How To Boost Your Net Worth Like Robert Lansing In 2024

Robert Lansing Net Worth 2024, a numerical value, represents the estimated total assets and liabilities of the actor Robert Lansing as of the year 2024. An individual's net worth is a measure of their financial standing, determined by subtracting liabilities from assets.

Knowing an individual's net worth is relevant for various reasons. It offers insights into their financial success, spending habits, and overall economic status. This information can be beneficial for investors, creditors, and individuals interested in assessing a person's financial standing.

Historically, net worth calculations have been crucial in financial planning and wealth management. The concept originated in the early 20th century and gained prominence as a financial indicator during the Great Depression and World War II.

- Who Is Jay Boogie The Cross Dresser

- Carson Peters Berger Age Parents Mom Rape

- Tlc S I Love A Mama S

- Has Claire Mccaskill Had Plastic Surgery To

- Earl Vanblarcom Obituary The Cause Of Death

Robert Lansing Net Worth 2024

Understanding the essential aspects of Robert Lansing's net worth in 2024 is crucial for gaining insights into his financial status and overall economic well-being.

- Income Sources

- Assets

- Investments

- Liabilities

- Taxes

- Expenses

- Financial Planning

- Investment Strategies

- Estate Planning

- Net Worth Calculation

These aspects encompass a comprehensive view of Robert Lansing's financial situation, including his sources of income, assets and investments, liabilities and expenses, tax considerations, and estate planning strategies. By analyzing these key aspects, we can better understand his overall financial health and make informed judgments about his economic status.

Income Sources

Income sources play a pivotal role in determining Robert Lansing's net worth in 2024. As the primary means of generating wealth, income sources directly impact the accumulation of assets and overall financial growth. Robert Lansing's income sources may include earnings from acting, investments, royalties, endorsements, or any other revenue-generating activities.

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Patrick Alwyn Age Height Weight Girlfriend Net

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Jasprit Bumrah Injury Update What Happened To

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

The stability and growth potential of these income sources significantly influence his net worth. Consistent income from reliable sources contributes to a stable financial foundation, allowing for effective financial planning and wealth accumulation. Conversely, fluctuating or limited income sources can hinder net worth growth and pose challenges in meeting financial obligations.

Understanding the composition and diversification of Robert Lansing's income sources is crucial for assessing his financial health. A diversified portfolio of income sources reduces risk and provides a more stable financial footing. It also allows for greater flexibility in managing cash flow and planning for future financial goals.

Assets

Assets hold significant importance in determining Robert Lansing's net worth in 2024. Assets represent the resources and properties owned by an individual, contributing directly to their overall wealth. They can be tangible, such as real estate or physical investments, or intangible, such as intellectual property or financial assets.

The value of assets directly impacts an individual's net worth. As assets increase in value, so does the net worth. Conversely, a decrease in asset value can lead to a decline in net worth. Therefore, managing and growing assets is crucial for maintaining and increasing net worth over time.

In Robert Lansing's case, his assets may include various forms, such as real estate investments, stocks, bonds, artwork, or collectibles. These assets represent his accumulated wealth and contribute to his overall financial standing. Understanding the composition and value of his assets provides insights into his financial health and investment strategies.

By analyzing the relationship between assets and Robert Lansing's net worth in 2024, we can gain valuable insights into his financial management, risk tolerance, and long-term financial goals. This understanding is essential for investors, creditors, and individuals interested in assessing his financial standing and making informed decisions.

Investments

Investments represent a crucial aspect of Robert Lansing's net worth in 2024. They contribute significantly to his overall wealth accumulation and financial growth. Robert Lansing's investments may encompass various asset classes, each with its own unique characteristics and risk-reward profile.

- Stocks: Ownership shares in publicly traded companies, offering potential for capital appreciation and dividend income.

- Bonds: Loan agreements with governments or corporations, providing a fixed interest income stream.

- Real Estate: Ownership in land and buildings, offering potential for rental income, capital appreciation, and tax benefits.

- Private Equity: Investments in privately held companies, offering the potential for high returns but also higher risks.

