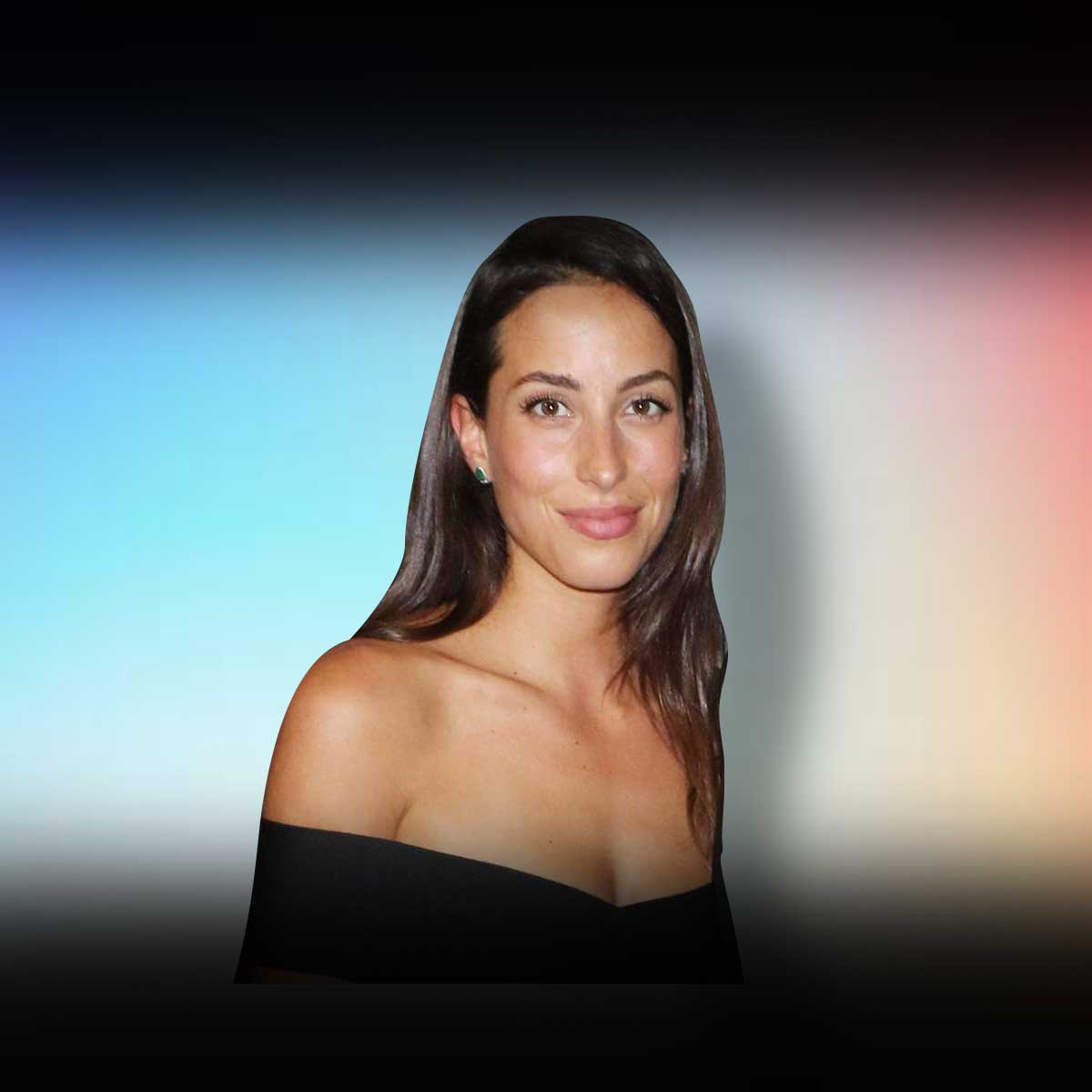

How Ines De Ramon Built Her Impressive Net Worth: Strategies And Investments

Ines De Ramon Net Worth refers to the combined value of the assets and income of Ines De Ramon, a person known in the entertainment industry. It encompasses her financial worth, including holdings in various forms such as cash, investments, and properties.

