How Aron Ralston's Journey To Millions Inspires "HelloHelen" Readers

NOUN Aron Ralston Net Worth refers to the total financial value of Aron Ralston's assets and liabilities, such as his real estate, investments, and cash. For instance, if Aron Ralston owns $5 million in assets and owes $1 million in debts, his net worth would be $4 million.

Aron Ralston's net worth is significant because it provides insight into his financial well-being and success. It can influence his ability to secure loans, invest in new ventures, or make donations to charitable causes.

Historically, net worth has been used as a measure of an individual's financial status and stability. It has evolved over time to include more comprehensive factors such as investments, debt, and equity.

- Has Claire Mccaskill Had Plastic Surgery To

- Tlc S I Love A Mama S

- Melissa Kaltveit Died Como Park Senior High

- Truth About Nadine Caridi Jordan Belfort S

- New Roms Xci Nsp Juegos Nintendo Switch

Aron Ralston Net Worth

Understanding the various dimensions associated with Aron Ralston's net worth provides valuable insights into his financial standing and overall success.

- Assets

- Liabilities

- Income

- Investments

- Real Estate

- Cash

- Debt

- Equity

- Financial Stability

- Wealth Management

These key aspects offer a comprehensive view of Ralston's financial situation, including his sources of income, investments, and assets, as well as his liabilities and debts. By examining these factors, we gain a deeper understanding of his financial strategies and overall financial health.

Assets

Assets form the foundation of Aron Ralston's net worth, representing the resources and valuables he owns that contribute to his overall financial well-being. These assets can take various forms, each with its own unique characteristics and implications.

- Chris Brown Net Worth Daughter Ex Girlfriend

- Who Is Jahira Dar Who Became Engaged

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Who Is Jay Boogie The Cross Dresser

- Simona Halep Early Life Career Husband Net

- Real Estate: Properties owned by Ralston, such as his primary residence, vacation homes, or investment properties, hold significant value and contribute to his net worth.

- Investments: Financial instruments such as stocks, bonds, and mutual funds that Ralston has invested in, with the potential to generate income or appreciate in value over time.

- Cash: Liquid assets that Ralston holds in the form of cash, checking accounts, or money market accounts, providing immediate access to funds for expenses or investments.

- Intellectual Property: Intangible assets such as patents, trademarks, or copyrights that Ralston may own, representing valuable creations or rights that contribute to his net worth.

Understanding the composition and value of Ralston's assets provides insights into his financial stability, risk tolerance, and investment strategies. It also highlights the diversification of his wealth across different asset classes, which can mitigate risks and enhance long-term financial growth.

Liabilities

Liabilities are financial obligations that Aron Ralston owes to individuals or organizations. They represent claims against his assets and can significantly impact his net worth. Understanding the types and implications of Ralston's liabilities is crucial for assessing his financial health.

- Outstanding Loans: These include mortgages, personal loans, and business loans that Ralston has taken out, representing debts that must be repaid with interest over time.

- Accounts Payable: Unpaid invoices or bills owed to suppliers, contractors, or other businesses for goods or services received but not yet settled.

- Taxes Payable: Liabilities incurred for unpaid income taxes, property taxes, or other government-imposed levies, which must be settled within specified deadlines.

- Legal Liabilities: Potential financial obligations arising from lawsuits, settlements, or judgments against Ralston, which can be substantial and impact his net worth.

The presence and extent of Ralston's liabilities provide insights into his financial leverage, risk exposure, and overall financial stability. High levels of debt or contingent liabilities can limit his ability to invest, acquire new assets, or withstand financial setbacks. Conversely, manageable liabilities, such as a mortgage on a primary residence, can be part of a sound financial strategy.

Income

Income plays a pivotal role in shaping Aron Ralston's net worth. It represents the inflows of funds that increase his financial resources and contribute to his overall wealth. Income can come from various sources, each with its own implications and impact on Ralston's net worth.

