How To Unlock Walter Ostanek's Net Worth Secrets For Financial Success

Walter Ostanek Net Worth is a measure of the total value of the assets owned by the individual, minus any liabilities owed. For example, if Walter Ostanek owns assets worth $10 million and has liabilities of $2 million, his net worth would be $8 million.

Net worth is an important financial metric as it provides a snapshot of an individual's financial health. It can be used to track progress towards financial goals, compare financial performance to others, and make informed decisions about investments and spending.

The concept of net worth has been around for centuries, but it was not until the 20th century that it became a widely used financial metric. The increasing complexity of the modern financial system has made it more important than ever to track net worth as a way to manage personal finances effectively.

- Bad Bunny Used To Make Mix Cds

- Matthew Cassina Dies In Burlington Motorcycle Accident

- New Roms Xci Nsp Juegos Nintendo Switch

- Noah Pc3a9rez Chris Perez Son Age

- How Tall Is Markiplier The Truth About

Walter Ostanek Net Worth

Walter Ostanek's net worth is a measure of his financial health. It is calculated by taking the total value of his assets and subtracting his liabilities. Net worth is an important metric because it provides a snapshot of an individual's financial situation at a given point in time.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Savings

- Debt

- Credit score

- Financial goals

- Estate plan

These factors all play a role in determining Walter Ostanek's net worth. By understanding these aspects, he can make informed decisions about his financial future.

Assets

Assets are a critical component of Walter Ostanek's net worth. They represent the value of everything he owns, from his home and car to his investments and savings. The more assets Walter Ostanek has, the higher his net worth will be.

- What Religion Is Daphne Oz And Is

- Woody Allen Net Worth 2023 What Are

- Earl Vanblarcom Obituary The Cause Of Death

- Meet Maya Erskine S Parents Mutsuko Erskine

- Is Duncan Crabtree Ireland Gay Wiki Partner

There are many different types of assets. Some assets, like cash and stocks, are relatively liquid, meaning they can be easily converted into cash. Other assets, like real estate and collectibles, are less liquid. However, all assets have the potential to increase in value over time, which can help to increase Walter Ostanek's net worth.

One of the most important things Walter Ostanek can do to increase his net worth is to invest in assets that have the potential to appreciate in value. For example, investing in a diversified portfolio of stocks and bonds can help Walter Ostanek to grow his wealth over time. Additionally, investing in real estate can be a good way to build equity and increase net worth.

Liabilities

Liabilities are a critical component of Walter Ostanek's net worth. They represent the amount of money he owes to others, such as banks, credit card companies, and other creditors. The higher Walter Ostanek's liabilities are, the lower his net worth will be.

There are many different types of liabilities. Some liabilities, like mortgages and car loans, are considered to be "good debt." This is because they are used to finance the purchase of assets that can appreciate in value over time. Other liabilities, like credit card debt and personal loans, are considered to be "bad debt." This is because they are often used to finance the purchase of depreciating assets or to cover unexpected expenses.

It is important for Walter Ostanek to carefully manage his liabilities. If he takes on too much debt, he may find it difficult to make his monthly payments. This can lead to late fees, damage to his credit score, and even bankruptcy. Additionally, high levels of debt can make it difficult for Walter Ostanek to save for the future and reach his financial goals.

One of the most important things Walter Ostanek can do to improve his net worth is to reduce his liabilities. He can do this by paying down his debt as quickly as possible and by avoiding taking on new debt. Additionally, Walter Ostanek can increase his net worth by increasing his assets. He can do this by investing in a diversified portfolio of stocks and bonds, and by building equity in his home.

Income

Income is a critical component of Walter Ostanek's net worth. It is the amount of money he earns from his job, investments, and other sources. The higher Walter Ostanek's income is, the higher his net worth will be.

There are many different ways to increase income. Some people choose to work more hours, while others choose to get a higher paying job. Additionally, Walter Ostanek can increase his income by investing in assets that generate income, such as stocks, bonds, and real estate.

One of the most important things Walter Ostanek can do to improve his net worth is to increase his income. He can do this by working harder, getting a higher paying job, or investing in income-generating assets. By increasing his income, Walter Ostanek can increase his net worth and achieve his financial goals.

Expenses

Expenses play a significant role in determining Walter Ostanek's net worth. They represent the amount of money he spends on various needs and wants, and can include essential costs like housing and food, as well as discretionary expenses like entertainment and travel. Understanding and managing expenses is crucial for maintaining a healthy financial position.

