Unveiling Johnny Paycheck's Net Worth: A Comprehensive Guide

Johnny Paycheck At Death Net Worth refers to the financial value of the assets and liabilities of Johnny Paycheck, an American country music singer-songwriter, at the time of his death.

Determining the net worth of a deceased individual is essential for estate planning, tax purposes, and understanding the financial impact of their life and career. It involves assessing the value of all owned assets, such as real estate, investments, and personal property, and subtracting any outstanding debts or obligations.

In the case of Johnny Paycheck, his net worth at the time of his death provides insights into the financial legacy of a renowned country music icon. Exploring the details of his assets and liabilities sheds light on his financial management, earnings, and the impact of his career on his overall wealth.

- A Tragic Loss Remembering Dr Brandon Collofello

- Officer Nicholas Mcdaniel Died A Life Of

- Joe Kennedy Iii Religion Meet His Parents

- Antony Varghese Wife Net Worth Height Parents

- Does Robert Ri Chard Have A Wife

Johnny Paycheck At Death Net Worth

Understanding the essential aspects of Johnny Paycheck's net worth at the time of his death is crucial for gaining insights into his financial legacy and the impact of his career.

- Assets: Cash, investments, real estate, personal property

- Liabilities: Debts, loans, outstanding expenses

- Income: Earnings from music sales, performances, royalties

- Expenses: Living costs, business expenses, taxes

- Estate Planning: Wills, trusts, beneficiaries

- Tax Implications: Estate taxes, inheritance taxes

- Financial Management: Investments, wealth preservation strategies

- Career Impact: Success, earnings, legacy

These aspects provide a comprehensive view of Johnny Paycheck's financial situation at the time of his death. They reveal the value of his assets, the extent of his liabilities, the sources of his income, and the expenses he incurred. By examining these aspects, we can better understand the financial impact of his career, his wealth management strategies, and the legacy he left behind.

Assets

Assets refer to the resources and valuables owned by an individual or organization, which hold monetary value. In the context of Johnny Paycheck's net worth at the time of his death, his assets include cash, investments, real estate, and personal property. These assets contribute directly to his overall financial worth and provide insights into his financial status.

- Tlc S I Love A Mama S

- Carson Peters Berger Age Parents Mom Rape

- Janice Huff And Husband Warren Dowdy Had

- Zeinab Harake Boyfriend Who Is She Dating

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

The value of these assets is a critical component in determining Johnny Paycheck's net worth. Cash represents immediate liquidity and financial flexibility, while investments indicate long-term wealth preservation and growth potential. Real estate, such as properties or land, contributes to net worth through its market value and potential rental income. Personal property, including valuables like jewelry, art, or collectibles, also adds to the overall asset portfolio.

Understanding the composition and value of Johnny Paycheck's assets is essential for assessing his financial legacy. It provides a snapshot of his financial management strategies, investment decisions, and the sources of his wealth. By analyzing the types and value of his assets, we can gain insights into his financial acumen and the factors that shaped his net worth at the time of his death.

Liabilities

Liabilities represent the financial obligations and debts owed by an individual or organization. In the context of Johnny Paycheck's net worth at the time of his death, liabilities include any outstanding debts, loans, or expenses that reduce his overall financial worth.

- Outstanding Loans: Unpaid balances on mortgages, personal loans, or business loans, which can significantly impact net worth.

- Credit Card Debt: Accumulated unpaid balances on credit cards, often carrying high interest rates and affecting credit scores.

- Unpaid Taxes: Delinquent taxes owed to government agencies, which may result in penalties and legal consequences.

- Business Expenses: Unpaid invoices, accounts payable, or other business-related expenses that reduce net worth.

Understanding the extent and nature of Johnny Paycheck's liabilities is crucial for evaluating his financial situation at the time of his death. Liabilities can limit financial flexibility, affect creditworthiness, and reduce the overall value of an individual's assets. By analyzing the types and amounts of liabilities, we can gain insights into Johnny Paycheck's financial management, debt obligations, and the potential impact on his net worth.

Income

Income derived from music sales, performances, and royalties plays a pivotal role in shaping the net worth of musicians like Johnny Paycheck. As the primary source of revenue for artists, this income directly contributes to the accumulation of wealth and financial stability. Earnings from album sales, concert tours, and royalties from songwriting and publishing rights form the foundation of an artist's financial portfolio.