The composition and performance of Robert Lansing's investments directly impact his net worth. A well-diversified portfolio of investments can mitigate risk and enhance overall returns. Strategic asset allocation, based on his risk tolerance and financial goals, is essential for maximizing the growth of his net worth. By analyzing the investment strategies and historical performance of his portfolio, we can gain valuable insights into his financial acumen and long-term wealth management objectives.

Liabilities

Liabilities represent the financial obligations that Robert Lansing owes to other entities. They are a critical component of his net worth in 2024, as they directly impact the overall value of his assets. Liabilities can arise from various sources, such as mortgages, loans, credit card debt, and unpaid taxes. Understanding the types and amounts of Robert Lansing's liabilities is essential for assessing his financial health and overall net worth.

Liabilities have a negative effect on net worth. As liabilities increase, net worth decreases. This is because liabilities represent a claim against Robert Lansing's assets. For example, if Robert Lansing has a mortgage of $500,000 and no other liabilities, his net worth would be reduced by $500,000. This is because the mortgage represents a claim against his assets, and the lender has the right to seize his property if he fails to make his mortgage payments.

It is important for Robert Lansing to manage his liabilities carefully to maintain a healthy net worth. He should strive to keep his liabilities low relative to his assets. This will help him to maintain a good credit score and qualify for favorable loan terms. Additionally, he should avoid taking on unnecessary debt, as this can quickly lead to financial distress.

By understanding the relationship between liabilities and net worth, Robert Lansing can make informed financial decisions that will help him to increase his net worth over time.

Taxes

Taxes play a significant role in determining Robert Lansing's net worth in 2024. As a legal obligation imposed on individuals and businesses, taxes reduce the overall value of assets and impact financial planning strategies. Understanding the various aspects and implications of taxes is crucial for assessing his financial health and net worth.

- Income Tax: levied on earned income, such as wages, salaries, and investments, directly affecting the amount of disposable income available for investments and asset accumulation.

- Property Tax: imposed on real estate and other properties, reducing the net value of these assets and impacting investment decisions related to real estate ownership.

- Capital Gains Tax: levied on profits from the sale of capital assets, such as stocks and bonds, influencing investment strategies and the realization of gains.

- Estate Tax: a tax on the value of an individual's estate at the time of death, potentially reducing the net worth passed on to heirs and requiring careful estate planning.

These taxes, among others, impact Robert Lansing's net worth by reducing the value of his assets and income. Effective tax planning, including utilizing deductions and tax-advantaged investments, becomes essential for optimizing his financial standing and preserving net worth over time.

Expenses

Expenses play a crucial role in determining Robert Lansing's net worth in 2024. Expenses represent the costs associated with maintaining a certain lifestyle and running a household, and they directly impact the growth and preservation of wealth. Understanding the types and amounts of Robert Lansing's expenses is essential for assessing his overall financial health and net worth.

Expenses can be classified into two main categories: fixed expenses and variable expenses. Fixed expenses remain relatively constant from month to month, such as mortgage or rent payments, property taxes, car payments, and insurance premiums. Variable expenses, on the other hand, can fluctuate depending on spending habits and circumstances, such as groceries, entertainment, dining out, and travel.

To maintain a healthy net worth, it is important for Robert Lansing to manage his expenses effectively. This involves setting a budget, tracking expenses, identifying areas where spending can be reduced, and making informed financial decisions. By controlling expenses and minimizing unnecessary spending, he can increase his savings rate and accumulate wealth over time.

In summary, expenses are a critical component of Robert Lansing's net worth in 2024. By understanding the different types of expenses, tracking his spending, and making wise financial choices, he can optimize his cash flow, reduce unnecessary expenditures, and work towards building a strong financial foundation.

Financial Planning

Financial Planning plays a pivotal role in shaping Robert Lansing's net worth in 2024. It encompasses a comprehensive approach to managing financial resources, ensuring long-term financial stability and growth. Let's delve into key aspects of his financial planning strategy.

