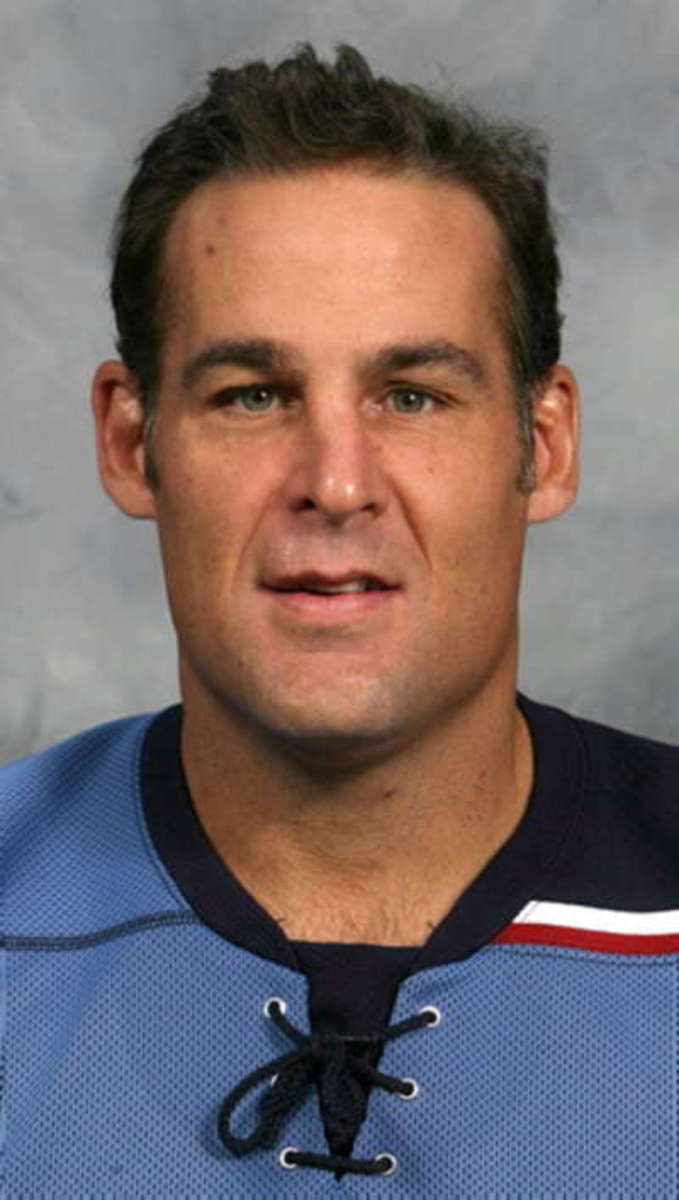

Scott Mellanby's Net Worth: How The Hockey Star Built His Fortune

Scott Mellanby's net worth, a monetary value quantifying his assets and liabilities, provides insights into the financial standing of the former NHL player.

Determining net worth involves calculating the total value of one's assets, such as property, investments, and cash, and deducting any outstanding debts. This provides a comprehensive measure of an individual's financial health, allowing for comparisons and assessments.

In the case of Scott Mellanby, understanding his net worth offers a glimpse into his financial achievements during and after his hockey career. It can also shed light on his investment strategies, wealth management decisions, and overall financial well-being.

- Joe Kennedy Iii Religion Meet His Parents

- Anna Faris Net Worth Movies Career Lifestyle

- Matthew Cassina Dies In Burlington Motorcycle Accident

- Officer Nicholas Mcdaniel Died A Life Of

- New Roms Xci Nsp Juegos Nintendo Switch

Scott Mellanby Net Worth

Understanding the essential aspects of Scott Mellanby's net worth provides valuable insights into his financial standing and wealth management strategies. These key aspects encompass various dimensions related to his net worth, including:

- Income

- Assets

- Liabilities

- Investments

- Taxes

- Financial Planning

- Retirement Planning

- Estate Planning

- Philanthropy

Examining these aspects offers a comprehensive view of Scott Mellanby's financial situation, allowing for analysis of his wealth accumulation, investment decisions, and overall financial health. By exploring these key aspects, we gain insights into the strategies and factors that have contributed to his financial success.

Income

Income plays a fundamental role in shaping Scott Mellanby's net worth, representing the total amount of money he earns from various sources. Understanding the components of his income provides insights into the sources of his wealth and the factors contributing to his financial success.

