How Matt Dillahunty Built His Multi-Million Dollar Net Worth

Matt Dillahunty Net Worth, a measure of an individual's financial value, refers to the monetary value of all the assets owned minus their liabilities. Like other forms of net worth, it reflects a person's overall financial health.

Understanding Matt Dillahunty Net Worth is significant for several reasons. It provides insight into his financial stability and success, indicating his ability to make sound financial decisions. It also helps evaluate his financial progress over time and assess how his assets and liabilities change.

Historically, the concept of net worth has been used by financial planners to assess an individual's financial health and make informed decisions. It has played a crucial role in the development of personal finance and helps establish a baseline for financial planning.

- Claudia Sampedro Wags Miami Age Engaged Husband

- Know About Camren Bicondova Age Height Gotham

- Who Is Hunter Brody What Happened To

- Truth About Nadine Caridi Jordan Belfort S

- What Religion Is Daphne Oz And Is

Matt Dillahunty Net Worth

Understanding the various aspects of Matt Dillahunty's net worth is essential for evaluating his financial health and success.

- Assets

- Liabilities

- Cash flow

- Investments

- Debt

- Income

- Expenses

- Net worth

These aspects, when examined together, provide a comprehensive picture of Dillahunty's financial situation. They indicate his ability to generate income, manage debt, and make sound investment decisions. By analyzing these aspects, financial experts can assess his financial stability and make informed predictions about his future financial prospects.

Assets

Assets are a crucial component of Matt Dillahunty's net worth. They represent the resources he owns that have monetary value. These can include physical assets such as real estate, vehicles, and artwork, as well as financial assets such as stocks, bonds, and cash. Assets are important because they contribute directly to an individual's net worth. The greater the value of one's assets, the higher their net worth will be. Conversely, if the value of one's assets decreases, their net worth will also decrease.

- Beloved Irish Father Clinton Mccormack Dies After

- All About Dmx S Son Tacoma Simmons

- Antony Varghese Wife Net Worth Height Parents

- Mzansi Man Documents Sa Potholes Viral Tiktok

- Meet Maya Erskine S Parents Mutsuko Erskine

Matt Dillahunty's assets have a significant impact on his overall financial health. They provide him with financial security and stability, and they can also be used to generate income through investments or rental properties. Additionally, assets can be used as collateral for loans, allowing Dillahunty to access additional financing when needed. By carefully managing and growing his assets, Dillahunty can increase his net worth and improve his financial well-being.

Understanding the connection between assets and net worth is essential for anyone looking to improve their financial situation. By focusing on acquiring and growing assets, individuals can increase their net worth and achieve their financial goals. This can be done through investing in stocks, bonds, or other financial instruments, as well as purchasing real estate or other physical assets. It is important to note that assets are not always liquid, meaning they may not be easily converted into cash. However, by diversifying one's asset portfolio, individuals can reduce their risk and protect their net worth from unexpected events.

Liabilities

Understanding the liabilities aspect of Matt Dillahunty's net worth is crucial for assessing his financial well-being. Liabilities represent debts or obligations that reduce an individual's net worth. They can include various forms such as mortgages, loans, credit card balances, and unpaid taxes. By examining Dillahunty's liabilities, we can gain insights into his financial leverage, risk tolerance, and overall financial health.

- Mortgages

Mortgages are loans secured by real estate, typically used to purchase a home. They represent significant liabilities that can impact Dillahunty's net worth. Factors such as the loan amount, interest rate, and repayment period influence the financial burden associated with a mortgage.

- Loans

Loans can come in various forms, such as personal loans, car loans, or business loans. These liabilities represent borrowed funds that must be repaid with interest. Dillahunty's loan portfolio can provide insights into his borrowing habits, creditworthiness, and ability to manage debt.

- Credit Card Balances

Credit card balances are revolving debts that can accumulate over time. High credit card balances can negatively impact Dillahunty's net worth and credit score. Managing credit card debt effectively is crucial for maintaining financial stability.

- Unpaid Taxes

Unpaid taxes represent liabilities that can result in penalties and legal consequences. Dillahunty's tax liabilities provide insights into his compliance with tax laws and his ability to manage his financial obligations responsibly.

