How To Build A Fortune Like Ray Huger: Uncovering His Net Worth Secrets

Ray Huger Net Worth, or simply net worth, is a financial calculation that reflects an individual's total assets minus their liabilities. For instance, if someone possesses assets worth $2 million and owes $500,000 in debts, their net worth would be $1.5 million.

Understanding net worth holds immense significance as it offers a comprehensive financial snapshot, aids in making informed decisions, and enables tracking of wealth accumulation over time. Historically, the concept of net worth emerged as a crucial indicator of financial stability, prompting individuals to seek strategies for increasing their net worth and improving their overall financial well-being.

This article delves into the multifaceted aspects of Ray Huger's net worth, exploring its contributing factors, potential changes over time, and the broader implications for wealth management and financial security.

- Janice Huff And Husband Warren Dowdy Had

- Zeinab Harake Boyfriend Who Is She Dating

- Singer Sami Chokri And Case Update As

- Simona Halep Early Life Career Husband Net

- How Tall Is Markiplier The Truth About

Ray Huger Net Worth

Ray Huger's net worth encompasses essential aspects that provide insights into his financial standing and wealth management strategies.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Cash flow

- Debt

- Equity

These aspects are interconnected and influence Huger's overall net worth. Assets, such as real estate and investments, contribute positively, while liabilities, including mortgages and loans, reduce it. Income and expenses impact cash flow and affect net worth over time. Understanding these key aspects enables a comprehensive analysis of Huger's financial situation and provides valuable insights into his wealth management strategies.

Assets

Assets play a crucial role in determining Ray Huger's net worth. Assets are anything of value that Huger owns, such as cash, investments, real estate, and personal belongings. The value of Huger's assets contributes directly to his overall net worth. For example, if Huger owns a house worth $1 million, this asset would increase his net worth by $1 million.

- Kathy Griffin S Husband Was An Unflinching

- What Is Sonia Acevedo Doing Now Jamison

- Tlc S I Love A Mama S

- Wwe Billy Graham Illness Before Death Was

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

Assets are a critical component of net worth because they represent the resources that an individual has available to them. Assets can be used to generate income, provide financial security, and meet financial obligations. In Huger's case, his assets allow him to maintain his lifestyle, invest in new opportunities, and plan for his financial future.

Understanding the relationship between assets and net worth is essential for effective financial management. By tracking and managing his assets, Huger can make informed decisions that will help him increase his net worth and achieve his financial goals. For example, Huger may choose to invest in assets that have the potential to appreciate in value, such as real estate or stocks. Alternatively, he may choose to sell assets that are no longer needed or that are generating a low return on investment.

In summary, assets are a key component of Ray Huger's net worth. The value of his assets directly impacts his overall financial standing. By understanding the relationship between assets and net worth, Huger can make informed decisions that will help him grow his wealth and achieve his financial goals.

Liabilities

Liabilities represent a critical component of Ray Huger's net worth, as they directly impact his overall financial standing. Liabilities are debts or obligations that Huger owes to other individuals or entities. Common examples of liabilities include mortgages, loans, credit card balances, and unpaid taxes. Liabilities reduce Huger's net worth because they represent claims against his assets.

Understanding the relationship between liabilities and net worth is essential for effective financial management. By tracking and managing his liabilities, Huger can make informed decisions that will help him improve his financial standing. For example, he may choose to pay down high-interest debt or negotiate lower interest rates on his loans. Additionally, he may choose to avoid taking on unnecessary debt to minimize the impact on his net worth.

In summary, liabilities play a crucial role in determining Ray Huger's net worth. The amount of liabilities he owes directly affects his overall financial standing. By understanding the relationship between liabilities and net worth, Huger can make informed decisions that will help him manage his debt effectively and improve his financial health.

Income

Income plays a vital role in Ray Huger's net worth. Income represents the money that Huger earns from various sources, such as his salary, investments, and business ventures. Income is a critical component of net worth because it directly impacts the amount of money that Huger has available to save and invest. The more income that Huger earns, the more he can contribute to his net worth.

There are many ways that Huger can increase his income. He may choose to negotiate a higher salary, start a new business venture, or invest in income-generating assets. Additionally, Huger can also reduce his expenses to free up more money to invest. By understanding the relationship between income and net worth, Huger can make informed decisions that will help him increase his net worth and achieve his financial goals.

One real-life example of how income impacts Ray Huger's net worth is his investment in real estate. Huger owns several properties that he rents out to tenants. The rental income that Huger earns from these properties contributes directly to his net worth. By investing in income-generating assets, Huger is able to increase his net worth over time.

In summary, income is a crucial factor in determining Ray Huger's net worth. The amount of income that Huger earns directly impacts his ability to save, invest, and grow his wealth. By understanding the relationship between income and net worth, Huger can make informed decisions that will help him achieve his financial goals.

