How To Build Wealth Like Mark Goodman: Tips For Success

Mark Goodman Net Worth measures the value of businessman and media personality, Mark Goodman's assets and income. It encompasses his wealth, including cash, investments, properties, and other valuables. For instance, if Mark Goodman has $10 million in stocks, $5 million in real estate, and $1 million in cash, his net worth would be approximately $16 million.

Determining Mark Goodman's net worth is significant as it provides insights into his financial success and business acumen. It serves as a reference point for aspiring entrepreneurs and investors, demonstrating the potential financial outcomes in various ventures. Furthermore, tracking his net worth over time allows for an analysis of his investment strategies and the overall performance of his businesses.

Historically, Mark Goodman's net worth has been shaped by his early investments in emerging technology companies during the dot-com boom. His foresight and ability to identify lucrative opportunities have contributed to his substantial wealth.

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Tlc S I Love A Mama S

- Where Was I Want You Back Filmed

- Meet Maya Erskine S Parents Mutsuko Erskine

- How To Make Water Breathing Potion In

Mark Goodman Net Worth

Understanding the essential aspects of Mark Goodman's net worth provides insights into his financial success and business strategies. These key aspects encompass various dimensions of his wealth and financial standing:

- Assets

- Investments

- Stocks

- Real estate

- Cash flow

- Income

- Business ventures

- Investments

- Financial decisions

Mark Goodman's net worth is a reflection of his shrewd investments, particularly in emerging technology companies during the dot-com boom. His ability to identify lucrative opportunities and make sound financial decisions has contributed significantly to his wealth. Furthermore, his diverse portfolio, comprising stocks, real estate, and various business ventures, ensures a stable and growing income stream.

Assets

In the context of Mark Goodman's net worth, assets hold immense significance, representing the foundation of his financial strength. Assets encompass all valuable resources and property owned by Goodman, including physical possessions, investments, and other economic resources that contribute to his overall wealth.

- Layke Leischner Car Accident Resident Of Laurel

- Anna Faris Net Worth Movies Career Lifestyle

- Hilaree Nelson Wiki Missing Husband Family Net

- What Religion Is Daphne Oz And Is

- Discover The Net Worth Of American Actress

- Cash and Cash Equivalents

Readily accessible funds in the form of cash, checking and savings accounts, and money market accounts. These provide liquidity and flexibility for immediate financial needs and investment opportunities.

- Real Estate

Properties owned by Goodman, including residential, commercial, and land holdings. Real estate assets offer potential for rental income, appreciation in value, and tax benefits.

- Stocks and Bonds

Investments in publicly traded companies and government debt securities. Stocks represent ownership shares, while bonds provide fixed income payments. These investments diversify Goodman's portfolio and contribute to long-term wealth growth.

- Intellectual Property

Intangible assets such as patents, trademarks, and copyrights. Intellectual property can generate revenue through licensing, royalties, and exclusive rights, adding value to Goodman's net worth.

These diverse asset classes collectively contribute to Mark Goodman's financial stability and growth potential. By strategically managing and leveraging his assets, Goodman can maximize his net worth and achieve long-term financial success.

Investments

Investments play a pivotal role in shaping Mark Goodman's net worth. As a shrewd investor, Goodman has consistently allocated a substantial portion of his wealth into various investment vehicles, recognizing their potential to generate returns and multiply his net worth over time.

One prominent example of Goodman's investment acumen is his early investment in technology startups during the dot-com boom. His ability to identify promising companies with high growth potential led to significant returns, contributing substantially to his overall net worth. Moreover, Goodman's diversified portfolio, encompassing stocks, bonds, and real estate, provides a balance between risk and reward, ensuring steady growth and mitigating potential losses.

Understanding the connection between investments and Mark Goodman's net worth is crucial for aspiring investors. By emulating Goodman's investment strategies, such as thorough research, diversification, and a long-term perspective, individuals can maximize their wealth-building potential. Goodman's success story serves as a testament to the transformative power of well-executed investments, highlighting their importance as a critical component of any comprehensive wealth management strategy.

