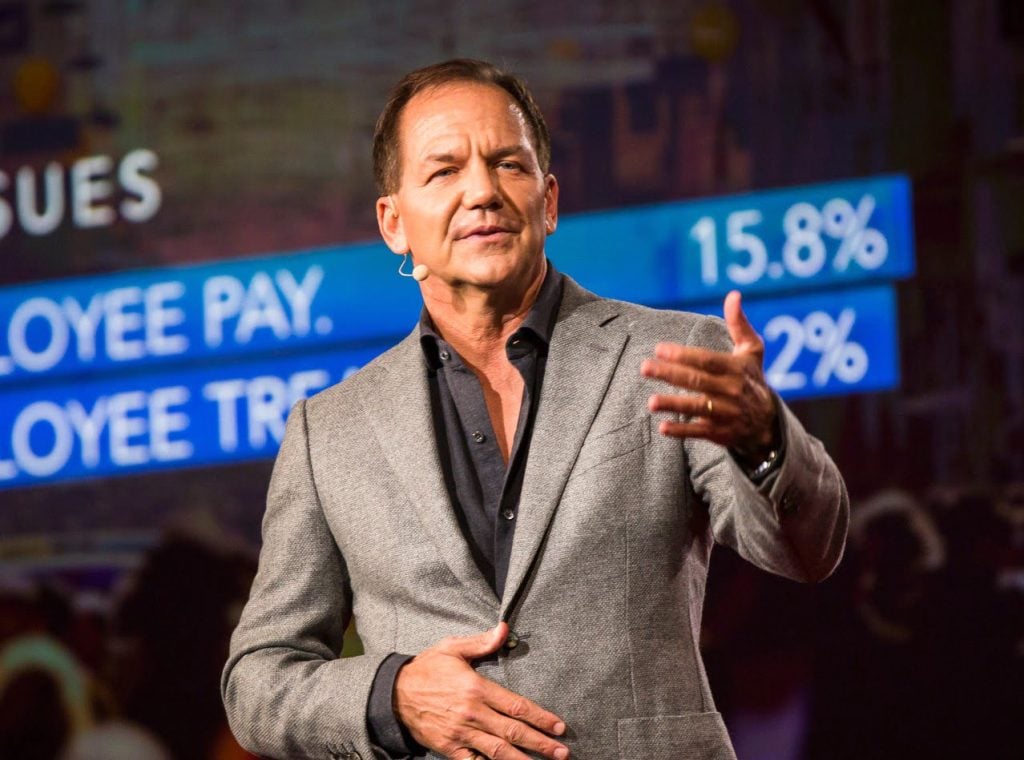

How To Build Wealth Like Paul Tudor Jones: Tips For Success

Paul Tudor Jones Net Worth is a measurement of the financial wealth of the American billionaire investor.

It is a widely reported statistic that provides insights into the success of his hedge fund management firm, Tudor Investment Corporation.

This article will delve into the details of Paul Tudor Jones' net worth, exploring its significance, historical development, and investment strategies.

- Antony Varghese Wife Net Worth Height Parents

- A Tragic Loss Remembering Dr Brandon Collofello

- Does Robert Ri Chard Have A Wife

- Claudia Sampedro Wags Miami Age Engaged Husband

- What Is Sonia Acevedo Doing Now Jamison

Paul Tudor Jones Net Worth

Paul Tudor Jones' net worth is a reflection of his success as an investor and hedge fund manager. Key aspects of his net worth include:

- Investment strategy

- Risk management

- Macroeconomic forecasting

- Market timing

- Portfolio management

- Hedge fund performance

- Personal wealth

- Philanthropy

These aspects are interconnected and have contributed to Jones' overall net worth. His investment strategy, risk management, and macroeconomic forecasting skills have enabled him to generate strong returns for his investors. His market timing and portfolio management have also been key to his success. Jones' personal wealth and philanthropy are reflections of his financial success and his commitment to giving back to society.