Determining an individual's net worth is significant in assessing their financial status and evaluating their overall wealth. It provides insights into their financial stability, investment acumen, and earning capacity. Historically, net worth has been a tool for financial analysis and has evolved over time to include complex calculations that consider factors beyond traditional assets.

This article will delve into the net worth of Ines De Ramon, examining her sources of income, assets, and lifestyle. It will provide an in-depth analysis of her financial standing and explore the factors that have contributed to her wealth.

- Patrick Alwyn Age Height Weight Girlfriend Net

- Singer Sami Chokri And Case Update As

- Anna Faris Net Worth Movies Career Lifestyle

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Mzansi Man Documents Sa Potholes Viral Tiktok

Ines De Ramon Net Worth

Understanding the essential aspects of Ines De Ramon's net worth is crucial for gaining a comprehensive view of her financial well-being. These aspects encompass various dimensions, providing insights into her sources of income, investment strategies, and overall wealth management.

- Income Sources

- Asset Allocation

- Investment Returns

- Property Holdings

- Business Ventures

- Endorsement Deals

- Lifestyle Expenses

- Tax Liabilities

- Estate Planning

- Philanthropic Contributions

Ines De Ramon's net worth is a reflection of her financial acumen and strategic planning. Her diverse income streams, coupled with savvy investments and a balanced approach to wealth management, have contributed to her substantial net worth. Additionally, her philanthropic efforts and estate planning measures showcase her commitment to responsible wealth distribution and legacy creation.

Income Sources

Income sources play a pivotal role in shaping Ines De Ramon's net worth. As the primary means of generating wealth, income sources determine the overall cash flow and financial resources available for investment, asset acquisition, and lifestyle expenses. Without a steady stream of income, it would be challenging to accumulate wealth and maintain a high net worth.

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Claudia Sampedro Wags Miami Age Engaged Husband

- What Is Sonia Acevedo Doing Now Jamison

- Carson Peters Berger Age Parents Mom Rape

- Meet Maya Erskine S Parents Mutsuko Erskine

Ines De Ramon's income sources are diverse, ranging from her professional earnings as an entrepreneur, investor, and brand ambassador to passive income streams such as dividends and rental income. Each source contributes to her overall net worth, allowing her to grow her wealth and maintain her financial stability.

Understanding the connection between income sources and net worth is crucial for anyone seeking to manage their finances effectively. By identifying and optimizing income streams, individuals can increase their net worth over time. Additionally, diversifying income sources can mitigate financial risks and provide a more stable financial foundation.

Asset Allocation

Asset allocation is a fundamental aspect of Ines De Ramon's net worth management strategy. It involves distributing her financial resources across different asset classes, such as stocks, bonds, real estate, and commodities. This diversification aims to reduce overall investment risk while potentially enhancing returns.

Asset allocation plays a critical role in determining Ines De Ramon's net worth by influencing the growth and stability of her investments. The careful selection and balancing of asset classes allow her to align her portfolio with her risk tolerance and financial goals. By diversifying her assets, she reduces the impact of market fluctuations on her overall wealth.

For instance, during periods of economic growth, Ines De Ramon may allocate a larger portion of her portfolio to stocks, which have the potential for higher returns. Conversely, in times of economic uncertainty, she may shift towards more conservative asset classes like bonds, which offer lower returns but provide stability.

Understanding the relationship between asset allocation and net worth is crucial for effective wealth management. By optimizing her asset allocation strategy, Ines De Ramon can maximize her investment returns, mitigate risks, and ultimately increase her net worth over time.

