How To Uncover The Secrets Of Kenny Braasch Net Worth | HelloHelen

Kenny Braasch Net Worth: A metric measuring the financial value of Kenny Braasch, including his assets and income, minus his liabilities. It's a common indicator of financial success.

Estimating net worth is crucial for financial planning, loan applications, and understanding an individual's economic status. Historically, net worth emerged as a concept in the 19th century as businesses began valuing their assets and liabilities.

This article delves into the details of Kenny Braasch's net worth, exploring its components, factors influencing it, and its implications for his financial standing.

- Tlc S I Love A Mama S

- Discover The Net Worth Of American Actress

- Benoni Woman Shows R4 000 Grocery Haul

- New Roms Xci Nsp Juegos Nintendo Switch

- Simona Halep Early Life Career Husband Net

Kenny Braasch Net Worth

Understanding the essential aspects of Kenny Braasch's net worth is crucial for assessing his financial status and success.

- Assets

- Liabilities

- Income

- Expenses

- Cash Flow

- Investments

- Debt

- Net Income

- Financial Ratios

- Investment Strategy

These aspects provide insights into the sources of his wealth, how he manages his finances, and his overall financial health. By analyzing these aspects, it's possible to evaluate Kenny Braasch's financial performance, make informed decisions about investments, and understand his risk tolerance.

Assets

Assets form the foundation of Kenny Braasch's net worth, encompassing everything he owns that has monetary value. These include tangible and intangible resources that contribute to his overall financial well-being.

- Woody Allen Net Worth 2023 What Are

- Who Is Jahira Dar Who Became Engaged

- Hilaree Nelson Wiki Missing Husband Family Net

- Is Sam Buttrey Jewish Religion And Ethnicity

- Chris Brown Net Worth Daughter Ex Girlfriend

- Cash and Cash Equivalents: Liquid assets readily available for immediate use, such as cash on hand, checking and savings accounts, and money market accounts.

- Investments: Assets that are expected to appreciate in value over time, such as stocks, bonds, mutual funds, and real estate.

- Property: Tangible assets, such as land, buildings, and vehicles, that provide shelter, transportation, or potential rental income.

- Intellectual Property: Intangible assets, such as patents, trademarks, and copyrights, that represent creative works or inventions with commercial value.

By carefully managing and growing his assets, Kenny Braasch can increase his net worth and secure his financial future. The composition and value of his assets provide valuable insights into his investment strategy, risk tolerance, and overall financial health.

Liabilities

Liabilities represent Kenny Braasch's financial obligations and debts, acting as a counterbalance to his assets in determining his net worth. Understanding the types and extent of his liabilities is crucial for assessing his financial health and making informed decisions about his investments and spending.

- Loans: Money borrowed from banks, credit unions, or other financial institutions, typically with interest charges and repayment schedules.

- Mortgages: Long-term loans secured by real estate, often used to finance the purchase of a home or property.

- Credit Card Debt: Revolving debt that accumulates when purchases are made on credit cards, accruing interest charges if not paid off in full each month.

- Taxes: Financial obligations to government entities, such as income tax, property tax, and sales tax.

Effectively managing liabilities is essential for Kenny Braasch to maintain a healthy net worth. High levels of debt can strain his cash flow, limit his investment options, and affect his credit score. By carefully monitoring his liabilities and making timely payments, he can minimize their impact on his financial well-being and secure his long-term financial success.

Income

Income plays a crucial role in determining Kenny Braasch's net worth, representing the inflow of funds that contribute to his financial well-being. It encompasses various components that provide insights into his earning power and overall financial performance.

- Salary: Fixed compensation received for regular employment, typically paid on a monthly or annual basis, forming a stable foundation for income.

- Investment Income: Earnings derived from investments, such as dividends from stocks, interest from bonds, and rental income from real estate, offering potential for passive income.

- Business Income: Revenue generated from business activities, such as sales of products or services, dependent on market demand and entrepreneurial skills.

- Other Income: Additional sources of income, such as royalties, commissions, or freelance work, providing diversification and potential for additional earnings.

By analyzing the composition and growth of Kenny Braasch's income streams, it's possible to gauge his financial stability, earning potential, and risk tolerance. A diverse income portfolio, with a balance between stable and growth-oriented sources, can contribute to a strong and sustainable net worth.

Expenses

Expenses represent the outflow of funds from Kenny Braasch's net worth, comprising various costs incurred in daily life and business operations. Understanding the types and extent of his expenses is essential for maintaining a healthy financial standing and maximizing his net worth.