In Johnny Paycheck's case, his successful music career spanned several decades, generating substantial income from record sales and live performances. His iconic hits, such as "Take This Job and Shove It" and "She's All I Got," continue to be popular, ensuring a steady stream of royalties. Moreover, Paycheck's extensive touring schedule further boosted his earnings, allowing him to amass a significant net worth.

Understanding the relationship between income from music sales, performances, and royalties, and an artist's net worth is essential for several reasons. Firstly, it highlights the importance of commercial success in the music industry. Financial rewards are often commensurate with an artist's popularity and ability to generate revenue through their music. Secondly, it underscores the value of intellectual property rights. Royalties from songwriting and publishing provide artists with a passive income stream, contributing to their long-term financial security.

In conclusion, income from music sales, performances, and royalties is a critical component of Johnny Paycheck's net worth at the time of his death. It reflects the financial fruits of his successful career and the enduring value of his musical legacy. This understanding not only illuminates the financial dynamics of the music industry but also highlights the importance of protecting and leveraging intellectual property rights for financial stability.

Expenses

Understanding the expenses incurred by Johnny Paycheck, including living costs, business expenses, and taxes, is crucial for assessing his financial situation at the time of his death. These expenses play a significant role in determining his overall net worth and provide insights into his lifestyle, financial management, and tax obligations.

- Living Costs: Day-to-day expenses such as housing, food, transportation, and healthcare, which directly impact an individual's financial well-being. For Johnny Paycheck, his living costs would have included expenses related to his lifestyle, family, and personal needs.

- Business Expenses: Costs incurred in the course of running a business, such as salaries for band members, recording and production expenses, and touring costs. These expenses are essential for maintaining and growing a music career, but they can also significantly impact an artist's net worth.

- Taxes: Mandatory payments to government agencies, including income tax, property tax, and sales tax. Johnny Paycheck, like all taxpayers, had to comply with tax regulations, and his net worth would have been affected by the amount of taxes he owed.

The balance between income and expenses is a critical factor in determining an individual's net worth. In Johnny Paycheck's case, his income from music sales, performances, and royalties had to cover not only his living costs but also his business expenses and tax obligations. Understanding these expenses provides a comprehensive view of his financial situation and the factors that shaped his overall wealth at the time of his death.

Estate Planning

Estate planning, encompassing wills, trusts, and beneficiaries, plays a critical role in determining the distribution and management of Johnny Paycheck's assets after his death. It involves legal and financial strategies to ensure that his wishes regarding the distribution of his net worth are carried out.

- Wills: A legal document outlining how an individual's assets and property should be distributed upon their death. Wills allow Johnny Paycheck to specify the beneficiaries of his estate and appoint an executor to oversee its administration.

- Trusts: Legal entities created to hold and manage assets for the benefit of designated beneficiaries. Trusts can provide tax benefits, protect assets from creditors, and ensure that assets are distributed according to specific instructions.

- Beneficiaries: Individuals or organizations designated to receive assets from an estate. Beneficiaries can include family members, friends, charities, or other entities. Johnny Paycheck's will and trusts would have specified the beneficiaries of his estate and the distribution of his assets.

Understanding the estate planning strategies implemented by Johnny Paycheck provides insights into his financial planning, legacy, and the distribution of his wealth after his death. Wills, trusts, and beneficiaries are essential components of estate planning, ensuring that assets are distributed according to an individual's wishes and that their legacy is preserved.

Tax Implications

When examining the net worth of Johnny Paycheck at the time of his death, it is essential to consider the tax implications, specifically estate taxes and inheritance taxes. These taxes can significantly impact the distribution and value of an individual's assets after their passing.

- Estate Tax: Estate tax is levied on the total value of an individual's estate before distribution to beneficiaries. The amount of tax owed depends on the size of the estate and the applicable tax rates. Johnny Paycheck's estate would have been subject to estate tax, potentially reducing the amount passed on to his beneficiaries.

- Inheritance Tax: Inheritance tax is levied on the value of assets inherited by individual beneficiaries. The amount of tax owed depends on the value of the inheritance and the relationship between the deceased and the beneficiary. Beneficiaries of Johnny Paycheck's estate may have faced inheritance taxes, further impacting the distribution of his wealth.

Understanding the potential tax implications of estate and inheritance taxes is crucial for estate planning and ensuring that Johnny Paycheck's financial legacy is distributed according to his wishes. These taxes can have a substantial impact on the value of an estate, and it is essential to consider them when assessing the net worth of an individual at the time of their death.

Financial Management

Financial management encompasses a range of strategies and decisions aimed at preserving and growing wealth. In the context of Johnny Paycheck's net worth at the time of his death, financial management played a critical role in shaping the overall value of his estate. Effective financial management involves making sound investment decisions, implementing tax-efficient strategies, and planning for the future to ensure financial security.

