Unveiling Ismail Al Azhari's Net Worth: A Comprehensive Guide For The "hellohelen" Niche

Ismail Al Azhari Net Worth: A Measure of Financial Success

Ismail Al Azhari Net Worth is a numerical representation of the total value of an individual's assets minus their liabilities. It serves as a comprehensive indicator of one's financial standing and is commonly used by lenders, investors, and financial analysts to assess an individual's creditworthiness and overall financial health. Historically, the calculation of net worth has evolved significantly, with modern accounting practices providing standardized frameworks for its determination.

In this article, we delve into the intricacies of Ismail Al Azhari Net Worth, exploring its relevance in various domains, discussing its benefits, and highlighting key historical developments that have shaped its significance in financial decision-making.

- Tony Romo Net Worth 2023 Assets Endorsements

- Where Was I Want You Back Filmed

- Najiba Faiz Video Leaked On Telegram New

- Wiki Biography Age Height Parents Nationality Boyfriend

- Is Gerrit Cole Jewish Or Christian Ethnicity

Ismail Al Azhari Net Worth

Understanding the essential aspects of Ismail Al Azhari Net Worth is crucial for comprehensive financial analysis. These aspects provide insights into an individual's financial well-being, creditworthiness, and overall economic status.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Savings

- Debt

- Cash Flow

- Credit Score

- Financial Goals

Analyzing these aspects can reveal an individual's financial strengths and weaknesses, allowing for informed decision-making and strategic financial planning. For instance, a high net worth coupled with a strong cash flow may indicate financial stability and the ability to withstand economic downturns, while a low net worth and high debt may suggest financial distress and the need for debt management strategies.

Assets

Assets, a crucial component of Ismail Al Azhari Net Worth, encompass valuable possessions and resources owned by an individual or organization. They represent economic value and contribute to an individual's overall financial health and stability.

- Janice Huff And Husband Warren Dowdy Had

- Melissa Kaltveit Died Como Park Senior High

- Legendary Rella S Relationship Status Is She

- New Roms Xci Nsp Juegos Nintendo Switch

- Tony Hawk Net Worth A Closer Look

- Current Assets

Short-term, highly liquid assets that can be easily converted into cash within a year, such as cash, cash equivalents, marketable securities, and accounts receivable.

- Fixed Assets

Long-term, tangible assets that are not easily convertible into cash, such as land, buildings, equipment, and vehicles.

- Intangible Assets

Non-physical assets that lack a physical form but hold value, such as intellectual property, patents, trademarks, and goodwill.

Understanding the composition and value of assets is essential for assessing Ismail Al Azhari Net Worth. Current assets provide an indication of liquidity and short-term financial flexibility, while fixed assets represent long-term investments and contribute to the productive capacity of an individual or organization. Intangible assets, though difficult to quantify, can significantly enhance an individual's overall financial position.

Liabilities

Liabilities, the counterpart of assets in Ismail Al Azhari Net Worth, represent financial obligations and debts owed to individuals or organizations. Understanding liabilities is crucial for assessing an individual's or organization's financial health and ability to meet its financial commitments.

- Current Liabilities

Short-term obligations due within a year, such as accounts payable, short-term loans, and accrued expenses.

- Long-Term Liabilities

Long-term obligations due beyond a year, such as mortgages, bonds, and long-term loans.

- Contingent Liabilities

Potential obligations that may arise depending on the outcome of a future event, such as guarantees or lawsuits.

Analyzing liabilities provides insights into an individual's or organization's financial leverage and risk profile. High levels of liabilities relative to assets may indicate financial distress or overleveraging, while low levels of liabilities may suggest financial conservatism or a lack of access to credit. Understanding the nature and maturity of liabilities is crucial for informed decision-making and strategic financial planning.

Income

Income plays a pivotal role in determining Ismail Al Azhari Net Worth. It represents the inflows of economic resources that increase an individual's or organization's financial standing and contribute to the accumulation of assets. Income can stem from various sources, such as salaries, wages, business profits, investments, and government benefits.

The relationship between income and Ismail Al Azhari Net Worth is direct and causal. Higher levels of income generally lead to a higher net worth, as individuals or organizations can accumulate more assets and reduce their liabilities. Conversely, a decrease in income may result in a decline in net worth, especially if expenses remain constant or increase.

