Unveiling The Riches: Wajeeh Mahmood's Net Worth Decoded

Wajeeh Mahmood Net Worth, a metric in finance, measures the value of an individual's assets and liabilities. For example, if Wajeeh Mahmood has assets worth $1 million and liabilities of $200,000, his net worth would be $800,000.

Calculating net worth provides insights into an individual's financial health. It helps determine solvency, assess risk tolerance, and make informed investment decisions. Historically, net worth has been a significant factor in determining creditworthiness and socioeconomic status.

This article analyzes the components of Wajeeh Mahmood's net worth, exploring his income sources, investments, and spending habits. It will also compare his wealth to others in his industry and assess his financial trajectory.

- Who Is Miranda Rae Mayo Partner Her

- A Tragic Loss Remembering Dr Brandon Collofello

- Janice Huff And Husband Warren Dowdy Had

- Anna Faris Net Worth Movies Career Lifestyle

- Matthew Cassina Dies In Burlington Motorcycle Accident

Wajeeh Mahmood Net Worth

Understanding the essential aspects of Wajeeh Mahmood's net worth is crucial for assessing his financial standing. These aspects include:

- Income sources

- Assets

- Liabilities

- Investments

- Investment returns

- Spending habits

- Financial goals

- Risk tolerance

- Tax implications

- Estate planning

Analyzing these aspects provides insights into Mahmood's wealth accumulation strategies, financial decision-making, and overall financial well-being. It also enables comparisons with industry peers and assesses his financial trajectory. Understanding these aspects is essential for anyone interested in Mahmood's financial situation and the factors influencing his net worth.

Income sources

Income sources form the foundation of Wajeeh Mahmood's net worth, determining his capacity to generate wealth and sustain his financial well-being. These sources encompass various activities, ventures, and investments that contribute to his overall income.

- Bad Bunny Used To Make Mix Cds

- Antony Varghese Wife Net Worth Height Parents

- Beloved Irish Father Clinton Mccormack Dies After

- Chris Brown Net Worth Daughter Ex Girlfriend

- Did Tori Bowie Baby Survive What Happened

- Business ventures

Mahmood's primary income source is his business ventures, which include a diverse portfolio of companies spanning multiple industries. His success in these ventures has significantly contributed to his net worth.

- Investments

Mahmood has made strategic investments in various asset classes, including real estate, stocks, and bonds. The returns on these investments have played a crucial role in growing his net worth over time.

- Endorsements and sponsorships

Mahmood's reputation and influence have earned him lucrative endorsement deals and sponsorships with major brands. These partnerships provide him with additional income streams.

- Other income

Mahmood also generates income from various other sources, such as royalties, dividends, and speaking engagements. These additional streams contribute to his overall financial picture.

Understanding the diversity and strength of Mahmood's income sources is essential for assessing the stability and growth potential of his net worth. A well-diversified income portfolio mitigates risk and provides a solid foundation for long-term wealth creation.

Assets

Assets play a significant role in determining Wajeeh Mahmood's net worth, representing the resources and valuables he owns. These assets hold economic value and contribute to his overall financial standing.

- Cash and cash equivalents

This category includes physical cash, demand deposits, and other highly liquid assets that can be easily converted into cash. It provides immediate access to funds for various purposes and serves as a buffer against short-term financial needs.

- Real estate

Mahmood's real estate portfolio encompasses residential and commercial properties. These assets appreciate in value over time, providing a stable source of income through rent and potential capital gains upon sale.

- Investments

Mahmood has invested in a diverse range of financial instruments, including stocks, bonds, and mutual funds. These investments generate passive income through dividends, interest, or capital appreciation.

- Intellectual property

Mahmood's patents, trademarks, and copyrights are valuable assets that protect his intellectual creations. They provide exclusive rights to use, reproduce, and profit from his innovations.

The composition and value of Mahmood's assets are crucial factors in assessing his financial health and long-term wealth potential. A well-balanced portfolio of assets diversifies risk and provides a solid foundation for sustainable wealth growth.

