How To Build A Net Worth Like Anne Helm: A Guide For Financial Success

"Anne Helm Net Worth" is a noun that quantifies the total value of Anne Helm's assets and properties. It represents her financial standing at a specific point in time, such as the present or a past date.

Knowing someone's net worth can provide insights into their financial success, wealth accumulation, and overall economic status. It's relevant to financial analysts, investors, and anyone interested in understanding a person's financial situation. Historically, the concept of net worth emerged from accounting practices and has evolved into a crucial financial metric.

This article aims to explore Anne Helm's net worth, examining its components, growth trajectory, and potential factors that have influenced its value.

- Melissa Kaltveit Died Como Park Senior High

- What Is Sonia Acevedo Doing Now Jamison

- A Tragic Loss Remembering Dr Brandon Collofello

- Tammy Camacho Obituary A Remarkable Life Remembered

- Truth About Nadine Caridi Jordan Belfort S

Anne Helm Net Worth

Anne Helm's net worth encompasses various key aspects that provide a comprehensive overview of her financial status and wealth accumulation. These aspects include:

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cash & Cash Equivalents

- Property

- Debt

- Net Income

Understanding these aspects is crucial for assessing Anne Helm's financial well-being, investment strategies, and overall economic standing. By examining the interplay of these factors, we can gain insights into her wealth management, financial decision-making, and the trajectory of her net worth over time.

Assets

Assets, a crucial component of Anne Helm's net worth, represent the resources and properties she owns that have economic value. They encompass a wide range of tangible and intangible items that contribute to her overall financial standing.

- Mzansi Man Documents Sa Potholes Viral Tiktok

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Justin Bieber Sells Entire Music Catalogue For

- Tony Hawk Net Worth A Closer Look

- Is Sam Buttrey Jewish Religion And Ethnicity

- Cash and Cash Equivalents

Cash on hand, demand deposits, and other assets quickly convertible to cash. - Property

Real estate, land, and buildings owned by Anne Helm. - Investments

Stocks, bonds, mutual funds, and other financial instruments that represent ownership or debt in other entities. - Intellectual Property

Patents, trademarks, copyrights, and other intangible assets that have economic value.

Collectively, these assets provide a snapshot of Anne Helm's economic strength and serve as a foundation for her financial planning and decision-making. Their composition, value, and management strategies offer insights into her financial acumen, investment philosophy, and overall wealth accumulation trajectory.

Liabilities

Liabilities are financial obligations that Anne Helm owes to other entities or individuals. They represent claims against her assets and can significantly impact her net worth. Liabilities arise from various sources, such as loans, mortgages, unpaid taxes, and legal judgments.

Understanding the connection between liabilities and Anne Helm's net worth is crucial. Liabilities reduce her net worth by decreasing the value of her assets. For instance, if Anne Helm has a mortgage on her house, the outstanding balance of the mortgage is considered a liability. As she pays down the mortgage, her liability decreases, and her net worth increases.

Managing liabilities effectively is essential for Anne Helm's financial well-being. High levels of debt can strain her cash flow, limit her investment opportunities, and increase her vulnerability to financial shocks. Prudent financial planning involves balancing liabilities with assets, ensuring that her debt obligations do not outweigh her ability to repay them.

Investments

Investments play a pivotal role in shaping Anne Helm's net worth, acting as a catalyst for wealth accumulation and long-term financial growth. By allocating funds into various investment vehicles, Anne Helm seeks to multiply her assets, generate passive income, and secure her financial future.

The connection between investments and Anne Helm's net worth is evident in the potential for returns and capital appreciation. When investments perform well, their value increases, directly boosting Anne Helm's net worth. For example, if she invests in a stock that rises in value, the unrealized gain contributes positively to her net worth. Conversely, underperforming investments can lead to losses, reducing her overall wealth.

Real-life examples of Anne Helm's investments include stocks, bonds, mutual funds, and real estate. Her investment strategy, asset allocation, and risk tolerance all influence the composition and performance of her investment portfolio. By understanding the relationship between investments and net worth, Anne Helm can make informed decisions to optimize her financial outcomes.

