How To Master Absa Online Banking: A Comprehensive Guide For Hartcelite Users

Online banking refers to the management of finances through the internet, offering convenience and time-saving benefits. One prominent example is Absa Online Banking, a digital platform provided by Absa Bank.

Online banking has revolutionized financial management, enabling customers to access their accounts, perform various transactions, and receive real-time updates. Absa Online Banking, in particular, has emerged as a highly regarded service, offering a secure and user-friendly interface for managing finances.

This article will delve into the comprehensive process of how to register for Absa Online Banking, guiding readers through each step with clear instructions and helpful tips.

- Does Robert Ri Chard Have A Wife

- Simona Halep Early Life Career Husband Net

- Tony Romo Net Worth 2023 Assets Endorsements

- Meet Ezer Billie White The Daughter Of

- What Religion Is Daphne Oz And Is

How To Register For Absa Online Banking

Understanding the essential aspects of registering for Absa Online Banking is crucial for a seamless and secure experience. These aspects encompass various dimensions, including security measures, account management, transaction capabilities, customer support, and more:

- Online security

- Account setup

- Fund transfers

- Bill payments

- Mobile banking

- Transaction history

- Customer service

- Account management

These aspects are interconnected and contribute to the overall functionality and user experience of Absa Online Banking. Understanding each aspect ensures that you can harness the full potential of this digital banking platform, manage your finances effectively, and enjoy the convenience and security it offers.

Online security

Online security plays a critical role in the process of registering for Absa Online Banking. It ensures that your personal and financial information remains protected throughout the registration process and beyond. Absa Bank employs robust security measures to safeguard your data and transactions, giving you peace of mind when banking online.

- Meet Maya Erskine S Parents Mutsuko Erskine

- Who Is Natalie Tene What To Know

- Where Was I Want You Back Filmed

- Zeinab Harake Boyfriend Who Is She Dating

- What Is Sonia Acevedo Doing Now Jamison

One of the key security features is the use of strong encryption protocols. This means that all data transmitted between your device and Absa's servers is encrypted, making it virtually impossible for unauthorized individuals to intercept or access it. Additionally, Absa implements multi-factor authentication, which requires you to provide multiple forms of identification when logging in to your account. This helps prevent unauthorized access, even if your password is compromised.

By prioritizing online security, Absa Online Banking provides a safe and secure environment for you to manage your finances. You can register with confidence, knowing that your personal and financial information is well-protected.