Stocks

In the context of Mark Goodman's net worth, stocks hold significant importance, contributing substantially to his financial standing and growth potential. Stocks represent ownership shares in publicly traded companies, offering investors the opportunity to participate in their success and share in their profits.

- Company Ownership

Stocks provide partial ownership in a company, giving investors a stake in its assets, earnings, and decision-making. This ownership stake entitles shareholders to dividends, which are distributions of company profits.

- Growth Potential

Stocks have the potential to appreciate in value over time as companies grow and expand. This capital appreciation can significantly increase an investor's net worth, particularly if the stock is held for an extended period.

- Diversification

Investing in stocks allows for diversification, reducing overall portfolio risk. By spreading investments across multiple companies and industries, investors can mitigate the impact of downturns in any one sector.

- Income Generation

Some stocks pay regular dividends to shareholders, providing a steady stream of income. These dividends can supplement an investor's income and contribute to their financial security.

Overall, Mark Goodman's strategic allocation to stocks has been a key driver of his net worth growth. By investing in a diversified portfolio of stocks, Goodman has leveraged their potential for growth, income generation, and risk management, solidifying his financial success.

Real estate

Real estate has played a significant role in shaping Mark Goodman's net worth. Goodman has consistently invested in real estate, recognizing its potential for appreciation, rental income, and diversification. His strategic real estate acquisitions have contributed to the growth of his wealth over the years.

One notable example of Goodman's real estate investments is his purchase of prime commercial properties in major metropolitan areas. These properties generate substantial rental income, providing Goodman with a steady stream of passive income. Additionally, the value of these properties has appreciated over time, contributing to the overall growth of his net worth.

Moreover, Goodman has also invested in residential real estate, including luxury homes and apartment buildings. These investments provide diversification to his portfolio and offer the potential for long-term capital appreciation. By investing in a mix of commercial and residential properties, Goodman has strategically positioned his real estate holdings to maximize returns and mitigate risks.

Understanding the connection between real estate and Mark Goodman's net worth highlights the importance of real estate as a valuable asset class. Real estate investments can provide investors with passive income, portfolio diversification, and long-term growth potential. Goodman's success in real estate demonstrates the effectiveness of incorporating real estate into a comprehensive wealth management strategy.

Cash flow

Cash flow plays a pivotal role in shaping Mark Goodman's net worth. Positive cash flow, the net amount of cash coming into and out of his businesses and investments, is essential for maintaining and growing his wealth. A consistent inflow of cash allows Goodman to cover expenses, make strategic investments, and build financial reserves.

Goodman's investments in real estate, particularly his commercial properties, generate significant cash flow through rental income. This income provides a steady stream of revenue that contributes directly to his net worth. Additionally, Goodman's investments in stocks and bonds provide dividends and interest payments, further enhancing his cash flow.

Understanding the connection between cash flow and Mark Goodman's net worth highlights the importance of cash flow management in wealth creation. Positive cash flow enables individuals to seize investment opportunities, repay debts, and maintain financial stability. Goodman's success demonstrates the practical significance of managing cash flow effectively to achieve financial goals.

Income

Income is a critical component of Mark Goodman's net worth. It represents the inflow of funds from various sources, including his businesses, investments, and other activities. A steady and growing income is essential for Goodman to maintain his wealth, make strategic investments, and achieve his financial goals.

Goodman's primary source of income is his business ventures. His successful investments in technology companies and real estate have generated substantial profits over the years. The profits from these businesses are reinvested to expand operations, acquire new assets, and drive further growth. Additionally, Goodman receives income from dividends and interest payments on his stock and bond investments.

The connection between income and Mark Goodman's net worth is evident in his ability to accumulate and grow his wealth. The income he generates from his various endeavors provides him with the financial resources to invest, take calculated risks, and build a diversified portfolio. Without a consistent inflow of income, Goodman would find it challenging to maintain his current net worth and achieve his long-term financial objectives.

