How To Get A Bank Statement: A Comprehensive Guide For Beginners

How To Get A Bank Statement From, also known as an account statement, presents a detailed record of all financial transactions associated with a specific bank account.

Bank statements are essential for managing personal finances, tracking expenses and income, and providing documentation for loan applications or tax purposes. Historically, bank statements were only available in paper format, but today, they can be accessed online or through mobile banking apps.

This article will provide a comprehensive guide on how to obtain a bank statement from various financial institutions, including step-by-step instructions, alternative methods, and frequently asked questions.

- Zeinab Harake Boyfriend Who Is She Dating

- Bad Bunny Used To Make Mix Cds

- What Religion Is Daphne Oz And Is

- Meet Maya Erskine S Parents Mutsuko Erskine

- Meet Jordyn Hamilton Dave Portnoy S Ex

How To Get A Bank Statement From

Understanding the essential aspects of obtaining a bank statement is crucial for effective financial management. These aspects encompass various dimensions, from accessing methods to security considerations.

- Online Banking

- Mobile Banking

- In-Person Request

- Mail Request

- ATM Withdrawal

- Transaction History

- Account Balance

- Security Features

- Statement Frequency

- Historical Records

The availability of online and mobile banking has simplified the process of obtaining bank statements, providing convenient and real-time access to account information. In-person and mail requests remain viable options, offering a more traditional approach. ATMs provide a quick and easy way to access recent transactions and account balances. Understanding the different methods and their respective advantages allows individuals to choose the most suitable option based on their specific needs.

Online Banking

The advent of online banking has revolutionized the way individuals access and manage their finances, including obtaining bank statements. Online banking platforms provide secure and convenient access to account information, making it easier than ever to retrieve bank statements.

- Does Robert Ri Chard Have A Wife

- A Tragic Loss Remembering Dr Brandon Collofello

- Singer Sami Chokri And Case Update As

- Legendary Rella S Relationship Status Is She

- Did Tori Bowie Baby Survive What Happened

Online banking eliminates the need for physical visits to bank branches or reliance on paper statements. With a few clicks or taps on a mobile device, users can access their bank accounts, view transaction histories, and download or print bank statements in real-time. This convenience simplifies financial management and enables timely decision-making based on up-to-date account information.

Furthermore, online banking often offers additional features that enhance the process of obtaining bank statements. These features may include customizable statement formats, the ability to set up email or text alerts for new statements, and the option to download statements in various electronic formats, such as PDF or CSV. By leveraging these features, individuals can tailor the statement retrieval process to their specific needs and preferences.

The connection between online banking and obtaining bank statements is undeniable. Online banking has become an integral component of modern banking, providing a convenient and efficient way to access account information, including bank statements. Its user-friendly interface, real-time access, and customizable features make it an indispensable tool for effective financial management.

Mobile Banking

The rise of mobile banking has significantly transformed how individuals access and manage their finances, including obtaining bank statements. Mobile banking apps provide convenient and real-time access to bank accounts, making it easier than ever to retrieve statements on the go.

- Convenience and Accessibility

Mobile banking apps allow users to access their bank accounts from anywhere with an internet connection. This eliminates the need for physical visits to bank branches or reliance on paper statements, providing 24/7 access to account information.

- Real-Time Updates

Mobile banking apps provide real-time updates on account activity. Users can view the latest transactions, check account balances, and download or print bank statements as soon as they become available.

- Customization and Alerts

Many mobile banking apps allow users to customize their experience. They can set up personalized alerts for new transactions, low balances, or upcoming payments. Users can also choose to receive digital statements or download them in various formats.

- Security Features

Mobile banking apps are equipped with robust security measures to protect user data. These measures include multi-factor authentication, biometric login, and encryption.

In conclusion, mobile banking has revolutionized the process of obtaining bank statements. Its convenience, real-time updates, customization options, and strong security features have made it an indispensable tool for effective financial management.

In-Person Request

In-person requests have been a traditional and widely used method for obtaining bank statements. This method involves visiting a bank branch and making a request to a bank teller or customer service representative. The process typically includes providing identification, such as a government-issued ID or passport, and specifying the desired statement period.

