Uncover The Secrets Of Murr Net Worth: A Comprehensive Guide For Financial Empowerment

Murr Net Worth: A Comprehensive Exploration

Murr Net Worth refers to the total value of an individual, organization, or entity's financial assets, such as stocks, bonds, real estate, and cash, minus liabilities like debts and taxes. Understanding one's net worth is crucial for financial planning, investment decisions, and determining overall financial well-being.

Calculating net worth provides valuable insights into an individual's financial standing and progress towards financial goals. Its historical evolution has been marked by the establishment of accounting standards and the introduction of sophisticated financial modeling techniques.

- Meet Ezer Billie White The Daughter Of

- Is Sam Buttrey Jewish Religion And Ethnicity

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Chris Brown Net Worth Daughter Ex Girlfriend

- New Roms Xci Nsp Juegos Nintendo Switch

This article will delve into the significance and intricacies of net worth, covering its role in economic decision-making, the factors that influence its calculation, and strategies for managing and improving net worth over time.

Murr Net Worth

Identifying the essential aspects of Murr Net Worth is crucial for a comprehensive analysis of an individual's financial health. These aspects, intertwined through various dimensions, provide insights into the sources, composition, and overall value of net worth.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Debt

- Savings

- Financial Goals

Understanding these aspects enables individuals to make informed financial decisions, set realistic financial goals, and develop effective wealth management strategies. For instance, identifying high-yield assets and reducing unnecessary expenses can contribute to net worth growth. Additionally, managing debt levels and creating a savings plan are essential for long-term financial stability.

- Claudia Sampedro Wags Miami Age Engaged Husband

- Antony Varghese Wife Net Worth Height Parents

- Who Is Natalie Tene What To Know

- Tlc S I Love A Mama S

- Anna Faris Net Worth Movies Career Lifestyle

Assets

Assets are the foundation of Murr Net Worth, representing the totality of financial resources and economic value that contribute positively to one's financial position. Understanding the composition and value of assets is essential for assessing an individual's overall financial health and progress towards financial goals.

- Cash and Cash Equivalents

Cash on hand, demand deposits, and other highly liquid assets that can be easily converted into cash. These provide immediate access to funds and serve as a buffer against financial emergencies.

- Investments

Financial instruments such as stocks, bonds, mutual funds, and real estate that have the potential to appreciate in value over time, generating income or capital gains.

- Property

Real estate, including land, buildings, and other physical assets, represents tangible and potentially valuable holdings. These can provide rental income, tax advantages, and long-term appreciation.

- Business Interests

Ownership stakes in businesses, whether private or publicly traded, can contribute to net worth. The value of these interests depends on factors such as profitability, growth potential, and market conditions.

A well-diversified portfolio of assets, encompassing a mix of asset classes, risk levels, and income-generating potential, is crucial for long-term wealth accumulation and Murr Net Worth growth.

Liabilities

Liabilities represent financial obligations or debts owed by an individual or entity, which detract from their net worth. Understanding the types, impact, and management of liabilities is essential for maintaining a healthy financial position and achieving long-term financial goals. Liabilities can arise from various sources, including loans, mortgages, credit card debt, and unpaid taxes.

The presence of liabilities can significantly affect net worth. High levels of debt can strain cash flow, limit investment opportunities, and hinder overall financial progress. Conversely, managing liabilities effectively, such as paying down debt and avoiding excessive borrowing, can improve net worth and increase financial flexibility.

Real-life examples of liabilities include car loans, student loans, and mortgages. These liabilities represent financial commitments that must be factored into overall financial planning and budgeting. By carefully considering the terms, interest rates, and repayment schedules of liabilities, individuals can make informed decisions that minimize their impact on net worth while achieving their financial goals.

Understanding the connection between liabilities and net worth empowers individuals to make responsible financial decisions, prioritize debt repayment, and develop strategies for long-term wealth accumulation. It highlights the importance of financial literacy, prudent borrowing, and effective liability management as cornerstones of financial well-being.

Income

Income plays a pivotal role in shaping an individual's Murr Net Worth, determining their financial well-being and capacity to accumulate wealth over time. Income encompasses various forms of earnings and financial gains that contribute to an individual's overall financial position.

- Wages and Salaries

Regular compensation received for performing work or services, typically from employment or self-employment.

- Business Profits

Net income generated from business operations, including revenue minus expenses and other related costs.

- Investments

Income derived from financial assets such as dividends, interest, and capital gains, providing passive income streams.

- Rental Income

Revenue earned from renting out properties, providing a steady stream of income and potential for capital appreciation.

