Unveiling Don Amendolia's Net Worth: A Comprehensive Review For The "hellohelen" Community

Don Amendolia Net Worth refers to the monetary value of individuals named "Don Amendolia". For instance, if an individual named Don Amendolia owns assets worth $5 million and owes $2 million in debts, their net worth would be $3 million.

Determining net worth is crucial for managing personal finances, accessing credit, and understanding one's overall financial situation. Historically, net worth has evolved from a concept associated with the landed gentry to a metric relevant to individuals from all socioeconomic backgrounds.

This article will delve into the net worth of Don Amendolia, exploring its components, factors that influence it, and its significance in personal finance.

- Dd Returns Ott Release Date The Most

- Tammy Camacho Obituary A Remarkable Life Remembered

- Anna Faris Net Worth Movies Career Lifestyle

- Jasprit Bumrah Injury Update What Happened To

- Meet Jason Weathers And Matthew Weathers Carl

Don Amendolia Net Worth

Analyzing the various aspects of Don Amendolia's net worth is crucial for understanding their overall financial situation. These aspects encompass:

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Debt

- Savings

- Cash Flow

- Financial Goals

Examining these aspects provides insights into Don Amendolia's ability to generate income, manage debt, and accumulate wealth. For instance, understanding their income sources and expenses helps assess their financial stability, while analyzing their investments and debt levels sheds light on their risk tolerance and financial planning strategies.

Assets

Assets play a crucial role in determining Don Amendolia's net worth and reflect their financial strength. Assets encompass anything of value that Don Amendolia owns, including both tangible and intangible possessions.

- Justin Bieber Sells Entire Music Catalogue For

- Chris Brown Net Worth Daughter Ex Girlfriend

- New Roms Xci Nsp Juegos Nintendo Switch

- All About Dmx S Son Tacoma Simmons

- Matthew Cassina Dies In Burlington Motorcycle Accident

- Cash and Cash Equivalents

This includes physical cash, demand deposits, and other assets that can be quickly converted into cash.

- Investments

Stocks, bonds, mutual funds, and real estate are examples of investments that can appreciate in value over time.

- Physical Assets

These are tangible assets such as a house, car, jewelry, or artwork, which can provide both financial security and personal enjoyment.

- Intellectual Property

Patents, trademarks, and copyrights fall under this category and can be valuable assets for individuals involved in creative or innovative fields.

By understanding the composition and value of Don Amendolia's assets, we gain insights into their financial stability, risk tolerance, and overall wealth accumulation strategies.

Liabilities

Liabilities are a crucial component of Don Amendolia's net worth and represent their financial obligations. They encompass any debts or financial responsibilities that Don Amendolia owes to individuals or organizations.

Understanding the relationship between liabilities and net worth is essential. Liabilities have a negative impact on net worth, as they reduce the overall value of assets. For instance, if Don Amendolia has assets worth $1 million and liabilities of $200,000, their net worth would be $800,000. This demonstrates how liabilities can significantly affect an individual's financial position.

Common types of liabilities include mortgages, personal loans, credit card debt, and unpaid taxes. It is important for Don Amendolia to manage their liabilities effectively to maintain a healthy financial profile. This involves staying within their borrowing limits, making timely payments, and avoiding excessive debt. By doing so, they can minimize the negative impact of liabilities on their net worth.

In conclusion, understanding the connection between liabilities and Don Amendolia's net worth is vital for assessing their overall financial health. Liabilities represent financial obligations that reduce net worth, and managing them effectively is crucial for maintaining a strong financial position.

Income

Income plays a pivotal role in determining Don Amendolia's net worth, acting as the primary source of funds used to acquire assets and reduce liabilities. In essence, it is the lifeblood of net worth accumulation.

Without a steady stream of income, it is difficult to build and maintain wealth. Income provides the financial foundation upon which Don Amendolia can invest, save, and pay off debts. For instance, if Don Amendolia earns a monthly salary of $10,000 and allocates $2,000 towards savings and investments, this consistent income contributes directly to the growth of their net worth over time.

Understanding the relationship between income and net worth is crucial for making informed financial decisions. By analyzing income sources, stability, and growth potential, Don Amendolia can develop effective strategies to increase their net worth. This may involve negotiating a salary increase, exploring additional income streams, or investing in income-generating assets.

Expenses

Expenses are a crucial aspect of Don Amendolia's net worth, representing the outflow of funds that reduces their overall financial standing. Understanding the nature and components of expenses is essential for effective financial management.

- Fixed Expenses

These expenses remain relatively constant each month and are essential for maintaining a certain standard of living. Examples include rent, mortgage payments, and insurance premiums.