Real-life examples abound to illustrate this connection. Individuals with high-paying jobs or successful businesses tend to have higher net worths compared to those with lower incomes. Similarly, organizations with strong revenue streams and profitability typically have higher net worths, enabling them to invest in growth and expansion.

Understanding the connection between income and Ismail Al Azhari Net Worth is crucial for informed financial decision-making. Individuals can strive to increase their income through career advancement, skill development, or entrepreneurship to enhance their financial well-being and accumulate wealth. Organizations can focus on revenue generation strategies, cost optimization, and operational efficiency to improve their bottom line and increase their net worth.

Expenses

Expenses play a crucial role in determining Ismail Al Azhari Net Worth. They represent the outflows of economic resources that decrease an individual's or organization's financial standing and contribute to the accumulation of liabilities. Expenses can arise from various activities, such as operating costs, interest payments, taxes, and personal consumption.

The relationship between expenses and Ismail Al Azhari Net Worth is inverse and causal. Higher levels of expenses generally lead to a lower net worth, as individuals or organizations have fewer resources available to accumulate assets or repay liabilities. Conversely, a decrease in expenses may result in an increase in net worth, especially if income remains constant or increases.

Real-life examples illustrate the impact of expenses on net worth. Individuals with high living expenses or excessive debt payments tend to have lower net worths compared to those with lower expenses. Similarly, organizations with high operating costs or inefficient resource allocation may have lower net worths, limiting their ability to invest in growth and expansion.

Understanding the connection between expenses and Ismail Al Azhari Net Worth is crucial for informed financial decision-making. Individuals can strive to reduce unnecessary expenses, negotiate lower interest rates, and optimize their financial plans to improve their net worth. Organizations can focus on cost optimization, revenue enhancement, and operational efficiency to increase their net worth and enhance their financial stability.

Investments

Investments represent a crucial aspect of Ismail Al Azhari Net Worth, involving the allocation of financial resources to assets with the expectation of generating future income or appreciation. These investments play a significant role in growing wealth and securing financial stability over the long term.

- Stocks

Ownership shares in publicly traded companies, offering potential for capital appreciation and dividends.

- Bonds

Fixed-income securities issued by governments or corporations, providing regular interest payments and a return of principal at maturity.

- Real Estate

Land and buildings purchased for residential, commercial, or industrial purposes, offering potential for rental income and property value appreciation.

- Alternative Investments

Investments outside traditional asset classes, such as hedge funds, private equity, and commodities, offering diversification and potentially higher returns but also carrying higher risks.

The composition and performance of investments significantly impact Ismail Al Azhari Net Worth. A well-diversified portfolio of investments can mitigate risk and enhance overall returns, while poorly performing investments can erode wealth and negatively affect net worth. Understanding the risks and rewards associated with different investment options is crucial for making informed decisions and managing net worth effectively.

Savings

Savings, a crucial component of Ismail Al Azhari Net Worth, represent the portion of income that is not spent on current consumption and is instead set aside for future use. Savings play a pivotal role in building wealth and enhancing financial security over the long term.

The relationship between savings and Ismail Al Azhari Net Worth is direct and causal. Higher levels of savings generally lead to a higher net worth, as individuals or organizations can accumulate more assets and reduce their liabilities. Conversely, low levels of savings may result in a decline in net worth, especially if expenses remain constant or increase. Real-life examples abound to illustrate this connection. Individuals who prioritize saving a portion of their income tend to have higher net worths compared to those who spend most or all of their earnings. Similarly, organizations with strong saving habits and prudent financial management practices typically have higher net worths, enabling them to invest in growth and expansion.

Understanding the connection between savings and Ismail Al Azhari Net Worth is crucial for informed financial decision-making. Individuals can strive to increase their savings rate by creating budgets, reducing unnecessary expenses, and exploring additional income streams. Organizations can focus on optimizing their financial performance, reducing costs, and implementing sound saving strategies to enhance their net worth and achieve long-term financial stability.

Debt

Debt represents a crucial component of Ismail Al Azhari Net Worth, referring to any amount owed by an individual or organization. Understanding the connection between debt and net worth is essential for assessing financial health and making informed financial decisions.

