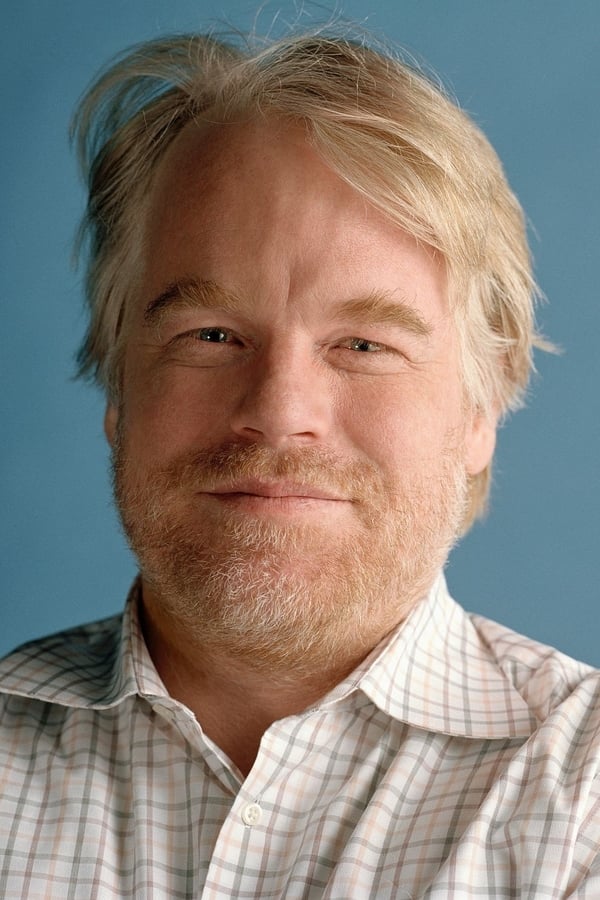

Unveiling Philip Seymour Hoffman's Wealth: Net Worth 2

The phrase "Philip Seymour Hoffman Net Worth 2" refers to the financial assets and liabilities of the late American actor, Philip Seymour Hoffman, as of a particular date.

The study of celebrity net worth provides insights into the financial success and lifestyles of influential individuals. It enables comparisons of wealth accumulation, informs financial decisions, and offers a glimpse into the impact of fame on personal finances.

Historically, the concept of net worth has evolved from personal accounting to a valuable metric for assessing an individual's financial well-being. Today, it is widely used in wealth management, estate planning, and economic analysis.

- Najiba Faiz Video Leaked On Telegram New

- Is Sam Buttrey Jewish Religion And Ethnicity

- Matthew Cassina Dies In Burlington Motorcycle Accident

- Who Is Hunter Brody What Happened To

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

Philip Seymour Hoffman Net Worth 2

Understanding the essential aspects of Philip Seymour Hoffman's net worth provides insights into his financial legacy and the factors that contributed to his wealth.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Estate Planning

- Tax Obligations

- Financial Management

These aspects reveal the value of Hoffman's estate, his financial obligations, the sources of his income, his spending habits, his investment strategies, his arrangements for the distribution of his wealth after his death, his tax liabilities, and his approach to managing his finances. By examining these aspects, we gain a comprehensive understanding of Hoffman's financial situation and the factors that shaped it.

Assets

Assets play a critical role in determining Philip Seymour Hoffman's net worth. They represent the resources and valuables he owned at the time of his death, which contribute to his overall financial position. Assets can include tangible possessions such as real estate, vehicles, and artwork, as well as intangible assets like investments, intellectual property, and royalties.

- Dd Returns Ott Release Date The Most

- Janice Huff And Husband Warren Dowdy Had

- Justin Bieber Sells Entire Music Catalogue For

- Beloved Irish Father Clinton Mccormack Dies After

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

The value of Hoffman's assets is a significant factor in calculating his net worth. For instance, if he owned a house worth $2 million and had $1 million in cash and investments, these assets would increase his net worth to $3 million. Conversely, if he had significant debts or liabilities, such as a mortgage or unpaid taxes, these would reduce his net worth.