- Fixed Expenses

Fixed expenses are those that remain relatively constant from month to month, such as rent or mortgage payments, car payments, and insurance premiums. These expenses form the foundation of a budget and are essential for maintaining a stable financial situation.

- Variable Expenses

Variable expenses fluctuate from month to month, depending on usage or consumption. Examples include utilities, groceries, and entertainment. Managing variable expenses effectively can help individuals save money and improve their overall financial health.

- Discretionary Expenses

Discretionary expenses are those that are not essential for survival, but rather provide enjoyment or convenience. Examples include dining out, shopping, and travel. While discretionary expenses can enhance quality of life, it is important to monitor and control them to avoid overspending and debt.

- Unexpected Expenses

Unexpected expenses are those that arise suddenly and are not part of a regular budget. Examples include medical emergencies or car repairs. Having an emergency fund can help individuals cover these expenses without resorting to debt or compromising their financial stability.

By carefully tracking and managing expenses, Walter Ostanek can optimize his financial resources, reduce unnecessary spending, and increase his net worth over time. A well-planned budget that prioritizes essential expenses, minimizes discretionary spending, and prepares for unexpected events can help him achieve his financial goals and maintain a sound financial footing.

Investments

Investments are a crucial aspect of Walter Ostanek's net worth. They represent the portion of his assets that are allocated to growing wealth over time. By investing wisely, Walter Ostanek can potentially increase his net worth and achieve his financial goals.

- Stocks

Stocks represent ownership in publicly traded companies. When a company performs well, its stock price tends to rise, potentially increasing the value of Walter Ostanek's investment. However, stock prices can also fluctuate, so there is always some risk involved.

- Bonds

Bonds are loans that Walter Ostanek makes to governments or corporations. In return, he receives regular interest payments and the repayment of the principal when the bond matures. Bonds are generally considered less risky than stocks, but they also offer lower potential returns.

- Real Estate

Real estate refers to land and the buildings on it. Walter Ostanek can invest in real estate by purchasing properties directly or through real estate investment trusts (REITs). Real estate can provide both rental income and potential appreciation in value.

- Alternative Investments

Alternative investments include a wide range of assets such as commodities, hedge funds, and private equity. These investments can offer diversification and potentially higher returns, but they also come with higher risks.

The specific investments that Walter Ostanek chooses will depend on his risk tolerance, investment goals, and time horizon. By carefully selecting and managing his investments, he can increase his chances of achieving his financial objectives.

Savings

Savings play a critical role in Walter Ostanek's net worth. Savings represent the portion of his income that he sets aside for future use, rather than spending it on current expenses. By saving money, Walter Ostanek can accumulate wealth over time and increase his net worth.

The relationship between savings and net worth is direct and positive. The more Walter Ostanek saves, the higher his net worth will be. This is because savings are a component of assets, which are used to calculate net worth. Additionally, savings can be used to invest in income-generating assets, which can further increase net worth over time.

For example, if Walter Ostanek saves $1,000 per month and invests it in a diversified portfolio of stocks and bonds, he can expect to see his savings grow over time. This growth will contribute to an increase in his net worth. Conversely, if Walter Ostanek spends all of his income and does not save any money, his net worth will not increase.

Understanding the connection between savings and net worth is important for individuals who want to improve their financial health. By saving money and investing it wisely, individuals can increase their net worth and achieve their financial goals.

Debt

Debt is a critical component of Walter Ostanek's net worth. It represents the amount of money he owes to others, such as banks, credit card companies, and other creditors. The higher Walter Ostanek's debt is, the lower his net worth will be.

There are many different types of debt. Some debt, like mortgages and car loans, is considered to be "good debt." This is because it is used to finance the purchase of assets that can appreciate in value over time. Other debt, like credit card debt and personal loans, is considered to be "bad debt." This is because it is often used to finance the purchase of depreciating assets or to cover unexpected expenses.

It is important for Walter Ostanek to carefully manage his debt. If he takes on too much debt, he may find it difficult to make his monthly payments. This can lead to late fees, damage to his credit score, and even bankruptcy. Additionally, high levels of debt can make it difficult for Walter Ostanek to save for the future and reach his financial goals.

One of the most important things Walter Ostanek can do to improve his net worth is to reduce his debt. He can do this by paying down his debt as quickly as possible and by avoiding taking on new debt. Additionally, Walter Ostanek can increase his net worth by increasing his assets. He can do this by investing in a diversified portfolio of stocks and bonds, and by building equity in his home.

Credit score

Credit score is a numerical representation of an individual's creditworthiness, which plays a significant role in determining Walter Ostanek's net worth. A higher credit score indicates a lower risk of default, making it easier to obtain loans and other forms of credit at favorable interest rates. Conversely, a lower credit score can limit access to credit and result in higher interest charges.

