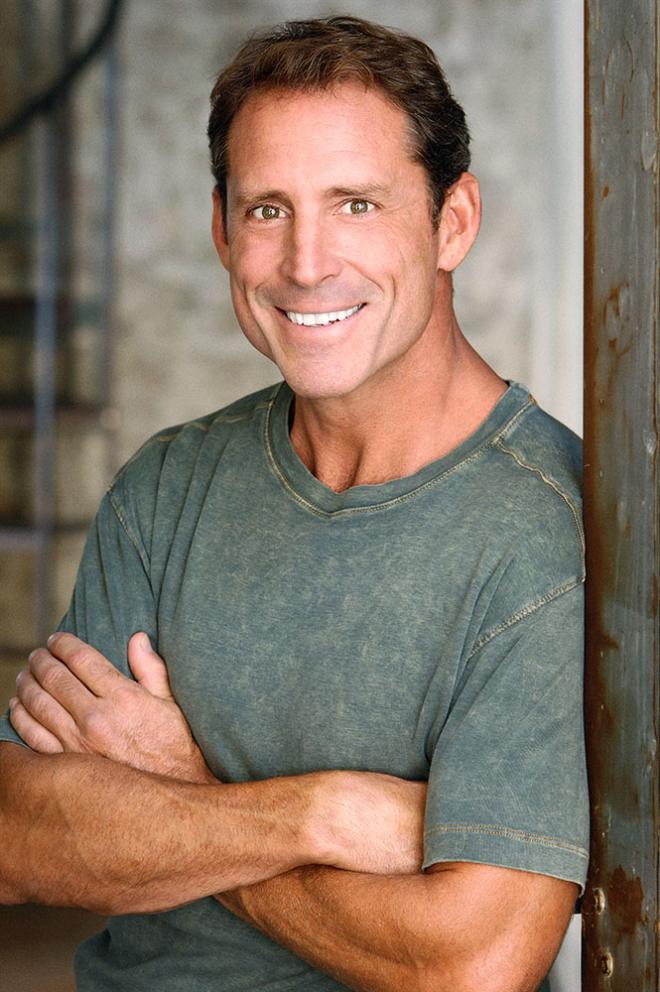

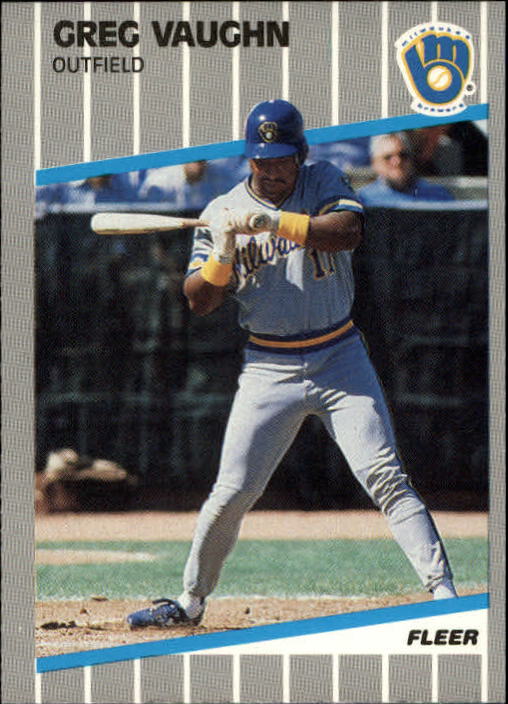

Greg Vaughn Net Worth 2024: How A Baseball Star Built His Fortune

Greg Vaughn Net Worth 2024 refers to the estimated monetary value of all assets owned by the professional baseball player, Greg Vaughn, in 2024. For instance, if Vaughn possesses $10 million in assets such as real estate, investments, and cash, his net worth for the year would be $10 million.

Evaluating an individual's net worth is crucial for assessing their financial health and wealth management strategies. It provides insights into their overall financial standing, investment performance, and potential financial risks. Historically, tracking net worth has been significant, especially during periods of economic instability, as it helps individuals make informed decisions regarding their finances.

This article aims to provide an in-depth analysis of Greg Vaughn's net worth in 2024, exploring the factors that have contributed to its growth, his investment strategies, and his overall financial trajectory.

