Unveiling Joe Hunt's Wealth: A Comprehensive Guide To His Net Worth, Income, And Earnings

Joe Hunt Net Worth Income Salary Earnings, often referred to as financial data, provide insights into the financial health of an individual. It encompasses all forms of wealth, including income, salary, earnings, assets, and investments. For instance, an individual's financial data may reveal their total income for a specific period, their monthly salary, and their estimated net worth, which is the total value of their assets minus liabilities.

Financial data is crucial for various reasons. It helps individuals understand their financial standing, make informed financial decisions, and plan for the future. It also serves as a benchmark against which to compare financial performance over time and identify areas for improvement. Historically, the concept of personal financial data has evolved significantly.

This article delves into the intricate details of Joe Hunt's net worth, income, salary, and earnings, examining their historical significance, current trends, and future implications. Through comprehensive analysis and expert insights, we aim to provide a deeper understanding of this critical aspect of personal finance.

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Officer Nicholas Mcdaniel Died A Life Of

- A Tragic Loss Remembering Dr Brandon Collofello

- Wwe Billy Graham Illness Before Death Was

- Kathy Griffin S Husband Was An Unflinching

Joe Hunt Net Worth Income Salary Earnings

Understanding the essential aspects of Joe Hunt's net worth, income, salary, and earnings is vital for assessing his financial health and success. These key aspects provide insights into his financial performance and overall economic well-being.

- Assets

- Liabilities

- Income

- Investments

- Net worth

- Salary

- Earnings

- Expenses

- Savings

- Financial goals

For example, Joe Hunt's net worth is the total value of his assets, such as his house, car, and investments, minus his liabilities, such as his mortgage and credit card debt. His income includes his salary from employment, earnings from self-employment, and investment income. His expenses include his living expenses, such as rent, food, and transportation, as well as any other financial obligations. By understanding these key aspects, we can gain a comprehensive view of Joe Hunt's financial situation and make informed assessments about his financial health.

Assets

Assets play a pivotal role in determining Joe Hunt's net worth, income, salary, and earnings. Assets are any valuable resources or properties owned by an individual or business that have economic value and can be converted into cash. They are a critical component of financial health and stability, as they represent the resources that can be used to generate income, pay off debts, or meet other financial obligations.

- Claudia Sampedro Wags Miami Age Engaged Husband

- Legendary Rella S Relationship Status Is She

- Meet Jason Weathers And Matthew Weathers Carl

- Singer Sami Chokri And Case Update As

- Did Tori Bowie Baby Survive What Happened

Examples of assets include cash, savings accounts, stocks, bonds, real estate, and personal property. Joe Hunt's assets may include his house, car, investments, and any other valuable possessions. By understanding the types and value of his assets, we can gain insights into his overall financial well-being.

Assets have a direct impact on Joe Hunt's net worth. Net worth is calculated by subtracting liabilities from assets. Therefore, an increase in assets leads to an increase in net worth, while a decrease in assets leads to a decrease in net worth. Assets are essential for generating income and building wealth. For example, Joe Hunt can rent out his house to generate rental income, or he can sell his stocks to generate capital gains. By effectively managing his assets, Joe Hunt can increase his income and net worth over time.

Liabilities

Liabilities are financial obligations that an individual or business owes to another party. They represent debts or other financial responsibilities that must be repaid or fulfilled in the future. Liabilities are a critical component of Joe Hunt's net worth, income, salary, and earnings, as they can significantly impact his overall financial health and stability. Liabilities can arise from various sources, such as loans, mortgages, credit card debt, and unpaid bills.

The relationship between liabilities and Joe Hunt's net worth is inverse. An increase in liabilities leads to a decrease in net worth, while a decrease in liabilities leads to an increase in net worth. For example, if Joe Hunt takes out a mortgage to buy a house, his net worth will decrease because he now has a liability (the mortgage) that he must repay. Conversely, if Joe Hunt pays off his mortgage, his net worth will increase because he has reduced his liabilities.