- Payment history

This is the most important factor in determining a credit score. It measures how consistently an individual has made their loan and credit card payments on time. Late payments or missed payments can significantly damage a credit score.

- Amounts owed

This factor considers the amount of debt an individual has relative to their available credit. Using too much of one's available credit can lower a credit score. It is generally recommended to keep credit utilization below 30%.

- Length of credit history

A longer credit history is generally seen as more favorable by lenders. It demonstrates that an individual has a track record of managing credit responsibly.

- New credit

Applying for multiple new lines of credit in a short period can lower a credit score. This is because it suggests that an individual may be taking on more debt than they can handle.

In conclusion, credit score is a multifaceted metric that is heavily influenced by factors such as payment history, amounts owed, length of credit history, and new credit. By understanding these factors and managing their credit responsibly, Walter Ostanek can improve his credit score and increase his net worth.

Financial goals

Financial goals are an integral part of Walter Ostanek's net worth. They represent his aspirations and plans for his financial future, and they serve as a roadmap for his financial decision-making. As Walter Ostanek works towards his financial goals, his net worth is likely to increase, reflecting his progress toward financial success.

- Retirement planning

Walter Ostanek's retirement planning goals will influence his net worth significantly. He needs to consider how much money he will need to save and invest to maintain his desired lifestyle in retirement. Factors such as his expected retirement age, life expectancy, and desired retirement income will play a role in determining his retirement savings goals.

- Education funding

If Walter Ostanek has children or plans to have children in the future, education funding will be an important financial goal. The cost of education continues to rise, so it is important to start saving early to ensure that he can afford to pay for his children's education.

- Homeownership

For many people, homeownership is a key financial goal. Walter Ostanek will need to save for a down payment and closing costs, as well as factor in the ongoing costs of homeownership, such as mortgage payments, property taxes, and insurance.

- Investment goals

Walter Ostanek's investment goals will also impact his net worth. He will need to consider his risk tolerance and time horizon when making investment decisions. His investment goals will help him determine how to allocate his assets and how much risk he is willing to take.

By setting clear financial goals and developing a plan to achieve them, Walter Ostanek can increase his net worth and secure his financial future. His financial goals will serve as a guide for his financial decisions and help him stay on track towards achieving his long-term financial objectives.

Estate plan

An estate plan is a crucial aspect of Walter Ostanek's net worth as it ensures the orderly distribution of his assets after his death. By having a well-defined estate plan, Walter Ostanek can protect his assets, minimize taxes, and ensure that his wishes are carried out.

- Will

A will is a legal document that outlines how Walter Ostanek's assets will be distributed after his death. It allows him to designate beneficiaries, appoint an executor, and specify any special instructions regarding his estate.

- Trust

A trust is a legal entity that holds and manages assets for the benefit of designated beneficiaries. Walter Ostanek can use a trust to avoid probate, minimize taxes, and provide for the ongoing management of his assets.

- Power of attorney

A power of attorney is a legal document that gives another person the authority to make decisions on Walter Ostanek's behalf in the event that he becomes incapacitated. This can be especially important for managing financial and healthcare decisions.

- Beneficiary designations

Beneficiary designations are instructions that Walter Ostanek can provide on retirement accounts, life insurance policies, and other financial accounts. These designations determine who will receive the proceeds of these accounts upon his death.

By incorporating these elements into his estate plan, Walter Ostanek can ensure that his assets are distributed according to his wishes, his taxes are minimized, and his loved ones are provided for after his death. A well-crafted estate plan can also help avoid probate, which can be a lengthy and costly process.

Frequently Asked Questions about Walter Ostanek Net Worth

This section addresses commonly asked questions and provides clear and concise answers to enhance your understanding of Walter Ostanek's net worth.

Question 1: How is Walter Ostanek's net worth calculated?

Walter Ostanek's net worth is calculated by subtracting his liabilities from his assets. Assets include cash, investments, and property, while liabilities include debts and loans.

Question 2: What factors contribute to Walter Ostanek's net worth?

Walter Ostanek's net worth is influenced by various factors, including his income, expenses, investments, and debt. Managing these factors effectively can help him increase his net worth over time.

Question 3: How can Walter Ostanek increase his net worth?

Walter Ostanek can increase his net worth by increasing his assets and reducing his liabilities. This can involve earning more income, investing wisely, and managing expenses carefully.

Question 4: What role does debt play in Walter Ostanek's net worth?