Understanding the sources and components of income is crucial for effective financial planning and net worth management. Individuals can identify opportunities to increase their income, reduce expenses, and optimize their financial strategies to maximize their net worth over time.

Expenses

Within the purview of Murr Net Worth, expenses play a crucial role in shaping an individual's financial trajectory. Understanding the various facets of expenses and their impact on net worth is essential for effective financial management and long-term wealth accumulation.

- Fixed Expenses

Regular and consistent expenses that remain relatively constant from month to month, such as rent or mortgage payments, insurance premiums, and car payments. These expenses form a stable foundation in budgeting and financial planning.

- Variable Expenses

Expenses that fluctuate in amount or frequency, such as groceries, entertainment, and transportation costs. Managing variable expenses effectively can create opportunities for savings and net worth growth.

- Discretionary Expenses

Non-essential expenses that are not necessary for survival or basic living, such as dining out, travel, and hobbies. While discretionary expenses can add enjoyment to life, mindful spending in these areas can contribute to net worth accumulation.

- Unexpected Expenses

Expenses that arise suddenly or unexpectedly, such as medical emergencies, car repairs, or job loss. Having an emergency fund or savings can serve as a buffer against these expenses and protect net worth from significant setbacks.

By categorizing and understanding their expenses, individuals gain greater control over their finances and can make informed decisions about spending and saving. Prioritizing essential expenses, minimizing unnecessary spending, and leveraging strategies to reduce expenses can contribute significantly to increasing net worth over time.

Investments

Investments form a cornerstone of Murr Net Worth, representing a critical component that drives long-term wealth accumulation and financial security. They encompass a wide range of financial instruments and strategies aimed at generating future income or capital appreciation.

Investing involves allocating funds into various asset classes, such as stocks, bonds, mutual funds, and real estate, each with varying risk-return profiles. By diversifying investments across different asset classes, individuals can manage risk and enhance the overall performance of their portfolios. Investments serve as a key catalyst for increasing Murr Net Worth over time, as they have the potential to generate passive income, capital gains, and long-term wealth growth.

Real-life examples of investments within Murr Net Worth include stocks in publicly traded companies, bonds issued by governments or corporations, and real estate properties acquired for rental income or capital appreciation. Each investment type carries its own unique set of risks and returns, and individuals should carefully consider their investment goals, risk tolerance, and time horizon before making any investment decisions. Practical applications of understanding the connection between investments and Murr Net Worth include the development of tailored investment strategies, informed asset allocation, and regular portfolio monitoring to maximize returns and manage risks.

Debt

Debt represents a crucial aspect of Murr Net Worth, capturing financial obligations that can significantly impact an individual's or entity's overall financial well-being. It encompasses various forms of borrowed funds that must be repaid with interest over time. Understanding the types, implications, and management of debt is essential for maintaining a healthy financial position and achieving long-term wealth accumulation.

- Consumer Debt

Debt incurred for personal consumption purposes, such as credit card balances, personal loans, and auto loans. These debts can strain cash flow and hinder saving and investment.

- Mortgage Debt

Debt secured by real estate, typically used to finance the purchase of a home. While mortgages can provide leverage for homeownership, excessive debt can pose financial risks.

- Business Debt

Debt incurred to fund business operations, such as loans, lines of credit, and bonds. Business debt can facilitate growth but must be managed prudently to avoid overburdening the company's finances.

- Investment Debt

Debt used to finance investments, such as margin loans or leveraged buyouts. While investment debt can magnify returns, it also amplifies risks and can lead to significant losses.

Debt management strategies vary depending on the type of debt, interest rates, and the individual's financial situation. Prioritizing high-interest debt, consolidating debts to secure lower rates, and exploring debt forgiveness programs can be effective approaches to reducing debt and improving Murr Net Worth.

Savings

Savings play a critical role in shaping an individual's financial trajectory and overall Murr Net Worth. It represents the portion of income that is not spent on current consumption and is instead set aside for future use, emergencies, and financial goals.

The accumulation of savings over time is essential for increasing Murr Net Worth. It provides a buffer against unexpected expenses, allows for investment opportunities that can generate passive income and capital appreciation, and ultimately contributes to long-term financial security. Without sufficient savings, individuals may struggle to cover financial emergencies, pursue educational or career advancement opportunities, and achieve their financial goals.

Real-life examples of savings within Murr Net Worth include emergency funds, retirement accounts, and short-term savings goals for specific purposes such as a down payment on a house or a new car. By prioritizing saving, individuals can gradually increase their financial resilience, build wealth, and improve their overall Murr Net Worth.