Practically, this understanding empowers Anne Helm to set financial goals, plan for retirement, and navigate economic fluctuations. It enables her to balance risk and reward, diversify her portfolio, and make strategic investment choices that align with her long-term financial objectives.

Income

Income is a critical component of Anne Helm's net worth, acting as a primary driver of wealth accumulation and financial stability. The connection between income and net worth is evident in the direct impact that earnings have on her overall financial standing. Higher levels of income allow Anne Helm to save and invest more, contributing to the growth of her net worth over time.

Real-life examples of income within Anne Helm's net worth include her earnings from employment, such as salaries, bonuses, and commissions. Additionally, income generated from investments, such as dividends, interest, and rental income, further contributes to her net worth. Understanding this relationship empowers Anne Helm to make informed decisions about her career, investments, and spending habits to optimize her financial outcomes.

Practically, this understanding enables Anne Helm to set realistic financial goals, plan for retirement, and navigate economic fluctuations. It allows her to assess her earning potential, identify opportunities for income growth, and make strategic choices that support her long-term financial objectives. Moreover, it highlights the importance of financial literacy and the role of income in building and maintaining wealth.

Expenses

Expenses play a significant role in shaping Anne Helm's net worth, representing the consumption of resources and reduction of wealth. Understanding the various facets of expenses is crucial for assessing her financial situation and making informed decisions.

- Operational Expenses

Costs associated with running a business, such as salaries, rent, and utilities, which directly impact profit margins and cash flow.

- Personal Expenses

Discretionary spending on items such as entertainment, travel, and dining, which affect disposable income and savings.

- Financial Expenses

Interest payments on loans and other financing costs, which reduce net income and impact overall financial leverage.

- Taxes

Obligations to government entities, such as income tax, property tax, and sales tax, which reduce disposable income and affect net worth.

These expenses interact dynamically with Anne Helm's income and investments, influencing her financial health and long-term wealth accumulation. Managing expenses effectively, optimizing operational efficiency, and making strategic investment decisions are key to maximizing her net worth and achieving financial goals.

Cash & Cash Equivalents

Cash and cash equivalents represent a critical component of Anne Helm's net worth, providing a foundation for financial liquidity, stability, and growth. They encompass readily accessible funds, such as physical cash, demand deposits, and short-term investments that can be quickly converted into cash, offering flexibility and immediate purchasing power.

The direct connection between cash and cash equivalents and Anne Helm's net worth lies in their impact on her overall financial standing. Ample cash reserves enhance her financial resilience, enabling her to meet short-term obligations, seize investment opportunities, and navigate economic downturns. Conversely, insufficient cash and cash equivalents can limit her financial flexibility, potentially leading to missed opportunities or financial distress.

Real-life examples of cash and cash equivalents within Anne Helm's net worth include checking accounts, savings accounts, money market accounts, and short-term government bonds. These assets provide a liquid cushion, ensuring she has the necessary funds to cover immediate expenses, manage cash flow fluctuations, and make strategic investments.

Understanding the significance of cash and cash equivalents empowers Anne Helm to make informed financial decisions. By maintaining an appropriate level of liquidity, she can optimize her financial performance, mitigate risks, and pursue long-term wealth accumulation goals effectively. This understanding also highlights the importance of financial planning and prudent cash management practices for individuals and businesses alike.

Property

Property is a crucial component of Anne Helm's net worth, representing a significant portion of her overall wealth. The connection between property and Anne Helm's net worth is multifaceted, with property serving as both a store of value and a source of income.

Real estate, land, and buildings owned by Anne Helm contribute directly to her net worth. The value of these properties appreciates over time, especially in favorable real estate markets. Moreover, rental income generated from properties provides a steady stream of passive income, further increasing Anne Helm's net worth.

Understanding the relationship between property and Anne Helm's net worth is essential for effective financial planning and wealth management. By investing in strategic property acquisitions and managing them efficiently, Anne Helm can optimize her net worth and secure her financial future. This understanding also highlights the importance of real estate as an asset class and its role in building and preserving wealth.

