive return, making them a popular choice for cash equivalent investments.

The inclusion of cash equivalents in Murphy's net worth demonstrates his prudent financial management. These assets provide liquidity, safety, and the potential for modest returns, contributing to the overall strength of his financial portfolio and enabling him to capitalize on investment opportunities as they arise.

Real Estate

Real estate plays a significant role in shaping Phil Dunton Murphy's net worth, serving as a cornerstone of his overall financial portfolio. The value of his real estate holdings directly contributes to his net worth, making it a critical component of his financial well-being.

Murphy's real estate portfolio encompasses a diverse range of properties, including his primary residence, investment properties, and land. His primary residence, a luxurious estate in Middletown, New Jersey, is a valuable asset that contributes substantially to his net worth. Additionally, Murphy owns several investment properties in New Jersey and New York, which generate rental income and potential capital appreciation.

The inclusion of real estate in Murphy's net worth demonstrates his savvy investment strategy. Real estate offers several advantages, including potential rental income, capital appreciation, tax benefits, and diversification. By investing in a mix of residential and commercial properties, Murphy has created a diversified portfolio that reduces risk and enhances his overall financial standing.

Understanding the relationship between real estate and Phil Dunton Murphy's net worth is essential for comprehending his financial health and investment strategy. Real estate serves as a valuable asset class, providing income, appreciation potential, and diversification benefits. Murphy's prudent investment decisions have contributed to the growth of his real estate portfolio, which remains a significant driver of his net worth.

Business Interests

Phil Dunton Murphy's business interests play a pivotal role in shaping his overall net worth. Through strategic investments in various sectors, Murphy has diversified his financial portfolio and created multiple streams of income. His business interests encompass a range of industries, including investment firms, technology companies, and real estate ventures.

The success of Murphy's business interests has a direct impact on his net worth. For instance, his investment in the venture capital firm Reinvent Capital has generated substantial returns, contributing significantly to his overall wealth. Similarly, his involvement in real estate development projects has led to the creation of valuable assets that appreciate in value over time.

Understanding the connection between business interests and net worth is crucial for evaluating an individual's financial health. By investing in businesses with strong growth potential and profitability, individuals can expand their income sources and increase their net worth. Murphy's business acumen and strategic investments have enabled him to build a robust financial portfolio, contributing to his overall financial well-being.

Furthermore, business interests can provide tax benefits, such as deductions for expenses and capital gains treatment on investments. These benefits can help reduce tax liabilities and further enhance an individual's net worth. By leveraging his business interests, Murphy has optimized his tax strategy and preserved his wealth more effectively.

Trusts

Trusts, a crucial aspect of Phil Dunton Murphy's net worth, warrant a detailed examination. These legal entities hold assets for the benefit of designated beneficiaries, offering various advantages and contributing significantly to Murphy's overall financial well-being.

- Revocable Living Trusts

Revocable living trusts allow Murphy to transfer assets to beneficiaries while maintaining control during his lifetime. This strategy reduces probate costs and ensures privacy, simplifying the distribution of assets upon his passing.

- Irrevocable Life Insurance Trusts

Irrevocable life insurance trusts remove life insurance policies from Murphy's estate, reducing estate taxes and providing tax-free proceeds to beneficiaries upon his death. This advanced estate planning tool safeguards his wealth and minimizes tax liabilities.

- Charitable Trusts

Charitable trusts enable Murphy to donate assets to non-profit organizations while receiving tax benefits. These trusts provide a structured approach to philanthropy, allowing him to support causes he cares about and potentially reduce his tax burden.

- Special Needs Trusts

Special needs trusts protect assets intended for individuals with disabilities. By placing assets in these trusts, Murphy can ensure that his loved ones with special needs continue to qualify for government benefits while maintaining access to financial resources.

In conclusion, trusts play a multifaceted role in Phil Dunton Murphy's net worth. They provide estate planning flexibility, tax optimization, and philanthropic opportunities. By leveraging these legal instruments, Murphy has taken proactive steps to protect his wealth, minimize taxes, and support causes close to his heart, contributing to his overall financial well-being and legacy.