Investment Returns

Investment returns constitute a significant component of Ines De Ramon's net worth, influencing its growth and stability over time. These returns encompass the earnings generated from her investments in various asset classes, including stocks, bonds, real estate, and commodities.

- Capital Appreciation

Refers to the increase in the value of an investment over time, resulting in a higher selling price than the original purchase price. For instance, if Ines De Ramon invests in a stock that increases in value from $100 to $150, she realizes a capital appreciation of $50.

- Dividends and Interest

Passive income earned from certain investments, such as stocks and bonds. Dividends represent a portion of a company's profits distributed to shareholders, while interest is the regular payment made on bonds.

- Rental Income

Income generated from renting out properties owned by Ines De Ramon. This can be a steady stream of passive income, contributing to her overall net worth.

- Capital Gains

Profit earned from the sale of an investment at a price higher than its acquisition cost. Capital gains are typically realized when selling stocks, bonds, or real estate.

Investment returns play a crucial role in shaping Ines De Ramon's net worth by providing a source of income and capital appreciation. By diversifying her investments and making strategic allocation decisions, she optimizes her returns and minimizes risks. Ultimately, the effective management of investment returns contributes to the overall growth and preservation of her wealth.

Property Holdings

Property holdings represent a significant aspect of Ines De Ramon's net worth, contributing to her overall financial stability and long-term wealth. They encompass various types of real estate assets, each with its own unique characteristics and implications for her net worth.

- Residential Properties

Ines De Ramon's primary residence, as well as any additional houses, apartments, or vacation homes, fall under this category. These properties provide her with a place to live, while also having the potential to appreciate in value over time, contributing to her net worth.

- Investment Properties

Properties acquired specifically for generating rental income or capital gains. Ines De Ramon may own apartments, houses, or commercial buildings that she rents out to tenants, providing a steady stream of passive income and potential long-term appreciation.

The value of Ines De Ramon's property holdings fluctuates based on market conditions, rental income, and the overall real estate market. However, over the long term, real estate has historically been a stable and appreciating asset class, contributing to the growth and preservation of her net worth.

Business Ventures

Business ventures encompass a significant aspect of Ines De Ramon's net worth, contributing to her financial growth and diversification. These ventures involve entrepreneurial endeavors and investments in various business entities, each with its own unique characteristics and potential impact on her overall wealth.

- Equity Investments

Ines De Ramon may invest in stocks or shares of publicly traded companies, gaining ownership and potentially benefiting from capital appreciation and dividend income. These investments diversify her portfolio and contribute to her long-term wealth.

- Private Equity Investments

Ines De Ramon could invest in private companies, providing capital for growth and expansion. These investments offer the potential for higher returns but also carry greater risk compared to public equity investments.

- Start-up Investments

Investing in early-stage companies or startups allows Ines De Ramon to support innovative ventures with high growth potential. These investments involve a higher risk but also the possibility of substantial returns if the startups succeed.

The success and performance of Ines De Ramon's business ventures directly influence her net worth. Positive returns on her investments and successful exits from business ventures contribute to her overall wealth accumulation, while setbacks or underperforming ventures can impact her net worth.

Endorsement Deals

Endorsement deals are a significant component of Ines De Ramon's net worth, contributing to her income and enhancing her overall financial standing. These deals involve agreements between Ines De Ramon and companies or brands, where she promotes or endorses their products or services in exchange for compensation.

- Brand Partnerships

Ines De Ramon collaborates with reputable brands, promoting their products or services through various channels such as social media, personal appearances, and advertising campaigns. These partnerships leverage her influence and credibility to reach a wider audience, generating income and boosting her net worth.

- Product Endorsements

Ines De Ramon endorses specific products, showcasing their features and benefits to her followers. These endorsements can range from fashion and beauty products to lifestyle and travel brands, reflecting her personal style and interests. Product endorsements contribute directly to her income and enhance her net worth.