Debt can negatively impact Walter Ostanek's net worth by reducing his assets. High levels of debt can also lead to financial stress and make it more difficult to save and invest.

Question 5: How does Walter Ostanek's credit score affect his net worth?

A high credit score can benefit Walter Ostanek's net worth by giving him access to lower interest rates on loans and credit cards. This can save him money on interest payments and help him increase his net worth.

Question 6: Why is it important for Walter Ostanek to monitor his net worth?

Monitoring his net worth allows Walter Ostanek to track his financial progress and make informed decisions about his financial future. It can also help him identify areas for improvement and set financial goals.

These FAQs provide key insights into the factors that influence Walter Ostanek's net worth and the importance of managing his finances effectively. Understanding these concepts can empower Walter Ostanek to make informed decisions and achieve his financial objectives.

In the next section, we will delve deeper into the strategies Walter Ostanek can employ to increase his net worth and secure his financial well-being.

Tips to Increase Walter Ostanek's Net Worth

This section provides actionable tips that Walter Ostanek can implement to increase his net worth and improve his financial well-being.

Tip 1: Increase Income: Explore opportunities to enhance earning potential through career advancement, side hustles, or investments that generate passive income.

Tip 2: Reduce Expenses: Analyze spending patterns and identify areas where expenses can be minimized. Consider negotiating lower bills, cutting unnecessary subscriptions, or adopting a more frugal lifestyle.

Tip 3: Invest Wisely: Allocate assets into a diversified portfolio of investments, such as stocks, bonds, or real estate. Consider consulting with a financial advisor for personalized guidance.

Tip 4: Manage Debt Effectively: Prioritize paying down high-interest debt and consolidate debts to secure lower interest rates. Avoid taking on unnecessary debt and maintain a healthy credit score.

Tip 5: Save Consistently: Establish a regular savings plan and set financial goals. Automate savings to ensure consistency and build wealth over time.

Following these tips can empower Walter Ostanek to increase his net worth, achieve financial stability, and secure his financial future.

The next section of this article will delve into strategies for long-term wealth management and financial planning, building upon the foundation established in this TIPS section.

Conclusion

The multifaceted nature of Walter Ostanek's net worth underscores the importance of financial literacy and prudent decision-making. By understanding the interplay between assets, liabilities, income, expenses, and other factors, individuals can harness strategies to increase their net worth and secure their financial well-being.

Key takeaways from this exploration include the significance of managing debt effectively, investing wisely, and cultivating a disciplined savings habit. These practices empower individuals to build wealth over time and safeguard their financial future. By implementing these strategies, Walter Ostanek can maximize his net worth and achieve his long-term financial goals.

- Julia Dweck Dead And Obituary Nstructor Willow

- Is Duncan Crabtree Ireland Gay Wiki Partner

- What Religion Is Daphne Oz And Is

- Layke Leischner Car Accident Resident Of Laurel

- Wiki Biography Age Height Parents Nationality Boyfriend

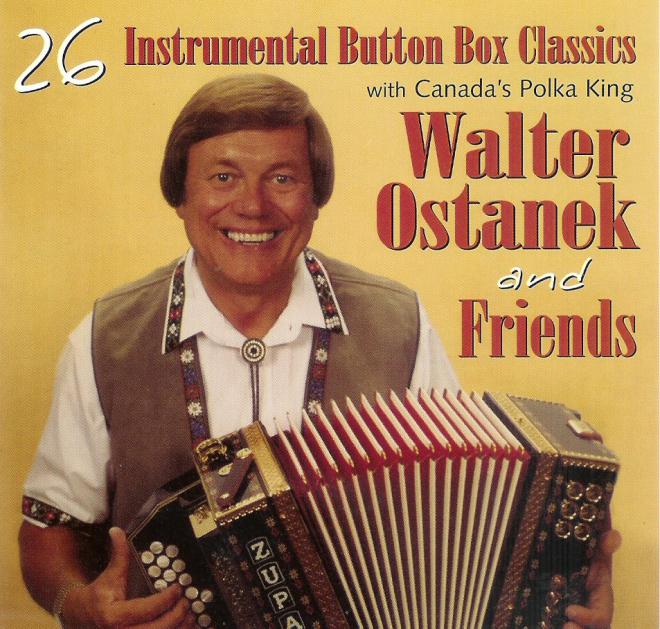

Walter Ostanek Net Worth 2024 Wiki Bio, Married, Dating, Family

Walter Ostanek, Canada's 'Polka King,' Now A Lottery King, Too

Canada’s polka king Walter Ostanek strikes it rich 620 CKRM The