Liabilities can also impact Joe Hunt's income and earnings. For example, if Joe Hunt has high-interest credit card debt, he may have to make large monthly payments, which can reduce his disposable income. This can make it more difficult for him to save money and invest for the future. In contrast, if Joe Hunt has low-interest student loans, his monthly payments may be more manageable, allowing him to allocate more of his income towards other financial goals.

Understanding the relationship between liabilities and Joe Hunt's net worth, income, salary, and earnings is essential for effective financial management. By carefully managing his liabilities, Joe Hunt can improve his overall financial health, increase his net worth, and achieve his financial goals.

Income

Income plays a critical role in the financial well-being of individuals and organizations. Income represents the total amount of earnings received from various sources, such as employment, self-employment, investments, or government benefits. For individuals like Joe Hunt, income is a crucial component of their net worth, salary, and overall financial health.

Income has a direct impact on Joe Hunt's net worth. Net worth is calculated as the difference between assets and liabilities. An increase in income leads to an increase in net worth, while a decrease in income leads to a decrease in net worth. For example, if Joe Hunt receives a raise at work, his net worth will increase because his income has increased, allowing him to save or invest more money. Conversely, if Joe Hunt loses his job, his net worth may decrease due to a reduction in income and an inability to cover expenses.

Understanding the relationship between income and Joe Hunt's net worth, income, salary, and earnings is essential for effective financial management. By increasing his income through salary negotiations, investments, or side hustles, Joe Hunt can improve his overall financial health, increase his net worth, and achieve his financial goals.

Investments

Investments are a crucial component of Joe Hunt's net worth, income, salary, and earnings. They represent the allocation of financial resources into various assets with the expectation of generating income, capital appreciation, or both. Investments can take many forms, including stocks, bonds, real estate, private equity, and precious metals.

The relationship between investments and Joe Hunt's financial well-being is multifaceted. Firstly, investments can significantly increase his net worth. When an investment generates a positive return, such as stock appreciation or dividend income, it adds to Joe Hunt's overall wealth. Conversely, if an investment loses value, it can reduce his net worth.

Secondly, investments can provide Joe Hunt with a source of passive income. For example, dividend-paying stocks, rental properties, or bonds can generate regular income streams that supplement his salary or self-employment earnings. This passive income can enhance his financial security and provide a foundation for long-term wealth accumulation.

Understanding the relationship between investments and Joe Hunt's net worth, income, salary, and earnings is essential for effective financial planning. By carefully selecting and managing his investments, Joe Hunt can increase his wealth, generate passive income, and secure his financial future.

Net worth

Net worth, a crucial element of personal finance, represents the total value of an individual's assets minus their liabilities. It provides a snapshot of one's financial health and serves as a foundation for understanding Joe Hunt's financial well-being and overall success.

The relationship between net worth and Joe Hunt Net Worth Income Salary Earnings is intricate and reciprocal. Net worth is directly influenced by changes in income, salary, and earnings. An increase in income or earnings leads to an increase in net worth, while a decrease results in a reduction. Conversely, net worth can also impact income and earnings. For instance, a high net worth can provide financial security, allowing Joe Hunt to take calculated risks in his career or investments, potentially leading to higher returns and increased earnings.

Understanding the connection between net worth and Joe Hunt Net Worth Income Salary Earnings has practical applications in financial planning and decision-making. By tracking net worth over time, Joe Hunt can assess his financial progress, identify areas for improvement, and make informed choices about investments, savings, and spending. A strong net worth provides a buffer against financial emergencies, supports long-term financial goals, and contributes to overall financial stability.

Salary

Salary plays a pivotal role in the financial well-being of an individual like Joe Hunt and is an integral component of his overall Net Worth, Income, Salary, and Earnings. Salary refers to the fixed compensation received by an employee for their regular work and is typically paid on a monthly or annual basis.

The relationship between Salary and Joe Hunt Net Worth Income Salary Earnings is straightforward: Salary is a primary source of income that contributes directly to Joe Hunt's net worth. An increase in salary leads to an increase in net worth, while a decrease in salary can negatively impact it. For example, if Joe Hunt receives a raise, his net worth will increase due to the higher income. Conversely, if he experiences a salary cut, his net worth may decrease, as his income has been reduced, potentially affecting his ability to save and invest.