Expenses

Expenses play a vital role in determining Ray Huger's net worth. Expenses represent the money that Huger spends on various goods and services, such as housing, food, transportation, and entertainment. Expenses are a critical component of net worth because they reduce the amount of money that Huger has available to save and invest. The more expenses that Huger has, the less he can contribute to his net worth.

- Housing Costs: Housing costs are typically a significant expense for Huger. This category includes mortgage payments, rent, property taxes, and homeowners insurance.

- Transportation Costs: Transportation costs can vary depending on Huger's lifestyle and location. This category includes car payments, gas, public transportation, and ride-sharing services.

- Living Expenses: Living expenses encompass basic necessities such as groceries, utilities, and clothing. These expenses can fluctuate depending on Huger's spending habits and family size.

- Entertainment and Recreation: Entertainment and recreation expenses include activities such as dining out, attending events, and pursuing hobbies. These expenses can provide enjoyment but can also impact Huger's net worth.

By understanding the relationship between expenses and net worth, Huger can make informed decisions that will help him manage his expenses effectively and improve his financial standing. For example, Huger may choose to reduce discretionary expenses, such as entertainment and recreation, to free up more money to invest. Additionally, Huger may explore ways to reduce his housing costs, such as refinancing his mortgage or negotiating a lower rent payment. In summary, expenses play a crucial role in determining Ray Huger's net worth. By understanding the relationship between expenses and net worth, Huger can make informed decisions that will help him achieve his financial goals.

Investments

Investments play a crucial role in Ray Huger's net worth as they represent a means of growing wealth and generating passive income. By allocating funds into various investment vehicles, Huger can potentially increase his net worth over time while mitigating risk.

- Stocks: Stocks represent ownership in publicly traded companies. Huger may invest in stocks to gain exposure to the potential growth of these companies and earn dividends.

- Bonds: Bonds are fixed-income securities that pay regular interest payments. Huger may invest in bonds to generate a steady stream of income and preserve capital.

- Real Estate: Real estate investments involve purchasing properties for rental income or appreciation. Huger may invest in residential or commercial properties to diversify his portfolio and potentially generate passive income.

- Private Equity: Private equity investments involve investing in privately held companies that are not publicly traded. Huger may invest in private equity to gain access to exclusive investment opportunities and potentially earn high returns.

These investments contribute to Ray Huger's net worth by providing potential growth and income streams. The diversification of his investments helps spread risk and enhance the overall stability of his financial portfolio. By actively managing his investments and making strategic decisions, Huger can optimize his net worth and achieve his financial goals.

Cash flow

Cash flow is the movement of money into and out of a business, project, or individual's financial accounts. Positive cash flow indicates that more money is coming in than going out, while negative cash flow indicates the opposite. Cash flow is a critical component of Ray Huger's net worth because it directly impacts his ability to pay for expenses, invest, and grow his wealth. A steady and positive cash flow is essential for financial stability and long-term success.

There are many factors that can affect Ray Huger's cash flow. These include his income, expenses, investments, and savings. If Huger's income exceeds his expenses, he will have a positive cash flow. However, if his expenses exceed his income, he will have a negative cash flow. It is important for Huger to carefully manage his cash flow to ensure that he has enough money to meet his financial obligations and achieve his financial goals.

There are many ways that Ray Huger can improve his cash flow. He can increase his income by getting a raise, starting a new business, or investing in income-generating assets. He can also reduce his expenses by cutting back on unnecessary spending, negotiating lower interest rates on his debts, or refinancing his mortgage. By taking steps to improve his cash flow, Huger can improve his financial standing and increase his net worth.

In summary, cash flow is a critical component of Ray Huger's net worth. By understanding the relationship between cash flow and net worth, Huger can make informed decisions that will help him improve his financial standing and achieve his financial goals.

Debt

Debt plays a significant role in Ray Huger's net worth, creating a dynamic relationship that requires careful management. Debt can positively or negatively impact net worth depending on its type, amount, and management strategy.

When Ray Huger incurs debt, such as a mortgage or business loan, it increases his liabilities, which in turn reduces his net worth. Consequently, high levels of debt can hinder his ability to accumulate wealth and achieve financial freedom. However, debt can also be utilized strategically to leverage growth and expand assets. For instance, a mortgage allows Huger to acquire real estate, which can appreciate over time, potentially increasing his net worth in the long run.

Effectively managing debt is crucial for Ray Huger to maintain a healthy financial position. This involves paying down high-interest debts first, negotiating lower interest rates, and avoiding excessive debt that could impair his cash flow and overall financial stability. By striking a balance between debt utilization and responsible management, Huger can harness the potential benefits of debt while minimizing its negative impact on his net worth.