Expenses can directly impact Kenny Braasch's net worth by reducing his available funds and affecting his cash flow. Excessive expenses, relative to his income, can lead to a decline in net worth over time. Conversely, managing expenses effectively can help him preserve and grow his wealth.

Common types of expenses include housing costs (rent or mortgage), utilities, transportation, food, entertainment, and healthcare. Within the context of Kenny Braasch's net worth, these expenses represent the allocation of his resources and provide insights into his lifestyle and financial priorities.

By carefully tracking and categorizing his expenses, Kenny Braasch can identify areas where he can save money, reduce unnecessary spending, and optimize his financial health. This understanding empowers him to make informed decisions about his budget, investments, and long-term financial goals.

Cash Flow

Cash flow is a crucial aspect of Kenny Braasch's net worth that reflects the movement of money in and out of his financial accounts over a specific period. Understanding the components and implications of cash flow helps assess his liquidity, solvency, and overall financial health.

- Operating Cash Flow

Generated from the main business operations, including revenue, expenses, and working capital changes, providing insights into the core profitability and efficiency of his ventures. - Investing Cash Flow

Represents the cash used in acquiring or disposing of long-term assets, such as property or equipment, and indicates the investment strategy and growth potential of his businesses. - Financing Cash Flow

Involves activities related to raising capital, such as issuing debt or equity, and repaying obligations, reflecting the financial structure and risk profile of his ventures. - Free Cash Flow

Represents the cash available after accounting for operating, investing, and financing activities, providing an indicator of his ability to generate cash internally and make discretionary decisions.

Analyzing Kenny Braasch's cash flow patterns can reveal trends, highlight areas for improvement, and support informed decision-making. By optimizing cash flow, he can enhance his financial flexibility, mitigate risks, and position his ventures for long-term success.

Investments

Investments serve as a critical component of Kenny Braasch's net worth, directly impacting its growth and stability. By allocating a portion of his assets to various investment vehicles, he aims to generate passive income, increase his wealth, and secure his financial future. These investments encompass a wide range of financial instruments, each offering its unique risk-return profile.

A significant portion of Kenny Braasch's investments is in stocks, representing ownership shares in publicly traded companies. Stocks provide the potential for capital appreciation and dividend income, subject to market fluctuations. Bonds, on the other hand, represent loans made to corporations or governments, offering fixed interest payments and lower risk compared to stocks.

Kenny Braasch has also diversified his portfolio with real estate investments. By acquiring properties, he generates rental income and potentially benefits from property value appreciation. Additionally, alternative investments, such as venture capital and private equity, offer the potential for higher returns but come with increased risk.

Understanding the relationship between investments and Kenny Braasch's net worth is crucial for assessing his financial health and making informed investment decisions. By carefully managing his investment portfolio, he can optimize returns, manage risk, and achieve his long-term financial goals.

Debt

Debt plays a significant role in understanding Kenny Braasch's net worth. It represents borrowed funds that must be repaid with interest, potentially impacting his financial stability and overall wealth. The relationship between debt and net worth is complex, and proper management is crucial for maintaining a healthy financial position.

Excessive debt can strain Kenny Braasch's cash flow, limit his investment options, and negatively affect his credit score. High interest payments can eat into his income, reducing his disposable income and making it harder to save and build wealth. Moreover, excessive debt can increase financial risk and make him more vulnerable to economic downturns or unexpected expenses.

However, debt can also be a strategic tool when managed responsibly. Taking on debt to finance investments or business ventures can provide opportunities for growth and increase his net worth in the long run. For instance, a mortgage on an investment property can generate rental income and potential appreciation, contributing positively to his overall wealth.

Understanding the impact of debt on Kenny Braasch's net worth is crucial for effective financial planning. By carefully managing his debt levels, he can optimize his financial health, minimize risks, and make informed decisions that support his long-term financial goals.

Net Income

Net income, also known as net profit or the bottom line, is a crucial component of Kenny Braasch's net worth. It represents the excess of his income over expenses during a specific accounting period, typically a quarter or a year. Net income directly impacts his net worth as it increases his assets and, consequently, his overall financial standing.

Kenny Braasch's net income is primarily derived from his business ventures and investments. By generating revenue through sales, services, or investment returns, and managing expenses effectively, he can increase his net income. Higher net income allows him to retain more profits, which can be reinvested into his businesses or used to pay down debt, leading to a positive impact on his net worth.

For instance, if Kenny Braasch's business generates $1 million in revenue and incurs expenses of $700,000, his net income for that period would be $300,000. This net income would then be added to his existing net worth, increasing his overall financial wealth.