Debt can impact Ismail Al Azhari Net Worth in complex ways. On the one hand, debt can be a useful tool for financing investments, such as purchasing a home or starting a business. When used wisely, debt can help individuals and organizations acquire assets that can appreciate in value or generate income, ultimately contributing to a higher net worth. On the other hand, excessive debt or debt used for consumption rather than investment can have detrimental effects on net worth.

High levels of debt relative to assets and income can lead to financial distress, reduced creditworthiness, and difficulty in obtaining future financing. Moreover, interest payments on debt can eat into income, reducing the amount of money available for savings and investments. Real-life examples illustrate the potential impact of debt on net worth. Individuals with high levels of consumer debt, such as credit card balances and personal loans, may have lower net worths compared to those with lower debt burdens. Similarly, organizations with excessive levels of debt may have lower net worths and face challenges in maintaining financial stability.

Understanding the connection between debt and Ismail Al Azhari Net Worth is crucial for informed financial decision-making. Individuals should strive to manage their debt responsibly, prioritizing high-interest debt repayment and avoiding excessive borrowing. Organizations should carefully consider the costs and benefits of debt financing, ensuring that debt is used strategically for investments that will enhance their long-term financial position.

Cash Flow

Cash flow plays a pivotal role in understanding Ismail Al Azhari Net Worth, representing the movement of money into and out of an individual or organization over a specific period. It provides insights into the liquidity, financial flexibility, and overall financial health of a person or entity.

Positive cash flow, where more money flows in than out, is crucial for maintaining a healthy net worth. It allows individuals and organizations to meet their financial obligations, invest in growth opportunities, and accumulate assets. Conversely, negative cash flow, where more money flows out than in, can lead to financial distress, reduced net worth, and difficulty in meeting financial commitments.

Real-life examples illustrate the connection between cash flow and Ismail Al Azhari Net Worth. Individuals with stable and positive cash flow, such as those with steady employment or successful businesses, tend to have higher net worths. They can save and invest more, leading to growth in their net worth. Conversely, individuals with inconsistent or negative cash flow may struggle to accumulate wealth and may have lower net worths.

Understanding the connection between cash flow and Ismail Al Azhari Net Worth is crucial for informed financial decision-making. Individuals can focus on increasing their cash flow by optimizing their income and expenses, while organizations can implement strategies to improve their cash flow management and financial performance. By doing so, they can enhance their net worth, achieve financial stability, and pursue their long-term financial goals.

Credit Score

A credit score plays a significant role in determining Ismail Al Azhari Net Worth. It represents a numerical evaluation of an individual's credit history and repayment behavior, providing lenders and other financial institutions with an assessment of their creditworthiness.

A high credit score generally indicates a history of responsible credit management, which can lead to favorable loan terms, lower interest rates, and access to a wider range of financial products. This, in turn, can contribute to a higher Ismail Al Azhari Net Worth. Conversely, a low credit score may result in higher interest rates, limited access to credit, and difficulty in securing loans or favorable financial terms. This can negatively impact an individual's ability to accumulate assets and build wealth, potentially leading to a lower net worth.

Real-life examples illustrate the connection between credit score and Ismail Al Azhari Net Worth. Individuals with high credit scores often have access to lower-interest mortgages, allowing them to purchase homes at more affordable prices and accumulate equity faster. Additionally, they may qualify for higher credit limits and favorable terms on credit cards, enabling them to make larger purchases or consolidate debt at lower interest rates.

Understanding the connection between credit score and Ismail Al Azhari Net Worth is crucial for informed financial decision-making. Individuals can strive to improve their credit scores by paying bills on time, maintaining low credit utilization, and avoiding excessive debt. By doing so, they can enhance their access to financial resources, reduce their borrowing costs, and ultimately increase their net worth.

Financial Goals

Financial goals are central to Ismail Al Azhari Net Worth, serving as a roadmap for individuals or organizations to manage their finances and accumulate wealth over time. Setting clear and achievable financial goals is a crucial step in building a strong financial foundation and ultimately enhancing net worth.

