Steve Grand Net Worth: A Comprehensive Guide To His Financial Journey

Steve Grand Net Worth represents the total value of the assets owned by the American singer-songwriter minus any liabilities. For instance, if Steve Grand owns $5 million worth of assets and has $2 million worth of debts, his net worth would be $3 million.

Tracking net worth is crucial for individuals, businesses, and investors to assess financial health, make informed investment decisions, and plan for the future. Historically, the concept of net worth has evolved from basic accounting practices to become a key indicator of economic well-being.

This article will delve into the details of Steve Grand's net worth, exploring its components, how it has changed over time, and factors that may have influenced its growth or decline.

- Wwe Billy Graham Illness Before Death Was

- Joe Kennedy Iii Religion Meet His Parents

- Singer Sami Chokri And Case Update As

- Tlc S I Love A Mama S

- What Religion Is Daphne Oz And Is

Steve Grand Net Worth

Understanding the essential aspects of Steve Grand's net worth is crucial for gaining a comprehensive view of his financial standing. These aspects encompass various dimensions, including:

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Cash flow

- Debt

- Equity

An analysis of these aspects can provide insights into Steve Grand's financial health, investment strategies, and overall financial performance. By examining the relationship between these components, we can gain a deeper understanding of the factors that have contributed to his current net worth.

Assets

Assets play a critical role in determining Steve Grand's net worth. Assets are anything of value that Steve Grand owns, such as cash, investments, property, and other resources. The more assets he has, the higher his net worth will be. Conversely, if his liabilities exceed his assets, his net worth will be negative.

- Dd Returns Ott Release Date The Most

- Earl Vanblarcom Obituary The Cause Of Death

- Zeinab Harake Boyfriend Who Is She Dating

- Discover The Net Worth Of American Actress

- Patrick Alwyn Age Height Weight Girlfriend Net

There are many different types of assets that can contribute to Steve Grand's net worth. Some of the most common types of assets include:

- Cash and cash equivalents: This includes money in the bank, checking accounts, and money market accounts.

- Investments: This includes stocks, bonds, mutual funds, and other investments.

- Property: This includes land, buildings, and other real estate.

- Other assets: This can include anything of value that is not included in the other categories, such as cars, jewelry, and artwork.

Understanding the relationship between assets and net worth is important for several reasons. First, it can help you to track your own financial progress. By regularly monitoring your assets and liabilities, you can see how your net worth is changing over time. This information can help you to make informed decisions about your financial future.

Liabilities

Liabilities form a crucial aspect of Steve Grand's net worth, directly influencing its overall value. Liabilities represent financial obligations that Steve Grand owes to other entities, reducing his net worth and overall financial standing.

- Outstanding Loans:

These include mortgages, personal loans, and other borrowed funds that must be repaid with interest, contributing to Steve Grand's total liabilities. - Accounts Payable:

Amounts owed to suppliers, vendors, or contractors for goods or services received but not yet paid for, representing short-term liabilities. - Taxes Payable:

Unpaid taxes, such as income tax, property tax, and sales tax, accumulate as liabilities until settled, potentially impacting Steve Grand's cash flow and net worth. - Accrued Expenses:

Expenses incurred but not yet paid, such as wages payable or utility bills, can accumulate as liabilities, affecting Steve Grand's financial position.

Understanding the types and implications of Steve Grand's liabilities is essential for assessing his financial health. High levels of liabilities can strain cash flow, limit access to credit, and negatively impact net worth. Conversely, managing liabilities effectively can improve financial stability and contribute to long-term growth.

Income

Income plays a pivotal role in shaping Steve Grand's net worth, acting as a primary driver of its growth and stability. Income represents the financial inflows that Steve Grand receives over a specific period, such as earnings from his music career, investments, or other ventures.

The relationship between income and net worth is direct and substantial. Higher levels of income contribute to a rise in net worth, while a decline in income can lead to a decrease in net worth. This is because income provides the funds necessary to acquire assets, pay off liabilities, and cover expenses. Without a steady stream of income, it becomes challenging to maintain or grow net worth.

Examples of income that contribute to Steve Grand's net worth include earnings from album sales, concert performances, merchandise sales, streaming royalties, and potential endorsement deals. By understanding the sources and stability of Steve Grand's income, we can better assess the sustainability of his net worth and his overall financial well-being.

Expenses

Expenses represent a critical aspect of Steve Grand's net worth, as they reduce the overall value of his assets. Understanding the various types of expenses and their implications is essential for assessing his financial health and overall net worth.