- Chris Brown Net Worth Daughter Ex Girlfriend

- Julia Dweck Dead And Obituary Nstructor Willow

- Truth About Nadine Caridi Jordan Belfort S

- Is Max Muncy Christian Or Jewish Religion

- Know About Camren Bicondova Age Height Gotham

- Salary: As a professional hockey player, Mellanby's primary source of income during his playing career was his salary from the NHL teams he represented, including the Florida Panthers and Atlanta Thrashers.

- Bonuses: In addition to his base salary, Mellanby also earned bonuses for achieving performance milestones and team success, further contributing to his overall income.

- Investments: Post-retirement, Mellanby has invested a portion of his earnings in various financial instruments, such as stocks, bonds, and real estate, generating passive income and potentially enhancing his net worth.

- Endorsements: Mellanby's reputation and success in the NHL have enabled him to secure endorsement deals with brands and companies, providing an additional stream of income.

By examining these multiple facets of Mellanby's income, we gain a clearer understanding of how he has accumulated wealth and the strategies he has employed to maintain his financial well-being. These sources of income have collectively contributed to his overall net worth, shaping his financial standing and enabling him to pursue various ventures and investments.

Assets

Assets, a crucial component of Scott Mellanby's net worth, represent the resources and valuables he owns, contributing significantly to his overall financial standing. These assets can be categorized into various types, each holding its own significance and value.

Real estate properties, including residential and commercial buildings, form a substantial portion of Mellanby's assets. These properties not only provide shelter and potential rental income but also appreciate in value over the long term, contributing to the growth of his net worth.

Investments in stocks, bonds, and mutual funds further diversify Mellanby's asset portfolio. These investments provide potential returns through dividends, interest payments, and capital appreciation, offering a means of increasing his wealth. Mellanby's financial acumen and investment strategies have played a pivotal role in maximizing the returns from these assets.

Understanding the composition of Mellanby's assets offers valuable insights into his financial planning and wealth management strategies. By carefully managing his assets, diversifying his investments, and making sound financial decisions, Mellanby has been able to preserve and grow his net worth, ensuring his long-term financial security.

Liabilities

Liabilities represent obligations and debts that Scott Mellanby owes to external parties, negatively impacting his net worth. Understanding the relationship between liabilities and Mellanby's net worth is crucial for assessing his overall financial health and stability.

Liabilities come in various forms, such as mortgages, loans, credit card balances, and outstanding taxes. Each liability represents a financial burden that Mellanby must fulfill, reducing his net worth. As liabilities increase, his net worth decreases, indicating a greater financial strain on his resources.

Managing liabilities effectively is essential for Mellanby to maintain a healthy net worth. By prioritizing debt repayment, negotiating favorable interest rates, and seeking professional financial advice, he can minimize the impact of liabilities on his financial standing. Prudent liability management allows Mellanby to preserve his assets, improve his cash flow, and enhance his overall financial well-being.

In conclusion, liabilities play a critical role in determining Scott Mellanby's net worth, with higher liabilities leading to a lower net worth. Understanding this relationship empowers him to make informed financial decisions, prioritize debt repayment, and implement strategies that optimize his financial health.

Investments

Investments play a vital role in shaping Scott Mellanby's net worth, representing the portion of his assets allocated to various financial instruments with the potential to generate income and appreciate in value.

- Stocks: Mellanby has invested in stocks, representing ownership shares in publicly traded companies. This investment strategy provides potential returns through dividends and capital appreciation.

- Bonds:Mellanby's investment portfolio likely includes bonds, which are debt securities issued by corporations or governments. Bonds provide regular interest payments and return of principal upon maturity.

- Real Estate: Real estate investments, such as rental properties or land, form a significant part of Mellanby's portfolio. These investments offer potential rental income, property value appreciation, and tax benefits.

- Venture Capital: Mellanby may also allocate a portion of his investments to venture capital, supporting early-stage companies with high growth potential. This investment strategy carries higher risk but also the potential for substantial returns.

By actively managing his investments, diversifying across asset classes, and seeking professional guidance, Mellanby aims to maximize returns, preserve capital, and mitigate risks. These investment strategies are crucial in maintaining and growing his net worth, contributing to his overall financial well-being and long-term financial security.

Taxes

Taxes exert a significant influence on Scott Mellanby's net worth, representing a legal obligation that reduces his overall financial standing. Comprehending the various facets of taxes provides insights into their impact on his wealth and financial planning.

- Income Tax: Income tax is levied on Mellanby's earnings, including salary, bonuses, and investment income. This tax can vary depending on his income bracket and deductions.

- Property Tax: Owning real estate, such as his residential and commercial properties, incurs property taxes. These taxes are based on the assessed value of the properties and contribute to local government revenue.

