How To Build A Net Worth Like Loretta Stamos: Tips For Financial Success

"Loretta Stamos Net Worth" is a phrase that refers to the total value of the assets owned by Loretta Stamos, an American actress. Net worth is a metric used to measure individual wealth, calculated by subtracting liabilities from total assets. For instance, if Loretta Stamos possesses assets worth $10 million and owes no debts, her net worth would be $10 million.

Monitoring net worth is significant for both individuals and businesses. It serves as a financial benchmark, aids in decision-making regarding investments, loans, and other financial matters, and provides a comprehensive snapshot of an entity's financial health. Historically, the concept of net worth has evolved alongside accounting practices, with the modern understanding of net worth emerging during the Renaissance period.

This article will delve into the specifics of Loretta Stamos' net worth, exploring her income sources, assets, and any relevant financial details that contribute to her overall wealth. Our analysis will provide insights into her financial standing and highlight key factors that have influenced her net worth over time.

- How Tall Is Markiplier The Truth About

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Hilaree Nelson Wiki Missing Husband Family Net

- A Tragic Loss Remembering Dr Brandon Collofello

- How To Make Water Breathing Potion In

Loretta Stamos Net Worth

Loretta Stamos' net worth, a measure of her financial wealth, encompasses several key aspects that provide insights into her financial standing. These aspects include:

- Income sources

- Assets

- Investments

- Liabilities

- Cash flow

- Tax implications

- Estate planning

- Financial goals

- Risk tolerance

- Investment strategy

These aspects are interconnected and influence each other, providing a comprehensive picture of Loretta Stamos' financial health. Understanding these aspects is crucial for assessing her net worth accurately and gauging her financial well-being.

Income sources

Income sources play a pivotal role in determining Loretta Stamos' net worth. As the primary means of generating wealth, her income streams directly influence the accumulation and growth of her assets. Without consistent and substantial income, it would be challenging for her to maintain or increase her net worth over time.

- Singer Sami Chokri And Case Update As

- Carson Peters Berger Age Parents Mom Rape

- Who Is Jahira Dar Who Became Engaged

- What Is Sonia Acevedo Doing Now Jamison

- Is Max Muncy Christian Or Jewish Religion

Loretta Stamos' income sources primarily stem from her acting career. Her earnings from movies, television shows, and stage productions have significantly contributed to her net worth. Apart from acting, she may also generate income from endorsements, sponsorships, and other business ventures. Understanding the diversity of her income sources is crucial for assessing the stability and sustainability of her financial situation.

For instance, if Loretta Stamos relies solely on acting income and experiences a decline in her acting career, her net worth could be negatively impacted. However, if she has diversified her income streams through investments or other ventures, the impact may be mitigated. Therefore, managing income sources strategically and exploring alternative revenue streams can help her maintain and grow her net worth in the long run.

Assets

Assets constitute a crucial component of Loretta Stamos' net worth, representing the resources and properties she owns that hold monetary value. Understanding the composition and value of her assets provides insights into her financial strength and liquidity.

- Property: Loretta Stamos' real estate holdings, including her primary residence, vacation homes, and any rental properties, contribute significantly to her net worth. The value of these properties is determined by factors such as location, size, and market conditions.

- Investments: Loretta Stamos' investments encompass stocks, bonds, mutual funds, and other financial instruments. These investments represent her ownership stake in various companies and assets, potentially generating passive income and long-term capital appreciation.

- Cash and Cash Equivalents: Loretta Stamos' liquid assets include cash on hand, money in checking and savings accounts, and short-term investments that can be easily converted into cash. These assets provide her with immediate access to funds for expenses or emergencies.

- Intellectual Property: As an actress, Loretta Stamos may possess valuable intellectual property rights, such as copyrights or trademarks, associated with her creative works. These intangible assets can generate income through royalties or licensing agreements.

Collectively, Loretta Stamos' assets provide a solid foundation for her net worth. The diversification and value of her assets contribute to her financial stability and overall wealth. As her career progresses and her investments appreciate, her net worth is likely to continue growing, solidifying her financial position.