In-person requests offer several advantages. Firstly, they provide a face-to-face interaction, which can be helpful for individuals who prefer personalized assistance or have complex inquiries. Secondly, in-person requests allow for immediate retrieval of bank statements, eliminating any delays associated with mailing or electronic delivery. This can be particularly beneficial for urgent matters, such as loan applications or visa processing.

While in-person requests were once the primary method for obtaining bank statements, the advent of online and mobile banking has reduced their prevalence. However, in-person requests remain a critical component of "How To Get A Bank Statement From" for individuals who prefer traditional banking methods or require immediate access to their statements.

Mail Request

In the realm of "How To Get A Bank Statement From", mail request presents a time-tested method for obtaining official documentation of financial transactions. Despite the rise of digital banking, mail requests continue to serve as a critical component, fulfilling specific needs and preferences.

Mail requests involve submitting a written request to the bank, typically via postal mail or a secure online portal. This method offers several advantages. Firstly, it provides a physical copy of the bank statement, which may be required for certain legal or administrative purposes. Secondly, mail requests eliminate the need for internet access or mobile devices, making them accessible to individuals who may not have these technologies.

Real-life examples of mail requests within "How To Get A Bank Statement From" include obtaining statements for closed accounts, requesting historical records for tax purposes, or providing documentation for loan applications. In cases where immediate access is not necessary and a physical copy is preferred, mail requests remain a practical solution.

Understanding the connection between "Mail Request" and "How To Get A Bank Statement From" is essential for individuals seeking a comprehensive understanding of their financial records. Mail requests offer a secure and reliable method for obtaining bank statements, complementing other methods such as online and mobile banking. By recognizing the practical applications of mail requests, individuals can effectively navigate the process of obtaining bank statements, ensuring access to accurate and up-to-date financial information.

ATM Withdrawal

In the realm of "How To Get A Bank Statement From", ATM withdrawal presents a convenient method for obtaining transaction records. While not directly providing a comprehensive bank statement, ATM withdrawals serve as valuable data points within the larger context of managing finances and tracking expenses.

The connection between "ATM Withdrawal" and "How To Get A Bank Statement From" stems from the fact that ATM withdrawals are captured as transactions on bank statements. By analyzing the date, time, amount, and location of ATM withdrawals, individuals can gain insights into their spending habits, identify unauthorized transactions, and monitor overall account activity. This information plays a crucial role in creating and maintaining accurate bank statements, ensuring a clear and up-to-date record of financial activities.

Real-life examples of "ATM Withdrawal" within "How To Get A Bank Statement From" include using ATM receipts as supporting documentation for expense reports, tracking cash withdrawals for budgeting purposes, and verifying transactions for fraud detection. By cross-referencing ATM withdrawals with bank statements, individuals can enhance their financial management practices and gain a comprehensive understanding of their account activity.

Understanding the relationship between "ATM Withdrawal" and "How To Get A Bank Statement From" empowers individuals to effectively utilize ATM withdrawals as a tool for financial tracking and record-keeping. By integrating ATM withdrawal data into their bank statement analysis, they can gain a more complete picture of their financial situation, make informed decisions, and maintain healthy financial habits.

Transaction History

Within the context of "How To Get A Bank Statement From", transaction history plays a pivotal role as the foundation upon which bank statements are built. Transaction history refers to the detailed chronological record of all financial transactions associated with a specific bank account, capturing each deposit, withdrawal, transfer, and other activities that affect the account balance.

Bank statements serve as comprehensive summaries of transaction history, providing a consolidated view of all account activity within a specified period. By analyzing transaction history, individuals can track their spending patterns, monitor cash flow, identify potential errors or fraudulent activities, and make informed financial decisions. Transaction history is the raw data that underpins the generation of accurate and informative bank statements.

Real-life examples of the connection between "Transaction History" and "How To Get A Bank Statement From" include using transaction history to reconcile personal budgets, gather supporting documentation for loan applications, or provide proof of income for tax purposes. By cross-referencing transaction history with bank statements, individuals can verify the accuracy of their financial records and ensure that all transactions are accounted for.