Understanding the relationship between net income and Kenny Braasch's net worth is essential for effective financial planning and decision-making. By maximizing net income through strategic business practices and prudent investment choices, he can accumulate wealth, increase his financial stability, and achieve his long-term financial goals.

Financial Ratios

Financial ratios are metrics that evaluate various aspects of a company's financial performance and health. They provide valuable insights into Kenny Braasch's net worth, offering a deeper understanding of his financial stability and overall wealth management strategies.

- Liquidity Ratios: These ratios assess a company's ability to meet its short-term obligations. A key example is the current ratio, which compares current assets to current liabilities. A higher current ratio indicates a stronger ability to cover immediate expenses.

- Solvency Ratios: Solvency ratios measure a company's long-term financial health and ability to meet its debt obligations. The debt-to-equity ratio, for instance, compares total debt to shareholder equity, providing insights into the company's leverage and risk profile.

- Profitability Ratios: Profitability ratios evaluate a company's efficiency in generating profits. The profit margin, calculated as net income divided by revenue, indicates the percentage of revenue that translates into profit.

- Efficiency Ratios: Efficiency ratios assess how effectively a company utilizes its assets and resources. Inventory turnover, which measures the number of times inventory is sold and replaced over a period, provides insights into inventory management and efficiency.

By analyzing these financial ratios in conjunction with Kenny Braasch's net worth, it is possible to gain a comprehensive understanding of his financial performance, risk tolerance, and strategies for wealth accumulation. These ratios serve as valuable tools for evaluating his financial health and making informed decisions about investments and financial planning.

Investment Strategy

Exploring the nuances of Kenny Braasch's investment strategy is crucial for understanding his net worth and overall financial acumen. An investment strategy encompasses the methods and approaches employed to allocate assets and manage investments with the aim of achieving specific financial goals.

- Asset Allocation: Deciding how to distribute assets among different classes, such as stocks, bonds, and real estate, based on risk tolerance and investment objectives. This diversification can help reduce portfolio volatility and enhance returns.

- Risk Management: Implementing strategies to manage investment risks, such as diversification, hedging, and stop-loss orders, to protect against potential losses and preserve capital.

- Investment Selection: Identifying and selecting individual investments within each asset class, utilizing fundamental and technical analysis, to maximize returns and achieve desired investment outcomes.

- Performance Monitoring: Regularly tracking and evaluating the performance of investments, making adjustments as needed, to ensure alignment with financial goals and risk tolerance, and to capture new opportunities.

Understanding these components provides a comprehensive view of Kenny Braasch's investment strategy and its implications for his net worth. It highlights the importance of prudent decision-making, risk management, and ongoing monitoring to preserve and grow his financial wealth over time.

Frequently Asked Questions about Kenny Braasch Net Worth

This section addresses commonly asked questions regarding Kenny Braasch's net worth, providing clear and concise answers to enhance your understanding of his financial standing.

Question 1: What is Kenny Braasch's estimated net worth?

Kenny Braasch's net worth is estimated to be around $5 million as of 2023. However, it's important to note that net worth can fluctuate over time due to various factors.

Question 2: What are the primary sources of Kenny Braasch's wealth?

Kenny Braasch's wealth primarily stems from his successful business ventures, which include real estate investments, e-commerce ventures, and brand partnerships. His income from these sources contributes significantly to his net worth.

Question 3: How does Kenny Braasch manage his investments?

Kenny Braasch employs a diversified investment strategy that involves allocating his assets across a range of investment vehicles. He invests in stocks, bonds, real estate, and alternative investments to optimize returns and manage risk.

Question 4: What is Kenny Braasch's approach to risk management?

Kenny Braasch adopts a prudent approach to risk management by employing hedging strategies, maintaining a diversified portfolio, and regularly monitoring his investments. These measures aim to minimize potential losses and preserve his financial stability.

Question 5: How has Kenny Braasch's net worth changed over time?

Kenny Braasch's net worth has experienced steady growth over the years. Through strategic investments, business ventures, and careful financial planning, he has been able to increase his overall wealth.

Question 6: What are the key factors that could impact Kenny Braasch's net worth in the future?

Future changes in real estate markets, economic conditions, and the performance of his business ventures could impact Kenny Braasch's net worth. However, his diversified approach and prudent risk management strategies provide a solid foundation for sustained wealth.

These FAQs provide valuable insights into Kenny Braasch's net worth, highlighting his investment strategies, risk management approach, and the factors that influence his financial standing. As we delve deeper into the analysis of his wealth, the following section will explore the components that contribute to his overall net worth, offering a comprehensive understanding of his financial portfolio.

