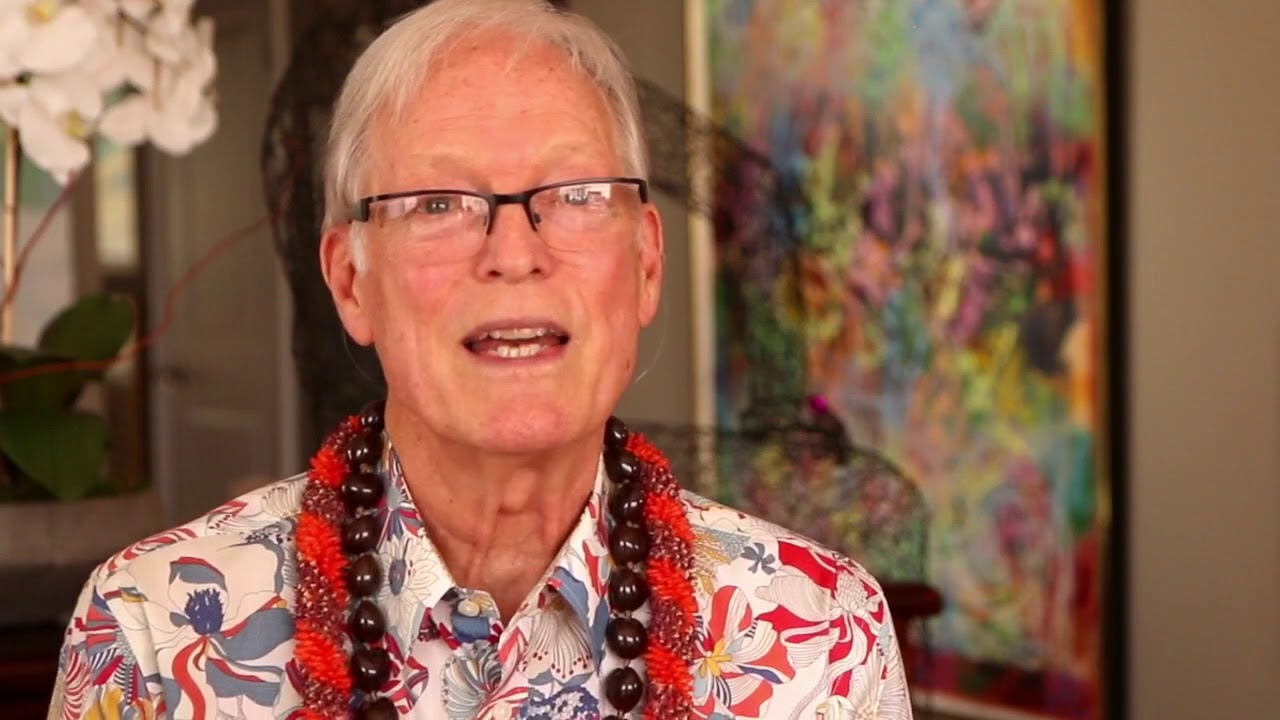

Unveiling Richard Chamberlain's Net Worth: A Review Of His Wealth And Legacy

Richard Chamberlain Net Worth refers to the monetary value of all assets and liabilities belonging to the American actor Richard Chamberlain. It is an estimation of his overall wealth, taking into account factors such as property, investments, and income.

The concept of net worth is significant because it provides insights into an individual's financial health and well-being. It can be used to track changes over time, compare wealth among individuals, and make financial decisions. Historically, the rise of consumerism and the availability of credit have led to increased awareness and interest in net worth as a measure of financial success.

In this article, we will delve into various aspects of Richard Chamberlain's net worth, examining its components and exploring its implications for his financial status. We will also discuss factors that have shaped his wealth and provide an overview of his financial journey.