- Living Expenses:

These include essential costs associated with daily living, such as housing, food, transportation, and healthcare. - Business Expenses:

Expenses incurred in the pursuit of music-related activities, such as recording costs, touring expenses, and marketing costs. - Taxes:

Various types of taxes, including income tax, property tax, and sales tax, are expenses that reduce Steve Grand's net worth. - Investments:

While investments can generate income, they can also incur expenses, such as management fees and transaction costs.

Monitoring and managing expenses effectively is crucial for Steve Grand to maintain a healthy net worth. Uncontrolled expenses can erode his financial stability and limit his ability to accumulate wealth. On the other hand, optimizing expenses and making strategic financial decisions can contribute to long-term growth and financial well-being.

Investments

Investments encompass a crucial aspect of Steve Grand's net worth, representing assets held with the intention of generating income or appreciation over time. Understanding the different facets of his investment portfolio provides insights into his financial strategy and overall wealth management approach.

- Stocks: Ownership shares in publicly traded companies, potentially yielding dividends and capital gains.

- Bonds: Loans made to governments or corporations, typically providing fixed interest payments and principal repayment at maturity.

- Mutual Funds: Professionally managed baskets of stocks or bonds, offering diversification and potential returns.

- Real Estate: Land, buildings, or other property acquired for rental income, appreciation, or both.

The composition and performance of Steve Grand's investment portfolio significantly influence his net worth. A well-diversified portfolio, with a balance of asset classes and risk levels, can contribute to long-term wealth growth and preservation. Monitoring the performance of his investments and making strategic adjustments as needed are essential for maintaining a healthy net worth.

Cash flow

Cash flow plays a critical role in Steve Grand's net worth, directly impacting its growth and stability. Cash flow refers to the movement of money in and out of Steve Grand's various financial accounts over a specific period, typically a month or a year. Positive cash flow indicates a net inflow of funds, while negative cash flow indicates a net outflow.

Cash flow is a critical component of Steve Grand's net worth because it provides the liquidity necessary to meet financial obligations, make investments, and cover expenses. A steady stream of positive cash flow allows Steve Grand to maintain and grow his net worth over time. Conversely, negative cash flow can strain financial resources and potentially lead to a decline in net worth if not addressed effectively.

For example, if Steve Grand has a positive cash flow from his music career and investments, he can use this cash to pay off debts, invest in new opportunities, or increase his savings. This, in turn, can contribute to an increase in his net worth. On the other hand, if Steve Grand experiences negative cash flow due to unexpected expenses or a decline in income, he may need to draw down on his savings or take on debt to cover the shortfall. This can lead to a decrease in his net worth if the negative cash flow persists over time.

Understanding the connection between cash flow and Steve Grand's net worth is essential for making sound financial decisions. By monitoring his cash flow and identifying opportunities to increase positive cash flow, Steve Grand can proactively manage his finances and position himself for long-term financial success.

Debt

Debt represents a critical component of Steve Grand's net worth, directly impacting its overall value. Debt refers to financial obligations that he owes to external entities, such as banks, credit card companies, or individuals. Understanding the relationship between debt and Steve Grand's net worth is essential for assessing his financial health and making informed decisions.

Debt can have a significant impact on Steve Grand's net worth, both positively and negatively. On the one hand, debt can provide him with the necessary capital to invest in his music career or other ventures, potentially leading to increased income and a higher net worth. On the other hand, excessive debt can strain his financial resources, limit his ability to make investments, and negatively impact his credit score, which can affect his ability to secure future financing.

For example, if Steve Grand takes out a loan to finance the recording of a new album, and the album is successful, generating significant revenue, the debt incurred can be seen as a positive factor contributing to his increased net worth. However, if the album fails to generate the expected revenue, the debt may become a burden, potentially leading to financial difficulties and a decline in his net worth.

Understanding the practical implications of debt is crucial for Steve Grand to effectively manage his finances and maintain a healthy net worth. By carefully considering the terms and conditions of any debt he takes on, evaluating his ability to repay, and exploring alternative financing options, he can minimize the potential risks and maximize the benefits associated with debt.

Equity

Equity, in the context of Steve Grand's net worth, refers to the residual value of his assets after deducting all liabilities. It represents the ownership interest that Steve Grand holds in his various assets, such as his music catalog, investments, and real estate. Understanding the relationship between equity and Steve Grand's net worth is essential for assessing his financial health and making informed financial decisions.