Investment strategy

Investment strategy is a crucial aspect of Paul Tudor Jones' net worth. Jones' investment strategy has been a key driver of his success as a hedge fund manager and investor. It is a combination of fundamental analysis, technical analysis, and macroeconomic forecasting.

- Meet Ezer Billie White The Daughter Of

- All About Dmx S Son Tacoma Simmons

- Who Is Natalie Tene What To Know

- How Tall Is Markiplier The Truth About

- Tony Romo Net Worth 2023 Assets Endorsements

- Fundamental analysis

Jones uses fundamental analysis to evaluate the intrinsic value of a company. He looks at factors such as the company's financial statements, industry trends, and competitive landscape.

- Technical analysis

Jones also uses technical analysis to identify trading opportunities. He looks at price charts and other technical indicators to identify trends and patterns.

- Macroeconomic forecasting

Jones uses macroeconomic forecasting to anticipate changes in the economy. He looks at factors such as interest rates, inflation, and economic growth to identify potential investment opportunities.

- Risk management

Jones places a great deal of emphasis on risk management. He uses a variety of risk management techniques to protect his capital. These techniques include diversification, hedging, and stop-loss orders.

Jones' investment strategy is a complex and sophisticated approach to investing. It has been a key driver of his success as a hedge fund manager and investor.

Risk management

Risk management is a critical component of Paul Tudor Jones' net worth. Jones has a deep understanding of risk and has developed a comprehensive risk management framework that has helped him to preserve his capital and generate strong returns for his investors.

Jones' risk management framework includes a variety of techniques, such as diversification, hedging, and stop-loss orders. He also has a team of risk managers who are responsible for monitoring the firm's risk exposure and developing new risk management strategies.

One of the most important aspects of Jones' risk management framework is his focus on downside protection. He is always looking for ways to reduce the risk of losing money in his portfolio. This focus on downside protection has helped Jones to weather market downturns and generate strong returns for his investors over the long term.

Jones' risk management framework is a key reason for his success as a hedge fund manager. His ability to manage risk effectively has helped him to preserve his capital and generate strong returns for his investors. This has contributed significantly to his net worth.

Macroeconomic forecasting

Macroeconomic forecasting is the process of predicting economic trends and developments. It is a critical component of Paul Tudor Jones' net worth because it allows him to make informed investment decisions. By understanding the macroeconomic environment, Jones can identify opportunities and risks, and position his portfolio accordingly.

One of the most famous examples of Jones' macroeconomic forecasting skills is his prediction of the 1987 stock market crash. Jones correctly predicted that the market was overvalued and that a correction was imminent. He sold his stocks just before the crash, and he profited handsomely from the market decline.

Another example of Jones' macroeconomic forecasting skills is his prediction of the 2008 financial crisis. Jones correctly predicted that the housing market was overheated and that a collapse was imminent. He reduced his exposure to the housing market, and he again profited handsomely from the market decline.

Jones' macroeconomic forecasting skills are a key reason for his success as a hedge fund manager. By understanding the macroeconomic environment, he can make informed investment decisions and generate strong returns for his investors.

Market timing

Market timing is the ability to predict the direction of the financial markets. It is a critical component of Paul Tudor Jones' net worth because it allows him to make informed investment decisions and generate strong returns for his investors. Jones has a long track record of successful market timing, and he has used this skill to build his net worth to over $5 billion.

One of the most famous examples of Jones' market timing skills is his prediction of the 1987 stock market crash. Jones correctly predicted that the market was overvalued and that a correction was imminent. He sold his stocks just before the crash, and he profited handsomely from the market decline.

Another example of Jones' market timing skills is his prediction of the 2008 financial crisis. Jones correctly predicted that the housing market was overheated and that a collapse was imminent. He reduced his exposure to the housing market, and he again profited handsomely from the market decline.

