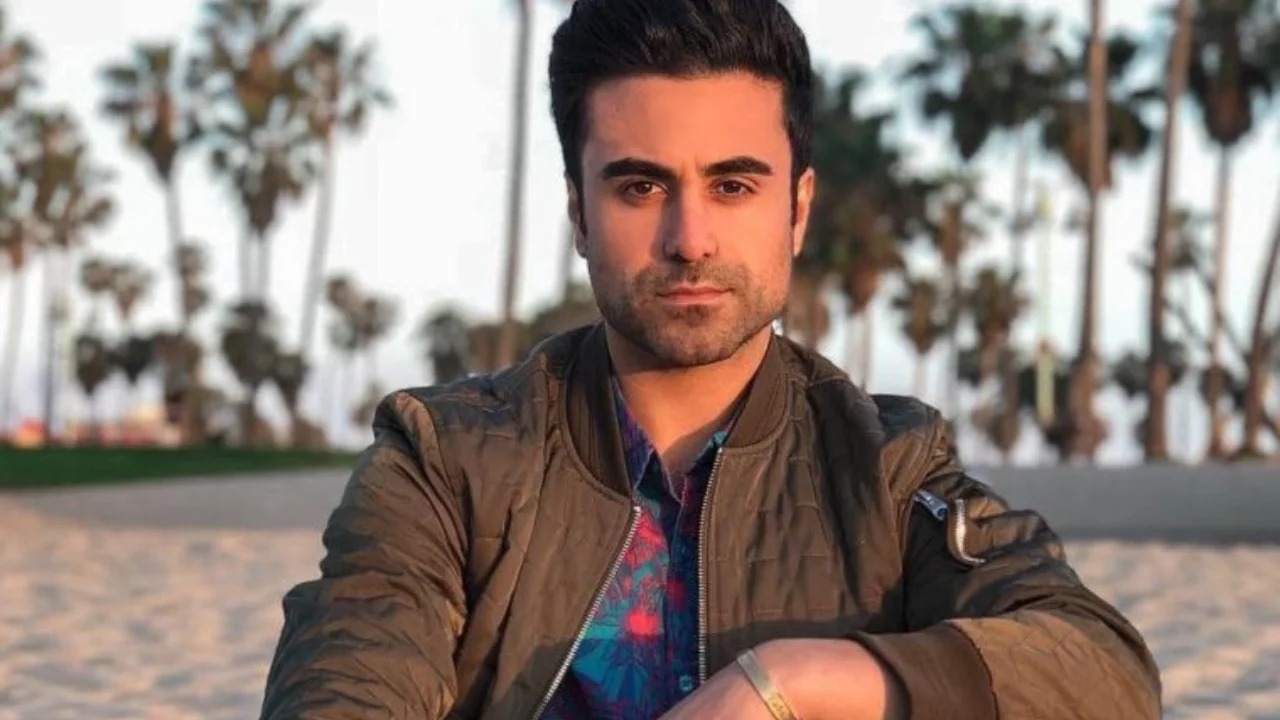

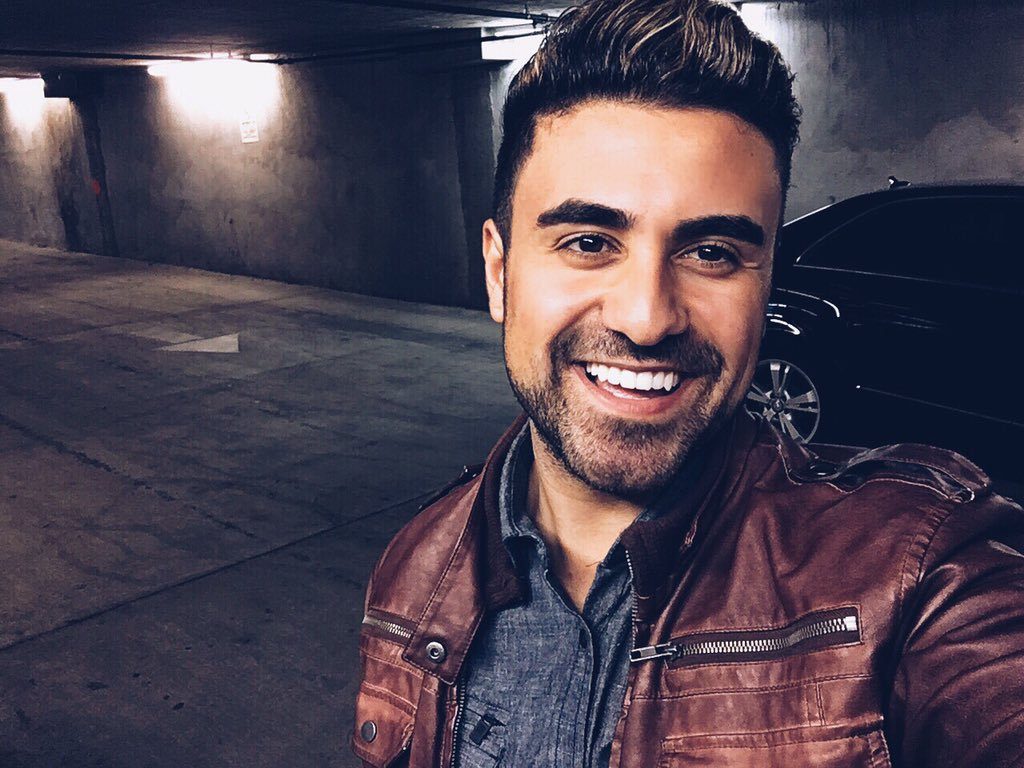

How To Grow Your Net Worth Like George Janko: Tips For Success

George Janko Net Worth refers to the monetary value of all of the assets, investments, and possessions owned by the YouTuber, minus any liabilities or debts. For instance, if Janko owns $10 million in assets and has $5 million in debts, his net worth would be $5 million.

Evaluating net worth is crucial for understanding an individual's or organization's financial standing. It provides insights into their overall wealth, stability, and ability to meet obligations. Historically, calculating net worth has been a standard practice in financial planning and accounting.

In this article, we will explore George Janko's net worth, examining his income sources, investments, and financial strategies. We will also analyze the factors that have contributed to his wealth and discuss the lessons that can be learned from his financial success.

- What Is Sonia Acevedo Doing Now Jamison

- Know About Camren Bicondova Age Height Gotham

- How To Make Water Breathing Potion In

- Melissa Kaltveit Died Como Park Senior High

- Chris Brown Net Worth Daughter Ex Girlfriend

George Janko Net Worth

Understanding the essential aspects of George Janko's net worth provides valuable insights into his financial success and overall wealth management strategies.

- Income sources: YouTube, sponsorships, merchandise

- Investments: Stocks, real estate, venture capital

- Assets: House, cars, jewelry

- Liabilities: Mortgages, loans

- Tax obligations: Income tax, capital gains tax

- Financial planning: Retirement savings, investment strategies

- Wealth management: Advisors, accountants, lawyers

- Lifestyle expenses: Travel, entertainment, luxury goods

- Charitable giving: Donations, philanthropy

- Net worth growth: Historical trends, future projections

