Stephen Boss Net Worth: A Guide To Building Wealth Through Diversification And Strategic Investments

Stephen Boss Net Worth, a metric of financial value and success, represents the total wealth accumulated by the renowned choreographer, dancer, and actor, Stephen Boss. For instance, in 2023, Boss's net worth stood at an estimated $10 million, highlighting his accomplishments and financial status.

Understanding Stephen Boss's net worth is essential for understanding financial success and personal finance. It provides valuable insights into the accumulation of wealth, investment strategies, and long-term planning. Notably, Boss's growth in wealth reflects his dedication, creativity, and astute business decisions throughout his career.

This article delves into the details of Stephen Boss's net worth, examining its components, tracing its historical development, and exploring its implications for personal finance and wealth management.

- Hilaree Nelson Wiki Missing Husband Family Net

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- How Tall Is Markiplier The Truth About

- Tammy Camacho Obituary A Remarkable Life Remembered

- Has Claire Mccaskill Had Plastic Surgery To

Stephen Boss Net Worth

Understanding the essential aspects of Stephen Boss's net worth is crucial for gaining a comprehensive view of his financial status and success. These aspects encompass various dimensions related to his wealth, providing insights into his career, investments, and financial management.

- Income Sources

- Investments

- Assets

- Liabilities

- Cash Flow

- Net Income

- Financial Planning

- Wealth Management

- Tax Implications

These aspects are interconnected and contribute to the overall picture of Stephen Boss's net worth. For instance, his income sources, such as earnings from choreography, dancing, and acting projects, directly impact his cash flow and net income. His investments, including real estate and stocks, contribute to his asset portfolio and potential growth of wealth. Financial planning and wealth management strategies play a crucial role in preserving and growing his net worth over time.

Income Sources

Income sources form the foundation of Stephen Boss's net worth, providing the financial resources that contribute to his overall wealth. These sources encompass various streams of earnings generated through his diverse talents and business ventures.

- Who Is Jay Boogie The Cross Dresser

- Jasprit Bumrah Injury Update What Happened To

- Tlc S I Love A Mama S

- David Foster Net Worth From Grammy Winning

- Who Is Jahira Dar Who Became Engaged

- Choreography

Boss's expertise in choreography has been a significant source of income throughout his career. His work with renowned artists such as Beyonc, Jennifer Lopez, and Justin Bieber has earned him substantial fees, contributing to his net worth.

- Dancing

Boss's exceptional dancing skills have not only brought him fame but also financial rewards. His performances on shows like "So You Think You Can Dance" and "Dancing with the Stars" have garnered significant earnings, boosting his net worth.

- Acting

Boss's foray into acting has added another income stream to his portfolio. His roles in films and television shows, including "Step Up 2: The Streets" and "New Girl," have contributed to his growing net worth.

- Business Ventures

Beyond his artistic endeavors, Boss has ventured into business, launching his own dance studio, clothing line, and production company. These ventures have diversified his income sources, contributing to the overall growth of his net worth.

The diversity of Stephen Boss's income sources has played a crucial role in building and maintaining his net worth. By leveraging his talents, pursuing new opportunities, and managing his finances wisely, he has established a solid financial foundation that continues to support his personal and professional endeavors.

Investments

Investments are a vital aspect of Stephen Boss's net worth, representing his allocation of financial resources to generate future wealth and preserve capital. Through strategic investments, he has diversified his portfolio and increased his overall financial stability.

- Real Estate

Boss has invested a significant portion of his wealth in real estate, including residential properties and commercial buildings. Rental income, appreciation, and potential tax benefits contribute to the growth of his net worth.

- Stocks and Bonds

Boss's investment portfolio includes stocks and bonds, providing him with exposure to the financial markets. Dividends, capital gains, and long-term growth contribute to the overall value of his investments.

- Business Ventures

Beyond his artistic endeavors, Boss has invested in various business ventures, including his own dance studio, clothing line, and production company. These investments generate additional income streams and contribute to the diversification of his net worth.

- Private Equity and Venture Capital

Boss has allocated a portion of his investments to private equity and venture capital, providing him with the potential for high returns and exposure to emerging companies.

Stephen Boss's investments are a testament to his financial acumen and long-term planning. By diversifying his portfolio across multiple asset classes and industries, he has mitigated risk and positioned himself for continued wealth creation.

