How Ramon Rodriguez Built His Impressive Net Worth: A Guide To Financial Success

Ramon Rodriguez Net Worth: The financial value of Ramon Rodriguez's assets, investments, and earnings, often estimated based on publicly available information.

Understanding an individual's net worth provides insights into their financial status, success, and overall wealth. It can influence decision-making, investment strategies, and financial planning.

The concept of net worth has evolved over time, from simple asset calculation to a more comprehensive analysis considering factors such as liabilities, investments, and earning potential.

- Did Tori Bowie Baby Survive What Happened

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Who Is Jay Boogie The Cross Dresser

- Fun Fact Is Sydney Leroux Lesbian And

- Tony Hawk Net Worth A Closer Look

Ramon Rodriguez Net Worth

The essential aspects of Ramon Rodriguez's net worth provide insights into his financial status, success, and wealth management strategies. These key aspects include:

- Assets

- Investments

- Income

- Expenses

- Liabilities

- Cash flow

- Financial planning

- Investment strategies

- Tax implications

- Estate planning

Understanding these aspects allows for a comprehensive analysis of Ramon Rodriguez's financial situation. Assets and investments represent the sources of his wealth, while income and expenses indicate his cash flow and financial stability. Liabilities and financial planning provide insights into his financial obligations and strategies for managing risk. Tax implications and estate planning highlight the legal and financial considerations that impact his net worth. By examining these key aspects, we gain a deeper understanding of Ramon Rodriguez's overall financial well-being and wealth management approach.

Assets

Assets play a crucial role in determining Ramon Rodriguez's net worth. Assets are anything of value that Ramon Rodriguez owns that can be converted into cash. Common types of assets include cash, real estate, stocks, bonds, and intellectual property. The value of Ramon Rodriguez's assets minus his liabilities equals his net worth.

- Truth About Nadine Caridi Jordan Belfort S

- Benoni Woman Shows R4 000 Grocery Haul

- What Is Sonia Acevedo Doing Now Jamison

- David Foster Net Worth From Grammy Winning

- Is Sam Buttrey Jewish Religion And Ethnicity

Increasing assets is a key strategy for building net worth. For instance, if Ramon Rodriguez invests in a rental property that generates income, this asset will contribute to his net worth. Similarly, if he invests in stocks that appreciate in value, his net worth will also increase. Conversely, if Ramon Rodriguez's assets decrease in value, his net worth will also decrease. For example, if the value of his real estate declines due to a downturn in the housing market, his net worth will be negatively impacted.

Understanding the connection between assets and net worth is essential for effective financial planning. By carefully managing his assets and making strategic investment decisions, Ramon Rodriguez can increase his net worth over time and achieve his financial goals.

Investments

Investments are a critical component of Ramon Rodriguez's net worth. Investing involves allocating money with the expectation of generating a profit or income. Investments can take various forms, including stocks, bonds, real estate, and private equity. The performance of these investments directly impacts Ramon Rodriguez's net worth.

When investments perform well and generate positive returns, Ramon Rodriguez's net worth increases. For instance, if he invests in a stock that appreciates in value, the increase in the stock's price will contribute to his overall net worth. Similarly, if he invests in a rental property that generates rental income, the income generated will increase his net worth.

Conversely, if investments perform poorly and generate negative returns, Ramon Rodriguez's net worth decreases. For example, if he invests in a stock that declines in value, the decrease in the stock's price will negatively impact his net worth. Additionally, if he invests in a rental property that becomes vacant or requires significant repairs, the expenses associated with the property could reduce his net worth.

Understanding the connection between investments and net worth is crucial for effective financial planning. By making informed investment decisions and managing his investments prudently, Ramon Rodriguez can increase his net worth over time and achieve his financial goals.

Income

Income plays a vital role in determining Ramon Rodriguez's net worth. It represents the inflow of funds that contribute to his overall financial standing. Income can stem from various sources, including employment, investments, and business ventures.

- Salary: Income earned from employment, including wages, bonuses, and commissions.

- Investment Income: Returns generated from investments, such as dividends, interest, and capital gains.

- Business Income: Profits earned from operating a business, including revenue from sales and services.

- Other Income: Any additional income streams, such as royalties, annuities, or rental income.

Understanding the composition and stability of Ramon Rodriguez's income sources is crucial for assessing his net worth and financial well-being. Consistent and growing income streams contribute positively to his net worth, while volatile or declining income can have a negative impact. By analyzing his income sources and managing them effectively, Ramon Rodriguez can ensure the long-term growth of his net worth.