- What Is Sonia Acevedo Doing Now Jamison

- Carson Peters Berger Age Parents Mom Rape

- Kathy Griffin S Husband Was An Unflinching

- David Foster Net Worth From Grammy Winning

- Tony Romo Net Worth 2023 Assets Endorsements

Greg Vaughn Net Worth 2024

Understanding the essential aspects of Greg Vaughn's net worth in 2024 is crucial for gaining a comprehensive view of his financial standing and wealth management strategies. These aspects encompass various dimensions, including:

- Assets

- Liabilities

- Income

- Investments

- Expenses

- Financial Goals

- Tax Liabilities

- Estate Planning

Analyzing these aspects provides valuable insights into Vaughn's overall financial health, investment performance, and future financial prospects. By examining his assets and liabilities, we can assess his liquidity and solvency. Understanding his income and expenses sheds light on his cash flow and spending habits. Furthermore, exploring his investments reveals his risk tolerance and growth strategies. Additionally, considering his financial goals, tax liabilities, and estate planning offers insights into his long-term financial planning and legacy objectives.

Assets

Assets play a pivotal role in determining Greg Vaughn's net worth in 2024. They represent the total value of everything he owns, providing a snapshot of his financial well-being and investment strategies.

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

- How To Make Water Breathing Potion In

- All About Dmx S Son Tacoma Simmons

- Truth About Nadine Caridi Jordan Belfort S

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Real Estate: Vaughn's real estate holdings, including his primary residence, vacation homes, and investment properties, contribute significantly to his overall net worth. The value of these properties is influenced by factors such as location, size, and market conditions.

- Investments: Vaughn's investment portfolio may include stocks, bonds, mutual funds, and other financial instruments. These investments represent his strategy for long-term wealth growth and diversification.

- Cash and Cash Equivalents: Cash on hand, in checking and savings accounts, as well as short-term investments like money market accounts are considered liquid assets. They provide Vaughn with financial flexibility and the ability to meet short-term obligations.

- Personal Property: This includes valuable possessions such as jewelry, artwork, collectibles, and vehicles. While they may not generate income, they can hold significant monetary value and contribute to Vaughn's overall wealth.

By carefully managing and growing his assets, Greg Vaughn can increase his net worth and secure his financial future. The composition and performance of his assets provide valuable insights into his investment philosophy and risk tolerance, shaping his overall financial trajectory.

Liabilities

Liabilities, representing amounts owed to creditors, play a crucial role in assessing Greg Vaughn's net worth in 2024. They can have a significant impact on his financial standing and overall wealth management strategies.

- Mortgages: Loans secured by real estate, such as Vaughn's primary residence or investment properties, constitute a major liability. Repayment typically involves regular monthly payments over a predetermined period.

- Personal Loans: These unsecured loans, often used for personal expenses or debt consolidation, can accumulate interest charges over time, potentially increasing the overall liability.

- Taxes Payable: Outstanding taxes owed to government entities, including income tax, property tax, and sales tax, represent a significant liability until settled.

- Business Debts: If Vaughn engages in business ventures, he may incur liabilities related to unpaid invoices, loans, or other financial obligations associated with the business.

By carefully managing his liabilities and ensuring timely repayments, Greg Vaughn can maintain a healthy financial profile and preserve his net worth. Liabilities can impact his cash flow, investment decisions, and overall financial stability. Understanding the nature and extent of his liabilities is crucial for informed financial planning and long-term wealth accumulation.

Income

Income plays a pivotal role in shaping Greg Vaughn's net worth in 2024. As an active professional baseball player, his primary source of income is his salary earned from his team. The amount of his salary is determined by his contract negotiations and performance incentives. Vaughn's income also includes endorsements, sponsorships, and other performance-based bonuses.

The stability and growth of Vaughn's income directly influence his net worth. A higher income allows him to accumulate wealth more rapidly, invest in assets that appreciate in value, and increase his overall financial standing. Conversely, a decline in income could impact his ability to maintain his current lifestyle, invest for the future, or meet financial obligations.

Understanding the relationship between income and net worth is crucial for financial planning and wealth management. By optimizing his income streams and making prudent financial decisions, Vaughn can maximize his net worth and secure his financial future. This understanding can also guide other individuals in managing their finances and achieving their financial goals.

Investments

In examining Greg Vaughn's net worth in 2024, it is imperative to investigate the aspect of "Investments." Investments represent a crucial component of wealth management, allowing individuals to grow their assets, generate passive income, and secure their financial future. Vaughn's investment portfolio likely encompasses a range of asset classes, each with its own unique characteristics and potential returns.

- Stocks: Vaughn may invest in stocks, which represent ownership shares in publicly traded companies. Stocks offer the potential for capital appreciation and dividend income.

- Bonds: Bonds are fixed-income securities that pay regular interest payments and return the principal amount at maturity. They provide a more conservative investment option compared to stocks.

- Real Estate: Investing in real estate, such as rental properties or undeveloped land, can generate rental income, potential appreciation, and tax benefits.

- Alternative Investments: Vaughn may also allocate a portion of his portfolio to alternative investments such as private equity, venture capital, or hedge funds. These investments offer the potential for higher returns but also carry higher risks.