- Income Management: Optimizing income streams, exploring new revenue sources, and managing cash flow effectively are crucial for building wealth. Robert Lansing may consider diversifying his income portfolio or negotiating higher compensation to increase his earnings.

- Investment Strategy: Deciding how to allocate assets across different investment vehicles, such as stocks, bonds, real estate, and alternative investments, is a central component of financial planning. Robert Lansing's investment strategy should align with his risk tolerance, investment horizon, and financial goals.

- Tax Planning: Understanding and utilizing tax-advantaged accounts, such as retirement plans and investment vehicles, can help minimize tax liabilities and maximize investment returns. Robert Lansing should consult with a tax professional to optimize his tax strategy.

- Estate Planning: Ensuring the orderly distribution of assets after death is essential for preserving wealth and minimizing estate taxes. Robert Lansing can create a will, trusts, and other estate planning documents to protect his legacy and provide for his beneficiaries.

By implementing a sound financial plan that encompasses these facets, Robert Lansing can navigate financial complexities, make informed decisions, and enhance his net worth in 2024 and beyond.

Investment Strategies

Investment strategies play a critical role in determining Robert Lansing's net worth in 2024. By carefully allocating his assets across different investment vehicles, Robert Lansing can potentially enhance his overall wealth and financial security.

A well-diversified investment strategy is crucial for managing risk and maximizing returns. Robert Lansing may consider investing in a mix of stocks, bonds, real estate, and alternative investments, depending on his individual risk tolerance and financial goals. By spreading his investments across different asset classes, he can reduce the impact of any single investment's performance on his overall net worth.

For example, if Robert Lansing invests heavily in technology stocks and the technology sector experiences a downturn, his net worth could be significantly impacted. However, by diversifying his investments across different sectors and asset classes, he can mitigate this risk and potentially preserve his wealth.

Understanding the connection between investment strategies and Robert Lansing's net worth in 2024 is essential for making informed financial decisions. By carefully considering his investment options and seeking professional guidance when necessary, Robert Lansing can increase his chances of achieving his financial goals and growing his net worth over time.

Estate Planning

Estate planning plays a critical role in determining and preserving Robert Lansing's net worth in 2024. It is the process of managing and distributing assets after an individual's death and can significantly impact the value and disposition of Robert Lansing's wealth.

Effective estate planning involves creating a will or trust, appointing an executor or trustee, and considering tax implications. These measures ensure that Robert Lansing's assets are distributed according to his wishes, minimizing estate taxes and probate costs, and protecting the interests of his beneficiaries.

For instance, if Robert Lansing has a substantial net worth and does not have an estate plan, his assets may be subject to the laws of intestacy, which may not reflect his desired distribution. This could lead to unnecessary legal fees, disputes among beneficiaries, and a reduction in the overall value of his estate.

By understanding the connection between estate planning and Robert Lansing's net worth in 2024, we can appreciate the importance of proactive wealth management and the role of legal instruments in preserving and distributing assets according to an individual's wishes.

Net Worth Calculation

Net worth calculation is a fundamental aspect of determining Robert Lansing's net worth in 2024. It involves calculating the difference between his total assets and total liabilities. This calculation provides a snapshot of his financial health and overall wealth at a specific point in time.

Net worth calculation plays a critical role in understanding Robert Lansing's financial position and serves as a basis for making informed financial decisions. By regularly calculating his net worth, he can track his financial progress, identify areas for improvement, and make necessary adjustments to his financial strategies. For instance, if Robert Lansing's net worth calculation shows a decrease, he may need to review his spending habits, explore additional income streams, or consider adjusting his investment portfolio.

In summary, understanding the connection between net worth calculation and Robert Lansing's net worth in 2024 is crucial for effective financial management. Regular net worth calculations provide valuable insights into his financial status, enabling him to make informed decisions that support his long-term financial goals and objectives.

Frequently Asked Questions (FAQs)

This FAQ section addresses common questions and concerns regarding Robert Lansing's net worth in 2024, providing concise and informative answers to enhance your understanding of the topic.