Frequently Asked Questions about Phil Dunton Murphy Net Worth

This section addresses some of the most common questions and misconceptions surrounding Phil Dunton Murphy's net worth.

Question 1: How much is Phil Murphy worth?

As of 2023, Phil Murphy's net worth is estimated to be around $10 million, according to various sources, including Celebrity Net Worth and The Richest. This figure includes his assets, investments, and income, minus any liabilities or debts.

Question 2: What are the sources of Phil Murphy's wealth?

Murphy has amassed his wealth through a combination of his career as a businessman, investor, and politician. Prior to entering politics, he was a successful executive at Goldman Sachs and a co-founder of the investment firm Murphy & Associates.

Question 3: How has Murphy's net worth changed over time?

Murphy's net worth has fluctuated over the years, influenced by factors such as investment performance, political campaigns, and changes in asset values. However, it has generally trended upwards over time.

Question 4: What are Murphy's investments?

Murphy's investment portfolio includes a diverse range of assets, including stocks, bonds, real estate, and private equity. He is known for his focus on long-term investments and his commitment to socially responsible investing.

Question 5: What is Murphy's spending style?

Murphy is known for his relatively modest spending habits. He lives in a modest home in Middletown, New Jersey, and drives a Chevrolet Suburban. He has also pledged to donate a portion of his salary to charity.

Question 6: What is the significance of Murphy's net worth?

Murphy's net worth provides insights into his financial well-being and his ability to influence policy decisions. It also serves as a barometer of his overall success in business and politics.

In summary, Phil Dunton Murphy's net worth is a reflection of his financial acumen, investment strategies, and overall success in various fields. It underscores his ability to generate wealth and his commitment to responsible financial management.

This exploration of Murphy's net worth sets the stage for further discussion on the implications of wealth in politics and the role of financial transparency in public service.

Tips for Understanding Phil Dunton Murphy Net Worth

To enhance your understanding of Phil Dunton Murphy's net worth and its implications, consider these valuable tips:

Tip 1: Examine the Composition of Assets

Analyze Murphy's assets, including real estate, investments, and business interests, to gain insights into his wealth distribution and diversification strategies.

Tip 2: Evaluate Investment Performance

Assess the performance of Murphy's investments over time, considering factors such as risk tolerance, asset allocation, and returns.

Tip 3: Analyze Liabilities and Debt

Understand Murphy's liabilities, including mortgages, loans, and outstanding obligations, to gauge his financial leverage and risk profile.

Tip 4: Consider Income Sources

Identify the sources of Murphy's income, such as salary, investment income, and business profits, to determine the stability and sustainability of his financial position.

Tip 5: Explore Tax Strategies

Examine Murphy's tax-saving strategies, such as trusts and charitable donations, to understand how he manages his tax liability and preserves his wealth.

Summary: By implementing these tips, you can gain a comprehensive understanding of Phil Dunton Murphy's net worth, his financial management strategies, and the factors that contribute to his overall wealth.

These insights provide a solid foundation for evaluating the role of wealth in politics and the importance of financial transparency in public service, as discussed in the article's conclusion.

Conclusion

In exploring the multifaceted nature of Phil Dunton Murphy's net worth, this article has provided valuable insights into his financial profile, investment strategies, and wealth management techniques. The examination of his assets, investments, liabilities, and income sources has revealed the composition and drivers of his financial well-being.

Key takeaways from this analysis include: the significance of diversification in Murphy's investment portfolio, the role of real estate and business interests in driving his net worth, and the impact of tax-saving strategies on preserving his wealth. Understanding these elements offers a window into the financial acumen and wealth-building strategies of a prominent political figure.

- How Tall Is Markiplier The Truth About

- Officer Nicholas Mcdaniel Died A Life Of

- Meet Ezer Billie White The Daughter Of

- Chris Brown Net Worth Daughter Ex Girlfriend

- Does Robert Ri Chard Have A Wife

NJ Governor Murphy slams new racist flyer in Edison mayoral race The

NJ Gubernatorial Candidate Murphy Files Over 40 Thousand Petition

Gov. Murphy unveils Energy Master Plan at Stockton University DOWNBEACH