Understanding the connection between assets and net worth is crucial for managing personal finances and making informed financial decisions. By tracking and valuing assets, individuals can assess their financial health, plan for future expenses, and make strategic investment choices. This understanding is also essential for estate planning purposes, ensuring that assets are distributed according to the deceased's wishes and that potential tax liabilities are minimized.

Liabilities

Liabilities represent financial obligations and debts that reduce Philip Seymour Hoffman's net worth. They encompass various types of expenses and commitments that must be settled, impacting his overall financial standing.

- Outstanding Loans: Loans acquired for personal or business purposes, such as mortgages, car loans, or lines of credit, create liabilities until they are fully repaid.

- Unpaid Taxes: Liabilities arise from unpaid taxes, including income tax, property tax, or sales tax, which must be settled to avoid penalties and legal consequences.

- Accounts Payable: Unpaid invoices or bills owed to suppliers, vendors, or contractors constitute accounts payable, representing liabilities that need to be fulfilled.

- Legal Obligations: Liabilities may also arise from legal settlements, court judgments, or contractual agreements that impose financial responsibilities.

Understanding the different types of liabilities is essential for assessing Philip Seymour Hoffman's net worth accurately. By considering both assets and liabilities, we gain a comprehensive view of his financial situation and the factors that contributed to his wealth.

Income

Income played a pivotal role in Philip Seymour Hoffman's net worth, providing the financial foundation for his wealth accumulation. It encompassed various sources and streams of earnings throughout his career.

- Film Acting

Hoffman's primary source of income was his successful acting career in films. His critically acclaimed performances in movies like "Capote" and "The Master" generated substantial earnings.

- Stage Acting

In addition to film, Hoffman was also an accomplished stage actor. His performances in Broadway productions and Off-Broadway plays contributed to his income and enhanced his reputation.

- Endorsements

Hoffman's fame and popularity earned him endorsement deals with various brands. These partnerships provided additional income streams and helped increase his overall net worth.

Understanding the different sources of Hoffman's income provides insights into the factors that contributed to his financial success. His diverse income streams, combined with his talent and dedication to his craft, enabled him to accumulate significant wealth during his lifetime.

Expenses

Understanding the various types of expenses incurred by Philip Seymour Hoffman is crucial for gaining a comprehensive view of his net worth. Expenses represent the costs and outlays that reduce his overall financial position.

- Personal Expenses

These include day-to-day living costs such as housing, food, transportation, and entertainment. Personal expenses can vary significantly depending on an individual's lifestyle and financial habits.

- Business Expenses

As an actor, Hoffman incurred expenses related to his professional activities, such as travel, wardrobe, and equipment. These expenses are essential for maintaining and developing his career.

- Taxes

Taxes are mandatory payments to the government, including income tax, property tax, and sales tax. Taxes represent a significant expense that reduces an individual's net worth.

- Investments

While investments can generate income and increase net worth over time, they also involve expenses such as management fees, transaction costs, and potential losses. Understanding the expenses associated with investments is crucial for making informed financial decisions.

These categories of expenses provide insights into how Philip Seymour Hoffman managed his finances and the factors that influenced his net worth. By carefully managing expenses, individuals can optimize their financial resources and achieve their financial goals.

Investments

Investments played a significant role in shaping Philip Seymour Hoffman's net worth, influencing its growth and overall financial trajectory. By exploring different investment vehicles and strategies, Hoffman diversified his wealth, managed risk, and sought potential returns.

- Stocks and Bonds

Hoffman invested in stocks and bonds, representing ownership shares in companies and loan agreements with governments or corporations, respectively. These investments provided potential for capital appreciation and dividend or interest income.