One primary source of income for Ralston is his professional earnings as an adventurer, author, and motivational speaker. His expeditions, book sales, and speaking engagements generate revenue that directly contributes to his net worth. Additionally, Ralston may have income from investments, such as dividends from stocks or interest from bonds, which further augment his financial resources.

The level and stability of Ralston's income are crucial factors influencing his net worth. Consistent and substantial income allows him to invest, acquire assets, and build wealth over time. Conversely, fluctuations or interruptions in income can impact his ability to maintain his current net worth or accumulate additional wealth.

Understanding the connection between income and net worth is essential for financial planning and wealth management. By maximizing his income streams and managing his expenses effectively, Ralston can proactively increase his net worth and achieve his financial goals.

Investments

Investments are a significant aspect of Aron Ralston's net worth, representing assets that have the potential to generate income or appreciate in value over time. Ralston's investment portfolio is likely diversified across various asset classes, each with unique characteristics and implications.

- Stocks: Ownership shares in publicly traded companies, potentially providing returns through dividends and capital appreciation.

- Bonds: Loans made to governments or corporations, typically offering fixed interest payments and a return of principal at maturity.

- Mutual Funds: Professionally managed baskets of stocks or bonds, offering diversification and access to a range of investments.

- Real Estate: Properties acquired for rental income, potential capital appreciation, or other investment purposes.

The allocation of Ralston's investments across these asset classes depends on factors such as his risk tolerance, investment goals, and time horizon. By investing wisely and managing his portfolio effectively, Ralston can potentially grow his net worth and secure his financial future.

Real Estate

Real estate constitutes a significant component of Aron Ralston's net worth, comprising properties owned for investment purposes, rental income, or personal use. His real estate portfolio encompasses a range of properties, each offering unique contributions to his overall financial standing.

- Residential Properties: Ralston may own primary residences, vacation homes, or rental properties that generate income through rent payments. These properties contribute to his net worth through their value appreciation potential and rental income.

- Commercial Properties: Ownership of commercial properties, such as office buildings or retail spaces, provides Ralston with rental income and potential capital gains. These properties offer diversification to his real estate portfolio and can contribute to a stable stream of income.

- Land: Undeveloped land held by Ralston represents an investment with potential for future development or appreciation in value. Land banking can be a strategic move to increase his net worth over the long term.

- Mortgaged Properties: Some of Ralston's real estate holdings may be financed through mortgages, which impact his net worth calculation. Mortgages represent debt obligations that reduce his overall equity in the properties.

The composition and value of Ralston's real estate portfolio provide insights into his investment strategies, risk tolerance, and financial goals. By diversifying his holdings across residential, commercial, and land investments, Ralston mitigates risks and enhances the potential for long-term wealth accumulation.

Cash

Cash, as a highly liquid asset, plays a critical role in determining Aron Ralston's net worth. It encompasses various forms of immediate and accessible funds that contribute to his overall financial flexibility and stability.

- Physical Currency: Notes and coins held by Ralston in his wallet or safe, providing immediate access to funds for everyday transactions or emergencies.

- Checking Accounts: Liquid funds deposited in banks, allowing Ralston to easily access his money through checks, debit cards, or online banking.

- Savings Accounts: Interest-bearing accounts holding Ralston's cash reserves, offering a balance between accessibility and potential returns.

- Money Market Accounts: Hybrid accounts combining features of checking and savings accounts, providing limited check-writing privileges and competitive interest rates.

Understanding the composition and value of Ralston's cash holdings offers insights into his liquidity, financial preparedness, and short-term investment strategies. Adequate cash reserves provide a buffer against unexpected expenses, facilitate financial transactions, and enhance Ralston's ability to seize investment opportunities or navigate economic downturns.

Debt

Debt plays a significant role in understanding Aron Ralston's net worth. It represents financial obligations that reduce his overall financial standing and can impact his investment decisions and long-term wealth accumulation.