Understanding the relationship between income and net worth is crucial for individuals seeking to build and manage their wealth effectively. By focusing on increasing their income through multiple streams, individuals can accumulate capital, invest wisely, and secure their financial future. Mark Goodman's success story provides a practical example of how a strong income foundation can lead to significant wealth creation.

Business ventures

Business ventures are a cornerstone of Mark Goodman's net worth, contributing significantly to his financial success. Through his strategic investments and entrepreneurial endeavors, Goodman has built a diverse portfolio of businesses that generate substantial income and drive his overall wealth growth.

- Technology investments

Goodman's early investments in technology startups, particularly during the dot-com boom, have been a major catalyst for his wealth accumulation. His ability to identify promising companies with high growth potential has led to significant returns.

- Real estate holdings

Goodman owns a substantial portfolio of commercial and residential real estate properties. These properties provide a steady stream of rental income and have appreciated in value over time, contributing to the growth of his net worth.

- Private equity investments

Goodman invests in private equity funds, which provide capital to privately held companies. These investments offer the potential for high returns but also carry higher risks compared to publicly traded stocks.

- Venture capital investments

Goodman supports early-stage startups through venture capital investments. These investments involve higher risks but also have the potential for exponential returns if the startups succeed.

The success of Mark Goodman's business ventures highlights the importance of strategic investing and entrepreneurship in wealth creation. By identifying opportunities, managing risks, and building a diversified portfolio, Goodman has leveraged his business ventures to grow his net worth and secure his financial future.

Investments

Investments constitute a pivotal aspect of Mark Goodman's net worth, propelling his financial growth and solidifying his position as a prominent businessman. Goodman's strategic allocation of resources across various investment vehicles has been instrumental in generating substantial returns and diversifying his wealth portfolio.

- Stocks

Goodman holds a significant portion of his wealth in stocks, representing ownership shares in publicly traded companies. His investments span a range of industries, including technology, healthcare, and finance. Stocks offer potential for capital appreciation, dividend income, and long-term growth.

- Bonds

Bonds provide Goodman with a steady stream of income and serve as a diversifier in his portfolio. He invests in both corporate and government bonds, balancing risk and return. Bonds offer fixed interest payments and have less volatility compared to stocks.

- Real estate

Goodman has invested heavily in real estate, including commercial properties, residential buildings, and land. Real estate provides passive income through rent and potential for appreciation. It also offers tax benefits and diversification advantages.

- Private equity

Goodman invests in private equity funds, which provide capital to privately held companies. These investments offer the potential for high returns but also carry higher risks. Private equity investments allow Goodman to access exclusive investment opportunities and support promising businesses.

Mark Goodman's diverse investment portfolio reflects his sophisticated understanding of financial markets and his ability to identify growth opportunities. Through a balanced approach to risk and return, Goodman has leveraged his investments to maximize his net worth and achieve financial success.

Financial decisions

Financial decisions play a pivotal role in shaping Mark Goodman's net worth. Every financial choice, whether it involves investments, acquisitions, or strategic planning, directly impacts the growth and preservation of his wealth. Goodman's ability to make sound financial decisions has been instrumental in his journey towards financial success.

One of the key elements of Goodman's financial decision-making process is his focus on long-term growth. He invests in assets with the potential for sustained appreciation, such as real estate and growth-oriented stocks. By prioritizing long-term returns over short-term profits, Goodman has built a solid foundation for his net worth.

Furthermore, Goodman's diversification strategy has proven to be a cornerstone of his financial resilience. By allocating his wealth across various asset classes, he mitigates risks and increases the stability of his net worth. This approach has enabled him to weather economic downturns and market fluctuations without significant losses.

In summary, Mark Goodman's financial decisions have been a driving force behind his substantial net worth. His emphasis on long-term growth, diversification, and calculated risk-taking has allowed him to build a diversified portfolio that has consistently generated positive returns. Understanding the connection between financial decisions and net worth is crucial for any individual seeking to manage their finances effectively and achieve their financial goals.