Liabilities

When examining Wajeeh Mahmood's net worth, it is essential to consider his liabilities, which represent his financial obligations and debts. Understanding the types and extent of his liabilities provides a comprehensive view of his financial standing and risk profile.

- Outstanding Loans

Mahmood may have various outstanding loans, such as mortgages, business loans, or personal loans. These represent significant liabilities that reduce his net worth and require regular payments, impacting his cash flow and financial flexibility.

- Accounts Payable

Mahmood's business operations may involve accounts payable, representing unpaid invoices to suppliers or vendors. These liabilities accumulate over time and must be settled to maintain supplier relationships and avoid late payment penalties.

- Deferred Taxes

Mahmood may have deferred tax liabilities, which arise when he defers paying taxes on certain types of income or expenses. These liabilities represent future tax obligations that will reduce his net worth when they become due.

- Legal Obligations

Mahmood may have legal obligations, such as court judgments or settlements, that create liabilities. These obligations can be substantial and can significantly impact his financial well-being if not managed appropriately.

The presence and extent of these liabilities affect Mahmood's financial leverage, solvency, and ability to access additional financing. By analyzing his liabilities in conjunction with his assets and income, a more accurate assessment of his overall financial health and risk profile can be obtained.

Investments

Investments are a crucial aspect of Wajeeh Mahmood's net worth, representing the portion of his wealth allocated to various financial instruments and assets. These investments contribute significantly to his overall financial growth and stability, providing passive income and potential for capital appreciation.

- Stocks

Mahmood invests in stocks, representing ownership shares in publicly traded companies. Stocks offer the potential for capital gains through price appreciation and dividends, providing a balance of growth and income.

- Real Estate

Mahmood's real estate investments include both residential and commercial properties. These investments generate rental income and provide potential for appreciation over time, offering a tangible and income-generating asset.

- Bonds

Bonds are debt instruments issued by governments or corporations, providing fixed interest payments over a specific period. Mahmood's bond investments offer a stable source of income and diversification within his portfolio.

- Venture Capital

Mahmood invests in early-stage businesses and startups through venture capital funds. These investments carry higher risk but also offer the potential for significant returns if the businesses succeed.

Mahmood's investment strategy involves a diversified portfolio that balances risk and return. By allocating his wealth across various asset classes, he aims to mitigate market volatility and maximize his long-term financial growth. The performance of these investments directly impacts his net worth, making them a key factor in assessing his overall financial health and wealth accumulation.

Investment returns

Investment returns are a crucial component of Wajeeh Mahmood's net worth, playing a significant role in its growth and sustainability. Investment returns encompass the gains or profits generated from investing in various asset classes, such as stocks, bonds, real estate, and venture capital.

Mahmood's investment returns directly impact his net worth. Positive returns, such as capital appreciation or dividends, increase his net worth, while negative returns lead to a decrease. Over time, the cumulative effect of investment returns can significantly influence his overall financial standing.

For instance, Mahmood's investment in a tech startup yielded a substantial return when the company went public. The profit from this investment significantly boosted his net worth, demonstrating the potential of investment returns to drive wealth creation.

Understanding the relationship between investment returns and Wajeeh Mahmood's net worth is essential for several reasons. It highlights the importance of strategic asset allocation and risk management in wealth management. By diversifying his investments and managing risk, Mahmood enhances the potential for positive returns and mitigates the impact of losses. Furthermore, it underscores the significance of long-term investment horizons. Many investments require time to mature and generate substantial returns, and maintaining a disciplined approach is crucial for maximizing their impact on net worth.

Spending habits

Spending habits play a significant role in shaping Wajeeh Mahmood's net worth. Mahmood's spending patterns directly impact the accumulation and maintenance of his wealth. When he spends less than he earns, the surplus can be invested, increasing his net worth over time. Conversely, excessive spending can deplete his assets and reduce his overall financial standing.

For example, Mahmood's decision to purchase a luxurious yacht may provide him with immediate gratification, but it also represents a substantial expense that reduces his net worth. On the other hand, his choice to invest in a rental property generates passive income, increasing his net worth in the long run. These examples illustrate the cause-and-effect relationship between spending habits and net worth.