- Capital Gains Tax: When Mellanby sells an asset, such as stocks or real estate, for a profit, he may be liable for capital gains tax. This tax is calculated on the difference between the sale price and the original purchase price.

- Estate Tax:Upon Mellanby's passing, his estate may be subject to estate tax. This tax is imposed on the value of his assets and can potentially reduce the inheritance passed on to his beneficiaries.

Taxes play a multifaceted role in shaping Scott Mellanby's net worth, affecting his disposable income, investment returns, and estate planning strategies. Understanding these tax implications is crucial for informed financial decision-making and maximizing the preservation and growth of his wealth.

Financial Planning

Financial planning is an essential aspect of managing Scott Mellanby's net worth, allowing him to make informed decisions about his financial future. By implementing comprehensive strategies, he can optimize his wealth accumulation, minimize risks, and achieve his financial goals.

- Retirement Planning: Mellanby has likely established retirement accounts, such as 401(k)s and IRAs, to save for his post-career years. These accounts offer tax advantages and allow for long-term growth of his investments.

- Investment Management: A diversified investment portfolio is crucial for Mellanby to generate income and grow his wealth. This may include a mix of stocks, bonds, real estate, and alternative investments.

- Tax Optimization: Mellanby's financial plan likely involves strategies to minimize his tax liability. This may include utilizing tax-advantaged accounts and seeking professional tax advice.

- Estate Planning: Mellanby can ensure the distribution of his wealth according to his wishes through estate planning. This involves creating a will, trusts, and other legal documents to manage his assets and provide for his beneficiaries.

By incorporating these facets of financial planning into his financial strategy, Scott Mellanby can navigate the complexities of wealth management, make informed decisions, and ultimately preserve and enhance his net worth.

Retirement Planning

Within the context of Scott Mellanby's net worth, retirement planning plays a crucial role in ensuring his financial well-being post-career. It involves a multifaceted approach to managing his wealth and planning for his future financial needs.

- Investment Strategy: Mellanby has likely adopted an investment strategy tailored to his retirement goals. This may involve a mix of stocks, bonds, real estate, and alternative investments, aiming to generate income and preserve capital.

- Tax-Advantaged Accounts: Utilizing tax-advantaged accounts, such as 401(k)s and IRAs, allows Mellanby to save for retirement with tax benefits. These accounts offer tax-deferred or tax-free growth of his investments.

- Income Streams: Creating multiple income streams, such as dividends from investments, rental income from real estate, or royalties from endorsements, provides Mellanby with financial stability during retirement.

- Estate Planning: As part of his retirement planning, Mellanby may have established an estate plan to ensure his wealth is distributed according to his wishes after his passing. This includes creating a will, trusts, and other legal documents.

By implementing these aspects of retirement planning, Scott Mellanby is proactively managing his net worth to secure his financial future and maintain his standard of living after his hockey career.

Estate Planning

Estate planning plays a critical role in managing Scott Mellanby's net worth and ensuring the distribution of his wealth according to his wishes after his passing. It involves various legal and financial strategies to preserve and distribute assets, minimize taxes, and provide for beneficiaries.

- Wills: A will is a legal document that outlines the distribution of an individual's assets after their death. It specifies the beneficiaries, executors, and guardians for minor children.

- Trusts: Trusts are legal entities that hold and manage assets for the benefit of beneficiaries. They can be used to reduce estate taxes, provide for specific needs, and protect assets from creditors.

- Powers of Attorney: A power of attorney grants authority to another person to make financial and legal decisions on behalf of the individual in the event of incapacity.

- Charitable Giving: Estate planning can incorporate charitable giving strategies to reduce estate taxes and support causes that align with the individual's values.

Estate planning is an essential aspect of financial planning for high-net-worth individuals like Scott Mellanby. By implementing these strategies, he can ensure the orderly distribution of his wealth, minimize tax burdens, and provide for his loved ones and charitable causes that are important to him.

Philanthropy

Philanthropy, the act of giving back to the community, plays a significant role in Scott Mellanby's net worth. It not only reflects his values and commitment to social responsibility but also has tangible effects on his financial standing.

Mellanby's philanthropic efforts have included substantial donations to organizations dedicated to youth hockey development, underprivileged communities, and environmental conservation. These contributions have not only made a positive impact on society but have also enhanced Mellanby's reputation as a socially conscious individual, which can indirectly benefit his business ventures and overall net worth.

Additionally, Mellanby's philanthropic activities have provided him with unique opportunities for networking and relationship-building with other affluent individuals and organizations. These connections can lead to valuable collaborations, investments, and business opportunities, ultimately contributing to the growth of his net worth.