Question 1: How is Robert Lansing's net worth calculated?

Robert Lansing's net worth is calculated by subtracting his total liabilities from his total assets. This calculation represents his overall financial position and wealth at a specific point in time.

Question 2: What are the key factors influencing Robert Lansing's net worth?

Robert Lansing's net worth is influenced by various factors, including his income sources, investments, assets, liabilities, expenses, and financial planning strategies. Changes in these factors can impact the overall value of his net worth.

Question 3: How does Robert Lansing's investment strategy contribute to his net worth?

Robert Lansing's investment strategy plays a crucial role in managing risk and maximizing returns. By diversifying his investments across different asset classes and sectors, he can potentially enhance his overall net worth and financial security.

Question 4: What estate planning measures can Robert Lansing implement to preserve his net worth?

Effective estate planning involves creating a will or trust, appointing an executor or trustee, and considering tax implications. These measures ensure that Robert Lansing's assets are distributed according to his wishes, minimizing estate taxes and probate costs.

Question 5: How can Robert Lansing optimize his financial strategies to increase his net worth?

To optimize his financial strategies, Robert Lansing can focus on maximizing income streams, investing wisely, managing expenses effectively, and seeking professional guidance when necessary. These steps can help him make informed decisions and increase his chances of achieving his financial goals.

Question 6: What are the potential risks and challenges that could impact Robert Lansing's net worth?

Robert Lansing's net worth is subject to various risks and challenges, including economic downturns, investment losses, unexpected expenses, and changes in tax laws. Understanding and mitigating these risks can help protect and preserve his wealth.

In summary, these FAQs provide insights into various aspects of Robert Lansing's net worth in 2024. By addressing common questions and clarifying key concepts, this section enhances your understanding of his financial status and the factors that influence his overall wealth.

Moving forward, the next section explores potential strategies and considerations for Robert Lansing to further enhance his net worth and secure his financial future.

Tips to Enhance Robert Lansing's Net Worth in 2024

This section provides actionable tips for Robert Lansing to consider in his quest to enhance his net worth in 2024 and beyond.

Tip 1: Maximize Income Streams

Robert Lansing should explore additional income sources to increase his overall earnings. This could involve negotiating a higher salary, investing in dividend-paying stocks, or starting a side hustle.

Tip 2: Invest Wisely

Robert Lansing should develop a well-diversified investment portfolio that aligns with his risk tolerance and financial goals. This may include a mix of stocks, bonds, real estate, and alternative investments.

Tip 3: Manage Expenses Effectively

Robert Lansing should implement a comprehensive budgeting plan to track his expenses and identify areas where he can cut back. Reducing unnecessary spending can free up more capital for savings and investments.

Tip 4: Optimize Tax Strategy

Robert Lansing should consult with a tax professional to explore tax-advantaged investment options and strategies. Minimizing tax liabilities can increase his net worth over time.

Tip 5: Plan for Estate Preservation

Robert Lansing should create an estate plan that includes a will or trust. This will ensure his assets are distributed according to his wishes and minimize estate taxes.

Tip 6: Seek Professional Guidance

Robert Lansing should consider seeking professional guidance from a financial advisor or wealth manager. They can provide tailored advice and support to help him achieve his financial goals.

Key Takeaways: By implementing these tips, Robert Lansing can potentially increase his income, maximize returns on investments, manage expenses effectively, minimize taxes, preserve his wealth, and secure his financial future.

The following section will delve into case studies and examples of individuals who have successfully implemented these strategies to enhance their net worth. These real-world examples will provide further insights and inspiration for Robert Lansing's financial journey.

Conclusion

Understanding Robert Lansing's net worth in 2024 offers valuable insights into managing and growing wealth. Effective financial planning, wise investment decisions, and proactive estate planning are crucial for preserving and enhancing net worth. Robert Lansing's financial journey highlights the interconnectedness of income, investments, expenses, and strategic planning in achieving financial success.