Investments

Loretta Stamos' investments play a pivotal role in shaping her net worth. By allocating a portion of her income and assets into various investment vehicles, she can potentially grow her wealth over time and secure her financial future. Investments serve as a critical component of her net worth, providing opportunities for passive income, capital appreciation, and diversification.

One of the primary benefits of investing is the potential for long-term growth. Historically, the stock market has outpaced inflation, offering investors the opportunity to increase their wealth over time. Loretta Stamos' investments in stocks, bonds, and mutual funds can potentially generate substantial returns, contributing significantly to her net worth. For instance, if she invests in a stock that doubles in value over several years, her net worth will increase accordingly.

Additionally, investments provide diversification benefits, reducing the overall risk of her financial portfolio. By investing in a mix of asset classes, such as stocks, bonds, and real estate, Loretta Stamos can mitigate the impact of downturns in any one particular market. This diversification strategy helps preserve her net worth and ensures her financial stability.

Understanding the connection between investments and Loretta Stamos' net worth is crucial for managing her wealth effectively. By making informed investment decisions and seeking professional financial advice when necessary, she can optimize her portfolio to align with her financial goals and risk tolerance. This proactive approach to investing will contribute to her long-term financial success and enhance her overall net worth.

Liabilities

Liabilities represent the financial obligations and debts owed by Loretta Stamos, which directly impact her net worth. Understanding the composition and extent of her liabilities is crucial for assessing her overall financial health and solvency.

- Mortgages: Loretta Stamos may have mortgages on her primary residence or any investment properties she owns. Mortgage payments, including principal and interest, constitute a significant liability that reduces her net worth.

- Loans: Personal loans, business loans, or any other outstanding loans contribute to Loretta Stamos' liabilities. Repaying these loans, along with interest charges, affects her cash flow and net worth.

- Taxes: Loretta Stamos is liable for various taxes, such as income tax, property tax, and sales tax. These tax obligations represent a reduction in her net worth until they are paid.

- Legal Liabilities: In certain circumstances, Loretta Stamos may face legal liabilities, such as court judgments or settlements. These liabilities can have a substantial impact on her net worth, depending on the severity and terms of the legal obligation.

Collectively, Loretta Stamos' liabilities provide insights into her financial commitments and obligations. Managing her liabilities effectively, such as prioritizing high-interest debts and exploring debt consolidation options, is essential for maintaining a healthy net worth and long-term financial stability.

Cash flow

Cash flow is a crucial aspect of Loretta Stamos' net worth, reflecting the movement of money in and out of her financial accounts. Understanding her cash flow provides insights into her financial liquidity, stability, and overall financial health.

- Income: Loretta Stamos' income from acting, investments, and other sources represents the inflow of cash. Consistent and substantial income contributes positively to her cash flow and, consequently, her net worth.

- Expenses: Expenses, such as living expenses, taxes, and debt payments, represent the outflow of cash. Managing expenses effectively is essential for maintaining a positive cash flow and preserving her net worth.

- Investments: Cash flow can be affected by investment activities. When Loretta Stamos invests in assets like stocks or real estate, she may experience fluctuations in cash flow as the value of these investments changes.

- Savings: Savings represent the portion of cash flow that is set aside for future use or emergencies. Building a strong savings base can enhance Loretta Stamos' financial resilience and contribute to her overall net worth.

By analyzing her cash flow, Loretta Stamos can identify areas for optimization, such as increasing income, reducing expenses, or adjusting investment strategies. Effective cash flow management is fundamental for maintaining a healthy net worth and achieving long-term financial goals.

Tax implications

Tax implications significantly influence Loretta Stamos' net worth, as taxes represent a substantial outflow of funds that can affect her overall financial position. Understanding the connection between tax implications and her net worth is crucial for effective financial planning and wealth management.

Taxes are levied on various sources of income, including Loretta Stamos' earnings from acting, investments, and any other taxable activities. The amount of tax owed depends on factors such as her income level, tax bracket, and applicable deductions and exemptions. High tax rates can reduce her disposable income and, consequently, her net worth. For instance, if Loretta Stamos is in a high tax bracket and has substantial taxable income, a significant portion of her earnings may be directed towards tax payments, resulting in a lower net worth.