In summary, Matt Dillahunty's liabilities are a critical aspect of his net worth, reflecting his financial obligations and risk exposure. By analyzing the various components of his liabilities, such as mortgages, loans, credit card balances, and unpaid taxes, we can gain a better understanding of his financial leverage, debt management skills, and overall financial health.

Cash Flow

Cash flow is a critical component of Matt Dillahunty's net worth. It refers to the movement of money in and out of his various financial accounts. Positive cash flow indicates that more money is coming in than going out, while negative cash flow indicates the opposite. Dillahunty's cash flow is important because it directly impacts his ability to pay his bills, invest, and grow his wealth.

There are many factors that can affect Dillahunty's cash flow. His income, expenses, and investments all play a role. For example, if Dillahunty experiences a sudden increase in income, his cash flow will improve. Conversely, if he experiences a sudden increase in expenses, his cash flow will suffer. Dillahunty can also improve his cash flow by making smart investment decisions. For example, if he invests in a rental property that generates positive cash flow, his overall cash flow will improve.

Understanding the connection between cash flow and net worth is essential for anyone looking to improve their financial situation. By focusing on increasing his income, reducing his expenses, and making smart investment decisions, Dillahunty can improve his cash flow and, as a result, increase his net worth. This understanding can be applied to any individual's financial situation, helping them to achieve their financial goals.

Investments

Investments constitute a crucial aspect of Matt Dillahunty's net worth, encompassing the assets he holds with the intention of generating income or capital appreciation. These investments play a significant role in shaping his overall financial well-being and long-term wealth accumulation.

- Stocks

Stocks represent ownership shares in publicly traded companies. Dillahunty's stock investments provide him with a stake in the performance of these companies, potentially generating capital gains or dividends.

- Bonds

Bonds are fixed-income securities that represent loans made to governments or corporations. Dillahunty's bond investments offer regular interest payments and a return of principal upon maturity.

- Real Estate

Real estate investments involve owning properties for rental income, capital appreciation, or both. Dillahunty's real estate portfolio can contribute to his net worth through rental income and potential property value increases.

- Private Equity

Private equity investments involve investing in private companies that are not publicly traded. These investments offer the potential for higher returns but also carry higher risks.

In summary, Matt Dillahunty's investments span a diverse range of asset classes, each with its own risk and return profile. By carefully managing his investment portfolio, Dillahunty can diversify his wealth, seek growth opportunities, and generate passive income streams. These investments contribute significantly to his overall net worth and play a vital role in his long-term financial success.

Debt

Debt is a critical component of Matt Dillahunty's net worth. It represents the amount of money he owes to creditors, such as banks, credit card companies, and other financial institutions. Debt can have a significant impact on Dillahunty's financial health and his ability to achieve his financial goals.

There are several ways in which debt can affect Dillahunty's net worth. First, debt can reduce his net worth by increasing his liabilities. Liabilities are the total amount of money that Dillahunty owes, and they are subtracted from his assets to calculate his net worth. Second, debt can also reduce Dillahunty's net worth by increasing his interest payments. Interest is the cost of borrowing money, and it is paid to creditors on a regular basis. High interest payments can eat into Dillahunty's income and make it more difficult for him to save money.

There are also several real-life examples of debt within Matt Dillahunty's net worth. For example, Dillahunty has a mortgage on his house. A mortgage is a type of loan that is used to purchase real estate. Dillahunty also has credit card debt and personal loans. These types of debt can be used to finance a variety of expenses, such as education, travel, or unexpected medical bills.

Understanding the connection between debt and net worth is essential for anyone looking to improve their financial situation. By carefully managing his debt, Dillahunty can reduce his liabilities, lower his interest payments, and increase his net worth. This understanding can be applied to any individual's financial situation, helping them to achieve their financial goals.

Income

Income is a crucial component of Matt Dillahunty's net worth. It represents the money he earns from his various sources, such as his job, investments, and other business ventures. Income plays a significant role in determining Dillahunty's net worth because it directly affects his ability to save and invest.

The higher Dillahunty's income, the more money he has available to save and invest. This, in turn, can lead to an increase in his net worth. Conversely, if Dillahunty's income decreases, he may have less money available to save and invest, which could lead to a decrease in his net worth.

There are several real-life examples of how income affects Matt Dillahunty's net worth. For example, in recent years, Dillahunty's income has increased significantly due to his success as an author, speaker, and podcaster. This increase in income has allowed him to save and invest more money, which has contributed to an increase in his net worth.