Expenses

Expenses represent deductions from Ramon Rodriguez's income and play a crucial role in determining his net worth. Managing expenses effectively is essential for preserving and growing wealth. Several key facets of expenses impact Ramon Rodriguez's net worth:

- Living Expenses: Costs associated with maintaining a certain lifestyle, including housing, food, transportation, and utilities.

- Taxes: Mandatory payments to government entities, such as income tax, property tax, and sales tax.

- Debt Repayments: Payments made towards outstanding loans, such as mortgages, car loans, and personal loans.

- Business Expenses: Costs incurred in operating a business, such as salaries, rent, and marketing.

Understanding these expense categories and tracking them diligently allows Ramon Rodriguez to optimize his financial decisions. Controlling living expenses, minimizing taxes through smart planning, managing debt responsibly, and optimizing business expenses can contribute to increasing his net worth over time. A comprehensive analysis of expenses provides valuable insights into Ramon Rodriguez's financial health and empowers him to make informed choices for long-term wealth accumulation.

Liabilities

Liabilities represent the financial obligations of Ramon Rodriguez, encompassing debts and other commitments that reduce his net worth. Understanding the connection between liabilities and Ramon Rodriguez's net worth is crucial for assessing his overall financial health and making informed decisions.

Liabilities are critical components of Ramon Rodriguez's net worth as they directly affect its calculation. Liabilities, when subtracted from assets, determine the net worth of an individual or entity. Reducing liabilities, such as paying off debts or negotiating lower interest rates, can increase Ramon Rodriguez's net worth, while acquiring new liabilities or increasing existing ones will decrease it.

Real-life examples of liabilities in Ramon Rodriguez's net worth include mortgages, car loans, personal loans, credit card balances, and unpaid taxes. Effectively managing these liabilities is essential for maintaining a healthy financial position and preserving net worth. For instance, strategically allocating funds to pay down high-interest debts can free up cash flow and contribute to long-term wealth accumulation.

Understanding the connection between liabilities and net worth empowers Ramon Rodriguez to make informed financial choices and devise strategies to optimize his financial well-being. By carefully managing liabilities, he can increase his net worth, reduce financial stress, and achieve his long-term financial goals.

Cash Flow

Cash flow, the movement of money in and out of Ramon Rodriguez's financial accounts, plays a critical role in determining his net worth. Positive cash flow indicates that more money is coming in than going out, leading to an increase in net worth, while negative cash flow has the opposite effect.

Cash flow is a crucial component of Ramon Rodriguez's net worth because it directly impacts his ability to cover expenses, make investments, and grow his wealth. Consistent positive cash flow allows him to maintain a healthy financial position, pay off debts, and accumulate assets. Conversely, negative cash flow can strain his financial resources, limit his investment opportunities, and potentially erode his net worth.

Real-life examples of cash flow within Ramon Rodriguez's net worth include income from his acting career, investment returns, and rental income from properties he owns. Understanding the sources and uses of his cash flow allows him to make informed decisions about budgeting, spending, and investing, thereby optimizing his net worth.

By carefully managing his cash flow, Ramon Rodriguez can maximize his net worth and achieve his long-term financial goals. This includes setting up a budget to track income and expenses, prioritizing essential expenses, exploring additional income streams, and seeking professional financial advice when needed.

Financial planning

Financial planning is a critical component of Ramon Rodriguez's net worth. Through the process of financial planning, individuals create a comprehensive roadmap for managing their financial resources to achieve their long-term financial goals. This involves setting financial objectives, assessing current financial situations, and implementing strategies to bridge the gap between the two. By engaging in effective financial planning, Ramon Rodriguez can optimize his net worth and secure his financial future.

Financial planning encompasses various aspects that directly impact Ramon Rodriguez's net worth. It involves budgeting, debt management, investment planning, tax planning, estate planning, and insurance planning. By carefully considering each of these elements, Ramon Rodriguez can make informed decisions that positively contribute to his overall financial well-being. For instance, creating a budget allows him to track his income and expenses, enabling him to identify areas for saving and potential investments. Similarly, developing an investment plan helps him allocate his assets wisely, aiming to maximize returns and minimize risks, ultimately contributing to the growth of his net worth.