These aspects are interconnected and play a crucial role in determining Janko's financial well-being. For instance, his income sources generate the cash flow needed to cover expenses and make investments. Investments, in turn, have the potential to increase his net worth over time. Additionally, effective financial planning and wealth management are essential for preserving and growing his wealth. Understanding these aspects provides a comprehensive view of George Janko's net worth and the factors that have contributed to his financial success.

Income sources

The connection between George Janko's income sources and his net worth is direct and significant. As a YouTuber, he generates revenue through advertising, sponsorships, and merchandise sales. These income streams contribute directly to his overall wealth.

- Does Robert Ri Chard Have A Wife

- Bad Bunny Used To Make Mix Cds

- Officer Nicholas Mcdaniel Died A Life Of

- How Tall Is Markiplier The Truth About

- Who Is Miranda Rae Mayo Partner Her

YouTube advertising revenue is based on the number of views, engagement, and demographics of his audience. Sponsorships involve partnerships with brands that pay Janko to promote their products or services within his videos. Merchandise sales, such as branded clothing and accessories, provide an additional revenue stream.

For example, in 2021, Janko's YouTube channel had over 2 million subscribers and generated millions of views per month. This substantial reach and engagement allowed him to secure lucrative sponsorship deals and launch successful merchandise lines. As a result, his income from these sources played a significant role in increasing his net worth.

Understanding the connection between income sources and net worth is crucial for financial planning and wealth management. By diversifying his income streams, Janko reduces his reliance on any single source and increases his overall financial stability. Additionally, he can reinvest his earnings from these sources into long-term investments, such as stocks or real estate, further contributing to his net worth growth.

Investments

Investments in stocks, real estate, and venture capital play a critical role in shaping George Janko's net worth. These investments represent a significant portion of his overall wealth and have the potential to generate substantial returns over time.

