The Ultimate Guide To Understanding Kristy Mcnichols Net Worth

Kristy Mcnichols Net Worth refers to the total value of assets owned by Kristy Mcnichols, a former American actress. It includes her earnings from acting, investments, and other sources.

Kristy Mcnichols' net worth is relevant because it provides an indicator of her financial success and the returns on her investments. Understanding net worth can assist in decision-making, investment planning, and assessing an individual's financial health. Historically, the concept of net worth has evolved from a simple calculation of assets minus liabilities to a more comprehensive measure of an individual's overall financial standing.

This article will delve into Kristy Mcnichols' net worth, exploring its various components, her sources of income, and providing an analysis of her financial journey.

- Tammy Camacho Obituary A Remarkable Life Remembered

- David Foster Net Worth From Grammy Winning

- Tony Hawk Net Worth A Closer Look

- Officer Nicholas Mcdaniel Died A Life Of

- Layke Leischner Car Accident Resident Of Laurel

Kristy Mcnichols Net Worth

Understanding the essential aspects of Kristy Mcnichols' net worth provides insights into her financial status, investment strategies, and overall financial well-being.

- Earnings

- Assets

- Investments

- Liabilities

- Expenses

- Income streams

- Financial goals

- Tax implications

- Estate planning

- Philanthropy

These aspects are interconnected and influence each other. For instance, Mcnichols' earnings from acting contribute to her overall net worth, while her investments and expenses impact its growth and stability. Understanding the interplay between these aspects provides a holistic view of her financial situation. Additionally, considering Mcnichols' financial goals, tax implications, and philanthropic endeavors offers insights into her values and long-term plans.

Earnings

Earnings represent a crucial component of Kristy Mcnichols' net worth, encompassing the income she has generated throughout her career. These earnings stem from various sources, each with its own implications for her overall financial situation.

- Wwe Billy Graham Illness Before Death Was

- Hilaree Nelson Wiki Missing Husband Family Net

- Meet Maya Erskine S Parents Mutsuko Erskine

- How To Make Water Breathing Potion In

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Acting Salaries: Mcnichols' primary source of earnings has been her successful acting career. Her roles in popular films and television shows have contributed significantly to her net worth.

- Endorsements: Mcnichols has also earned income through endorsement deals with various brands. Her association with reputable companies has not only boosted her earnings but also enhanced her public image.

- Investments: A portion of Mcnichols' earnings has been invested in stocks, bonds, and real estate. These investments have the potential to generate passive income and contribute to the growth of her net worth.

- Residual Income: Mcnichols continues to earn royalties from her past acting work, providing her with a steady stream of income even after her active career has ended.

Understanding the diverse sources of Mcnichols' earnings provides a deeper insight into the factors that have shaped her net worth. These earnings have allowed her to accumulate wealth, make investments, and secure her financial future.

Assets

Assets play a critical role in determining Kristy Mcnichols' net worth. They represent the tangible and intangible resources she owns that have monetary value. Assets can include various forms, each contributing to her overall financial picture.

Examples of assets in Kristy Mcnichols' net worth could include her real estate holdings, such as her house and any investment properties. Additionally, her personal belongings, such as jewelry, art collections, and vehicles, can also be considered assets. Furthermore, Mcnichols may have investments in stocks, bonds, or mutual funds, which contribute to her net worth's growth.

Understanding the composition of Mcnichols' assets is essential because it provides insights into her investment strategies, risk tolerance, and financial goals. By analyzing her asset allocation, we can gain a better understanding of her financial decision-making and how she manages her wealth. Moreover, it highlights the importance of asset diversification and the role it plays in preserving and growing net worth over time.

Investments

Investments are a critical aspect of Kristy Mcnichols' net worth, representing her allocation of funds into various assets with the aim of generating returns and achieving long-term financial growth. Understanding the composition and performance of her investments provides insights into her risk tolerance, financial goals, and overall investment strategy.

- Stocks: Stocks represent ownership shares in publicly traded companies. Mcnichols may invest in stocks to gain potential capital appreciation and dividends, which can contribute to her net worth's growth.

- Bonds: Bonds are fixed-income securities that pay regular interest payments and return the principal amount at maturity. Mcnichols may invest in bonds to generate a stable stream of income and diversify her portfolio.

- Real Estate: Real estate investments involve purchasing properties, such as residential or commercial buildings, with the expectation of rental income, capital appreciation, or both. Mcnichols' real estate investments can provide diversification, passive income, and potential tax benefits.

- Mutual Funds: Mutual funds are professionally managed investment funds that pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other assets. Mcnichols may invest in mutual funds to gain exposure to a broader market, reduce risk, and potentially enhance returns.

