Dive Into The Financial Prowess Of Bob Clendenin: Analyzing Net Worth And Wealth Management Strategies For Success

Bob Clendenin Net Worth: Financial Profile of a Notable Figure

"Bob Clendenin Net Worth" refers to the accumulated financial value of assets owned by Robert Clendenin, an individual renowned for his accomplishments in business or other fields. Understanding an individual's net worth provides insights into their financial success, wealth management strategies, and overall financial standing.

Knowing a person's net worth is significant as it can indicate their financial stability, investment decisions, and overall economic influence. It can also highlight historical trends in personal finance, showcasing evolving economic landscapes and changing societal norms surrounding wealth accumulation.

- New Roms Xci Nsp Juegos Nintendo Switch

- Legendary Rella S Relationship Status Is She

- Who Is Jay Boogie The Cross Dresser

- Tammy Camacho Obituary A Remarkable Life Remembered

- Tlc S I Love A Mama S

Bob Clendenin Net Worth

Understanding the essential aspects of Bob Clendenin's net worth is crucial for gaining a comprehensive view of his financial standing and wealth management strategies.

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Debt

- Financial Goals

- Estate Planning

Analyzing these aspects can provide valuable insights into his overall financial health, risk tolerance, and long-term financial objectives. By examining the composition of his assets and liabilities, we can assess his diversification strategies and investment preferences. Furthermore, understanding his income and expenses provides a glimpse into his cash flow management and spending habits. Additionally, evaluating his debt and financial goals sheds light on his financial leverage and future aspirations.

Assets

Assets form the foundation of Bob Clendenin's net worth, representing the valuable resources and properties he owns. Understanding the composition of his assets provides insights into his investment strategies, risk tolerance, and overall financial stability.

- A Tragic Loss Remembering Dr Brandon Collofello

- What Religion Is Daphne Oz And Is

- Who Is Hunter Brody What Happened To

- Meet Jason Weathers And Matthew Weathers Carl

- All About Dmx S Son Tacoma Simmons

- Cash and Cash Equivalents

Cash on hand, demand deposits, and short-term investments that can be easily converted to cash. These provide liquidity and serve as a buffer against unexpected expenses.

- Investments

Stocks, bonds, mutual funds, and real estate that represent ownership or a claim on future earnings. These assets have the potential to generate income and appreciate in value over time.

- Property and Equipment

Land, buildings, machinery, and other physical assets used in business operations or for personal use. These assets provide tangible value and can be leveraged for loans.

- Intellectual Property

Patents, trademarks, copyrights, and other intangible assets that represent creative works or unique ideas. These assets can generate licensing fees and enhance brand value.

By diversifying his assets across different classes, Bob Clendenin mitigates risk and positions his portfolio for growth. The value and composition of his assets will fluctuate over time, reflecting market conditions and his investment decisions, ultimately impacting his overall net worth.

Liabilities

Liabilities represent the financial obligations of Bob Clendenin, which reduce his net worth. They encompass debts, accounts payable, and other financial commitments that must be fulfilled. Understanding the relationship between liabilities and Bob Clendenin's net worth is crucial for assessing his financial leverage, risk exposure, and overall financial health.

High levels of liabilities can strain cash flow, limit investment opportunities, and increase financial risk. For instance, excessive debt can lead to higher interest payments, reducing disposable income and potentially impairing the ability to meet other financial obligations. Conversely, managed liabilities can provide financial flexibility and leverage for growth. Prudent use of debt can fund income-generating assets, such as real estate or business investments, potentially enhancing Bob Clendenin's net worth over time.

Examples of liabilities within Bob Clendenin's net worth may include mortgages, loans, unpaid taxes, and accrued expenses. These liabilities represent claims against his assets and must be considered when evaluating his financial position. By carefully managing his liabilities, Bob Clendenin can optimize his net worth, reduce financial risks, and position himself for long-term financial success.

Investments

Investments are a crucial component of Bob Clendenin's net worth, playing a pivotal role in shaping his overall financial landscape. By allocating funds into various investment vehicles, Bob Clendenin aims to grow his wealth, generate passive income, and secure his financial future. The connection between investments and Bob Clendenin's net worth is multifaceted, involving both direct and indirect effects.

Firstly, investments have the potential to appreciate in value over time, directly contributing to the growth of Bob Clendenin's net worth. For example, stocks representing ownership in publicly traded companies may increase in value as the underlying businesses perform well and generate profits. Real estate investments, such as rental properties or land, can also appreciate in value, especially in favorable market conditions. These increases in the value of investments lead to a corresponding increase in Bob Clendenin's net worth.

Secondly, investments can generate passive income, which further contributes to Bob Clendenin's net worth. Dividend-paying stocks, bonds, and rental properties can provide a steady stream of income, supplementing Bob Clendenin's other sources of revenue. This passive income can be reinvested to acquire additional assets, creating a snowball effect that amplifies the growth of his net worth. By leveraging the power of compounding, Bob Clendenin can harness the potential of investments to build long-term wealth.