By carefully selecting and managing his investments, Greg Vaughn can potentially increase his net worth, diversify his portfolio, and achieve his long-term financial goals. The composition and performance of his investments will play a significant role in shaping his overall financial trajectory and securing his financial well-being in 2024 and beyond.

Expenses

Expenses play a crucial role in determining Greg Vaughn's net worth in 2024. They represent the costs incurred by Vaughn in maintaining his lifestyle and financial obligations. Expenses can be classified into two primary categories: fixed expenses and variable expenses.

Fixed expenses are those that remain relatively constant from month to month, regardless of Vaughn's income or spending habits. These expenses typically include mortgage or rent payments, car payments, insurance premiums, and property taxes. Variable expenses, on the other hand, fluctuate based on Vaughn's spending patterns and can include groceries, entertainment, travel, and dining out.

Understanding and managing expenses is essential for Vaughn to maintain a healthy financial standing and increase his net worth. By minimizing unnecessary expenses and prioritizing essential ones, he can maximize his savings and investments. Additionally, tracking expenses allows Vaughn to identify areas where he can potentially cut costs or optimize his spending. This knowledge empowers him to make informed financial decisions and allocate his resources effectively.

In summary, expenses are a critical component of Greg Vaughn's net worth in 2024. By carefully managing his expenses and making strategic financial choices, Vaughn can increase his savings, reduce debt, and enhance his overall financial well-being.

Financial Goals

Financial goals are a cornerstone of Greg Vaughn's net worth in 2024. These goals serve as a roadmap, guiding his financial decisions and investment strategies. By establishing clear and achievable financial objectives, Vaughn can align his actions with his long-term vision for financial success.

Financial goals can encompass a wide range of objectives, from saving for retirement and building an emergency fund to investing for growth and generating passive income. For Vaughn, his financial goals will likely include maintaining his current lifestyle, securing his family's financial future, and maximizing his earning potential both on and off the field. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, Vaughn can create a roadmap for his financial journey.

The practical applications of understanding the connection between financial goals and net worth are immense. By aligning his financial decisions with his goals, Vaughn can make informed choices that contribute to his overall financial well-being. For example, if Vaughn desires to retire comfortably in 15 years, he can determine the necessary savings rate and investment strategies to achieve that goal. By setting clear financial goals and regularly monitoring his progress, Vaughn can stay on track and make adjustments as needed.

Tax Liabilities

Tax liabilities play a crucial role in Greg Vaughn's net worth in 2024. As a high-earning professional athlete, Vaughn is subject to various taxes on his income, investments, and properties. Understanding the components of tax liabilities helps provide a comprehensive view of his overall financial picture and the strategies he employs to manage his wealth.

- Income Tax: Vaughn's primary tax liability is income tax, which is levied on his earnings from baseball contracts, endorsements, and other sources. The tax rate and amount owed depend on his taxable income and applicable tax brackets.

- Capital Gains Tax: When Vaughn sells assets such as stocks or real estate for a profit, he may incur capital gains tax. This tax is calculated based on the difference between the purchase price and the sale price of the asset.

- Property Tax: Vaughn is likely subject to property tax on his real estate holdings, including his primary residence and any investment properties. Property tax rates vary depending on the jurisdiction and the assessed value of the property.

- Estimated Taxes: As an independent contractor, Vaughn may be required to make estimated tax payments throughout the year to cover his anticipated tax liability. These payments are based on his estimated income and deductions.

Tax liabilities can have a significant impact on Greg Vaughn's net worth. By understanding the different types of taxes he is responsible for and implementing effective tax planning strategies, Vaughn can minimize his tax burden and maximize his wealth accumulation. This may involve utilizing tax deductions and credits, investing in tax-advantaged accounts, and seeking professional tax advice.

Estate Planning

Estate planning plays a pivotal role in securing and managing Greg Vaughn's net worth in 2024. It involves the proactive arrangement and distribution of assets during an individual's lifetime and after their passing. By implementing a comprehensive estate plan, Vaughn can ensure his wealth is distributed according to his wishes while minimizing tax liabilities and preserving his legacy for future generations.

A well-crafted estate plan typically includes a will or trust, which outlines the distribution of assets after death. It also commonly involves the use of financial instruments like life insurance and retirement accounts to provide for beneficiaries and ensure the smooth transfer of wealth. By engaging in estate planning, Vaughn can maintain control over the distribution of his assets, reducing the likelihood of disputes or legal challenges.

Understanding the connection between estate planning and Greg Vaughn's net worth in 2024 is crucial for several reasons. Firstly, it ensures the preservation of his wealth and its distribution according to his wishes. Secondly, it minimizes estate taxes and other financial burdens that could deplete his assets. Thirdly, it provides peace of mind, knowing that his legacy will be managed and distributed as he intended.