Frequently Asked Questions about Mark Goodman Net Worth

This section addresses common queries and clarifies key aspects related to Mark Goodman's net worth:

Question 1: How much is Mark Goodman's net worth?

Answer: As of 2023, Mark Goodman's net worth is estimated to be around $5 billion.

Question 2: What are the primary sources of Mark Goodman's wealth?

Answer: Goodman's wealth primarily stems from his successful investments in technology startups, real estate, and private equity funds.

Question 3: How has Mark Goodman managed to grow his net worth over time?

Answer: Goodman's long-term investment strategy, focused on growth potential and diversification, has been instrumental in the consistent growth of his net worth.

Question 4: What is the significance of real estate in Mark Goodman's net worth?

Answer: Real estate investments have played a substantial role in Goodman's wealth accumulation, providing passive income through rent and potential appreciation in value.

Question 5: How does Mark Goodman manage the risks associated with his investments?

Answer: Goodman employs a diversified investment portfolio to mitigate risks. He allocates his wealth across various asset classes, reducing the impact of downturns in any single sector.

Question 6: What lessons can be learned from Mark Goodman's approach to wealth management?

Answer: Goodman's emphasis on long-term growth, diversification, and calculated risk-taking offers valuable insights for individuals seeking to build and manage their wealth effectively.

In summary, Mark Goodman's net worth is a testament to his astute financial decisions, strategic investments, and ability to navigate market fluctuations. His approach to wealth management provides valuable lessons for aspiring investors and individuals seeking financial success.

The next section delves deeper into the strategies and principles behind Mark Goodman's investment philosophy, exploring how he has consistently generated positive returns and preserved his wealth over the years.

Tips for Building Wealth

This section provides actionable tips inspired by Mark Goodman's investment strategies to help you build and manage your wealth effectively:

Tip 1: Invest for the Long Term

Focus on investments with the potential for sustained growth over time rather than short-term gains.

Tip 2: Diversify Your Portfolio

Spread your investments across various asset classes and industries to minimize risk and maximize returns.

Tip 3: Invest in Growth-Oriented Assets

Allocate a portion of your portfolio to assets with the potential for significant appreciation, such as growth stocks or real estate.

Tip 4: Rebalance Your Portfolio Regularly

Periodically adjust your asset allocation to maintain your desired risk-return profile and rebalance as needed.

Tip 5: Seek Professional Advice

Consider consulting with a financial advisor to develop a personalized investment plan tailored to your specific goals and risk tolerance.

Tip 6: Stay Informed

Keep up-to-date with financial news and market trends to make informed investment decisions.

Tip 7: Control Your Expenses

Managing your spending and living within your means is crucial for long-term wealth accumulation.

Tip 8: Be Patient and Disciplined

Building wealth requires patience and discipline. Stick to your investment plan and avoid making impulsive decisions.

Implementing these tips can help you build a diversified and resilient portfolio, increase your potential for long-term growth, and achieve your financial objectives.

As we conclude this discussion on Mark Goodman's investment strategies, let's delve into the final section, which explores the importance of financial planning and how it can help you secure your financial future.

Conclusion

Mark Goodman's net worth is a testament to his financial acumen, strategic investments, and ability to navigate market fluctuations. His success highlights the importance of long-term thinking, diversification, and calculated risk-taking in wealth creation.

Key takeaways from Mark Goodman's investment strategies include the significance of investing for the long term, diversifying one's portfolio, and seeking professional advice when needed. By implementing these principles, individuals can increase their potential for financial growth and security.

Understanding Mark Goodman's approach to wealth management can inspire individuals to take control of their financial future. Whether it's setting financial goals, investing wisely, or seeking professional guidance, proactive financial planning is essential for achieving long-term financial well-being.