Income

Income serves as the lifeblood of Bob Clendenin's net worth, representing the inflows of funds that contribute to its growth. Understanding the composition and sources of his income is essential for assessing his financial health, cash flow, and overall economic well-being.

- Salary and Wages

Compensation received from employment, representing a fixed or variable amount based on job responsibilities and performance. This forms a significant portion of income for many individuals, providing a stable foundation for financial planning and wealth accumulation.

- Business Income

Earnings generated from entrepreneurial ventures or self-employment. This can include profits from product sales, service fees, or investment returns. Business income offers potential for substantial growth but may also involve higher risks and fluctuations.

- Investments

Income derived from financial assets such as stocks, bonds, and real estate. Dividends, interest payments, and rental income fall under this category. Investment income provides passive earnings and can contribute significantly to Bob Clendenin's net worth over time.

- Other Income

Additional sources of income that may not fit into the previous categories, such as royalties, annuities, or inheritance. These can provide diversification and supplement Bob Clendenin's overall income profile.

The interplay of these income streams determines Bob Clendenin's financial flexibility, savings capacity, and ability to invest for the future. By managing his income effectively, he can optimize his net worth, pursue financial goals, and build a secure financial foundation.

Expenses

Expenses represent a crucial aspect of Bob Clendenin's net worth, encompassing outflows of funds that reduce his overall wealth. Understanding the composition and implications of expenses is essential for assessing his financial health, budgeting strategies, and long-term financial goals.

- Fixed Expenses

Regular, consistent expenses that remain relatively stable over time. Examples include mortgage or rent payments, car payments, insurance premiums, and property taxes. These expenses form a predictable base for budgeting and financial planning.

- Variable Expenses

Expenses that fluctuate based on usage or consumption patterns. Utilities, groceries, entertainment, and transportation costs fall under this category. Managing variable expenses effectively requires careful budgeting and monitoring of spending habits.

- Discretionary Expenses

Non-essential expenses that offer flexibility in spending. Dining out, travel, hobbies, and personal care are examples of discretionary expenses. These expenses provide enjoyment but can be adjusted to align with financial goals and priorities.

- Debt Repayment

Expenses allocated towards reducing outstanding loans or credit card balances. Mortgage payments, student loan payments, and personal loan repayments are common examples. Managing debt effectively is crucial for improving financial stability and reducing interest charges.

Bob Clendenin's expenses directly impact his net worth by reducing his available financial resources. Prudent expense management involves balancing essential spending with discretionary choices, while also prioritizing debt repayment to minimize the burden of interest payments. Understanding and controlling expenses is fundamental for preserving and growing Bob Clendenin's net worth, allowing him to allocate more funds towards investments and long-term financial goals.

Debt

Debt is a crucial aspect to consider when evaluating Bob Clendenin's net worth. It represents financial obligations that reduce his overall wealth and can have significant implications for his financial stability and investment strategies.

- Mortgages

Loans secured by real estate, typically used to finance the purchase of a home. Mortgages often represent a substantial portion of Bob Clendenin's debt and can impact his cash flow and borrowing capacity.

- Business Loans

Funds borrowed to finance business operations, expansion, or investments. Business loans can provide leverage for growth but also increase financial risk and debt burden.

- Consumer Debt

Debt incurred for personal expenses, such as credit card balances or personal loans. Consumer debt can accumulate quickly and strain cash flow if not managed responsibly.

- Tax Debt

Unpaid taxes owed to government entities. Tax debt can result in penalties, interest charges, and even legal consequences, making it crucial to address promptly.

Understanding the composition and implications of Bob Clendenin's debt is essential for assessing his financial health and making informed decisions about investments, savings, and risk management. High levels of debt can limit his financial flexibility, reduce investment returns, and increase the likelihood of financial distress. Conversely, managed debt can provide leverage for growth and enhance returns on investment, contributing positively to Bob Clendenin's net worth.

Financial Goals

Financial goals are the cornerstones of Bob Clendenin's net worth, guiding his financial decisions and shaping his long-term wealth trajectory. These goals encompass specific, measurable, achievable, relevant, and time-bound objectives that provide a roadmap for his financial future.

- Retirement Planning

Ensuring financial security during retirement years. Examples include saving through retirement accounts, investing in income-generating assets, and planning for healthcare expenses.

- Wealth Creation

Growing net worth through investments, business ventures, or other value-generating activities. Examples include building a diversified investment portfolio, starting a business, or investing in real estate.

- Financial Independence

Achieving a level of wealth where passive income covers living expenses. Examples include generating income from investments, royalties, or rental properties.