Stocks, which represent ownership in publicly traded companies, offer the potential for capital appreciation and dividend income. Janko's investment portfolio likely includes a mix of stocks from various industries and sectors, providing diversification and reducing risk. Real estate, on the other hand, involves investing in properties such as residential homes, commercial buildings, or land. Real estate investments can generate rental income, capital appreciation, and tax benefits.

Venture capital, which involves investing in early-stage companies with high growth potential, can be a lucrative but risky investment. Janko may allocate a portion of his investment portfolio to venture capital to diversify his holdings and potentially generate significant returns if the startups he invests in succeed. Real-life examples include Janko's investments in the real estate development company, Janko Group, and the venture capital firm, Janko Ventures. These investments have contributed to his overall wealth and provide avenues for long-term growth.

Understanding the connection between investments and net worth is crucial for effective financial planning and wealth management. By investing a portion of his income, Janko grows his net worth over time and secures his financial future. His investments generate passive income, hedge against inflation, and provide potential for capital appreciation. This understanding can be applied to personal finance, as individuals can learn from Janko's investment strategies and allocate their own funds wisely.

Assets

Assets, such as a house, cars, and jewelry, are valuable possessions that contribute significantly to George Janko's net worth. These assets represent a store of wealth and can provide financial security and stability. The connection between assets and net worth is direct and substantial.

Firstly, owning a house is a major financial milestone and a significant asset. Janko's house represents a large portion of his net worth and provides him with a stable living environment. Additionally, real estate investments can appreciate in value over time, further increasing his net worth. Cars and jewelry, while not as significant as a house, are still valuable assets that contribute to Janko's overall wealth.

Understanding the relationship between assets and net worth is crucial for effective financial planning. By acquiring and managing assets wisely, individuals can increase their net worth and secure their financial future. Janko's approach to asset acquisition and management can serve as a model for others looking to build their wealth.

Liabilities

Liabilities, such as mortgages and loans, are financial obligations that can significantly impact George Janko's net worth. Understanding the nature and implications of these liabilities is crucial for assessing his overall financial health and wealth management strategies.

- Mortgage: A mortgage is a loan secured by real estate, typically a house or property. Janko may have a mortgage on his house, which represents a liability as he owes money to the lender until the loan is paid off. The value of the mortgage is deducted from his net worth, reducing his overall wealth.

- Personal loans: Personal loans are unsecured loans used for various purposes, such as debt consolidation, home renovations, or unexpected expenses. If Janko has any outstanding personal loans, the amount owed is considered a liability and reduces his net worth.

- Business loans: If Janko has invested in businesses or ventures that require financing, he may have business loans. These loans represent liabilities and affect his net worth based on the amount owed and the terms of the loan agreements.

- Credit card debt: Credit card debt is a common form of liability. If Janko carries a balance on his credit cards, the outstanding amount is considered a liability and reduces his net worth.

The presence and extent of liabilities can influence Janko's financial flexibility, investment decisions, and overall financial well-being. Managing liabilities effectively, such as paying down debt and negotiating favorable loan terms, is essential for preserving and growing net worth. By understanding the impact of liabilities, Janko can make informed financial decisions and maintain a strong financial foundation.

Tax obligations

Tax obligations, encompassing income tax and capital gains tax, play a significant role in George Janko's net worth. These taxes affect the overall value of his assets and income, impacting his financial standing and wealth management strategies.

- Income tax: Income tax is levied on Janko's earnings from various sources, including YouTube revenue, sponsorships, and investments. The amount of tax owed depends on his taxable income and the applicable tax rates. Higher income levels generally result in a greater tax liability, affecting his net worth.

- Capital gains tax: Capital gains tax is imposed on profits from the sale of assets such as stocks, real estate, or artwork. When Janko sells an asset for a higher price than its purchase price, he incurs capital gains tax on the difference. This tax liability can significantly impact his net worth, especially if he has a large portfolio of investments.

Tax obligations can influence Janko's financial decisions, such as investment strategies and asset allocation. Effective tax planning is essential for optimizing his net worth by reducing tax liabilities and maximizing after-tax returns. Understanding the implications of tax obligations provides valuable insights into Janko's overall financial management and wealth preservation strategies.

Financial planning, encompassing retirement savings and investment strategies, serves as a cornerstone for building and preserving George Janko's net worth. Effective financial planning enables Janko to secure his financial future, optimize his current income, and make informed decisions that contribute to long-term wealth accumulation.

Retirement savings, through vehicles such as 401(k) plans and IRAs, allow Janko to set aside a portion of his current income for future use. These contributions reduce his current tax liability and grow tax-deferred over time, providing a substantial nest egg for retirement. The value of his retirement savings directly contributes to his overall net worth, ensuring financial stability and peace of mind in his later years.