Account setup

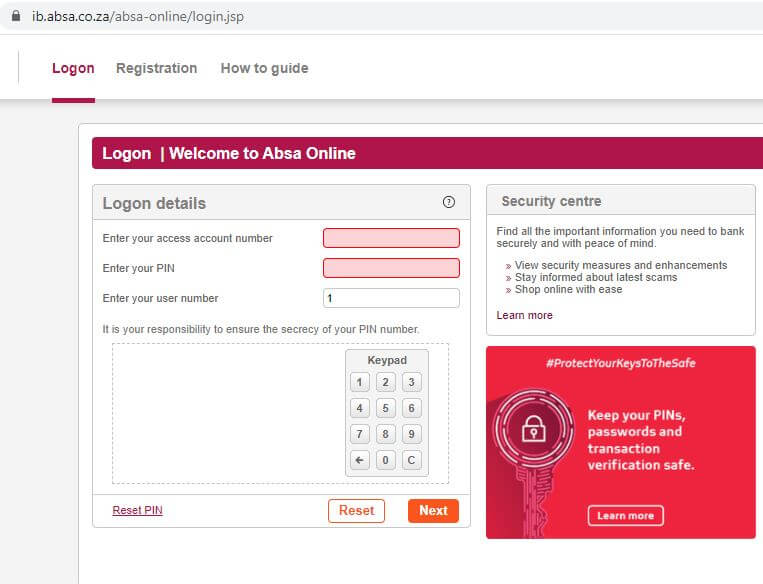

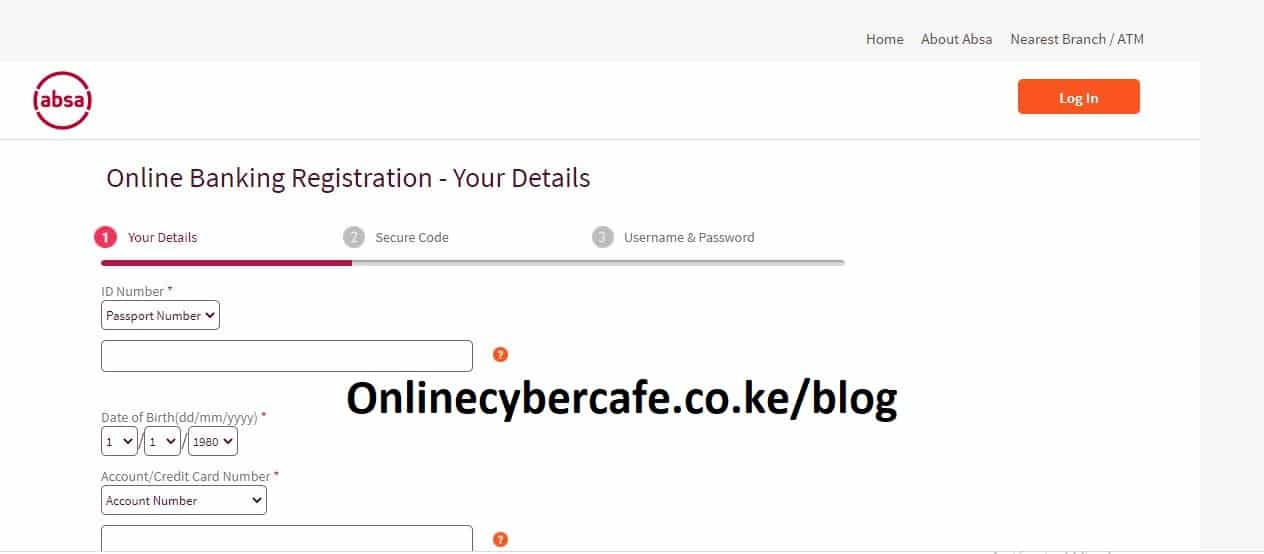

Account setup is a critical component of the Absa Online Banking registration process. It involves creating a unique username and password, as well as providing personal and financial information to verify your identity. This information includes your name, address, contact details, and account number. Once your account is set up, you can access all the features and benefits of Absa Online Banking, including online banking, bill payments, and account management.

Without proper account setup, you will not be able to register for Absa Online Banking. It is therefore essential to provide accurate and complete information during the account setup process. You should also choose a strong password and keep it confidential to protect your account from unauthorized access.

By understanding the connection between account setup and Absa Online Banking registration, you can ensure a smooth and successful registration process. This understanding will also help you appreciate the importance of account security and take the necessary steps to protect your financial information.

Fund transfers

Fund transfers are a critical component of Absa Online Banking, enabling you to send and receive money securely and conveniently. Without the ability to transfer funds, Absa Online Banking would be limited in its functionality and unable to meet the needs of its users.

During the registration process for Absa Online Banking, you will be required to provide information about your bank accounts, including account numbers and balances. This information is essential for setting up fund transfer capabilities and ensuring that you can manage your finances effectively.

Once your Absa Online Banking account is registered, you can initiate fund transfers to other Absa accounts or to accounts at other banks. The process is simple and straightforward, allowing you to transfer funds quickly and easily. Real-life examples of fund transfers within Absa Online Banking include paying utility bills, sending money to family and friends, and making online purchases.

Understanding the connection between fund transfers and Absa Online Banking registration is important for several reasons. First, it helps you appreciate the full range of services offered by Absa Online Banking and how these services can benefit you. Second, it enables you to troubleshoot any issues that may arise during the registration process, particularly those related to fund transfer capabilities. Third, it provides a foundation for understanding more advanced features of Absa Online Banking, such as scheduled transfers and international payments.

Bill payments

The aspect of "Bill payments" plays a significant role within the broader scope of "How To Register For Absa Online Banking," as it enables users to conveniently manage and pay their bills online. This feature offers numerous advantages and encompasses various facets, including:

- Convenience: With Absa Online Banking, users can pay their bills anytime, anywhere, without the need to visit a physical branch or write checks. This convenience saves time and effort, making it easier to stay on top of financial obligations.