- Mortgages: Loans secured by real estate properties, commonly used to finance the purchase of homes or investment properties. Ralston's mortgage debt affects his net worth by reducing his equity in the properties and increasing his monthly expenses.

- Personal Loans: Unsecured loans obtained for various purposes, such as debt consolidation, home improvements, or emergency expenses. These loans typically have higher interest rates and shorter repayment periods, potentially straining Ralston's cash flow.

- Business Loans: Debt incurred to finance business operations, such as equipment purchases, inventory, or expansion projects. Business loans can be secured or unsecured, and their impact on Ralston's net worth depends on the terms of the loan and the performance of his businesses.

- Tax Debt: Unpaid taxes owed to government agencies, such as income tax or property tax. Tax debt can accumulate penalties and interest, significantly reducing Ralston's net worth if left unresolved.

The presence and extent of debt in Ralston's financial profile provide insights into his financial leverage, risk tolerance, and overall financial health. High levels of debt can limit his ability to invest, acquire new assets, or withstand financial setbacks. Conversely, manageable debt, such as a mortgage on a primary residence, can be part of a sound financial strategy. Understanding the types and implications of debt is crucial for assessing Ralston's net worth and making informed judgments about his financial standing.

Equity

Equity, in the context of Aron Ralston's net worth, refers to the value of assets that he owns outright, free from any claims or encumbrances. It represents the portion of his net worth that he has full control over and can utilize as he sees fit.

Equity is a critical component of Ralston's net worth as it contributes positively to his overall financial standing. A higher equity-to-debt ratio indicates a stronger financial position, as it demonstrates Ralston's ability to finance his assets with his own resources rather than relying heavily on debt. This, in turn, reduces his financial risk and enhances his financial flexibility.

For instance, if Ralston owns a house worth $500,000 with a mortgage of $200,000, his equity in the property would be $300,000. This equity represents the portion of the house that he truly owns and has the potential to appreciate in value over time. As Ralston pays down his mortgage, his equity in the property will increase, further strengthening his financial position.

Understanding the connection between equity and Ralston's net worth is essential for making informed financial decisions. By increasing his equity through strategic investments and prudent financial planning, Ralston can build a solid financial foundation and enhance his long-term wealth accumulation goals.

Financial Stability

Financial Stability is a crucial aspect of Aron Ralston's net worth, serving as a cornerstone of his overall financial well-being. It encompasses several key facets that contribute to his ability to withstand financial shocks, maintain a positive cash flow, and achieve long-term financial success.

- Income Stability: A consistent and predictable income stream is essential for financial stability. Ralston's income from various sources, such as his adventures, writing, and speaking engagements, provides a solid foundation for his net worth.

- Low Debt-to-Income Ratio: Maintaining a low ratio of debt to income indicates a healthy financial situation. Ralston's ability to manage his debt obligations relative to his income enhances his financial flexibility and reduces his vulnerability to financial distress.

- Emergency Fund: Having a sufficient emergency fund provides a safety net to cover unexpected expenses or income disruptions. Ralston's emergency savings contribute to his financial stability by allowing him to respond to unforeseen circumstances without compromising his long-term financial goals.

- Diversified Investments: A well-diversified investment portfolio helps mitigate risk and enhance the stability of Ralston's net worth. By investing across different asset classes, such as stocks, bonds, and real estate, he reduces his exposure to any single market or economic sector.

These facets of Financial Stability are interconnected and work together to strengthen Ralston's overall financial position. By maintaining a stable income, managing debt effectively, building an emergency fund, and diversifying his investments, Ralston increases his resilience to financial setbacks and positions himself for long-term financial success.

Wealth Management

Wealth management plays a pivotal role in understanding Aron Ralston's net worth. It encompasses a range of strategies and services aimed at preserving and growing his financial resources, ensuring their alignment with his financial goals and objectives.

- Investment Management: Ralston's wealth manager helps him make informed investment decisions, diversifying his portfolio across various asset classes to optimize returns and mitigate risks. This includes selecting stocks, bonds, real estate, and other investments that align with his risk tolerance and long-term financial goals.

