Unlocking The Secrets Of Deion Sanders Wife's Net Worth: A Guide To Financial Success

Deion Sanders Wife Net Worth: The monetary value of all assets and liabilities held by Deion Sanders' wife.

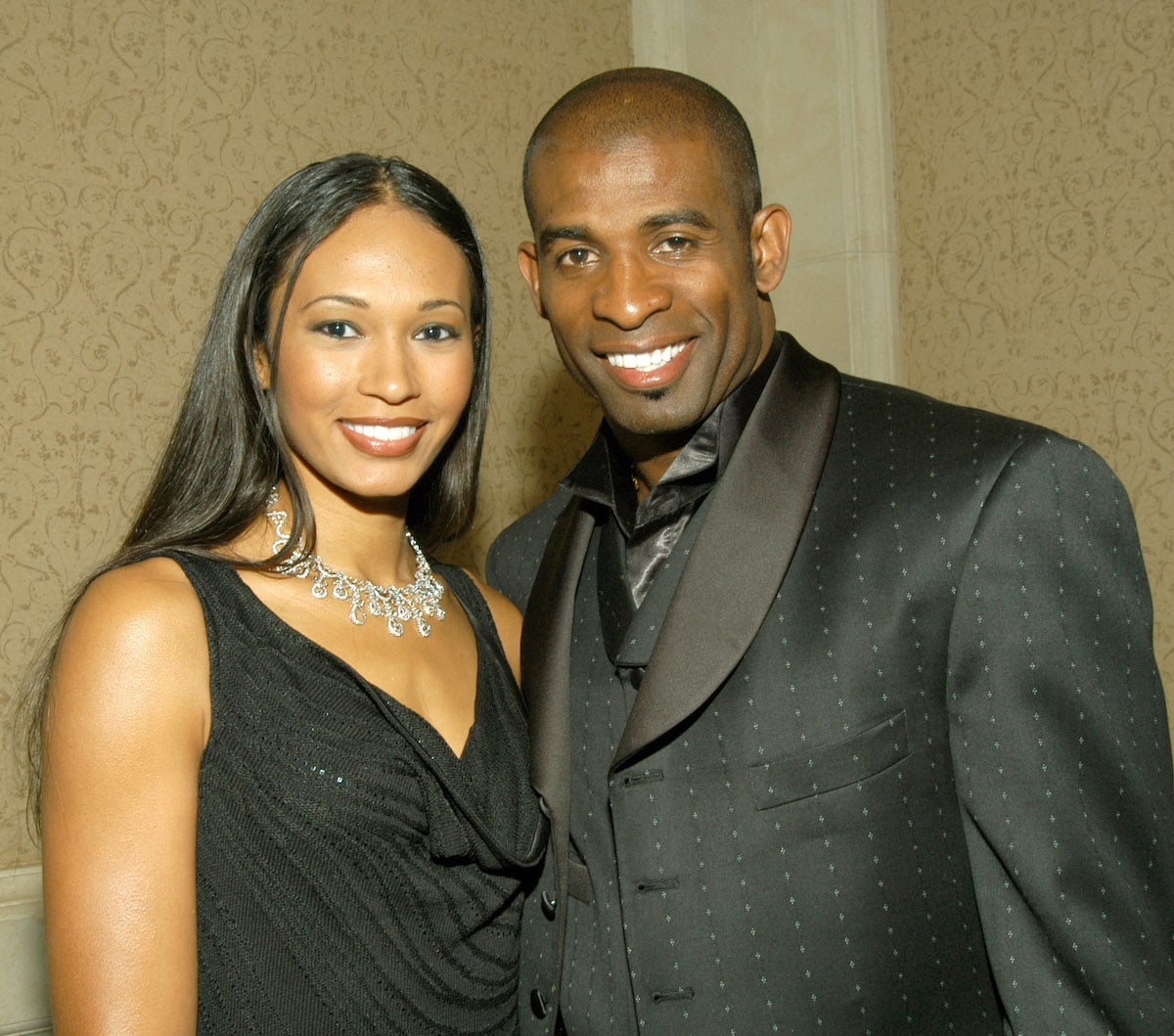

Example: Deion Sanders is a renowned football coach with an esteemed career. His wife's net worth is a subject of interest to many, reflecting the financial success achieved by the couple.

