Unveiling The Secrets To Building Wealth: A Guide To Josh Otusanya's Net Worth

Josh Otusanya Net Worth is a metric that measures the value of the English footballer's financial assets. It reflects the total value of his properties, investments, and cash, minus any liabilities or debts he may have. For instance, if Josh Otusanya owns a house worth 1 million, has 50,000 in savings, and owes 100,000 on a car loan, his net worth would be 950,000.

Josh Otusanya Net Worth is an important indicator of his financial well-being. It can be used to assess his ability to pay for expenses, invest in new opportunities, or retire comfortably. Additionally, it can influence decisions such as loan approvals, insurance premiums, and tax payments.

The concept of net worth has evolved over time. Historically, wealth was primarily measured by land ownership. However, as economies have become more diversified, net worth has become a comprehensive measure of financial health.

- Zeinab Harake Boyfriend Who Is She Dating

- Meet Maya Erskine S Parents Mutsuko Erskine

- Who Is Jay Boogie The Cross Dresser

- Is Max Muncy Christian Or Jewish Religion

- Who Is Jahira Dar Who Became Engaged

Josh Otusanya Net Worth

Understanding the essential aspects of Josh Otusanya's net worth is crucial for assessing his financial well-being. These aspects provide insights into his financial strength, investment strategies, and overall financial health.

- Assets: Properties, investments, cash

- Liabilities: Debts, loans, mortgages

- Income: Salary, bonuses, investments returns

- Expenses: Living costs, taxes, investments

- Investments: Stocks, bonds, real estate

- Cash flow: Inflow and outflow of funds

- Financial goals: Retirement planning, financial independence

- Tax implications: Taxes on income, investments, and assets

These aspects are interconnected and influence each other. For instance, a high income can lead to increased assets and investments, which in turn can generate more income. Similarly, high expenses or liabilities can reduce net worth and limit financial flexibility. By understanding these aspects, we can gain insights into Josh Otusanya's financial situation and make informed decisions regarding his financial future.

Assets

Assets constitute a significant portion of Josh Otusanya's net worth, providing a financial cushion and potential for growth. They encompass a diverse range of holdings, including properties, investments, and cash.

- Kathy Griffin S Husband Was An Unflinching

- Joe Kennedy Iii Religion Meet His Parents

- Najiba Faiz Video Leaked On Telegram New

- Jasprit Bumrah Injury Update What Happened To

- Meet Jason Weathers And Matthew Weathers Carl

- Real Estate

Properties, such as houses, apartments, and land, represent a tangible asset class that can appreciate in value over time. Rental income from properties can also provide a steady income stream. - Investments

Investments in stocks, bonds, and mutual funds offer the potential for capital appreciation and dividend income. Josh Otusanya's investment portfolio may include a mix of asset classes to diversify risk. - Cash

Cash on hand provides liquidity and financial flexibility. It can be used to cover unexpected expenses, make investments, or reduce debt. - Other Assets

Other assets may include vehicles, artwork, or collectibles. While these assets may not generate income, they can contribute to Josh Otusanya's overall net worth.

Josh Otusanya's asset allocation strategy, diversification, and risk tolerance play a crucial role in determining the growth and stability of his net worth. By carefully managing his assets, he can optimize his financial position and achieve long-term financial goals.

Liabilities

Liabilities represent the debts and obligations that reduce Josh Otusanya's net worth, impacting his financial flexibility and overall financial health. Understanding the different types of liabilities he may have is crucial for assessing his financial well-being.

- Mortgages

Mortgages are loans secured by real estate, typically used to finance the purchase of a home. They represent a significant liability, but can also be a form of investment if the property appreciates in value. - Personal Loans

Personal loans are unsecured loans used for various purposes, such as debt consolidation, home renovations, or unexpected expenses. They typically have higher interest rates than secured loans. - Auto Loans

Auto loans are secured loans used to finance the purchase of a vehicle. They are typically shorter-term loans with fixed interest rates. - Credit Card Debt

Credit card debt is a revolving debt that can accumulate over time if not managed properly. High credit card balances can negatively impact credit scores and increase interest charges.