In summary, debt is an integral component of Ray Huger's net worth, influencing its trajectory based on its usage and management. Understanding the interplay between debt and net worth empowers him to make informed financial decisions, optimize his debt portfolio, and maximize his wealth-building potential.

Equity

Equity forms a pivotal component of Ray Huger's net worth, representing the value of his assets minus outstanding liabilities. Understanding the intricacies of equity provides valuable insights into his financial health and overall wealth management strategies.

- Ownership Interest

Equity signifies Huger's ownership stake in various assets, such as real estate, businesses, and investments. It reflects the residual value after subtracting any associated liabilities or debts.

- Home Equity

A significant portion of Huger's equity may be tied to his primary residence or investment properties. The difference between the market value of these properties and any outstanding mortgage or loan balances represents his home equity.

- Investment Equity

Huger's equity extends to his investment portfolio, including stocks, bonds, and mutual funds. The value of these investments fluctuates with market conditions, influencing his overall equity position.

- Business Equity

If Huger owns a business, the value of his ownership stake contributes to his equity. This includes the assets, inventory, and goodwill associated with the business.

In summary, equity is a multifaceted aspect of Ray Huger's net worth, encompassing his ownership interest in assets, real estate, investments, and business ventures. By monitoring and managing his equity effectively, Huger can track his wealth accumulation, make sound financial decisions, and enhance his long-term financial security.

Frequently Asked Questions about Ray Huger Net Worth

This section addresses common questions and provides clear answers to enhance your understanding of Ray Huger's net worth and its contributing factors.

Question 1: How is Ray Huger's net worth calculated?

Ray Huger's net worth is calculated by subtracting his total liabilities from his total assets. This includes his cash, investments, and properties, minus any outstanding debts or loans.

Question 2: What is the primary source of Ray Huger's net worth?

Ray Huger's primary source of net worth is his real estate investments. He owns several properties, including residential and commercial buildings, which contribute significantly to his overall wealth.

Question 3: Has Ray Huger's net worth been impacted by his television appearances?

While Ray Huger's television appearances have undoubtedly raised his public profile, their direct impact on his net worth is difficult to quantify. However, these appearances may have indirectly influenced his business ventures and investment decisions.

Question 4: How does Ray Huger manage his wealth?

Ray Huger has a team of financial advisors who assist him in managing his wealth. He reportedly invests in a diversified portfolio of assets, including real estate, stocks, and bonds, to mitigate risk and maximize returns.

Question 5: What are some of the challenges Ray Huger faces in maintaining his net worth?

Like many high-net-worth individuals, Ray Huger faces challenges such as market fluctuations, tax liabilities, and the need to preserve his wealth for future generations.

Question 6: What is the significance of Ray Huger's net worth?

Ray Huger's net worth is not only a measure of his financial success but also an indicator of his business acumen and investment strategies. It provides insights into the financial landscape of reality television stars and entrepreneurs.

In summary, Ray Huger's net worth is a complex and dynamic aspect of his financial profile, influenced by various factors and presenting both opportunities and challenges. Understanding the nuances of his wealth management strategy can offer valuable lessons for aspiring investors and entrepreneurs.

Now that we have explored the intricacies of Ray Huger's net worth, let's delve into the factors that have contributed to his financial success.

Tips to Enhance Your Net Worth

To conclude our exploration of Ray Huger's net worth, let's examine some actionable tips that can help you enhance your own financial standing and work towards your wealth-building goals.

Tip 1: Track Your Expenses: Monitor your spending habits and categorize your expenses to identify areas where you can reduce unnecessary outflows.

Tip 2: Build an Emergency Fund: Set aside a portion of your income regularly to create a safety net for unexpected expenses and financial emergencies.

Tip 3: Invest Wisely: Diversify your investment portfolio across various asset classes, such as stocks, bonds, and real estate, to spread risk and maximize returns.

Tip 4: Reduce Debt: Prioritize paying off high-interest debts, such as credit card balances, to free up cash flow and improve your credit score.

Tip 5: Increase Your Income: Explore opportunities to enhance your earning potential through career advancement, side hustles, or passive income streams.

Tip 6: Seek Professional Advice: Consult with a financial advisor who can provide personalized guidance and help you develop a tailored wealth management plan.

By incorporating these tips into your financial strategy, you can take proactive steps towards building a strong financial foundation and increasing your net worth over time. Remember, wealth accumulation is a journey that requires consistent effort, discipline, and smart financial decisions.

In the next section, we will delve into the importance of financial literacy and how it empowers individuals to make informed choices that contribute to their long-term financial success.

Conclusion

Our exploration of Ray Huger's net worth has revealed the intricate interplay between assets, liabilities, income, expenses, and investments. Key findings suggest that strategic investment in real estate and prudent management of debt have been instrumental in building his wealth. Furthermore, his ability to generate passive income streams has contributed to the stability and growth of his net worth.