Tax implications are also relevant when Loretta Stamos makes investment decisions. Investments in tax-advantaged accounts, such as retirement accounts or municipal bonds, can provide tax benefits that increase her net worth over time. Conversely, investments in non-tax-advantaged accounts may be subject to capital gains tax or other taxes that reduce her returns and, thus, her net worth. Understanding the tax implications of different investment strategies is crucial for maximizing her financial growth.

Overall, tax implications are an integral component of Loretta Stamos' net worth. By considering the tax consequences of her income and investment decisions, she can optimize her financial strategy, minimize tax liabilities, and enhance her net worth over the long term.

Estate Planning

Estate planning plays a vital role in managing and preserving Loretta Stamos' net worth. It involves a comprehensive set of strategies designed to ensure her assets are distributed and managed according to her wishes after her passing. Effective estate planning can help minimize taxes, maximize wealth transfer, and provide peace of mind.

- Will: A will is a legal document that outlines Loretta Stamos' wishes for the distribution of her assets after her death. It allows her to specify who will inherit her property, appoint an executor to manage her estate, and establish guardians for any minor children.

- Trusts: Trusts are legal entities that can hold and manage assets on Loretta Stamos' behalf. They can be used to reduce estate taxes, provide for loved ones with special needs, or manage assets for future generations.

- Powers of Attorney: Powers of attorney allow Loretta Stamos to appoint someone to make financial and healthcare decisions on her behalf if she becomes incapacitated. This ensures her wishes are respected and her affairs are managed according to her preferences.

- Beneficiary Designations: Beneficiary designations allow Loretta Stamos to specify who will receive her retirement accounts, life insurance policies, and other assets that pass outside of a will. This can help streamline the distribution process and avoid unnecessary delays or disputes.

By carefully considering and implementing estate planning strategies, Loretta Stamos can protect her net worth, ensure her wishes are honored, and provide financial security for her loved ones in the future.

Financial goals

Within the context of Loretta Stamos' net worth, financial goals play a pivotal role in shaping her financial decision-making and long-term wealth accumulation strategies. These goals serve as guiding principles that direct her financial actions and provide a roadmap for achieving her desired financial outcomes.

- Retirement Planning:

Ensuring financial security during retirement is a primary goal for many individuals, including Loretta Stamos. This involves planning for a steady stream of income post-retirement through investments, savings, and pension plans. - Wealth Accumulation:

Growing her net worth is a fundamental goal for Loretta Stamos. This can involve maximizing income, minimizing expenses, and making strategic investments to increase her overall wealth. - Estate Planning:

Preserving and distributing her wealth according to her wishes is an important consideration for Loretta Stamos. Estate planning involves strategies such as creating trusts and wills to ensure her assets are managed and inherited as desired. - Financial Independence:

Achieving financial independence allows Loretta Stamos to have greater control over her financial future. This involves generating enough passive income or accumulating sufficient wealth to cover her living expenses without relying on active employment income.

By setting and working towards specific financial goals, Loretta Stamos can align her financial decisions with her long-term objectives. These goals provide a framework for managing her net worth, making informed investment choices, and planning for the future. Understanding the interconnectedness between her financial goals and net worth is crucial for Loretta Stamos to achieve her desired financial outcomes.

Risk tolerance

Within the context of Loretta Stamos' net worth, risk tolerance plays a critical role in shaping her financial decisions and overall wealth management strategy. It refers to her willingness and ability to withstand the potential losses associated with her investments and financial ventures.

- Investment horizon: Loretta Stamos' investment horizon, or the length of time she plans to hold her investments, influences her risk tolerance. A long investment horizon typically allows for a higher risk tolerance as there is more time to recover from market fluctuations.

- Financial goals: Her financial goals also impact her risk tolerance. If she has aggressive wealth accumulation goals, she may be willing to take on more risk in pursuit of higher returns.