The level and composition of Josh Otusanya's liabilities can provide insights into his financial management strategies, risk tolerance, and overall financial stability. By effectively managing his liabilities, he can minimize their impact on his net worth and improve his financial well-being.

Income

Income, encompassing salary, bonuses, and investments returns, plays a vital role in shaping Josh Otusanya's net worth. It represents the inflow of funds that are used to offset expenses, accumulate assets, and build wealth over time. Understanding the different components of income is crucial for assessing his financial well-being and long-term financial goals.

- Salary

Salary is the primary source of income for many individuals, including Josh Otusanya. It represents the fixed compensation received for performing a job or service over a specific period, typically on a monthly or annual basis. - Bonuses

Bonuses are performance-based incentives or rewards paid to employees in recognition of exceptional performance or achievements. They can vary in amount and frequency, and are often tied to individual or company-wide targets. - Investment Returns

Investment returns encompass income generated from investments, such as dividends, interest, and capital gains. Josh Otusanya may invest in stocks, bonds, mutual funds, or other financial instruments to generate additional income streams and potentially enhance his net worth.

The stability and growth of Josh Otusanya's income are crucial for maintaining a positive net worth. Consistent income allows him to meet financial obligations, invest for the future, and accumulate wealth over time. Conversely, a decline in income or unexpected expenses can impact his financial stability and net worth. Understanding the composition, stability, and potential growth of his income is essential for assessing his overall financial health and evaluating his progress towards achieving his long-term financial goals.

Expenses

In examining "Josh Otusanya Net Worth," it is imperative to consider the crucial aspect of his expenses. These encompass living costs, taxes, and investments, all of which impact his financial well-being and overall net worth.

- Living Costs

Living costs refer to the expenses incurred to maintain a certain standard of living, including housing, food, transportation, and healthcare. Josh Otusanya's living costs will depend on his lifestyle, location, and personal preferences. - Taxes

Taxes are mandatory payments levied by governments on individuals and businesses. Josh Otusanya may be subject to various taxes, such as income tax, property tax, and sales tax. These taxes reduce his disposable income and impact his net worth. - Investments

Investments involve allocating funds with the expectation of generating income or capital appreciation. While investments have the potential to increase Josh Otusanya's net worth, they also carry inherent risks. Investment expenses may include management fees, transaction costs, and potential losses.

Understanding the composition and implications of Josh Otusanya's expenses is vital for assessing his financial stability, cash flow, and long-term wealth accumulation strategies. By optimizing his living costs, managing tax liabilities, and making informed investment decisions, he can effectively manage his expenses and enhance his net worth over time.

Investments

Investments in stocks, bonds, and real estate play a significant role in shaping Josh Otusanya's net worth. These investments represent a critical component of his overall financial portfolio and have the potential to generate substantial returns over time.

Stocks, which represent ownership shares in publicly traded companies, offer the potential for capital appreciation and dividend income. Bonds, on the other hand, are fixed-income securities that provide regular interest payments and are generally considered less risky than stocks. Real estate, including properties and land, can provide rental income, potential capital gains, and diversification benefits.

Josh Otusanya's investment strategy and asset allocation are crucial factors influencing his net worth. By diversifying his investments across different asset classes and sectors, he can spread risk and enhance the overall stability of his portfolio. Successful investments can lead to a substantial increase in his net worth, providing financial security and the potential for long-term wealth accumulation.

Understanding the connection between investments and net worth is essential for individuals seeking to build and manage their own wealth. By investing wisely and making informed financial decisions, Josh Otusanya demonstrates the importance of strategic asset allocation and risk management in achieving financial success.

Cash flow

Cash flow, encompassing both the inflow and outflow of funds, plays a pivotal role in determining Josh Otusanya's net worth. Inflow refers to the sources of income and gains that increase his financial resources, while outflow represents expenses and losses that deplete them. Understanding the dynamics of cash flow is crucial for managing net worth effectively.

Positive cash flow, where inflow exceeds outflow, contributes directly to an increase in net worth. This occurs when Josh Otusanya generates more income and gains than he spends. Conversely, negative cash flow, where outflow exceeds inflow, leads to a decrease in net worth. This can result from excessive spending, unexpected expenses, or a decline in income.

