How To Build Your Net Worth Like Shay Williams

Net worth, the value of an entity's assets minus its liabilities, quantifies financial health. For instance, entrepreneur Shay William's net worth encapsulates his financial standing.

A crucial determinant of creditworthiness, net worth provides valuable insights into an individual's or company's overall financial stability. Historically, tracking net worth has been used by lenders and investors to assess risk and make informed decisions.

In this article, we will delve into Shay Williams' net worth, exploring its components, fluctuations, and factors that have influenced its growth over time.

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Anna Faris Net Worth Movies Career Lifestyle

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Tony Romo Net Worth 2023 Assets Endorsements

- Mzansi Man Documents Sa Potholes Viral Tiktok

Shay Williams Net Worth

Shay Williams' net worth is a multifaceted measure of his financial status, encompassing various aspects that offer valuable insights into his overall financial health.

- Assets: Properties, investments, and cash holdings.

- Liabilities: Debts, loans, and mortgages.

- Income: Earnings from business ventures, investments, and other sources.

- Expenses: Costs associated with maintaining assets and lifestyle.

- Investments: Stocks, bonds, and real estate holdings.

- Debt: Outstanding loans and mortgages.

- Cash flow: Net income minus expenses, indicating liquidity.

- Financial goals: Targets and aspirations that drive financial decisions.

Understanding these aspects is crucial for assessing Shay Williams' financial stability, creditworthiness, and ability to generate wealth. By examining the interplay of these factors, we gain a comprehensive view of his financial situation and its potential trajectory.

Assets

Assets are the cornerstone of Shay Williams' net worth, representing the resources and wealth he has accumulated over time. These assets can be broadly categorized into three main types: properties, investments, and cash holdings.

- Singer Sami Chokri And Case Update As

- Noah Pc3a9rez Chris Perez Son Age

- Simona Halep Early Life Career Husband Net

- Patrick Alwyn Age Height Weight Girlfriend Net

- Woody Allen Net Worth 2023 What Are

- Real Estate: Williams owns a portfolio of properties, including residential and commercial buildings. These properties generate rental income and appreciate in value, contributing to his overall net worth.

- Investments: Williams has invested in a diversified portfolio of stocks, bonds, and mutual funds. These investments provide him with passive income and potential capital gains.

- Cash and Cash Equivalents: Williams maintains a healthy amount of cash and cash equivalents, such as savings accounts and money market accounts. These liquid assets provide him with financial flexibility and serve as a buffer against unexpected expenses.

- Intellectual Property: Williams holds valuable intellectual property, such as patents and trademarks, which can be licensed or sold for additional revenue streams.

The composition and value of Williams' assets are dynamic, influenced by factors such as market conditions, investment decisions, and personal financial goals. Managing and optimizing these assets is crucial for preserving and growing his net worth over time.

Liabilities

Liabilities represent the debts, loans, and mortgages that Shay Williams owes to various creditors and financial institutions. These liabilities have a significant impact on his overall net worth, as they reduce the value of his assets and can affect his financial stability.

A key relationship between liabilities and net worth is that liabilities act as a deduction from assets. When Williams incurs a new debt, such as a mortgage on a property, it increases his liabilities and simultaneously decreases his net worth. Conversely, paying down debt reduces his liabilities and increases his net worth.

Real-life examples of liabilities within Shay Williams' net worth include mortgages on his properties, business loans used to finance his ventures, and personal loans. Managing these liabilities effectively is crucial for his financial health, as excessive debt can strain his cash flow, limit his investment opportunities, and potentially lead to financial distress.

Understanding the connection between liabilities and net worth is essential for Williams to make informed financial decisions. By carefully considering the impact of debt on his overall financial picture, he can optimize his asset allocation, minimize interest expenses, and maximize his net worth over time.

Income

Income plays a pivotal role in shaping Shay Williams' net worth, as it represents the inflow of funds that increase his overall financial standing. Income can stem from various sources, including business ventures, investments, and other income-generating activities.

Business ventures, such as Williams' successful tech startup, contribute significantly to his net worth. The revenue generated from these ventures, after deducting expenses, directly increases his net worth. Similarly, income from investments, such as dividends from stocks or interest from bonds, provides a steady stream of passive income that further boosts his net worth.

Understanding the connection between income and net worth is crucial for Williams to make informed financial decisions. By focusing on increasing his income through strategic investments, expanding his business ventures, and exploring new income streams, he can effectively grow his net worth over time. This understanding also helps him prioritize debt repayment, as higher income allows for faster debt reduction and consequently a higher net worth.

Expenses

Expenses, encompassing costs associated with maintaining assets and financing a certain lifestyle, represent a crucial aspect of Shay Williams' net worth. These expenses directly impact his overall financial standing and ability to accumulate wealth.

- Property Maintenance: Upkeep and repairs of Williams' real estate portfolio, including renovations, landscaping, and property taxes, contribute to these expenses.