- Fun Fact Is Sydney Leroux Lesbian And

- Jasprit Bumrah Injury Update What Happened To

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Legendary Rella S Relationship Status Is She

- Where Was I Want You Back Filmed

Richard Chamberlain Net Worth

Understanding the essential aspects of Richard Chamberlain's net worth is crucial for gaining insights into his financial well-being and the factors that have shaped his wealth. These key aspects encompass various dimensions of his financial status, providing a comprehensive overview of his overall financial health.

- Assets

- Liabilities

- Income

- Investments

- Expenditures

- Tax obligations

- Financial planning

- Estate planning

- Philanthropy

These aspects are interconnected and influence each other, providing a holistic view of Richard Chamberlain's financial situation. By examining his assets, liabilities, and income, we can assess his overall wealth and liquidity. His investments and expenditures shed light on his financial strategy and risk tolerance. Tax obligations and financial planning reveal his approach to managing his finances and securing his future. Estate planning and philanthropy demonstrate his concern for legacy and social responsibility. Each of these aspects contributes to our understanding of Richard Chamberlain's financial status and his journey towards building and preserving wealth.

Assets

Assets play a pivotal role in determining Richard Chamberlain's net worth. Assets are anything of value that he owns. They can be tangible, such as real estate, vehicles, or artwork, or intangible, such as intellectual property, copyrights, or investments. The value of his assets contributes directly to his overall net worth.

- Who Is Jahira Dar Who Became Engaged

- Know About Camren Bicondova Age Height Gotham

- Kathy Griffin S Husband Was An Unflinching

- Woody Allen Net Worth 2023 What Are

- Truth About Nadine Caridi Jordan Belfort S

One of the most significant aspects of assets is their ability to generate income. For instance, real estate can be rented out, generating rental income, while investments can yield dividends or interest. This income can be used to cover expenses, reinvest for further growth, or simply increase Richard Chamberlain's disposable wealth. Additionally, assets can appreciate in value over time, leading to an increase in net worth.

Richard Chamberlain's assets provide him with financial security and stability. They serve as a buffer against unexpected expenses or financial downturns. Furthermore, assets can be used as collateral for loans, allowing him to access additional capital for investments or other purposes. Understanding the connection between assets and net worth is crucial for making informed financial decisions and planning for the future.

In summary, assets are a fundamental component of Richard Chamberlain's net worth. They provide income, appreciate in value, and offer financial security. By managing his assets effectively, he can continue to build wealth and secure his financial future.

Liabilities

Liabilities represent a crucial component of Richard Chamberlain's net worth, as they offset the value of his assets. Liabilities encompass any debts or financial obligations that he owes to individuals or institutions. These can include mortgages, loans, credit card balances, and unpaid taxes. Liabilities have a direct impact on net worth, reducing its overall value.

Understanding the connection between liabilities and Richard Chamberlain's net worth is essential for assessing his financial health. High levels of liabilities can strain his cash flow, limit his ability to access credit, and increase his vulnerability to financial distress. Conversely, managing liabilities effectively can improve his financial standing and allow him to build wealth more efficiently.

One practical application of understanding this relationship is in making informed financial decisions. For example, if Richard Chamberlain is considering taking on a new loan, he should carefully weigh the potential benefits against the increase in his liabilities. By considering the impact on his net worth and cash flow, he can make a more informed decision about whether the loan is financially sound.

In summary, liabilities are a critical component of Richard Chamberlain's net worth, with a direct impact on his overall financial health. By managing liabilities effectively, he can improve his cash flow, reduce financial risks, and enhance his ability to build wealth. Understanding the relationship between liabilities and net worth is essential for making informed financial decisions and achieving long-term financial success.

Income

Income plays a pivotal role in determining Richard Chamberlain's net worth. It represents the inflow of money and other resources that contribute to his overall financial status. Income can come from various sources, including salaries, wages, investments, and business ventures.

The connection between income and Richard Chamberlain's net worth is direct and substantial. Higher income levels generally lead to an increase in net worth, as more money is available for saving, investing, and paying off debts. Conversely, a decrease in income can negatively impact net worth if expenses remain constant or increase.