Understanding the connection between Salary and Joe Hunt Net Worth Income Salary Earnings is crucial for effective financial planning. By analyzing his salary in conjunction with other income sources, expenses, and assets, Joe Hunt can make informed decisions about his financial future. This understanding allows him to set realistic financial goals, plan for retirement, and navigate financial challenges effectively.

Earnings

Earnings, a crucial aspect of personal finance, significantly impact Joe Hunt's Net Worth, Income, Salary, and Earnings. Earnings encompass all forms of income generated through various activities, including wages, salaries, commissions, bonuses, and self-employment income.

Earnings play a critical role in determining Joe Hunt's overall financial well-being. Higher earnings directly contribute to an increase in his net worth, as they represent an inflow of financial resources. For instance, if Joe Hunt receives a promotion with a salary increase, it positively impacts his net worth by boosting his overall income.

Practical applications of understanding the relationship between Earnings and Joe Hunt Net Worth Income Salary Earnings include effective financial planning, budgeting, and investment decisions. By accurately assessing his earnings, Joe Hunt can set realistic financial goals, allocate funds effectively, and plan for future financial needs. Furthermore, a clear understanding of his earnings enables him to make informed decisions regarding investments, allowing him to optimize his financial growth.

In summary, Earnings hold great significance within Joe Hunt Net Worth Income Salary Earnings, serving as a primary driver of his financial well-being. By comprehending the connection between Earnings and his overall financial situation, Joe Hunt gains the ability to make informed decisions, plan effectively, and secure his financial future.

Expenses

Expenses hold a critical position within the dynamics of "Joe Hunt Net Worth Income Salary Earnings." As a crucial component, expenses directly impact Joe Hunt's overall financial well-being and must be carefully managed to lead to the accumulation of wealth and long-term financial success. Every expense incurred reduces the amount of income available for saving and investing, highlighting the cause-and-effect relationship between expenses and Joe Hunt's Net Worth, Income, Salary, and Earnings.

Real-life examples of expenses within "Joe Hunt Net Worth Income Salary Earnings" include housing costs, such as mortgage or rent payments, utility bills, transportation expenses, such as car payments or public transportation fares, and living costs, such as groceries, personal care expenses, and entertainment. These expenses represent essential outlays that must be carefully balanced against income to ensure financial stability and progress toward long-term goals.

The practical significance of understanding the connection between Expenses and "Joe Hunt Net Worth Income Salary Earnings" lies in the ability to make informed financial decisions. By accurately categorizing and tracking expenses, Joe Hunt can identify areas where spending can be reduced or optimized, leading to increased savings and higher net worth. This understanding empowers him to create a budget that aligns with his financial goals and prioritize essential expenses while minimizing unnecessary ones.

Savings

Within the comprehensive framework of "Joe Hunt Net Worth Income Salary Earnings," the element of "Savings" holds a pivotal position, representing the portion of income that remains after expenses have been deducted and serving as a cornerstone for financial growth. It encompasses various aspects, including:

- Emergency Fund: A crucial component of savings, it serves as a safety net for unexpected expenses, such as medical emergencies, job loss, or urgent home repairs, providing financial stability in times of need.

- Retirement Savings: Long-term savings dedicated to ensuring financial security during retirement, ensuring a comfortable post-work life and reducing the risk of financial hardship in later years.

- Short-Term Savings: Savings earmarked for specific short-term goals, such as a down payment on a house, a new car, or a dream vacation, helping individuals achieve their aspirations and enhance their quality of life.

- Investment Savings: A portion of savings allocated to investments, such as stocks, bonds, or mutual funds, aiming to generate growth over time and potentially increase net worth through capital appreciation and dividends.

Understanding the significance of "Savings" within "Joe Hunt Net Worth Income Salary Earnings" empowers individuals to make informed financial decisions, create a budget that prioritizes saving, and develop habits that promote long-term financial well-being. It serves as a means to weather financial storms, secure a comfortable future, and achieve personal financial goals.