The connection between financial goals and Ismail Al Azhari Net Worth is bidirectional. Financial goals guide financial decision-making, influencing asset allocation, savings, and investment strategies. By setting specific financial goals, individuals and organizations can prioritize their financial objectives, whether it's purchasing a home, funding retirement, or expanding a business. These goals provide a sense of purpose and direction, motivating individuals to make informed choices and take calculated risks to achieve their desired financial outcomes.

Real-life examples abound to illustrate the practical significance of financial goals within Ismail Al Azhari Net Worth. Individuals who establish a financial goal of saving for a down payment on a house may prioritize allocating a portion of their income towards a dedicated savings account. This focused saving strategy can help them accumulate the necessary funds over time, contributing positively to their net worth.

Understanding the connection between financial goals and Ismail Al Azhari Net Worth is not merely theoretical but has tangible implications for financial planning and decision-making. By setting clear financial goals and aligning financial strategies accordingly, individuals and organizations can increase their chances of achieving their long-term financial objectives and building a strong net worth. This understanding empowers them to take control of their financial future and work towards their financial aspirations.

Frequently Asked Questions about Ismail Al Azhari Net Worth

This FAQ section aims to address some of the most common questions and provide clarification on various aspects of Ismail Al Azhari Net Worth.

Question 1: What is Ismail Al Azhari Net Worth?Ismail Al Azhari Net Worth refers to the total value of assets owned by Ismail Al Azhari minus any outstanding liabilities. It provides a snapshot of his overall financial standing and wealth.

Question 2: How is Ismail Al Azhari Net Worth calculated?Ismail Al Azhari Net Worth is calculated by adding up the value of all his assets, such as cash, investments, and property, and subtracting any debts or liabilities he owes.

Summary: These FAQs provide a basic understanding of the concept of Ismail Al Azhari Net Worth, its calculation, and its significance as an indicator of financial well-being. To further explore strategies for building and managing net worth, refer to the following section.

Transition: To delve deeper into the topic of Ismail Al Azhari Net Worth and discover actionable steps for financial success, let's explore some proven strategies in the next section.

Tips for Building and Managing Net Worth

This section provides actionable tips to help you build and manage your net worth effectively.

Tip 1: Track your expenses: Monitor your spending habits to identify areas where you can cut back and save more.

Tip 2: Create a budget: Plan your income and expenses in advance to ensure you are living within your means and saving consistently.

Tip 3: Increase your income: Explore opportunities to increase your earning potential through career advancement, side hustles, or investments.

Tip 4: Invest wisely: Allocate a portion of your savings to investments that align with your financial goals and risk tolerance.

Tip 5: Reduce debt: Prioritize paying down high-interest debt to free up cash flow and improve your credit score.

Tip 6: Build an emergency fund: Set aside money for unexpected expenses to avoid relying on debt or depleting your savings.

Tip 7: Seek professional advice: Consider consulting with a financial advisor to develop a personalized plan and optimize your financial strategies.

Tip 8: Stay informed: Keep up-to-date on financial news and trends to make informed decisions about your finances.

Summary: Following these tips can help you increase your savings, reduce debt, and make wiser investment decisions. By implementing these strategies, you can build and manage your net worth effectively, creating a solid foundation for your financial future.

Transition: In the next section, we will discuss the importance of financial literacy and how it can empower you to take control of your finances and achieve your financial goals.

Conclusion

In exploring the intricacies of Ismail Al Azhari Net Worth, this article has shed light on its significance as a comprehensive indicator of financial well-being. We have examined the various components that contribute to net worth, including assets, liabilities, income, and expenses. Understanding the interconnections between these elements is crucial for informed financial decision-making.

Throughout our discussion, several key points have emerged. Firstly, Ismail Al Azhari Net Worth serves as a valuable tool for assessing an individual's financial health and creditworthiness. Secondly, it is essential to manage net worth proactively through responsible financial habits, such as budgeting, saving, and investing. Finally, seeking professional advice can provide valuable insights and guidance in optimizing financial strategies.