- Variable Expenses

These expenses can fluctuate from month to month and are often discretionary in nature. Examples include groceries, entertainment, and transportation costs.

- Essential Expenses

These expenses are necessary for maintaining a basic standard of living and well-being. They include food, shelter, and healthcare.

- Discretionary Expenses

These expenses are non-essential and can be adjusted based on individual preferences and financial circumstances. Examples include dining out, travel, and hobbies.

Tracking and managing expenses effectively is crucial for Don Amendolia's financial health. By understanding the various facets of expenses, they can prioritize essential expenses, reduce discretionary spending, and make informed decisions that contribute to the growth of their net worth.

Investments

Investments constitute a vital component of Don Amendolia's net worth, representing assets that have the potential to appreciate in value over time. By allocating funds to various investment vehicles, Don Amendolia aims to generate income, grow their wealth, and secure their financial future.

- Stocks

Stocks represent ownership shares in publicly traded companies, offering the potential for capital gains and dividends. Investing in stocks can contribute significantly to the growth of Don Amendolia's net worth over the long term.

- Bonds

Bonds are fixed-income instruments that provide regular interest payments and return the principal amount at maturity. They offer a lower risk-return profile compared to stocks and can provide stability to Don Amendolia's investment portfolio.

- Real Estate

Investing in real estate involves purchasing properties, either for rental income or potential appreciation. Real estate can be a tangible asset that generates passive income and contributes to the diversification of Don Amendolia's net worth.

- Alternative Investments

This category encompasses a wide range of investments outside of traditional stocks, bonds, and real estate. Examples include private equity, hedge funds, and commodities. Alternative investments can offer diversification and potentially higher returns but also come with higher risks.

The composition and performance of Don Amendolia's investment portfolio directly impact their net worth. By understanding the different types of investments and their associated risks and returns, they can make informed decisions that align with their financial goals and risk tolerance.

Debt

Within the context of "Don Amendolia Net Worth", debt plays a significant role in determining the overall financial health and stability of the individual. It represents any outstanding financial obligations or liabilities that Don Amendolia owes to creditors or lenders.

- Outstanding Loans

This includes various types of loans, such as mortgages, personal loans, and student loans, which represent borrowed funds that must be repaid with interest.

- Credit Card Balances

Accumulated unpaid balances on credit cards can contribute to debt and impact Don Amendolia's credit score if not managed responsibly.

- Lines of Credit

Lines of credit, such as home equity lines of credit (HELOCs) or margin loans, provide access to funds up to a certain limit but also come with interest charges and potential risks.

- Unsecured Debts

Debts without collateral, such as medical bills or tax liabilities, can pose a higher risk to Don Amendolia's financial stability if not addressed promptly.

Understanding the composition and level of Don Amendolia's debt is crucial for assessing their net worth and making informed financial decisions. High levels of debt can strain cash flow, limit investment opportunities, and negatively impact credit ratings. On the other hand, managed debt, such as mortgages used for real estate investments, can contribute to wealth accumulation over time. By carefully evaluating debt obligations and implementing responsible debt management strategies, Don Amendolia can maintain a healthy net worth and achieve their financial goals.

Savings

Savings constitute a vital aspect of Don Amendolia's net worth, acting as a safety net and a foundation for future financial growth. Saving involves setting aside a portion of current income for future use, thereby contributing directly to the accumulation of wealth.

The relationship between savings and net worth is inherently positive. By consistently saving and investing, Don Amendolia can increase their assets, an integral component of net worth. Savings provide a buffer against unexpected expenses or financial emergencies, preventing the need to resort to debt, which can negatively impact net worth. Moreover, savings can be channeled into investments that have the potential to generate income and further increase net worth over time.

Real-life examples of savings within Don Amendolia's net worth may include a high-yield savings account, a diversified investment portfolio comprising stocks and bonds, or real estate properties. Understanding the relationship between savings and net worth empowers Don Amendolia to make informed financial decisions that prioritize long-term wealth accumulation. By consistently setting aside funds for savings and investing wisely, they can navigate financial challenges, capitalize on opportunities, and build a secure financial future.

In summary, savings play a crucial role in determining Don Amendolia's net worth. By understanding this connection, they can develop effective savings strategies, invest prudently, and achieve their financial goals. The positive impact of savings on net worth highlights the importance of financial discipline, long-term planning, and the power of compounding interest in building wealth over time.

Cash Flow

Cash flow plays a pivotal role in shaping Don Amendolia's net worth. It represents the movement of money in and out of Don Amendolia's financial accounts over a specific period. Positive cash flow occurs when more money flows in than out, while negative cash flow occurs when more money flows out than in.