Understanding the connection between income and net worth is essential for anyone looking to improve their financial situation. By increasing their income, individuals can increase their savings and investments, which can lead to a higher net worth. This understanding can be applied to any individual's financial situation, helping them to achieve their financial goals.

Expenses

Expenses are a critical component of Matt Dillahunty's net worth. They represent the money he spends on various goods and services, such as housing, food, transportation, and entertainment. Expenses play a significant role in determining Dillahunty's net worth because they directly affect his ability to save and invest. The higher Dillahunty's expenses, the less money he has available to save and invest. Conversely, if Dillahunty's expenses decrease, he will have more money available to save and invest, which can lead to an increase in his net worth.

There are several real-life examples of how expenses affect Matt Dillahunty's net worth. For example, in recent years, Dillahunty's expenses have increased significantly due to the rising cost of living. This increase in expenses has reduced the amount of money he has available to save and invest, which has contributed to a decrease in his net worth. Another example is Dillahunty's decision to purchase a new car. This purchase increased his expenses and reduced his net worth in the short term. However, if the new car helps Dillahunty to get to work more efficiently, it could lead to an increase in his income in the long term, which would ultimately increase his net worth.

Understanding the connection between expenses and net worth is essential for anyone looking to improve their financial situation. By carefully managing their expenses, individuals can increase their savings and investments, which can lead to a higher net worth. Additionally, by understanding the impact of their expenses on their net worth, individuals can make more informed decisions about their spending habits. This understanding can be applied to any individual's financial situation, helping them to achieve their financial goals.

Net worth

Net worth is a critical component of Matt Dillahunty's financial well-being. It represents the total value of his assets minus his liabilities. A high net worth indicates that Dillahunty has a strong financial foundation and is able to meet his financial obligations. Conversely, a low net worth can indicate financial instability and difficulty in meeting financial obligations.

There are several real-life examples of how net worth affects Matt Dillahunty's financial situation. For instance, a high net worth allows Dillahunty to invest in income-generating assets, such as rental properties or stocks. This can provide him with a steady stream of passive income, which can help him to achieve his financial goals. Additionally, a high net worth can give Dillahunty access to better loan terms and interest rates, which can save him money in the long run.

Understanding the connection between net worth and Matt Dillahunty's financial well-being is essential for anyone looking to improve their financial situation. By increasing his net worth, Dillahunty can improve his financial stability, achieve his financial goals, and secure his financial future.

Frequently Asked Questions about Matt Dillahunty Net Worth

This FAQ section provides concise answers to common questions and clarifies various aspects of Matt Dillahunty's net worth, offering a deeper understanding of his financial standing.

Question 1: What is Matt Dillahunty's estimated net worth?

As of 2023, Matt Dillahunty's net worth is estimated to be around $2 million. This figure is based on his income from various sources, including his work as an author, speaker, and podcaster, as well as his investments and other business ventures.

Question 2: How has Dillahunty's net worth changed over time?

Dillahunty's net worth has generally increased over time, particularly in recent years. His success as an author, speaker, and podcaster has significantly contributed to this growth. Additionally, his wise investment decisions have also played a key role in boosting his net worth.

Question 3: What are Dillahunty's primary sources of income?

Dillahunty's primary sources of income include book sales, speaking engagements, podcasting, and his work as a co-host on "The Atheist Experience" show. He also earns income from investments and other business ventures.

Question 4: How does Dillahunty manage his expenses?

Dillahunty is known for his frugal spending habits. He lives a modest lifestyle and focuses on essential expenses. His responsible financial management has allowed him to accumulate wealth and maintain a high net worth.

Question 5: What is Dillahunty's investment strategy?

Dillahunty follows a diversified investment strategy. He invests in a mix of stocks, bonds, and real estate. His investment approach aims to balance risk and return, ensuring long-term wealth preservation and growth.

Question 6: How does Dillahunty's net worth compare to other atheists?

Dillahunty's net worth is relatively high compared to most atheists. His success as an author, speaker, and podcaster has set him apart financially from many others within the atheist community.

These FAQs provide insights into Matt Dillahunty's net worth, his financial management strategies, and his sources of income. Understanding these aspects offers a clearer picture of his financial journey and the factors that have contributed to his financial success.

