Uncovering Leigha Sanderson's Net Worth: Tips For Building Financial Wealth

Leigha Sanderson Net Worth is the sum of all her financial assets, including money in the bank and investments like stocks, bonds, or real estate. For example, if Leigha Sanderson has $10,000 in cash, $50,000 in stocks, and $20,000 in real estate, then her net worth would be $80,000.

Knowing a person's net worth is essential because it gives a quick overview of their financial position. It can be used to make decisions about lending money or investing in a business. Net worth has also been a key metric for determining an individual's social and economic status throughout history.

In this article, we will dive deeper into the specifics of Leigha Sanderson's net worth, examining her income, assets, and other financial information to provide a comprehensive understanding of her financial status.

- Mzansi Man Documents Sa Potholes Viral Tiktok

- Claudia Sampedro Wags Miami Age Engaged Husband

- Tammy Camacho Obituary A Remarkable Life Remembered

- Najiba Faiz Video Leaked On Telegram New

- Matthew Cassina Dies In Burlington Motorcycle Accident

Leigha Sanderson Net Worth

The essential aspects of Leigha Sanderson's net worth provide insights into her overall financial situation and economic well-being. These key aspects include:

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Debt

- Cash flow

- Financial goals

Understanding these aspects allows for a comprehensive analysis of Leigha Sanderson's financial standing. By examining her assets and liabilities, one can determine her overall financial leverage and risk exposure. Income and expenses provide insights into her cash flow and financial stability, while investments and debt shed light on her long-term financial strategy. Cash flow analysis helps assess her liquidity and ability to meet short-term obligations, while financial goals provide context for her financial decision-making. Together, these aspects paint a holistic picture of Leigha Sanderson's net worth and financial well-being.

Assets

As a crucial component of Leigha Sanderson's net worth, assets represent the economic resources she owns or controls. These assets contribute positively to her overall financial position and play a significant role in determining her financial strength and stability.

- How To Make Water Breathing Potion In

- Meet Jordyn Hamilton Dave Portnoy S Ex

- All About Dmx S Son Tacoma Simmons

- Has Claire Mccaskill Had Plastic Surgery To

- Simona Halep Early Life Career Husband Net

- Cash and Cash Equivalents: This category includes physical cash, money in checking and savings accounts, and other highly liquid assets that can be easily converted into cash, providing immediate access to funds for various needs and opportunities.

- Investments: This facet encompasses a range of financial instruments such as stocks, bonds, and mutual funds. Investments represent Leigha Sanderson's ownership or stake in various companies and entities, offering potential returns through dividends, interest payments, and capital appreciation.

- Real Estate: Real estate assets include land, buildings, and other physical properties owned by Leigha Sanderson. These assets can generate rental income, provide capital appreciation, and serve as a hedge against inflation.

- Personal Property: This category includes valuable personal belongings such as jewelry, artwork, collectibles, and vehicles. While not as liquid as other assets, personal property can contribute to Leigha Sanderson's overall net worth and reflect her lifestyle and preferences.

Collectively, these assets provide a comprehensive overview of Leigha Sanderson's financial resources and economic well-being. By analyzing the composition and value of her assets, one can gain insights into her risk tolerance, investment strategy, and long-term financial goals.

Liabilities

Liabilities represent the financial obligations of Leigha Sanderson, encompassing debts and other financial commitments that reduce her net worth. Understanding liabilities is crucial as they significantly impact her financial health and overall economic well-being.

Liabilities can arise from various sources, such as unpaid bills, loans, mortgages, and taxes. When Leigha Sanderson incurs a liability, it creates a legal obligation to repay the debt or fulfill the commitment. Liabilities can be short-term, requiring repayment within a year, or long-term, extending beyond one year.

The relationship between liabilities and Leigha Sanderson's net worth is inversely proportional. As her liabilities increase, her net worth decreases, and vice versa. This is because liabilities represent financial obligations that must be met, reducing her overall financial resources. Managing liabilities effectively is vital for maintaining a healthy net worth and ensuring financial stability.

Income

Income plays a pivotal role in determining Leigha Sanderson's net worth. It represents the inflow of financial resources that contribute to her overall wealth and economic well-being. Income can stem from various sources, each with its own characteristics and implications.