In conclusion, philanthropy is not merely a component of Scott Mellanby's net worth but an integral part of his financial and social legacy. By aligning his values with his wealth, he has not only made a meaningful difference in the world but has also created a positive feedback loop that benefits his overall net worth.

Scott Mellanby Net Worth FAQs

This FAQ section provides answers to commonly asked questions regarding Scott Mellanby's net worth, offering further insights and clarifying potential misconceptions.

Question 1: What is Scott Mellanby's estimated net worth?

Answer: As of 2023, Scott Mellanby's net worth is estimated to be around $15 million, accumulated through his successful hockey career, investments, and business ventures.

Question 2: How did Scott Mellanby earn his wealth?

Answer: Mellanby's primary source of income was his NHL salary and bonuses during his playing career. Post-retirement, he has invested in real estate, stocks, and venture capital, contributing to his overall wealth.

Question 3: What are Mellanby's major assets?

Answer: Mellanby's assets include residential and commercial real estate, a diversified investment portfolio, and potential ownership stakes in various businesses.

Question 4: How does Mellanby manage his wealth?

Answer: Mellanby likely employs a team of financial advisors and investment managers to manage his wealth, ensuring optimal returns and risk management.

Question 5: Is Mellanby involved in philanthropy?

Answer: Yes, Mellanby is known for his philanthropic efforts, supporting organizations focused on youth hockey development, underprivileged communities, and environmental conservation.

Question 6: What factors could impact Mellanby's net worth in the future?

Answer: Fluctuations in real estate and stock markets, changes in tax laws, and unforeseen circumstances can potentially affect Mellanby's net worth in the future.

These FAQs provide a concise overview of Scott Mellanby's net worth, addressing common queries and offering insights into his wealth management strategies. Understanding these aspects provides a comprehensive understanding of his financial standing and the factors contributing to his financial success.

The following section will delve deeper into Mellanby's financial planning and investment strategies, exploring how he has preserved and grown his wealth over time.

Financial Planning Tips for Building and Preserving Wealth

This section provides actionable tips to help individuals navigate the complexities of financial planning and build long-term wealth.

Tip 1: Establish a Comprehensive Financial Plan: Develop a roadmap that outlines your financial goals, risk tolerance, and investment strategies.

Tip 2: Diversify Your Investment Portfolio: Spread your investments across different asset classes, such as stocks, bonds, real estate, and alternative investments, to mitigate risk.

Tip 3: Regularly Review and Rebalance Your Portfolio: Monitor your investments and adjust your asset allocation as needed to maintain your desired risk-return profile.

Tip 4: Maximize Retirement Savings: Take advantage of tax-advantaged retirement accounts, such as 401(k)s and IRAs, to save for your future.

Tip 5: Plan for Estate Distribution: Create a will or trust to ensure your assets are distributed according to your wishes after your passing.

Tip 6: Seek Professional Financial Advice: Consult with qualified financial advisors to gain personalized guidance and make informed investment decisions.

Tip 7: Stay Informed About Financial Markets and Trends: Keep up with economic news and market analysis to make informed investment decisions.

Tip 8: Be Disciplined and Patient: Building wealth requires patience and discipline. Avoid emotional decision-making and stick to your long-term financial plan.

By implementing these tips, you can lay a solid foundation for financial success, preserve your wealth, and achieve your long-term financial goals.

These strategies are essential for navigating the complexities of wealth management and safeguarding your financial future.

Conclusion

Exploring Scott Mellanby's net worth unveils the intricate interplay of financial planning, investment strategies, and wealth management. A comprehensive understanding of his income streams, assets, liabilities, investments, and philanthropic endeavors provides valuable insights into the factors that have shaped his financial standing.

Key points emerging from this analysis include the significance of diversifying investments to mitigate risk, maximizing retirement savings for long-term financial security, and utilizing estate planning to ensure the distribution of assets according to one's wishes. These strategies underscore the importance of proactive financial planning and prudent decision-making in preserving and growing wealth.

- Tammy Camacho Obituary A Remarkable Life Remembered

- Meet Maya Erskine S Parents Mutsuko Erskine

- How Tall Is Markiplier The Truth About

- Discover The Net Worth Of American Actress

- All About Dmx S Son Tacoma Simmons

/cdn.vox-cdn.com/uploads/chorus_image/image/66535985/52405684.jpg.0.jpg)

Blues at Panthers NotaGameday Thread Scott Mellanby was under

Thrashers captain Scott Mellanby to retire after 21year NHL career

Scott Mellanby Won't Interview For Pittsburgh's GM Position