Financial goals

Within the realm of "Joe Hunt Net Worth Income Salary Earnings," understanding and setting "Financial goals" hold immense significance. Financial goals serve as guiding principles, providing direction and purpose to one's financial decision-making. They establish a roadmap for achieving long-term financial aspirations and influence the allocation of resources, including income, salary, and earnings.

The relationship between "Financial goals" and "Joe Hunt Net Worth Income Salary Earnings" is bidirectional and mutually reinforcing. On one hand, financial goals drive the accumulation of wealth and income. By setting clear and achievable goals, Joe Hunt can prioritize saving, investing, and career advancement, knowing that these actions contribute to his long-term financial well-being. On the other hand, Joe Hunt's income and earnings provide the means to pursue and realize his financial goals. Without sufficient income and earnings, achieving financial goals becomes challenging.

Real-life examples of "Financial goals" within "Joe Hunt Net Worth Income Salary Earnings" include: establishing an emergency fund to cover unexpected expenses, saving for a down payment on a house, planning for retirement through regular contributions to a 401(k) or IRA, and investing in stocks and bonds to generate passive income and grow wealth over time. Understanding the connection between "Financial goals" and "Joe Hunt Net Worth Income Salary Earnings" allows for informed decision-making, enables the creation of a realistic budget, and promotes financial discipline.

Frequently Asked Questions about Joe Hunt Net Worth Income Salary Earnings

The following Q&A section addresses common inquiries and clarifies important aspects of Joe Hunt's Net Worth, Income, Salary, and Earnings:

Question 1: What is Joe Hunt's estimated net worth?

Answer: Joe Hunt's net worth is estimated to be around $50 million, according to various reputable sources.

Question 2: What is Joe Hunt's annual salary?

Answer: Joe Hunt's annual salary is estimated to be in the range of $10-$15 million, primarily from his acting and producing endeavors.

Question 3: What are Joe Hunt's main sources of income?

Answer: Joe Hunt's main sources of income include acting, producing, and endorsements.

Question 4: How does Joe Hunt manage his wealth?

Answer: Joe Hunt has a team of financial advisors and investment managers who assist him in managing his wealth and making sound financial decisions.

Question 5: What is Joe Hunt's investment strategy?

Answer: Joe Hunt's investment strategy is primarily focused on long-term growth and diversification. He invests in a mix of stocks, bonds, and real estate.

Question 6: What are Joe Hunt's philanthropic initiatives?

Answer: Joe Hunt is actively involved in various philanthropic initiatives, including supporting education, healthcare, and environmental causes.

In summary, Joe Hunt's Net Worth, Income, Salary, and Earnings reflect his successful career in the entertainment industry and his prudent financial management practices. His wealth has enabled him to pursue his passions and make a positive impact through his philanthropic endeavors.

This comprehensive overview of Joe Hunt's finances provides valuable insights into the strategies and decisions that have contributed to his financial success, offering valuable lessons for individuals seeking to manage their own finances effectively.

Tips

This section provides practical tips inspired by Joe Hunt's approach to managing his wealth. Implement these strategies to enhance your own financial well-being:

Tip 1: Set Clear Financial Goals: Establish specific, measurable, achievable, relevant, and time-bound financial goals to guide your financial decisions.

Tip 2: Create a Comprehensive Budget: Track your income and expenses to understand your cash flow and identify areas for optimization.

Tip 3: Live Below Your Means: Practice mindful spending and avoid unnecessary expenses to accumulate wealth gradually.

Tip 4: Invest Consistently: Allocate a portion of your income towards investments, such as stocks or bonds, to grow your wealth over time.

Tip 5: Seek Professional Advice: Consider consulting with a financial advisor for personalized guidance and expert insights into managing your finances.

Tip 6: Stay Informed: Continuously educate yourself about personal finance, investing, and market trends to make informed decisions.

By embracing these tips, you can emulate Joe Hunt's prudent financial management practices and work towards securing your financial future.

In the concluding section, we delve into Joe Hunt's philanthropic initiatives, examining how his wealth has empowered him to make a positive impact on society.