- Legacy Planning

Preserving and distributing wealth according to personal values and goals. Examples include setting up trusts, making charitable donations, or passing on assets to heirs.

Bob Clendenin's financial goals serve as a compass for his investment decisions, savings strategies, and risk management. By aligning his actions with these goals, he can increase the likelihood of achieving financial success and building a secure financial foundation for himself and his loved ones.

Estate Planning

Estate planning plays a critical role in preserving and distributing Bob Clendenin's net worth according to his wishes, ensuring that his assets are managed and distributed according to his will. Without proper estate planning, the distribution of his wealth may be subject to legal processes such as probate, which can be time-consuming, costly, and may not align with his intentions.

Effective estate planning involves strategies such as creating trusts, wills, and powers of attorney, which provide a framework for managing and distributing Bob Clendenin's assets during his lifetime and after his passing. These legal arrangements allow him to specify the distribution of his assets, appoint executors and trustees to carry out his wishes, and minimize estate taxes and other expenses.

Practical applications of estate planning in Bob Clendenin's net worth management include reducing probate costs and legal fees, avoiding disputes among heirs, ensuring privacy regarding his financial affairs, and providing for the care of dependents or charitable causes. Estate planning also enables him to make provisions for incapacity or long-term care, ensuring that his assets are managed according to his wishes even if he is unable to do so himself.

Frequently Asked Questions about Bob Clendenin Net Worth

This section provides answers to frequently asked questions about Bob Clendenin's net worth. These questions aim to clarify common misconceptions and provide further insights into his financial standing.

Question 1: How did Bob Clendenin accumulate his wealth?Bob Clendenin's wealth primarily stems from his successful business ventures, particularly in the technology and real estate sectors. His investments in various companies and properties have generated significant returns over the years.

Question 2: What is the primary driver of Bob Clendenin's net worth growth?The steady appreciation of his investment portfolio, coupled with his strategic acquisitions and expansions, has been the main catalyst for Bob Clendenin's net worth growth.

Question 3: How does Bob Clendenin manage his net worth?Bob Clendenin follows a diversified investment approach, spreading his wealth across various asset classes, including stocks, bonds, real estate, and private equity. This strategy aims to reduce overall risk and enhance returns.

Question 4: What philanthropic initiatives does Bob Clendenin support?Bob Clendenin actively supports organizations involved in education, healthcare, and environmental conservation. He believes in giving back to society and making a positive impact through strategic philanthropy.

Question 5: How does Bob Clendenin's net worth compare to others in his industry?Bob Clendenin's net worth ranks among the top in his industry. His business acumen, coupled with his long-term investment strategy, has positioned him as a notable figure in the financial world.

Question 6: What is Bob Clendenin's financial outlook for the future?Bob Clendenin's financial outlook remains positive. His diversified portfolio and continued investment strategy indicate a strong foundation for sustained growth and preservation of wealth.

These FAQs shed light on various aspects of Bob Clendenin's net worth, providing a deeper understanding of his financial journey and wealth management strategies. As we delve further into this article, we will explore additional facets of his financial profile, including his investment philosophy and estate planning.

Tips to Manage Your Net Worth Like Bob Clendenin

The following tips offer practical guidance inspired by Bob Clendenin's wealth management strategies:

- Tip 1: Diversify Your Investments: Spread your wealth across various asset classes, such as stocks, bonds, real estate, and commodities, to reduce risk and enhance returns.

- Tip 2: Invest for the Long Term: Adopt a long-term investment horizon to ride out market fluctuations and capture the benefits of compound growth.

- Tip 3: Seek Professional Advice: Consult with financial advisors and tax experts to optimize your investment strategies and minimize tax liabilities.

- Tip 4: Manage Your Debt Wisely: Prioritize paying down high-interest debts and maintain a low debt-to-income ratio to improve your financial flexibility.

- Tip 5: Plan for Retirement Early: Begin saving for retirement as early as possible and explore various retirement accounts to maximize tax benefits and future income.

- Tip 6: Build an Emergency Fund: Set aside a portion of your income for unexpected expenses to avoid relying on debt and protect your financial stability.

- Tip 7: Track Your Expenses: Monitor your spending habits to identify areas where you can save and redirect funds towards investments or debt reduction.

- Tip 8: Set Financial Goals: Establish clear and achievable financial goals to guide your investment decisions and stay on track with your wealth management objectives.

By implementing these tips, you can enhance your financial well-being, build a strong net worth, and secure your financial future.

These tips serve as a foundation for the comprehensive examination of Bob Clendenin's net worth and wealth management strategies presented in the following sections of this article.

Conclusion

In exploring Bob Clendenin's net worth, we gained valuable insights into the strategies and principles that have shaped his financial success. His diversified investment portfolio, long-term investment horizon, and prudent risk management have played a significant role in building his wealth.