- Is Shauntae Heard Fired From Her Job

- Is Max Muncy Christian Or Jewish Religion

- Zeinab Harake Boyfriend Who Is She Dating

- Wiki Biography Age Height Parents Nationality Boyfriend

- Justin Bieber Sells Entire Music Catalogue For

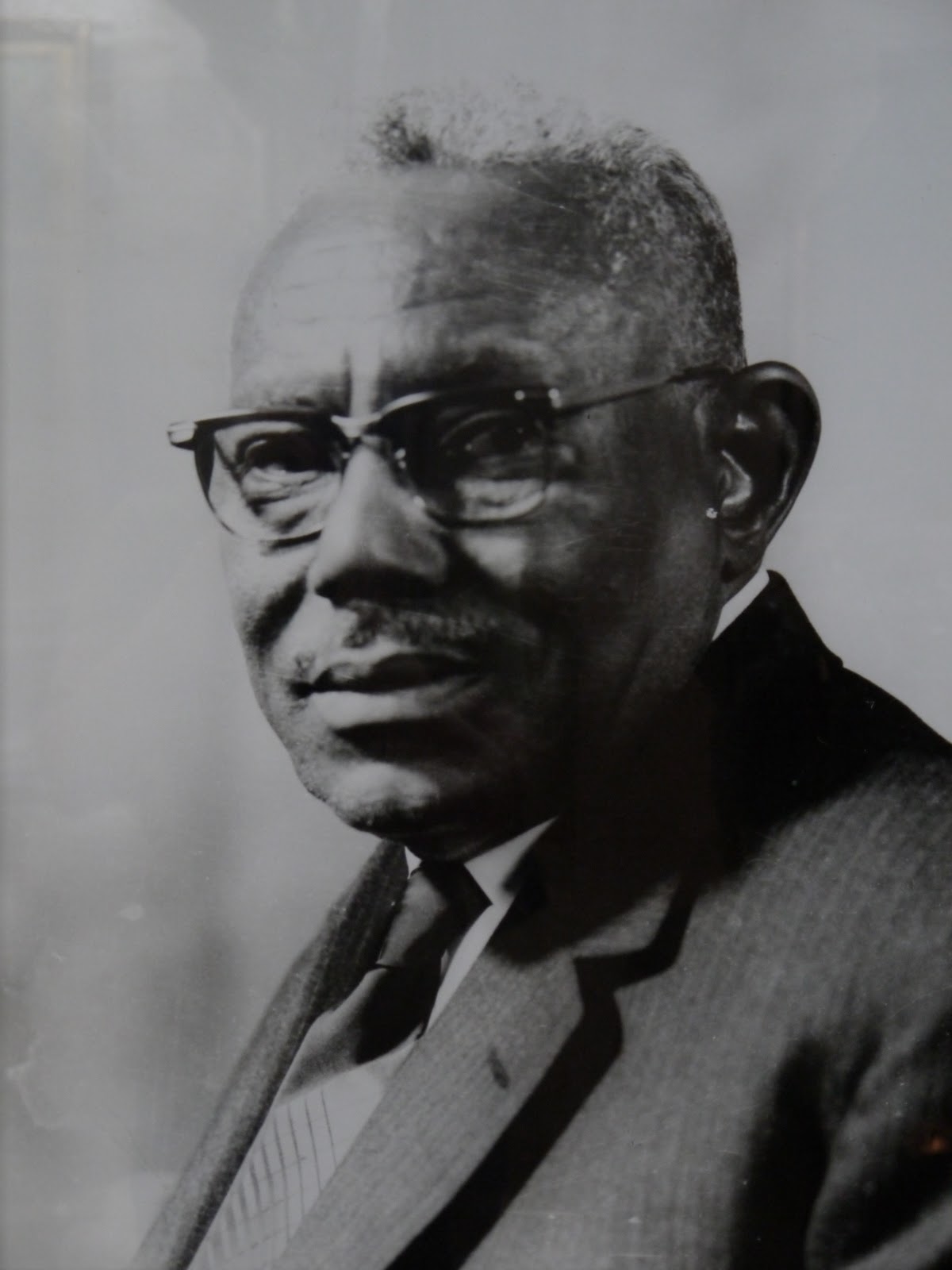

10 Most Famous Sudanese People Discover Walks Blog

A Khawaja in Khartoum Whose History?

Biography of Ismailal Azhari,Origin,Education,Policies,Achievements