Investments are a crucial component of financial management, as they allow individuals to grow their wealth over time. Johnny Paycheck's investment portfolio likely included a mix of stocks, bonds, and real estate, each with varying levels of risk and return. By diversifying his investments, he could spread his risk and potentially increase his overall returns.

Wealth preservation strategies are also essential for protecting and maintaining wealth. These strategies may include estate planning, tax optimization, and asset protection. By implementing effective wealth preservation strategies, Johnny Paycheck could have ensured that his assets were distributed according to his wishes and that his family's financial future was secure.

Understanding the connection between financial management and net worth is crucial for individuals seeking to build and preserve their wealth. By making informed financial decisions and implementing sound strategies, individuals can increase their chances of achieving financial success and securing their financial future.

Career Impact

The impact of a successful career significantly influences the net worth of an individual at the time of their death. In the case of Johnny Paycheck, his career as a country music singer-songwriter had a profound impact on his overall net worth. Success in his career led to substantial earnings, which in turn contributed directly to the accumulation of assets and wealth.

Paycheck's musical success brought in significant revenue from album sales, live performances, and royalties. His iconic hits, such as "Take This Job and Shove It" and "She's All I Got," generated substantial income that formed the foundation of his net worth. Furthermore, his extensive touring schedule provided additional earnings, allowing him to amass a considerable fortune.

Beyond the financial rewards, Paycheck's career also had a lasting impact on his legacy. His music continues to be enjoyed by fans worldwide, and his influence on the country music genre remains significant. This legacy contributes to the ongoing value of his intellectual property, ensuring a steady stream of royalties for his estate. Understanding the connection between career success, earnings, and legacy is crucial for evaluating the net worth of individuals in the entertainment industry and beyond.

Frequently Asked Questions about Johnny Paycheck's Net Worth at Death

This FAQ section addresses common questions and provides clarifications regarding Johnny Paycheck's net worth at the time of his death.

Question 1: What was the primary source of income that contributed to Johnny Paycheck's net worth?Answer: Johnny Paycheck's primary source of income was his successful career as a country music singer-songwriter. His earnings from album sales, live performances, and royalties formed the foundation of his net worth.

Question 2: Did Johnny Paycheck have any notable assets that contributed to his wealth?Answer: In addition to his music-related income, Johnny Paycheck also owned various assets, including real estate, investments, and personal property. These assets contributed to his overall net worth and provided financial stability.

Question 3: Were there any significant liabilities or debts that reduced Johnny Paycheck's net worth?Answer: While specific details may not be publicly available, it is likely that Johnny Paycheck had certain liabilities and debts, such as mortgages, taxes, and business expenses. These liabilities would have reduced his overall net worth.

Question 4: Did Johnny Paycheck have a will or estate plan in place?Answer: Information regarding Johnny Paycheck's estate planning is not readily available. However, it is common practice for individuals to have a will or estate plan to ensure the distribution of their assets after their passing.

Question 5: How did Johnny Paycheck's career success contribute to his net worth?Answer: Johnny Paycheck's successful career in country music significantly boosted his net worth. His hit songs and extensive touring generated substantial income, allowing him to accumulate wealth and build a solid financial foundation.

Question 6: What are some factors that may have influenced Johnny Paycheck's net worth at the time of his death?Answer: Factors such as investments, financial management strategies, lifestyle choices, and tax obligations could have influenced Johnny Paycheck's net worth at the time of his death. Understanding these factors provides a comprehensive view of his financial situation.

These FAQs provide insights into various aspects of Johnny Paycheck's net worth at the time of his death. By addressing common questions and clarifying misconceptions, this section aims to enhance the understanding of his financial legacy and the factors that shaped it.

Transition to the next article section: For a deeper dive into Johnny Paycheck's financial management and wealth preservation strategies, continue reading the following section.

Tips for Understanding Net Worth at the Time of Death

This TIPS section provides actionable advice to help you better understand the concept of net worth at the time of death and its various aspects. By implementing these tips, you can gain a clearer perspective on the financial legacy and wealth management strategies of individuals like Johnny Paycheck.

Tip 1: Determine the Value of Assets: Identify and assess the value of all assets owned by the deceased, including cash, investments, real estate, and personal property.

Tip 2: Calculate Outstanding Liabilities: Determine any outstanding debts, loans, or expenses that reduce the overall value of the estate, such as mortgages, taxes, and business obligations.