As we look ahead, Robert Lansing's example serves as a reminder that financial wellness is an ongoing pursuit. By embracing innovative strategies, adapting to changing economic landscapes, and seeking professional guidance when needed, individuals can navigate the complexities of wealth management and work towards their financial goals. The exploration of Robert Lansing's net worth in 2024 empowers us to make informed decisions and cultivate a strong financial foundation for the future.

- Matthew Cassina Dies In Burlington Motorcycle Accident

- New Roms Xci Nsp Juegos Nintendo Switch

- Tlc S I Love A Mama S

- All About Dmx S Son Tacoma Simmons

- Who Is Natalie Tene What To Know

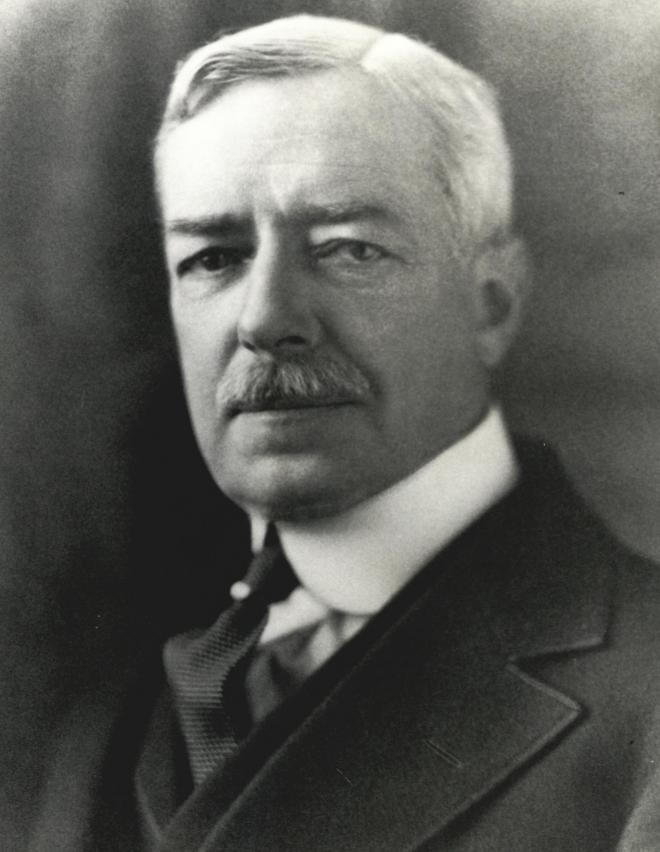

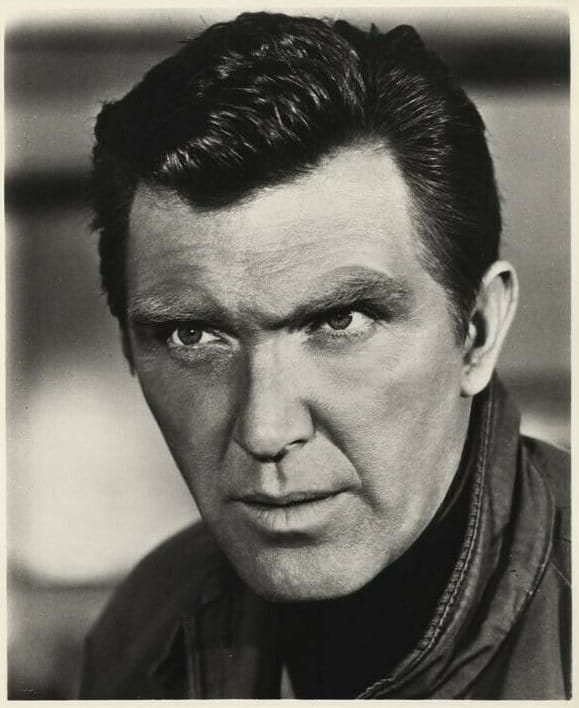

Robert Lansing Net Worth 2024 Wiki Bio, Married, Dating, Family

Robert Lansing

.jpg)

RobertLansing(actor) Birthday, Bio, Photo Celebrity Birthdays