Understanding the connection between spending habits and net worth is crucial for effective wealth management. By controlling unnecessary expenses and prioritizing investments, Mahmood can optimize his financial growth. Practical applications of this understanding include creating a budget, tracking expenses, and seeking professional financial advice to make informed spending decisions.

In summary, spending habits are an integral component of Wajeeh Mahmood's net worth. Managing expenses wisely, investing surplus funds, and seeking professional guidance are essential practices for preserving and growing wealth. Understanding the relationship between spending habits and net worth empowers individuals to make informed financial decisions that support their long-term financial goals.

Financial goals

Financial goals are an intrinsic aspect of Wajeeh Mahmood's net worth, influencing his financial decision-making and long-term wealth accumulation strategies. These goals provide direction, purpose, and motivation to his financial endeavors.

- Retirement planning

Mahmood's retirement goals involve securing his financial future by accumulating sufficient assets and investments to maintain his desired lifestyle after leaving the workforce. These goals shape his savings, investment strategies, and risk tolerance.

- Wealth creation

Mahmood's wealth creation goals focus on increasing his net worth through strategic investments, business ventures, and asset appreciation. These goals drive his pursuit of growth opportunities and financial independence.

- Estate planning

Mahmood's estate planning goals ensure the orderly transfer of his wealth upon his passing. They involve creating a will or trust to distribute his assets according to his wishes and minimize estate taxes.

- Philanthropy

Mahmood's philanthropic goals align his financial resources with his values and desire to contribute to social causes. These goals involve charitable giving, supporting non-profit organizations, and investing in community development projects.

In summary, Wajeeh Mahmood's financial goals encompass a range of objectives, including retirement planning, wealth creation, estate planning, and philanthropy. These goals guide his financial decisions, motivating him to accumulate, preserve, and distribute his wealth in a manner consistent with his values and long-term aspirations.

Risk tolerance

Risk tolerance plays a pivotal role in shaping Wajeeh Mahmood's net worth, influencing his investment decisions and overall financial strategy. It refers to his willingness and capacity to withstand potential losses in pursuit of higher returns.

- Investment horizon

Mahmood's investment horizon, or the time frame over which he plans to hold investments, impacts his risk tolerance. Longer horizons generally allow for greater risk tolerance as fluctuations can be absorbed over time.

- Financial goals

The specific financial goals Mahmood is pursuing, such as retirement planning or wealth creation, influence his risk tolerance. Goals with longer time horizons and higher return requirements may warrant a higher risk tolerance.

- Income stability

Mahmood's income stability affects his ability to tolerate risk. Stable income sources provide a buffer against potential losses, enabling him to take on more risk in investments.

- Psychological factors

Mahmood's personal risk tolerance is also influenced by psychological factors, such as his emotional resilience and ability to handle setbacks. Some individuals are naturally more risk-averse than others.

Understanding Mahmood's risk tolerance is essential for assessing the potential trajectory of his net worth. A higher risk tolerance may lead to greater investment returns, but also exposes him to more potential losses. Conversely, a lower risk tolerance may result in more conservative investments, potentially limiting returns but preserving capital. Balancing risk and return is crucial for Mahmood to achieve his financial goals while managing his risk exposure effectively.

Tax implications

Tax implications play a significant role in determining Wajeeh Mahmood's net worth. Taxes are levied on various sources of income, including business profits, investments, and property ownership. The amount of tax he owes directly affects his net worth, as it reduces his disposable income and available assets.

For example, if Mahmood's business generates $1 million in profit, he may be liable to pay a substantial amount in corporate taxes. This reduces his business's net income and, consequently, his overall net worth. Similarly, if he sells a property for a profit, he may incur capital gains tax, further impacting his net worth.

Understanding the tax implications of financial decisions is crucial for wealth management. Mahmood must consider the tax consequences before making investment or business decisions. Tax-efficient strategies, such as utilizing tax-advantaged accounts or investing in tax-efficient assets, can help minimize his tax liability and preserve his net worth.

In summary, tax implications are a critical component of Wajeeh Mahmood's net worth, as they directly affect the amount of wealth he accumulates and retains. By understanding and managing tax implications effectively, he can optimize his financial strategies and maximize his net worth.