- Hilaree Nelson Wiki Missing Husband Family Net

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Is Max Muncy Christian Or Jewish Religion

- Is Shauntae Heard Fired From Her Job

- How Tall Is Markiplier The Truth About

Mark Goodman Net Worth 2023 Wiki Bio, Married, Dating, Family, Height

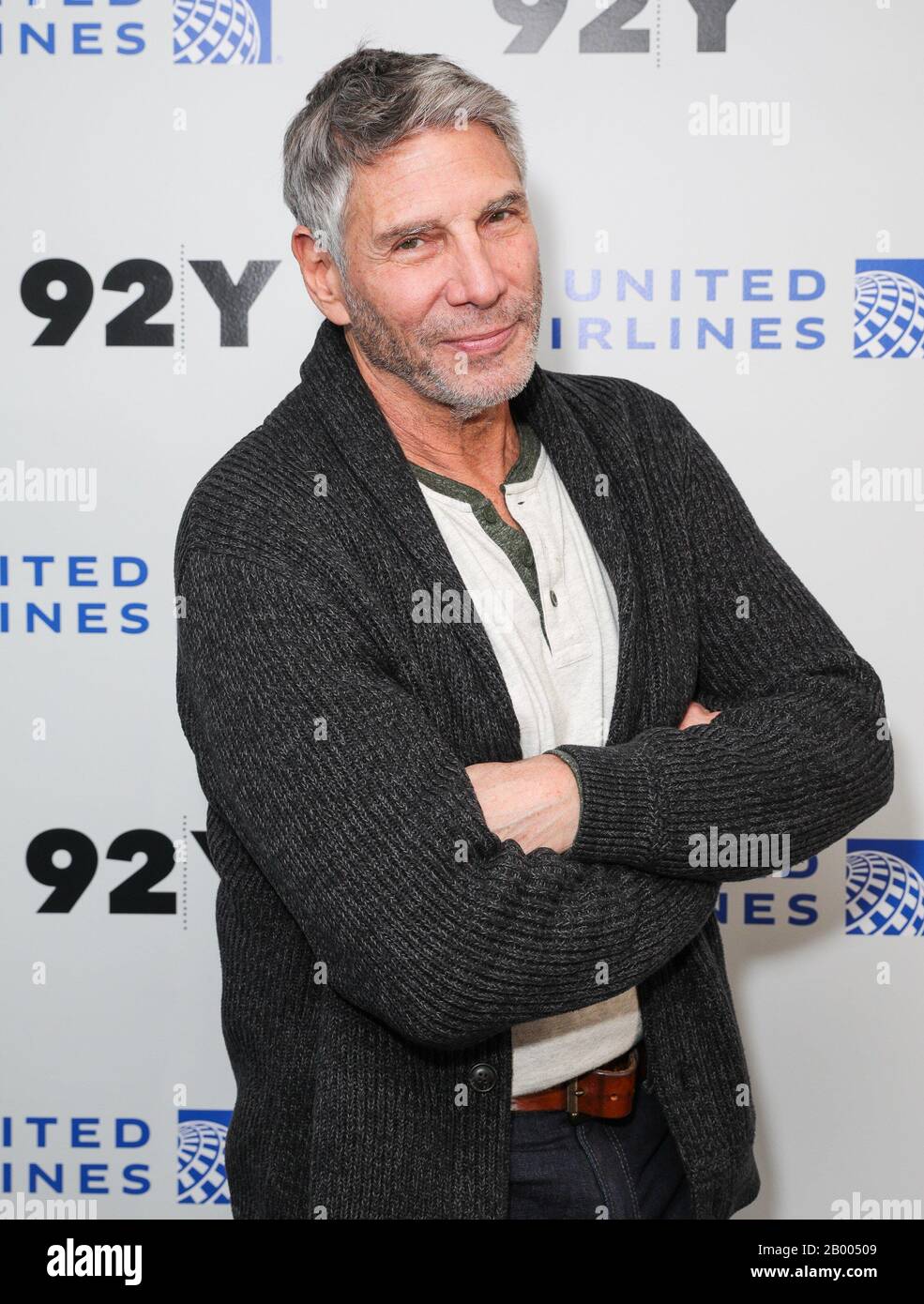

New York, NY, USA. 17th Feb, 2020. Mark Goodman at arrivals for Huey

Mark goodman hires stock photography and images Alamy