Real-life examples of financial planning within Ramon Rodriguez's net worth include setting financial goals, such as saving for a down payment on a house or planning for retirement. These goals serve as the foundation for his financial decisions and guide his financial planning process. By setting clear and attainable financial goals, Ramon Rodriguez can prioritize his saving habits, make informed investment choices, and work towards building a secure financial future, leading to an increase in his net worth over time.

Investment strategies

Investment strategies form a crucial aspect of Ramon Rodriguez's net worth, guiding his financial decisions and shaping his overall wealth management approach. By implementing well-crafted investment strategies, he can harness the power of compound interest, mitigate risks, and potentially increase his net worth over time.

- Diversification: Allocating investments across various asset classes, such as stocks, bonds, and real estate, to balance risk and potentially enhance returns.

- Asset allocation: Determining the optimal mix of different asset classes based on individual risk tolerance and financial goals.

- Rebalancing: Periodically adjusting the investment portfolio to maintain the desired asset allocation and manage risk.

- Tax optimization: Employing strategies to minimize tax liabilities on investment gains and maximize returns.

The combination of these investment strategies enables Ramon Rodriguez to navigate market fluctuations, preserve capital, and pursue growth opportunities strategically. Understanding the role and implications of investment strategies is essential for comprehending the dynamics of Ramon Rodriguez's net worth and appreciating the complexities of wealth management.

Tax implications

Tax implications play a significant role in shaping Ramon Rodriguez's net worth. Understanding the various facets of tax implications is crucial for comprehending his financial standing and overall wealth management strategy.

- Income tax: The portion of Ramon Rodriguez's income that is subject to taxation, impacting his net income and cash flow.

- Capital gains tax: Tax levied on profits from the sale of assets like stocks or real estate, influencing his investment decisions and asset allocation.

- Property tax: Annual tax on real estate property, affecting his housing expenses and potential rental income.

- Estate tax: Tax on the value of an estate upon the owner's death, impacting the distribution of his wealth and legacy planning.

Effective tax planning and optimization can enhance Ramon Rodriguez's net worth by reducing tax liabilities and preserving wealth. Exploring tax-advantaged investment options, utilizing tax deductions, and implementing estate planning strategies are crucial elements of his overall financial strategy.

Estate planning

Estate planning is a critical component of Ramon Rodriguez's net worth strategy as it ensures the distribution of his assets according to his wishes after his passing. Without proper estate planning, the distribution of assets may not align with his intentions, potentially leading to disputes among heirs and negatively impacting his net worth.

Real-life examples of estate planning within Ramon Rodriguez's net worth include establishing a will or trust to specify the distribution of assets, setting up powers of attorney to manage his affairs in case of incapacity, and minimizing estate taxes through various strategies. Effective estate planning allows Ramon Rodriguez to control the distribution of his wealth, provide for his loved ones, and protect his net worth from unnecessary erosion.

Understanding the connection between estate planning and Ramon Rodriguez's net worth is crucial for preserving and growing his wealth. By implementing a comprehensive estate plan, he can ensure that his assets are managed according to his wishes, minimizing the impact of estate taxes and potential legal challenges. Moreover, estate planning provides peace of mind, knowing that his legacy and financial affairs are in order.

Frequently Asked Questions about Ramon Rodriguez Net Worth

This section addresses common questions and clarifies various aspects related to Ramon Rodriguez's net worth.

Question 1: How is Ramon Rodriguez's net worth calculated?

Answer: Ramon Rodriguez's net worth is estimated by calculating the total value of his assets, including cash, investments, real estate, and other valuable possessions, and then subtracting his liabilities, such as debts and outstanding loans.

Question 2: What are the primary sources of Ramon Rodriguez's income?

Answer: Ramon Rodriguez's primary sources of income include his acting career, brand endorsements, and various business ventures.

Question 3: How does Ramon Rodriguez manage his investments?

Answer: Ramon Rodriguez is known to have a diversified investment portfolio that includes real estate, stocks, and bonds. He reportedly seeks professional advice and employs investment strategies to optimize his returns and manage risks.

Question 4: What is Ramon Rodriguez's approach to philanthropy?

Answer: Ramon Rodriguez is recognized for his philanthropic efforts. He supports various charitable causes, particularly those focused on education, health, and community development.

Question 5: How does Ramon Rodriguez's net worth compare to other celebrities?

Answer: Ramon Rodriguez's net worth is often compared to other celebrities in the entertainment industry. However, it is important to note that net worth can vary significantly based on individual circumstances and career trajectories.

Question 6: What are the factors that could impact Ramon Rodriguez's net worth in the future?