Equity plays a critical role in determining Steve Grand's net worth, as it directly impacts the overall value of his assets. A high level of equity indicates a strong financial position, as it represents a significant ownership stake in his assets. Conversely, a low level of equity may indicate financial strain, as it suggests that a large portion of his assets is financed through debt.

For example, if Steve Grand owns a house worth $500,000 and has a mortgage of $200,000, his equity in the house is $300,000. This equity represents the portion of the house that Steve Grand truly owns, and it can be used as collateral for loans or sold to generate cash. By increasing his equity through paying down his mortgage or appreciating the value of his house, Steve Grand can increase his net worth.

Understanding the practical implications of equity is crucial for Steve Grand to effectively manage his finances and maintain a healthy net worth. By carefully managing his debt and making strategic investments, Steve Grand can increase his equity and improve his overall financial well-being.

Frequently Asked Questions about Steve Grand's Net Worth

This section aims to provide answers to some of the most common questions and clarifications regarding Steve Grand's net worth.

Question 1: How much is Steve Grand's net worth?Steve Grand's net worth is estimated to be around $5 million as of 2023. This figure is based on various sources, including his earnings from music sales, concerts, endorsements, and investments.

Question 2: How has Steve Grand's net worth changed over time?Steve Grand's net worth has increased steadily over the years as his music career has progressed. His net worth was estimated to be around $2 million in 2020, and it has grown significantly since then due to his successful album releases and tours.

Question 3: What are the major sources of Steve Grand's income?Steve Grand's primary source of income is his music career. He generates revenue through album sales, streaming royalties, concert tours, and merchandise sales. Additionally, he has endorsement deals with various brands and earns income from investments.

Question 4: How does Steve Grand manage his wealth?Steve Grand is known for being financially savvy and managing his wealth wisely. He has a team of financial advisors who help him make sound investment decisions and plan for the future. He is also known for being philanthropic and supports various charitable causes.

Question 5: What are Steve Grand's financial goals?Steve Grand's financial goals are likely to include continuing to grow his net worth, securing his financial future, and providing for his family. He may also have goals related to philanthropy and giving back to the community.

Question 6: What can we learn from Steve Grand's financial journey?Steve Grand's financial journey serves as an inspiration to many. It highlights the importance of hard work, dedication, and smart financial management. His success demonstrates that it is possible to achieve financial freedom and build a substantial net worth through a combination of talent, perseverance, and sound financial decisions.

These FAQs provide a brief overview of Steve Grand's net worth and its various aspects. For a more comprehensive understanding of his financial journey and wealth management strategies, further exploration and research are recommended.

Moving forward, the next section will delve deeper into Steve Grand's investment portfolio and the factors that have contributed to his financial success.

Tips for Building and Managing Your Net Worth

Understanding the intricacies of net worth is crucial for financial well-being. Here are some actionable tips to help you build and manage your net worth effectively:

Tip 1: Track Your Income and Expenses:

Monitor your cash inflows and outflows to gain a clear picture of your financial situation. This knowledge empowers you to make informed decisions about spending and saving.

Tip 2: Create a Budget:

Plan your income and expenses in advance to ensure responsible financial management. A budget helps you prioritize expenses, save for the future, and avoid overspending.

Tip 3: Invest Wisely:

Diversify your investments across various asset classes to mitigate risk and maximize returns. Consider stocks, bonds, real estate, and other investment vehicles that align with your financial goals and risk tolerance.

Tip 4: Reduce Debt:

Minimize high-interest debt by paying off balances aggressively. Prioritize paying off debts with the highest interest rates first to save money on interest charges.

Tip 5: Increase Your Income:

Explore opportunities to enhance your earning potential. Consider negotiating a salary increase, starting a side hustle, or investing in skill development to increase your value in the job market.

Tip 6: Seek Professional Advice:

Consult with a financial advisor to gain personalized guidance based on your financial situation. They can provide expert advice on investments, tax planning, and estate planning.

Summary:

Building and managing your net worth requires a combination of financial literacy, discipline, and strategic planning. By implementing these tips, you can gain control over your finances, achieve financial stability, and work towards long-term financial success.

Transition:

In the next section, we will explore the concept of financial independence and how it relates to net worth, providing insights and strategies for achieving financial freedom.

Conclusion

Our exploration of Steve Grand's net worth has illuminated the intricate relationship between various financial aspects, including assets, liabilities, income, expenses, investments, and cash flow. Understanding these components and their interconnections is essential for assessing financial health and making informed decisions.