Estate planning

Estate planning is a crucial aspect of managing Wajeeh Mahmood's net worth as it ensures the orderly transfer and distribution of wealth after his passing. It involves creating legal documents and strategies to minimize taxes, avoid probate, and fulfill personal wishes.

- Last Will and Testament

A legal document that outlines the distribution of assets, appointment of an executor, and guardianship of minor children.

- Trusts

Legal entities that hold and manage assets for beneficiaries, providing tax advantages and privacy.

- Probate Avoidance

Strategies to minimize or eliminate the legal process of probate, reducing costs and delays in distributing assets.

- Charitable Giving

Incorporating charitable donations into estate plans, reducing tax liability and supporting causes.

Estate planning is essential for protecting Mahmood's wealth and ensuring his wishes are carried out after his passing. By implementing these strategies, he can ensure a smooth transfer of assets, minimize tax burdens, and leave a lasting legacy.

Frequently Asked Questions

This section addresses common questions and clarifies aspects related to Wajeeh Mahmood's net worth.

Question 1: How is Wajeeh Mahmood's net worth calculated?Mahmood's net worth is calculated by subtracting his liabilities (debts and obligations) from his assets (cash, investments, properties, etc.).

Question 2: What is the primary source of Mahmood's wealth?Mahmood's primary source of wealth is his successful business ventures, including real estate, technology, and investments.

Question 3: How has Mahmood's net worth changed over time?Mahmood's net worth has grown significantly over the years due to successful investments, business expansion, and asset appreciation.

Question 4: What are some of Mahmood's most notable investments?Mahmood has made notable investments in real estate, stocks, venture capital, and philanthropic initiatives.

Question 5: How does Mahmood manage his wealth?Mahmood manages his wealth through a team of financial advisors who handle investments, tax planning, and estate planning.

Question 6: What is Mahmood's estimated net worth?Mahmood's net worth is estimated to be in the billions, making him one of the wealthiest individuals in his industry.

These FAQs provide insights into the various aspects of Wajeeh Mahmood's net worth, highlighting his successful ventures and strategic financial management. Understanding these aspects is crucial for comprehending the factors contributing to his immense wealth.

The next section will delve into the factors that have influenced Mahmood's financial success, exploring his entrepreneurial journey and investment strategies.

Tips for Building a Strong Financial Foundation

This section provides actionable tips to assist individuals in building a strong financial foundation. By implementing these strategies, readers can enhance their financial well-being and achieve their long-term financial goals.

Tip 1: Create a budget: Track income and expenses to identify areas for savings and responsible spending.

Tip 2: Reduce debt: Prioritize paying off high-interest debt to improve cash flow and credit score.

Tip 3: Save regularly: Establish a consistent savings plan to accumulate funds for emergencies, investments, and future goals.

Tip 4: Invest wisely: Diversify investments across asset classes and consider professional advice to maximize returns.

Tip 5: Build an emergency fund: Set aside savings to cover unexpected expenses and avoid financial setbacks.

Tip 6: Seek professional guidance: Consult with financial advisors for personalized advice and support in navigating complex financial decisions.

Tip 7: Educate yourself: Continuously learn about personal finance, investing, and wealth management to make informed choices.

Tip 8: Stay disciplined: Maintain consistency in implementing these tips over time to achieve lasting financial success.

By following these tips, individuals can establish a solid financial foundation, secure their financial future, and achieve their financial aspirations.

These tips complement the insights provided in the previous sections, emphasizing practical steps to enhance financial well-being. The concluding section will provide additional strategies and considerations for long-term financial success.

Conclusion

This comprehensive analysis of Wajeeh Mahmood's net worth has revealed several key insights. Firstly, his wealth is primarily attributed to successful business ventures, wise investments, and a strategic approach to financial management. Secondly, understanding the components of his net worth, such as income sources, assets, and liabilities, provides a holistic view of his financial health. Thirdly, tax implications, estate planning, and risk tolerance play crucial roles in shaping his financial trajectory.