- Efficiency: Absa Online Banking automates the bill payment process, eliminating the risk of late payments and associated penalties. Users can set up automatic payments or reminders, ensuring that their bills are paid on time, every time.

- Security: Absa Online Banking employs robust security measures to protect users' financial information and transactions. This includes encryption technologies and multi-factor authentication, providing peace of mind when paying bills online.

- Record-keeping: Absa Online Banking maintains a detailed history of bill payments, providing users with easy access to past transactions and supporting documentation for budgeting and expense tracking.

In conclusion, the "Bill payments" aspect of Absa Online Banking is a valuable feature that streamlines financial management and offers numerous benefits. By understanding the different facets of bill payments, users can fully leverage this service to stay organized, avoid late fees, and enjoy the convenience of paying bills online.

Mobile banking

The "Mobile banking" aspect of Absa Online Banking allows users to access and manage their finances using a mobile device. This integration offers convenience, flexibility, and real-time control over banking transactions.

- Account management: Manage account balances, view transaction history, and update personal information from anywhere, at any time.

- Fund transfers: Send and receive money between Absa accounts or to other banks, including instant payments using cell phone numbers.

- Bill payments: Pay bills conveniently and avoid late fees by setting up automatic payments or reminders through the mobile banking app.

- Card management: Activate, block, or replace lost or stolen cards, set spending limits, and receive notifications for suspicious activity.

In summary, the "Mobile banking" aspect of Absa Online Banking complements the online banking experience, providing users with the convenience and flexibility to manage their finances on the go. By leveraging the capabilities of mobile devices, users can access their accounts, make transactions, and stay in control of their financial well-being anytime, anywhere.

Transaction history

Transaction history serves as a crucial component of "How To Register For Absa Online Banking" as it provides a detailed record of all financial transactions made through the platform. This history plays a vital role in various aspects of the registration process and subsequent online banking activities.

During the registration process, Absa Online Banking requires users to provide information about their financial transactions, including account numbers, balances, and recent transactions. This information is used to verify the user's identity and ensure the security of their account. By providing an accurate transaction history, users can complete the registration process seamlessly and establish a secure online banking environment.

Once registered, transaction history becomes an essential tool for managing finances effectively. It offers a comprehensive view of all account activity, enabling users to track expenses, identify patterns, and make informed financial decisions. Real-life examples of transaction history's significance include monitoring cash flow, budgeting, and detecting unauthorized transactions. Additionally, transaction history serves as supporting documentation for financial audits, tax filings, and other accounting purposes.

Understanding the connection between transaction history and Absa Online Banking registration is vital for several reasons. Firstly, it emphasizes the importance of providing accurate information during the registration process to ensure a secure and efficient account setup. Secondly, it highlights the value of maintaining a detailed transaction history for effective financial management and record-keeping. Thirdly, it demonstrates how transaction history empowers users to make informed decisions, prevent fraud, and stay in control of their financial well-being.

Customer service

Customer service plays a critical role in the process of registering for Absa Online Banking, providing support, guidance, and problem resolution throughout the user's journey. It encompasses various facets, including:

- Registration assistance: Absa Online Banking offers multiple channels for customer support, including phone, email, and live chat. These channels provide assistance with the registration process, answering queries, and resolving any technical difficulties encountered by users.

- Account management: Once registered, customers may require assistance with managing their online banking accounts. Customer service representatives can guide users on how to set up beneficiaries, schedule payments, and access account statements.

- Transaction support: Customer service can provide support related to transactions, including inquiries about pending or completed transactions, reversal of incorrect transactions, and reporting of fraudulent activities.

- Security advice: Absa Online Banking prioritizes security, and customer service plays a vital role in educating users on best practices for protecting their accounts. They provide guidance on creating strong passwords, recognizing phishing attempts, and reporting suspicious activities.

These facets of customer service contribute to a seamless and secure registration process for Absa Online Banking. By providing assistance, resolving queries, and ensuring the safety of user accounts, customer service empowers users to confidently manage their finances online.