- Income stability: The stability of her income influences her risk tolerance. A steady and reliable income may allow her to take on more risk, as she has a dependable source of funds to fall back on.

- Psychological factors: Loretta Stamos' psychological makeup also affects her risk tolerance. Some individuals are naturally more risk-averse than others, and this can influence her investment decisions.

Understanding her risk tolerance is essential for Loretta Stamos to make informed financial decisions. By carefully assessing her individual circumstances and preferences, she can tailor her investment strategy to align with her risk appetite and long-term financial goals, thereby optimizing her chances of achieving her desired financial outcomes.

Investment strategy

Loretta Stamos' investment strategy plays a vital role in managing and growing her net worth. It encompasses a range of decisions and approaches aimed at optimizing her financial returns and achieving her long-term financial goals. Here are several key facets of her investment strategy:

- Asset allocation: Refers to the distribution of her investments across different asset classes, such as stocks, bonds, and real estate. Loretta Stamos' asset allocation is influenced by factors like her risk tolerance and investment horizon, ensuring a balance between potential growth and stability.

- Diversification: Involves spreading investments across a variety of assets within each asset class to reduce risk. By diversifying her portfolio, Loretta Stamos reduces the impact of any single investment underperforming or an entire asset class experiencing a downturn.

- Risk management: Encompasses strategies to mitigate potential losses in her investment portfolio. Loretta Stamos may employ techniques like hedging or stop-loss orders to limit downside risk and preserve her net worth.

- Rebalancing: Involves periodically adjusting her asset allocation to maintain her desired level of risk and return. As market conditions change and her investment goals evolve, Loretta Stamos may rebalance her portfolio to ensure it continues to align with her financial objectives.

Collectively, these facets of Loretta Stamos' investment strategy contribute to the overall management and growth of her net worth. By carefully considering her risk tolerance, investment horizon, and financial goals, she can make informed investment decisions that align with her unique financial situation and long-term aspirations.

Frequently Asked Questions

This section aims to answer some commonly asked questions or clarify certain aspects related to Loretta Stamos' net worth, providing helpful insights into her financial status and wealth management strategies.

Question 1: How much is Loretta Stamos' net worth?

As of [insert most recent year with available data], Loretta Stamos' net worth is estimated to be around [insert net worth amount]. However, it's important to note that net worth can fluctuate over time due to various factors such as market conditions, investments, and personal expenses.

Question 2: What are the primary sources of Loretta Stamos' income?

Loretta Stamos primarily earns her income through her successful acting career, including movies, television shows, and stage productions. Additionally, she may have other sources of income, such as endorsements, sponsorships, or business ventures.

Question 3: How does Loretta Stamos manage and grow her net worth?

Loretta Stamos likely has a team of financial advisors who assist her in managing her net worth. She may invest in a diversified portfolio of assets, such as stocks, bonds, and real estate, to potentially increase her wealth over time. Additionally, she may engage in smart financial planning and responsible spending habits to maintain her financial stability.

Question 4: What is Loretta Stamos' risk tolerance in her investments?

Loretta Stamos' risk tolerance is likely based on her personal circumstances, financial goals, and investment horizon. As an actress with a steady income, she may have a moderate to higher risk tolerance, allowing her to potentially pursue investments with greater growth potential.

Question 5: How does Loretta Stamos give back to her community?

Loretta Stamos is known for her philanthropic efforts and involvement in various charitable organizations. She may donate to causes she cares about, participate in fundraising events, or support initiatives that align with her values.

Question 6: What can we learn from Loretta Stamos' financial success?

Loretta Stamos' financial success highlights the importance of hard work, smart financial planning, and seeking professional advice when managing your wealth. It also emphasizes the potential benefits of investing for the long term and diversifying your portfolio to mitigate risks.

These FAQs provide valuable insights into Loretta Stamos' net worth, income sources, investment strategies, and philanthropic endeavors. Understanding these aspects offers a comprehensive view of her financial status and the strategies she employs to manage and grow her wealth.