Debt

Debt is a crucial aspect of Anne Helm's net worth, representing obligations that reduce her overall financial standing. Understanding the various facets of debt is essential for assessing her financial health and making informed decisions.

- Mortgages

Loans secured by real estate, typically used to finance the purchase of a home or property. These constitute a significant portion of debt for many individuals and impact net worth accordingly.

- Personal Loans

Unsecured loans used for various purposes such as debt consolidation, home renovations, or unexpected expenses. They can accumulate interest and impact net worth if not managed effectively.

- Business Loans

Funds borrowed to finance business operations, expansion, or investments. These loans can contribute to net worth growth if the business generates sufficient revenue to cover debt obligations and interest.

- Credit Card Debt

Revolving debt that allows individuals to borrow money for purchases or cash advances. High levels of credit card debt can negatively impact net worth due to interest charges and potential damage to credit scores.

Managing debt effectively is crucial for Anne Helm's financial well-being. By maintaining a healthy debt-to-income ratio, diversifying debt sources, and prioritizing debt repayment, she can minimize the impact of debt on her net worth and achieve her long-term financial goals.

Net Income

Net income, a crucial component of Anne Helm's net worth, directly impacts her overall financial standing. As the difference between her total income and expenses, net income represents the amount of money she has available to save, invest, and grow her wealth. A higher net income positively influences Anne Helm's net worth, enabling her to accumulate assets, reduce debt, and strengthen her financial foundation.

Real-life examples of net income within Anne Helm's net worth include her earnings from employment, such as salaries, wages, and bonuses. Additionally, net income generated from her investments, including dividends, interest, and rental income, further contributes to her wealth. Understanding this relationship empowers Anne Helm to make informed decisions about her career, investments, and spending habits to optimize her financial outcomes.

Practically, this understanding enables Anne Helm to set realistic financial goals, plan for retirement, and navigate economic fluctuations. It allows her to assess her earning potential, identify opportunities for income growth, and make strategic choices that support her long-term financial objectives. Moreover, it highlights the importance of financial literacy and the role of net income in building and maintaining wealth.

In conclusion, net income plays a vital role in shaping Anne Helm's net worth, providing a foundation for financial growth and stability. By understanding the connection between net income and net worth, Anne Helm can make informed financial decisions, optimize her income-generating activities, and effectively manage her expenses to achieve her financial goals.

Frequently Asked Questions about Anne Helm Net Worth

This section provides answers to commonly asked questions regarding Anne Helm's net worth, clarifying key concepts and addressing potential areas of confusion.

Question 1: What is included in Anne Helm's net worth?Anne Helm's net worth encompasses her assets, such as property, investments, and cash, minus her liabilities, such as debt and loans. It represents her overall financial standing at a specific point in time.

Question 2: How does Anne Helm's income affect her net worth?Higher income levels contribute to Anne Helm's net worth growth, as they provide her with more disposable income to save, invest, and reduce debt. Net income, calculated as total income minus expenses, directly impacts her overall financial standing.

Question 3: What role do investments play in Anne Helm's net worth?Anne Helm's investments, including stocks, bonds, and real estate, have the potential to increase her net worth through capital appreciation and income generation. Investment returns can significantly contribute to her overall wealth accumulation.

Question 4: How does debt impact Anne Helm's net worth?Debt, such as mortgages and personal loans, reduces Anne Helm's net worth as it represents financial obligations that must be repaid. Managing debt effectively is crucial for maintaining a healthy financial position.

Question 5: What is the importance of understanding Anne Helm's net worth?Understanding Anne Helm's net worth provides insights into her financial stability, wealth accumulation trajectory, and overall economic status. It aids in assessing her financial performance, making informed investment decisions, and planning for the future.

Question 6: How can Anne Helm optimize her net worth?Anne Helm can optimize her net worth by increasing her income, managing expenses effectively, making strategic investments, and reducing debt. Financial planning and prudent decision-making are essential for maximizing her wealth and achieving her financial goals.

These FAQs shed light on various aspects of Anne Helm's net worth, offering a comprehensive understanding of its components, influences, and significance. They provide a foundation for further discussion on her wealth management strategies and overall financial trajectory.