In summary, estate planning is a critical component of Greg Vaughn's net worth management in 2024, allowing him to protect and distribute his wealth effectively. By implementing a comprehensive estate plan, Vaughn can safeguard his assets, minimize tax liabilities, and ensure his legacy aligns with his values and personal goals.

Frequently Asked Questions

This section aims to address common inquiries and provide clarification on various aspects of Greg Vaughn's net worth in 2024.

Question 1: What is Greg Vaughn's estimated net worth in 2024?

Greg Vaughn's net worth in 2024 is projected to be around $50 million, based on his current earnings, investments, and assets.

Question 2: What are the primary sources of Greg Vaughn's income?

Vaughn's primary source of income is his salary from professional baseball. Additionally, he earns significant revenue through endorsements, sponsorships, and other business ventures.

Question 3: How does Greg Vaughn invest his wealth?

Vaughn invests his wealth in a diversified portfolio that includes stocks, bonds, real estate, and alternative investments. He seeks to balance risk and return to maximize his long-term financial growth.

Question 4: What are Greg Vaughn's financial goals for 2024?

Vaughn aims to increase his net worth through strategic investments and endorsements while maintaining his current lifestyle and providing for his family's financial security.

Question 5: How does Greg Vaughn manage his tax liabilities?

Vaughn employs tax planning strategies to minimize his tax burden while ensuring compliance with all applicable laws and regulations.

Question 6: What estate planning measures has Greg Vaughn implemented?

Vaughn has implemented a comprehensive estate plan to preserve and distribute his wealth according to his wishes, reduce estate taxes, and secure his family's financial future.

In summary, Greg Vaughn's net worth in 2024 reflects his successful baseball career, savvy investments, and prudent financial planning. His financial strategies aim to maximize his wealth, minimize risk, and secure his financial legacy.

Moving forward, we will delve deeper into Greg Vaughn's investment strategies and examine the factors that have contributed to his financial success.

Tips for Maximizing Your Net Worth

This section provides actionable tips to help you maximize your net worth and achieve your financial goals. By implementing these strategies, you can increase your assets, reduce your liabilities, and secure your financial future.

Tip 1: Create a Budget and Track Your Expenses: Keep a detailed record of your income and expenses to identify areas where you can save money and allocate funds more efficiently.

Tip 2: Invest Wisely: Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk and maximize growth potential.

Tip 3: Reduce Your Debt: Prioritize paying off high-interest debt, such as credit cards, to improve your credit score and reduce financial burdens.

Tip 4: Increase Your Income: Explore opportunities to increase your earning potential through career advancement, side hustles, or passive income streams.

Tip 5: Plan for Retirement: Start saving and investing for retirement early to ensure a financially secure future and maintain your lifestyle in your golden years.

Tip 6: Seek Professional Advice: Consult with a financial advisor to develop a personalized financial plan that aligns with your goals and risk tolerance.

Tip 7: Review Your Insurance Coverage: Ensure you have adequate insurance coverage to protect your assets and loved ones from unexpected events.

Tip 8: Stay Informed: Keep up-to-date on financial news and trends to make informed investment decisions and stay ahead of potential risks.

By following these tips, you can make informed financial decisions, build wealth, and reach your financial goals. Remember, managing your net worth is an ongoing process that requires discipline, planning, and a long-term perspective.

In the next section, we will discuss the importance of monitoring and adjusting your financial plan over time to adapt to changing circumstances and ensure continued success.

Greg Vaughn Net Worth 2024

This in-depth analysis of Greg Vaughn's net worth in 2024 reveals the intricate interplay between his baseball career, savvy investments, and prudent financial planning. The article highlights the importance of understanding the various components of net worth, from assets and liabilities to income, investments, and expenses.

The key takeaway is that Greg Vaughn's net worth is not merely a numerical value but a reflection of his financial health, investment acumen, and long-term goals. By examining his financial strategies, we gain valuable insights into the factors that have contributed to his financial success and the importance of proactive wealth management.

- Claudia Sampedro Wags Miami Age Engaged Husband

- Know About Camren Bicondova Age Height Gotham

- Who Is Jahira Dar Who Became Engaged

- Joe Kennedy Iii Religion Meet His Parents

- Where Was I Want You Back Filmed

June 16, 1991 Greg Vaughn’s walkoff slam gives Brewers win Society

Greg Wrangler Net Worth 2024 Wiki Bio, Married, Dating, Family, Height

Buy Greg Vaughn Cards Online Greg Vaughn Baseball Price Guide Beckett