- Tax Planning: Effective tax planning is crucial for minimizing Ralston's tax liabilities and maximizing his net worth. His wealth manager works closely with him to implement tax-saving strategies, such as utilizing tax-advantaged accounts, maximizing deductions, and optimizing investment strategies for tax efficiency.

- Estate Planning: A comprehensive estate plan ensures that Ralston's assets are distributed according to his wishes after his passing. His wealth manager assists him in creating wills, trusts, and other estate planning documents to minimize estate taxes, protect his legacy, and provide for his loved ones.

- Risk Management: Wealth management involves identifying and managing potential risks to Ralston's financial well-being. His wealth manager helps him assess and mitigate risks, such as market volatility, inflation, and unexpected events, through strategies like insurance, diversification, and regular portfolio reviews.

These interconnected facets of wealth management contribute to the preservation and growth of Aron Ralston's net worth. By implementing sound investment strategies, optimizing tax efficiency, planning for the future, and managing risks, Ralston can navigate the complexities of financial markets, protect his assets, and achieve his long-term financial goals.

Frequently Asked Questions (FAQs)

These FAQs aim to clarify common questions and misconceptions surrounding Aron Ralston's net worth, providing deeper insights into his financial standing and wealth management strategies.

Question 1: How did Aron Ralston accumulate his wealth?

Answer: Ralston's wealth primarily stems from his successful career as an adventurer, author, and motivational speaker. His expeditions, book sales, and speaking engagements have generated substantial income over the years.

Question 2: What is the estimated value of Aron Ralston's net worth?

Answer: As of [insert date], Aron Ralston's net worth is estimated to be around [insert amount]. This figure is based on publicly available information and may vary depending on market fluctuations and other factors.

Question 3: Is Aron Ralston a self-made millionaire?

Answer: Yes, Aron Ralston is considered self-made as he primarily built his wealth through his own efforts, skills, and entrepreneurial ventures.

Question 4: How does Aron Ralston manage and invest his wealth?

Answer: Ralston employs a team of financial advisors and wealth managers to manage his investments and preserve his wealth. He focuses on diversification, risk management, and long-term growth strategies.

Question 5: What are some of Aron Ralston's most significant financial achievements?

Answer: Ralston's notable financial achievements include building a successful outdoor adventure company, authoring bestselling books, and establishing a foundation dedicated to promoting outdoor education and safety.

Question 6: What can we learn from Aron Ralston's approach to wealth management?

Answer: Ralston's journey offers valuable lessons on the importance of hard work, financial discipline, and seeking professional guidance for wealth management.

These FAQs provide a deeper understanding of Aron Ralston's net worth, highlighting his financial success, investment strategies, and overall approach to wealth management. His story serves as an inspiration for aspiring entrepreneurs and investors alike.

Transition: In the next section, we will explore Aron Ralston's philanthropic endeavors and his commitment to giving back to the community, further showcasing his dedication to making a positive impact both financially and socially.

Tips for Understanding Aron Ralston's Net Worth

This section provides practical tips to help readers gain a deeper understanding of Aron Ralston's net worth and its implications for his financial standing and wealth management strategies.

Tip 1: Consider Multiple Income Streams: Diversify your income sources to increase financial stability and reduce reliance on a single income stream.

Tip 2: Invest for Long-Term Growth: Prioritize investments with a long-term perspective, focusing on asset classes that have historically appreciated in value over time.

Tip 3: Manage Debt Wisely: Keep debt levels manageable and prioritize paying down high-interest debt to improve your financial position.

Tip 4: Build an Emergency Fund: Establish a financial cushion to cover unexpected expenses or income disruptions, providing peace of mind and financial resilience.

Tip 5: Seek Professional Advice: Consult with financial advisors or wealth managers to optimize your investment strategies, minimize taxes, and plan for the future.