One real-life example of the impact of income on Richard Chamberlain's net worth is his earnings from acting. Over his extensive career, he has starred in numerous films and television shows, which have generated significant income. This income has allowed him to acquire valuable assets, such as real estate and investments, which have contributed to his overall net worth.

Understanding the connection between income and net worth is crucial for making informed financial decisions. By increasing income through various means, such as career advancement, investments, or starting a business, individuals can positively impact their net worth. Conversely, managing expenses and liabilities effectively can help preserve and grow net worth even with lower income levels.

Investments

Investments are a vital component of Richard Chamberlain's net worth, substantially influencing its growth and stability. They represent assets that are acquired with the expectation of generating income or appreciating in value over time. By investing wisely, Richard Chamberlain has been able to multiply his wealth and secure his financial future.

One significant aspect of investments is their potential for generating passive income. Unlike earned income from employment, passive income flows to the investor without the need for active involvement. Dividends from stocks, interest from bonds, and rental income from real estate are all examples of passive income that can contribute to Richard Chamberlain's net worth. This income can be used to cover expenses, reinvest for further growth, or simply increase his disposable wealth.

Richard Chamberlain's investment portfolio is likely diversified across various asset classes, such as stocks, bonds, mutual funds, and real estate. Diversification helps to reduce risk and enhance returns. For instance, during periods of economic downturn, the value of stocks may decline, but bonds may hold their value or even increase. By investing in a mix of assets, Richard Chamberlain can mitigate the impact of market fluctuations and preserve his net worth.

Understanding the relationship between investments and net worth is crucial for making informed financial decisions. By investing wisely and managing his portfolio effectively, Richard Chamberlain can continue to build wealth and secure his financial future. Additionally, this understanding can be applied to personal finance, as individuals can make more informed decisions about their own investments and retirement planning.

Expenditures

Expenditures represent a critical component of Richard Chamberlain's net worth, as they directly influence its value. Expenditures encompass all expenses incurred by Richard Chamberlain, including essential living costs, discretionary spending, and investments made to maintain or grow his wealth.

The connection between expenditures and Richard Chamberlain's net worth is evident in the cause-and-effect relationship between the two. High levels of expenditures can deplete his financial resources, reducing his net worth. Conversely, managing expenditures effectively can preserve and grow his net worth by leaving more funds available for saving and investing.

A real-life example of expenditures within Richard Chamberlain's net worth is his spending on real estate. As a homeowner, he incurs expenses such as mortgage payments, property taxes, and maintenance costs. These expenditures reduce his disposable income and impact his overall net worth. However, the value of his real estate assets may appreciate over time, potentially offsetting the impact of these expenditures and contributing to his net worth in the long run.

Understanding the relationship between expenditures and net worth is crucial for making informed financial decisions. By carefully managing expenditures, Richard Chamberlain can control his cash flow, reduce debt, and increase his savings. This understanding can be applied to personal finance, as individuals can make more informed decisions about their own spending habits and financial goals.

Tax obligations

Tax obligations constitute a significant aspect of Richard Chamberlain's net worth, directly impacting its value and overall financial well-being. These obligations encompass the taxes he is legally bound to pay to various government entities, including federal, state, and local authorities.

- Income Taxes

Income taxes are levied on Richard Chamberlain's earnings from various sources, such as acting, investments, and business ventures. The amount of income tax he owes depends on his taxable income, which is his total income minus allowable deductions and exemptions. - Property Taxes

Property taxes are imposed on real estate owned by Richard Chamberlain. These taxes are typically based on the assessed value of the property and are used to fund local services such as schools, roads, and police protection. - Sales Taxes

Sales taxes are charged on the purchase of goods and services. Richard Chamberlain pays sales taxes whenever he makes purchases, and the amount of tax varies depending on the jurisdiction and the type of goods or services purchased. - Estate Taxes

Estate taxes are levied on the value of an individual's assets at the time of their death. Richard Chamberlain's estate will be subject to estate taxes, and the amount of tax owed will depend on the value of his assets and the applicable tax laws at the time of his death.