Answer: Future changes in his income, investment performance, and personal expenses could impact Ramon Rodriguez's net worth. Additionally, economic conditions and market fluctuations can also influence his overall financial standing.

These FAQs provide insights into various aspects of Ramon Rodriguez's net worth and highlight the complexities of managing wealth within the entertainment industry.

In the following section, we will explore Ramon Rodriguez's financial habits and strategies for preserving and growing his net worth over time.

Tips for Building and Preserving Net Worth

This section provides actionable tips to help individuals build and preserve their net worth. By implementing these strategies, readers can gain insights into managing their finances effectively.

Tip 1: Create a Budget: Track income and expenses diligently to identify areas for saving and potential investments.

Tip 2: Reduce Unnecessary Expenses: Identify and eliminate non-essential expenses to free up cash flow for more important financial goals.

Tip 3: Increase Income: Explore opportunities for additional income streams through side hustles, part-time work, or investments.

Tip 4: Invest Wisely: Diversify investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risks and enhance returns.

Tip 5: Save Regularly: Automate savings to build a financial cushion and prepare for unexpected expenses or future goals.

Tip 6: Manage Debt Responsibly: Consolidate high-interest debts, negotiate lower interest rates, and prioritize debt repayment to improve financial health.

Tip 7: Seek Professional Advice: Consult with financial advisors or tax professionals for personalized guidance and support in managing finances effectively.

In summary, these tips emphasize the importance of budgeting, reducing expenses, increasing income, investing wisely, saving regularly, managing debt responsibly, and seeking professional advice. By implementing these strategies, individuals can work towards building a strong financial foundation and preserving their net worth over time.

The following section will delve into advanced financial planning strategies for further wealth accumulation and preservation.

Conclusion

In summary, the exploration of Ramon Rodriguez's net worth has highlighted the intricate relationship between his financial decisions and overall wealth management strategy. Understanding the key components of his net worth, including assets, investments, and financial planning, provides valuable insights into the complexities of managing wealth in the entertainment industry.

The article emphasizes the importance of financial planning and strategic decision-making in preserving and growing net worth. Effective tax planning, investment strategies, and estate planning are essential elements for securing financial well-being. Furthermore, the tips and strategies provided for building and preserving net worth can serve as a valuable resource for individuals seeking to improve their financial health.

Understanding the dynamics of net worth and the strategies employed by successful individuals can empower readers to make informed financial choices and strive for financial success in their own lives. The complexities of net worth management are an ongoing journey, and the insights gained from Ramon Rodriguez's financial journey serve as a reminder of the importance of financial literacy and prudent decision-making.

- Meet Maya Erskine S Parents Mutsuko Erskine

- Julia Dweck Dead And Obituary Nstructor Willow

- Is Shauntae Heard Fired From Her Job

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Who Is Natalie Tene What To Know

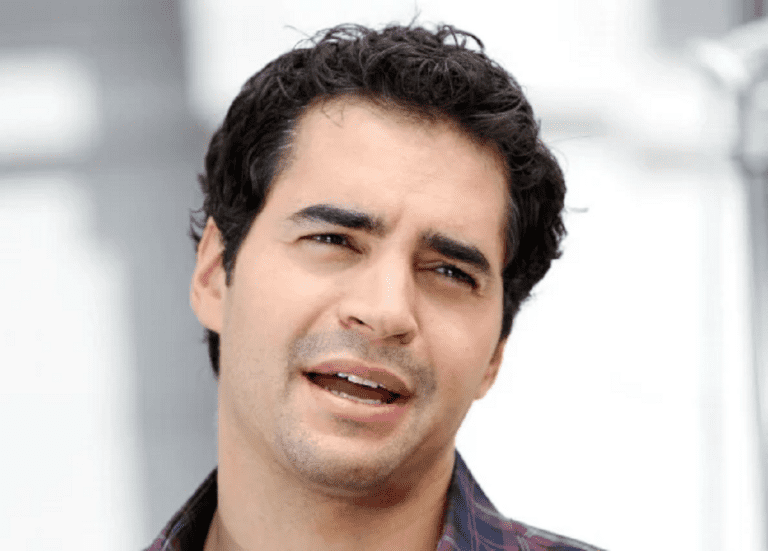

Who Is Ramón Rodríguez Wife? Kids Family And Net Worth

Ramón Rodríguez Actors, Puerto rican men, American beauty

Ramon Rodriguez IMDb