The performance of Mcnichols' investments directly impacts her net worth. Successful investments can contribute to its growth, while underperforming investments can negatively affect it. Monitoring the performance of her investments and adjusting her strategy accordingly is crucial for Mcnichols to meet her financial objectives and preserve her wealth over time.

Liabilities

Liabilities represent the financial obligations that Kristy Mcnichols owes to other individuals or entities. They are a crucial component of her net worth, as they directly impact its calculation. Liabilities can arise from various sources, such as unpaid bills, loans, mortgages, and legal settlements. Understanding the types and amounts of Mcnichols' liabilities provides insights into her financial situation and overall financial health.

When calculating net worth, liabilities are subtracted from assets. Therefore, a higher level of liabilities can result in a lower net worth. For instance, if Mcnichols has significant mortgage debt on her house, this liability will reduce her overall net worth. Conversely, reducing liabilities, such as paying off debts, can positively impact her net worth.

Real-life examples of liabilities within Kristy Mcnichols' net worth could include her mortgage, car loans, or outstanding credit card balances. These liabilities represent her financial obligations and must be considered when assessing her financial well-being. Understanding the relationship between liabilities and net worth empowers individuals to make informed financial decisions, prioritize debt repayment, and develop strategies to improve their overall financial position.

Expenses

Expenses are a crucial aspect of Kristy Mcnichols' net worth, representing the costs and obligations she incurs regularly or periodically. Understanding the types and amounts of her expenses provides insights into her lifestyle, financial priorities, and overall financial well-being.

- Living Expenses: These include basic costs of daily living, such as housing, utilities, groceries, and transportation. Mcnichols' living expenses directly impact her monthly cash flow and overall financial stability.

- Taxes: Mcnichols is subject to various taxes, including income tax, property tax, and sales tax. Tax payments reduce her disposable income and affect her net worth.

- Entertainment and Travel: Expenses related to leisure activities, such as travel, dining out, and entertainment, can vary based on Mcnichols' lifestyle and personal preferences.

- Investments: While investments are typically considered assets, the costs associated with managing and maintaining them, such as investment fees and taxes, can be recorded as expenses.

Tracking and managing expenses effectively is essential for Mcnichols to maintain a healthy financial position. By optimizing her spending, reducing unnecessary expenses, and maximizing tax deductions, she can increase her net worth and achieve her long-term financial goals.

Income streams

Income streams play a pivotal role in shaping Kristy Mcnichols' net worth. They represent the various sources through which she generates income, contributing to her overall financial well-being. Understanding these streams provides insights into her financial stability, investment strategies, and long-term financial goals.

- Acting: Mcnichols' primary income stream has been her successful acting career. Her roles in films and television shows have generated substantial earnings, contributing significantly to her net worth.

- Endorsements: Mcnichols has also earned income through endorsement deals with various brands. Her association with reputable companies has not only boosted her income but also enhanced her public image.

- Investments: A portion of Mcnichols' earnings has been invested in stocks, bonds, and real estate. These investments have the potential to generate passive income and contribute to the growth of her net worth.

- Residual Income: Mcnichols continues to earn royalties from her past acting work, providing her with a steady stream of income even after her active career has ended.

Diversifying her income streams has allowed Mcnichols to reduce her reliance on any single source, mitigate financial risks, and build a more stable financial foundation. By exploring new opportunities and managing her income streams strategically, she has been able to maintain her wealth and secure her financial future.

Financial goals

Financial goals are aspirations or targets that individuals set for themselves to manage their finances and achieve long-term financial well-being. These goals can range from short-term, such as saving for a down payment on a house, to long-term, such as planning for retirement. Understanding the connection between financial goals and Kristy Mcnichols' net worth is crucial for managing her wealth effectively and achieving her desired financial outcomes.

Financial goals act as a roadmap for Mcnichols' financial journey, guiding her investment decisions, spending habits, and overall financial strategy. By setting clear and achievable goals, she can align her financial actions with her long-term aspirations. For instance, if Mcnichols has a goal of retiring comfortably, she may prioritize saving and investing a portion of her income, ensuring that her net worth grows steadily over time.

Real-life examples of financial goals within Kristy Mcnichols' net worth include saving for a new car, establishing an emergency fund, or planning for her children's education. Each goal requires careful consideration of her income, expenses, and risk tolerance. By breaking down these goals into smaller, more manageable steps, Mcnichols can create a practical plan to achieve them. Practical applications of this understanding include creating a budget that allocates funds towards specific goals, seeking professional financial advice to optimize investment strategies, and regularly reviewing and adjusting goals based on changing circumstances or market conditions.

In summary, financial goals and Kristy Mcnichols' net worth are inextricably linked. By setting clear financial goals, she can make informed decisions about her wealth management, ensuring that her net worth continues to grow and support her desired lifestyle and long-term aspirations.