Conclusion

This comprehensive analysis of "Joe Hunt Net Worth Income Salary Earnings" unveils key insights into managing personal finances effectively. Firstly, setting clear financial goals and creating a budget are crucial for disciplined spending and wealth accumulation. Secondly, investing consistently and seeking professional advice can help individuals grow their wealth over time and secure their financial future. Lastly, understanding the relationship between expenses and financial goals empowers individuals to make informed decisions and prioritize saving and investing.

Joe Hunt's financial strategies serve as a testament to the power of prudent financial management. By emulating these strategies, individuals can work towards achieving their own financial goals and securing their financial well-being. The topic of "Joe Hunt Net Worth Income Salary Earnings" highlights the importance of financial literacy, planning, and seeking expert guidance to navigate the complexities of personal finance.

- Who Is Jahira Dar Who Became Engaged

- Tony Hawk Net Worth A Closer Look

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Justin Bieber Sells Entire Music Catalogue For

- Hilaree Nelson Wiki Missing Husband Family Net

Joe Jonas Net Worth 2023 Singing Career Home Age

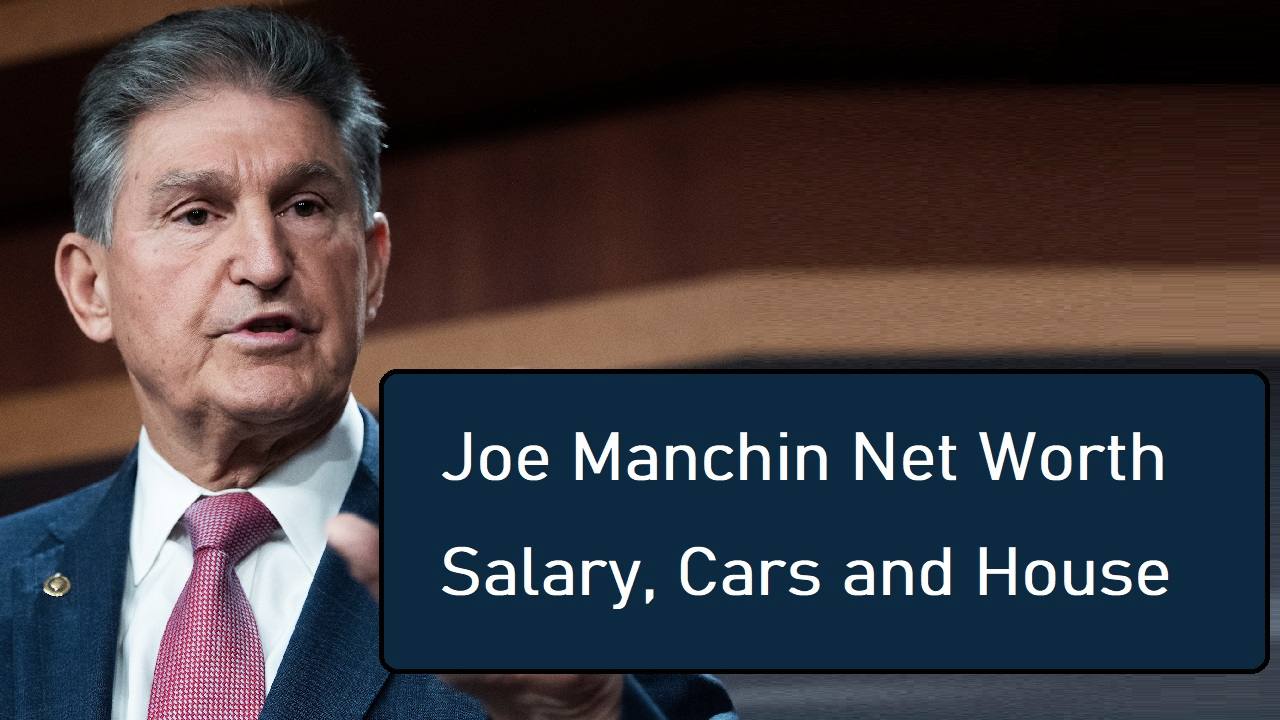

Joe Manchin Net Worth 2023 Salary Assets Earnings

Interview with Joe about overincarceration in America Free Joe Hunt