Endorsement deals play a crucial role in shaping Ines De Ramon's net worth by providing a steady stream of income and leveraging her influence to generate revenue. These deals not only contribute to her financial well-being but also enhance her brand value and overall recognition, further supporting her wealth accumulation efforts.

Lifestyle Expenses

Lifestyle expenses encompass the ongoing costs associated with maintaining a certain standard of living. Understanding the connection between lifestyle expenses and Ines De Ramon's net worth is crucial for assessing her overall financial well-being and wealth management strategy.

Lifestyle expenses can significantly impact Ines De Ramon's net worth, as they represent a drain on her financial resources. High spending on luxury goods, travel, entertainment, and other discretionary expenses can reduce her savings and investment capacity, potentially hindering the growth of her net worth. Conversely, prudent spending and budgeting can free up more funds for investment and wealth accumulation.

Some examples of lifestyle expenses that may affect Ines De Ramon's net worth include:

- Luxury fashion and accessories

- High-end dining and entertainment

- Exotic travel and vacations

- Personal care and grooming expenses

- Housing and utilities beyond basic needs

Managing lifestyle expenses effectively requires balancing personal preferences with long-term financial goals. By prioritizing essential expenses, minimizing discretionary spending, and seeking cost-effective alternatives, Ines De Ramon can optimize her net worth and achieve greater financial security.

Tax Liabilities

Tax liabilities play a significant role in shaping Ines De Ramon's net worth, representing her financial obligations to government entities. Understanding the components and implications of these liabilities is crucial for assessing her overall financial standing.

- Income Tax

Ines De Ramon is subject to income tax on her earnings from various sources, including business ventures, investments, and endorsement deals. The amount of income tax she owes depends on her taxable income and applicable tax rates.

- Property Tax

As a property owner, Ines De Ramon is responsible for paying property taxes on her residential and investment properties. These taxes are typically based on the assessed value of the properties.

- Capital Gains Tax

When Ines De Ramon sells assets such as stocks, bonds, or real estate for a profit, she may be liable for capital gains tax. The tax is calculated based on the difference between the sale price and the original purchase price.

- Sales Tax

Ines De Ramon is subject to sales tax when she purchases goods and services. The amount of sales tax she owes varies depending on the jurisdiction and the type of goods or services purchased.

Effectively managing tax liabilities is essential for Ines De Ramon to optimize her net worth. By utilizing tax-saving strategies, such as maximizing deductions and utilizing tax-advantaged investments, she can minimize her tax burden and preserve a larger portion of her wealth.

Estate Planning

Estate planning is a crucial aspect of Ines De Ramon's net worth management strategy, ensuring the preservation and distribution of her wealth according to her wishes and objectives. It involves a comprehensive approach to organizing and managing her assets, minimizing tax liabilities, and providing for her loved ones in the event of her passing.

- Will and Testament

A legal document that outlines Ines De Ramon's wishes regarding the distribution of her assets after her death, including the appointment of an executor to oversee the process.

- Trusts

Legal entities that hold and manage assets for the benefit of designated beneficiaries, providing flexibility and tax advantages in estate planning.

- Power of Attorney

A legal document that authorizes a designated individual to make financial and healthcare decisions on behalf of Ines De Ramon in the event of her incapacity.

- Charitable Giving

Incorporating charitable donations into her estate plan allows Ines De Ramon to support causes she cares about and potentially reduce her tax liability.

Through effective estate planning, Ines De Ramon can ensure that her wealth is preserved and distributed in accordance with her wishes, minimizing potential legal disputes and providing financial security for her family and loved ones. It is an essential component of her overall net worth management strategy, demonstrating her foresight and commitment to responsible wealth stewardship.

Philanthropic Contributions

Philanthropic contributions play a significant role in shaping Ines De Ramon's net worth and overall financial legacy. Her charitable endeavors not only reflect her values and commitment to giving back but also have tangible implications for her wealth management strategy.