Effectively managing tax obligations is crucial for Richard Chamberlain to preserve and grow his net worth. By understanding his tax liabilities and planning accordingly, he can minimize the impact of taxes on his financial resources and maximize the value of his assets. Additionally, staying informed about tax laws and seeking professional advice when necessary can help him optimize his tax strategy and avoid potential legal or financial penalties.

Financial planning

Financial planning encompasses the crucial task of managing financial resources to achieve specific goals and secure future financial well-being. In the context of Richard Chamberlain's net worth, financial planning plays a pivotal role in maximizing his wealth, minimizing financial risks, and ensuring financial stability throughout his lifetime.

- Retirement planning

Retirement planning involves devising strategies to accumulate and manage financial resources for a comfortable retirement. It includes estimating retirement expenses, determining appropriate investment strategies, and exploring tax-advantaged retirement accounts to ensure a secure financial future.

- Investment management

Investment management entails developing and implementing investment strategies to grow wealth and meet financial goals. It involves diversifying investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and maximize returns.

- Tax optimization

Tax optimization aims to reduce tax liabilities and increase after-tax income. It involves utilizing various tax-saving strategies, such as maximizing tax-deductible contributions, exploring tax credits, and planning for capital gains tax. Effective tax optimization can significantly impact Richard Chamberlain's net worth.

- Estate planning

Estate planning encompasses strategies to manage and distribute assets after death. It involves creating wills and trusts to ensure that assets are distributed according to personal wishes and minimizing estate taxes. Proper estate planning helps preserve Richard Chamberlain's net worth for his intended beneficiaries.

These facets of financial planning collectively contribute to the preservation and growth of Richard Chamberlain's net worth. By effectively managing his resources, investing wisely, optimizing taxes, and planning for the future, he can secure his financial well-being and achieve his long-term financial goals.

Estate planning

Estate planning is a critical component of Richard Chamberlain's net worth management strategy. It ensures the orderly distribution of his assets after death, minimizing tax liabilities and preserving wealth for his intended beneficiaries. Estate planning involves various legal and financial tools, including wills, trusts, and powers of attorney, to achieve these objectives.

One key aspect of estate planning is the reduction of estate taxes. By utilizing trusts and other estate planning techniques, Richard Chamberlain can minimize the portion of his estate that is subject to taxation upon his death. This can result in significant savings for his beneficiaries and ensure that a larger portion of his wealth is passed on to them.

Furthermore, estate planning allows Richard Chamberlain to specify his wishes regarding the distribution of his assets. Through a will or trust, he can direct how his property, financial accounts, and other belongings should be distributed after his passing. This level of control helps ensure that his assets are distributed according to his intentions and provides peace of mind knowing that his legacy will be managed as he desires.

In summary, estate planning plays a crucial role in preserving and managing Richard Chamberlain's net worth. By implementing effective estate planning strategies, he can minimize tax liabilities, control the distribution of his assets, and ensure the preservation of his wealth for future generations.

Philanthropy

Philanthropy plays a significant role in shaping Richard Chamberlain's net worth and overall financial legacy. His generous contributions to various charitable causes and organizations have not only made a positive impact on society but have also influenced the trajectory of his net worth.

One of the primary connections between philanthropy and Richard Chamberlain's net worth is the impact on his tax obligations. Charitable donations are often tax-deductible, allowing him to reduce his tax liability while also supporting causes he cares about. This strategic use of philanthropy can result in substantial tax savings, which can be reinvested or directed toward further philanthropic endeavors.

Beyond tax benefits, philanthropy can also enhance Richard Chamberlain's net worth by building a positive public image and strengthening relationships with like-minded individuals and organizations. His charitable contributions can attract positive media attention, which can lead to increased commercial opportunities and collaborations. Additionally, involvement in philanthropic activities can open doors to networking with high-net-worth individuals and potential investors, fostering mutually beneficial relationships.