Stay tuned for the next section, where we delve deeper into Anne Helm's investment portfolio and analyze her approach to wealth accumulation.

Tips for Optimizing Your Financial Standing

This section offers practical tips to help you enhance your financial well-being and work towards your financial goals.

Tip 1: Create a Comprehensive Budget

Track your income and expenses meticulously to gain insights into your cash flow and identify areas for optimization.

Tip 2: Prioritize High-Yield Savings

Allocate a portion of your income to savings accounts that offer competitive interest rates to maximize your returns.

Tip 3: Invest Wisely

Research and diversify your investment portfolio to mitigate risks and potentially generate long-term growth.

Tip 4: Manage Debt Effectively

Prioritize high-interest debt repayment, consider debt consolidation, and explore strategies to reduce your overall debt burden.

Tip 5: Increase Your Income

Explore opportunities for career advancement, additional income streams, or side hustles to boost your earning potential.

Tip 6: Seek Professional Advice

Consult with a financial advisor or planner to gain personalized guidance and tailored strategies for your financial situation.

Tip 7: Stay Informed about Financial Trends

Keep abreast of economic news, market movements, and tax laws to make informed financial decisions.

Tip 8: Plan for the Future

Establish long-term financial goals, such as retirement planning or education funding, and develop a roadmap to achieve them.

By implementing these tips, you can take control of your finances, build wealth, and secure your financial future. These strategies empower you to navigate financial challenges, make informed decisions, and achieve your financial aspirations.

In the next section, we will delve into the intricacies of personal finance management, exploring advanced strategies and techniques to optimize your financial well-being.

Conclusion

This article has provided a comprehensive overview of Anne Helm's net worth, exploring its various components and their interconnectedness. Understanding the interplay of assets, liabilities, investments, income, expenses, and debt is crucial for assessing her financial standing and wealth accumulation trajectory.

Key insights from this exploration include the significance of income generation, strategic investments, and effective debt management in shaping Anne Helm's net worth. By identifying opportunities for income growth, diversifying investment portfolios, and minimizing financial obligations, individuals can optimize their own financial well-being and work towards achieving their financial goals.

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Where Was I Want You Back Filmed

- Earl Vanblarcom Obituary The Cause Of Death

- Malachi Barton S Dating Life Girlfriend Rumors

- Dd Returns Ott Release Date The Most

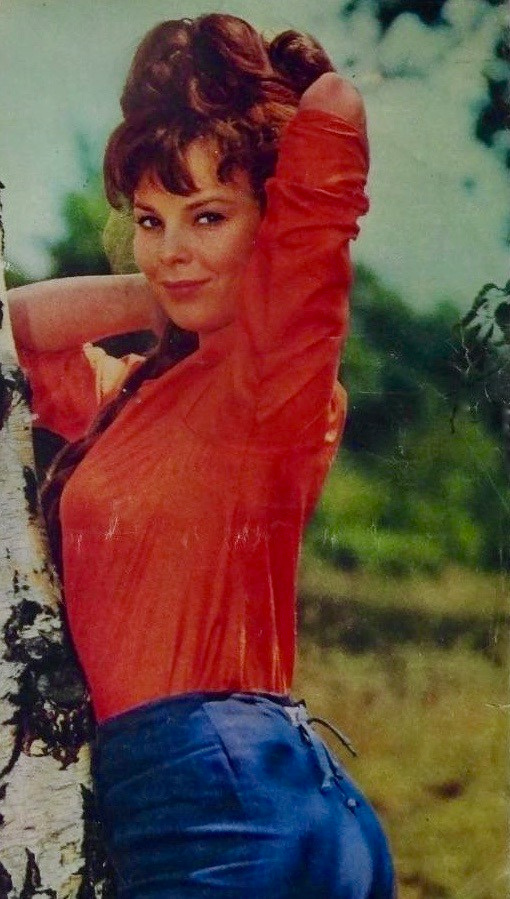

30 Glamorous Photos of Anne Helm in the 1950s and ’60s Vintage Everyday

30 Glamorous Photos of Anne Helm in the 1950s and ’60s Vintage Everyday

Picture of Anne Helm