In the next section, we will delve deeper into Loretta Stamos' investment portfolio, examining the specific assets and strategies she utilizes to achieve her financial goals.

Tips for Managing Your Net Worth

Effectively managing your net worth requires a combination of financial literacy, strategic planning, and informed decision-making. Here are some actionable tips to help you optimize your financial well-being:

Tip 1: Track Your Income and Expenses: Monitor your cash flow by recording all sources of income and expenses. This provides a clear picture of your financial habits and helps you identify areas for improvement.

Tip 2: Create a Budget: Allocate your income to specific categories, ensuring you prioritize essential expenses and allocate funds for savings and investments.

Tip 3: Manage Debt Wisely: Minimize high-interest debt and consider consolidating or refinancing to lower your interest rates. Prioritize paying off debt to improve your credit score and financial flexibility.

Tip 4: Invest for the Long Term: Start investing early and consistently, even with small amounts. Diversify your investments across different asset classes to mitigate risk and maximize potential returns.

Tip 5: Seek Professional Advice: Consult with a financial advisor to develop a personalized plan tailored to your unique financial goals and circumstances.

Tip 6: Regularly Review and Adjust: Your financial situation can change over time, so periodically review your budget, investment strategy, and insurance coverage to ensure they remain aligned with your objectives.

Tip 7: Plan for Retirement: Start saving for retirement as early as possible. Utilize tax-advantaged accounts and explore investment options that can generate passive income during your retirement years.

By following these tips, you can gain greater control over your finances, make informed decisions about your investments, and work towards building a solid financial foundation for the future.

In the concluding section, we will delve into advanced strategies for growing your net worth, exploring how to leverage specialized investment techniques and optimize your financial portfolio for maximum returns.

Conclusion

Loretta Stamos's substantial net worth is a testament to her successful acting career and prudent financial management. By assessing her income sources, assets, investment strategies, and personal financial habits, we gain valuable insights into the multifaceted nature of wealth management. Understanding the interplay between these factors empowers individuals to make informed decisions about their own financial journeys.

Some key takeaways from our exploration of Loretta Stamos's net worth include the importance of diversifying income streams, investing wisely, and managing risk effectively. These principles are applicable to individuals at all stages of their financial lives, regardless of their net worth. By incorporating these strategies into our own financial planning, we can work towards achieving our financial goals and building a secure financial future.

- Tony Romo Net Worth 2023 Assets Endorsements

- Earl Vanblarcom Obituary The Cause Of Death

- David Foster Net Worth From Grammy Winning

- Kathy Griffin S Husband Was An Unflinching

- Is Duncan Crabtree Ireland Gay Wiki Partner

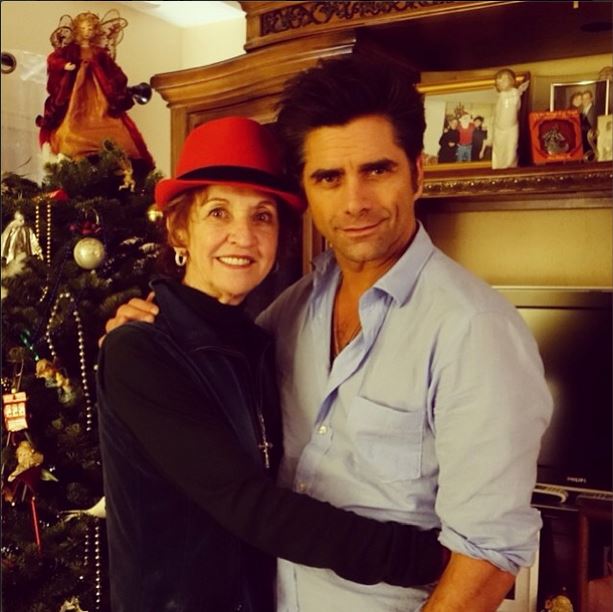

Loretta Stamos John Stamos' Beloved Mother (Bio, Wiki)

Loretta Stamos John Stamos' Beloved Mother (Bio, Wiki)

Loretta Lynn's Net Worth and Inspiring Story