Understanding the relationship between "Transaction History" and "How To Get A Bank Statement From" is essential for effective financial management. By leveraging transaction history to create and analyze bank statements, individuals gain a comprehensive understanding of their financial activities, empowering them to make informed decisions, track progress towards financial goals, and maintain healthy financial habits.

Account Balance

In the context of "How To Get A Bank Statement From", account balance holds a critical position as the central indicator of a bank account's financial status at a specific point in time. A bank statement serves as a detailed record of all transactions that affect the account balance, providing a comprehensive overview of account activity within a specified period.

The connection between "Account Balance" and "How To Get A Bank Statement From" is intrinsic. Bank statements are generated based on the account balance, capturing the starting and ending balances, as well as all intermediate changes resulting from deposits, withdrawals, transfers, and other transactions. By analyzing account balances over time, individuals can track their cash flow, monitor progress towards financial goals, and identify potential areas for improvement.

Real-life examples of the significance of "Account Balance" within "How To Get A Bank Statement From" include using bank statements to verify account balances for loan applications, reconciling personal budgets, or tracking expenses for tax purposes. Bank statements provide official documentation of account balances, supporting financial claims and ensuring the accuracy of financial records.

Understanding the relationship between "Account Balance" and "How To Get A Bank Statement From" is crucial for effective financial management. By analyzing account balances in conjunction with bank statements, individuals gain a comprehensive understanding of their financial activities, empowering them to make informed decisions, maintain healthy financial habits, and achieve their financial goals.

Security Features

In the digital age, security plays a paramount role in every aspect of online activity, including accessing and obtaining bank statements. Security features are essential components of "How To Get A Bank Statement From" as they safeguard sensitive financial data and protect against unauthorized access, fraud, and cyber threats.

Bank statements contain highly confidential information, including account balances, transaction history, and personal details. Security features such as strong encryption protocols, multi-factor authentication, and advanced fraud detection systems work in tandem to protect this sensitive data from falling into the wrong hands. By implementing robust security measures, banks ensure that customers can confidently access and retrieve their bank statements without compromising their financial security.

Real-life examples of security features within "How To Get A Bank Statement From" include secure login portals, one-time passwords (OTPs), and biometric authentication. These features add an extra layer of protection, making it significantly more difficult for unauthorized individuals to access bank accounts and obtain sensitive financial information. Furthermore, banks regularly update and enhance their security systems to stay ahead of evolving cyber threats, ensuring the continued safety of customer data.

Understanding the connection between "Security Features" and "How To Get A Bank Statement From" is crucial for individuals to make informed decisions about their financial security. By choosing banks with strong security measures and practices, customers can minimize the risk of fraud and identity theft. Additionally, being aware of the latest security features and best practices empowers individuals to take proactive steps to protect their financial data and maintain the integrity of their bank statements.

Statement Frequency

Statement Frequency, within the context of "How To Get A Bank Statement From", refers to the frequency or periodicity with which banks issue and deliver bank statements to their customers. Understanding Statement Frequency is crucial for individuals to effectively manage their finances and stay updated on account activity.

- Monthly Statements

The most common Statement Frequency, monthly statements provide a comprehensive summary of all transactions and account activity over a one-month period. They are typically issued and delivered around the end of each month or the beginning of the following month.

- Quarterly Statements

Quarterly statements offer a less frequent but still detailed overview of account activity over a three-month period. They are issued and delivered at the end of each quarter, providing a broader perspective on financial trends and patterns.

- Semi-Annual Statements

Semi-annual statements provide a summary of account activity over a six-month period. They offer a less detailed view compared to monthly or quarterly statements but may be preferred by individuals who prefer a less frequent reporting cycle.

- Customizable Frequency

Some banks offer customizable Statement Frequency, allowing customers to choose the frequency that best suits their needs. This flexibility empowers individuals to receive bank statements at their preferred intervals, such as weekly or bi-weekly.