Two key takeaways from this exploration are the importance of diversification and long-term planning. By spreading investments across various asset classes, Bob Clendenin reduces risk and enhances returns. Additionally, his long-term investment approach allows him to ride out market fluctuations and capture the benefits of compound growth.

Bob Clendenin's net worth serves as a testament to the power of sound financial decision-making and the significance of managing wealth wisely. It underscores the importance of setting financial goals, seeking professional advice, and continually monitoring and adjusting strategies to align with evolving circumstances.

- Where Was I Want You Back Filmed

- Who Is Jahira Dar Who Became Engaged

- Who Is Miranda Rae Mayo Partner Her

- Tony Romo Net Worth 2023 Assets Endorsements

- Meet Jason Weathers And Matthew Weathers Carl

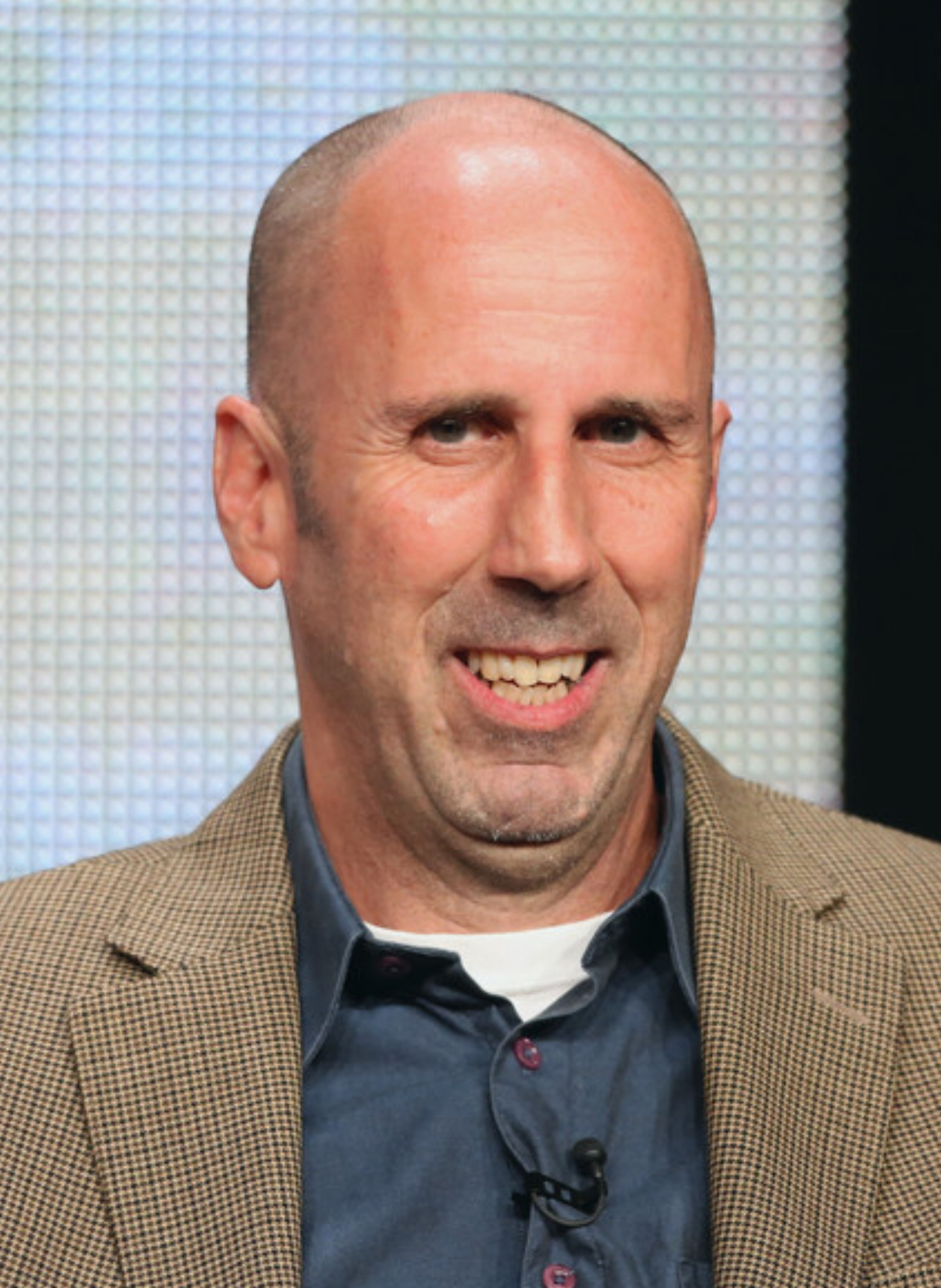

Bob Clendenin

Bob Clendenin Lemony Snicket Wiki Fandom

Bob CLENDENIN Biographie et filmographie