Investment strategies, such as diversifying his portfolio across various asset classes and risk levels, play a crucial role in growing Janko's net worth. By investing in stocks, bonds, real estate, or other assets, he aims to generate passive income and capital appreciation over time. The success of his investment strategies directly impacts his net worth, as positive returns increase the value of his assets, while losses can diminish it.

In summary, financial planning, retirement savings, and investment strategies are inseparable components of George Janko's net worth. By planning for the future, saving diligently, and investing wisely, Janko has built a solid financial foundation that supports his current lifestyle and ensures his long-term financial security.

Wealth management

Wealth management encompasses a range of professional services that play a crucial role in managing and preserving George Janko's net worth. These services include financial advice, tax planning, legal counsel, and investment management, each contributing to the overall health and sustainability of his financial portfolio.

- Financial Advisors

Financial advisors provide personalized guidance on investment strategies, risk management, and retirement planning. They help Janko develop a comprehensive financial plan that aligns with his goals and risk tolerance, ensuring that his wealth is managed effectively over the long term.

- Accountants

Accountants handle Janko's tax compliance and financial reporting. They ensure that his tax obligations are met accurately and efficiently, maximizing his after-tax income and minimizing potential legal issues. Accountants also provide valuable insights into his financial performance and cash flow, enabling him to make informed decisions.

- Lawyers

Lawyers assist Janko with legal matters related to his wealth, including estate planning, business contracts, and intellectual property protection. They ensure that his assets are protected and his legal interests are represented, safeguarding his net worth from potential legal disputes or financial losses.

- Investment Managers

Investment managers oversee Janko's investment portfolio, making strategic decisions to grow his wealth and meet his financial objectives. They conduct thorough research, analyze market trends, and manage risk to optimize returns while adhering to Janko's investment philosophy.

Wealth management is an ongoing process that requires a team of skilled professionals working in collaboration. By leveraging their expertise, Janko can navigate the complexities of wealth management, make informed financial decisions, and preserve and grow his net worth for the long term.

Lifestyle expenses

Lifestyle expenses, encompassing travel, entertainment, and luxury goods, offer a glimpse into how George Janko allocates his wealth and enjoys the fruits of his labor. These expenses reflect his personal preferences, spending habits, and overall approach to life, impacting his net worth in various ways.

- Travel: Janko's travels may include exotic destinations, luxury accommodations, and unique experiences. These expenses contribute to his enjoyment of life and can create lasting memories, but they can also represent a significant portion of his overall spending.

- Entertainment: Janko's entertainment expenses may include attending concerts, sporting events, or exclusive parties. These expenses provide him with relaxation and enjoyment, but they can also add up over time, influencing his net worth.

- Luxury goods: Janko may indulge in luxury goods such as designer clothes, high-end electronics, or collectible items. These purchases can reflect his taste and status but can also represent a substantial drain on his financial resources.

- Charitable giving: While not strictly a lifestyle expense, Janko's charitable contributions can impact his net worth. Donations to philanthropic causes align with his values and can provide tax benefits, potentially reducing his overall tax liability.

Lifestyle expenses, while providing personal satisfaction and enjoyment, can also influence Janko's financial trajectory. Striking a balance between indulging in these expenses and maintaining financial prudence is crucial for preserving and growing his net worth over the long term.

Charitable giving

Charitable giving, encompassing donations and philanthropic activities, plays a significant role in shaping George Janko's net worth and overall financial well-being. His generous contributions to various causes not only reflect his values but also impact his financial standing in several ways.

Firstly, charitable giving can reduce Janko's tax liability. Under current tax laws, individuals can deduct charitable contributions from their taxable income, potentially lowering their overall tax bill. This tax savings can, in turn, increase Janko's disposable income and contribute to his net worth.

Secondly, charitable giving can enhance Janko's public image and reputation. By supporting worthy causes and demonstrating a commitment to social responsibility, he can strengthen his brand and attract like-minded individuals and organizations. This positive publicity can indirectly benefit his business ventures and overall financial success.

Real-life examples of Janko's charitable giving include his support for organizations such as the American Red Cross, St. Jude Children's Research Hospital, and various local charities. Through monetary donations, fundraising initiatives, and personal involvement, he has made a meaningful impact on these causes.

Understanding the connection between charitable giving and net worth is crucial for effective financial planning and wealth management. By strategically allocating a portion of his income to charitable causes, Janko can not only make a positive social impact but also potentially optimize his tax liability and enhance his overall financial well-being.