- Salary and Wages: This traditional income source is earned through employment and represents regular payments received for work performed. It forms a stable foundation for Leigha Sanderson's net worth and provides a predictable cash flow.

- Business Income: If Leigha Sanderson owns a business, she may generate income from its operations. This income can fluctuate depending on the performance of the business and economic conditions.

- Investments: Income can also be derived from investments, such as dividends from stocks or interest payments from bonds. These passive income streams can supplement her other sources of income and contribute to the growth of her net worth.

- Rental Income: Owning rental properties can provide Leigha Sanderson with a steady stream of income. Rental income can be a valuable asset, especially if the properties appreciate in value over time.

Understanding the composition and stability of Leigha Sanderson's income sources is crucial for evaluating her net worth. A diversified income stream, with a mix of stable and growth-oriented sources, can contribute to a more robust and resilient net worth.

Expenses

Expenses represent the outflow of financial resources from Leigha Sanderson's net worth. They encompass all the costs she incurs to maintain her lifestyle, fulfill her obligations, and operate her businesses. Expenses can vary in nature and purpose, ranging from essential living costs to discretionary spending. Understanding Leigha Sanderson's expenses is crucial for evaluating her net worth and overall financial health.

Expenses directly impact Leigha Sanderson's net worth by reducing its value. The more she spends, the lower her net worth becomes. Conversely, reducing expenses can lead to an increase in net worth. Therefore, managing expenses effectively is essential for preserving and growing her wealth.

Common expense categories in Leigha Sanderson's net worth include:

- Living Expenses: These expenses cover basic necessities such as housing, food, utilities, and transportation. They are essential for maintaining a certain standard of living and well-being.

- Business Expenses: If Leigha Sanderson owns a business, she will incur expenses related to its operation, such as salaries, rent, marketing, and supplies. These expenses are necessary for the business to generate income and contribute to her net worth.

- Debt Repayments: Loan repayments, credit card payments, and mortgage payments are examples of debt repayment expenses. These expenses reduce her net worth as they represent a transfer of resources to creditors.

Analyzing Leigha Sanderson's expenses provides insights into her spending habits, financial priorities, and overall financial management. By identifying areas where expenses can be reduced or optimized, she can make informed decisions to maximize her net worth and achieve her financial goals.

Investments

Investments play a pivotal role in shaping Leigha Sanderson's net worth. They represent a concerted effort to allocate financial resources with the primary goal of generating long-term growth and returns. By investing wisely, Leigha Sanderson can potentially multiply her wealth and secure her financial future.

Investments encompass a wide range of asset classes, each with its own risk and return profile. Stocks, bonds, mutual funds, real estate, and private equity are some common investment options. Leigha Sanderson's investment strategy should align with her risk tolerance, time horizon, and financial goals. Investments can either positively or adversely impact her net worth, depending on their performance.

For instance, if Leigha Sanderson invests in a stock that significantly appreciates in value, her net worth will increase. Conversely, if the stock underperforms or loses value, her net worth will decrease. It is crucial for Leigha Sanderson to conduct thorough research, consult with financial advisors, and diversify her investments to mitigate risks and maximize returns.

Understanding the connection between investments and Leigha Sanderson's net worth empowers her to make informed financial decisions. By actively managing her investments, she can potentially increase her wealth, achieve financial independence, and secure her financial well-being in the long run.

Debt

Debt is a critical component of Leigha Sanderson's net worth, as it directly impacts her financial position and overall wealth. Understanding the relationship between debt and Leigha Sanderson's net worth is crucial for evaluating her financial health and making informed financial decisions.

Debt represents borrowed funds that must be repaid, plus interest. When Leigha Sanderson incurs debt, she increases her liabilities, which in turn reduces her net worth. Conversely, when she pays down debt, her liabilities decrease, leading to an increase in her net worth.

There are various types of debt, such as mortgages, personal loans, and credit card debt. Each type carries its own interest rate and repayment terms. The interest paid on debt is considered an expense, further reducing Leigha Sanderson's net worth. High levels of debt can be a significant financial burden, impairing her cash flow and limiting her ability to invest and grow her wealth.