Tax implications

Tax implications play a crucial role in determining the composition and growth of Kristy Mcnichols' net worth. Understanding these implications is essential for effective wealth management and financial planning.

- Income Taxes: Mcnichols' earnings from acting, endorsements, and investments are subject to income taxes. The amount of tax she owes depends on her income level and tax bracket. Minimizing tax liability through strategic tax planning can significantly impact her net worth.

- Capital Gains Taxes: When Mcnichols sells assets, such as stocks or real estate, she may be liable for capital gains taxes. The tax rate and amount owed depend on the asset's holding period and her tax bracket.

- Property Taxes: Mcnichols is responsible for paying property taxes on her real estate holdings. These taxes vary depending on the location and value of the properties.

- Estate Taxes: Upon Mcnichols' passing, her estate may be subject to estate taxes. Estate planning strategies, such as trusts and charitable donations, can help reduce the tax burden on her heirs.

Understanding the tax implications associated with various aspects of her net worth allows Mcnichols to make informed financial decisions. By optimizing tax efficiency, she can maximize her wealth accumulation and minimize the impact of taxes on her overall financial well-being.

Estate planning

Estate planning is a critical component of Kristy Mcnichols' financial strategy and plays a crucial role in preserving and distributing her net worth. It involves making legal arrangements to manage and distribute assets after her passing, ensuring her wishes are carried out and minimizing the tax burden on her heirs.

Effective estate planning can significantly impact Mcnichols' net worth by optimizing the distribution of her assets. For instance, establishing trusts can help reduce estate taxes and protect assets from creditors and lawsuits. Additionally, charitable donations can lower her taxable estate while supporting causes close to her heart.

Real-life examples of estate planning within Kristy Mcnichols' net worth include creating a will that outlines her wishes for distributing her assets, establishing a revocable living trust to manage her assets during her lifetime and after her passing, and utilizing life insurance policies to provide additional financial security for her beneficiaries. By implementing these strategies, Mcnichols can maintain control over her wealth and ensure its distribution according to her intentions.

Understanding the connection between estate planning and Kristy Mcnichols' net worth is essential for her financial well-being and legacy. Through meticulous planning, she can safeguard her assets, minimize taxes, and ensure her wealth is passed on to her desired beneficiaries in a manner that aligns with her values and financial goals.

Philanthropy

Philanthropy plays a significant role in shaping Kristy Mcnichols' net worth, reflecting her values and commitment to giving back to the community. Her charitable contributions have a positive impact on her overall financial well-being and legacy.

Charitable donations reduce Mcnichols' taxable income, potentially increasing her net worth. By directing a portion of her wealth towards philanthropic causes, she can lower her tax liability and optimize her financial resources. Additionally, her involvement in charitable activities and organizations can enhance her public image and reputation, which may indirectly benefit her net worth through increased opportunities or endorsements.

Real-life examples of Mcnichols' philanthropy include her support for organizations dedicated to animal welfare, environmental conservation, and arts education. Her contributions have made a tangible difference in these areas, demonstrating her commitment to using her wealth for positive social impact.

Understanding the connection between philanthropy and Kristy Mcnichols' net worth highlights the importance of aligning wealth management with personal values and social responsibility. By embracing philanthropy, she not only supports causes she cares about but also enhances her financial well-being and strengthens her legacy as a socially conscious individual.

Frequently Asked Questions about Kristy Mcnichols' Net Worth

This section addresses common questions and misconceptions surrounding Kristy Mcnichols' net worth, providing insights and clarifications.

Question 1: How much is Kristy Mcnichols' net worth?

As of 2023, Kristy Mcnichols' net worth is estimated to be around $4 million. This figure is based on her earnings from acting, endorsements, and investments, minus her expenses and liabilities.

Question 2: What are the main sources of Kristy Mcnichols' income?

Mcnichols' primary sources of income include acting, endorsements, and investment returns. Her successful acting career has contributed significantly to her wealth, and she has also benefited from brand partnerships and smart investments.

Question 3: How has Kristy Mcnichols' net worth changed over time?

Mcnichols' net worth has fluctuated over the years, influenced by her earnings, investments, and lifestyle. While her acting income has remained relatively stable, her net worth has grown through wise investments and strategic financial planning.

Question 4: What are some of Kristy Mcnichols' biggest expenses?

Mcnichols' expenses include living costs, taxes, and investments. Her lifestyle and personal preferences also impact her spending, such as travel, entertainment, and charitable donations.

Question 5: How does Kristy Mcnichols manage her wealth?

Mcnichols has a team of financial advisors who assist her in managing her wealth. She emphasizes diversification, long-term investments, and responsible spending to preserve and grow her net worth.

Question 6: What is Kristy Mcnichols' financial legacy?

Mcnichols' financial legacy is marked by her successful career and wise financial decisions. She has accumulated wealth while maintaining a balanced lifestyle and supporting charitable causes close to her heart.