Sustained positive cash flow is essential for building and maintaining a strong net worth. It provides the necessary liquidity to cover expenses, invest in assets, and generate wealth. For instance, if Don Amendolia consistently generates positive cash flow from their business ventures, they can use this cash to invest in new projects or expand their operations, leading to potential growth in their net worth.

Real-life examples of cash flow within Don Amendolia's net worth include revenue from their businesses, interest income from investments, and rental income from real estate properties. By tracking and analyzing their cash flow, Don Amendolia can gain insights into their financial performance, identify areas for optimization, and make informed decisions that contribute to their overall net worth.

Understanding the connection between cash flow and net worth empowers Don Amendolia to develop effective financial strategies. By prioritizing cash flow generation, they can create a solid foundation for wealth accumulation and long-term financial success. Conversely, negative cash flow can strain financial resources, limit investment opportunities, and potentially lead to a decline in net worth if not addressed promptly.

Financial Goals

Financial goals play a central role in shaping Don Amendolia's net worth. They represent the specific financial objectives that Don Amendolia aims to achieve over time, and they serve as a roadmap for building and managing their wealth. The connection between financial goals and net worth is a cause-and-effect relationship, where the achievement of financial goals directly contributes to the growth and maintenance of Don Amendolia's net worth.

To illustrate, if Don Amendolia has a financial goal of saving for a down payment on a house, they may develop a savings plan that includes regular contributions to a dedicated savings account. As they consistently save towards this goal, the balance in their savings account increases, contributing positively to their net worth. Conversely, if Don Amendolia has a financial goal of reducing debt, they may create a debt repayment plan that involves making additional payments on their outstanding balances. By reducing their debt, they decrease their liabilities, which in turn leads to an increase in their net worth.

Understanding the connection between financial goals and net worth is crucial for Don Amendolia to make informed financial decisions. By setting clear and achievable financial goals, Don Amendolia can create a roadmap for their financial future and develop strategies to increase their net worth. This understanding empowers them to prioritize their financial objectives, allocate resources effectively, and take calculated risks in pursuit of their financial aspirations.

FAQs on Don Amendolia Net Worth

This section addresses frequently asked questions and clarifies key aspects related to Don Amendolia's net worth.

Question 1: How is Don Amendolia's net worth calculated?

Answer: Don Amendolia's net worth is calculated by subtracting their total liabilities from their total assets.

Question 2: What are the major components of Don Amendolia's net worth?

Answer: Don Amendolia's net worth comprises assets (e.g., cash, investments, real estate) and liabilities (e.g., loans, credit card debt).

Question 3: How has Don Amendolia's net worth changed over time?

Answer: Don Amendolia's net worth has fluctuated over time due to factors such as changes in asset values, income, and debt.

Question 4: What are the factors that affect Don Amendolia's net worth?

Answer: Factors influencing Don Amendolia's net worth include investment performance, real estate market conditions, and changes in personal finances.

Question 5: How does Don Amendolia's net worth compare to others in a similar industry or profession?

Answer: Don Amendolia's net worth may vary compared to others in their field based on factors such as career stage, experience, and investment strategies.

Question 6: What are the implications of Don Amendolia's net worth?

Answer: Don Amendolia's net worth provides insights into their financial health, ability to generate income, and overall wealth accumulation.

In summary, these FAQs shed light on various aspects of Don Amendolia's net worth, its components, and its significance. Understanding these factors empowers individuals to make informed decisions and develop effective financial strategies for wealth management.

The following section will delve deeper into the factors that contribute to Don Amendolia's net worth, exploring their investment strategies, income sources, and financial habits.

Tips to Enhance Your Net Worth

Understanding the components and dynamics of net worth is crucial for effective financial planning. Here are some actionable tips to help you enhance your net worth:

Tip 1: Track Your Expenses: Monitor your spending patterns to identify areas where you can reduce unnecessary expenses and allocate funds towards savings and investments.

Tip 2: Increase Your Income: Explore opportunities to supplement your income through additional earnings, investments, or career advancements. Diversifying your income streams can provide a more stable financial foundation.

Tip 3: Invest Wisely: Allocate your savings into a diversified portfolio of assets, such as stocks, bonds, and real estate, to maximize growth potential while mitigating risks.

Tip 4: Manage Debt Effectively: Prioritize high-interest debts and create a plan to reduce your debt burden. Consider debt consolidation or balance transfer options to save on interest charges.