Managing debt effectively is vital for Leigha Sanderson's financial well-being. She should focus on reducing high-interest debt, consolidating debt to secure lower interest rates, and avoiding unnecessary or excessive borrowing. By adopting a prudent approach to debt management, Leigha Sanderson can improve her net worth, enhance her financial stability, and achieve her long-term financial goals.

Cash flow

Cash flow, an integral aspect of Leigha Sanderson's net worth, provides insights into the movement of money in and out of her financial system. It's a crucial indicator of her financial health and ability to generate, manage, and utilize funds effectively.

- Operating Cash Flow: This measures the cash generated from a company's core operations, excluding investments and financing activities. Positive operating cash flow indicates a company's ability to generate enough cash to cover its expenses and reinvest in its business.

- Investing Cash Flow: This reflects the cash used to acquire or dispose of long-term assets, such as property, equipment, or investments. Positive investing cash flow indicates that a company is expanding or investing in its future growth.

- Financing Cash Flow: This measures the cash used to finance a company's operations, such as issuing debt or raising equity. Positive financing cash flow indicates that a company is raising additional capital to fund its growth or operations.

- Free Cash Flow: This represents the cash flow available to a company after accounting for operating, investing, and financing activities. Positive free cash flow indicates that a company has excess cash that it can use to pay dividends, reduce debt, or invest in new opportunities.

Analyzing Leigha Sanderson's cash flow patterns can provide valuable insights into her financial performance, liquidity, and long-term viability. By understanding the sources and uses of her cash, she can make informed decisions about her investments, expenses, and overall financial strategy.

Financial goals

Financial goals play a critical role in shaping Leigha Sanderson's net worth by providing direction and purpose to her financial decisions. They serve as targets that guide her investment strategies, spending habits, and overall financial management.

- Retirement Planning: Encompasses saving and investing for a financially secure retirement. Leigha Sanderson may consider factors such as desired retirement age, lifestyle, and potential healthcare expenses.

- Wealth Accumulation: Involves building a substantial net worth over time. This may involve setting specific targets for asset growth, income generation, and minimizing expenses.

- Financial Independence: Aims to achieve a level of financial security where passive income covers living expenses, providing freedom from traditional employment.

- Legacy Planning: Considers the distribution of assets and wealth after Leigha Sanderson's lifetime. This involves estate planning, charitable giving, and providing for future generations.

Understanding Leigha Sanderson's financial goals is essential for evaluating her net worth as it provides context for her financial decisions and long-term financial trajectory. By aligning her financial goals with her values, risk tolerance, and time horizon, Leigha Sanderson can make informed choices that contribute to her overall financial well-being and net worth growth.

Frequently Asked Questions about Leigha Sanderson Net Worth

This FAQ section aims to address common queries and clarify various aspects related to Leigha Sanderson's net worth.

Question 1: How is Leigha Sanderson's net worth calculated?

Answer: Leigha Sanderson's net worth is calculated by summing her financial assets and subtracting her liabilities. Assets may include cash, investments, real estate, and personal property, while liabilities include debts, loans, and mortgages.

Question 2: What are the major sources of Leigha Sanderson's income?

Answer: Leigha Sanderson's income primarily comes from her salary as an actress and singer, as well as from endorsements, sponsorships, and business ventures.

Question 3: How does Leigha Sanderson manage her expenses?

Answer: Leigha Sanderson manages her expenses through budgeting, prioritizing essential costs, and seeking professional financial advice to optimize her spending and maximize her savings.

Question 4: What is Leigha Sanderson's investment strategy?

Answer: Leigha Sanderson's investment strategy involves diversifying her portfolio across different asset classes such as stocks, bonds, real estate, and alternative investments. She focuses on long-term growth and capital preservation.

Question 5: How has Leigha Sanderson's net worth changed over time?

Answer: Leigha Sanderson's net worth has experienced fluctuations over time, influenced by factors such as her career success, investment returns, and personal expenses. However, her overall net worth has generally shown a positive trajectory.

Question 6: What are Leigha Sanderson's financial goals?

Answer: Leigha Sanderson's financial goals include securing her financial future, achieving financial independence, and building a lasting legacy through charitable giving and supporting organizations close to her heart.