Assets

Assets play a critical role in determining Stephen Boss's net worth, representing the valuable resources and properties that he owns. Assets are categorized as anything that has economic value and can be converted into cash. In Boss's case, his assets contribute significantly to his overall financial standing and wealth.

One of the most significant types of assets in Stephen Boss's portfolio is real estate. He owns several residential and commercial properties, which generate rental income and contribute to his net worth. Additionally, Boss has invested in stocks, bonds, and other financial instruments, diversifying his asset portfolio and exposing himself to potential capital gains and dividends.

Understanding the connection between assets and Stephen Boss's net worth is essential for comprehending his financial stability and growth. Assets are not merely possessions but valuable tools that can be leveraged to generate wealth and secure financial well-being. By carefully managing and growing his assets, Boss has built a solid financial foundation that supports his lifestyle and long-term goals.

Liabilities

Liabilities play a crucial role in understanding Stephen Boss's net worth, representing his financial obligations and debts. They are the opposite of assets, reducing the overall value of his net worth. Liabilities can significantly impact Boss's financial stability and long-term wealth accumulation.

One significant type of liability for Stephen Boss is business loans. To finance his various business ventures, including his dance studio and production company, Boss may have acquired loans that represent liabilities. These loans require regular interest payments and repayment of the principal, which can affect his cash flow and profitability.

Understanding the connection between liabilities and Stephen Boss's net worth is essential for assessing his financial health. Liabilities can limit his financial flexibility, restrict access to additional financing, and potentially impact his creditworthiness. By carefully managing his liabilities and ensuring that they are outweighed by his assets, Boss can maintain a strong financial position and continue to grow his net worth.

Cash Flow

Cash flow, the movement of money in and out of a business or individual's accounts, plays a crucial role in Stephen Boss's net worth. Positive cash flow, when inflows exceed outflows, indicates financial health and the ability to meet financial obligations. Conversely, negative cash flow can strain resources and hinder growth.

Stephen Boss's income from various sources, including choreography, dancing, acting, and business ventures, contributes directly to his cash flow. Managing cash flow effectively allows him to cover expenses, invest in new opportunities, and maintain a healthy financial position. For instance, reinvesting profits from successful projects back into his businesses can generate additional revenue streams, leading to long-term growth in his net worth.

Understanding the connection between cash flow and Stephen Boss's net worth is essential for assessing his financial stability and long-term wealth accumulation. By carefully managing his cash flow, he can ensure that his assets continue to grow and that his liabilities are met on time. This enables him to sustain his lifestyle, pursue new endeavors, and preserve his financial well-being.

Net Income

Net income, or simply income, is a crucial component of Stephen Boss's net worth. It represents the total earnings from all sources minus expenses and deductions. A higher net income typically leads to an increase in net worth. For individuals like Boss, net income is primarily generated through their professional endeavors, such as choreography, dancing, acting, and business ventures.

Real-life examples of net income's impact on Stephen Boss's net worth can be seen in his investments and financial planning. A significant portion of Boss's net income is reinvested into his businesses, contributing to their growth and potential for future revenue generation. Understanding the connection between net income and net worth allows Boss to make informed financial decisions, plan for long-term financial security, and pursue opportunities that align with his financial goals.

In summary, net income is a fundamental driver of Stephen Boss's net worth. By maximizing net income through successful projects and prudent financial management, Boss can continue to grow his wealth and maintain his financial well-being. This understanding highlights the importance of income generation and responsible financial practices in building and preserving wealth over time.

Financial Planning

Financial planning is a crucial aspect of Stephen Boss's net worth management, as it involves strategizing and managing his financial resources to achieve specific financial goals. It encompasses various components and considerations that contribute to the overall health and growth of his wealth.

- Investment Planning

Boss's financial plan likely includes a strategy for investing his earnings wisely to generate passive income and grow his wealth over time. This may involve diversifying his portfolio across different asset classes, such as stocks, bonds, and real estate.

- Tax Planning

Effective tax planning is essential for optimizing Boss's net worth. His financial plan should consider tax implications and identify strategies to minimize tax liability, ensuring he retains a larger portion of his earnings.

- Retirement Planning

As Boss thinks about the future, retirement planning becomes increasingly important. His financial plan should include provisions for retirement savings and investments to ensure he has a secure financial foundation in his later years.

- Estate Planning

Estate planning is a crucial part of Boss's financial strategy as it involves planning for the distribution of his assets after his passing. This ensures that his wishes are carried out, and his legacy is preserved.