Understanding the connection between savings and Murr Net Worth empowers individuals to make informed financial decisions, set realistic financial goals, and develop effective wealth management strategies. It highlights the importance of delayed gratification, responsible spending habits, and the value of planning for the future. By prioritizing savings and integrating it into their financial plans, individuals can take control of their financial well-being and work towards achieving their long-term financial aspirations.

Financial Goals

Financial goals form the cornerstone of effective Murr Net Worth management. They provide direction, motivation, and a roadmap for individuals to navigate their financial journey and achieve their desired outcomes.

- Retirement Planning

Ensuring financial security during retirement years, involving saving, investing, and planning for healthcare and living expenses.

- Wealth Accumulation

Building long-term wealth through a combination of savings, investments, and smart financial decisions, aiming to increase overall Murr Net Worth.

- Debt Management

Strategically managing debt obligations to minimize interest payments, improve credit scores, and enhance financial stability, positively impacting Murr Net Worth.

- Financial Independence

Achieving a state where passive income or assets generate enough cash flow to cover living expenses, providing financial freedom and reducing reliance on active employment.

Understanding and aligning financial goals with Murr Net Worth is crucial for making informed financial decisions. By setting realistic goals, creating a plan to achieve them, and regularly monitoring progress, individuals can optimize their Murr Net Worth, secure their financial future, and live a life of financial well-being.

Frequently Asked Questions About Murr Net Worth

This section addresses common questions and clarifies aspects of Murr Net Worth, providing valuable insights to enhance your understanding.

Question 1: What is Murr Net Worth?

Murr Net Worth refers to the total value of an individual's financial assets, such as stocks, bonds, and real estate, minus their liabilities, including debts and taxes.

Question 2: How is Murr Net Worth calculated?

Murr Net Worth is calculated by adding up all financial assets, including cash, investments, and property, and subtracting all liabilities, such as mortgages, loans, and credit card debt.

Question 3: What factors can affect Murr Net Worth?

Murr Net Worth can be affected by various factors, including income, expenses, investments, savings, debt, and economic conditions.

Question 4: Why is it important to understand Murr Net Worth?

Understanding Murr Net Worth provides insights into an individual's financial health, helps set financial goals, make informed investment decisions, and can influence overall financial well-being.

Question 5: What are some strategies to increase Murr Net Worth?

Common strategies to increase Murr Net Worth include increasing income, reducing expenses, investing wisely, managing debt effectively, and setting financial goals.

Question 6: How often should I review my Murr Net Worth?

Regularly reviewing Murr Net Worth, at least annually or more frequently if significant changes occur, helps monitor progress, identify areas for improvement, and make adjustments to financial strategies.

These FAQs provide essential insights into Murr Net Worth, its calculation, influencing factors, and strategies for optimization. Understanding these aspects empowers individuals to make informed financial decisions and work towards improving their overall financial well-being.

The next section will delve deeper into the practical applications of Murr Net Worth and provide guidance on utilizing it effectively for financial planning and wealth management.

Tips for Effective Murr Net Worth Management

This section presents actionable tips to help you effectively manage your Murr Net Worth and achieve your financial goals.

Tip 1: Track Your Income and Expenses

Keep detailed records of all sources of income and expenses to understand your cash flow patterns and identify areas for optimization.

Tip 2: Create a Budget

Develop a comprehensive budget that aligns your spending with your financial goals and priorities, ensuring responsible financial management.

Tip 3: Reduce Unnecessary Expenses

Identify and eliminate non-essential expenses to free up more cash flow for savings, investments, and debt repayment.

Tip 4: Increase Your Income

Explore opportunities to enhance your earning potential through career advancement, side hustles, or investments that generate passive income.

Tip 5: Invest Wisely

Create a diversified investment portfolio that aligns with your risk tolerance and financial goals, aiming for long-term wealth accumulation.

Tip 6: Manage Debt Effectively

Prioritize high-interest debt repayment, consider debt consolidation, and maintain a low debt-to-income ratio to improve your financial health.

Tip 7: Set Financial Goals

Establish clear and specific financial goals, such as retirement planning, wealth accumulation, or debt repayment, to provide direction and motivation.

Tip 8: Regularly Review Your Progress

Monitor your Murr Net Worth and financial progress regularly, making adjustments as needed to stay on track and achieve your financial objectives.

By implementing these tips, you can gain control of your finances, increase your Murr Net Worth, and work towards achieving your financial goals.

In the final section, we will discuss advanced strategies for wealth management and explore how integrating these tips into your financial plan can lead to long-term financial success.