In summary, understanding Leigha Sanderson's net worth provides insights into her financial status, investment strategies, and overall financial well-being. As her career and personal life continue to evolve, her net worth is likely to undergo further changes, reflecting her financial decisions and life experiences.

Moving on, the next section will delve into the factors that have contributed to Leigha Sanderson's financial success and the lessons we can learn from her journey.

Tips for Building a Strong Net Worth

Building a strong net worth requires a combination of financial literacy, smart decision-making, and a commitment to long-term planning. Here are five actionable tips to help you increase your net worth and secure your financial future:

Tip 1: Create a Budget and Track ExpensesThe foundation of financial health is understanding your cash flow. Create a budget that tracks your income and expenses, and stick to it as closely as possible. This will help you identify areas where you can save money and make better financial decisions.

Tip 2: Invest Early and ConsistentlyThe power of compound interest is your greatest ally in building wealth. Start investing as early as possible, even with small amounts, and contribute regularly to your investment accounts. Over time, your investments will grow exponentially.

Tip 3: Reduce Debt and Avoid Unnecessary ExpensesHigh-interest debt can be a major obstacle to building wealth. Make a plan to pay off your debts as quickly as possible, and avoid taking on unnecessary new debt. Additionally, cut back on discretionary expenses to free up more cash for saving and investing.

Tip 4: Increase Your IncomeThe more you earn, the more you can save and invest. Explore opportunities for career advancement, start a side hustle, or invest in education to increase your earning potential.

Tip 5: Seek Professional Financial AdviceIf you need help with your financial planning, don't hesitate to seek professional advice from a financial advisor or certified financial planner. They can provide personalized guidance and help you make informed decisions based on your unique circumstances.

By following these tips, you can build a strong financial foundation and increase your net worth over time. Remember that building wealth is a journey, not a race. Stay disciplined, make smart financial choices, and don't be discouraged by setbacks along the way.

In the next section, we will explore the habits and strategies that successful investors use to build and maintain their wealth.

Conclusion

In exploring Leigha Sanderson's net worth, this article has highlighted the interplay of various financial factors that contribute to an individual's overall financial well-being. Key points include the importance of managing assets, liabilities, income, expenses, investments, and debt to maintain a healthy net worth.

Building a strong net worth requires a combination of financial literacy, long-term planning, and prudent decision-making. By understanding the principles outlined in this article, individuals can take control of their financial futures and work towards achieving their financial goals.

- Is Max Muncy Christian Or Jewish Religion

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Claudia Sampedro Wags Miami Age Engaged Husband

- Tammy Camacho Obituary A Remarkable Life Remembered

- Bad Bunny Used To Make Mix Cds

Leigha Rose Sanderson on Instagram “Thank you be_you_brands for the

Leigha Sanderson Lilliana Ketchman Wiki Fandom

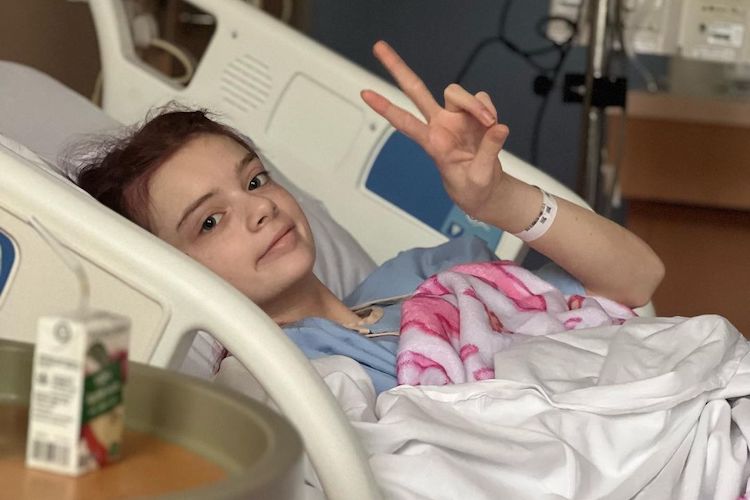

Former XOMG POP! Member Leigha Sanderson is in The Hospital