Jones' market timing skills are a key reason for his success as a hedge fund manager. By understanding the financial markets and being able to predict their direction, Jones can make informed investment decisions and generate strong returns for his investors. This has contributed significantly to his net worth.

Portfolio management

Within the realm of Paul Tudor Jones' vast net worth, portfolio management stands as a cornerstone, shaping his financial trajectory and amplifying his wealth.

- Asset allocation

Jones meticulously crafts a diversified portfolio, balancing stocks, bonds, commodities, and currencies to optimize risk and return.

- Risk management

Through rigorous analysis, he identifies and mitigates potential risks, safeguarding his portfolio from market volatility.

- Performance evaluation

Jones continuously monitors portfolio performance, adjusting strategies and rebalancing assets to maintain alignment with his investment objectives.

- Tax optimization

He leverages tax-efficient strategies, such as tax-loss harvesting and charitable giving, to minimize the impact of taxes on his wealth.

These facets of portfolio management, interwoven and executed with precision, have been instrumental in building Paul Tudor Jones' net worth. His ability to navigate market complexities, manage risk, and optimize portfolio performance has propelled him to the forefront of successful investors.

Hedge fund performance

Hedge fund performance plays a pivotal role in shaping the net worth of Paul Tudor Jones. As the founder and chief investment officer of Tudor Investment Corporation, Jones' wealth is directly tied to the performance of his hedge funds. Hedge fund performance is critical to Paul Tudor Jones' net worth because it determines the returns generated for investors, which in turn affects the fees earned by Tudor Investment Corporation and the value of Jones' ownership stake in the firm.

A prime example of the impact of hedge fund performance on Paul Tudor Jones' net worth is the strong performance of the Tudor BVI Global Fund. This fund has consistently outperformed the S&P 500 index, generating significant returns for investors. As a result, the fund has attracted substantial inflows, increasing Tudor Investment Corporation's assets under management and boosting Jones' net worth.

The practical applications of understanding the connection between hedge fund performance and Paul Tudor Jones' net worth are numerous. For investors, it highlights the importance of selecting hedge funds with strong track records and skilled investment teams. For aspiring hedge fund managers, it underscores the need to develop robust investment strategies and risk management frameworks to generate consistent returns for investors.

Personal wealth

Personal wealth constitutes a pivotal component of Paul Tudor Jones' net worth, reflecting his financial success and personal assets. The growth and management of his personal wealth are intricately intertwined with his hedge fund performance and financial acumen.

Jones' personal wealth has been amassed through his hedge fund's strong performance and investment returns. As Tudor Investment Corporation generates profits, Jones' personal wealth increases proportionally, as he holds a significant ownership stake in the firm. Additionally, Jones has made savvy personal investments, such as real estate and private equity, further contributing to his personal wealth.

The relationship between personal wealth and Paul Tudor Jones' net worth is mutually reinforcing. His personal wealth provides him with financial freedom and flexibility, allowing him to make bold investment decisions and explore new opportunities. Conversely, his success as a hedge fund manager enhances his personal wealth, creating a virtuous cycle of wealth accumulation.

Understanding the connection between personal wealth and Paul Tudor Jones' net worth is essential for aspiring investors and wealth managers. It highlights the importance of prudent financial management, strategic investments, and the potential rewards of successful money management.

Philanthropy

Philanthropy plays a significant role in the net worth of Paul Tudor Jones, shaping his legacy and making a positive impact on society. Jones has consistently dedicated a portion of his wealth to philanthropic endeavors, recognizing the responsibility that comes with financial success.

One notable example of Jones' philanthropy is his $100 million donation to the Robin Hood Foundation, a non-profit organization dedicated to fighting poverty in New York City. This generous contribution is a testament to Jones' commitment to social justice and his belief in giving back to the community where he has built his fortune.

The connection between philanthropy and Paul Tudor Jones' net worth extends beyond financial contributions. His philanthropic activities have enhanced his reputation as a responsible and compassionate investor, attracting investors who align with his values and are eager to support his charitable initiatives.