Account management

Account management is a crucial aspect of the "How To Register For Absa Online Banking" process, empowering users to control and oversee their financial activities conveniently and securely. It encompasses a range of functionalities that facilitate efficient management of finances.

- Profile Management: Update personal information, change passwords, and manage account settings to maintain a secure and up-to-date profile.

- Transaction Monitoring: Track account activity, view transaction history, and monitor balances in real-time to stay informed about financial movements.

- Beneficiary Management: Add, edit, and manage beneficiaries for quick and easy fund transfers, simplifying payment processes.

- Card Management: Activate, deactivate, and manage debit and credit cards, set spending limits, and report lost or stolen cards to enhance security and control.

These account management features collectively contribute to a seamless and empowering online banking experience. By providing users with the ability to their accounts, Absa Online Banking fosters financial responsibility and empowers individuals to make informed decisions.

Frequently Asked Questions

This FAQ section provides answers to common questions and clarifies essential aspects of the Absa Online Banking registration process.

Question 1: What are the eligibility criteria for Absa Online Banking registration?

Answer: To register for Absa Online Banking, you must have an active Absa account and be a resident of South Africa with a valid South African ID.

Question 2: How can I register for Absa Online Banking if I don't have an Absa account?

Answer: You can open an Absa account online or visit your nearest Absa branch to open an account before registering for Absa Online Banking.

Question 3: Is there a fee for registering for Absa Online Banking?

Answer: No, registering for Absa Online Banking is free of charge.

Question 4: How long does it take to register for Absa Online Banking?

Answer: The registration process usually takes a few minutes to complete.

Question 5: What information do I need to provide during the registration process?

Answer: You will need to provide your personal information, Absa account number, and create a username and password.

Question 6: Is it safe to bank online with Absa?

Answer: Yes, Absa Online Banking employs robust security measures to protect your personal and financial information.

These FAQs provide essential insights into the registration process for Absa Online Banking. By addressing common queries and clarifying key aspects, we aim to empower you to register and manage your finances conveniently and securely.

In the next section, we will explore the benefits and features of Absa Online Banking, demonstrating how it can enhance your financial management experience.

Tips for Registering for Absa Online Banking

To ensure a smooth and secure registration process for Absa Online Banking, consider the following practical tips:

- Choose a strong password: Create a complex password that includes a combination of uppercase and lowercase letters, numbers, and symbols to enhance account security.

- Keep your personal information confidential: Never share your Absa Online Banking login credentials or personal information with anyone to prevent unauthorized access.

- Use a secure internet connection: Avoid registering for Absa Online Banking on public Wi-Fi networks to protect your sensitive information from potential security risks.

- Verify the authenticity of the Absa Online Banking website: Ensure that you are on the official Absa website (https://www.absa.co.za/) before entering your personal information.

- Report any suspicious activity: If you notice any unauthorized transactions or suspicious activity on your account, report it to Absa immediately to safeguard your finances.

By following these tips, you can increase the security of your Absa Online Banking account and enjoy a seamless registration process.

In the next section, we will discuss the benefits of using Absa Online Banking, highlighting how it can enhance your financial management experience.

Conclusion

This comprehensive guide has explored the essential aspects of "How To Register For Absa Online Banking," providing a step-by-step approach to a secure and successful registration process. The key points highlighted throughout the article include the importance of providing accurate information, understanding the various aspects of online banking, and implementing security measures to safeguard your account.

By understanding the connection between these elements, you can harness the full potential of Absa Online Banking to manage your finances effectively. Embrace the convenience, security, and control that online banking offers, and take the first step towards a streamlined financial management experience. Register for Absa Online Banking today and unlock a world of financial possibilities.

- Kathy Griffin S Husband Was An Unflinching

- Matthew Cassina Dies In Burlington Motorcycle Accident

- Earl Vanblarcom Obituary The Cause Of Death

- Janice Huff And Husband Warren Dowdy Had

- Simona Halep Early Life Career Husband Net

Absa Login Absa Login Banking Guide South Africa

Absa mobile banking app Everything you need to know Ug Tech Mag

How to register for Absa banking in Kenya