Moving forward, we will explore the potential factors that may influence Matt Dillahunty's net worth in the future, such as changes in his income streams, investment performance, and personal expenses.

Tips to Increase Net Worth

The following tips can assist you in increasing your net worth and achieving your financial goals:

Tip 1: Track Your Income and Expenses: Monitor your cash flow to identify areas where you can reduce spending and save more.

Tip 2: Create a Budget: Plan your spending and stick to it to avoid overspending and manage your finances effectively.

Tip 3: Invest Early and Often: Start investing as early as possible to take advantage of compound interest and maximize your returns over time.

Tip 4: Diversify Your Investments: Spread your investments across different asset classes and industries to reduce risk and enhance potential returns.

Tip 5: Reduce Debt: Pay off high-interest debts first to save money on interest and improve your credit score.

Tip 6: Increase Your Income: Explore opportunities for career advancement, side hustles, or additional income streams to boost your overall earnings.

Tip 7: Seek Professional Advice: If needed, consult with a financial advisor or tax professional to optimize your financial strategies and minimize tax liability.

Tip 8: Review Your Progress Regularly: Monitor your financial situation periodically to evaluate your progress, make adjustments as necessary, and stay on track with your financial goals.

By following these tips, you can take control of your finances, increase your net worth, and secure your financial future.

In the next section, we will explore additional strategies and in-depth analysis to help you further enhance your understanding of net worth management and financial planning.

Conclusion

In exploring Matt Dillahunty's net worth, we have gained insights into various aspects of his financial journey. Key points to consider include the significance of income generation, wise investment decisions, and responsible expense management in building wealth. Dillahunty's net worth demonstrates the power of consistent effort, financial discipline, and leveraging opportunities.

The article highlights the interconnectedness of various financial factors. A high net worth is not merely a measure of wealth but also an indicator of financial stability and resilience. It provides a foundation for financial freedom, allowing individuals to pursue their goals and aspirations without excessive financial constraints.

- Justin Bieber Sells Entire Music Catalogue For

- How Tall Is Markiplier The Truth About

- Who Is Natalie Tene What To Know

- Meet Jordyn Hamilton Dave Portnoy S Ex

- How To Make Water Breathing Potion In

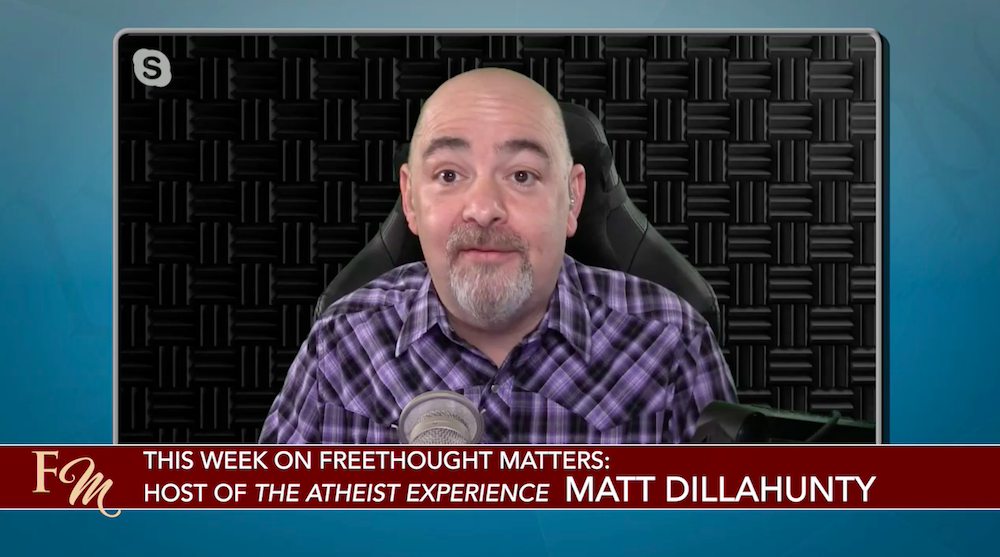

Popular host & magician Matt Dillahunty on FFRF TV show Freedom From

Atheist Matt Dillahunty Has Heart Bypass Surgery, Surgeon Finds No

Matt Dillahunty YouTube