Conclusion

This comprehensive exploration of Murr Net Worth has shed light on its multifaceted nature and its significance in understanding an individual's or entity's financial well-being. By examining the various aspects of Murr Net Worth, including assets, liabilities, income, expenses, investments, savings, debt, and financial goals, we have gained valuable insights into the interconnectedness of these components.

Key takeaways from this analysis include the importance of managing debt effectively to minimize its impact on net worth, the role of strategic investments in generating passive income and capital appreciation, and the significance of setting realistic financial goals as a roadmap for wealth accumulation. Understanding Murr Net Worth empowers individuals and organizations to make informed financial decisions, set achievable goals, and work towards long-term financial stability and success.

- Who Is Natalie Tene What To Know

- Dd Returns Ott Release Date The Most

- Officer Nicholas Mcdaniel Died A Life Of

- Janice Huff And Husband Warren Dowdy Had

- Malachi Barton S Dating Life Girlfriend Rumors

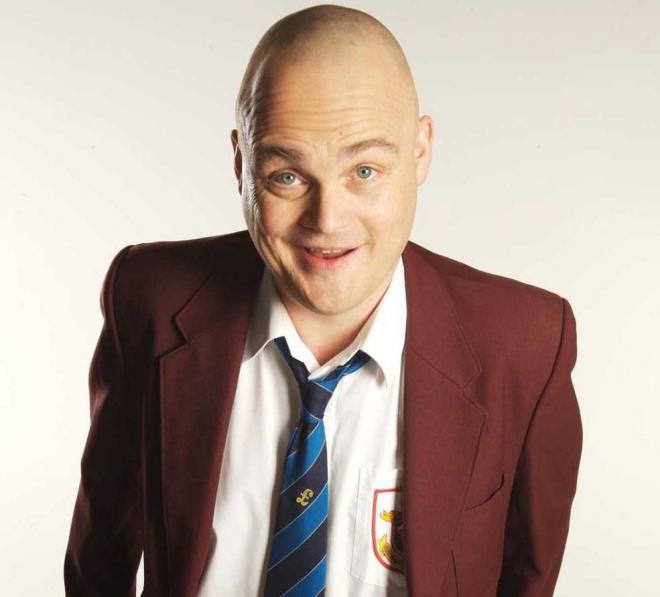

Stefan Murr Net Worth 2022 Wiki Bio, Married, Dating, Family, Height

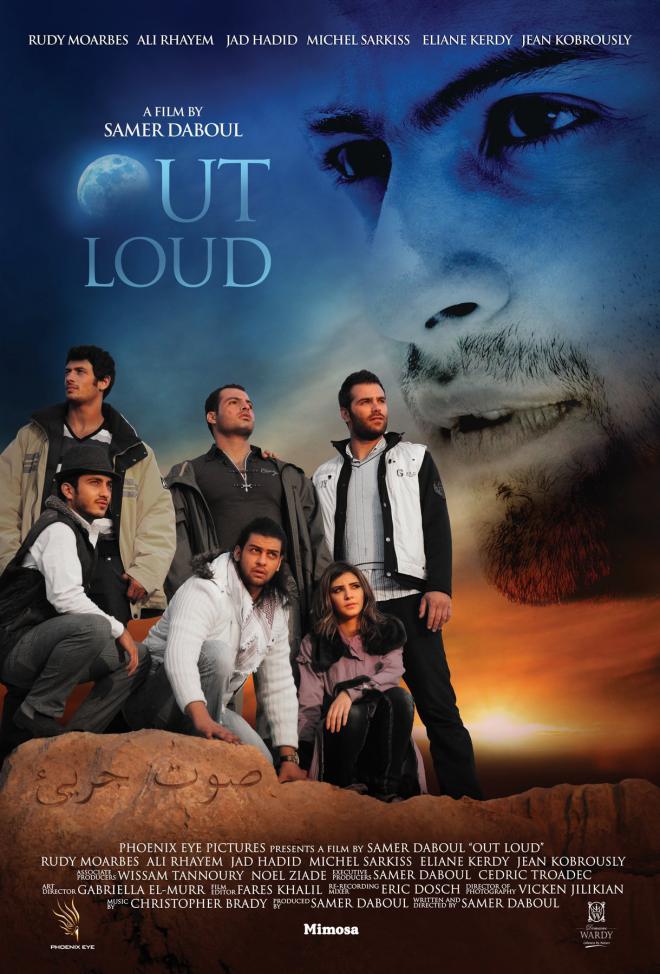

Gabriella El Murr Net Worth 2023 Wiki Bio, Married, Dating, Family

Andrew Murr Net Worth 2024, Age, Wife, Children, Family, Parents