Tip 6: Understand Your Net Worth Statement: Regularly review your net worth statement to track your financial progress and identify areas for improvement.

By following these tips, you can gain a clearer understanding of Aron Ralston's net worth and its significance for his overall financial well-being. These principles can be applied to your own financial situation to enhance your wealth management strategies and achieve your financial goals.

In the concluding section, we will delve into the broader implications of Aron Ralston's financial success, exploring the impact of his wealth on his lifestyle, philanthropic endeavors, and legacy.

Conclusion

Our exploration of Aron Ralston's net worth unveils a multifaceted picture of financial success, diversification, and wealth management strategies. Key insights gleaned from this analysis include the significance of multiple income streams, long-term investment growth, and the prudent management of debt.

Ralston's financial journey underscores the importance of building a solid financial foundation, focusing on long-term growth, and seeking professional guidance. His success story serves as an inspiration for aspiring entrepreneurs and investors, demonstrating the power of hard work, perseverance, and sound financial decision-making.

- David Foster Net Worth From Grammy Winning

- Truth About Nadine Caridi Jordan Belfort S

- New Roms Xci Nsp Juegos Nintendo Switch

- Zeinab Harake Boyfriend Who Is She Dating

- Has Claire Mccaskill Had Plastic Surgery To

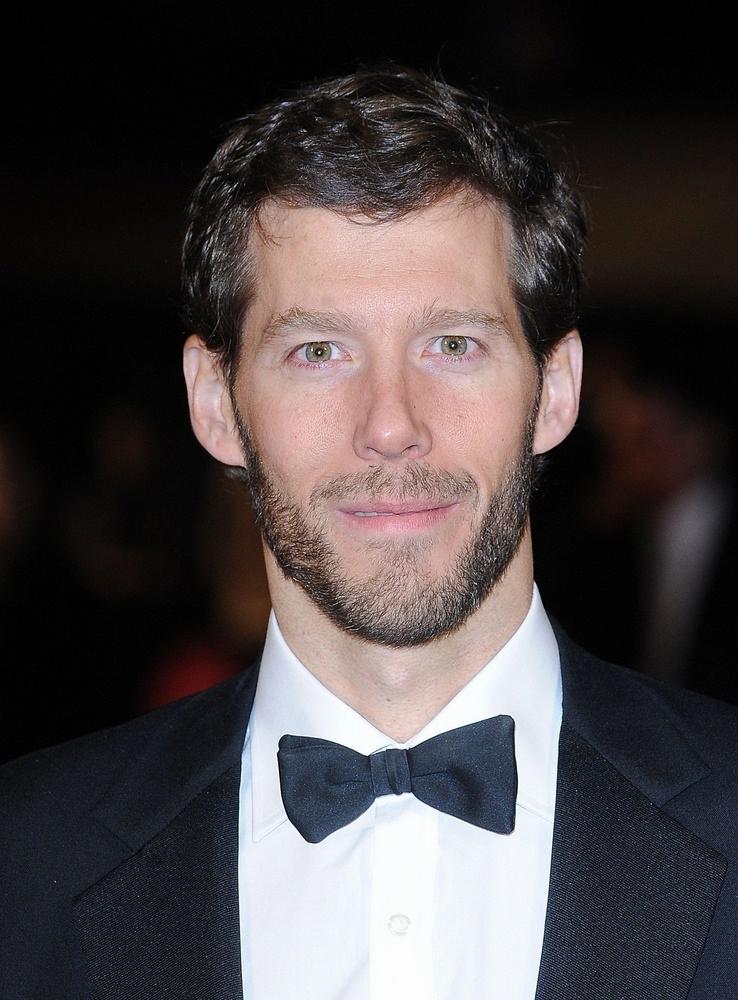

Aron Ralston Net Worth, Bio, Lifestyle

Aron Ralston Net Worth, Bio, Lifestyle

Aron Ralston is the main focus of the movie 127 Hours in which a man