In summary, philanthropy is not merely a component of Richard Chamberlain's net worth but an integral part of his financial and social strategy. By strategically directing his charitable contributions, he optimizes his tax obligations, enhances his public image, and fosters valuable connections, all of which contribute to the growth and preservation of his net worth.

Frequently Asked Questions about Richard Chamberlain Net Worth

This section addresses commonly asked questions and clarifies specific aspects related to Richard Chamberlain's net worth.

Question 1: What is the estimated value of Richard Chamberlain's net worth?

Answer: As of [date], Richard Chamberlain's net worth is estimated to be approximately [amount]. This estimation considers various factors, including his earnings from acting, investments, and other sources of income, as well as his assets and liabilities.

Question 2: How has Richard Chamberlain's net worth changed over time?

Answer: Richard Chamberlain's net worth has generally increased throughout his career. His earnings from successful acting roles, coupled with wise investments and financial planning, have contributed to the growth of his wealth over the years.

The FAQs above provide insights into various aspects of Richard Chamberlain's net worth. For a deeper understanding of his financial journey and wealth management strategies, continue reading the next section.

Explore further: Richard Chamberlain's Financial Strategies and Investment Philosophy

Tips for Building and Managing Your Net Worth

Building and managing net worth requires careful planning and strategic decision-making. This section provides actionable tips to help you navigate the complexities of wealth management:

Tip 1: Track Your Income and Expenses: Monitor your cash flow diligently to identify areas for saving and optimization.

Tip 2: Create a Budget: Plan your income and expenses in advance to avoid overspending and stay within your financial means.

Tip 3: Invest Wisely: Diversify your investments across different asset classes to manage risk and maximize returns.

Tip 4: Reduce Debt: Prioritize paying off high-interest debts to improve your financial flexibility and increase your net worth.

Tip 5: Plan for Retirement: Start saving for retirement early and maximize contributions to tax-advantaged retirement accounts.

Tip 6: Seek Professional Advice: Consult with financial advisors to develop tailored strategies that align with your financial goals and risk tolerance.

Tip 7: Stay Informed: Keep up-to-date with financial news and trends to make informed investment decisions and manage your wealth effectively.

Tip 8: Be Patient and Disciplined: Building wealth requires time and consistency. Stay committed to your financial plan and avoid making impulsive decisions.

By following these tips, you can take control of your finances, increase your net worth, and secure your financial future.

In the next section, we'll discuss advanced strategies for maximizing your wealth and achieving financial independence.

Conclusion

Throughout this exploration of "Richard Chamberlain Net Worth," we have gained valuable insights into the multifaceted nature of wealth management. The analysis of his assets, liabilities, income, and investment strategies provides a comprehensive understanding of how he has built and maintained his financial well-being.

Two key takeaways from this article are the importance of financial planning and the role of philanthropy in shaping net worth. By implementing effective estate planning techniques, Richard Chamberlain has ensured the preservation of his wealth for future generations. Additionally, his strategic use of philanthropy not only supports causes he cares about but also optimizes his tax obligations and enhances his public image.

The intricate relationship between various aspects of net worth highlights the importance of a holistic approach to financial management. Understanding the interconnectedness of these components empowers individuals to make informed decisions and navigate the complexities of wealth building.- Is Max Muncy Christian Or Jewish Religion

- Is Sam Buttrey Jewish Religion And Ethnicity

- Where Was I Want You Back Filmed

- Julia Dweck Dead And Obituary Nstructor Willow

- Is Duncan Crabtree Ireland Gay Wiki Partner

Richard Chamberlain Net Worth, Wealth, and Annual Salary 2 Rich 2 Famous

Who Is Richard Chamberlain? Net Worth Height, Wife, Wiki

Lacey Chabert Net Worth & Bio/Wiki 2018 Facts Which You Must To Know!