- Real Estate

Hoffman owned several properties, including a townhouse in Manhattan and a country home upstate New York. Real estate investments offered potential for rental income, property value appreciation, and diversification.

- Private Equity

Hoffman invested in private equity funds, which provided capital to businesses not publicly traded on stock exchanges. Private equity investments offered the potential for higher returns but also carried higher risks.

- Art and Collectibles

Hoffman was known to collect art and other valuable items. While these investments are less liquid than others, they offered potential for appreciation in value and diversification.

Hoffman's investment strategy demonstrated a balance between risk and reward, with a focus on preserving and growing his wealth over the long term. By understanding the various aspects of his investments, we gain insights into the financial acumen and risk tolerance that shaped Philip Seymour Hoffman's net worth.

Estate Planning

Estate planning is a critical component of Philip Seymour Hoffman's net worth 2. It plays a vital role in managing and distributing his assets after his death.

Through estate planning, individuals like Philip Seymour Hoffman can ensure that their wishes regarding the distribution of their wealth are carried out. This includes specifying beneficiaries, appointing executors, and establishing trusts to minimize taxes and protect assets. Proper estate planning can prevent legal disputes within the family, streamline the probate process, and help preserve the value of assets.

In Philip Seymour Hoffman's case, his estate plan likely included provisions for his children, charitable donations, and the management of his various assets. By understanding the connection between estate planning and net worth, we gain insights into the importance of financial planning and legacy management in preserving and distributing wealth.

Tax Obligations

Tax obligations played a critical role in Philip Seymour Hoffman's net worth 2, significantly impacting its composition and distribution. Understanding the relationship between taxes and net worth is essential for assessing an individual's financial situation and planning for the future.

Taxes are mandatory payments levied by governments on individuals and organizations to fund public services and infrastructure. They can take various forms, including income tax, property tax, and sales tax. In Philip Seymour Hoffman's case, his tax obligations likely included federal and state income taxes, as well as property taxes on his real estate holdings.

The amount of taxes owed is determined by a complex set of factors, including income level, deductions, and tax rates. High-income earners, like Philip Seymour Hoffman, typically have higher tax obligations due to progressive tax systems implemented in many countries. Additionally, assets such as real estate and investments can also be subject to property taxes and capital gains taxes upon sale.

Understanding the impact of tax obligations on net worth is crucial for financial planning. By considering the potential tax implications of investment decisions and estate planning strategies, individuals can optimize their financial outcomes and minimize the erosion of their wealth due to taxes. Proper tax planning can help preserve and grow net worth over the long term.

Financial Management

Financial management is a crucial aspect in understanding Philip Seymour Hoffman's net worth 2. It encompasses various strategies and practices that impact wealth accumulation, preservation, and distribution.

- Budgeting

Creating and adhering to a budget helps control expenses, allocate funds, and plan for future financial goals. Hoffman likely had a budget in place to manage his income and expenses, ensuring his financial stability.

- Investment Management

Investing involves making informed decisions about allocating funds into different asset classes, such as stocks, bonds, or real estate. Hoffman's investment portfolio likely played a significant role in growing his net worth over time.

- Tax Planning

Understanding and optimizing tax strategies can minimize financial obligations and maximize wealth preservation. Hoffman likely engaged in tax planning to reduce the impact of taxes on his income and assets.

- Estate Planning

Estate planning involves preparing for the distribution of assets after death, including wills and trusts. Hoffman's estate plan likely ensured that his assets were distributed according to his wishes and minimized estate taxes.

These facets of financial management provide insights into how Philip Seymour Hoffman managed his wealth and planned for the future. By understanding the principles and strategies involved, we gain a comprehensive view of the factors that contributed to his net worth.

Frequently Asked Questions

This FAQ section provides answers to common questions and clarifies various aspects of Philip Seymour Hoffman's net worth 2.

Question 1: How much was Philip Seymour Hoffman's net worth at the time of his death?