Real-life examples within Josh Otusanya's net worth include his salary, bonuses, and investment returns as sources of inflow. Expenses such as living costs, taxes, and investments represent outflow. By carefully managing his cash flow, he can ensure that his income and gains consistently exceed his expenses and losses, resulting in a positive net worth.

Practical applications of understanding the connection between cash flow and net worth include budgeting, financial planning, and investment decisions. By tracking his cash flow, Josh Otusanya can identify areas where he can optimize his income and reduce expenses. This knowledge empowers him to make informed financial decisions, such as investing in assets that generate positive cash flow or reducing discretionary spending to enhance his net worth over time.

Financial goals

Financial goals, particularly those centered around retirement planning and financial independence, bear a profound impact on Josh Otusanya's net worth. These goals serve as guiding principles that shape his financial decisions and drive his wealth accumulation strategies. Retirement planning is crucial for ensuring a financially secure future, where passive income streams or accumulated savings sustain his lifestyle during retirement. Financial independence, on the other hand, represents a state where his investment returns or other sources of income generate enough cash flow to cover his living expenses without the need for active employment.

Pursuing these financial goals requires careful planning, disciplined saving, and thoughtful investment decisions. By setting clear targets and developing a comprehensive plan, Josh Otusanya can allocate his resources effectively to achieve his desired retirement lifestyle and attain financial independence. A higher net worth provides a solid foundation for achieving these goals, as it increases the pool of financial assets available to generate income and meet expenses.

In practical terms, Josh Otusanya's investment portfolio may include a mix of stocks, bonds, and real estate, tailored to generate a combination of capital appreciation and income. Additionally, he may allocate a portion of his income towards retirement savings plans or other investment vehicles designed for long-term growth. By aligning his financial decisions with his retirement planning and financial independence goals, he increases the likelihood of achieving a secure and prosperous future. Understanding the connection between financial goals and net worth empowers Josh Otusanya to make informed choices that optimize his financial well-being over the long term.

Tax implications

Tax implications play a significant role in determining Josh Otusanya's net worth. Taxes reduce his disposable income, impacting his ability to accumulate wealth. Understanding these implications is crucial for effective financial planning and wealth management.

- Income Tax

Income tax is levied on Josh Otusanya's salary, bonuses, and other forms of income. The tax rate varies depending on his income bracket. Higher income levels result in a greater tax burden, reducing his net worth. - Capital Gains Tax

Capital gains tax is imposed on profits from the sale of assets, such as stocks and real estate. Josh Otusanya's investment strategy and asset allocation decisions are influenced by capital gains tax considerations to optimize his net worth. - Property Tax

Property tax is an annual levy on real estate holdings. Josh Otusanya's property investments are subject to property tax, which reduces his net rental income and overall net worth. - Inheritance Tax

Inheritance tax is levied on assets inherited by Josh Otusanya. This tax can significantly impact his net worth, especially in the case of large inheritances.

Josh Otusanya's financial advisors play a crucial role in navigating the complexities of tax implications. They optimize his tax strategies, ensuring compliance while minimizing the impact on his net worth. Understanding tax implications empowers Josh Otusanya to make informed financial decisions, maximize wealth accumulation, and secure his financial future.

Frequently Asked Questions about Josh Otusanya Net Worth

The following section addresses common questions and misconceptions surrounding Josh Otusanya's net worth, providing clarity and insights into its various aspects.

Question 1: How is Josh Otusanya's net worth calculated?

Josh Otusanya's net worth is calculated by subtracting his total liabilities, including debts and loans, from his total assets, which encompass properties, investments, and cash.

Question 2: What factors can impact Josh Otusanya's net worth?

Fluctuations in the value of his assets, such as stocks and real estate, as well as changes in his income and expenses, can significantly impact Josh Otusanya's net worth.

Question 3: How does Josh Otusanya's investment strategy influence his net worth?

Josh Otusanya's investment decisions, including asset allocation and risk management, play a crucial role in determining the growth and stability of his net worth.

Question 4: What are the tax implications of Josh Otusanya's net worth?

Taxes on income, capital gains, and property can reduce Josh Otusanya's disposable income and impact his overall net worth.

Question 5: How does Josh Otusanya's lifestyle affect his net worth?