Tip 5: Build an Emergency Fund: Establish a savings account specifically for unexpected expenses to avoid relying on debt or depleting your investments.

Tip 6: Seek Professional Advice: Consult with a financial advisor to develop a personalized plan tailored to your financial goals and risk tolerance.

Tip 7: Stay Informed: Stay updated on market trends and financial news to make informed decisions about your investments and financial strategy.

Tip 8: Be Patient and Disciplined: Building wealth requires patience and consistency. Stick to your financial plan and avoid impulsive spending or investment decisions.

By following these tips, you can gradually increase your assets, reduce your liabilities, and enhance your overall net worth. Remember, building wealth is a journey that requires ongoing effort and smart financial management.

The following section will delve into the importance of financial planning and how it can help you achieve your long-term financial goals.

Conclusion

This comprehensive analysis of Don Amendolia's net worth provides valuable insights into the interplay between assets, liabilities, income, expenses, investments, debt, savings, and cash flow. By understanding these components and their interconnectedness, individuals can develop informed financial strategies to enhance their net worth and achieve their long-term financial goals.

Key takeaways from this exploration include:

Don Amendolia's net worth is a dynamic measure that fluctuates based on various factors, including market conditions, investment decisions, and financial habits.Effective financial planning, including budgeting, debt management, and diversified investments, is crucial for building and maintaining a strong net worth.Financial goals play a pivotal role in guiding financial decisions and aligning financial strategies with personal aspirations.- Fun Fact Is Sydney Leroux Lesbian And

- A Tragic Loss Remembering Dr Brandon Collofello

- Who Is Jay Boogie The Cross Dresser

- What Religion Is Daphne Oz And Is

- Is Max Muncy Christian Or Jewish Religion

Don Amendolia Movies, Bio and Lists on MUBI

Don Amendolia IMDb

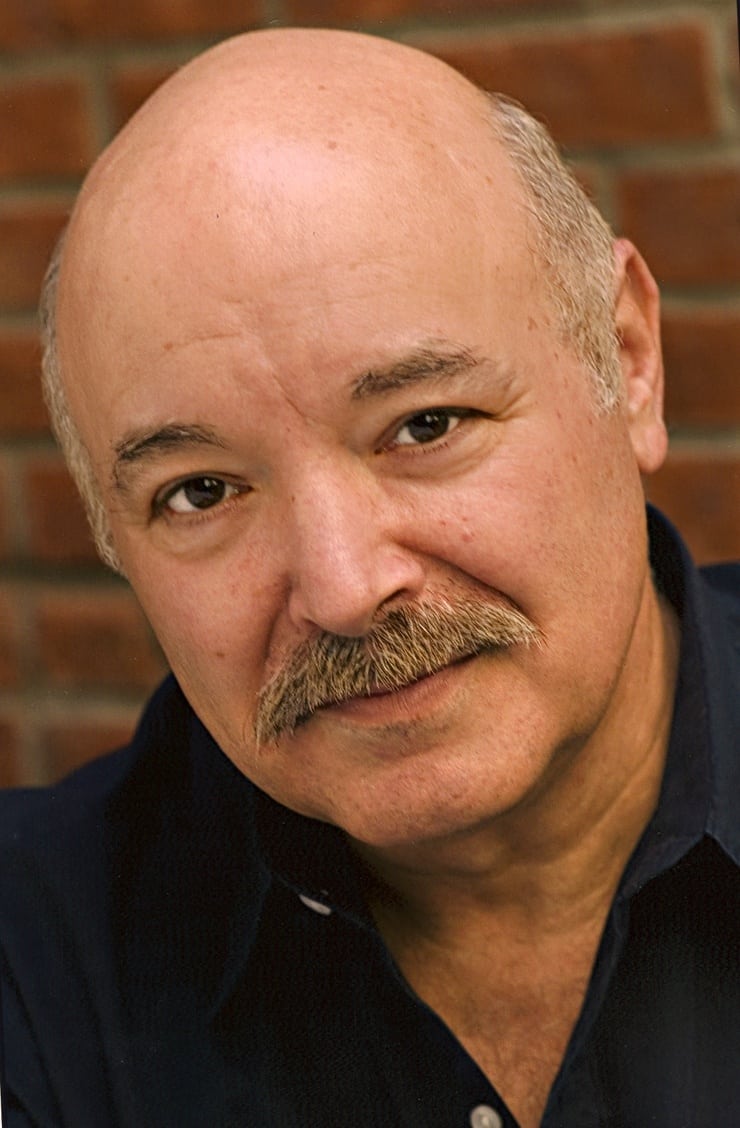

Picture of Don Amendolia