- Support for Arts and Culture

Ines De Ramon's philanthropic efforts extend to supporting arts and cultural organizations, recognizing the transformative power of these institutions in society. Her contributions may include sponsoring exhibitions, funding scholarships for aspiring artists, or supporting local theaters and museums.

- Advocacy for Social Causes

Ines De Ramon leverages her platform and resources to advocate for social causes close to her heart. She may donate to organizations working to address issues such as poverty, homelessness, or environmental conservation, aligning her philanthropic efforts with her values and passions.

Philanthropic contributions can positively impact Ines De Ramon's net worth in several ways. By supporting charitable organizations, she can potentially reduce her tax liability through itemized deductions, allowing her to preserve a larger portion of her wealth. Additionally, her philanthropic efforts can enhance her public image and reputation, potentially leading to increased brand value and business opportunities.

FAQs on Ines De Ramon Net Worth

This section addresses frequently asked questions and clarifies key aspects of Ines De Ramon's net worth, providing insights into her wealth management strategies and financial standing.

Question 1: What is the primary source of Ines De Ramon's income?Ines De Ramon's income primarily stems from her entrepreneurial ventures, investments, and endorsement deals. She generates revenue through her business investments, brand collaborations, and product endorsements.

Question 2: How does Ines De Ramon's investment strategy contribute to her net worth?Ines De Ramon's investment strategy plays a crucial role in growing her net worth. She diversifies her investments across various asset classes, including stocks, bonds, and real estate, to optimize returns and mitigate risks, contributing to the overall growth of her wealth.

These FAQs provide a deeper understanding of Ines De Ramon's net worth, highlighting her diverse income streams, investment strategies, and wealth management practices.

In the following section, we will delve into a detailed analysis of Ines De Ramon's wealth management strategies, exploring her investment portfolio, asset allocation, and the impact of her lifestyle expenses on her net worth.

Tips for Maximizing Net Worth

This section provides actionable tips to help you optimize your net worth and achieve greater financial well-being.

Tip 1: Track Your Income and Expenses

Monitor your cash flow to identify areas where you can save and invest more.

Tip 2: Create a Budget

Plan your spending and allocate funds wisely to avoid overspending and manage debt effectively.

Tip 3: Invest for the Long-term

Start investing early and let compounding returns work in your favor. Consider a diversified portfolio of stocks, bonds, and real estate.

Tip 4: Reduce Unnecessary Expenses

Evaluate your lifestyle and identify non-essential expenses that can be cut or reduced to free up more funds for saving and investing.

Tip 5: Increase Your Income

Explore opportunities to earn additional income through a side hustle, part-time job, or career advancement.

Tip 6: Seek Professional Advice

Consult with a financial advisor to develop a personalized plan that aligns with your financial goals and risk tolerance.

Summary: These tips empower you to take control of your finances, optimize your net worth, and secure your financial future.

In the next section, we will delve into case studies of individuals who have successfully applied these principles to achieve financial success.

Conclusion

In this article, we explored the multifaceted components of "Ines De Ramon Net Worth," providing insights into her income sources, investment strategies, asset allocation, lifestyle expenses, and philanthropic contributions. Our analysis revealed the interconnectedness of these factors, emphasizing the importance of a holistic approach to wealth management.

Key takeaways include the significance of diversifying income streams, optimizing investment returns, and aligning lifestyle expenses with financial goals. Ines De Ramon's astute financial decisions and commitment to responsible wealth stewardship serve as a testament to the transformative power of sound financial management.

- Meet Maya Erskine S Parents Mutsuko Erskine

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Does Robert Ri Chard Have A Wife

- What Is Sonia Acevedo Doing Now Jamison

- Is Gerrit Cole Jewish Or Christian Ethnicity

Ines de Ramon's Net Worth From Personal Training to Luxury Jewelry

Ines de Ramon Age, Bio, Birthday, Family, Net Worth

Ines de Ramon Net Worth How Much Is Ines de Ramon Worth?