Relevance: Understanding the financial standing of prominent individuals can provide insights into wealth management strategies and economic trends. It also highlights the contributions of spouses in building and maintaining wealth.

- What Is Sonia Acevedo Doing Now Jamison

- Know About Camren Bicondova Age Height Gotham

- Who Is Jahira Dar Who Became Engaged

- Fun Fact Is Sydney Leroux Lesbian And

- Antony Varghese Wife Net Worth Height Parents

Deion Sanders Wife Net Worth

Comprehending the key aspects of Deion Sanders' wife's net worth is crucial for understanding her financial standing and the factors contributing to it.

- Assets

- Liabilities

- Income

- Investments

- Financial Management

- Expenses

- Estate Planning

- Tax Implications

These aspects provide insights into her wealth accumulation strategies, financial goals, and the overall financial health of the Sanders family. By analyzing these factors, we can better understand the financial landscape of high-profile individuals and the complexities of wealth management.

Assets

Assets are a crucial component of Deion Sanders' wife's net worth, representing the resources and valuables she owns that have monetary value. Understanding the types and value of her assets provides insights into her overall financial standing.

- Melissa Kaltveit Died Como Park Senior High

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Julia Dweck Dead And Obituary Nstructor Willow

- Wwe Billy Graham Illness Before Death Was

- Noah Pc3a9rez Chris Perez Son Age

- Cash and Cash Equivalents: Liquid assets readily convertible to cash, including checking and savings accounts, money market accounts, and short-term certificates of deposit.

- Real Estate: Residential and commercial properties owned for personal use, investment, or rental income.

- Investments: Stocks, bonds, mutual funds, and other financial instruments representing ownership or debt in companies or governments.

- Personal Property: Valuable possessions such as jewelry, artwork, collectibles, and vehicles, which may have sentimental or monetary worth.

By assessing the value and composition of these assets, we can gain insights into her financial security, risk tolerance, and investment strategies. Analyzing asset allocation and performance can also provide valuable information about her financial management skills and long-term wealth accumulation goals.

Liabilities

Liabilities are a crucial aspect of Deion Sanders' wife's net worth, representing her financial obligations and debts. Understanding the types and value of her liabilities provides insights into her financial leverage, risk profile, and overall financial health.

- Outstanding Loans: Any unpaid balances on mortgages, personal loans, student loans, or other forms of debt, indicating her borrowing activity and repayment capacity.

- Credit Card Debt: Revolving debt from credit cards, reflecting her spending habits and ability to manage credit responsibly.

- Deferred Taxes: Taxes owed but not yet paid, providing insights into her tax planning strategies and potential future tax liabilities.

- Legal Obligations: Court-ordered payments such as child support, alimony, or judgments, indicating her legal responsibilities and financial commitments.

Analyzing the composition and value of these liabilities can provide valuable information about her financial obligations, risk tolerance, and long-term financial stability. High levels of debt relative to assets may indicate financial strain or aggressive borrowing, while manageable liabilities suggest prudent financial management and a strong financial foundation.

Income

Income plays a pivotal role in determining Deion Sanders' wife's net worth, representing the inflows of funds that contribute to her overall financial well-being. Understanding the various sources and components of her income provides valuable insights into her earning capacity and financial stability.

- Salary/Wages: Regular earnings from employment, reflecting her professional skills, experience, and industry. This can include base pay, bonuses, commissions, and other forms of compensation.

- Investments: Income generated from investments such as dividends, interest, and capital gains, indicating her investment portfolio's performance and risk tolerance.

- Business Income: Earnings from entrepreneurial ventures or self-employment, highlighting her business acumen and ability to generate revenue from personal endeavors.

- Other Income: Miscellaneous sources of income such as royalties, annuities, or inheritance, providing additional streams of revenue and diversifying her financial portfolio.

Analyzing the composition and stability of these income streams offers insights into her financial resilience, earning potential, and long-term wealth accumulation strategies. Consistent and diversified income sources contribute to a strong financial foundation and enhance her overall net worth.

Investments

Investments play a crucial role in shaping Deion Sanders' wife's net worth. As an essential component of her overall financial portfolio, investments offer the potential for substantial wealth accumulation and long-term financial growth.