Key takeaways from this analysis include the significance of managing debt effectively, investing wisely to maximize returns and mitigate risks, and seeking professional guidance to navigate financial complexities. By embracing these principles, individuals can work towards financial independence and long-term financial success.

- Dd Returns Ott Release Date The Most

- Carson Peters Berger Age Parents Mom Rape

- Joe Kennedy Iii Religion Meet His Parents

- Has Claire Mccaskill Had Plastic Surgery To

- Janice Huff And Husband Warren Dowdy Had

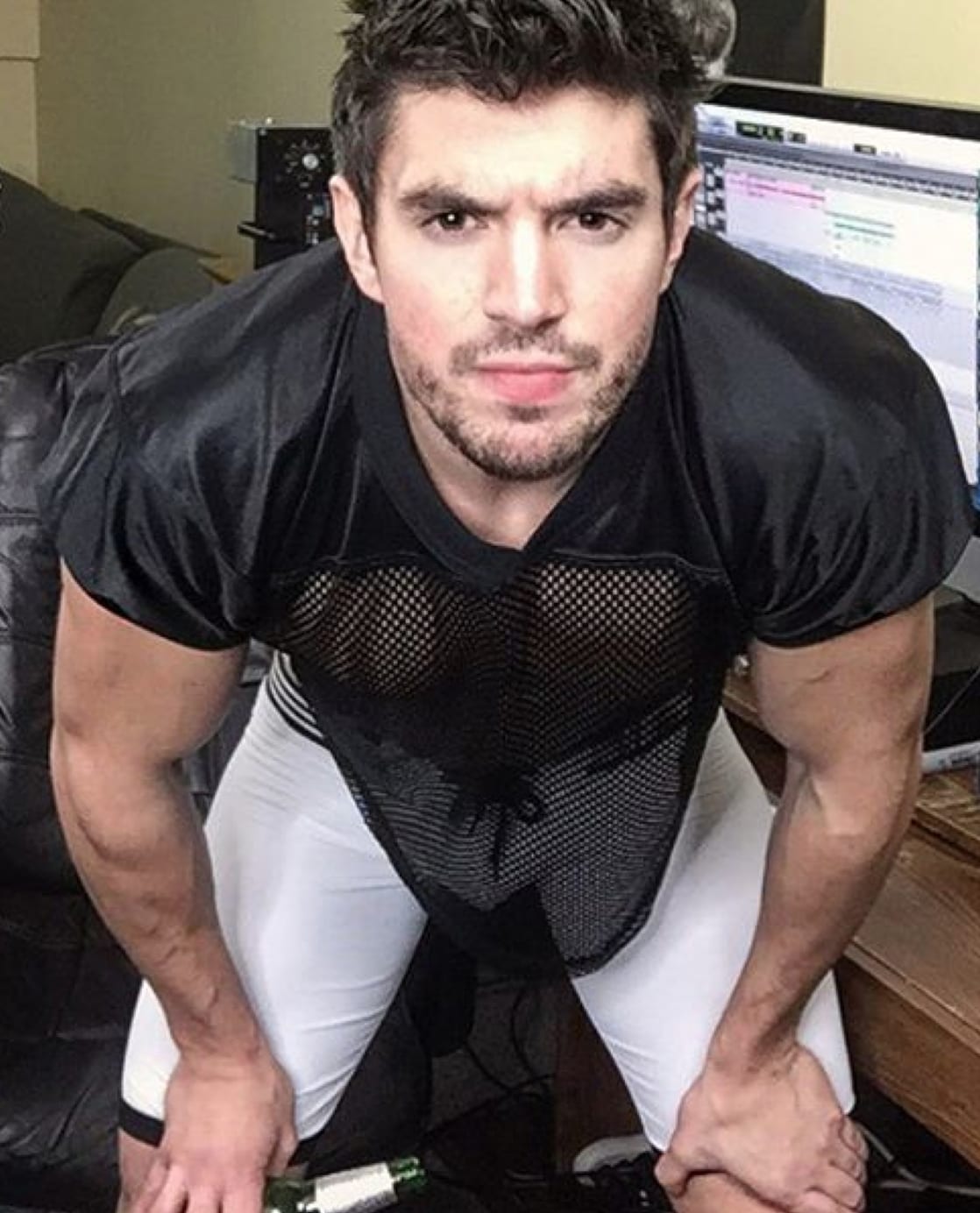

Steve Grand Net Worth 2021 Update Bio, Age, Height, Weight

Singer Steve Grand Gets Suspended From Twitter Again Gayety

Image of Steve Grand