Understanding Statement Frequency and choosing the appropriate frequency for individual needs is essential for effective financial management. By receiving bank statements at regular intervals, individuals can stay informed about their account activity, track expenses, monitor cash flow, and make informed financial decisions.

Historical Records

Within the context of "How To Get A Bank Statement From", Historical Records play a crucial role in providing a comprehensive and chronological account of financial transactions and account activity. These records serve as valuable references for tracking financial performance, analyzing trends, and supporting financial decisions.

- Transaction History

Transaction History forms the backbone of Historical Records, capturing every financial transaction, including deposits, withdrawals, transfers, and other activities, associated with a bank account. This detailed log provides a chronological record of account activity, allowing individuals to track their spending patterns, identify trends, and monitor cash flow.

- Account Balances

Account Balances provide a snapshot of the financial status of a bank account at specific points in time. Historical Records maintain a record of account balances, showing the starting and ending balances for each statement period. This information is essential for tracking changes in account balances over time, monitoring financial progress, and ensuring accurate financial reporting.

- Account Statements

Account Statements serve as consolidated summaries of Historical Records, providing a comprehensive overview of all transactions and account activity within a specified period. Historical Records maintain a collection of account statements, allowing individuals to access and review their financial history at any time.

- Exceptions and Adjustments

Historical Records also capture any exceptions or adjustments made to a bank account, such as corrections for errors, reversals of transactions, or adjustments for interest or fees. These records provide a complete and accurate account of all financial activities, ensuring that the Historical Records remain reliable and auditable.

In summary, Historical Records, encompassing Transaction History, Account Balances, Account Statements, and Exceptions and Adjustments, provide a comprehensive foundation for understanding financial activity and account performance. They serve as valuable tools for individuals to track their finances, make informed financial decisions, and maintain accurate financial records.

Frequently Asked Questions

This section aims to address common queries and provide additional clarity on various aspects of "How To Get A Bank Statement From".

Question 1: What is the most convenient method to obtain a bank statement?

Answer: Online banking and mobile banking offer the most convenient methods to access and download bank statements anytime, anywhere.

Question 2: Can I request a bank statement in person at a bank branch?

Answer: Yes, you can visit a bank branch and request a bank statement in person. However, this method may require longer processing time compared to online or mobile banking.

Question 3: How far back can I request bank statements?

Answer: The availability of historical bank statements varies depending on the bank's policies and regulations. Some banks may provide statements for a limited period, while others may offer access to older statements upon request.

Question 4: Are there any fees associated with obtaining a bank statement?

Answer: Most banks do not charge fees for online or mobile bank statements. However, some banks may charge a nominal fee for paper statements or expedited delivery.

Question 5: How can I verify the authenticity of a bank statement?

Answer: Bank statements typically include security features such as watermarks, holograms, or unique identification numbers. Additionally, you can compare the statement with your transaction history to ensure its accuracy.

Question 6: What alternative methods can I use to obtain proof of financial transactions?

Answer: Aside from bank statements, you can use passbooks, transaction receipts, or online account activity logs as alternative methods to provide proof of financial transactions.

These FAQs provide essential insights into the various aspects of obtaining bank statements. understanding these aspects can help you effectively manage your finances and maintain accurate financial records.

In the next section, we will explore the importance of bank statements and their role in financial planning and management.

TIPS

To enhance your understanding and practical application of obtaining bank statements, consider these valuable tips:

Tip 1: Utilize Online and Mobile Banking

Access bank statements conveniently and securely through online and mobile banking platforms.

Tip 2: Request Statements Regularly

Establish a regular schedule for obtaining bank statements to stay updated on account activity and avoid missing important information.

Tip 3: Choose the Preferred Delivery Method

Select the delivery method that best suits your needs, whether it's online, mobile, or paper statements.

Tip 4: Review Statements Thoroughly

Tip 5: Keep Statements Organized

Maintain a well-organized system for storing and archiving bank statements for easy retrieval and reference.

Tip 6: Utilize Statements for Financial Planning

Analyze bank statements to track spending habits, identify areas for improvement, and make informed financial decisions.