Deion Sanders' wife has reportedly made strategic investments in various asset classes, including stocks, bonds, and real estate. These investments generate passive income through dividends, interest, and rental income, respectively. By diversifying her investment portfolio, she mitigates risk and enhances the stability of her net worth.

Furthermore, investments can contribute to Deion Sanders' wife's financial security during market downturns and unexpected events. A well-balanced investment strategy helps preserve capital and provides a buffer against potential losses. It also aligns with long-term financial goals, such as retirement planning and intergenerational wealth transfer.

Understanding the connection between investments and Deion Sanders' wife's net worth highlights the importance of financial literacy and prudent investment decision-making. By leveraging investment opportunities and managing risk effectively, individuals can enhance their financial well-being and secure their long-term financial goals.

Financial Management

Financial Management is a crucial aspect of Deion Sanders' wife's net worth management. It encompasses various strategies and techniques employed to preserve and grow her financial resources.

- Budgeting: Creating and adhering to a budget helps track income and expenses, ensuring responsible spending and preventing overexpenditure.

- Saving: Setting aside a portion of income for future needs, emergencies, or long-term goals like retirement.

- Investing: Allocating funds into various investment vehicles to generate passive income and potentially grow wealth over time.

- Tax Planning: Implementing strategies to minimize tax liabilities and optimize financial returns.

Effective Financial Management enables Deion Sanders' wife to maintain financial stability, achieve her financial goals, and make informed decisions about her financial future. It empowers her to navigate financial challenges, capitalize on opportunities, and ultimately preserve and enhance her net worth.

Expenses

Expenses are a pivotal component of Deion Sanders' wife's net worth, representing the outflow of funds that impact her overall financial standing. Understanding the nature and composition of her expenses provides insights into her financial priorities, spending habits, and long-term financial goals.

Deion Sanders' wife's expenses can be categorized into various types, including living expenses, discretionary expenses, and financial obligations. Living expenses encompass essential outlays such as housing, food, transportation, and healthcare. Discretionary expenses, on the other hand, are non-essential expenses that enhance her lifestyle, such as entertainment, travel, and personal care. Additionally, financial obligations include debt repayments, taxes, and insurance premiums, which are crucial for maintaining financial stability.

Managing expenses effectively is central to preserving and growing Deion Sanders' wife's net worth. By optimizing living expenses, making conscious choices about discretionary spending, and prioritizing financial obligations, she can maximize her savings and investments. This, in turn, contributes to her overall financial well-being and supports her long-term financial goals.

Estate Planning

Estate Planning is a critical aspect of Deion Sanders' wife's net worth management, as it ensures the orderly distribution of her assets upon her passing and minimizes potential conflicts or legal challenges.

- Wills and Trusts: Legal documents that outline the distribution of assets after death, allowing for specific bequests and the establishment of trusts for beneficiaries.

- Power of Attorney: Grants legal authority to a designated individual to manage financial and healthcare decisions in the event of her incapacity.

- Advance Directives: Provide instructions regarding end-of-life care, such as medical treatments and preferences for life support.

- Tax Planning: Strategies to minimize estate taxes and optimize the transfer of wealth to beneficiaries, preserving her net worth for future generations.

Effective Estate Planning ensures that Deion Sanders' wife's wishes are respected, her assets are distributed according to her intentions, and her legacy is preserved. It provides peace of mind and helps protect her family from financial and legal burdens during a difficult time.

Tax Implications

Within the realm of "Deion Sanders Wife Net Worth," tax implications hold significant sway, influencing the overall financial standing and decision-making processes.

- Taxable Income: Identifying the sources and amounts of income subject to taxation is crucial, as it directly impacts the overall tax liability. This includes understanding various income types, deductions, and exemptions.

- Tax Rates: Applicable tax rates vary depending on income levels and tax brackets. Comprehending the progressive nature of tax rates is essential for accurate tax calculations and financial planning.

- Tax Credits and Deductions: Utilizing available tax credits and deductions can significantly reduce the tax liability. Understanding the eligibility criteria and limitations of these provisions is key to maximizing tax savings.