These FAQs provide a deeper understanding of Kristy Mcnichols' financial situation, highlighting her diverse income streams, prudent expense management, and commitment to wealth preservation. Moving forward, we will explore additional aspects of her financial journey and the factors that have shaped her net worth.

Tips for Optimizing Your Net Worth

This section provides practical tips to help you understand and optimize your net worth, drawing from the insights gained in the previous sections.

Tip 1: Track Your Income and Expenses: Monitor your earnings and spending habits to identify areas where you can increase income or reduce expenses.

Tip 2: Set Financial Goals: Define specific, measurable, achievable, relevant, and time-bound financial goals to guide your financial decisions and track progress.

Tip 3: Invest Wisely: Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk and enhance returns.

Tip 4: Manage Debt Effectively: Prioritize paying off high-interest debt and consider consolidating or refinancing to reduce interest expenses.

Tip 5: Plan for Retirement: Start saving early and maximize contributions to retirement accounts to secure your financial future.

Tip 6: Protect Your Assets: Obtain adequate insurance coverage, such as health, life, and disability insurance, to safeguard your financial well-being against unforeseen events.

Tip 7: Seek Professional Advice: Consult with financial advisors to gain personalized guidance on wealth management, tax planning, and investment strategies.

Tip 8: Stay Informed: Keep abreast of financial news and trends to make informed decisions and adapt to changing market conditions.

By incorporating these tips into your financial strategy, you can better understand and optimize your net worth, laying the foundation for long-term financial success.

In the concluding section, we will explore additional strategies for wealth management and discuss how these tips contribute to achieving a comprehensive and fulfilling financial life.

Conclusion

This article has delved into the multifaceted concept of Kristy Mcnichols' net worth, exploring its various components and their impact on her financial well-being. Key insights include the significance of understanding income streams, expenses, investments, and tax implications in managing net worth.

Moreover, the article highlights the importance of financial planning, estate planning, and philanthropy in shaping one's financial legacy. By strategically managing these aspects, individuals can optimize their net worth, achieve financial stability, and make a positive impact on the world.

- Bad Bunny Used To Make Mix Cds

- Is Max Muncy Christian Or Jewish Religion

- Woody Allen Net Worth 2023 What Are

- Joe Kennedy Iii Religion Meet His Parents

- All About Dmx S Son Tacoma Simmons

Kristy McNichol's Troubled Life with Bipolar Disorder, the Death of a

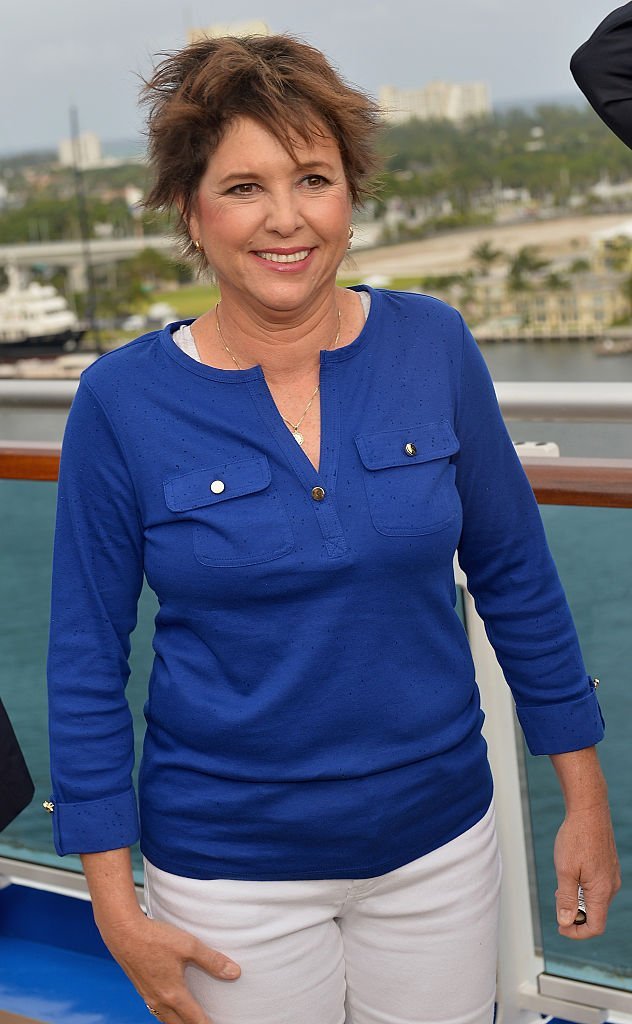

Kristy McNichol Talks Love Boat Reunion, Life After Hollywood CelebNest

The Perils of Lesbian Child Actor Kristy Mcnichol Daily Hawker