Tip 7: Protect Your Statements

Securely store and dispose of bank statements to prevent unauthorized access and protect sensitive financial information.

Tip 8: Consider Alternative Methods

Explore alternative methods of obtaining proof of financial transactions, such as passbooks or transaction receipts, when bank statements are not readily available.

By implementing these tips, you can effectively manage your bank statements, enhance financial awareness, and maintain accurate financial records.

In the concluding section, we will discuss the significance of bank statements in financial planning and management, highlighting how these tips contribute to overall financial well-being.

Conclusion

Understanding "How To Get A Bank Statement From" empowers individuals with essential tools for effective financial management. This article has explored various methods of obtaining bank statements, providing a comprehensive guide to accessing and utilizing these important documents.

Key takeaways include the convenience and security of online and mobile banking, the importance of regular statement requests, and the value of alternative methods for proof of financial transactions. By implementing these insights, individuals can stay informed about account activity, track spending habits, and make informed financial decisions.

- Who Is Jay Boogie The Cross Dresser

- All About Dmx S Son Tacoma Simmons

- Tony Hawk Net Worth A Closer Look

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Is Duncan Crabtree Ireland Gay Wiki Partner

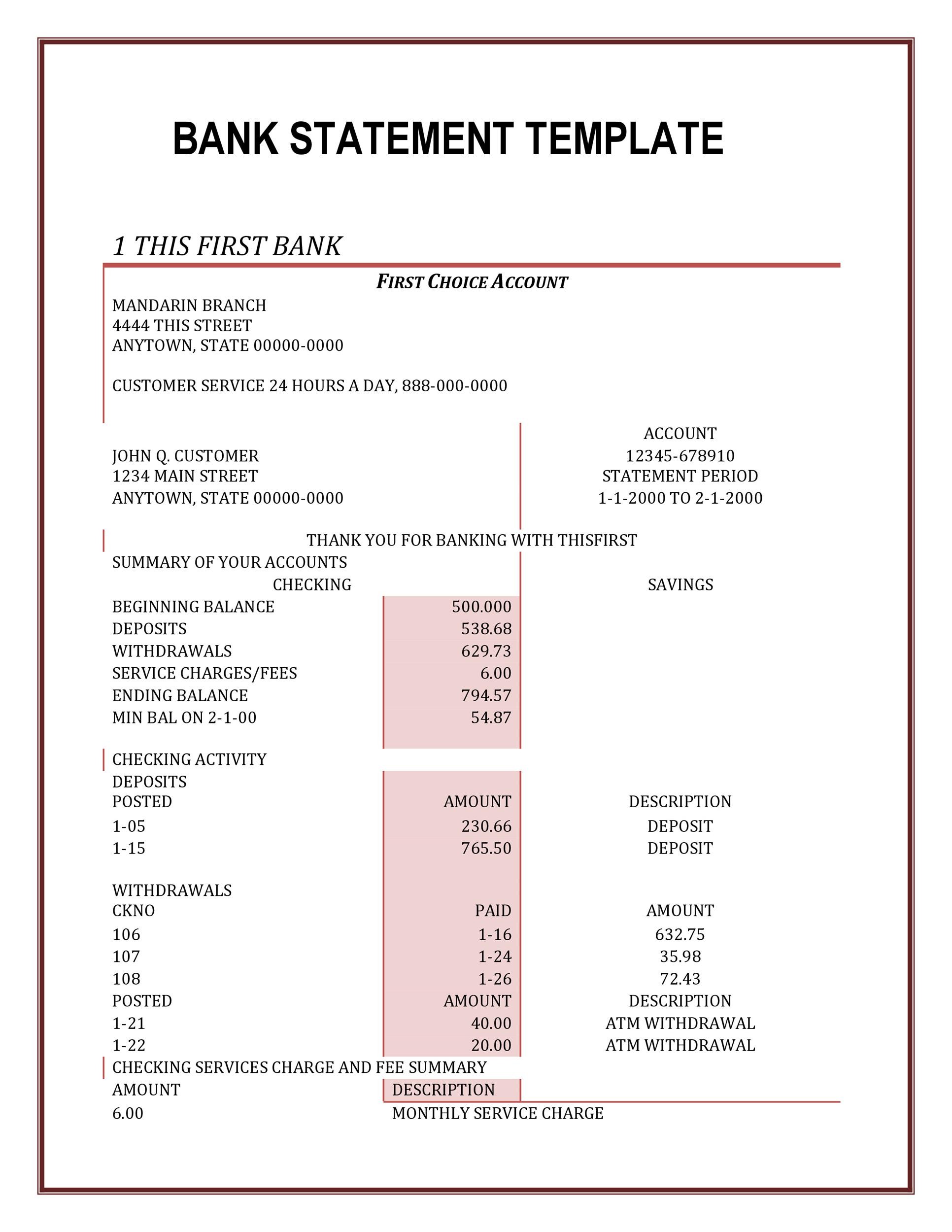

Fake Regions Bank Statement Template

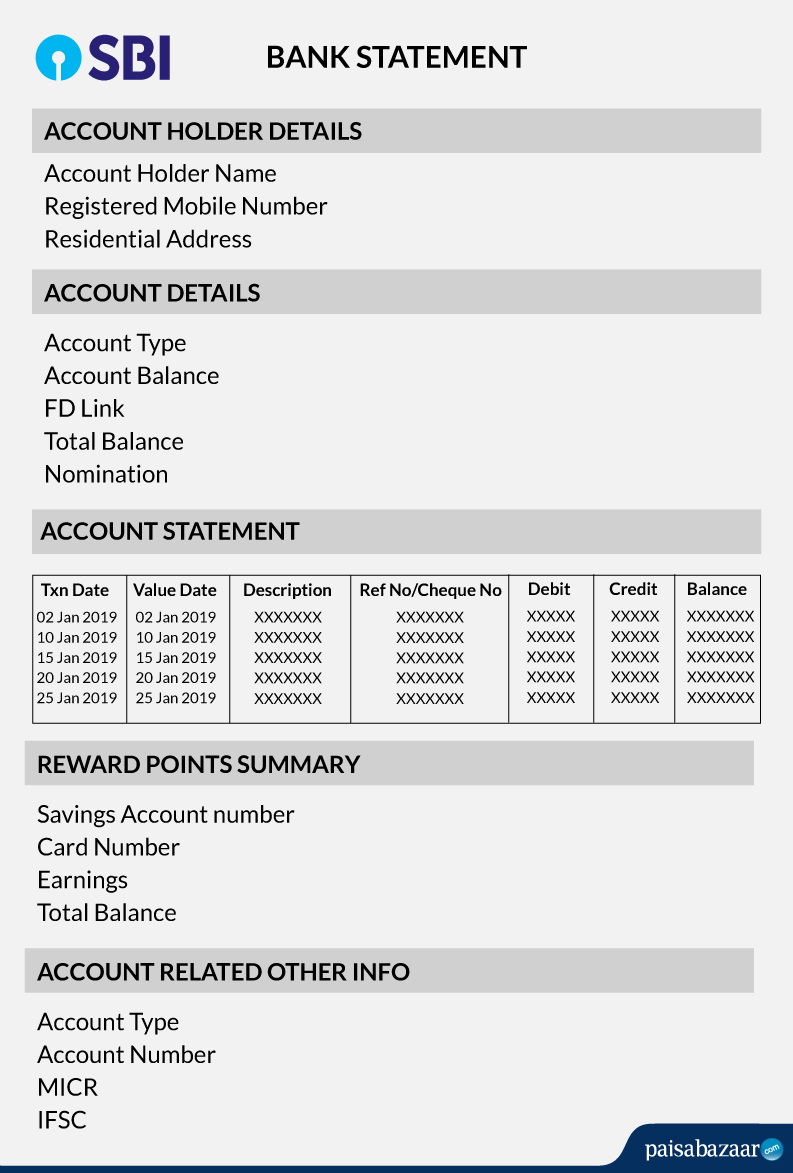

SBI Bank Statement Format, View, Download, Benefits Paisabazaar

How To Get A Bank Certificate From BDO About Philippines