These insights underscore the complexity of wealth management and the importance of considering various factors when evaluating an individual's financial standing. By understanding the interplay between these factors, we gain a deeper appreciation for the strategies and decisions that have contributed to Wajeeh Mahmood's remarkable net worth.

- How To Make Water Breathing Potion In

- David Foster Net Worth From Grammy Winning

- Tony Hawk Net Worth A Closer Look

- Benoni Woman Shows R4 000 Grocery Haul

- Does Robert Ri Chard Have A Wife

Wajeeh Mahmood Age, Biography, Family, Net Worth In 2020

Wajeeh Mahmood Wiki

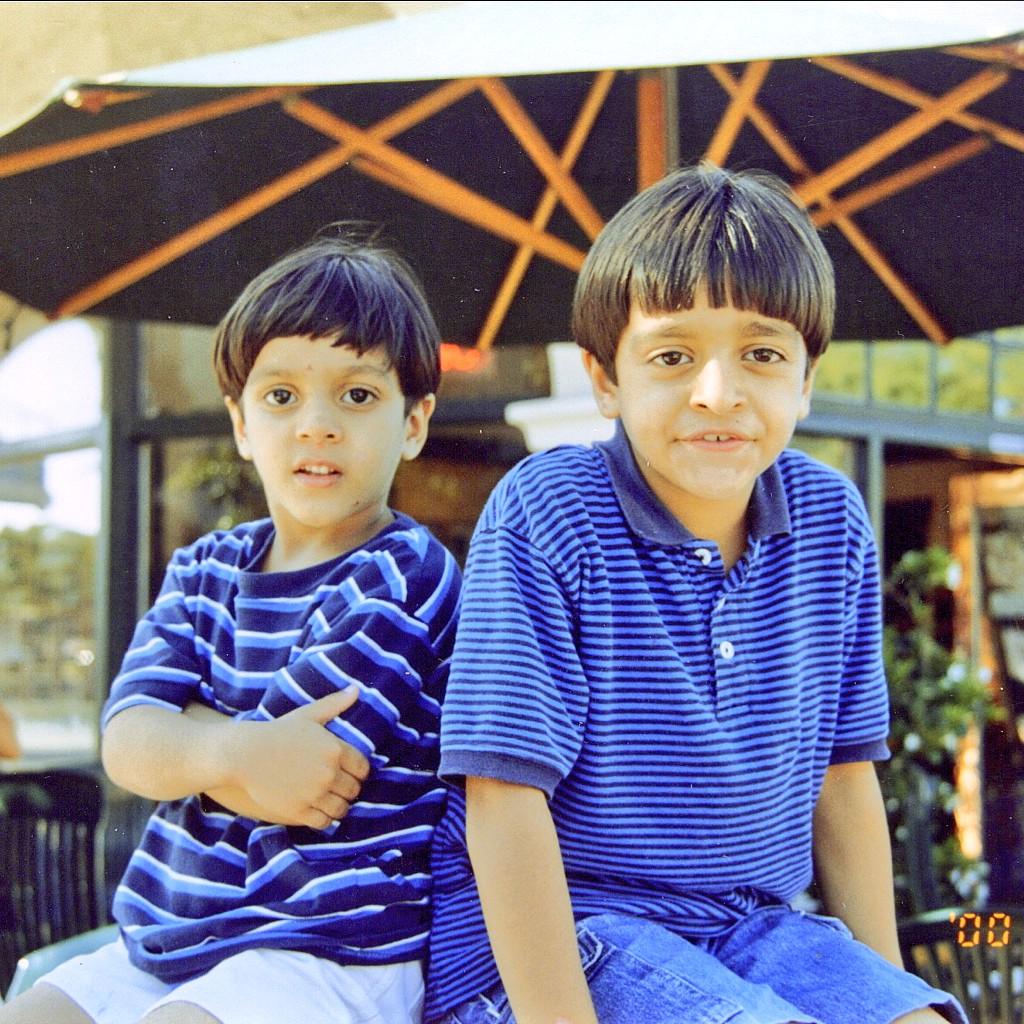

Wajeeh Mahmood on Twitter "A little throwback for the day lol