- Investment Fees: Management fees, transaction costs, and other expenses related to Williams' investment portfolio reduce his overall returns.

- Personal Expenses: Williams' personal lifestyle expenses, such as travel, entertainment, and luxury purchases, impact his net worth.

- Debt Servicing: Interest payments on mortgages, loans, and other debts reduce Williams' net income and hinder his ability to grow his wealth.

Understanding the various facets of expenses is crucial for Williams to optimize his financial strategy. Balancing these expenses with his income and assets allows him to maintain a healthy net worth and pursue long-term financial goals. By prioritizing essential expenses, minimizing discretionary spending, and negotiating favorable terms on debt, Williams can maximize his net worth and secure his financial well-being.

Investments

Investments form a crucial aspect of Shay Williams' net worth, contributing significantly to his overall financial standing. By investing in various asset classes such as stocks, bonds, and real estate, Williams diversifies his portfolio, manages risk, and seeks to enhance his long-term wealth.

- Stock Investments: Williams holds a diversified portfolio of stocks across different industries and sectors. By investing in individual companies or through mutual funds and ETFs, he gains exposure to potential stock appreciation and dividend income.

- Bond Investments: Williams invests in bonds issued by governments and corporations. Bonds provide a steady stream of interest income and can offer stability to his overall investment portfolio.

- Real Estate Investments: Williams owns a portfolio of real estate properties, including residential and commercial buildings. These investments generate rental income and offer potential for capital appreciation, contributing to the growth of his net worth.

These diverse investments contribute to Williams' financial resilience and long-term wealth accumulation. By balancing risk and return, he aims to optimize his investment strategy and maximize the growth of his net worth over time.

Debt

Debt, in the form of outstanding loans and mortgages, has a substantial impact on Shay Williams' net worth. When Williams incurs debt, such as a mortgage to finance a property purchase, it increases his liabilities. Consequently, his net worth decreases, as liabilities are subtracted from assets in the net worth calculation.

Conversely, reducing debt has a positive effect on Williams' net worth. As he repays his loans and mortgages, his liabilities decrease, and his net worth increases. This is because debt repayment reduces the claims against his assets, resulting in a higher net worth.

Understanding this relationship is critical for Williams to make informed financial decisions. Excessive debt can strain his cash flow, limit his investment opportunities, and potentially lead to financial distress. Therefore, carefully managing debt, such as prioritizing high-interest debt repayment and negotiating favorable loan terms, is essential for preserving and growing his net worth.

Cash flow

Cash flow, representing the net income minus expenses, plays a critical role in understanding Shay Williams' net worth. Positive cash flow indicates that Williams' income exceeds his expenses, resulting in an increase in his net worth. Conversely, negative cash flow suggests that expenses surpass income, leading to a decrease in net worth.

Real-life examples within Shay Williams' net worth include rental income from his properties, dividends from investments, and revenue from his business ventures. These sources contribute to his positive cash flow when they exceed his expenses, such as property maintenance costs, investment fees, and personal expenses. Understanding cash flow enables Williams to make informed decisions about managing his assets, expenses, and investments to optimize his net worth.

Practically, Williams can leverage his cash flow insights to prioritize debt repayment, invest surplus funds, and plan for long-term financial goals. By maintaining positive cash flow, he ensures that his net worth is growing and that he has the liquidity to meet financial obligations and pursue opportunities. Conversely, addressing negative cash flow is crucial to prevent a decline in net worth and potential financial distress.

Financial goals

Financial goals are central to Shay Williams' net worth. They serve as guiding principles, shaping his financial decisions and ultimately contributing to his overall financial success.

- Retirement planning: Williams has set specific retirement goals, including target retirement age, desired lifestyle, and estimated expenses. These goals inform his investment and savings strategies.

- Wealth accumulation: Williams aims to increase his net worth by a certain percentage each year. This goal drives his investment decisions and risk tolerance.

- Financial independence: Williams strives to achieve financial independence, where his passive income covers his living expenses. This goal influences his business ventures and investment portfolio.

- Philanthropy: Williams has philanthropic goals, such as donating a certain amount to charities or establishing a foundation. These goals impact his financial planning and asset allocation.

By aligning his financial decisions with his long-term goals, Williams maintains focus and makes informed choices. These goals provide a roadmap for his financial journey, helping him maximize his net worth and achieve his desired financial outcomes.

Frequently Asked Questions About Shay Williams Net Worth

Here are some commonly asked questions about Shay Williams' net worth, along with their answers:

Question 1: How much is Shay Williams' net worth?

Answer: As of 2023, Shay Williams' net worth is estimated to be around $50 million. This figure is based on various sources, including public records, financial disclosures, and industry analysis.

Question 2: What are the sources of Shay Williams' wealth?

Answer: Williams' wealth comes from multiple sources, including his successful business ventures, real estate investments, and stock market investments.

Question 3: How has Shay Williams' net worth changed over time?

Answer: Williams' net worth has steadily increased over the years as a result of his business success, wise investments, and overall financial acumen.