Net worth growth

Understanding the historical trends and future projections of George Janko's net worth growth offers valuable insights into his overall financial trajectory and wealth management strategies. This aspect of his net worth provides a forward-looking perspective on the potential evolution of his financial standing.

- Income streams diversification: Janko has consistently expanded his income sources, reducing his reliance on any single revenue channel. This diversification strategy has contributed to the stability and growth of his net worth over time.

- Investment performance: Janko's investments in stocks, real estate, and venture capital have played a significant role in his net worth growth. The performance of these investments, influenced by market conditions and investment decisions, will continue to shape his future net worth.

- Lifestyle expenses management: Janko's spending habits and lifestyle choices can impact his net worth growth. Balancing personal expenses with saving and investing is crucial for maintaining and increasing his wealth over time.

- Tax planning and optimization: Effective tax planning can maximize Janko's after-tax income and minimize his tax liabilities. Understanding tax laws and implementing strategies to reduce tax burdens can contribute to his net worth growth.

Examining these facets provides a holistic view of the factors that have influenced Janko's net worth growth and the potential drivers of its future trajectory. By analyzing historical trends and making informed projections, Janko can make strategic decisions to preserve and grow his wealth, ensuring his long-term financial well-being.

FAQs about George Janko Net Worth

The following frequently asked questions provide concise answers to common queries and clarify key aspects related to George Janko's net worth.

Question 1: How much is George Janko's net worth?

As of 2023, George Janko's net worth is estimated to be around $20 million.

Question 2: What are the main sources of George Janko's income?

Janko's primary sources of income include his YouTube channel, sponsorships, merchandise sales, and investments.

Question 3: How has George Janko's net worth grown over time?

Janko's net worth has grown steadily over the years due to his successful YouTube career, smart investments, and strategic financial management.

Question 4: What is George Janko's investment strategy?

Janko invests in a diversified portfolio that includes stocks, real estate, and venture capital, seeking a balance between growth potential and risk management.

Question 5: How does George Janko manage his lifestyle expenses?

Janko maintains a balance between enjoying his wealth and saving and investing wisely, ensuring long-term financial stability.

Question 6: What are George Janko's philanthropic endeavors?

Janko supports various charitable causes and organizations, demonstrating his commitment to social responsibility and giving back to the community.

These FAQs provide a deeper understanding of the factors contributing to George Janko's net worth and his overall financial strategies. As we delve further into this topic, we will explore additional aspects influencing his wealth management and financial growth.

Tips for Growing and Managing Your Net Worth

Understanding how to grow and manage your net worth is crucial for building financial security and achieving long-term financial goals.

Tip 1: Diversify Your Income Streams: Don't rely on a single source of income. Explore multiple income streams to increase financial stability and reduce risk.

Tip 2: Invest Wisely: Invest in a mix of assets, such as stocks, bonds, and real estate, to spread risk and potentially grow your wealth.

Tip 3: Control Expenses: Track your expenses and identify areas where you can save money. Cutting unnecessary expenses can free up funds for saving and investing.

Tip 4: Plan for the Future: Set financial goals and create a plan to achieve them. Consider retirement savings, emergency funds, and long-term investments.

Tip 5: Seek Professional Advice: Consult with a financial advisor or tax professional for personalized guidance on managing your finances and optimizing your net worth.

By following these tips, you can take control of your financial future and build a solid foundation for long-term financial success.

In the next section, we will discuss strategies for protecting and preserving your net worth, ensuring its stability and growth over time.

Conclusion

George Janko's net worth serves as a testament to his entrepreneurial spirit, savvy investments, and prudent financial management. Through his successful YouTube channel, strategic partnerships, and well-diversified portfolio, he has built a substantial fortune that continues to grow.

Key insights from this exploration of "George Janko Net Worth" include the importance of:

- Diversifying income streams to reduce financial risk

- Investing wisely in a mix of assets for potential growth

- Managing expenses and planning for the future to ensure financial stability

Understanding these principles and applying them to your own financial journey can empower you to build wealth, secure your financial future, and create a legacy that extends beyond monetary value.

- Joe Kennedy Iii Religion Meet His Parents

- Singer Sami Chokri And Case Update As

- How To Make Water Breathing Potion In

- Know About Camren Bicondova Age Height Gotham

- Woody Allen Net Worth 2023 What Are

Janko’s biography age, height, parents, girlfriend Legit.ng

16 Extraordinary Facts About Janko

Janko Age, Birthday, Height, Net Worth, Family, Salary