Answer: Philip Seymour Hoffman's net worth was estimated to be around $30 million at the time of his death in 2014.

Question 2: What were the primary sources of Philip Seymour Hoffman's income?

Answer: Hoffman's primary sources of income were acting in films and stage productions, as well as endorsements.

Question 3: How did investments contribute to Philip Seymour Hoffman's net worth?

Answer: Hoffman made investments in stocks, bonds, real estate, private equity, and art, which contributed to the growth of his net worth over time.

Question 4: What was the significance of estate planning in Philip Seymour Hoffman's net worth?

Answer: Estate planning ensured that Hoffman's assets were distributed according to his wishes and minimized estate taxes upon his death.

Question 5: How did Philip Seymour Hoffman manage his financial obligations?

Answer: Hoffman likely employed budgeting, investment management, and tax planning strategies to manage his financial obligations.

Question 6: What are some key insights gained from examining Philip Seymour Hoffman's net worth 2?

Answer: Analyzing Hoffman's net worth highlights the importance of financial management, diversification of income streams, and the role of estate planning in preserving and distributing wealth.

These FAQs provide a concise overview of Philip Seymour Hoffman's net worth and its contributing factors. Understanding these aspects offers valuable insights into wealth management and financial planning.

The next section will delve deeper into the investment strategies employed by Philip Seymour Hoffman, exploring their impact on his overall financial trajectory.

Tips for Understanding Philip Seymour Hoffman's Net Worth

The following tips provide actionable guidance for comprehending the intricacies of Philip Seymour Hoffman's net worth and its contributing factors.

Tip 1: Examine Income Sources: Identify the various streams of income that contributed to Hoffman's wealth, including acting, endorsements, and investments.

Tip 2: Analyze Investment Strategies: Explore the types of investments Hoffman made, such as stocks, bonds, real estate, and private equity, and evaluate their impact on his net worth.

Tip 3: Consider Tax Implications: Understand the role of taxes in shaping Hoffman's net worth, including income tax, property tax, and capital gains tax.

Tip 4: Evaluate Estate Planning: Examine the estate plan Hoffman implemented to ensure the distribution of his assets according to his wishes and minimize estate taxes.

Tip 5: Review Financial Management Practices: Analyze the budgeting, investment management, and tax planning strategies employed by Hoffman to manage his financial obligations.

By following these tips, you can gain a comprehensive understanding of the factors that influenced Philip Seymour Hoffman's net worth and its significance in assessing his financial legacy.

The concluding section of this article will delve into the importance of financial planning and wealth management, drawing upon insights gained from examining Hoffman's net worth.

Conclusion

This exploration of Philip Seymour Hoffman's net worth provides valuable insights into the complexities of wealth management and financial planning. By examining his diverse income streams, investment strategies, tax obligations, estate planning, and financial management practices, we gain a holistic understanding of the factors that shaped his financial trajectory.

Three key points emerge from this analysis. Firstly, diversification of income sources is crucial for building a strong financial foundation. Secondly, thoughtful investment strategies can significantly contribute to wealth accumulation over time. Thirdly, effective estate planning ensures the preservation and distribution of wealth according to an individual's wishes.

Understanding these principles is essential for anyone seeking to manage their finances effectively and achieve long-term financial well-being. Philip Seymour Hoffman's net worth serves as a testament to the transformative power of sound financial planning and the importance of seeking professional guidance when navigating complex financial decisions.

- Janice Huff And Husband Warren Dowdy Had

- Wwe Billy Graham Illness Before Death Was

- Beloved Irish Father Clinton Mccormack Dies After

- Anna Faris Net Worth Movies Career Lifestyle

- Najiba Faiz Video Leaked On Telegram New

Philip Seymour Hoffman What's Come Out About Him Since He Died

Philip Seymour Hoffman's 21 Best Performances

Philip Seymour Hoffman — The Movie Database (TMDB)