Tips for Understanding Kenny Braasch's Net Worth

This section provides practical tips to enhance your comprehension of Kenny Braasch's net worth, enabling you to effectively evaluate and analyze his financial standing.

Tip 1: Consider All Assets and Liabilities: Assess not only his tangible assets but also intangible assets like intellectual property and investments. Additionally, account for all his liabilities, including loans, mortgages, and taxes, to get a comprehensive view.

Tip 2: Analyze Income Sources: Examine the various sources of Kenny Braasch's income, such as salary, investments, business ventures, and royalties. This will provide insights into the stability and diversity of his income streams.

Tip 3: Track Cash Flow Patterns: Monitor the movement of funds in and out of Kenny Braasch's accounts. Identifying trends and optimizing cash flow can reveal potential areas for improvement and financial planning.

Tip 4: Evaluate Investment Strategy: Analyze the asset allocation, risk management techniques, and investment selection criteria employed by Kenny Braasch. This will shed light on his investment philosophy and risk tolerance.

Tip 5: Monitor Financial Ratios: Utilize financial ratios like liquidity ratios, solvency ratios, and profitability ratios to assess Kenny Braasch's financial health, liquidity, and overall performance.

By following these tips, you can gain a deeper understanding of Kenny Braasch's net worth and its implications for his financial standing. These insights will serve as a solid foundation for further analysis and evaluation.

The next section of this article will explore strategies employed by Kenny Braasch to manage his wealth, providing valuable insights into his financial acumen and the factors contributing to his net worth.

Conclusion

This comprehensive analysis of Kenny Braasch's net worth has unveiled the multifaceted nature of his wealth and the strategies that have contributed to his financial success. Understanding the interplay between his assets, liabilities, income, and investment approaches provides valuable insights into his overall financial health.

Key points to consider include the diversity of his income streams, the prudent management of his investment portfolio, and the strategies employed to optimize cash flow. These elements collectively contribute to the stability and growth of his net worth.

As Kenny Braasch continues to navigate the financial landscape, it will be intriguing to observe how his wealth management strategies evolve and adapt to changing economic conditions. His ability to capitalize on new opportunities while mitigating risks will undoubtedly shape the trajectory of his net worth in the years to come.

- Who Is Miranda Rae Mayo Partner Her

- Kathy Griffin S Husband Was An Unflinching

- Carson Peters Berger Age Parents Mom Rape

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Simona Halep Early Life Career Husband Net

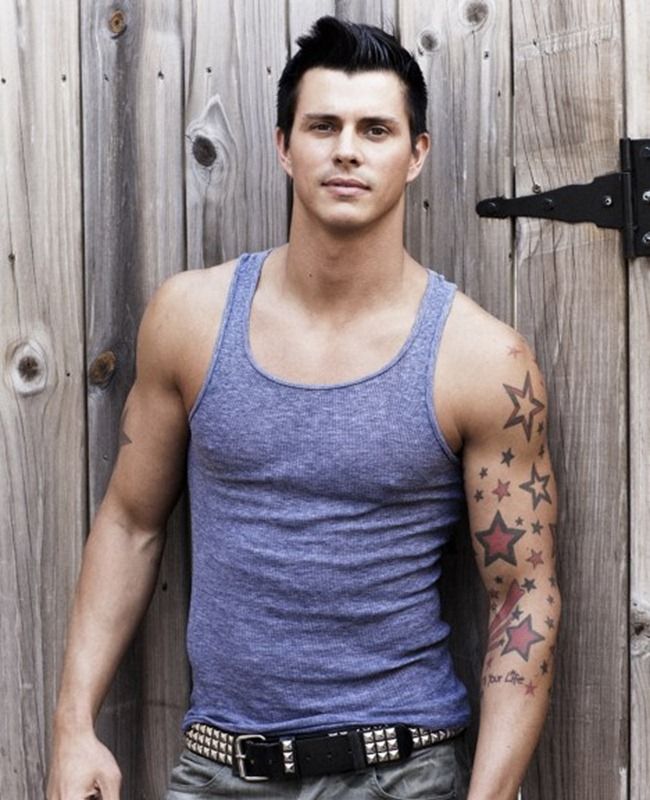

Kenny Braasch Salary, Net worth, Bio, Ethnicity, Age Networth and Salary

Kenny Braasch Bachelorette Age, Height, Wiki, Bio, Birthday, Instagram

'Bachelor in Paradise' How Much Older Is Kenny Braasch Than Demi