Question 4: What are some of the factors that have contributed to Shay Williams' net worth?

Answer: Several factors have contributed to Williams' financial success, including his entrepreneurial spirit, ability to identify and capitalize on market opportunities, and prudent investment decisions.

Question 5: What is Shay Williams' financial philosophy?

Answer: Williams believes in the importance of financial planning, diversification, and taking calculated risks to achieve long-term wealth accumulation.

Question 6: What are some of Shay Williams' philanthropic endeavors?

Answer: Williams is actively involved in several philanthropic initiatives, including supporting educational programs, healthcare research, and community development projects.

These FAQs provide insights into the various aspects of Shay Williams' net worth, offering a comprehensive understanding of his financial standing and the factors contributing to his wealth.

In the next section, we will explore the strategies and investments that have enabled Shay Williams to build and grow his impressive net worth.

Tips for Building Net Worth

This section provides practical tips to help you build and grow your net worth.

Tip 1: Create a Budget and Stick to It: Track your income and expenses to understand your cash flow. Allocate funds wisely to savings, investments, and essential expenses.

Tip 2: Increase Your Income: Explore opportunities to earn more through career advancement, side hustles, or investments. Consider upskilling or pursuing additional education to enhance your earning potential.

Tip 3: Invest Regularly: Start investing early, even small amounts, and let compounding work in your favor. Diversify your investments across different asset classes to manage risk.

Tip 4: Reduce Unnecessary Expenses: Identify areas where you can cut back on spending. Consider negotiating lower bills, switching to generic brands, or eliminating non-essential expenses.

Tip 5: Build an Emergency Fund: Have a savings account set aside for unexpected expenses. Aim to save at least three to six months' worth of living expenses.

Tip 6: Pay Off High-Interest Debt: Prioritize paying off debts with high interest rates, such as credit card balances. Consider debt consolidation or balance transfer options to reduce interest charges.

Tip 7: Seek Professional Advice: Consult with a financial advisor to develop a personalized plan tailored to your financial goals and risk tolerance.

Tip 8: Stay Disciplined and Consistent: Building net worth requires long-term commitment and discipline. Stick to your financial plan, even during market fluctuations or economic downturns.

Remember, building net worth is a gradual process that requires patience and persistence. By implementing these tips, you can take control of your finances and work towards achieving your financial goals.

In the next section, we will discuss strategies for maximizing your investment returns, a key aspect of growing your net worth.

Conclusion

This comprehensive analysis of Shay Williams' net worth has highlighted the multifaceted nature of his financial standing and the interplay of various factors that have shaped its growth. Key insights include the importance of:

- Diversifying income streams and investments to mitigate risk and enhance wealth accumulation.

- Managing debt effectively to avoid financial strain and preserve net worth.

- Setting clear financial goals and making informed decisions to align investments and expenses with long-term objectives.

Ultimately, Shay Williams' net worth serves as a testament to his financial acumen, entrepreneurial spirit, and commitment to building a solid financial foundation. It underscores the importance of financial literacy, strategic planning, and perseverance in achieving financial success.

- Woody Allen Net Worth 2023 What Are

- What Religion Is Daphne Oz And Is

- Know About Camren Bicondova Age Height Gotham

- Melissa Kaltveit Died Como Park Senior High

- Wiki Biography Age Height Parents Nationality Boyfriend

Shay Williams Bio, Age, Height, Nationality, Net Worth, Facts

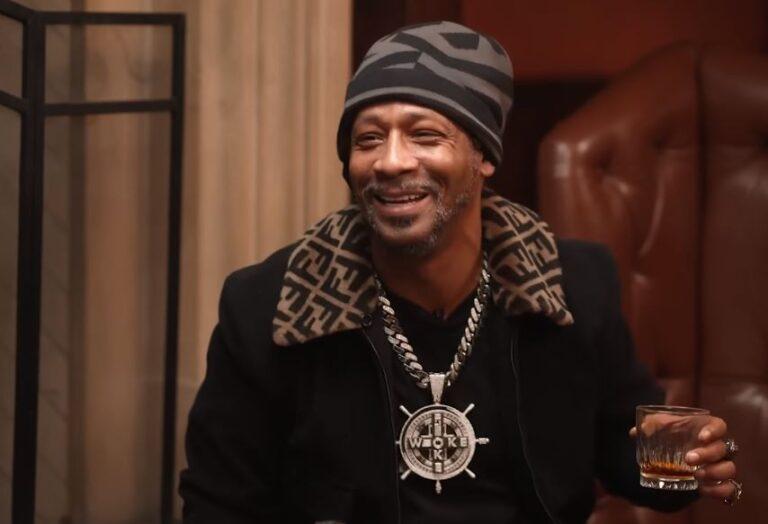

Comedian Katt Williams Unleashed on Club Shay Shay Channel Nonfiction

Katt Williams Net Worth 2024 Skinny Ninja Mom