Understanding the relationship between philanthropy and Paul Tudor Jones' net worth highlights the importance of social responsibility in wealth management. It demonstrates that financial success can be used as a force for good, creating a meaningful impact on society while enhancing the legacy of the individual.

FAQs on Paul Tudor Jones Net Worth

These FAQs address common questions and misconceptions surrounding Paul Tudor Jones' net worth, providing clarity on its various aspects.

Question 1: How has Paul Tudor Jones accumulated his wealth?

Answer: Jones' wealth primarily stems from the success of his hedge fund, Tudor Investment Corporation, which has consistently generated strong returns for investors.

Question 2: What is Jones' investment strategy?

Answer: Jones employs a multi-strategy approach, combining fundamental analysis, technical analysis, and macroeconomic forecasting to identify investment opportunities and manage risk.

Question 3: How has Jones' performance impacted his net worth?

Answer: The strong performance of Tudor Investment Corporation has been a major contributor to Jones' net worth, as his personal wealth is tied to the firm's success.

Question 4: What role does philanthropy play in Jones' net worth?

Answer: Jones is a notable philanthropist, dedicating a portion of his wealth to various charitable causes. His philanthropic activities enhance his reputation and align with his values.

Question 5: How has Jones' risk management contributed to his net worth?

Answer: Jones places great emphasis on risk management, utilizing techniques such as diversification, hedging, and stop-loss orders to protect his capital and preserve his wealth.

Question 6: What are the key factors driving Paul Tudor Jones' net worth?

Answer: Jones' investment strategy, risk management, macroeconomic forecasting, market timing, and personal wealth management skills are all key factors contributing to his substantial net worth.

These FAQs offer valuable insights into the various aspects of Paul Tudor Jones' net worth, highlighting the complexities and strategies behind his financial success. To gain further insights, let's delve into a detailed analysis of his investment philosophy and risk management techniques.

Tips for Building Wealth

The following tips can help you build wealth and achieve your financial goals.

Tip 1: Create a budget

Tracking your income and expenses is crucial for understanding your financial situation and identifying areas where you can save.

Tip 2: Invest early

The power of compound interest can help your money grow exponentially over time, so starting to invest as early as possible is key.

Tip 3: Live below your means

Spending less than you earn is essential for building wealth. Avoid unnecessary expenses and focus on saving and investing the difference.

Tip 4: Increase your earning potential

Investing in your education, developing new skills, and negotiating salary increases can help you boost your income and accelerate wealth accumulation.

Tip 5: Seek professional advice

Consulting with a financial advisor can provide personalized guidance and help you make informed investment decisions.

Follow these tips to start building wealth today and secure your financial future. By implementing these strategies, you can increase your savings, grow your investments, and achieve your long-term financial goals.

In the next section, we will explore the importance of financial planning and how it can help you maximize your wealth-building efforts.

Conclusion

Paul Tudor Jones' net worth is a testament to his financial acumen, strategic investments, and unwavering commitment to risk management. His ability to identify market trends, execute complex trading strategies, and navigate economic uncertainties has propelled him to the forefront of successful investors.

Key takeaways from this exploration include the importance of developing a robust investment philosophy, the power of diversification and risk mitigation, and the role of philanthropy in shaping one's legacy. By understanding the drivers of Jones' wealth, we gain valuable insights into the complexities of wealth management and the strategies employed by successful investors.

- Hilaree Nelson Wiki Missing Husband Family Net

- Wiki Biography Age Height Parents Nationality Boyfriend

- Mzansi Man Documents Sa Potholes Viral Tiktok

- Who Is Miranda Rae Mayo Partner Her

- Is Max Muncy Christian Or Jewish Religion

Paul Tudor Jones Net Worth 2022 Biography Salary Assets

Paul Tudor Jones, Gold, Silver, Miners And More King World News

The Richest Forex Traders in the World (2023) Things To Know