By incorporating these components into his financial plan, Stephen Boss can make informed decisions about his finances, manage risk, and optimize his net worth growth. Effective financial planning is not just about accumulating wealth but also about preserving and using it wisely to achieve long-term financial security and peace of mind.

Wealth Management

Wealth management plays a critical role in Stephen Boss's net worth by providing a structured approach to managing and growing his financial assets. It involves a comprehensive range of services tailored to meet his specific financial goals and objectives.

Effective wealth management considers various aspects of Boss's financial life, including investment planning, tax optimization, retirement planning, and estate planning. By working closely with financial advisors and wealth managers, Boss can make informed decisions about his finances, reduce potential risks, and maximize the growth of his net worth.

Real-life examples of wealth management within Stephen Boss's net worth include his diverse investment portfolio, which encompasses stocks, bonds, real estate, and private equity. His financial advisors help him allocate his assets strategically, considering factors such as risk tolerance, investment horizon, and tax implications. Additionally, tax optimization strategies implemented through wealth management have enabled Boss to minimize his tax liability and preserve a larger portion of his earnings.

Understanding the connection between wealth management and Stephen Boss's net worth highlights the importance of professional financial guidance in managing and growing wealth. By leveraging the expertise of wealth managers, Boss can navigate complex financial decisions, make informed investments, and preserve his financial well-being over the long term.

Tax Implications

Tax implications play a crucial role in shaping Stephen Boss's net worth, as they significantly impact the amount of wealth he can accumulate and preserve over time. Understanding the connection between tax implications and net worth is essential for effective financial planning and wealth management.

Tax implications arise from various sources of income for Stephen Boss, including his earnings from choreography, dancing, acting, and business ventures. Taxes, such as income tax, capital gains tax, and property tax, can reduce his net income and affect his overall financial position. Effective tax planning strategies, such as maximizing tax-advantaged investments and optimizing deductions, become necessary to minimize tax liability and preserve wealth.

Real-life examples of tax implications within Stephen Boss's net worth include his investments in real estate and his business ventures. Strategic decisions, such as holding properties for long-term capital gains treatment or utilizing tax credits associated with business operations, can have a significant impact on his tax liability and, consequently, his net worth. Understanding these implications allows him to make informed choices that optimize his financial outcomes.

Practical applications of this understanding extend to Boss's financial planning and wealth management. By considering tax implications in his financial decisions, he can allocate his resources more efficiently, reduce the erosion of his wealth due to taxes, and plan for the future with greater clarity. This knowledge empowers him to make proactive choices that align with his long-term financial goals.

Frequently Asked Questions

This FAQ section aims to clarify common inquiries and provide additional insights into the various aspects of Stephen Boss's net worth.

1. What are the primary sources of Stephen Boss's income?

Stephen Boss generates income through his diverse talents and business ventures, including choreography, dancing, acting, and various investments.

2. How does Stephen Boss manage his financial assets?

Boss employs wealth management strategies, working closely with financial advisors to optimize investment returns, minimize tax implications, and plan for his financial future.

3. What role does real estate play in Stephen Boss's net worth?

Real estate investments constitute a significant portion of Boss's net worth, providing rental income, potential appreciation, and tax benefits.

4. How has Stephen Boss diversified his investment portfolio?

Boss has diversified his portfolio across multiple asset classes, including stocks, bonds, and private equity, to manage risk and enhance growth potential.

5. What tax implications affect Stephen Boss's net worth?

Taxes on income, capital gains, and property impact Boss's net worth, emphasizing the importance of effective tax planning and optimization.

6. How does Stephen Boss plan for his financial future?

Boss utilizes retirement planning and estate planning strategies to ensure his financial security in the future and preserve his legacy.

These FAQs offer a deeper understanding of the diverse factors shaping Stephen Boss's net worth, highlighting the complexities and considerations involved in managing wealth.

Moving forward, the article will delve into the strategies and techniques employed by Stephen Boss to build and maintain his substantial net worth, providing valuable insights for financial planning and wealth management.

Tips for Building and Maintaining Wealth

This section offers actionable tips inspired by Stephen Boss's financial journey, empowering you to build and maintain your own wealth.

Tip 1: Diversify Your Income Streams

Explore multiple sources of income to reduce reliance on a single revenue stream. Consider freelancing, investing, or starting a side hustle.

Tip 2: Invest Wisely

Allocate your savings into a diversified portfolio of assets, including stocks, bonds, real estate, and alternative investments, to spread risk and enhance returns.