Josh Otusanya's spending habits and lifestyle choices can impact his expenses and, consequently, his net worth.

Question 6: What are some strategies Josh Otusanya can employ to increase his net worth?

Optimizing his investment portfolio, managing his expenses, and pursuing additional income streams are among the strategies Josh Otusanya can use to enhance his net worth.

These FAQs provide a deeper understanding of the dynamics of Josh Otusanya's net worth and its contributing factors.

In the next section, we will explore Josh Otusanya's financial habits and strategies in more detail, examining the principles and practices that shape his approach to wealth management.

Tips to Optimize Net Worth

The following tips can help individuals optimize their net worth and enhance their financial well-being:

Tip 1: Track Expenses and Optimize Cash Flow

Monitor expenses to identify areas for saving and allocate funds wisely to increase positive cash flow.

Tip 2: Invest for Long-Term Growth

Invest in a diversified portfolio of assets, such as stocks, bonds, and real estate, to build wealth over time.

Tip 3: Reduce Debt

Prioritize paying off high-interest debts, such as credit cards and personal loans, to reduce financial obligations.

Tip 4: Maximize Retirement Savings

Contribute to retirement accounts, such as 401(k)s and IRAs, to accumulate funds for the future.

Tip 5: Seek Professional Financial Advice

Consult with a financial advisor to develop a personalized plan and optimize financial strategies.

By implementing these tips, individuals can effectively manage their finances, increase their net worth, and achieve long-term financial security.

The principles and practices discussed in this section provide a foundation for building and maintaining a healthy net worth. In the concluding section, we will explore additional strategies and insights for enhancing financial well-being and achieving personal financial goals.

Conclusion

In exploring "Josh Otusanya Net Worth," we have gained valuable insights into the dynamics of wealth management. Key ideas and findings emerged, emphasizing the interplay between income, investments, expenses, and financial goals. Understanding these connections is crucial for building and maintaining a healthy net worth.

Firstly, the stability and growth of income provide the foundation for wealth accumulation. Strategic investment decisions, including asset allocation and risk management, play a vital role in enhancing net worth over time. Simultaneously, managing expenses and optimizing cash flow are essential to maximize financial resources.

Moreover, financial goals, such as retirement planning and financial independence, serve as guiding principles that shape financial decisions. Aligning investments and financial strategies with these goals ensures long-term financial security and well-being. By embracing these principles and seeking professional financial advice when needed, individuals can empower themselves to optimize their net worth and achieve their financial aspirations.

- Meet Jason Weathers And Matthew Weathers Carl

- Antony Varghese Wife Net Worth Height Parents

- How To Make Water Breathing Potion In

- Kathy Griffin S Husband Was An Unflinching

- Who Is Miranda Rae Mayo Partner Her

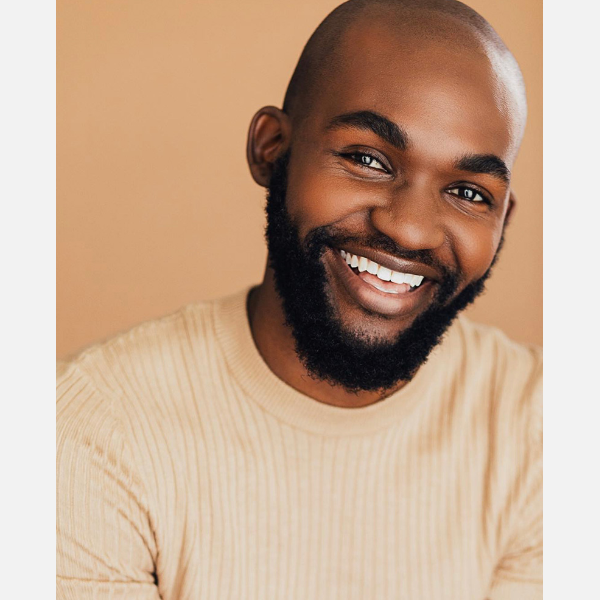

Josh Otusanya Height, Weight, Net Worth, Age, Birthday, Wikipedia, Who

Josh Otusanya Might Be the Funniest Person to Teach You About Life

Josh Otusanya (Tiktok Star) Wiki, biografía, edad, novias, familia