The article underscores the importance of financial literacy and informed decision-making in wealth accumulation. By understanding the dynamics of net worth and implementing sound financial strategies, individuals can unlock their financial potential and work towards their financial goals. Ray Huger's journey serves as a reminder that wealth building is a continuous process that requires a disciplined approach and a commitment to financial well-being.

- Where Was I Want You Back Filmed

- Bad Bunny Used To Make Mix Cds

- Jasprit Bumrah Injury Update What Happened To

- Know About Camren Bicondova Age Height Gotham

- Antony Varghese Wife Net Worth Height Parents

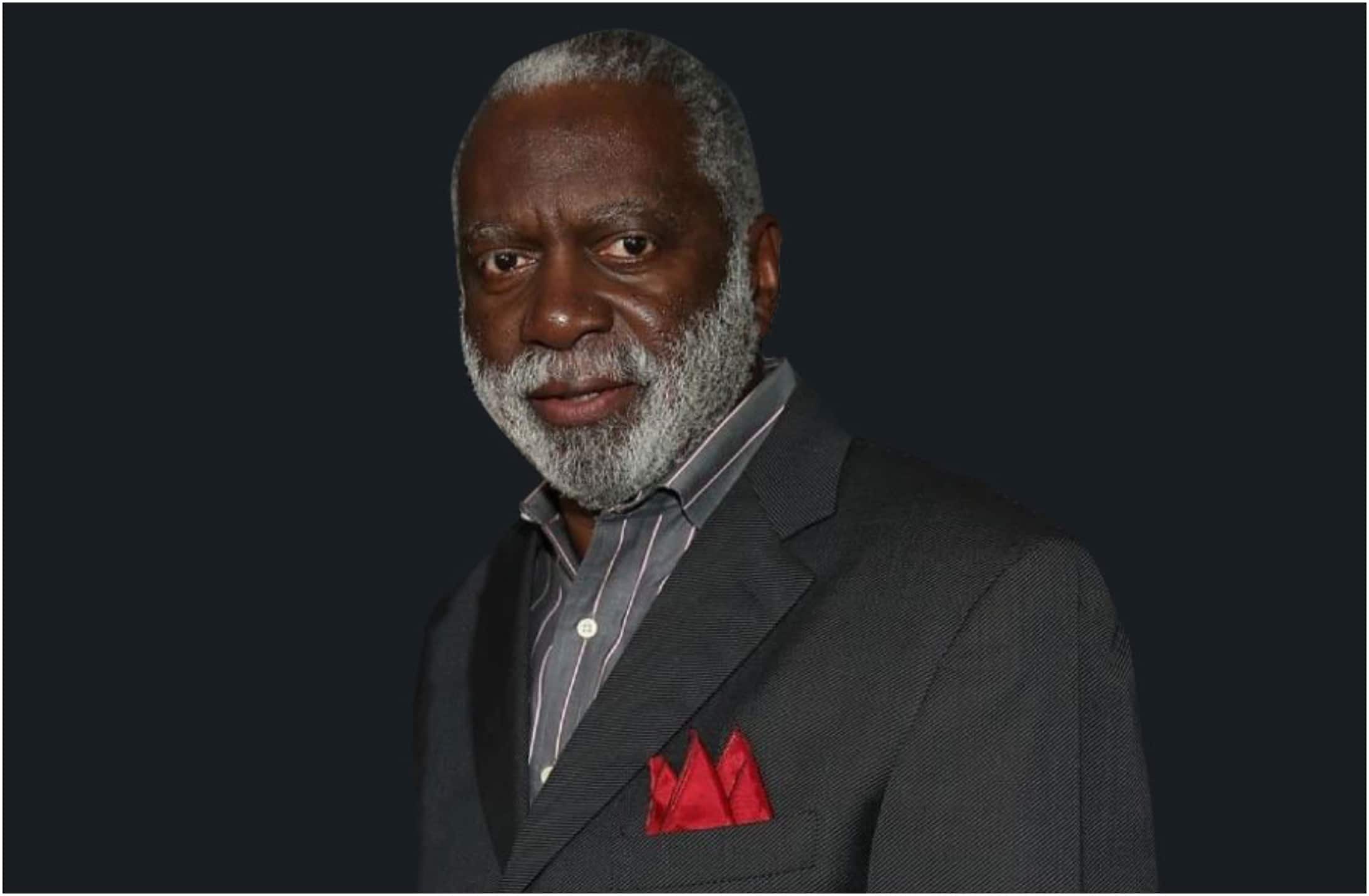

Ray Huger wwearing brown suit and Karen Huger wearing sequin peach outfit

Raymond Huger (Karen Huger Husband) bio wiki, age, height, weight

Ray Huger Net Worth How Much is Ray Huger Worth?