Tip 3: Manage Your Cash Flow Effectively

Track your income and expenses diligently to ensure you live within your means. Create a budget and stick to it to avoid unnecessary debt.

Tip 4: Seek Professional Financial Advice

Consult with a financial advisor or wealth manager to develop a personalized financial plan that aligns with your goals and risk tolerance.

Tip 5: Plan for Retirement Early

Start saving and investing for retirement as early as possible to take advantage of compound interest and secure your financial future.

Tip 6: Minimize Taxes

Explore tax-advantaged investment options and deductions to reduce your tax liability and preserve more of your wealth.

Tip 7: Stay Informed

Continuously educate yourself about financial markets, investment strategies, and tax laws to make informed decisions that support your wealth-building goals.

Tip 8: Be Patient and Disciplined

Building wealth is a marathon, not a sprint. Stay disciplined with your financial habits, avoid impulsive spending, and focus on long-term growth.

By implementing these tips, you can emulate Stephen Boss's approach to wealth management and take proactive steps toward securing your financial well-being.

The following section will delve deeper into Stephen Boss's financial strategies, providing further insights into the nuances of wealth creation and preservation.

Conclusion

Stephen Boss's net worth is a testament to his diverse talents, strategic investments, and prudent financial management. His journey offers valuable insights into the intricacies of wealth creation and preservation.

Key takeaways include the importance of diversifying income streams, investing wisely, and seeking professional financial advice. Additionally, effective tax planning, retirement planning, and a disciplined approach to cash flow management are crucial.

Building and maintaining wealth requires a holistic understanding of financial principles and a commitment to long-term goals. Stephen Boss's story is a reminder that with dedication, informed decision-making, and a focus on long-term growth, financial success is achievable.

- Claudia Sampedro Wags Miami Age Engaged Husband

- Noah Pc3a9rez Chris Perez Son Age

- Woody Allen Net Worth 2023 What Are

- Justin Bieber Sells Entire Music Catalogue For

- Matthew Cassina Dies In Burlington Motorcycle Accident

Stephen Boss Net Worth 2024 Wiki Bio, Married, Dating, Family, Height

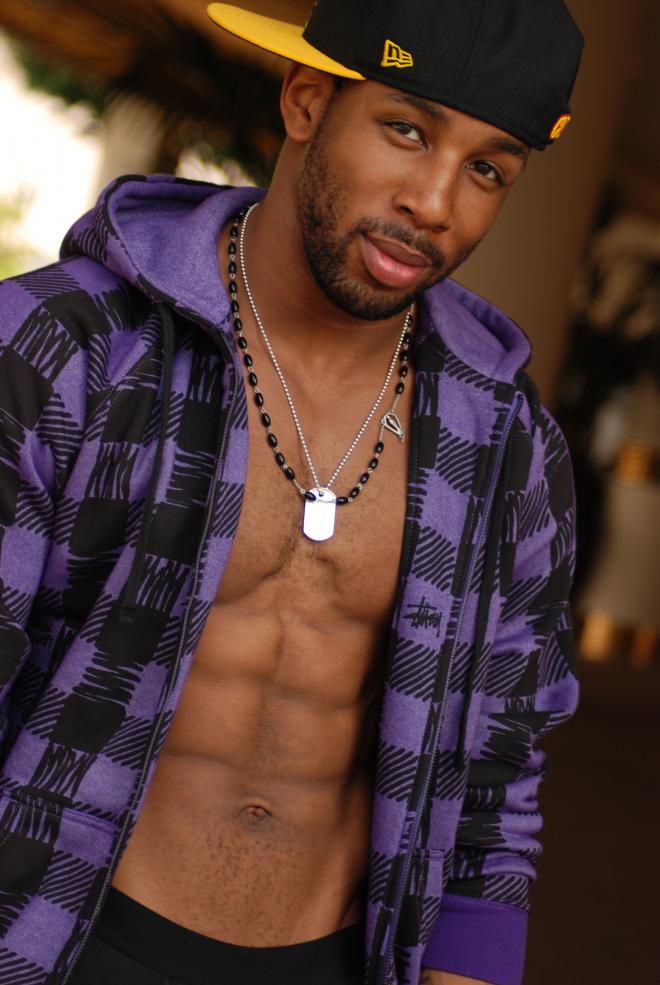

Stephen Boss

Stephen Boss Net Worth 2020, Wiki, Height, Age, Wife, Family