- Estate and Gift Taxes: Planning for the transfer of wealth upon death or through gifting requires careful consideration of estate and gift taxes. Implementing strategies to minimize these taxes can preserve the net worth for future generations.

Navigating the complexities of tax implications requires a comprehensive understanding of tax laws and regulations. By proactively managing tax liabilities and seeking professional guidance when necessary, Deion Sanders' wife can optimize her financial position, safeguard her net worth, and ensure compliance with tax obligations.

Frequently Asked Questions

This FAQ section addresses common queries and clarifies key aspects of "Deion Sanders Wife Net Worth," providing concise answers to anticipated questions.

Question 1: What is included in Deion Sanders' wife's net worth?

Deion Sanders' wife's net worth encompasses her assets, including cash, investments, real estate, and personal property, minus any outstanding liabilities such as debts and loans.

Question 2: How does Deion Sanders' wife generate income?

Her income streams may include earnings from employment, investments, business ventures, and other sources.

Question 3: What investment strategies does Deion Sanders' wife employ?

She may utilize a diversified portfolio of stocks, bonds, real estate, and alternative investments to generate passive income and grow her wealth.

Question 4: How does Deion Sanders' wife manage her expenses?

Effective expense management involves budgeting, prioritizing essential expenses, and making informed choices about discretionary spending.

Question 5: What tax implications affect Deion Sanders' wife's net worth?

Taxable income, applicable tax rates, and tax credits and deductions all impact her overall tax liability and net worth.

Question 6: How does Deion Sanders' wife plan for the future?

Estate planning strategies such as wills, trusts, and advance directives ensure the distribution of her assets according to her wishes and minimize potential conflicts.

These FAQs provide insights into the various components and considerations that shape Deion Sanders' wife's net worth, highlighting the importance of financial management and planning for long-term financial well-being.

Stay tuned for the next section, where we delve deeper into the financial strategies and investment choices employed by Deion Sanders' wife.

Tips for Managing and Growing Your Net Worth

This section provides practical tips to help you effectively manage and grow your net worth, inspired by the strategies employed by Deion Sanders' wife.

Tip 1: Track your income and expenses: Create a budget to monitor your cash flow and identify areas for savings.

Tip 2: Invest for the long term: Diversify your investments across asset classes and consider a buy-and-hold strategy.

Tip 3: Seek professional financial advice: Consult with a qualified financial advisor for personalized guidance and investment recommendations.

Tip 4: Reduce unnecessary expenses: Evaluate your spending habits and eliminate non-essential expenses to increase savings.

Tip 5: Enhance your earning potential: Invest in education, skill development, or starting a side hustle to increase your income streams.

Tip 6: Plan for retirement early: Begin contributing to retirement accounts and consider tax-advantaged savings options.

Tip 7: Manage debt wisely: Prioritize high-interest debt repayment and consider debt consolidation to reduce interest charges.

Tip 8: Protect your assets: Obtain adequate insurance coverage, including health, disability, and property insurance, to safeguard your financial well-being.

By implementing these tips, you can take proactive steps towards building and preserving your wealth, ensuring your long-term financial stability and success.

In the concluding section of this article, we will delve into the importance of estate planning and legacy building, highlighting strategies to ensure the preservation and transfer of wealth for future generations.

Conclusion

This comprehensive exploration of "Deion Sanders Wife Net Worth" unveils the multifaceted nature of wealth management and the strategies employed to preserve and grow financial resources. Understanding the interplay between assets, liabilities, income, investments, and expenses provides a roadmap for effective financial management and long-term financial well-being.

Key takeaways include the significance of financial planning, the power of strategic investments, and the importance of managing expenses wisely. By implementing these principles, individuals can emulate the financial acumen of Deion Sanders' wife and work towards building and sustaining their own financial legacy.

- David Foster Net Worth From Grammy Winning

- Who Is Jay Boogie The Cross Dresser

- Simona Halep Early Life Career Husband Net

- Wwe Billy Graham Illness Before Death Was

- Who Is Natalie Tene What To Know

Deion Sanders Drove His Car Off a Cliff and Survived During His Divorce

Deion Sanders' Two Divorces Led Him to a Woman Worth a Fortune

Deion Sanders' ExWife Pilar and Boyfriend J Prince May Be Engaged as