Tip 3: Understand Income Sources: Analyze the sources of income that contributed to the deceased's net worth, such as earnings from music sales, performances, royalties, or other business ventures.

Tip 4: Consider Expenses and Lifestyle: Examine the deceased's living costs, business expenses, and tax obligations to gain insights into their financial management and spending habits.

Tip 5: Review Estate Planning Documents: If available, review wills, trusts, and other estate planning documents to understand how assets were distributed and managed after the deceased's passing.

Tip 6: Consult with Financial Professionals: Seek guidance from estate attorneys, accountants, or financial advisors to obtain expert advice on estate planning, tax implications, and wealth management strategies.

By following these tips, you can gain valuable insights into the complexities of net worth at the time of death. Understanding these factors will help you make informed decisions regarding your own financial planning and legacy.

In the concluding section of this article, we will explore practical strategies for managing wealth and preserving assets to maximize your net worth and ensure a secure financial future for your loved ones.

Conclusion

Exploring Johnny Paycheck's net worth at the time of his death provides valuable insights into the financial legacy of a renowned country music icon. His success in the music industry, coupled with his financial management strategies, contributed significantly to his overall wealth. Understanding the interplay between his income from music sales, performances, and royalties, as well as his expenses and liabilities, sheds light on the factors that shaped his financial situation.

This analysis underscores the importance of financial planning and legacy preservation. By examining the estate planning strategies employed by Johnny Paycheck, we recognize the role of wills, trusts, and beneficiaries in ensuring the distribution of assets according to an individual's wishes. Furthermore, understanding the tax implications of estate and inheritance taxes highlights the need for careful planning to preserve wealth for future generations.

- New Roms Xci Nsp Juegos Nintendo Switch

- Tammy Camacho Obituary A Remarkable Life Remembered

- Justin Bieber Sells Entire Music Catalogue For

- David Foster Net Worth From Grammy Winning

- Woody Allen Net Worth 2023 What Are

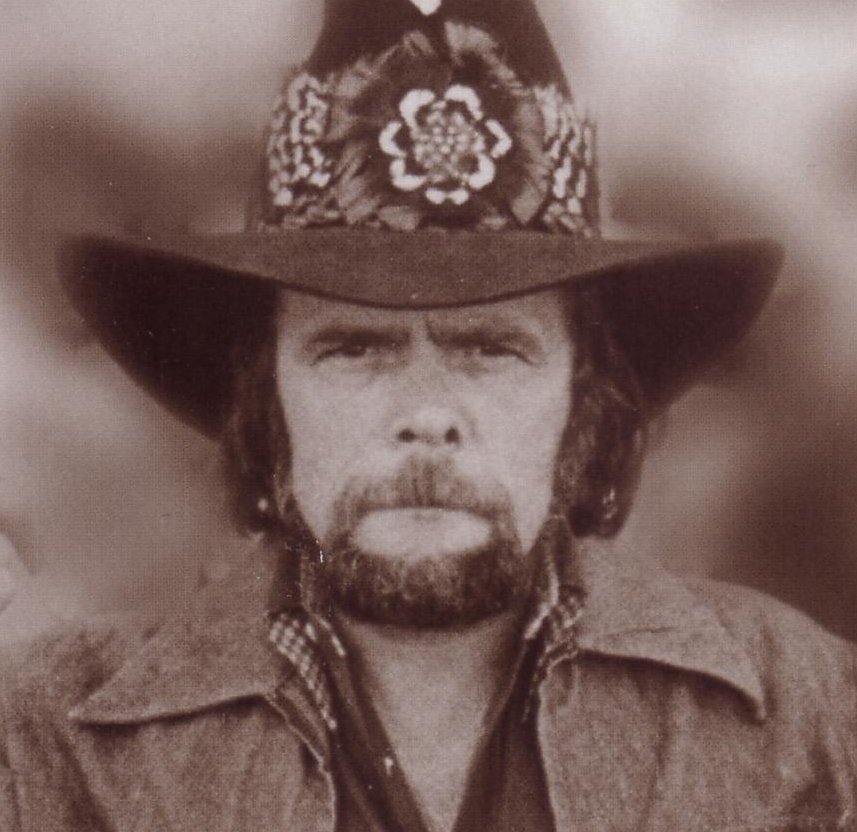

Johnny Paycheck The Man The Myth The Legend BoySetsFire

Johnny PayCheck Signed Photo ubicaciondepersonas.cdmx.gob.mx

Johnny Paycheck Net Worth At Death How I Got The Job